Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

39 viewsChange in PSR

Change in PSR

Uploaded by

PRABHAT JOSHI1. The partners X, Y, and Z previously shared profits in a 4:3:2 ratio but now decide to share equally. Their books show a profit and loss account with Rs. 120,000, general reserve of Rs. 45,000, workmen compensation reserve of Rs. 60,000, and an advertisement suspense account with a debit of Rs. 90,000.

2. Partners Anil, Sunil, and Ramesh previously shared profits in a 5:3:2 ratio but now decide to share equally. Goodwill is valued at Rs. 108,000 and exists in the books at Rs. 18,000.

3. Partners Babita, Kavita,

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You might also like

- Class 12 Accounts CA Parag GuptaDocument368 pagesClass 12 Accounts CA Parag GuptaJoel Varghese0% (1)

- Change in PSRDocument7 pagesChange in PSRBHUMIKA JAINNo ratings yet

- Change in Profit RatioDocument10 pagesChange in Profit RatioHansika SahuNo ratings yet

- Amity International School, Sector-1, Vasundhara Class Xii Subject: Accountancy Ch-3: Change in Profit Sharing Ratio Worksheet 1Document2 pagesAmity International School, Sector-1, Vasundhara Class Xii Subject: Accountancy Ch-3: Change in Profit Sharing Ratio Worksheet 1yuvanarya17No ratings yet

- Change in Profit Sharing Ratio - QnsDocument4 pagesChange in Profit Sharing Ratio - QnsChristo RajanNo ratings yet

- Retirement and Death (Revision) PDFDocument7 pagesRetirement and Death (Revision) PDFBHUMIKA JAINNo ratings yet

- Change in PSR WS 1 - DocxDocument3 pagesChange in PSR WS 1 - DocxGopika BaburajNo ratings yet

- Cheque in Profit Sharing RatioDocument3 pagesCheque in Profit Sharing Ratioxjnk6fwfvhNo ratings yet

- Saint Hood Convent School Assignment Ch.3 (Change in Profit Sharing Ratio Among The Existing Partners)Document3 pagesSaint Hood Convent School Assignment Ch.3 (Change in Profit Sharing Ratio Among The Existing Partners)Abhishek SharmaNo ratings yet

- Change in Profit Sharing Ratio Among Existing PartnersDocument3 pagesChange in Profit Sharing Ratio Among Existing Partnerssengaryashraj375No ratings yet

- Partnership and Non-For-Profit OrganisationsDocument4 pagesPartnership and Non-For-Profit OrganisationsJoshi DrcpNo ratings yet

- Summer Vacation Assignment - AccountancyDocument2 pagesSummer Vacation Assignment - Accountancykrishgupta723No ratings yet

- 12a PP-01 (1N2) AfpDocument6 pages12a PP-01 (1N2) AfpA.c. GuptaNo ratings yet

- WS 2 FUNDAMENTALS OF PARTNERSHIP - DocxDocument5 pagesWS 2 FUNDAMENTALS OF PARTNERSHIP - DocxGeorge Chalissery RajuNo ratings yet

- Reconstitution of A Partnership Firm: Learning ObjectivesDocument19 pagesReconstitution of A Partnership Firm: Learning ObjectivessukhjeetrajaNo ratings yet

- Accounting Question BankDocument4 pagesAccounting Question BankdhruvNo ratings yet

- (2022-23) 15-5-2022 Xii May Unit Test For Convent - Fundamental, Goodwill & Change in PSRDocument4 pages(2022-23) 15-5-2022 Xii May Unit Test For Convent - Fundamental, Goodwill & Change in PSRnitya mahajanNo ratings yet

- Sample Paper 2 G 12 - Accountancy - SUMMER BREAKDocument9 pagesSample Paper 2 G 12 - Accountancy - SUMMER BREAKpriya longaniNo ratings yet

- 2020 12 SP AccountancyDocument21 pages2020 12 SP AccountancySaroj ViswariNo ratings yet

- Ch-1 Accountancy 2019Document3 pagesCh-1 Accountancy 2019animeshmoh1No ratings yet

