Professional Documents

Culture Documents

Chapter 01

Chapter 01

Uploaded by

Oscar AnabizcaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 01

Chapter 01

Uploaded by

Oscar AnabizcaCopyright:

Available Formats

Table of Contents

Chapter 1 (Introduction)

Special Products Break-Even Analysis (Section 1.2)

1.2 – 1.6

Advertising Problem (UW Lecture)

1.8 – 1.21

An illustration of the management science approach to a problem. At the University of

Washington, this is the very first lecture in the core MBA class on management science. While it

includes some advanced topics (Solver, nonlinear objectives, etc.) it can be taught entirely on the

spreadsheet in a very intuitive way, and has proven to be a good introduction to the power of

Solver. The next several lectures then would need to “back up” and cover more of the

fundamentals of linear programming, modeling, the Solver, etc.

McGraw-Hill/Irwin 1.1 © The McGraw-Hill Companies, Inc., 2008

Special Products Break-Even Analysis

• The Special Products Company produces expensive and unusual gifts.

• The latest new-product proposal is a limited edition grandfather clock.

• Data:

– If they go ahead with this product, a fixed cost of $50,000 is incurred.

– The variable cost is $400 per clock produced.

– Each clock sold would generate $900 in revenue.

– A sales forecast will be obtained.

Question: Should they produce the clocks, and if so, how many?

McGraw-Hill/Irwin 1.2 © The McGraw-Hill Companies, Inc., 2008

Expressing the Problem Mathematically

• Decision variable:

– Q = Number of grandfather clocks to produce

• Costs:

– Fixed Cost = $50,000 (if Q > 0)

– Variable Cost = $400 Q

– Total Cost =

• 0, if Q = 0

• $50,000 + $400 Q, if Q > 0

• Profit:

– Profit = Total revenue – Total cost

• Profit = 0, if Q = 0

• Profit = $900Q – ($50,000 + $400Q) = –$50,000 + $500Q, if Q > 0

McGraw-Hill/Irwin 1.3 © The McGraw-Hill Companies, Inc., 2008

Special Products Co. Spreadsheet

B C D E F

3 Data Results

4 Unit Revenue $900 Total Revenue $180,000

5 Fixed Cost $50,000 Total Fixed Cost $50,000

6 Marginal Cost $400 Total Variable Cost $80,000

7 Sales Forecast 300 Profit (Loss) $50,000

8 Range Name Cell

9 Production Quantity 200 FixedCost C5

MarginalCost C6

ProductionQuantity C9

Profit F7

SalesForecast C7

E F TotalFixedCost F5

3 Results TotalRevenue F4

4 Total Revenue =UnitRevenue*MIN(SalesForecast,ProductionQuantity) TotalVariableCost F6

UnitRevenue C4

5 Total Fixed Cost =IF(ProductionQuantity>0,FixedCost,0)

6 Total Variable Cost =MarginalCost*ProductionQuantity

7 Profit (Loss) =TotalRevenue-(TotalFixedCost+TotalVariableCost)

McGraw-Hill/Irwin 1.4 © The McGraw-Hill Companies, Inc., 2008

Analysis of the Problem

$200,000

$160,000

Revenue = $900 x

Profit

$120,000

Fixed cost Cost = $50,000 + $400 x

$80,000

Loss

$40,000

0 40 80 120 160 200 x

Break-even point = 100 units

McGraw-Hill/Irwin 1.5 © The McGraw-Hill Companies, Inc., 2008

Management Science Interactive Modules

• Sensitivity analysis can be performed using the Break-Even module in the Interactive

Management Science Modules (available on your MS Courseware CD packaged with

the text).

– Here we see the impact of changing the fixed cost to $75,000.

