Professional Documents

Culture Documents

Ninth Edition: Cost-Volume-Profit Analysis: Additional Issues

Ninth Edition: Cost-Volume-Profit Analysis: Additional Issues

Uploaded by

GlenOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ninth Edition: Cost-Volume-Profit Analysis: Additional Issues

Ninth Edition: Cost-Volume-Profit Analysis: Additional Issues

Uploaded by

GlenCopyright:

Available Formats

Managerial Accounting

Ninth Edition

Weygandt Kimmel Mitchell

Chapter 6

Cost-Volume-Profit Analysis: Additional

Issues

This slide deck contains animations. Please disable animations if they cause issues with your device.

This deck contains equations authored in Math Type. For the full experience, please download the Math Type software plug-in.

Copyright ©2021 John Wiley & Sons, Inc.

Chapter Outline

Learning Objectives

LO 1 Apply basic CVP concepts.

LO 2 Explain the term sales mix and its effects on break-even sales.

LO 3 Determine sales mix when a company has limited resources.

LO 4 Indicate how operating leverage affects profitability.

Copyright ©2021 John Wiley & Sons, Inc. 2

Basic CVP Concepts

LEARNING OBJECTIVE 1

Apply basic CVP concepts.

CVP analysis:

• Study of the effects of changes in costs and volume on

a company’s profit.

• Important to profit planning.

• Critical in management decisions such as:

o determining product mix,

o maximizing use of production facilities, and

o setting selling prices.

LO 1 Copyright ©2021 John Wiley & Sons, Inc. 3

Basic CVP Concepts

• Management often wants the information reported in

a special format income statement.

• CVP income statement is for internal use only:

o Costs and expenses classified as fixed or variable.

o Reports contribution margin as a total amount and on

a per unit basis.

LO 1 Copyright ©2021 John Wiley & Sons, Inc. 4

Basic CVP Concepts

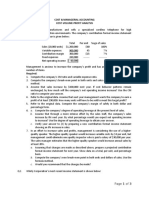

Detailed CVP income statement

Illustration 6.1

LO 1 Copyright ©2021 John Wiley & Sons, Inc. 5

Break-Even Analysis

Break-even point in units

Vargo Electronic’s CVP income statement (Ill. 6.1) shows that

total contribution margin is $320,000, and the company’s

contribution margin per unit is $200. Contribution margin

can also be expressed as the contribution margin ratio

which is 40% ($200 ÷ $500).

Illustration 6.2

LO 1 Copyright ©2021 John Wiley & Sons, Inc. 6

Break-Even Analysis

Break-even point in dollars

Vargo Electronic’s CVP income statement (Ill. 6.1) shows that

total contribution margin is $320,000, and the company’s

contribution margin per unit is $200. Break-even point in

sales dollars is $500,000 ($200,000 ÷ .40).

Illustration 6.3

LO 1 Copyright ©2021 John Wiley & Sons, Inc. 7

Target Net Income

Target net income in units

Once a company achieves break-even sales, it then sets a

sales goal that will generate a target net income.

Illustration: Assume Vargo’s management has a target net

income of $250,000. Compute the required sales in units to

achieve its target net income:

Illustration 6.4

LO 1 Copyright ©2021 John Wiley & Sons, Inc. 8

Target Net Income

Target net income in dollars

Once a company achieves break-even sales, it then sets a

sales goal that will generate a target net income.

Illustration: The contribution margin ratio is used to

compute required sales in dollars.

Illustration 6.5

LO 1 Copyright ©2021 John Wiley & Sons, Inc. 9

Margin of Safety

Margin of safety in dollars

• tells us how far sales can drop before the company will

operate at a loss.

• can be expressed in dollars or as a ratio.

Illustration: Assume Vargo’s sales are $800,000:

Illustration 6.6

LO 1 Copyright ©2021 John Wiley & Sons, Inc. 10

Margin of Safety

Margin of safety ratio

• tells us how far sales can drop before the company will

operate at a loss.

• can be expressed in dollars or as a ratio.

Illustration: Vargo’s sales could drop by $300,000, or 37.5%,

before the company would operate at a loss

Illustration 6.7

LO 1 Copyright ©2021 John Wiley & Sons, Inc. 11

CVP and Changes in the Bus.

Environment

Illustration: Original cell phone sales and cost data for Vargo

Electronics is as shown.

Illustration 6.8

Unit selling price $500

Unit variable costs $300

Total fixed costs $200,000

Break-even sales $500,000 or 1,000 units

LO 1 Copyright ©2021 John Wiley & Sons, Inc. 12

CVP and Changes in the Bus. Environment

Case I

A competitor is offering a 10% discount on the selling price

of its cell phones. What effect will a 10% discount on selling

price ($500 × 10% = $50) have on the breakeven point?