- 06 Sample PaperDocument40 pages06 Sample Papergaming loverNo ratings yet

- Past AdjustmentsDocument6 pagesPast Adjustmentsgaurav.jahnavimishraNo ratings yet

- QP Class Xii AccountancyDocument8 pagesQP Class Xii AccountancyRKS TECHNo ratings yet

- Accountancy Ques PaperDocument5 pagesAccountancy Ques Papersudarshanjha.0001No ratings yet

- ACCOUNTANCY-Practice QuestionsDocument6 pagesACCOUNTANCY-Practice QuestionsMary JaineNo ratings yet

- Delhi Public School: ACCOUNTANCY - (Subject Code: 055)Document4 pagesDelhi Public School: ACCOUNTANCY - (Subject Code: 055)AbhishekNo ratings yet

- Change in Profit Sharing Ratio Amongst TDocument2 pagesChange in Profit Sharing Ratio Amongst TSukhjinder SinghNo ratings yet

- Most Imp Questions Fundamentals To Admission - 240319 - 232457Document5 pagesMost Imp Questions Fundamentals To Admission - 240319 - 232457Qwe assdNo ratings yet

- CBSE Modle Question PaperDocument21 pagesCBSE Modle Question Papergaming loverNo ratings yet

- Account 12th ClassDocument4 pagesAccount 12th ClassMandeep KaurNo ratings yet

- Partnership FundamentalsDocument3 pagesPartnership FundamentalsDeepanshu kaushikNo ratings yet

- 12 Accounts CBSE Sample Papers 2019Document10 pages12 Accounts CBSE Sample Papers 2019Salokya KhandelwalNo ratings yet

- Aaaccountancy Ques Paper001Document5 pagesAaaccountancy Ques Paper001sudarshanjha.0001No ratings yet

- Practice Paper 2Document1 pagePractice Paper 2s99749649No ratings yet

- C XII Acc HOILDAY ASSIGNMENTDocument3 pagesC XII Acc HOILDAY ASSIGNMENTabhyanshsinghal49No ratings yet

- Grade-12 HHWDocument12 pagesGrade-12 HHWjanduharjinder65No ratings yet

- Partnership - Change in PSR - DPP 05 (Of Lecture 07) - (Kautilya)Document11 pagesPartnership - Change in PSR - DPP 05 (Of Lecture 07) - (Kautilya)Shreyash JhaNo ratings yet

- Summer Holiday Homework 2024 - Accountancy & Business StudiesDocument5 pagesSummer Holiday Homework 2024 - Accountancy & Business Studiessanskarprasad18No ratings yet

- Partnership Fundamentals - WorksheetDocument7 pagesPartnership Fundamentals - WorksheetMihika GunturNo ratings yet

- Basics of Partnership Unit 1Document1 pageBasics of Partnership Unit 1Kalpesh ShahNo ratings yet

- Change in Psr-12th Commerce-AccountancyDocument5 pagesChange in Psr-12th Commerce-Accountancysinghharshu3222No ratings yet

- Question Bank Accountancy (055) Class XiiDocument5 pagesQuestion Bank Accountancy (055) Class XiiDHIRENDRA KUMARNo ratings yet

- Xii Acct WDocument11 pagesXii Acct WFree Fire KingNo ratings yet

- Change in Profit Sharing Ratio - Weekly TestDocument6 pagesChange in Profit Sharing Ratio - Weekly TestAbi Abi100% (1)

- Accounting For Partnership Firms - Fundamentals (Revision)Document4 pagesAccounting For Partnership Firms - Fundamentals (Revision)pratham bhagatNo ratings yet

- Without AnswerDocument4 pagesWithout AnswerRakesh AryaNo ratings yet

- Class 12th Accountancy Set ADocument6 pagesClass 12th Accountancy Set AjashanjeetNo ratings yet

- Accountancy Sample Question PaperDocument20 pagesAccountancy Sample Question PaperrahulNo ratings yet

- Assignment PSRDocument3 pagesAssignment PSRTûshar ThakúrNo ratings yet

- Accounting For PartnershipDocument7 pagesAccounting For PartnershipShajila AnvarNo ratings yet