McGraw-Hill/Irwin 1.6 © The McGraw-Hill Companies, Inc., 2008

Special Products Co. Spreadsheet

B C D E F

3 Data Results

4 Unit Revenue $900 Total Revenue $270,000

5 Fixed Cost $50,000 Total Fixed Cost $50,000

6 Marginal Cost $400 Total Variable Cost $120,000

7 Sales Forecast 300 Profit (Loss) $100,000

8 Range Name Cell

9 Production Quantity 300 Break-Even Point 100 FixedCost C5

MarginalCost C6

ProductionQuantity C9

E F Profit F7

SalesForecast C7

3 Results

TotalFixedCost F5

4 Total Revenue =UnitRevenue*MIN(SalesForecast,ProductionQuantity) TotalRevenue F4

5 Total Fixed Cost =IF(ProductionQuantity>0,FixedCost,0) TotalVariableCost F6

6 Total Variable Cost =MarginalCost*ProductionQuantity UnitRevenue C4

7 Profit (Loss) =TotalRevenue-(TotalFixedCost+TotalVariableCost)

8

9 Break-Even Point =FixedCost/(UnitRevenue-MarginalCost)

McGraw-Hill/Irwin 1.7 © The McGraw-Hill Companies, Inc., 2008

An Advertising Problem

• Parker Mothers is a manufacturer of children’s toys and games. One of their hottest

selling toys is an interactive electronic Harry Potter doll.

• Some data:

– Unit Variable Cost: $48

– Unit Selling Price: $65

– Fixed Overhead: $42,000

• Parker Mothers has analyzed past data for the Harry Potter doll (and other similar toys),

and determined that sales are affected by a number of factors:

– the season (e.g., more at Christmas, more when a new Harry Potter book or movie is released,

etc.),

– the size of the sales force devoted to the product,

– the level of advertising.

Question: What should the advertising budget for the Harry Potter doll be? (Proposal:

$50,000)

McGraw-Hill/Irwin 1.8 © The McGraw-Hill Companies, Inc., 2008

Predicting the Sales Level

• After performing a statistical regression analysis, they estimate that sales for the quarter will be approximately

related to the season and advertising budget, as follows:

Sales (Seasonality Factor) 2000+35 $Advertising

• Seasonality Factors:

– Q1: 1.2 (publication of new Harry Potter book)

– Q2: 0.7

– Q3: 0.8

– Q4: 1.3 (Christmas and expected release of new Harry Potter movie)

• Effect of Advertising:

Sales

Advertising + (Sales Force/2)

McGraw-Hill/Irwin 1.9 © The McGraw-Hill Companies, Inc., 2008

Spreadsheet for Quarter 1

B C

3 Parameters:

4 Unit Variable Cost $48

5 Unit Price $65

6 Fixed Overhead $42,000

7 Seasonality 1.2

8

9 Decision Variable:

10 Advertising $50,000

11

12 Quarter Q1 B C

13 Expected Units Sold 11,791 12 Quarter Q1

14 13 Expected Units Sold =C7*(2000+35*SQRT(C10))