Illustration 6.9

LO 1 Copyright ©2021 John Wiley & Sons, Inc. 13

CVP and Changes in the Bus. Environment

Case II

Management invests in new robotic equipment that will

lower the amount of direct labor required to make cell

phones. The company estimates that total fixed costs will

increase 30% and that unit variable cost will decrease 30%.

What effect will the new equipment have on the sales

volume required to break even?

Illustration 6.10

LO 1 Copyright ©2021 John Wiley & Sons, Inc. 14

CVP and Changes in the Bus. Environment

Case III

Vargo’s principal supplier of raw materials has just

announced a price increase. The higher cost is expected to

increase the unit variable cost of cell phones by $25.

Management decides that it does not want to increase the

selling price of the cell phones. It plans a cost-cutting

program that will save $17,500 in fixed costs per month.

Vargo is currently realizing monthly net income of $80,000

on sales of 1,400 cell phones. What increase in units sold will

be needed to maintain the same level of net income?

LO 1 Copyright ©2021 John Wiley & Sons, Inc. 15

CVP and Changes in the Bus. Environment

Case III continued

Unit variable costs increase to $325 ($300 + $25).

Fixed costs are reduced to $182,500 ($200,000 − $17,500).

Unit contribution margin becomes $175 ($500 − $325).

Illustration 6.11

LO 1 Copyright ©2021 John Wiley & Sons, Inc. 16

Basic CVP Concepts

Review Question

Croc Catchers calculates its contribution margin to be less

than zero. Which statement is true?

a. Its fixed costs are less than the unit variable cost.

b. Its profits are greater than its total costs.

c. The company should sell more units.

d. Its selling price is less than its variable costs.

LO 1 Copyright ©2021 John Wiley & Sons, Inc. 17

Basic CVP Concepts

Review Answer

Croc Catchers calculates its contribution margin to be less

than zero. Which statement is true?

a. Its fixed costs are less than the unit variable cost.

b. Its profits are greater than its total costs.

c. The company should sell more units.

d. Answer: Its selling price is less than its variable costs.

LO 1 Copyright ©2021 John Wiley & Sons, Inc. 18

DO IT! 1: CVP Analysis

Krisanne Company reports the following operating

results for the month of June.

To increase net income, management is considering

reducing the selling price by 10%, with no changes to unit

variable costs or fixed costs. Management is confident

that this change will increase unit sales by 25%.

LO 1 Copyright ©2021 John Wiley & Sons, Inc. 19

DO IT! 1: CVP Analysis

Solution

Using the contribution margin technique, compute the break-

even point in sales units and sales dollars and margin of

safety in dollars assuming no changes to sales price or costs.

Break-even point in units = 4,167 units (rounded) ($100,000 ÷ $24)

Break-even point in sales dollars = $250,000 ($100,000 ÷ 40a)

Margin of safety in dollars = $50,000 ($300,000 − $250,000)

a

$24 ÷ $60

LO 1 Copyright ©2021 John Wiley & Sons, Inc. 20

DO IT! 1: CVP Analysis

Solution continued

Using the contribution margin technique, compute the

break-even point in sales units and sales dollars and margin

of safety in dollars assuming changes to sales price and

volume as described.

Break-even point in units = 5,556 units (round) ($100,000 ÷ $18b)

Break-even point in sales dollars = $300,000 ($100,000 ÷ ($18 ÷ $54c))

Margin of safety in dollars = $37,500 ($337,500d − $300,000)

b

($60 − (.10 × $60) − 36 = $18)

c

($60 − (.10 × $60)

d

(5,000 + (.25 × 5,000) = 6,250 units, 6,250 units × $54 = $337,500)

LO 1 Copyright ©2021 John Wiley & Sons, Inc. 21

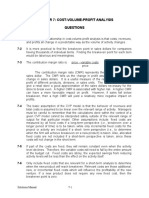

Sales Mix and Break-Even Sales

LEARNING OBJECTIVE 2

Explain the term sales mix and its effects on break-even

sales.

• Sales mix is the relative percentage in which a

company sells its products.

• If a company’s unit sales are 80% printers and 20% PCs,

its sales mix is 80% to 20%.

• Sales mix is important because different products often

have very different contribution margins.

LO 2 Copyright ©2021 John Wiley & Sons, Inc. 22

Break-Even Sales in Units

Sales mix as a percentage of units sold

Companies can compute break-even sales for a mix of

two or more products by determining the weighted-

average unit contribution margin of all the products.

