Professional Documents

Culture Documents

Onsumer Protection at The Bottom of The Pyramid (BOP) : Striking The Right Balance Between Access, Protection and Innovation

Onsumer Protection at The Bottom of The Pyramid (BOP) : Striking The Right Balance Between Access, Protection and Innovation

Uploaded by

Muhamamd FayazOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Onsumer Protection at The Bottom of The Pyramid (BOP) : Striking The Right Balance Between Access, Protection and Innovation

Onsumer Protection at The Bottom of The Pyramid (BOP) : Striking The Right Balance Between Access, Protection and Innovation

Uploaded by

Muhamamd FayazCopyright:

Available Formats

Building Financial Systems for the Poor

Consumer Protection at the Bottom of the Pyramid (BOP):

Striking the right balance between access, protection and innovation

Kate McKee, Senior Policy Advisor Global Seminar on Consumer Protection and Financial Literacy Washington, DC September 3, 2008

Four key messages

1. Low-income and first-time financial consumers

face specific risks >consumer protection policy and regulation should consider needs of different client segments 2. Different financial products also raise distinct risks > product-specific regulation may be appropriate 3. With the huge growth projected in branchless banking, specific channel risks need attention 4. A light-touch approach to regulation can permit evolution of standards as risks evolve -- enabling regulators to encourage innovation, access and protection

The market at the bottom of the pyramid Whats different?

The

demand side clients tend to have lower . . . Income and assets Levels of literacy, education and financial capability Experience with formal providers and products

The supply side BOP providers Typically, the poor rely more on non-bank providers, use a more limited product range (each with distinct

protection concerns) payments, credit, deposit, insurance and are likely to depend more on branchless banking models for future access

Consider the CP issues for a low-income consumer . . .

Looking for a safe place to save Trying to get cash for a remittance transferred

from a relative working overseas Opening her first basic banking account Shopping around for a business loan Going into a community retailer to send money to his mother in the village Deciding whether to permit her MFI to report payment info to the credit bureau Receiving his social payment (pension, child allowance, etc.) via a card linked to an account

Lets look at branchless banking . . .

The logic of branchless banking: a low-cost transactional channel

1. Use existing retailers shops, lottery, POs 2. Deliver trust through technology 3. Use existing technology in use

Agent

Real-time accountto-account transfers

Customer

Any store can potentially be an agent

The power of using existing infrastructure

Philippines 1,000 branches 7,000 ATMs 25,000 POS terminals in stores 1.1 million prepaid airtime resellers Panama Largest bank has 65 branches 850 shared ATMs (many in branches!) 12,000 prepaid airtime resellers

Worldwide points of presence

~3bn

~25m

~1m

250k

Western Union

500k

Bank branches

600k

Mobile Phones

Post Offcs

ATMs

POS

Experience to date with branchless banking

Promising strategy to extend access to those

currently unserved, by driving down costs Typical models use mobile phones, cards, and/or POS devices Alliances between Mobile Network Operators and financial institutions common Partnerships with non-bank agents (e.g., neighborhood shops, airtime dealers, even lottery outlets) also often in the mix to reduce costs and reach lower-end and more remote clients

Consumer protection issues in branchless banking

What concerns arise?

Distance between bank HQ or branch and point at which

financial services are delivered Use of non-bank agents introduces additional issues of service quality, error resolution, fraud and abuse Use of technology (mobile phone, cards, POS devices, biometric) including potentially much larger data footprint and wider data access Note, however, that branchless models also can offer some consumer protection advantages over conventional delivery (real-time info, traceability for errors/disputes) trust through technology

Key consumer protection issues in branchless banking

Transparent pricing -- # of players in chain, service

bundling, agent corruption Service quality, incl. agent training, consistent availability of cash-in/cash-out services Complaints and error resolution Who is responsible? What is the process? ADR vs. courts? Data quality, privacy and security Note: some financial services raise more consumer protection issues than others, e.g., deposits, credit

What can go wrong? Who is responsible?

