Professional Documents

Culture Documents

Tools of Monetary Policy: Open - Market Operations Discount Rate Reserve Requirements

Tools of Monetary Policy: Open - Market Operations Discount Rate Reserve Requirements

Uploaded by

Angelica Beltran0 ratings0% found this document useful (0 votes)

3 views15 pagesThe document summarizes various tools and concepts related to monetary policy in the United States. It discusses open market operations conducted by the Federal Open Market Committee to influence money supply and interest rates. It also outlines discount rates set by the Federal Reserve, reserve requirements for banks, and how these tools can be used to fight inflation and recession by expanding or contracting the money supply. Transmission mechanisms and potential limitations like the liquidity trap are also summarized. Key banking and monetary control acts that impacted regulation are briefly explained.

Original Description:

Original Title

Untitled

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document summarizes various tools and concepts related to monetary policy in the United States. It discusses open market operations conducted by the Federal Open Market Committee to influence money supply and interest rates. It also outlines discount rates set by the Federal Reserve, reserve requirements for banks, and how these tools can be used to fight inflation and recession by expanding or contracting the money supply. Transmission mechanisms and potential limitations like the liquidity trap are also summarized. Key banking and monetary control acts that impacted regulation are briefly explained.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

3 views15 pagesTools of Monetary Policy: Open - Market Operations Discount Rate Reserve Requirements

Tools of Monetary Policy: Open - Market Operations Discount Rate Reserve Requirements

Uploaded by

Angelica BeltranThe document summarizes various tools and concepts related to monetary policy in the United States. It discusses open market operations conducted by the Federal Open Market Committee to influence money supply and interest rates. It also outlines discount rates set by the Federal Reserve, reserve requirements for banks, and how these tools can be used to fight inflation and recession by expanding or contracting the money supply. Transmission mechanisms and potential limitations like the liquidity trap are also summarized. Key banking and monetary control acts that impacted regulation are briefly explained.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 15

Tools of Monetary Policy

Open – Market Operations

Discount Rate

Reserve Requirements

How Open-Market Operations Work

- The Federal Reserve purchases a security

bonds to increase money supply and to

reduce the money supply the FED sells the

bonds.

The Federal Open-Market Committee

Open – market operations are conducted by the

Federal Open – Market Committee.

The Federal Open – Market Committee is the

group within the Federal reserve that creates

monetary policy.

The Federal Open - Market Committee consist

of 12 people.

Discount Rate and Federal Funds Rate

Changes

Discount rate

- interest rate paid by member banks when they

borrow at the Federal reserve district bank.

Federal Funds Rate

-Is the interest rate that depository institutions

,banks, savings and loans, and credit unions,

charge each other for overnight loans.

Changing Reserve Requirements

Increasing reserve requirements, the Federal

Reserve is essentially taking money out of the

money supply and increasing the cost credit.

Lowering the reserve requirements pumps

money into the economy by giving bank excess

reserve, which expands the bank credit and

lowers rate.

The Fed’s effectiveness in fighting

Inflation and Recession

When the Fed increase the rate of monetary

growth, this tends to raise GDP growth.

The monetary policy is having some difficulty

in handling recession, because business

Transmission Mechanism: Expansionary

Monetary Policy

Transmision Mechanism: Contractionary

The Liquidity Trap

Liquidity Trap

- when monetary policy becomes ineffective

due to a very low interest rates combined

with consumers who prefer to save raher

than invest in higher – yielding bonds or other

investments.

John Maynard Keynes determined that at a very

low interest rates people would not lend out their

money.

The Depository Institutions Deregulation

and Monetary Control Act of 1980

Key Provisions

1. All depository instituions are now subject to

the Fed’s legal reserve requirements

2. All depository institutions are now authorized

to issue checking deposits.

3. All depository institutions now enjoy all the

advantages that only Federal Reserve member

banks formerly enjoyed.

The Banking act of 1999

The Gram – Leach – Bliley Act

- partially deregulates the financial industry.

- The law repealed big parts of the Glass –

Steagall Act of 1933.

Monetary Policy Lags

Fiscal and Monetary Policy Should Mesh

Who controls our Interest Rates?

The financial dependency of the U.S. Treasury

will have the foreign countries controlled the

Interest Rates. This foreign countries include,

Shanghai, Tokyo, London, Frankfurt and other

financial capitals.