15 Sales Revenue $766,447 14

16 Cost of Sales $565,991 15 Sales Revenue =C13*$C$5

17 Gross Margin $200,455 16 Cost of Sales =C13*$C$4

18 17 Gross Margin =C15-C16

18

19 Advertising Cost $50,000 19 Advertising Cost =C10

20 Fixed Overhead $42,000 20 Fixed Overhead =$C$6

21 21

22 Profit $108,455 22 Profit =C17-C19-C20

McGraw-Hill/Irwin 1.10 © The McGraw-Hill Companies, Inc., 2008

3 Parameters:

B C

Trial Solutions

4 Unit Variable Cost $48

5 Unit Price $65

6 Fixed Overhead $42,000

7 Seasonality 1.2

8

9 Decision Variable: C C C

10 Advertising $50,000 10 $100,000 10 $150,000 10 $200,000

11 11 11 11

12 Quarter Q1 12 Q1 12 Q1 12 Q1

13 Expected Units Sold 11,791 13 15,682 13 18,667 13 21,183

14 14 14 14

15 Sales Revenue $766,447 15 $1,019,302 15 $1,213,324 15 $1,376,893

16 Cost of Sales $565,991 16 $752,715 16 $895,993 16 $1,016,783

17 Gross Margin $200,455 17 $266,587 17 $317,331 17 $360,111

18 18 18 18

19 Advertising Cost $50,000 19 $100,000 19 $150,000 19 $200,000

20 Fixed Overhead $42,000 20 $42,000 20 $42,000 20 $42,000

21 21 21 21

22 Profit $108,455 22 $124,587 22 $125,331 22 $118,111

B C

9 Decision Variable:

10 Advertising $125,000

11

12 Quarter Q1

13 Expected Units Sold 17,249

14

15 Sales Revenue $1,121,201

16 Cost of Sales $827,964

17 Gross Margin $293,237

18

19 Advertising Cost $125,000

20 Fixed Overhead $42,000

21

22 Profit $126,237

McGraw-Hill/Irwin 1.11 © The McGraw-Hill Companies, Inc., 2008

The Excel Solver

B C

3 Parameters:

4 Unit Variable Cost $48

5 Unit Price $65

6 Fixed Overhead $42,000

7 Seasonality 1.2

8

9 Decision Variable:

10 Advertising $50,000

11

12 Quarter Q1

13 Expected Units Sold 11,791

14

15 Sales Revenue $766,447

16 Cost of Sales $565,991

17 Gross Margin $200,455

18

19 Advertising Cost $50,000

20 Fixed Overhead $42,000

21

22 Profit $108,455

McGraw-Hill/Irwin 1.12 © The McGraw-Hill Companies, Inc., 2008

The Optimized Solution

B C

3 Parameters:

4 Unit Variable Cost $48

5 Unit Price $65

6 Fixed Overhead $42,000

7 Seasonality 1.2

8

9 Decision Variable:

10 Advertising $127,449

11

12 Quarter Q1

13 Expected Units Sold 17,394

14

15 Sales Revenue $1,130,610

16 Cost of Sales $834,912

17 Gross Margin $295,698

18

19 Advertising Cost $127,449

20 Fixed Overhead $42,000

21

22 Profit $126,249

McGraw-Hill/Irwin 1.13 © The McGraw-Hill Companies, Inc., 2008

Four Quarters Spreadsheet

B C D E F G

3 Parameters:

4 Unit Variable Cost $48

5 Unit Price $65

6 Fixed Overhead $42,000

7 Seasonality 1.2 0.7 0.8 1.3

8

9 Total

10 Decision Variables: Advertising

11 Advertising $50,000 $50,000 $50,000 $50,000 $200,000

12

13 Quarter Q1 Q2 Q3 Q4 Total

14 Expected Units Sold 11,791 6,878 7,861 12,774 39,305

15

16 Sales Revenue $766,447 $447,094 $510,964 $830,317 $2,554,822

17 Cost of Sales $565,991 $330,162 $377,328 $613,157 $1,886,638

18 Gross Margin $200,455 $116,932 $133,637 $217,160 $668,184

19

20 Advertising Cost $50,000 $50,000 $50,000 $50,000 $200,000

21 Fixed Overhead $42,000 $42,000 $42,000 $42,000 $168,000

22

23 Profit $108,455 $24,932 $41,637 $125,160 $300,184

McGraw-Hill/Irwin 1.14 © The McGraw-Hill Companies, Inc., 2008

Four Quarters Solver Optimized

B C D E F G

3 Parameters:

4 Unit Variable Cost $48

5 Unit Price $65

6 Fixed Overhead $42,000

7 Seasonality 1.2 0.7 0.8 1.3

8

9 Total

10 Decision Variables: Advertising

11 Advertising $127,449 $43,368 $56,644 $149,576 $377,036

12

13 Quarter Q1 Q2 Q3 Q4 Total

14 Expected Units Sold 17,394 6,502 8,264 20,197 52,357

15

16 Sales Revenue $1,130,610 $422,638 $537,160 $1,312,813 $3,403,221

17 Cost of Sales $834,912 $312,102 $396,672 $969,462 $2,513,148

18 Gross Margin $295,698 $110,536 $140,488 $343,351 $890,073

19

20 Advertising Cost $127,449 $43,368 $56,644 $149,576 $377,036

21 Fixed Overhead $42,000 $42,000 $42,000 $42,000 $168,000

22

23 Profit $126,249 $25,168 $41,844 $151,776 $345,037

McGraw-Hill/Irwin 1.15 © The McGraw-Hill Companies, Inc., 2008