- Class XII Assignment - 2 Accounting For Partnership Firms-Fundamentals 1Document3 pagesClass XII Assignment - 2 Accounting For Partnership Firms-Fundamentals 1Lester Williams100% (1)

- Class XII Commerce (1) GGBDocument10 pagesClass XII Commerce (1) GGBAditya KocharNo ratings yet

- Admission of A Partner: Other Educational PortalsDocument31 pagesAdmission of A Partner: Other Educational Portalskkaur4No ratings yet

- 12 Accountancy Sample Paper 2014 04Document6 pages12 Accountancy Sample Paper 2014 04artisingh3412No ratings yet

- Xii Comm Holiday Homework 2020 23Document44 pagesXii Comm Holiday Homework 2020 23Mohit SuryavanshiNo ratings yet

- 12 Cbse Accountancy Set 1 QPDocument12 pages12 Cbse Accountancy Set 1 QPAymenNo ratings yet

- Retirement and Death of A Partner WorksheetDocument4 pagesRetirement and Death of A Partner WorksheettherealsadbroccoliNo ratings yet

- Cbse Questions Change in PSRDocument4 pagesCbse Questions Change in PSRDeepanshu kaushikNo ratings yet

- Corporate Financial Mastering: Simple Methods and Strategies to Financial Analysis MasteringFrom EverandCorporate Financial Mastering: Simple Methods and Strategies to Financial Analysis MasteringNo ratings yet

- Change in Profit Sharing Ratios: Class - XiiDocument23 pagesChange in Profit Sharing Ratios: Class - XiiPRABHAT JOSHINo ratings yet

- Fundamentals of PartnershipDocument26 pagesFundamentals of PartnershipPRABHAT JOSHINo ratings yet

- Cashflow Statement: Class - XiiDocument23 pagesCashflow Statement: Class - XiiPRABHAT JOSHINo ratings yet

- Accountancy: Goodwill: Nature and Valuation 1:00 HOURS Maximum Marks: 20Document3 pagesAccountancy: Goodwill: Nature and Valuation 1:00 HOURS Maximum Marks: 20PRABHAT JOSHINo ratings yet

Change in PSR

Change in PSR

Uploaded by

PRABHAT JOSHI0 ratings0% found this document useful (0 votes)

39 views26 pages1. The partners X, Y, and Z previously shared profits in a 4:3:2 ratio but now decide to share equally. Their books show a profit and loss account with Rs. 120,000, general reserve of Rs. 45,000, workmen compensation reserve of Rs. 60,000, and an advertisement suspense account with a debit of Rs. 90,000.

2. Partners Anil, Sunil, and Ramesh previously shared profits in a 5:3:2 ratio but now decide to share equally. Goodwill is valued at Rs. 108,000 and exists in the books at Rs. 18,000.

3. Partners Babita, Kavita,

Original Description:

Original Title

Untitled

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. The partners X, Y, and Z previously shared profits in a 4:3:2 ratio but now decide to share equally. Their books show a profit and loss account with Rs. 120,000, general reserve of Rs. 45,000, workmen compensation reserve of Rs. 60,000, and an advertisement suspense account with a debit of Rs. 90,000.

2. Partners Anil, Sunil, and Ramesh previously shared profits in a 5:3:2 ratio but now decide to share equally. Goodwill is valued at Rs. 108,000 and exists in the books at Rs. 18,000.

3. Partners Babita, Kavita,

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

39 views26 pagesChange in PSR

Change in PSR

Uploaded by

PRABHAT JOSHI1. The partners X, Y, and Z previously shared profits in a 4:3:2 ratio but now decide to share equally. Their books show a profit and loss account with Rs. 120,000, general reserve of Rs. 45,000, workmen compensation reserve of Rs. 60,000, and an advertisement suspense account with a debit of Rs. 90,000.

2. Partners Anil, Sunil, and Ramesh previously shared profits in a 5:3:2 ratio but now decide to share equally. Goodwill is valued at Rs. 108,000 and exists in the books at Rs. 18,000.