Customer shares his mobile phone and PIN and it is used

malevolently

Fraudster manages to electronically intercept the clients PIN Client is robbed inside agents store The agents store is robbed and the cash is stolen Client makes a deposit, and value credited to his account is less than

what he paid in and also less than what is shown on the receipt

Using P2P transfer capability on mobile phone, the client sends money

to the wrong phone number (= bank account number)

Client makes a deposit, but the account is empty when the customer

goes to withdraw

Fraudulent agent is set up

Which regulatory tools to use?

1. Prudential and market conduct regulation, e.g., Agent licensing/training/monitoring outsourcing rules Disclosure requirements plain language -agent/bank relationship, pricing, product terms Prohibited products (e.g. credit) and/or practices (e.g., steering, cross-selling, unauthorized data sharing) Required practices, e.g., standard contracts or provisions

Which non-regulatory tools to use?

3. 4.

Recourse/redress mechanisms Market-based mechanisms (e.g., quality seal, satisfaction index, publish data)

5.

6.

Self-regulation, e.g., voluntary codes of conduct

Consumer awareness, education and financial literacy

Note that regulators may need to define the rules of the game for these tools

Closing thoughts on consumer protection in BOP markets

Keep regulation light-touch and focused on

most important products, providers and delivery channels

Consider regulatory capacity constraints and

ability to enforce

Need to leave space for market innovation and

experimentation

Balance protection and access policy goals

Building Financial Systems for the Poor Thank you!

You might also like

- Hacking Point of Sale: Payment Application Secrets, Threats, and SolutionsFrom EverandHacking Point of Sale: Payment Application Secrets, Threats, and SolutionsRating: 5 out of 5 stars5/5 (1)

- Advanced Welding Techniques in Ship ManufacturingDocument15 pagesAdvanced Welding Techniques in Ship Manufacturingmadhan_kumar2000No ratings yet

- 2 Introduction To Digital Banking - Reading Material - MAB PDFDocument11 pages2 Introduction To Digital Banking - Reading Material - MAB PDFANJU KOLLAKKARAN ThomasNo ratings yet

- Banking Through Networks of Retail AgentsDocument24 pagesBanking Through Networks of Retail AgentsGautam IvaturyNo ratings yet

- Functions of Commercial BanksDocument6 pagesFunctions of Commercial BanksPravikuttan UnniNo ratings yet

- Fintech-Banking SectorDocument17 pagesFintech-Banking Sectorhimanshu bhattNo ratings yet

- Assignment-2: Submitted by Anjanna Matta MA08M001Document9 pagesAssignment-2: Submitted by Anjanna Matta MA08M001Rafiqul Islam TalukderNo ratings yet

- Unit 3 E-CommerceDocument13 pagesUnit 3 E-Commercebhattd20002No ratings yet

- Chapter-8 Consumer Oriented e Commerce PDFDocument17 pagesChapter-8 Consumer Oriented e Commerce PDFSuman Bhandari75% (4)

- K FinishDocument63 pagesK FinishPrakash ChauhanNo ratings yet

- Technology in Retail LendingDocument31 pagesTechnology in Retail LendingRedSunNo ratings yet

- Information Systems For ManagersDocument10 pagesInformation Systems For ManagersSamyak GargNo ratings yet

- FRP Dev-2Document88 pagesFRP Dev-2Shivanshu AwasthiNo ratings yet

- E - Banking: P. Nagendra Kumar CS06B032Document9 pagesE - Banking: P. Nagendra Kumar CS06B032Dhamo DharanNo ratings yet

- Information Systems For ManagersDocument10 pagesInformation Systems For ManagersRajni KumariNo ratings yet

- Kirti Um8803 Akshita Um8103 Nisha Um8109 Shivani Um8808Document47 pagesKirti Um8803 Akshita Um8103 Nisha Um8109 Shivani Um8808Siddhant SingalNo ratings yet

- Retail and Wholesale Banking Session 2Document14 pagesRetail and Wholesale Banking Session 2Rishabh AroraNo ratings yet