Current Issue: The Housing Bubble, the

Subprime Mortgage Mess, and the Financial

Crisis of 2008

You might also like

- Daikin VRV Handbook - OHUS08-1FCU-bDocument72 pagesDaikin VRV Handbook - OHUS08-1FCU-bthanhthuan100% (1)

- Design Build and Assess Composite Hub Bar For Gyroplane Application GYRATEDocument30 pagesDesign Build and Assess Composite Hub Bar For Gyroplane Application GYRATEvictorNo ratings yet

- Villagracia Vs Fifth 5th Shari A District Court Case DigestDocument2 pagesVillagracia Vs Fifth 5th Shari A District Court Case Digestyannie110% (1)

- The Federal Reserve System and Monetary PolicyDocument20 pagesThe Federal Reserve System and Monetary PolicyBrithney ButalidNo ratings yet

- Fin 464 Chapter 2Document18 pagesFin 464 Chapter 2Ibteda Bin Sakayet 2013312630No ratings yet

- 6 Federal Reserve System and Monetary PolicyDocument20 pages6 Federal Reserve System and Monetary PolicyIrene OdatoNo ratings yet

- Fin 464 Chapter-02Document13 pagesFin 464 Chapter-02Sadia11No ratings yet

- 4.2.4. Interest Rate DeterminationDocument21 pages4.2.4. Interest Rate DeterminationGuy WilkinsonNo ratings yet

- CHAPTER 4 NarrativeDocument5 pagesCHAPTER 4 NarrativeJoyce Anne GarduqueNo ratings yet

- Government Policies and Financial Services (Commercial Banks)Document14 pagesGovernment Policies and Financial Services (Commercial Banks)Ahmed El KhateebNo ratings yet

- Interest Rate Determination TopicsDocument6 pagesInterest Rate Determination TopicsGian ErickaNo ratings yet

- Monetary Policy and Central Banking: Geriel I. Fajardo 3FM3 Assignment 2Document3 pagesMonetary Policy and Central Banking: Geriel I. Fajardo 3FM3 Assignment 2Geriel FajardoNo ratings yet

- Overview of Central BanksDocument6 pagesOverview of Central BanksMehwish AsimNo ratings yet

- FM Qu and AnswerDocument11 pagesFM Qu and AnswerMikiyas AnberbirNo ratings yet

- Unit 7 Central Banking - ESP Int'l Banking and FinanceDocument27 pagesUnit 7 Central Banking - ESP Int'l Banking and FinanceUyên PhươngNo ratings yet

- Banking OperationDocument5 pagesBanking OperationenobbeNo ratings yet

- Economic Development CHAPTER 14Document39 pagesEconomic Development CHAPTER 14Angelica BeltranNo ratings yet

- Fed and Financial PolicyDocument2 pagesFed and Financial PolicyjosephjbucciNo ratings yet

- Monetary Policy ToolsDocument8 pagesMonetary Policy ToolsFreddie254No ratings yet

- Central Banks, Their Functions and Role: Monetary Policy Bank Regulation Provide Financial Services HistoryDocument10 pagesCentral Banks, Their Functions and Role: Monetary Policy Bank Regulation Provide Financial Services HistoryJaypee JavierNo ratings yet

- Money and The Federal Reserve System: Learning ObjectivesDocument16 pagesMoney and The Federal Reserve System: Learning ObjectivesNeven Ahmed HassanNo ratings yet

- Depository Institutions (Chapter No - 4)Document53 pagesDepository Institutions (Chapter No - 4)Hashir AliNo ratings yet

- Definition of The Federal Funds RateDocument7 pagesDefinition of The Federal Funds RateNguyễn DungNo ratings yet

- CH 1 An Overview of The Financial System (Part 1A)Document32 pagesCH 1 An Overview of The Financial System (Part 1A)Sherif ElSheemyNo ratings yet

- Lecture 21 (19th Jan, 2009)Document16 pagesLecture 21 (19th Jan, 2009)sana ziaNo ratings yet

- Mac CH 14Document25 pagesMac CH 14karim kobeissiNo ratings yet

- Chapter Two: Banking SystemDocument45 pagesChapter Two: Banking Systemዝምታ ተሻለNo ratings yet

- Chapter 4 - Activities and Charactristics Under Depository InstitutionsDocument7 pagesChapter 4 - Activities and Charactristics Under Depository Institutionssonchaenyoung2No ratings yet

- C4 - Theory of Central Bank - NHACLC - G I L PDocument23 pagesC4 - Theory of Central Bank - NHACLC - G I L Pk60.2114310053No ratings yet

- 3 Chapter 3 Financial Institutions and Their Operations Lecture NotesDocument133 pages3 Chapter 3 Financial Institutions and Their Operations Lecture NotesAnimaw Yayeh100% (4)

- Functions of Central Bank in An EconomyDocument4 pagesFunctions of Central Bank in An EconomyShafiq MirdhaNo ratings yet

- Essen ch21 PresentationDocument21 pagesEssen ch21 PresentationVidya AsNo ratings yet