Illustration: Vargo Electronics sells not only cell phones

but high-definition TVs as well. Vargo sells its two

products in the following amounts: 1,500 cell phones and

500 TVs.

Illustration 6.12

Cell Phones TVs

1,500 units ÷ 2,000 units = 75% 500 units ÷ 2,000 units = 25%

LO 2 Copyright ©2021 John Wiley & Sons, Inc. 23

Break-Even Sales in Units

Per unit data-sales mix

Additional information related to Vargo Electronics.

Illustration 6.13

Unit Data Cell Phones TVs

Selling price $500 $1,000

Variable costs 300 500

Contribution margin $200 $500

Sales mix ─ units 75% 25%

Fixed costs = $275,000

LO 2 Copyright ©2021 John Wiley & Sons, Inc. 24

Break-Even Sales in Units

Weighted-average unit contribution margin

First, determine weighted-average unit contribution

margin.

Illustration 6.14

LO 2 Copyright ©2021 John Wiley & Sons, Inc. 25

Break-Even Sales in Units

For a given sales mix

Then, compute the break-even point in sales units by

dividing the fixed costs by the weighted-average unit

contribution margin.

Illustration 6.15

LO 2 Copyright ©2021 John Wiley & Sons, Inc. 26

Break-Even Sales in Units

Break-even proof – sales units

• With break-even point of 1,000 units, Vargo must sell:

o 750 cell phones (1,000 units × 75%)

o 250 TVs (1,000 units × 25%)

• At this level, the total contribution margin will equal

the fixed costs of $275,000.

Illustration 6.16

LO 2 Copyright ©2021 John Wiley & Sons, Inc. 27

Break-Even Sales in Dollars

• Works well if company has many products.

• Calculates break-even point in terms of sales dollars for

o divisions or

o product lines,

o not individual products.

LO 2 Copyright ©2021 John Wiley & Sons, Inc. 28

Break-Even Sales in Dollars

Cost-volume-profit data

Kale Garden Supply Company has two divisions.

Illustration 6.17

Illustration 6.18

LO 2 Copyright ©2021 John Wiley & Sons, Inc. 29

Break-Even Sales in Dollars

Weighted average contribution margin

Determine weighted-average contribution margin.

Illustration 6.19

LO 2 Copyright ©2021 John Wiley & Sons, Inc. 30

Break-Even Sales in Dollars

Break-even point

Calculate break-even point in sales dollars.

Illustration 6.20

LO 2 Copyright ©2021 John Wiley & Sons, Inc. 31

Break-Even Sales in Dollars

More information

• With break-even sales of $937,500 and a sales mix of

20% to 80%, Kale must sell:

o $187,500 from the Indoor Plant Division

o $750,000 from the Outdoor Plant Division

• If sales mix becomes 50% to 50%, the weighted-

average contribution margin ratio changes to 35%,

resulting in a lower break-even point of $857,143.

LO 2 Copyright ©2021 John Wiley & Sons, Inc. 32

Break-Even Sales in Dollars

Review Question

Net income will be:

a. Greater if more higher-contribution margin units are

sold than lower-contribution margin units.

b. Greater if more lower-contribution margin units are

sold than higher-contribution margin units.

c. Equal as long as total sales remain equal, regardless of

which products are sold.

d. Unaffected by changes in the mix of products sold.

LO 2 Copyright ©2021 John Wiley & Sons, Inc. 33

Break-Even Sales in Dollars

Review Answer

Net income will be:

a. Answer: Greater if more higher-contribution margin

units are sold than lower-contribution margin units.

b. Greater if more lower-contribution margin units are

sold than higher-contribution margin units.

c. Equal as long as total sales remain equal, regardless of

which products are sold.

d. Unaffected by changes in the mix of products sold.

LO 2 Copyright ©2021 John Wiley & Sons, Inc. 34

DO IT! 2: Sales Mix Break-Even

Manzeck Bicycles International produces and sells three

different types of mountain bikes. Information regarding

the three models is shown below.

Pro Intermediate Standard Total

Units sold 5,000 10,000 25,000 40,000

Selling price $800 $500 $350

Variable costs $500 $300 $250

The company’s total fixed costs to produce the bicycles

are $7,500,000.

LO 2 Copyright ©2021 John Wiley & Sons, Inc. 35

DO IT! 2: Sales Mix Break-Even

Part (a) with solution

a) Determine the sales mix as a function of units sold for the

three products.

Pro Intermediate Standard Total

Units sold 5,000 10,000 25,000 40,000

Selling price $800 $500 $350

Variable costs $500 $300 $250

Solution

5,000 10,000 25,000

Pro = = 12.5% Intermediate = = 25% Standard = = 62.5%

40,000 40,000 40,000

LO 2 Copyright ©2021 John Wiley & Sons, Inc. 36

DO IT! 2: Sales Mix Break-Even

Part (b) with solution

b) Determine the weighted-average unit contribution

margin.