3. Partners Babita, Kavita,

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 26

Change in PSR

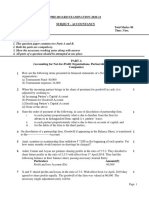

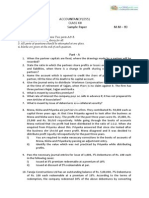

1. X, Y and Z are partners sharing profits in the ratio of 4:3:2.

From April 1, 2022, they decided to share the profits equally. On

that date their books showed the following items :

(i) Profit & Loss Account (Cr.) - Rs.1,20,000

(ii) General Reserve - Rs.45,000 ;

(iii) Workmen Compensation Reserve - Rs.60,000

(iv) Advertisement Suspense Account (Dr.) - Rs.90,000

Record the necessary Journal entries.

2. Anil, Sunil and Ramesh are partners sharing profits in the

ratio of 5:3: 2. They decide to share profits equally with effect

from 1st April, 2023. Goodwill of the firm is valued at

Rs.1,08,000. Goodwill exists in the books at Rs.18,000. Pass

the Jounal entries to record the above change :

(i) By passing a single adjustment entry

(ii) By raising and writing off goodwill.

3. Babita, Kavita and Dinesh were partners in a firm. From 1st

April, 2018 they decided to share the profits in the ratio of 2:3:5.

On this date the Balance Sheet of the firm showed a balance of

Rs.60,000 in Contingency Reserve and debit balance of

Rs.1,20,000 in Profit and Loss Account. The Goodwill of the firm

was valued at Rs.3,60,000. Pass necessary journal entries for the

above transactions in the books of the firm.

4. Vivek, Anil and Raman are partners in a firm sharing profits in the

ratio of 5:3:2. They decided to share profits, in the ratio of 2:3:5

w.e.f, 1st April, 2023. On the date of change in profit-sharing ratio,

the firm had balance in General Reserve of Rs.1,00,000. It was

agreed by the partners that out of General Reserve Rs.50,000 be

transferred to Workmen Compensation Reserve to meet a claim of

workers, if any. Pass the Journal entry for distributing General

Reserve on change in profit-sharing ratio.

5. X, Y and Z who are presently sharing profits and losses in the

ratio of 5:3:2 decide to share future profits & losses equally with

effect from 1st April, 2023. Goodwill of the firm is valued at

Rs.1,80,000. Goodwill already exists in the books at Rs.30,000.

Pass the necessary Journal entries for the adjustment of Goodwill

by raising and writing it off.

You might also like

- Class 12 Accounts CA Parag GuptaDocument368 pagesClass 12 Accounts CA Parag GuptaJoel Varghese0% (1)

- Change in PSRDocument7 pagesChange in PSRBHUMIKA JAINNo ratings yet

- Change in Profit RatioDocument10 pagesChange in Profit RatioHansika SahuNo ratings yet

- Amity International School, Sector-1, Vasundhara Class Xii Subject: Accountancy Ch-3: Change in Profit Sharing Ratio Worksheet 1Document2 pagesAmity International School, Sector-1, Vasundhara Class Xii Subject: Accountancy Ch-3: Change in Profit Sharing Ratio Worksheet 1yuvanarya17No ratings yet

- Change in Profit Sharing Ratio - QnsDocument4 pagesChange in Profit Sharing Ratio - QnsChristo RajanNo ratings yet

- Retirement and Death (Revision) PDFDocument7 pagesRetirement and Death (Revision) PDFBHUMIKA JAINNo ratings yet

- Change in PSR WS 1 - DocxDocument3 pagesChange in PSR WS 1 - DocxGopika BaburajNo ratings yet

- Cheque in Profit Sharing RatioDocument3 pagesCheque in Profit Sharing Ratioxjnk6fwfvhNo ratings yet

- Saint Hood Convent School Assignment Ch.3 (Change in Profit Sharing Ratio Among The Existing Partners)Document3 pagesSaint Hood Convent School Assignment Ch.3 (Change in Profit Sharing Ratio Among The Existing Partners)Abhishek SharmaNo ratings yet