Residual Effect

B C D E F G

3 Parameters:

4 Unit Variable Cost $48

5 Unit Price $65

6 Fixed Overhead $42,000

7 Seasonality 1.2 0.7 0.8 1.3

8 Advertising Previous Q4 $50,000

9 Total

10 Decision Variables: Advertising

11 Advertising $127,449 $43,368 $56,644 $149,576 $377,036

12

13 Quarter Q1 Q2 Q3 Q4 Total

14 Expected Units Sold 15,959 7,817 8,025 18,473 50,273

15

16 Sales Revenue $1,037,305 $508,078 $521,654 $1,200,723 $3,267,760

17 Cost of Sales $766,010 $375,196 $385,221 $886,688 $2,413,115

18 Gross Margin $271,295 $132,882 $136,433 $314,035 $854,645

19

20 Advertising Cost $127,449 $43,368 $56,644 $149,576 $377,036

21 Fixed Overhead $42,000 $42,000 $42,000 $42,000 $168,000

22

23 Profit $101,846 $47,514 $37,789 $122,460 $309,608

B C D

7 Seasonality 1.2 0.7

8 Advertising Previous Q4 50000

13 Quarter Q1 Q2

14 Expected Units Sold =C7*(2000+35*SQRT(0.7*C11+0.3*C8)) =D7*(2000+35*SQRT(0.7*D11+0.3*C11))

E F G

13 Q3 Q4 Total

14 =E7*(2000+35*SQRT(0.7*E11+0.3*D11)) =F7*(2000+35*SQRT(0.7*F11+0.3*E11)) =SUM(C14:F14)

McGraw-Hill/Irwin 1.16 © The McGraw-Hill Companies, Inc., 2008

Residual Effect (Solver Optimized)

B C D E F G

3 Parameters:

4 Unit Variable Cost $48

5 Unit Price $65

6 Fixed Overhead $42,000

7 Seasonality 1.2 0.7 0.8 1.3

8 Advertising Previous Q4 $50,000

9 Total

10 Decision Variables: Advertising

11 Advertising $173,577 -$21,148 $130,494 $48,777 $331,700

12

13 Quarter Q1 Q2 Q3 Q4 Total

14 Expected Units Sold 17,917 6,130 9,763 14,918 48,729

15

16 Sales Revenue $1,164,637 $398,437 $634,621 $969,669 $3,167,364

17 Cost of Sales $860,040 $294,231 $468,643 $716,063 $2,338,977

18 Gross Margin $304,597 $104,207 $165,978 $253,606 $828,388

19

20 Advertising Cost $173,577 -$21,148 $130,494 $48,777 $331,700

21 Fixed Overhead $42,000 $42,000 $42,000 $42,000 $168,000

22

23 Profit $89,021 $83,354 -$6,516 $162,829 $328,688

McGraw-Hill/Irwin 1.17 © The McGraw-Hill Companies, Inc., 2008

Solver Options

McGraw-Hill/Irwin 1.18 © The McGraw-Hill Companies, Inc., 2008

Residual Effect (Solver Re-Optimized)

B C D E F G

3 Parameters:

4 Unit Variable Cost $48

5 Unit Price $65

6 Fixed Overhead $42,000

7 Seasonality 1.2 0.7 0.8 1.3

8 Advertising Previous Q4 $50,000

9 Total

10 Decision Variables: Advertising

11 Advertising $155,280 $0 $121,431 $52,661 $329,371

12

13 Quarter Q1 Q2 Q3 Q4 Total

14 Expected Units Sold 17,172 6,688 9,763 14,918 48,541

15

16 Sales Revenue $1,116,152 $434,714 $634,621 $969,669 $3,155,157

17 Cost of Sales $824,236 $321,020 $468,643 $716,063 $2,329,962

18 Gross Margin $291,917 $113,694 $165,978 $253,606 $825,195

19

20 Advertising Cost $155,280 $0 $121,431 $52,661 $329,371

21 Fixed Overhead $42,000 $42,000 $42,000 $42,000 $168,000

22

23 Profit $94,637 $71,694 $2,547 $158,945 $327,823

McGraw-Hill/Irwin 1.19 © The McGraw-Hill Companies, Inc., 2008

Residual Effect with Budget (Optimized)

B C D E F G H I

3 Parameters:

4 Unit Variable Cost $48

5 Unit Price $65

6 Fixed Overhead $42,000

7 Seasonality 1.2 0.7 0.8 1.3

8 Advertising Previous Q4 $50,000

9 Total

10 Decision Variables: Advertising

11 Advertising $91,433 $0 $75,727 $32,841 $200,000 <= $200,000

12

13 Quarter Q1 Q2 Q3 Q4 Total

14 Expected Units Sold 14,205 5,458 8,047 12,327 40,037

15

16 Sales Revenue $923,334 $354,749 $523,030 $801,286 $2,602,398

17 Cost of Sales $681,846 $261,969 $386,237 $591,719 $1,921,771

18 Gross Margin $241,487 $92,781 $136,792 $209,567 $680,627

19

20 Advertising Cost $91,433 $0 $75,727 $32,841 $200,000

21 Fixed Overhead $42,000 $42,000 $42,000 $42,000 $168,000

22

23 Profit $108,055 $50,781 $19,066 $134,726 $312,627

McGraw-Hill/Irwin 1.20 © The McGraw-Hill Companies, Inc., 2008

Adding a Constraint in Solver

McGraw-Hill/Irwin 1.21 © The McGraw-Hill Companies, Inc., 2008

You might also like

- Team 6 - Pricing Assignment 2 - Cambridge Software Corporation V 1.0Document7 pagesTeam 6 - Pricing Assignment 2 - Cambridge Software Corporation V 1.0SJ100% (1)

