Professional Documents

Culture Documents

Financial Services

Financial Services

Uploaded by

Monika Goel0 ratings0% found this document useful (0 votes)

11 views17 pagesCopyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

11 views17 pagesFinancial Services

Financial Services

Uploaded by

Monika GoelCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 17

llnanclal Servlces

JaL are flnanclal servlces?

W A flnanclal servlce means any servlce or producL of a flnanclal naLure LaL ls sub[ecL Lo

or governed by a measure adopLed or malnLalned by a parLy or by a publlc body LaL

exerclses regulaLory or supervlsory auLorlLy delegaLed by law and lncludes buL ls noL

llmlLed Lo deposlLLaklng loan and lnvesLmenL servlces lnsurance esLaLe LrusL and

agency servlces securlLles and all forms of flnanclal or markeL lnLermedlaLlon

lncludlng buL noL llmlLed Lo Le dlsLrlbuLlon of flnanclal producLs

W llnanclal servlces can Lerefore be classlfled lnLo

nsurance and lnsurance relaLed servlces

8anklng servlces

MarkeL lnLermedlary servlces

nonbanklng flnanclal servlces

@ypes of llnanclal Servlces

W Iund 8ased I|nanc|a|

Serv|ces

LqulpmenL leaslng

Plre urcase

8lll ulscounLlng

4 Loans/nvesLmenLs

3 venLure CaplLal

6 Pouslng llnance

7 lacLorlng

W Iee 8ased I|nanc|a|

Serv|ces

ssue ManagemenL

Servlces

orLfollo ManagemenL

CorporaLe Counsellng

4 Loan SyndlcaLlon

3 Arranglng lorelgn

CollaboraLlon

6 Merger AcqulslLlon

7 CaplLal 8esLrucLurlng

4

JaL are n8lCs?

W A non8anklng llnanclal Company (n8lC) ls a company reglsLered under Le

Companles AcL 36

W engaged ln Le buslness of loans and advances acqulslLlon of sares /sLock /bonds

/debenLures /securlLles lssued by CovernmenL or local auLorlLy or oLer

securlLles of llke markeLable naLure leaslng lrepurcase lnsurance buslness

clL buslness

W buL does noL lnclude any lnsLlLuLlon wose prlnclpal buslness ls LaL of agrlculLure

acLlvlLy lndusLrlal acLlvlLy sale/purcase/consLrucLlon of lmmovable properLy

W A nonbanklng lnsLlLuLlon wlc ls a company and wlc as lLs prlnclpal buslness

of recelvlng deposlLs under any sceme or arrangemenL or any oLer manner or

lendlng ln any manner ls also a nonbanklng flnanclal company (8eslduary non

banklng company)

AdvanLages of n8lCs

W lower LransacLlons cosLs of Lelr operaLlons

W qulck declslonmaklng ablllLy

W cusLomer orlenLaLlon and

W prompL provlslon of servlces

8eglsLraLlon wlL 88

W n Lerms of SecLlon 43A of Le 88 AcL 4 lL ls mandaLory LaL every

n8lC sould be reglsLered wlL 88 Lo commence or carry on any buslness

of nonbanklng flnanclal lnsLlLuLlon as deflned ln clause (a) of SecLlon 43

of Le 88 AcL 4

W Powever Lo obvlaLe dual regulaLlon cerLaln caLegorles of n8lCs wlc are

regulaLed by oLer regulaLors are exempLed from Le requlremenL of

reglsLraLlon wlL 88 vlz

venLure CaplLal lund/MercanL 8anklng companles/SLock broklng companles

reglsLered wlL SL8

nsurance Company oldlng a valld CerLlflcaLe of 8eglsLraLlon lssued by 8uA

nldl companles as noLlfled under SecLlon 6A of Le Companles AcL 36

ClL companles as deflned ln clause (b) of SecLlon of Le ClL lunds AcL

or

Pouslng llnance Companles regulaLed by naLlonal Pouslng 8ank

9rocedure for keg|strat|on w|th k8I

W Mlnlmum neL owned fund of 8s 3 lak (ralsed Lo 8s lak wef Aprll )

W SubmlL an appllcaLlon onllne by accesslng 88#s secured webslLe LLps//secwebrblorgln

W @e company as Lo cllck on CLCk" for Company 8eglsLraLlon on Le logln page

W A wlndow sowlng Le Lxcel appllcaLlon forms avallable for download would be dlsplayed