Pro Intermediate Standard Total

Units sold 5,000 10,000 25,000 40,000

Selling price $800 $500 $350

Variable costs $500 $300 $250

Solution

[.125 × ($800 - $500)] +

[. 25 × ($500 - $300)] +

[ .625 × ($350 - $250)] = $150

LO 2 Copyright ©2021 John Wiley & Sons, Inc. 37

DO IT! 2: Sales Mix Break-Even

Part (c) with solution

c) Determine the total number of units that the company

must sell to break even.

Pro Intermediate Standard Total

Units sold 5,000 10,000 25,000 40,000

Selling price $800 $500 $350

Variable costs $500 $300 $250

Solution

$7,500,000 ÷ $150 = 50,000 units

LO 2 Copyright ©2021 John Wiley & Sons, Inc. 38

DO IT! 2: Sales Mix Break-Even

Part (d) with solution

d) Determine the number of units of each model that the

company must sell to break even.

Pro Intermediate Standard Total

Units sold 5,000 10,000 25,000 40,000

Selling price $800 $500 $350

Variable costs $500 $300 $250

Solution

Pro: 50,000 units × 12.5% = 6,250 units

Intermediate: 50,000 units × 25% = 12,500 units

Standard: 50,000 units × 62.5% = 31,250 units

50,000 units

LO 2 Copyright ©2021 John Wiley & Sons, Inc. 39

Sales Mix with Limited Resources

LEARNING OBJECTIVE 3

Determine sales mix when a company has limited

resources.

• All companies have limited resources whether it be floor

space, raw materials, direct labor hours, etc.

• Management must decide which products to sell in order

to maximize net income.

Illustration: Vargo manufactures cell phones and TVs.

Machine capacity is limited to 3,600 hours per month.

Illustration 6.21

Cell Phones TVs

Unit contribution margin $200 $500

Machine hours required per unit .2 .625

LO 3 Copyright ©2021 John Wiley & Sons, Inc. 40

Sales Mix with Limited Resources

Contribution margin per unit of limited resource

Calculate the contribution margin per unit of limited

resource.

Illustration 6.22

This would suggest that, given sufficient demand for cell

phones, Vargo should shift the sales mix to produce more

cell phones or increase machine capacity.

LO 3 Copyright ©2021 John Wiley & Sons, Inc. 41

Sales Mix with Limited Resources

• Approach used to identify and manage constraints so

as to maximize the contribution margin given the

constraint.

• Company must continually

o identify its constraints and

o find ways to reduce or eliminate them, where

appropriate.

LO 3 Copyright ©2021 John Wiley & Sons, Inc. 42

Sales Mix with Limited Resources

Review Question

If the unit contribution margin is $15 and it takes 3.0

machine hours to produce the unit, the contribution

margin per unit of limited resource is:

a. $25.

b. $5.

c. $4.

d. No correct answer is given.

LO 3 Copyright ©2021 John Wiley & Sons, Inc. 43

Sales Mix with Limited Resources

Review Answer

If the unit contribution margin is $15 and it takes 3.0

machine hours to produce the unit, the contribution

margin per unit of limited resource is:

a. $25.

b. Answer: $5.

c. $4.

d. No correct answer is given.

LO 3 Copyright ©2021 John Wiley & Sons, Inc. 44

DO IT! 3: Sales Mix with Limited

Resources

Carolina Corporation manufactures and sells three

different types of high-quality sealed ball bearings for

mountain bike wheels. The bearings vary in terms of their

quality specifications—primarily with respect to their

smoothness and roundness. They are referred to as Fine,

Extra-Fine, and Super-Fine bearings. Machine time is

limited. More machine time is required to manufacture

the Extra-Fine and Super-Fine bearings.

LO 3 Copyright ©2021 John Wiley & Sons, Inc. 45

DO IT! 3: Sales Mix with Limited Resources

Additional information

LO 3 Copyright ©2021 John Wiley & Sons, Inc. 46

DO IT! 3: Sales Mix with Limited Resources

Solution

What is the contribution margin per unit of limited resource

for each type of bearing?

Fine Extra - Fine Super - Fine

Unit Contribution margin $2 $3.5 $5

= $100 = $87.50 = $62.50

Limited resource consumed per unit .02 .04 .08

LO 3 Copyright ©2021 John Wiley & Sons, Inc. 47

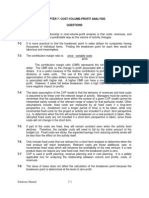

Operating Leverage and Profitability

LEARNING OBJECTIVE 4

Indicate how operating leverage affects profitability.