- Money Fulfills: Medium of Exchange Unit of Account Store of Value Standard of Deferred PaymentDocument43 pagesMoney Fulfills: Medium of Exchange Unit of Account Store of Value Standard of Deferred PaymentKc NgNo ratings yet

- Lect 2498Document29 pagesLect 2498AmrNo ratings yet

- Federal Funds Rate - What It Is, How It's Determined, and Why It's ImportantDocument6 pagesFederal Funds Rate - What It Is, How It's Determined, and Why It's ImportantDat TranNo ratings yet

- Submission Number: 1 Group Number: 34 Group Members: Non-Contributing Member (X)Document5 pagesSubmission Number: 1 Group Number: 34 Group Members: Non-Contributing Member (X)Darshna JhaNo ratings yet

- Dome Ba21 - Assign. Wk6-8Document2 pagesDome Ba21 - Assign. Wk6-8Jay Ann DomeNo ratings yet

- Week 6: Chapter 8Document2 pagesWeek 6: Chapter 8Jay Ann DomeNo ratings yet

- Financial and Fiscal PolicyDocument7 pagesFinancial and Fiscal PolicyLeonardo BanayNo ratings yet

- Lecture 1: Basics of Central Banks & Monetary Policy: Harjoat S. BhamraDocument68 pagesLecture 1: Basics of Central Banks & Monetary Policy: Harjoat S. Bhamranicola0808No ratings yet

- Lecture5 MonetaryPolicyFixedIncomeDocument133 pagesLecture5 MonetaryPolicyFixedIncomegghthtrhtNo ratings yet

- Monetary System: Dr. Katherine Sauer A Citizen's Guide To Economics ECO 1040Document32 pagesMonetary System: Dr. Katherine Sauer A Citizen's Guide To Economics ECO 1040Katherine SauerNo ratings yet

- Government Policy: Monetary & Fiscal PolicyDocument27 pagesGovernment Policy: Monetary & Fiscal PolicyGeorgia HolstNo ratings yet

- Banking in Other CountriesDocument37 pagesBanking in Other CountriesSudhansuSekharNo ratings yet

- Management 01Document15 pagesManagement 01Janet AnotdeNo ratings yet

- Major Duties and Responsibilities of Central BankDocument25 pagesMajor Duties and Responsibilities of Central BankSakkarai ManiNo ratings yet

- DF 53 Fmbo2Document20 pagesDF 53 Fmbo2Ashish PatangeNo ratings yet

- The Federal Reserve and Monetary PolicyDocument24 pagesThe Federal Reserve and Monetary PolicyMinijika MinijikaNo ratings yet

- What Is Monetary Policy?: Availability of CreditDocument15 pagesWhat Is Monetary Policy?: Availability of CreditGeraldine GuittapNo ratings yet

- US Subprime Mortgage CrisisDocument18 pagesUS Subprime Mortgage CrisisTestNo ratings yet

- Finance Assignment 2: Financial Crisis of 2008: Housing Market in USADocument2 pagesFinance Assignment 2: Financial Crisis of 2008: Housing Market in USADipankar BasumataryNo ratings yet

- Conduct of Monetary Policy Goal and TargetsDocument12 pagesConduct of Monetary Policy Goal and TargetsSumra KhanNo ratings yet

- Hid - Chapter 3 2015Document91 pagesHid - Chapter 3 2015hizkel hermNo ratings yet

- World Economy Financial Repression 1Document9 pagesWorld Economy Financial Repression 1dontmove14150No ratings yet

- Ch-CM-Depository InstitutionsDocument59 pagesCh-CM-Depository InstitutionsUzzaam HaiderNo ratings yet

- Lecture 9 Monetary Policy Decision Making 2022Document40 pagesLecture 9 Monetary Policy Decision Making 2022Onyee FongNo ratings yet

- Financial Institutions NotesDocument12 pagesFinancial Institutions NotesSherif ElSheemyNo ratings yet

- Money ExamDocument17 pagesMoney ExamRuslan MagamedovNo ratings yet

- Monetory Vs Fiscal Policy 25042021 121138amDocument52 pagesMonetory Vs Fiscal Policy 25042021 121138amMuhammad SarmadNo ratings yet

- The Money Supply and The Federal Reserve SystemDocument18 pagesThe Money Supply and The Federal Reserve SystemYuri AnnisaNo ratings yet

- Chapter 10 Conduct of Monetary Policy (Chapter 10) MishkinDocument82 pagesChapter 10 Conduct of Monetary Policy (Chapter 10) MishkinethandanfordNo ratings yet

