Professional Documents

Culture Documents

3 - Financial Statements and Ratio Analysis Ratios - Liquidity Ratios and Activity Ratios

3 - Financial Statements and Ratio Analysis Ratios - Liquidity Ratios and Activity Ratios

Uploaded by

Raneem AlCopyright:

Available Formats

You might also like

- FRM Part 2 TopicsDocument4 pagesFRM Part 2 Topicschan6No ratings yet

- Economics-: Stock Investing 101Document2 pagesEconomics-: Stock Investing 101Tanishka Saluja0% (1)

- ORF 335: Introduction To Financial Mathematics Instructor: Course InformationDocument3 pagesORF 335: Introduction To Financial Mathematics Instructor: Course Informationtsrockon28No ratings yet

- Financial Statements and Ratio AnalysisDocument47 pagesFinancial Statements and Ratio AnalysisYunita AngelicaNo ratings yet

- Chapter 3-Ratio AnalysisDocument25 pagesChapter 3-Ratio AnalysisDewi khornida marheniNo ratings yet

- Financial Statement and Ratio Analysis GitmanDocument51 pagesFinancial Statement and Ratio Analysis GitmanrajeshNo ratings yet

- Chapter 3Document59 pagesChapter 3NEW TECK INFINITYNo ratings yet

- Financial Statements and Ratio Analysis: All Rights ReservedDocument54 pagesFinancial Statements and Ratio Analysis: All Rights ReservedDark WingsNo ratings yet

- The Stockholders' Report: © 2012 Pearson Prentice Hall. All Rights ReservedDocument185 pagesThe Stockholders' Report: © 2012 Pearson Prentice Hall. All Rights ReservedrabNo ratings yet

- The Stockholders' Report: © 2012 Pearson Prentice Hall. All Rights ReservedDocument56 pagesThe Stockholders' Report: © 2012 Pearson Prentice Hall. All Rights ReservedJanine ElijahNo ratings yet

- FIN Chapter 3Document42 pagesFIN Chapter 3tarek khanNo ratings yet

- Financial Statements and Ratio Analysis: Learning GoalsDocument31 pagesFinancial Statements and Ratio Analysis: Learning GoalsMohammadNo ratings yet

- C3 - Financial Statement and Ratio AnalysisDocument13 pagesC3 - Financial Statement and Ratio AnalysisRoxanne GiananNo ratings yet

- Gitman pmf13 ppt03Document68 pagesGitman pmf13 ppt03CARLOS ANDRESNo ratings yet

- Financial Statements and Ratio Analysis: All Rights ReservedDocument68 pagesFinancial Statements and Ratio Analysis: All Rights ReservedAshis Ur RahmanNo ratings yet

- Financial Statements and Ratio AnalysisDocument42 pagesFinancial Statements and Ratio AnalysisMd. Rezwan Hossain Sakib 1711977630No ratings yet

- Curso DE Finanzas Corporativas. Material Tomado De: Financial Statements and Ratio AnalysisDocument58 pagesCurso DE Finanzas Corporativas. Material Tomado De: Financial Statements and Ratio AnalysisCArmen CruzNo ratings yet

- Financial Statments and Ratio - Chapter 2-p1Document12 pagesFinancial Statments and Ratio - Chapter 2-p1Mo'men ElboklNo ratings yet

- 2 - CH 3 Gitman 14eDocument64 pages2 - CH 3 Gitman 14eannisawulandariNo ratings yet

- M03 Gitman50803X 14 MF C03Document65 pagesM03 Gitman50803X 14 MF C03layan123456No ratings yet

- Chapter 3Document46 pagesChapter 3Md. Shams SaleheenNo ratings yet

- M03 Gitman50803X 14 MF C03Document73 pagesM03 Gitman50803X 14 MF C03Burhan AzharNo ratings yet

- FINMGT Topic 2 FinalDocument66 pagesFINMGT Topic 2 Finaljunioiris50No ratings yet

- Chapter 5 - Basics of AnalysisDocument76 pagesChapter 5 - Basics of AnalysisNguyễn Yến NhiNo ratings yet

- Module 2 - Fs AnalysisDocument69 pagesModule 2 - Fs AnalysisSkyler LeeNo ratings yet