- Change in Profit Sharing Ratio Among Existing PartnersDocument3 pagesChange in Profit Sharing Ratio Among Existing Partnerssengaryashraj375No ratings yet

- Partnership and Non-For-Profit OrganisationsDocument4 pagesPartnership and Non-For-Profit OrganisationsJoshi DrcpNo ratings yet

- Summer Vacation Assignment - AccountancyDocument2 pagesSummer Vacation Assignment - Accountancykrishgupta723No ratings yet

- 12a PP-01 (1N2) AfpDocument6 pages12a PP-01 (1N2) AfpA.c. GuptaNo ratings yet

- WS 2 FUNDAMENTALS OF PARTNERSHIP - DocxDocument5 pagesWS 2 FUNDAMENTALS OF PARTNERSHIP - DocxGeorge Chalissery RajuNo ratings yet

- Reconstitution of A Partnership Firm: Learning ObjectivesDocument19 pagesReconstitution of A Partnership Firm: Learning ObjectivessukhjeetrajaNo ratings yet

- Accounting Question BankDocument4 pagesAccounting Question BankdhruvNo ratings yet

- (2022-23) 15-5-2022 Xii May Unit Test For Convent - Fundamental, Goodwill & Change in PSRDocument4 pages(2022-23) 15-5-2022 Xii May Unit Test For Convent - Fundamental, Goodwill & Change in PSRnitya mahajanNo ratings yet

- Sample Paper 2 G 12 - Accountancy - SUMMER BREAKDocument9 pagesSample Paper 2 G 12 - Accountancy - SUMMER BREAKpriya longaniNo ratings yet

- 2020 12 SP AccountancyDocument21 pages2020 12 SP AccountancySaroj ViswariNo ratings yet

- Ch-1 Accountancy 2019Document3 pagesCh-1 Accountancy 2019animeshmoh1No ratings yet

- 06 Sample PaperDocument40 pages06 Sample Papergaming loverNo ratings yet

- Past AdjustmentsDocument6 pagesPast Adjustmentsgaurav.jahnavimishraNo ratings yet

- QP Class Xii AccountancyDocument8 pagesQP Class Xii AccountancyRKS TECHNo ratings yet

- Accountancy Ques PaperDocument5 pagesAccountancy Ques Papersudarshanjha.0001No ratings yet

- ACCOUNTANCY-Practice QuestionsDocument6 pagesACCOUNTANCY-Practice QuestionsMary JaineNo ratings yet

- Delhi Public School: ACCOUNTANCY - (Subject Code: 055)Document4 pagesDelhi Public School: ACCOUNTANCY - (Subject Code: 055)AbhishekNo ratings yet

- Change in Profit Sharing Ratio Amongst TDocument2 pagesChange in Profit Sharing Ratio Amongst TSukhjinder SinghNo ratings yet

- Most Imp Questions Fundamentals To Admission - 240319 - 232457Document5 pagesMost Imp Questions Fundamentals To Admission - 240319 - 232457Qwe assdNo ratings yet

- CBSE Modle Question PaperDocument21 pagesCBSE Modle Question Papergaming loverNo ratings yet

- Account 12th ClassDocument4 pagesAccount 12th ClassMandeep KaurNo ratings yet

- Partnership FundamentalsDocument3 pagesPartnership FundamentalsDeepanshu kaushikNo ratings yet

- 12 Accounts CBSE Sample Papers 2019Document10 pages12 Accounts CBSE Sample Papers 2019Salokya KhandelwalNo ratings yet

- Aaaccountancy Ques Paper001Document5 pagesAaaccountancy Ques Paper001sudarshanjha.0001No ratings yet

- Practice Paper 2Document1 pagePractice Paper 2s99749649No ratings yet

- C XII Acc HOILDAY ASSIGNMENTDocument3 pagesC XII Acc HOILDAY ASSIGNMENTabhyanshsinghal49No ratings yet