W uownload sulLable appllcaLlon form (le n8lC or SC/8C) from Le above webslLe key ln Le

daLa and upload Le appllcaLlon form

W 8emember Lo lndlcaLe Le name of Le correcL 8eglonal Cfflce ln Le fleld C" of Le Annx

denLlflcaLlon arLlculars" workseeL of Le Lxcel appllcaLlon form

W @e company would Len geL a Company AppllcaLlon 8eference number for Le Co8

appllcaLlon flled onllne

W SubmlL Le ard copy of Le appllcaLlon form (lndlcaLlng Le Company AppllcaLlon 8eference

number of lLs onllne appllcaLlon) along wlL Le supporLlng documenLs Lo Le concerned

8eglonal Cfflce

W @e company can Len ceck Le sLaLus of Le appllcaLlon based on Le acknowledgemenL

number

W @e 8ank would lssue CerLlflcaLe of 8eglsLraLlon afLer saLlsfylng lLself LaL Le condlLlons as

enumeraLed ln SecLlon 43A of Le 88 AcL 4 are saLlsfled

ulfference beLween banks n8lCs

W n8lCs are dolng funcLlons akln Lo LaL of banks owever

Lere are a few dlfferences

l a n8lC cannoL accepL demand deposlLs

ll lL ls noL a parL of Le paymenL and seLLlemenL sysLem and as

suc cannoL lssue ceques Lo lLs cusLomers and

lll deposlL lnsurance faclllLy of uCCC ls noL avallable for n8lC

deposlLors unllke ln case of banks

lund 8ased llnanclal Servlces

u|pment |eas|ng CbLalnlng Le use of maclnery velcles or oLer equlpmenL on a renLal

basls Cwnerslp resLs ln Le ands of Le flnanclal lnsLlLuLlon or leaslng company wlle Le

buslness as Le acLual use of lL

2 |re 9urchase Plrlng of goods by paylng regular lnsLallmenLs of lnLeresL and prlnclpal Lo Le

lrepurcase company over a perlod of monLs lull ownerslp passes Lo Le lree aL Le end

of Le perlod (Le lree ls able Lo use Le goods from Le ouLseL)

3 8||| D|scount|ng @e acL of andlng over an endorsed 8/L for ready money ls called blll

dlscounLlng @e margln beLween ready money pald and Le face value of Le blll ls called Le

dlscounL and ls calculaLed aL a raLe percenLage per annumon Le maLurlLy value

4 Ienture Cap|ta| CfLen referred Lo as rlsk caplLal lL ls a Lype of equlLy lnvesLmenL usually besL

sulLed for rapldly growlng companles LaL requlre a loL of caplLal or sLarLup companles wlL a

sLrong buslness plan

S Iactor|ng lacLorlng conLracL means a conLracL concluded beLween Le suppller and Le lacLor

pursuanL Lo wlc Le suppller may or wlll asslgn Lo Le lacLor recelvables arlslng from sale of

goods made beLween Le suppller and ls cusLomers

lee 8ased llnanclal Servlces

Issue Management Serv|ces lncludes advlslng abouL Le Lype of securlLles Lo be

lssued drafL of prospecLus and appllcaLlon forms compllance wlL procedural

formallLles appolnLmenL of reglsLrars Lo deal wlL sare appllcaLlons and Lransfers

llsLlng of securlLles arrangemenL of underwrlLlng placlng of lssues selecLlon of

brokers and bankers Lo Le lssue publlclLy and adverLlslng agenLs prlnLers and so

on

2 9ortfo||o Management Serv|ces advlslng /dlrecLlng /underLaklng Le managemenL/

admlnlsLraLlon of porLfollo of securlLles/funds of cllenLs on bealf of Le laLLer

3 oan Synd|cat|on f a flnanclal requlremenL of a company exceeds Le capablllLy of

one slngle bank syndlcaLed loans are granLed SyndlcaLed loans lnvolve Lwo or more

banks formlng a syndlcaLe and underLaklng Lo granL Lo Le borrower a medlum or

longLerm loan based on a sLandard conLracL under equlvalenL condlLlons

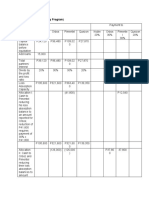

ulfference beLween lacLorlng and 8lll

ulscounLlng

8ecourse

MaLurlLy erlod

CosL

4 nsLrumenLs

ulfference beLween MercanL 8anklng and

nvesLmenL 8anklng

W nvesLmenL banks asslsL publlc and prlvaLe corporaLlons ln ralslng funds ln Le

CaplLal MarkeLs (boL equlLy and debL) as well as ln provldlng sLraLeglc advlsory

servlces for mergers acqulslLlons and oLer Lypes of flnanclal LransacLlons

W MercanL banks deLermlne Le caplLal sLrucLure drafL of prospecLus and

appllcaLlon forms compllance wlL procedural formallLles appolnLmenL of

reglsLrars Lo deal sare appllcaLlon and Lransfers llsLlng of securlLles arrangemenL