- Ch5 PointsDocument22 pagesCh5 PointsHiruthik RajaNo ratings yet

- Chapter 3 E - CommerceDocument11 pagesChapter 3 E - CommerceWolde JanfaNo ratings yet

- Chapter 3 E - CommerceDocument11 pagesChapter 3 E - CommerceAtaklti TekaNo ratings yet

- Ftpartnersresearch TransactionsecurityDocument124 pagesFtpartnersresearch Transactionsecurityapi-276414739No ratings yet

- IDRBT Banking Technology Excellence AwardsDocument5 pagesIDRBT Banking Technology Excellence AwardskshitijsaxenaNo ratings yet

- Topic 9Document4 pagesTopic 9nghuonglasilyNo ratings yet

- Information Systems For Managers - N (1A) UpdatedDocument11 pagesInformation Systems For Managers - N (1A) UpdatedIsha TilokaniNo ratings yet

- The Effect On Five Forces Model in Banking and Financial IndustryDocument21 pagesThe Effect On Five Forces Model in Banking and Financial IndustryMay Myat ThuNo ratings yet

- Unit IiiDocument51 pagesUnit IiiAnju ANo ratings yet

- Irene Jepkosgei Kemu BUSS 342-E-Commerce Assignment 1st Trimester 2019 Instructions: Answer All QuestionsDocument9 pagesIrene Jepkosgei Kemu BUSS 342-E-Commerce Assignment 1st Trimester 2019 Instructions: Answer All QuestionsKevin ObaraNo ratings yet

- Assig2 Solutions 112 PgradDocument18 pagesAssig2 Solutions 112 PgradYolanda WuNo ratings yet

- TitleDocument4 pagesTitleJoan TemplonuevoNo ratings yet

- DOCDocument45 pagesDOCPraba KaranNo ratings yet

- Retail Banking - Assignment June 2021 s0zu4qpaZTDocument11 pagesRetail Banking - Assignment June 2021 s0zu4qpaZTsadiaNo ratings yet

- Bo Assignment 2Document3 pagesBo Assignment 2Sonu LolamNo ratings yet

- Q.) Banking Services Have Improved With The Use of Technology, But The Risks Associated Have Also Increased. DiscussDocument3 pagesQ.) Banking Services Have Improved With The Use of Technology, But The Risks Associated Have Also Increased. DiscussSonu LolamNo ratings yet

- Banking Sector-An Overview: Syed Asad Raza HBLDocument39 pagesBanking Sector-An Overview: Syed Asad Raza HBL007tahir007No ratings yet

- Assist Through Unexpected MeasuresDocument3 pagesAssist Through Unexpected MeasuresNoman WarraichNo ratings yet

- Retail Banking Dec 2023Document10 pagesRetail Banking Dec 2023Rameshwar BhatiNo ratings yet

- Module 5Document29 pagesModule 5pavithran selvamNo ratings yet

- Unit II Part 1 KYCDocument100 pagesUnit II Part 1 KYCramyaNo ratings yet

- Analytical Tools (Strat Plan) - 1Document16 pagesAnalytical Tools (Strat Plan) - 1Low El LaNo ratings yet

- Aci PRM Enterprise RiskDocument23 pagesAci PRM Enterprise RiskRajesh VasudevanNo ratings yet

- E PaymentDocument8 pagesE PaymentPrashant SinghNo ratings yet

- 12 Delivery Channel of Retail BankingDocument8 pages12 Delivery Channel of Retail BankingShoyeab Rahman AbirNo ratings yet

- Future Trends Nick SkinnerDocument6 pagesFuture Trends Nick Skinnerrishabhjain6722No ratings yet

- Banking in The Modern AgeDocument26 pagesBanking in The Modern AgeMeesam NaqviNo ratings yet

- Digital Finance - UNIT 2Document8 pagesDigital Finance - UNIT 2NAVYA JUNEJA 2023323No ratings yet