- Lecture 2Document85 pagesLecture 2Bintang David SusantoNo ratings yet

- Lecture 2Document85 pagesLecture 2Lee Li HengNo ratings yet

- Git3e CH 02Document48 pagesGit3e CH 02Edgar Iván Díaz CadenaNo ratings yet

- Comparing Annual Report of Mahindra Satyam and Infosys For The YEAR 2011-12Document26 pagesComparing Annual Report of Mahindra Satyam and Infosys For The YEAR 2011-12Sandip GhoshNo ratings yet

- CHAPTER 1 Intro To FinanceDocument38 pagesCHAPTER 1 Intro To FinanceHazlina HusseinNo ratings yet

- CH 8 FeasibiltyDocument36 pagesCH 8 FeasibiltyDalia ElarabyNo ratings yet

- The Role of Managerial Finance - PearsonDocument60 pagesThe Role of Managerial Finance - PearsonHerdi SularkoNo ratings yet

- BCO 10 Block 02 1Document52 pagesBCO 10 Block 02 1Madhumitha ANo ratings yet

- Financial Statement and Ratio AnalysisDocument56 pagesFinancial Statement and Ratio Analysisuznahid4No ratings yet

- Lecture 2 - Financial Statements and AnalysisDocument58 pagesLecture 2 - Financial Statements and AnalysisMegat AlifNo ratings yet

- Chapter 4Document48 pagesChapter 4FadhilahAbdullahNo ratings yet

- Financial Statement AnalysisDocument68 pagesFinancial Statement AnalysisAqib ShahzadNo ratings yet

- Concepts of FS AnalysisDocument10 pagesConcepts of FS AnalysisRussia CortesNo ratings yet

- Module 8 (FINP7)Document4 pagesModule 8 (FINP7)David VillaNo ratings yet

- ProjectDocument27 pagesProjectrajanikant DesaiNo ratings yet

- 1-1 © Pearson Education 2013Document25 pages1-1 © Pearson Education 2013Ramadan IbrahemNo ratings yet

- Topic1gitman pmf13 ppt01Document31 pagesTopic1gitman pmf13 ppt01zack farisNo ratings yet

- Gitman Pmf13 Ppt01pinar 2Document36 pagesGitman Pmf13 Ppt01pinar 2Sinem Dilara HaşimoğluNo ratings yet

- 01 Ch4 Analysis of Financial StatementsDocument25 pages01 Ch4 Analysis of Financial Statementsvoves44055No ratings yet

- Acc CompilationDocument89 pagesAcc CompilationMehedi Hasan DurjoyNo ratings yet

- Ratio Analysis - 1Document52 pagesRatio Analysis - 1Arpit BishnoiNo ratings yet

- Financial ManagementDocument120 pagesFinancial Managementdaniellema5752No ratings yet

- Baximco RatioDocument9 pagesBaximco RatioAfsana Mimi (211011065)No ratings yet

- Project Accounting & FM ch5Document74 pagesProject Accounting & FM ch5Nesri YayaNo ratings yet

- Financial AnalysisDocument14 pagesFinancial AnalysisTusharNo ratings yet

- The Role of Managerial Finance: All Rights ReservedDocument39 pagesThe Role of Managerial Finance: All Rights ReservedJesterdanceNo ratings yet

- Ratio AnalysisDocument50 pagesRatio AnalysissshreyasNo ratings yet

- Pertemuan 4: Finance and Operating ActivityDocument20 pagesPertemuan 4: Finance and Operating ActivitySofyan AliNo ratings yet

- Modified 15ratiosDocument24 pagesModified 15ratiosSahifa MisbahNo ratings yet

- A Project Report On Financial Ratios at B.D.K. Ltd. Hubli Project ReportDocument69 pagesA Project Report On Financial Ratios at B.D.K. Ltd. Hubli Project Reportsatish pawarNo ratings yet

- Financial Statements Analysis: © Tata Mcgraw-Hill Publishing Company Limited, Management AccountingDocument50 pagesFinancial Statements Analysis: © Tata Mcgraw-Hill Publishing Company Limited, Management Accountingpandey_hariom12No ratings yet

- Financial Statements Analysis: © Tata Mcgraw-Hill Publishing Company Limited, Management AccountingDocument50 pagesFinancial Statements Analysis: © Tata Mcgraw-Hill Publishing Company Limited, Management AccountingYadgar RashidNo ratings yet