- FinTech Rising: Navigating the maze of US & EU regulationsFrom EverandFinTech Rising: Navigating the maze of US & EU regulationsRating: 5 out of 5 stars5/5 (1)

- Money Facts: 169 Questions & Answers on MoneyFrom EverandMoney Facts: 169 Questions & Answers on MoneyNo ratings yet

- AngelDocument11 pagesAngelAngelica BeltranNo ratings yet

- Economic Development CHAPTER 14Document39 pagesEconomic Development CHAPTER 14Angelica BeltranNo ratings yet

- Internet ConnectionDocument14 pagesInternet ConnectionAngelica BeltranNo ratings yet

- Internal ControlDocument40 pagesInternal ControlAngelica BeltranNo ratings yet

- Traverse Adjustment ReportDocument3 pagesTraverse Adjustment Reportpopovicib_2No ratings yet

- E-Tivity 4 Research Question Proposed in E-Tivity-1Document2 pagesE-Tivity 4 Research Question Proposed in E-Tivity-1shanNo ratings yet

- Basicuma GD&TDocument258 pagesBasicuma GD&Tashu_adbnelNo ratings yet

- University of Gondar College of Business and Economics: Scool of Economics PPT Compiled For Macroeconomics IDocument83 pagesUniversity of Gondar College of Business and Economics: Scool of Economics PPT Compiled For Macroeconomics IMERSHANo ratings yet

- Icao Flight Plan FilingDocument2 pagesIcao Flight Plan FilingAnwar MuhammadNo ratings yet

- Water Proofing MethodologyDocument6 pagesWater Proofing Methodologykartick adhikaryNo ratings yet

- Comp DiumDocument1,003 pagesComp Diumdaw feiNo ratings yet

- OpenDesign Specification For .DWG FilesDocument246 pagesOpenDesign Specification For .DWG FilesPhilip Jeffrey TroweNo ratings yet

- The Management of Foreign Exchange RiskDocument97 pagesThe Management of Foreign Exchange RiskVajira Weerasena100% (1)

- 1 - Definition and Importance of Specification Writing - NewDocument16 pages1 - Definition and Importance of Specification Writing - Newprajoshi62No ratings yet

- Crew Appraisal Report: ALLIANZ-FRM-0202.13Document1 pageCrew Appraisal Report: ALLIANZ-FRM-0202.13dicky rahmatsyahNo ratings yet

- BSP Circular 942 PHDocument11 pagesBSP Circular 942 PHJoyce100% (1)

- Computers & Geosciences: Peisheng Zhao, Theodor Foerster, Peng YueDocument10 pagesComputers & Geosciences: Peisheng Zhao, Theodor Foerster, Peng YueBimotedjoNo ratings yet

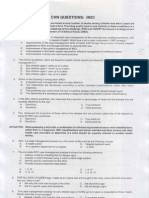

- CHN Questions ImciDocument5 pagesCHN Questions Imciredskie08100% (6)

- Manila Prince Hotel vs. GSISDocument5 pagesManila Prince Hotel vs. GSISFenina ReyesNo ratings yet

- Distribution Channel in Wagh Bakri TeaDocument5 pagesDistribution Channel in Wagh Bakri TeaJuned RajaNo ratings yet

- DynprogDocument18 pagesDynprogHykinel Bon GuarteNo ratings yet

- Proceso Quiros and Leonarda Villegas v. Marcelo Arjona, Teresita Balarbar, Josephine Arjona, and Conchita ArjonaDocument2 pagesProceso Quiros and Leonarda Villegas v. Marcelo Arjona, Teresita Balarbar, Josephine Arjona, and Conchita Arjonacassandra leeNo ratings yet

- 10 May 2021Document1 page10 May 2021TushNo ratings yet

- ESG Media ListDocument4 pagesESG Media ListPoojaa ShirsatNo ratings yet

- Japanese Depreciable Assets Tax Summary Report: No Data FoundDocument1 pageJapanese Depreciable Assets Tax Summary Report: No Data FoundrpillzNo ratings yet

- Iset 438Document13 pagesIset 438Nona AnnisaNo ratings yet

- RCPI OBE BST Paediatrics Curriculum Final PilotDocument40 pagesRCPI OBE BST Paediatrics Curriculum Final PilotBharat Kumar SharmaNo ratings yet

- Issue #72Document84 pagesIssue #72baltazzar_90No ratings yet

- Project Report On Ulip & Mutual FundDocument55 pagesProject Report On Ulip & Mutual FundGovind BhakuniNo ratings yet

- IU Video IndexDocument24 pagesIU Video IndexRhian VelasquezNo ratings yet

- Hospitals Air DistributionDocument51 pagesHospitals Air DistributionluisNo ratings yet