- Advanced Portfolio Management: A Quant's Guide for Fundamental InvestorsFrom EverandAdvanced Portfolio Management: A Quant's Guide for Fundamental InvestorsNo ratings yet

- HatilDocument29 pagesHatilmd. nazmul100% (1)

- Test Bank Business Environment and Concepts 2Document69 pagesTest Bank Business Environment and Concepts 2Sky SoronoiNo ratings yet

- Sikap Sari SariDocument3 pagesSikap Sari SariJuliet Lobrino Rozos100% (5)

- 6-3B - High-Low Method, Scattergraph, Least-Squares RegressionDocument8 pages6-3B - High-Low Method, Scattergraph, Least-Squares RegressionDias AdhyaksaNo ratings yet

- Chapter 1 (Introduction) : Special Products Break-Even Analysis (Section 1.2) 1.2 - 1.6Document6 pagesChapter 1 (Introduction) : Special Products Break-Even Analysis (Section 1.2) 1.2 - 1.6Ashish Kumar SinghNo ratings yet

- MGT1107 Management Science Chapter 1Document20 pagesMGT1107 Management Science Chapter 1mark100% (1)

- Chapter 4 CVP AnalysisDocument15 pagesChapter 4 CVP AnalysisMaria Beatriz NavecisNo ratings yet

- Cost-Volume-Profit Relationships: Chapter SixDocument70 pagesCost-Volume-Profit Relationships: Chapter SixFadillah AhmadNo ratings yet

- Cost-Volume-Profit Relationships: Chapter SixDocument82 pagesCost-Volume-Profit Relationships: Chapter SixThet MatiasNo ratings yet

- Break-Even Analysis: Cost-Volume-Profit AnalysisDocument64 pagesBreak-Even Analysis: Cost-Volume-Profit AnalysisKelvin LeongNo ratings yet

- Foundations of Financial Management: Spreadsheet TemplatesDocument7 pagesFoundations of Financial Management: Spreadsheet Templatesalaa_h1100% (1)

- CVP AnalysisDocument36 pagesCVP Analysisghosh71No ratings yet

- 5a Relevant Revenue Cost and Decision MakingDocument6 pages5a Relevant Revenue Cost and Decision MakingGina TingdayNo ratings yet

- CHP 4Document132 pagesCHP 4HumaNo ratings yet

- Cost-Volume-Profit: Prepared by Meifida IlyasDocument64 pagesCost-Volume-Profit: Prepared by Meifida IlyasDixi AndriantoNo ratings yet

- Pure Competition: Mcgraw-Hill/IrwinDocument31 pagesPure Competition: Mcgraw-Hill/IrwinLeticia AvelynNo ratings yet

- Chapter 05Document97 pagesChapter 05milkie beigeNo ratings yet

- Solutions For CH 9 2-26-14Document15 pagesSolutions For CH 9 2-26-14Rafael Ricardo VilleroNo ratings yet

- CVP AnalysisDocument25 pagesCVP AnalysisemonNo ratings yet

- CH 8 Part 2Document15 pagesCH 8 Part 2Hanif QusyairyNo ratings yet

- CH 05Document3 pagesCH 05Gus JooNo ratings yet

- CH 9 Key Ans and Practice QuestionsDocument19 pagesCH 9 Key Ans and Practice QuestionsNCTNo ratings yet

- Lecture 8 CVP Analysis Spring 2023Document30 pagesLecture 8 CVP Analysis Spring 2023MJ jNo ratings yet

- Breakeven New ProductDocument2 pagesBreakeven New Productapi-26315128No ratings yet

- Demonstration Problem For Chapter 3Document6 pagesDemonstration Problem For Chapter 3Abiha SamarahNo ratings yet