- Financial Statements and Ratio Analysis: ChapterDocument25 pagesFinancial Statements and Ratio Analysis: Chapterkarim67% (3)

- Financial Statements and AnalysisDocument60 pagesFinancial Statements and AnalysissezarusssssNo ratings yet

- Ratio Analysis Heritage Foods Ltd-2Document64 pagesRatio Analysis Heritage Foods Ltd-2Varun ThatiNo ratings yet

- Ch13 Wiley Plus Wk3Document58 pagesCh13 Wiley Plus Wk3Prakash VaidhyanathanNo ratings yet

- EE-lecture 5-Money Financial Services-29Apr23Document25 pagesEE-lecture 5-Money Financial Services-29Apr23Paramjit SinghNo ratings yet

- Chap006 Quiz PDFDocument23 pagesChap006 Quiz PDFLê Chấn PhongNo ratings yet

- Financial Asset at Fair ValueDocument4 pagesFinancial Asset at Fair ValueDianna DayawonNo ratings yet

- MakroDocument13 pagesMakroYuniar ArridhaNo ratings yet

- Asma RiskDocument2 pagesAsma RiskAsma ShoaibNo ratings yet

- 20 Pip Challenge (Creative Currency Edition) - 3Document3 pages20 Pip Challenge (Creative Currency Edition) - 3Muhammad SufyanNo ratings yet

- Dealroom - B2B Marketplaces Nov 22Document31 pagesDealroom - B2B Marketplaces Nov 22Никита МузафаровNo ratings yet

- Forex Summary Ca Final SFMDocument13 pagesForex Summary Ca Final SFMNksNo ratings yet

- Bài kiểm tra buổi 5 - Xem lại bài làmDocument4 pagesBài kiểm tra buổi 5 - Xem lại bài làmBảo KhangNo ratings yet

- Investment Analysis and Portfolio Management Canadian 1st Edition Reilly Test BankDocument43 pagesInvestment Analysis and Portfolio Management Canadian 1st Edition Reilly Test Bankjesselact0vvk100% (28)

- The Currency Trader's Handbook: by Rob Booker, ©2002-2006Document23 pagesThe Currency Trader's Handbook: by Rob Booker, ©2002-2006Pandelis NikolopoulosNo ratings yet

- Ccounting Basics and Interview Questions AnswersDocument18 pagesCcounting Basics and Interview Questions AnswersAamir100% (1)

- SHARVILDocument19 pagesSHARVILSharvil ChoudharyNo ratings yet

- DTTC 2Document44 pagesDTTC 2ngochanhime0906No ratings yet

- Financial Model - Colgate Palmolive (Solved) : Prepared by Dheeraj Vaidya, CFA, FRMDocument27 pagesFinancial Model - Colgate Palmolive (Solved) : Prepared by Dheeraj Vaidya, CFA, FRMMehmet Isbilen100% (1)

- Kumar+Kaushal+ +FB+PS3+Forex+Trading+StrategyDocument27 pagesKumar+Kaushal+ +FB+PS3+Forex+Trading+Strategynathaniel ekaiko100% (2)

- MARKET STUDY-WPS OfficeDocument37 pagesMARKET STUDY-WPS OfficeoliverreromaNo ratings yet

- 200 DMA StocksDocument6 pages200 DMA Stockspmishra3No ratings yet

- Introduction To InvestmentDocument2 pagesIntroduction To InvestmentseraNo ratings yet

- Practice Questions: Chapters 1 and 2 of Bodie, Kane, Marcus Investments Part I: Multiple ChoiceDocument6 pagesPractice Questions: Chapters 1 and 2 of Bodie, Kane, Marcus Investments Part I: Multiple ChoiceElisa CarnevaleNo ratings yet

- PinoyInvestor Free Version - 18 Nov 2013 FlytDocument52 pagesPinoyInvestor Free Version - 18 Nov 2013 FlytJay GalvanNo ratings yet

- Alexander ForbesDocument128 pagesAlexander ForbesSandra NarismuluNo ratings yet

- Trading Harmonic Patterns 1Document5 pagesTrading Harmonic Patterns 1Jewan JogaNo ratings yet

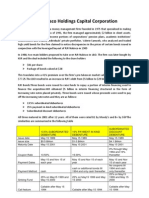

- RJR Nabisco Holdings Capital CorporationDocument3 pagesRJR Nabisco Holdings Capital CorporationManogana RasaNo ratings yet