Cost Structure is the relative proportion of fixed versus

variable costs that a company incurs.

• May have a significant effect on profitability

• Company must carefully consider its cost structure.

LO 4 Copyright ©2021 John Wiley & Sons, Inc. 48

Operating Leverage and Profitability

Vargo Electronics and one of its competitors, New Wave

Company, both make consumer electronics. Vargo uses a

traditional, labor-intensive manufacturing process. New

Wave has invested in a completely automated system.

The factory employees are involved only in setting up,

adjusting, and maintaining the machinery.

LO 4 Copyright ©2021 John Wiley & Sons, Inc. 49

Operating Leverage and Profitability

CVP income statements for two companies

Illustration 6.24

LO 4 Copyright ©2021 John Wiley & Sons, Inc. 50

Operating Leverage and Profitability

Contribution margin ratio for two companies

Illustration 6.25

• New Wave contributes 80 cents of contribution margin for

each dollar of increased sales while Vargo only contributes

40 cents.

• New Wave’s cost structure, which relies on fixed costs, is

more sensitive to changes in sales revenue.

LO 4 Copyright ©2021 John Wiley & Sons, Inc. 51

Effect on Break-Even Point

Illustration 6.26

• New Wave needs to generate $150,000 more in sales

($650,000 − $500,000) than Vargo to break-even.

• Because of the greater break-even sales required, New

Wave is a riskier company than Vargo.

LO 4 Copyright ©2021 John Wiley & Sons, Inc. 52

Effect on Margin of Safety

Illustration 6.27

• The difference in ratios reflects the difference in risk

between New Wave and Vargo.

• Vargo can sustain a 38% decline in sales before operating

at a loss versus only a 19% decline for New Wave.

LO 4 Copyright ©2021 John Wiley & Sons, Inc. 53

Operating Leverage

• Extent that net income reacts to a given change in

sales.

• Higher fixed costs relative to variable costs cause a

company to have higher operating leverage.

• When sales revenues are increasing, high operating

leverage means that profits will increase rapidly.

• When sales revenues are declining, too much

operating leverage can have devastating

consequences.

LO 4 Copyright ©2021 John Wiley & Sons, Inc. 54

Degree of Operating Leverage

• Provides a measure of a company’s earnings volatility.

• Computed by dividing contribution margin by net

income.

Illustration 6.28

LO 4 Copyright ©2021 John Wiley & Sons, Inc. 55

Operating Leverage

Review Question

The degree of operating leverage:

a. Can be computed by dividing contribution margin by

net income.

b. Provides a measure of the company’s earnings

volatility.

c. Affects a company’s break-even point.

d. All of the above.

LO 4 Copyright ©2021 John Wiley & Sons, Inc. 56

Operating Leverage

Review Answer

The degree of operating leverage:

a. Can be computed by dividing contribution margin by

net income.

b. Provides a measure of the company’s earnings

volatility.

c. Affects a company’s break-even point.

d. Answer: All of the above.

LO 4 Copyright ©2021 John Wiley & Sons, Inc. 57

DO IT! 4: Operating Leverage

Rexfield Corp., a company specializing in crime scene

investigations, is contemplating an investment in

automated mass-spectrometers. Its current process relies

on a high number of lab technicians. The new equipment

would employ a computerized expert system. The

company’s CEO has requested a comparison of the old

technology versus the new technology. The accounting

department has prepared the following CVP income

statements for use in your analysis.

LO 4 Copyright ©2021 John Wiley & Sons, Inc. 58

DO IT! 4: Operating Leverage

Solution

Compute the degree of operating leverage.

Contribution Margin ÷ Net Income = Degree of Operating Leverage

Old $600,000 ÷ $200,000 = 3.00

New $1,400,000 ÷ $200,000 = 7.00

LO 4 Copyright ©2021 John Wiley & Sons, Inc. 59

Absorption Costing vs. Variable Costing

LEARNING OBJECTIVE 5

Explain the differences between absorption costing and

variable costing.

• In earlier chapters, we classified both variable and

fixed manufacturing costs as product costs. This

costing approach is referred to as full or absorption

costing.

• We now present an alternative approach, variable

costing, which is consistent with the cost-volume-

profit material presented in Chapters 5 and 6.

LO 5 Copyright ©2021 John Wiley & Sons, Inc. 60

Absorption Costing versus Variable

Costing

Under variable costing, product costs consist of:

• Direct Materials

• Direct Labor

• Variable Manufacturing Overhead

Difference between absorption and variable costing is:

Illustration 6A.1

LO 5 Copyright ©2021 John Wiley & Sons, Inc. 61

Absorption Costing versus Variable

Costing

Additional differences

The difference between absorption and variable costing:

• Under both costing methods, selling and

administrative expenses are treated as period costs.