- Grade-12 HHWDocument12 pagesGrade-12 HHWjanduharjinder65No ratings yet

- Partnership - Change in PSR - DPP 05 (Of Lecture 07) - (Kautilya)Document11 pagesPartnership - Change in PSR - DPP 05 (Of Lecture 07) - (Kautilya)Shreyash JhaNo ratings yet

- Summer Holiday Homework 2024 - Accountancy & Business StudiesDocument5 pagesSummer Holiday Homework 2024 - Accountancy & Business Studiessanskarprasad18No ratings yet

- Partnership Fundamentals - WorksheetDocument7 pagesPartnership Fundamentals - WorksheetMihika GunturNo ratings yet

- Basics of Partnership Unit 1Document1 pageBasics of Partnership Unit 1Kalpesh ShahNo ratings yet

- Change in Psr-12th Commerce-AccountancyDocument5 pagesChange in Psr-12th Commerce-Accountancysinghharshu3222No ratings yet

- Question Bank Accountancy (055) Class XiiDocument5 pagesQuestion Bank Accountancy (055) Class XiiDHIRENDRA KUMARNo ratings yet

- Xii Acct WDocument11 pagesXii Acct WFree Fire KingNo ratings yet

- Change in Profit Sharing Ratio - Weekly TestDocument6 pagesChange in Profit Sharing Ratio - Weekly TestAbi Abi100% (1)

- Accounting For Partnership Firms - Fundamentals (Revision)Document4 pagesAccounting For Partnership Firms - Fundamentals (Revision)pratham bhagatNo ratings yet

- Without AnswerDocument4 pagesWithout AnswerRakesh AryaNo ratings yet

- Class 12th Accountancy Set ADocument6 pagesClass 12th Accountancy Set AjashanjeetNo ratings yet

- Accountancy Sample Question PaperDocument20 pagesAccountancy Sample Question PaperrahulNo ratings yet

- Assignment PSRDocument3 pagesAssignment PSRTûshar ThakúrNo ratings yet

- Accounting For PartnershipDocument7 pagesAccounting For PartnershipShajila AnvarNo ratings yet

- Class XII Assignment - 2 Accounting For Partnership Firms-Fundamentals 1Document3 pagesClass XII Assignment - 2 Accounting For Partnership Firms-Fundamentals 1Lester Williams100% (1)

- Class XII Commerce (1) GGBDocument10 pagesClass XII Commerce (1) GGBAditya KocharNo ratings yet

- Admission of A Partner: Other Educational PortalsDocument31 pagesAdmission of A Partner: Other Educational Portalskkaur4No ratings yet

- 12 Accountancy Sample Paper 2014 04Document6 pages12 Accountancy Sample Paper 2014 04artisingh3412No ratings yet

- Xii Comm Holiday Homework 2020 23Document44 pagesXii Comm Holiday Homework 2020 23Mohit SuryavanshiNo ratings yet

- 12 Cbse Accountancy Set 1 QPDocument12 pages12 Cbse Accountancy Set 1 QPAymenNo ratings yet

- Retirement and Death of A Partner WorksheetDocument4 pagesRetirement and Death of A Partner WorksheettherealsadbroccoliNo ratings yet

- Cbse Questions Change in PSRDocument4 pagesCbse Questions Change in PSRDeepanshu kaushikNo ratings yet

- Corporate Financial Mastering: Simple Methods and Strategies to Financial Analysis MasteringFrom EverandCorporate Financial Mastering: Simple Methods and Strategies to Financial Analysis MasteringNo ratings yet

- Change in Profit Sharing Ratios: Class - XiiDocument23 pagesChange in Profit Sharing Ratios: Class - XiiPRABHAT JOSHINo ratings yet

- Fundamentals of PartnershipDocument26 pagesFundamentals of PartnershipPRABHAT JOSHINo ratings yet

- Cashflow Statement: Class - XiiDocument23 pagesCashflow Statement: Class - XiiPRABHAT JOSHINo ratings yet

- Accountancy: Goodwill: Nature and Valuation 1:00 HOURS Maximum Marks: 20Document3 pagesAccountancy: Goodwill: Nature and Valuation 1:00 HOURS Maximum Marks: 20PRABHAT JOSHINo ratings yet