- Darkside Young CosDocument22 pagesDarkside Young CosNavneesh MalhanNo ratings yet

- WQU Financial Markets Module 7Document26 pagesWQU Financial Markets Module 7joca12890% (1)

- Chap 020Document11 pagesChap 020Mitra MallahiNo ratings yet

3 - Financial Statements and Ratio Analysis Ratios - Liquidity Ratios and Activity Ratios

3 - Financial Statements and Ratio Analysis Ratios - Liquidity Ratios and Activity Ratios

Uploaded by

Raneem AlOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3 - Financial Statements and Ratio Analysis Ratios - Liquidity Ratios and Activity Ratios

3 - Financial Statements and Ratio Analysis Ratios - Liquidity Ratios and Activity Ratios

Uploaded by

Raneem AlCopyright:

Available Formats

Chapter 3

Financial Statements

and Ratio Analysis

Copyright © 2012 Pearson Education

Learning Goals

LG1 Review the contents of the stockholders’

LG2 Understand who uses financial ratios and how.

LG3 Use ratios to analyze a firm’s liquidity and activity.

LG4 Discuss the relationship between debt and financial leverage and the ratios

used to analyze a firm’s debt.

LG5 Use ratios to analyze a firm’s profitability and its market value.

LG6 Use a summary of financial ratios and the DuPont system of analysis to

perform a complete ratio analysis.

© 2012 Pearson Education 3-2

The Stockholders’ Report

• Public corporations required to provide their stockholders with an annual

stockholders’ report.

• Stockholders’ report is an annual report that publicly owned corporations

must provide to stockholders; it summarizes and documents the firm’s

financial activities during the past year.

© 2012 Pearson Education 3-3

The Stockholders’ Report

• It begins with a letter to the stockholders from the firm’s

president and/or chairman of the board.

• Letter to stockholders => Typically, the first element of the

annual stockholders’ report and the primary communication

from management.

© 2012 Pearson Education 3-4

The Four Key Financial Statements:

The Income Statement

• The four financial statement are:

(1) The income statement.

(2) The balance sheet.

(3) The statement of stockholders’ equity.

(4) The statement of cash flow.

© 2012 Pearson Education 3-5

The Four Key Financial Statements:

The Income Statement

• The income statement provides a financial summary of a company’s

operating results during a specified period.

• Although they are prepared quarterly for reporting purposes, they are generally

computed monthly by management and quarterly for tax purposes.

© 2012 Pearson Education 3-6

Table 3.1 Bartlett Company

Income Statements ($000)

© 2012 Pearson Education 3-7

The Four Key Financial

Statements: The Balance Sheet

• The balance sheet presents a summary of a firm’s financial position at a given

point in time.

• The statement balances the firm’s assets (what it owns) against its financing,

which can be either debt (what it owes) or equity (what was provided by

owners).

• Assets = Liabilities + Stockholders’ Equity

– Liabilities = Assets - Stockholders’ Equity

– Stockholders’ Equity = Assets - Liabilities

© 2012 Pearson Education 3-8

Table 3.2a Bartlett Company

Balance Sheets ($000)

© 2012 Pearson Education 3-9

Table 3.2b Bartlett Company

Balance Sheets ($000)

© 2012 Pearson Education 3-10

The Four Key Financial Statements:

Statement of Retained Earnings

The statement of retained earnings reconciles the net income earned during a

given year, and any cash dividends paid, with the change in retained earnings

between the start and the end of that year.

© 2012 Pearson Education 3-11

Table 3.3 Bartlett Company Statement of

Retained Earnings ($000) for the Year Ended

December 31, 2012

© 2012 Pearson Education 3-12

The Four Key Financial Statements:

Statement of Cash Flows

• The statement of cash flows provides a summary of the firm’s operating,

investment, and financing cash flows and reconciles them with changes in its

cash and marketable securities during the period.

• This statement not only provides insight into a company’s investment,

financing and operating activities, but also ties together the income statement

and previous and current balance sheets.

© 2012 Pearson Education 3-13

Table 3.4 Bartlett Company Statement of

Cash Flows ($000) for the Year Ended

December 31, 2012

© 2012 Pearson Education 3-14

Using Financial Ratios:

Interested Parties

• Ratio analysis involves methods of calculating and interpreting financial ratios to analyze

and monitor the firm’s performance.