• Companies may not use variable costing for external

financial reports because GAAP requires that fixed

manufacturing overhead be treated as a product cost.

LO 5 Copyright ©2021 John Wiley & Sons, Inc. 62

Absorption Costing versus Variable Costing

Illustration

Premium Products Corporation manufactures a polyurethane

sealant, called Fix-It, for car windshields. Relevant data for Fix-It in

January 2022, the first month of production are shown.

Illustration 6A.2

Selling Price $20 per unit.

Units Produced 30,000; sold 20,000; beginning inventory zero.

Unit variable Manufacturing $9 (direct materials $5, direct labor $3, and variable

costs overhead $1).

Selling and administrative expenses $2.

Fixed costs Manufacturing overhead $120,000.

Selling and administrative expenses $15,000.

LO 5 Copyright ©2021 John Wiley & Sons, Inc. 63

Absorption versus Variable Costing

Contribution of per unit manufacturing cost

Illustration 6A.3

Manufacturing cost per unit is $4 ($13 − $9) higher for

absorption costing because fixed manufacturing costs are

treated as product costs.

LO 5 Copyright ©2021 John Wiley & Sons, Inc. 64

Absorption Costing Example

Illustration 6A.4

LO 5 Copyright ©2021 John Wiley & Sons, Inc. 65

Variable Costing Example

Illustration 6A.5

LO 5 Copyright ©2021 John Wiley & Sons, Inc. 66

Absorption Costing versus Variable Costing

Review Question

Fixed manufacturing overhead costs are recognized as:

a. Period costs under absorption costing.

b. Product costs under absorption costing.

c. Product costs under variable costing.

d. Part of ending inventory costs under both absorption

and variable costing.

LO 5 Copyright ©2021 John Wiley & Sons, Inc. 67

Absorption Costing versus Variable Costing

Review Answer

Fixed manufacturing overhead costs are recognized as:

a. Period costs under absorption costing.

b. Answer: Product costs under absorption costing.

c. Product costs under variable costing.

d. Part of ending inventory costs under both absorption

and variable costing.

LO 5 Copyright ©2021 John Wiley & Sons, Inc. 68

Decision-Making Concerns

• Generally accepted accounting principles require that

absorption costing be used for the costing of inventory

for external reporting purposes.

• Net income measured under GAAP (absorption

costing) is often used internally to

o evaluate performance,

o justify cost reductions, or

o evaluate new projects.

LO 5 Copyright ©2021 John Wiley & Sons, Inc. 69

Decision-Making Concerns

• Net income calculated using GAAP may not highlight

differences between variable and fixed costs and may

lead to poor business decisions.

• Thus, some companies use variable costing for internal

reporting purposes.

LO 5 Copyright ©2021 John Wiley & Sons, Inc. 70

Advantages of Variable Costing

1. Net income computed under variable costing is unaffected

by changes in production levels.

2. Variable costing readily supports cost-volume-profit

analysis.

3. Net income computed under variable costing is closely

tied to changes in sales levels and therefore provides a

more realistic assessment of a company’s success or

failure.

4. The presentation of fixed-cost and variable-cost

components on the variable costing income statement

makes it easier to identify these costs.

LO 5 Copyright ©2021 John Wiley & Sons, Inc. 71

DO IT! 5: Variable Costing

Franklin Company produces and sells tennis balls. The following

costs are available for the year ended December 31, 2022. The

company has no beginning inventory. In 2022, 8,000,000 units were

produced, but only 7,500,000 units were sold. The unit selling price

was $0.50 per ball. Costs and expenses were as follows.

Unit variable costs

Direct materials $0.10

Direct labor 0.05

Variable manufacturing overhead 0.08

Variable selling and administrative expenses 0.02

Annual fixed costs and expenses

Manufacturing overhead $500,000

Selling and administrative expenses 100,000

LO 5 Copyright ©2021 John Wiley & Sons, Inc. 72

DO IT! 5: Variable Costing

Solution to part a.

Unit variable costs

Direct materials $0.10

Direct labor 0.05

Variable manufacturing overhead 0.08

Variable selling and administrative expenses 0.02

Annual fixed costs and expenses

Manufacturing overhead $500,000

Selling and administrative expenses 100,000

a. Compute the manufacturing cost of one unit of product using

variable costing. Direct materials $0.10

Direct labor 0.05

Variable manufacturing overhead 0.08

$0.23

LO 5 Copyright ©2021 John Wiley & Sons, Inc. 73

DO IT! 5: Variable Costing

Solution to part b.

b. Prepare a 2022 income statement for Franklin

Company using variable costing.