- Garrison12ce PPT Ch04Document78 pagesGarrison12ce PPT Ch04snsahaNo ratings yet

- Cost Accounting Level 3/series 2-2009Document17 pagesCost Accounting Level 3/series 2-2009Hein Linn Kyaw100% (5)

- bài tập ôn MA1Document34 pagesbài tập ôn MA1Thái DươngNo ratings yet

- Ch.14 AnsDocument9 pagesCh.14 AnsWaSx3lyNo ratings yet

- Chap5 (E)Document60 pagesChap5 (E)Kiên Lê TrungNo ratings yet

- Operating Financial LeverageDocument64 pagesOperating Financial LeverageArafatNo ratings yet

- Man15e SG-Solutions Ch-06Document20 pagesMan15e SG-Solutions Ch-06DeniseNo ratings yet

- CVP PPT 1st YrDocument81 pagesCVP PPT 1st YrZachary AstorNo ratings yet

- b4 Biaya Profit VolumeDocument55 pagesb4 Biaya Profit Volumevi. bluesNo ratings yet

- CorpFin 2Document76 pagesCorpFin 2Rohan ShekarNo ratings yet

- Course Name Lecturer Name: Cost AccountingDocument21 pagesCourse Name Lecturer Name: Cost AccountingTurbo TechNo ratings yet

- Chapter3 CVP RelationshipDocument20 pagesChapter3 CVP RelationshipCarina Carollo MalinaoNo ratings yet

- Cost-Volume-Profit Analysis: Mcgraw-Hill/IrwinDocument78 pagesCost-Volume-Profit Analysis: Mcgraw-Hill/IrwinSheila Jane Maderse AbraganNo ratings yet

- Question 1-1-1Document14 pagesQuestion 1-1-1Aqsa AnumNo ratings yet

- Garrison 17e GEs PPT Chapter 6Document19 pagesGarrison 17e GEs PPT Chapter 6Jawad ahmadNo ratings yet

- Break-Even Analysis - Revision.: A Technique To Help Answer Some Key QuestionsDocument18 pagesBreak-Even Analysis - Revision.: A Technique To Help Answer Some Key QuestionsUncle MattNo ratings yet

- Test Bank Advanced Accounting 10E by Beams Chapter 05Document24 pagesTest Bank Advanced Accounting 10E by Beams Chapter 05Ahmed SuleymanNo ratings yet

- Small Firm SpreasheetDocument1 pageSmall Firm Spreasheetakpe1234No ratings yet

- LEVERAGEDocument46 pagesLEVERAGEFaza Rizky WijayaNo ratings yet

- Quiz 2 Am c1 - 20 FebDocument8 pagesQuiz 2 Am c1 - 20 FebJonathan ChandraNo ratings yet

- 06 Cost Volume Profit RelationshipsDocument74 pages06 Cost Volume Profit RelationshipsGxjn LxmnNo ratings yet

- Operating and Financial LeverageDocument64 pagesOperating and Financial Leveragendim betaNo ratings yet

- Operating and Financial Leverage Operating and Financial LeverageDocument64 pagesOperating and Financial Leverage Operating and Financial LeverageAbhiram Pratap SinghNo ratings yet

- Profitability AnalysisDocument6 pagesProfitability AnalysisawaischeemaNo ratings yet

- Fm10 Op and Fin LeverageDocument63 pagesFm10 Op and Fin Leverageayu nailil kiromahNo ratings yet

- Special Products Co. Break-Even Analysis: Data Results Range Name CellDocument1 pageSpecial Products Co. Break-Even Analysis: Data Results Range Name CellJoelo De VeraNo ratings yet

- Special Products Co. Break-Even Analysis: Data Results Range Name CellDocument1 pageSpecial Products Co. Break-Even Analysis: Data Results Range Name CellANo ratings yet

- Special Products Chapter 1Document1 pageSpecial Products Chapter 1Aina AguirreNo ratings yet

- Special ProductsDocument1 pageSpecial Productsjohngay1987No ratings yet

- Hansen AISE IM Ch11Document73 pagesHansen AISE IM Ch11indahNo ratings yet

- Hilton 11e Chap007PPTDocument53 pagesHilton 11e Chap007PPTNgô Khánh HòaNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Business Genetics: Understanding 21st Century Corporations using xBMLFrom EverandBusiness Genetics: Understanding 21st Century Corporations using xBMLNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Corbal Brand StoreDocument3 pagesCorbal Brand StoreYrishinadh ACCANo ratings yet