• Current and prospective shareholders are interested in the firm’s current and future level

of risk and return, which directly affect share price.

• Creditors are interested in the short-term liquidity of the company and its ability to make

interest and principal payments.

• Management is concerned with all aspects of the firm’s financial situation, and it attempts

to produce financial ratios that will be considered favorable by both owners and creditors.

© 2012 Pearson Education 3-15

Using Financial Ratios:

Types of Ratio Comparisons

• Cross-sectional analysis is the comparison of different firms’ financial ratios at the same

point in time; involves comparing the firm’s ratios to those of other firms in its industry or

to industry averages

• Benchmarking is a type of cross-sectional analysis in which the firm’s ratio values are

compared to those of a key competitor or group of competitors that it wishes to emulate.

• Comparison to industry averages is also popular, as in the following example.

© 2012 Pearson Education 3-16

Using Financial Ratios: Types

of Ratio Comparisons (cont.)

• Time-series analysis is the evaluation of the firm’s financial performance over

time using financial ratio analysis

• Comparison of current to past performance, using ratios, enables analysts to

assess the firm’s progress.

• Developing trends can be seen by using multiyear comparisons.

• The most informative approach to ratio analysis combines cross-sectional and

time-series analyses.

© 2012 Pearson Education 3-17

Figure 3.1 Combined Analysis

© 2012 Pearson Education 3-18

Using Financial Ratios: Cautions

about Using Ratio Analysis

1. Ratios that reveal large deviations from the norm merely indicate the possibility of a

problem.

2. A single ratio does not generally provide sufficient information from which to judge the

overall performance of the firm.

3. The ratios being compared should be calculated using financial statements dated at the

same point in time during the year.

4. It is preferable to use audited financial statements.

5. The financial data being compared should have been developed in the same way.

6. Results can be distorted by inflation.

© 2012 Pearson Education 3-19

Ratio Analysis Example

We will illustrate the use of financial ratios for analyzing financial statements

using the Bartlett Company Income Statements and Balance Sheets presented

earlier in

Tables 3.1 and 3.2.

© 2012 Pearson Education 3-20

Ratio Analysis

Liquidity Ratios

Current ratio = Current assets ÷ Current liabilities

The current ratio for Bartlett Company in 2012 is:

$1,223,000 ÷ $620,000 = 1.97 times

Standard: General Acceptable Norm is 2 times

Decision rule: As close as better

© 2012 Pearson Education 3-21

Matter of Fact

Determinants of liquidity needs

– Large enterprises generally have well established relationships with banks

that can provide lines of credit and other short-term loan products in the

event that the firm has a need for liquidity.

– Smaller firms may not have the same access to credit, and therefore they

tend to operate with more liquidity.

© 2012 Pearson Education 3-22

Ratio Analysis (cont.)

Liquidity Ratios

The quick ratio for Bartlett Company in 2012 is:

© 2012 Pearson Education 3-23

Ratio Analysis (cont.)

Activity Ratios

Inventory turnover = Cost of goods sold ÷ Inventory

Applying this relationship to Bartlett Company in 2012 yields:

$2,088,000 ÷ $289,000 = 7.2 times

Decision rule: As high as better!

© 2012 Pearson Education 3-24

Ratio Analysis (cont.)

Activity Ratios

Average Age of Inventory = 365 ÷ Inventory turnover

For Bartlett Company, the average age of inventory in 2012 is:

365 ÷ 7.2 = 50.7 days

Decision rule: as low as better!

ACP: In general, as low as better!

More informative when comparing with the credit term: (2/5 net 45)!

© 2012 Pearson Education 3-25

Ratio Analysis (cont.)

Activity Ratios

The average collection period for Bartlett Company in 2012 is:

© 2012 Pearson Education 3-26

Ratio Analysis (cont.)

Activity Ratios

If we assume that Bartlett Company’s purchases equaled 70 percent of its cost of goods

sold in 2012, its average payment period is:

© 2012 Pearson Education 3-27

Ratio Analysis (cont.)