LO 5 Copyright ©2021 John Wiley & Sons, Inc. 74

Copyright

Copyright © 2021 John Wiley & Sons, Inc.

All rights reserved. Reproduction or translation of this work beyond that permitted in

Section 117 of the 1976 United States Act without the express written permission of the

copyright owner is unlawful. Request for further information should be addressed to the

Permissions Department, John Wiley & Sons, Inc. The purchaser may make back-up copies

for his/her own use only and not for distribution or resale. The Publisher assumes no

responsibility for errors, omissions, or damages, caused by the use of these programs or

from the use of the information contained herein.

Copyright ©2021 John Wiley & Sons, Inc. 75

You might also like

- CH 06Document74 pagesCH 06Mohammed Samy100% (1)

- CH 06Document75 pagesCH 06nugroho.aditya12334No ratings yet

- Week 5 Ch05 Part IIDocument49 pagesWeek 5 Ch05 Part IIkhullarhimani1No ratings yet

- CH 06Document62 pagesCH 06Abdallah AlfaqiehNo ratings yet

- Managerial Accounting Ch06Document33 pagesManagerial Accounting Ch06Mohammed HassanNo ratings yet

- BAB 2024 CH06 - Cost Volume Profit Analysis-Add - Issue.Document74 pagesBAB 2024 CH06 - Cost Volume Profit Analysis-Add - Issue.mini3110No ratings yet

- Chapter 6 Lecture Slides 9eDocument44 pagesChapter 6 Lecture Slides 9ecolinmac8892No ratings yet

- Managerial Accounting: Tools For Business Decision-MakingDocument68 pagesManagerial Accounting: Tools For Business Decision-MakingdavidNo ratings yet

- Cost Volume Profit Analysis - With KEYDocument8 pagesCost Volume Profit Analysis - With KEYPatricia AtienzaNo ratings yet

- CVP Analysis F5 NotesDocument7 pagesCVP Analysis F5 NotesSiddiqua Kashif100% (1)

- Chapter 06 - Cost-Volume-Profit RelationshipsDocument15 pagesChapter 06 - Cost-Volume-Profit RelationshipsHardly Dare GonzalesNo ratings yet

- Chapter 6:part Two Cost-Volume-ProfitDocument44 pagesChapter 6:part Two Cost-Volume-ProfitFidelina CastroNo ratings yet

- Cost and Managerial Accounting LL Chap 1Document60 pagesCost and Managerial Accounting LL Chap 1fekadegebretsadik478729No ratings yet

- Managerial Accounting: Tools For Business Decision-MakingDocument69 pagesManagerial Accounting: Tools For Business Decision-MakingdavidNo ratings yet

- CVP H101Document4 pagesCVP H101poppy2890No ratings yet

- Week 8 Break Even PointDocument35 pagesWeek 8 Break Even Pointmeet swatchNo ratings yet

- I. Questions:: Let's Check!Document15 pagesI. Questions:: Let's Check!Santiago BuladacoNo ratings yet

- ULOb - Degree of Operating and Financial Leverage-SIM - 0Document11 pagesULOb - Degree of Operating and Financial Leverage-SIM - 0lilienesieraNo ratings yet

- Cost & Managerial Accounting Cost-Volume-Profit Analysis: Page 1 of 3Document3 pagesCost & Managerial Accounting Cost-Volume-Profit Analysis: Page 1 of 3mohammad bilal0% (1)

- Wey AP 14e PPT Ch22 Cost-Volume-ProfitDocument89 pagesWey AP 14e PPT Ch22 Cost-Volume-ProfitLan AnhNo ratings yet

- Cost Volume ProfitDocument4 pagesCost Volume ProfitProf_RamanaNo ratings yet

- Acst6003 Week11 Tutorial SolutionsDocument5 pagesAcst6003 Week11 Tutorial Solutionsyida chenNo ratings yet

- Chapter 7: Cost-Volume-Profit Analysis Questions: Solutions ManualDocument49 pagesChapter 7: Cost-Volume-Profit Analysis Questions: Solutions ManualdarraNo ratings yet

- Blue White and Black Geometric Mathematics Lesson Math Creative Presentation SlidesCarnivalDocument23 pagesBlue White and Black Geometric Mathematics Lesson Math Creative Presentation SlidesCarnivalUmer HanifNo ratings yet

- Nguyễn Bảo Ngọc - BAFNIU17016Document3 pagesNguyễn Bảo Ngọc - BAFNIU17016Thu ThuNo ratings yet