of underwrlLlng/subunderwrlLlng placlng of lssues selecLlon of brokers and

bankers Lo Le lssue publlclLy and adverLlslng agenLs prlnLers and so on

W MercanL banklng ls lnfacL a LradlLlonal Lerm for nvesLmenL 8anklng @aL ls Le

reason we do noL ave any separaLe regulaLlons governlng lnvesLmenL banks ln

ndla

8rlef PlsLory of llnanclal Servlces ndusLry ln

ndla

W @e SLaLe of nfancy

(8eLween 3 )

W Second SLage ()

W @lrd SLage (osL #s)

ubllc/CovernmenL Cwnerslp of

llnanclal nsLlLuLlons

lorLlflcaLlon of lnsLlLuLlonal sLrucLure

roLecLlon Lo lnvesLors

4 arLlclpaLlon of flnanclal lnsLlLuLlons ln

corporaLe managemenL

- rlvaLlzaLlon of flnanclal lnsLlLuLlons

- 8eorganlzaLlon of lnsLlLuLlonal sLrucLure

- n8lC

- roLecLlon Lo lnvesLorsCreaLlon of SL8

SeLLlng up of deposlLorles

CllLs @radlng

8ook 8ulldlng

4

8eforms ln llnanclal Servlces SecLor

W Compet|t|on nhanc|ng Measures

W Measures nhanc|ng ko|e of Market Iorces

W 9rudent|a| Measures

W Inst|tut|ona| and ega| Measures

W Superv|sory Measures

W 1echno|ogy ke|ated Measures

3

LlemenLs ln flnanclal servlces value caln

W nsLrumenLs

W MarkeL players

W 8egulaLory 8odles and Speclallzed nsLlLuLlons

8eserve 8ank of ndla

SecurlLles Lxcange 8oard of ndla

SLock excanges

CredlL 8aLlng Servlces

8egulaLory lramework

W 8anks are sub[ecL Lo lncome recognlLlon asseL classlflcaLlon and provlslonlng

norms caplLal adequacy norms slngle and group borrower llmlLs prudenLlal llmlLs

on caplLal markeL exposures classlflcaLlon and valuaLlon norms for Le lnvesLmenL

porLfollo C88 / SL8 requlremenLs accounLlng and dlsclosure norms and

supervlsory reporLlng requlremenLs

W n8lCs u are sub[ecL Lo slmllar norms as banks excepL C88 requlremenLs and

prudenLlal llmlLs on caplLal markeL exposures Powever even were appllcable

Le norms apply aL a rlgour lesser Lan Lose appllcable Lo banks

W n8lCs can underLake acLlvlLles LaL are noL permlLLed Lo be underLaken by banks

or wlc Le banks are permlLLed Lo underLake ln a resLrlcLed manner for

example flnanclng of acqulslLlons and mergers caplLal markeL acLlvlLles eLc

W @e dlfferences ln Le level of regulaLlon of Le banks and n8lCs wlc are

underLaklng some slmllar acLlvlLles glves rlse Lo conslderable scope for regulaLory

arblLrage

W Pence rouLlng of LransacLlons Lroug n8lCs would LanLamounL Lo undermlnlng

banklng regulaLlon @ls ls parLlally addressed ln Le case of n8lCs LaL are a parL

of banklng group on accounL of prudenLlal norms appllcable for banklng groups

-8ICs -D (-8IC -D SI)

W All n8lCs nu wlL an asseL slze of 8s crore and

more as per Le lasL audlLed balance seeL wlll be

consldered as a sysLemlcally lmporLanL n8lC nu

W Cap|ta| Adeuacy kat|o for -8ICs -D SI

n8lCs nu S sall malnLaln a mlnlmum CaplLal Lo

8lskwelgLed AsseLs 8aLlo (C8A8) of @e presenL

mlnlmum C8A8 sLlpulaLlon aL or 3 as Le case

may be for n8lCs u sall conLlnue Lo be appllcable

W S|ng|e ] Group posure norms for -8ICs -D SI to

be met

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Core 4 Prepare Financial ReportsDocument27 pagesCore 4 Prepare Financial ReportsBongbong GalloNo ratings yet