Activity Ratios

Total asset turnover = Sales ÷ Total assets = times

The value of Bartlett Company’s total asset turnover in 2012 is:

$3,074,000 ÷ $3,597,000 = 0.85 times

© 2012 Pearson Education 3-28

You might also like

- FRM Part 2 TopicsDocument4 pagesFRM Part 2 Topicschan6No ratings yet

- Economics-: Stock Investing 101Document2 pagesEconomics-: Stock Investing 101Tanishka Saluja0% (1)

- ORF 335: Introduction To Financial Mathematics Instructor: Course InformationDocument3 pagesORF 335: Introduction To Financial Mathematics Instructor: Course Informationtsrockon28No ratings yet

- Financial Statements and Ratio AnalysisDocument47 pagesFinancial Statements and Ratio AnalysisYunita AngelicaNo ratings yet

- Chapter 3-Ratio AnalysisDocument25 pagesChapter 3-Ratio AnalysisDewi khornida marheniNo ratings yet

- Financial Statement and Ratio Analysis GitmanDocument51 pagesFinancial Statement and Ratio Analysis GitmanrajeshNo ratings yet

- Chapter 3Document59 pagesChapter 3NEW TECK INFINITYNo ratings yet

- Financial Statements and Ratio Analysis: All Rights ReservedDocument54 pagesFinancial Statements and Ratio Analysis: All Rights ReservedDark WingsNo ratings yet

- The Stockholders' Report: © 2012 Pearson Prentice Hall. All Rights ReservedDocument185 pagesThe Stockholders' Report: © 2012 Pearson Prentice Hall. All Rights ReservedrabNo ratings yet

- The Stockholders' Report: © 2012 Pearson Prentice Hall. All Rights ReservedDocument56 pagesThe Stockholders' Report: © 2012 Pearson Prentice Hall. All Rights ReservedJanine ElijahNo ratings yet

- FIN Chapter 3Document42 pagesFIN Chapter 3tarek khanNo ratings yet

- Financial Statements and Ratio Analysis: Learning GoalsDocument31 pagesFinancial Statements and Ratio Analysis: Learning GoalsMohammadNo ratings yet

- C3 - Financial Statement and Ratio AnalysisDocument13 pagesC3 - Financial Statement and Ratio AnalysisRoxanne GiananNo ratings yet

- Gitman pmf13 ppt03Document68 pagesGitman pmf13 ppt03CARLOS ANDRESNo ratings yet

- Financial Statements and Ratio Analysis: All Rights ReservedDocument68 pagesFinancial Statements and Ratio Analysis: All Rights ReservedAshis Ur RahmanNo ratings yet

- Financial Statements and Ratio AnalysisDocument42 pagesFinancial Statements and Ratio AnalysisMd. Rezwan Hossain Sakib 1711977630No ratings yet

- Curso DE Finanzas Corporativas. Material Tomado De: Financial Statements and Ratio AnalysisDocument58 pagesCurso DE Finanzas Corporativas. Material Tomado De: Financial Statements and Ratio AnalysisCArmen CruzNo ratings yet

- Financial Statments and Ratio - Chapter 2-p1Document12 pagesFinancial Statments and Ratio - Chapter 2-p1Mo'men ElboklNo ratings yet

- 2 - CH 3 Gitman 14eDocument64 pages2 - CH 3 Gitman 14eannisawulandariNo ratings yet

- M03 Gitman50803X 14 MF C03Document65 pagesM03 Gitman50803X 14 MF C03layan123456No ratings yet

- Chapter 3Document46 pagesChapter 3Md. Shams SaleheenNo ratings yet

- M03 Gitman50803X 14 MF C03Document73 pagesM03 Gitman50803X 14 MF C03Burhan AzharNo ratings yet

- FINMGT Topic 2 FinalDocument66 pagesFINMGT Topic 2 Finaljunioiris50No ratings yet

- Chapter 5 - Basics of AnalysisDocument76 pagesChapter 5 - Basics of AnalysisNguyễn Yến NhiNo ratings yet

- Module 2 - Fs AnalysisDocument69 pagesModule 2 - Fs AnalysisSkyler LeeNo ratings yet

- Lecture 2Document85 pagesLecture 2Bintang David SusantoNo ratings yet

- Lecture 2Document85 pagesLecture 2Lee Li HengNo ratings yet

- Git3e CH 02Document48 pagesGit3e CH 02Edgar Iván Díaz CadenaNo ratings yet

- Comparing Annual Report of Mahindra Satyam and Infosys For The YEAR 2011-12Document26 pagesComparing Annual Report of Mahindra Satyam and Infosys For The YEAR 2011-12Sandip GhoshNo ratings yet