- Ms 03 - CVP AnalysisDocument10 pagesMs 03 - CVP AnalysisDin Rose GonzalesNo ratings yet

- At 3Document8 pagesAt 3Joshua GibsonNo ratings yet

- CH 5Document21 pagesCH 5gebremedhnNo ratings yet

- Week 4 ch05 Part IDocument34 pagesWeek 4 ch05 Part Ikhullarhimani1No ratings yet

- Wey - AP - 14e - PPT - Ch23 - Incremental-Analysis 2Document41 pagesWey - AP - 14e - PPT - Ch23 - Incremental-Analysis 2ffalghamdiNo ratings yet

- Acct 202 Ch6Document39 pagesAcct 202 Ch6Hải Anh LươngNo ratings yet

- Case Study On Standard Costing and CVP AnalysisDocument3 pagesCase Study On Standard Costing and CVP AnalysisEmmanuel VillafuerteNo ratings yet

- 2012 Quiz 2 Questions and Solutions All SectionsDocument9 pages2012 Quiz 2 Questions and Solutions All SectionsgckodaliNo ratings yet

- CVP Analysis Review Problem With SolutionDocument1 pageCVP Analysis Review Problem With SolutionSUNNY BHUSHAN0% (1)

- Chapter 6 Cost-Volume-Profit Relationships: True/False QuestionsDocument51 pagesChapter 6 Cost-Volume-Profit Relationships: True/False Questionsmimi supasNo ratings yet

- M09 Berk0821 04 Ism C091Document15 pagesM09 Berk0821 04 Ism C091Linda VoNo ratings yet

- CH 05Document87 pagesCH 05ChristyNo ratings yet

- CH 16Document95 pagesCH 16alexalbizzati.instacartNo ratings yet

- Chap 5Document52 pagesChap 5jacks ocNo ratings yet

- Day 11 Chap 6 Rev. FI5 Ex PRDocument8 pagesDay 11 Chap 6 Rev. FI5 Ex PRChristian De Leon0% (2)

- CH 22Document87 pagesCH 22ahmed eldemiryNo ratings yet

- CVPDocument45 pagesCVPRona Mae Ocampo ResareNo ratings yet

- Income Statement Ratios and Common-Size AnalysisDocument1 pageIncome Statement Ratios and Common-Size Analysisarmor.coverNo ratings yet

- Topic 6 Supplement (Cost of Capital, Capital Structure and Risk)Document36 pagesTopic 6 Supplement (Cost of Capital, Capital Structure and Risk)Jessica Adharana KurniaNo ratings yet

- CH 12Document48 pagesCH 12Nguyen Ngoc Minh Chau (K15 HL)No ratings yet

- Solutions To Week 3 Practice Text ExercisesDocument6 pagesSolutions To Week 3 Practice Text Exercisespinkgold48No ratings yet

- R37 Measures of Leverage Q BankDocument9 pagesR37 Measures of Leverage Q BankSohail MerchantNo ratings yet

- Cost-Volume-Profit Analysis - StudentDocument7 pagesCost-Volume-Profit Analysis - StudentGlaizel LarragaNo ratings yet

- Topic 5 ExercisesDocument3 pagesTopic 5 ExercisesLavenyaa Tharmamurthy100% (1)

- Exam 21082011Document8 pagesExam 21082011Rabah ElmasriNo ratings yet

- Materi Amb CH 8Document73 pagesMateri Amb CH 8Sri HaryantiNo ratings yet

- Chapter 3 CPV Latest For Non-FinMgrs - PPDocument61 pagesChapter 3 CPV Latest For Non-FinMgrs - PPWendimagen Meshesha FantaNo ratings yet

- Evaluating Project Economics and Capital Rationing: Before You Go On Questions and AnswersDocument46 pagesEvaluating Project Economics and Capital Rationing: Before You Go On Questions and AnswersNguyen Thanh Tung (K15 HL)No ratings yet

- Adv Cost Assignment 2023Document6 pagesAdv Cost Assignment 2023GETAHUN ASSEFA ALEMUNo ratings yet

- 01 Leverages FTDocument7 pages01 Leverages FT1038 Kareena SoodNo ratings yet

- TT09 CVPDocument10 pagesTT09 CVPanhhanna102No ratings yet

- Summary of Heather Brilliant & Elizabeth Collins's Why Moats MatterFrom EverandSummary of Heather Brilliant & Elizabeth Collins's Why Moats MatterNo ratings yet

- The Key to Higher Profits: Pricing PowerFrom EverandThe Key to Higher Profits: Pricing PowerRating: 5 out of 5 stars5/5 (1)