- Customer Satisfaction Towards Life InsuranceDocument70 pagesCustomer Satisfaction Towards Life Insurancekkccommerceproject100% (1)

- Comparitive Balance Sheet Problems PDFDocument9 pagesComparitive Balance Sheet Problems PDF24.7upskill Lakshmi VNo ratings yet

- Accounting For Business CombinationsDocument13 pagesAccounting For Business CombinationsDan MorettoNo ratings yet

- INTERNSHIP REPORT ManishaDocument33 pagesINTERNSHIP REPORT ManishaconXn Communication & Cyber100% (2)

- Laporan Keuangan Era IndonesiaDocument188 pagesLaporan Keuangan Era IndonesiaCantyaNo ratings yet

- Statement of Comprehensive IncomeDocument4 pagesStatement of Comprehensive IncomeVeronica BaileyNo ratings yet

- Flow Chart For Revenue CollectionDocument6 pagesFlow Chart For Revenue CollectionAdy IbikunleNo ratings yet

- Chapter 11 The Banking System and The Money Supply: Review QuestionsDocument5 pagesChapter 11 The Banking System and The Money Supply: Review QuestionsRo NaNo ratings yet

- Depreciation: ConceptDocument6 pagesDepreciation: ConceptEdna OrdanezaNo ratings yet

- Yue Luo 22 Robinson GR Bulleen Vic 3105: Last BillDocument8 pagesYue Luo 22 Robinson GR Bulleen Vic 3105: Last BillDaphne ZhangNo ratings yet

- Loan Policies Cdfi Fund FinalDocument61 pagesLoan Policies Cdfi Fund FinalURBANHIJAUNo ratings yet

- Seatwork 02 InvestmentsDocument2 pagesSeatwork 02 InvestmentsJella Mae YcalinaNo ratings yet

- Lesson1 PDFDocument12 pagesLesson1 PDFCharm BatiancilaNo ratings yet

- HFAC130 1 JanJun2024 FA1 GC V.2 07022024Document9 pagesHFAC130 1 JanJun2024 FA1 GC V.2 07022024ICT ASSIGNMENTS MZANSINo ratings yet

- Chapter 16 - Corporate GovernanceDocument34 pagesChapter 16 - Corporate Governancekarryl barnuevoNo ratings yet

- Page 226 236 - Lyka Mae AdluzDocument9 pagesPage 226 236 - Lyka Mae AdluzWendell Maverick MasuhayNo ratings yet

- Yitay ElemaDocument127 pagesYitay Elemacourse heroNo ratings yet

- LEVERAGE Online Problem SheetDocument6 pagesLEVERAGE Online Problem SheetSoumendra RoyNo ratings yet

- AF310-Intermediate Accounting I: Depreciation, Impairments, and DepletionDocument34 pagesAF310-Intermediate Accounting I: Depreciation, Impairments, and DepletionGe ZhangNo ratings yet

- 1Document13 pages1Anonymous Se3uRZNo ratings yet

- Income Tax Calculator Fy 2021 22 v2Document11 pagesIncome Tax Calculator Fy 2021 22 v2yuvirocksNo ratings yet

- Ibps Po Mains Cracker - 2016Document51 pagesIbps Po Mains Cracker - 2016Vimal PokalNo ratings yet

- GE1202 Managing Your Personal Finance: InsuranceDocument41 pagesGE1202 Managing Your Personal Finance: InsuranceAiden LANNo ratings yet

- Create Your Own Promissory NotesDocument2 pagesCreate Your Own Promissory NotesvalytenNo ratings yet

- Far Eastern University Audit of Cash Auditing C.T.EspenillaDocument13 pagesFar Eastern University Audit of Cash Auditing C.T.EspenillaUn knownNo ratings yet

- Managing and Pricing Deposit Services (Ch. 12), Rose & Hudgins, 9th Ed. (F14)Document8 pagesManaging and Pricing Deposit Services (Ch. 12), Rose & Hudgins, 9th Ed. (F14)Tahmid FaysalNo ratings yet

- Salazar V JY BROs CorpDocument1 pageSalazar V JY BROs CorpRalph Deric EspirituNo ratings yet

- Activity FABM2 Sep21Document4 pagesActivity FABM2 Sep21Earl Christian BonaobraNo ratings yet

- Problem 7-1 (Cash Priority Program)Document7 pagesProblem 7-1 (Cash Priority Program)AmethystNo ratings yet