- CHAPTER 1 Intro To FinanceDocument38 pagesCHAPTER 1 Intro To FinanceHazlina HusseinNo ratings yet

- CH 8 FeasibiltyDocument36 pagesCH 8 FeasibiltyDalia ElarabyNo ratings yet

- The Role of Managerial Finance - PearsonDocument60 pagesThe Role of Managerial Finance - PearsonHerdi SularkoNo ratings yet

- BCO 10 Block 02 1Document52 pagesBCO 10 Block 02 1Madhumitha ANo ratings yet

- Financial Statement and Ratio AnalysisDocument56 pagesFinancial Statement and Ratio Analysisuznahid4No ratings yet

- Lecture 2 - Financial Statements and AnalysisDocument58 pagesLecture 2 - Financial Statements and AnalysisMegat AlifNo ratings yet

- Chapter 4Document48 pagesChapter 4FadhilahAbdullahNo ratings yet

- Financial Statement AnalysisDocument68 pagesFinancial Statement AnalysisAqib ShahzadNo ratings yet

- Concepts of FS AnalysisDocument10 pagesConcepts of FS AnalysisRussia CortesNo ratings yet

- Module 8 (FINP7)Document4 pagesModule 8 (FINP7)David VillaNo ratings yet

- ProjectDocument27 pagesProjectrajanikant DesaiNo ratings yet

- 1-1 © Pearson Education 2013Document25 pages1-1 © Pearson Education 2013Ramadan IbrahemNo ratings yet

- Topic1gitman pmf13 ppt01Document31 pagesTopic1gitman pmf13 ppt01zack farisNo ratings yet

- Gitman Pmf13 Ppt01pinar 2Document36 pagesGitman Pmf13 Ppt01pinar 2Sinem Dilara HaşimoğluNo ratings yet

- 01 Ch4 Analysis of Financial StatementsDocument25 pages01 Ch4 Analysis of Financial Statementsvoves44055No ratings yet

- Acc CompilationDocument89 pagesAcc CompilationMehedi Hasan DurjoyNo ratings yet

- Ratio Analysis - 1Document52 pagesRatio Analysis - 1Arpit BishnoiNo ratings yet

- Financial ManagementDocument120 pagesFinancial Managementdaniellema5752No ratings yet

- Baximco RatioDocument9 pagesBaximco RatioAfsana Mimi (211011065)No ratings yet

- Project Accounting & FM ch5Document74 pagesProject Accounting & FM ch5Nesri YayaNo ratings yet

- Financial AnalysisDocument14 pagesFinancial AnalysisTusharNo ratings yet

- The Role of Managerial Finance: All Rights ReservedDocument39 pagesThe Role of Managerial Finance: All Rights ReservedJesterdanceNo ratings yet

- Ratio AnalysisDocument50 pagesRatio AnalysissshreyasNo ratings yet

- Pertemuan 4: Finance and Operating ActivityDocument20 pagesPertemuan 4: Finance and Operating ActivitySofyan AliNo ratings yet

- Modified 15ratiosDocument24 pagesModified 15ratiosSahifa MisbahNo ratings yet

- A Project Report On Financial Ratios at B.D.K. Ltd. Hubli Project ReportDocument69 pagesA Project Report On Financial Ratios at B.D.K. Ltd. Hubli Project Reportsatish pawarNo ratings yet

- Financial Statements Analysis: © Tata Mcgraw-Hill Publishing Company Limited, Management AccountingDocument50 pagesFinancial Statements Analysis: © Tata Mcgraw-Hill Publishing Company Limited, Management Accountingpandey_hariom12No ratings yet

- Financial Statements Analysis: © Tata Mcgraw-Hill Publishing Company Limited, Management AccountingDocument50 pagesFinancial Statements Analysis: © Tata Mcgraw-Hill Publishing Company Limited, Management AccountingYadgar RashidNo ratings yet

- Financial Statements and Ratio Analysis: ChapterDocument25 pagesFinancial Statements and Ratio Analysis: Chapterkarim67% (3)

- Financial Statements and AnalysisDocument60 pagesFinancial Statements and AnalysissezarusssssNo ratings yet