- Higher Interest Rate For Real Estate PDFDocument8 pagesHigher Interest Rate For Real Estate PDFRexxNo ratings yet

- Opencell FirstCall Deck v1Document18 pagesOpencell FirstCall Deck v1Langit BriuNo ratings yet

- InsideView Ebook Modern Guide To Social Selling PDFDocument14 pagesInsideView Ebook Modern Guide To Social Selling PDFGiridharNo ratings yet

- Product Differentiation Strategy For Competitive AdvantageDocument11 pagesProduct Differentiation Strategy For Competitive AdvantageOIRCNo ratings yet

- Marketing Management 2016.2017Document7 pagesMarketing Management 2016.2017seyon sithamparanathanNo ratings yet

- ElasticityDocument42 pagesElasticityVansh JainNo ratings yet

- Customer Satisfaction, Market Share and ProfitabilityDocument15 pagesCustomer Satisfaction, Market Share and Profitabilityxaxif826550% (2)

- Practice Set Audit - LiabilitiesDocument12 pagesPractice Set Audit - LiabilitiesKayla MirandaNo ratings yet

- The Big Three Credit Rating Agencies Emphasis: Standard and Poor'sDocument7 pagesThe Big Three Credit Rating Agencies Emphasis: Standard and Poor'sVanessa_Dsilva_1300No ratings yet

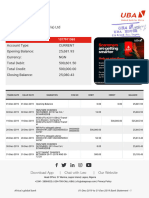

- Bank Statement For Ebesun Company (Nigeria) LTD, UBA GroupDocument2 pagesBank Statement For Ebesun Company (Nigeria) LTD, UBA GroupChidinma NnoliNo ratings yet

- Report On Credit Appraisal in PNBDocument76 pagesReport On Credit Appraisal in PNBSanchit GoyalNo ratings yet

- Module 3Document51 pagesModule 3SohnNo ratings yet

- Course Code:8503 Unit # 03: EntrepreneurshipDocument29 pagesCourse Code:8503 Unit # 03: EntrepreneurshipSalaha AbdullahNo ratings yet

- Resume CVDocument5 pagesResume CVNicky NgNo ratings yet

- Case Study PresentationDocument13 pagesCase Study PresentationOmkar PawarNo ratings yet

- Determinants of Interest RatesDocument27 pagesDeterminants of Interest RatesraviNo ratings yet

- © Mcgraw-Hill EducationDocument5 pages© Mcgraw-Hill EducationNishat TasnovaNo ratings yet

- 2nd Evaluation Exam Management Services - January 11, 2017 (G.Sanchez)Document16 pages2nd Evaluation Exam Management Services - January 11, 2017 (G.Sanchez)Beverlene BatiNo ratings yet

- Wiley CFA Test Bank 180408 (40 Preguntas) - PDF - Net Present Value - Internal Rate of ReturnDocument23 pagesWiley CFA Test Bank 180408 (40 Preguntas) - PDF - Net Present Value - Internal Rate of ReturndbohnentvNo ratings yet

- Brief Background and OverviewDocument2 pagesBrief Background and OverviewCamille MarieNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument21 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceAmbuj ChaturvediNo ratings yet

- Heo and Lee (2009) - IJHM PDFDocument8 pagesHeo and Lee (2009) - IJHM PDFCharlie RNo ratings yet

- Study of Emerging Retail Formats: Name: Class: Academic Year: Guided By: Prof. Prabha Kumari.:Submitted ToDocument22 pagesStudy of Emerging Retail Formats: Name: Class: Academic Year: Guided By: Prof. Prabha Kumari.:Submitted ToAniket PatekarNo ratings yet

- BE Mar 2020 Assignment SolutionDocument9 pagesBE Mar 2020 Assignment SolutionJATINNo ratings yet

- Ôn Tâp CLC 2022Document4 pagesÔn Tâp CLC 202227. Đặng Hà NhiNo ratings yet

- SBL Mini Case - WFI-Question - Part 1 - 7-9-2022Document2 pagesSBL Mini Case - WFI-Question - Part 1 - 7-9-2022RosieNo ratings yet

- General Manager Director Operations Sales in Cleveland OH Resume Christopher TerrellDocument2 pagesGeneral Manager Director Operations Sales in Cleveland OH Resume Christopher TerrellChristopher TerrellNo ratings yet