- Ratio Analysis Heritage Foods Ltd-2Document64 pagesRatio Analysis Heritage Foods Ltd-2Varun ThatiNo ratings yet

- Ch13 Wiley Plus Wk3Document58 pagesCh13 Wiley Plus Wk3Prakash VaidhyanathanNo ratings yet

- EE-lecture 5-Money Financial Services-29Apr23Document25 pagesEE-lecture 5-Money Financial Services-29Apr23Paramjit SinghNo ratings yet

- Chap006 Quiz PDFDocument23 pagesChap006 Quiz PDFLê Chấn PhongNo ratings yet

- Financial Asset at Fair ValueDocument4 pagesFinancial Asset at Fair ValueDianna DayawonNo ratings yet

- MakroDocument13 pagesMakroYuniar ArridhaNo ratings yet

- Asma RiskDocument2 pagesAsma RiskAsma ShoaibNo ratings yet

- 20 Pip Challenge (Creative Currency Edition) - 3Document3 pages20 Pip Challenge (Creative Currency Edition) - 3Muhammad SufyanNo ratings yet

- Dealroom - B2B Marketplaces Nov 22Document31 pagesDealroom - B2B Marketplaces Nov 22Никита МузафаровNo ratings yet

- Forex Summary Ca Final SFMDocument13 pagesForex Summary Ca Final SFMNksNo ratings yet

- Bài kiểm tra buổi 5 - Xem lại bài làmDocument4 pagesBài kiểm tra buổi 5 - Xem lại bài làmBảo KhangNo ratings yet

- Investment Analysis and Portfolio Management Canadian 1st Edition Reilly Test BankDocument43 pagesInvestment Analysis and Portfolio Management Canadian 1st Edition Reilly Test Bankjesselact0vvk100% (28)

- The Currency Trader's Handbook: by Rob Booker, ©2002-2006Document23 pagesThe Currency Trader's Handbook: by Rob Booker, ©2002-2006Pandelis NikolopoulosNo ratings yet

- Ccounting Basics and Interview Questions AnswersDocument18 pagesCcounting Basics and Interview Questions AnswersAamir100% (1)

- SHARVILDocument19 pagesSHARVILSharvil ChoudharyNo ratings yet

- DTTC 2Document44 pagesDTTC 2ngochanhime0906No ratings yet

- Financial Model - Colgate Palmolive (Solved) : Prepared by Dheeraj Vaidya, CFA, FRMDocument27 pagesFinancial Model - Colgate Palmolive (Solved) : Prepared by Dheeraj Vaidya, CFA, FRMMehmet Isbilen100% (1)

- Kumar+Kaushal+ +FB+PS3+Forex+Trading+StrategyDocument27 pagesKumar+Kaushal+ +FB+PS3+Forex+Trading+Strategynathaniel ekaiko100% (2)

- MARKET STUDY-WPS OfficeDocument37 pagesMARKET STUDY-WPS OfficeoliverreromaNo ratings yet

- 200 DMA StocksDocument6 pages200 DMA Stockspmishra3No ratings yet

- Introduction To InvestmentDocument2 pagesIntroduction To InvestmentseraNo ratings yet

- Practice Questions: Chapters 1 and 2 of Bodie, Kane, Marcus Investments Part I: Multiple ChoiceDocument6 pagesPractice Questions: Chapters 1 and 2 of Bodie, Kane, Marcus Investments Part I: Multiple ChoiceElisa CarnevaleNo ratings yet

- PinoyInvestor Free Version - 18 Nov 2013 FlytDocument52 pagesPinoyInvestor Free Version - 18 Nov 2013 FlytJay GalvanNo ratings yet

- Alexander ForbesDocument128 pagesAlexander ForbesSandra NarismuluNo ratings yet

- Trading Harmonic Patterns 1Document5 pagesTrading Harmonic Patterns 1Jewan JogaNo ratings yet

- RJR Nabisco Holdings Capital CorporationDocument3 pagesRJR Nabisco Holdings Capital CorporationManogana RasaNo ratings yet

- Darkside Young CosDocument22 pagesDarkside Young CosNavneesh MalhanNo ratings yet

- WQU Financial Markets Module 7Document26 pagesWQU Financial Markets Module 7joca12890% (1)

- Chap 020Document11 pagesChap 020Mitra MallahiNo ratings yet