- 1.TNASDC DBF Paper IV Module A Unit 1,2 and 3Document18 pages1.TNASDC DBF Paper IV Module A Unit 1,2 and 3dhanushtrack3No ratings yet

- E BankingDocument7 pagesE Bankingsatyam krNo ratings yet

- Script Operational Risk p3Document3 pagesScript Operational Risk p3Nguyễn Thanh TùngNo ratings yet

- OpenWay InsightsDocument8 pagesOpenWay InsightsHarisNo ratings yet

- Unit IVDocument18 pagesUnit IVVignana DeepthiNo ratings yet

- ChaptersDocument53 pagesChaptersHezekia KiruiNo ratings yet

- Electronic Retailing - (401) Unit-2 E-Commerce ApplicationsDocument24 pagesElectronic Retailing - (401) Unit-2 E-Commerce ApplicationsVinod NairNo ratings yet

- MR Latter Looks at The Implications of E-Commerce For The Banking and Monetary System in Hong KongDocument4 pagesMR Latter Looks at The Implications of E-Commerce For The Banking and Monetary System in Hong KongFlaviub23No ratings yet

- Name Netid Group Number: Website Link: Tutorial Details Time Spent On AssignmentDocument10 pagesName Netid Group Number: Website Link: Tutorial Details Time Spent On Assignmentstho976No ratings yet

- Digital BankingDocument3 pagesDigital BankingbehayluNo ratings yet

- Eje 3Document12 pagesEje 3Alinzon RuizNo ratings yet

- 3 - Mobile Banking Case StudyDocument7 pages3 - Mobile Banking Case StudyDevspringNo ratings yet

- Fi Unit 4 (1) LL MergedDocument24 pagesFi Unit 4 (1) LL MergedrohitNo ratings yet

- Credit Card Fraud Detection Full Doc 3Document74 pagesCredit Card Fraud Detection Full Doc 3BME AKASH SNo ratings yet

- Presented by Utkarsh PandeyDocument21 pagesPresented by Utkarsh PandeyUtkarsh PandeyNo ratings yet

- Financial ServicesDocument30 pagesFinancial Servicesmanojkumartanwar05No ratings yet

- Minelab Go Find 40Document2 pagesMinelab Go Find 40blagoj-1No ratings yet

- Active Subwoofer 8": Order Ref: 170.190 User ManualDocument4 pagesActive Subwoofer 8": Order Ref: 170.190 User Manuallaur dafinNo ratings yet

- OCT Retiview 500 Optical Coherence Tomography: FeatureDocument7 pagesOCT Retiview 500 Optical Coherence Tomography: FeatureNurul AminNo ratings yet

- ASTM Page For Degradable PlasticsDocument2 pagesASTM Page For Degradable Plasticsjohnsygeorge1978No ratings yet

- Veleta (Sierra Nevada)Document2 pagesVeleta (Sierra Nevada)catalinatorreNo ratings yet

- Moddingmorroblivion 1Document99 pagesModdingmorroblivion 1Deanna RussellNo ratings yet

- Laboratory Exercise 2: Basic Logic GatesDocument5 pagesLaboratory Exercise 2: Basic Logic GatesSantiago EspitiaNo ratings yet

- Minerals Engineering Volume 16 Issue 12 2003 (Doi 10.1016 - J.mineng.2003.08.011) M. Lindqvist C.M. Evertsson - Prediction of Worn Geometry in Cone CrushersDocument7 pagesMinerals Engineering Volume 16 Issue 12 2003 (Doi 10.1016 - J.mineng.2003.08.011) M. Lindqvist C.M. Evertsson - Prediction of Worn Geometry in Cone CrushersAditya NugrahaNo ratings yet

- Color Gradient: 1 Axial GradientsDocument3 pagesColor Gradient: 1 Axial GradientsManuel MensaNo ratings yet

- IntroDocument35 pagesIntroravthugNo ratings yet

- Advantage Yankee Dryer CHDocument12 pagesAdvantage Yankee Dryer CHnotengofffNo ratings yet

- Saudi Aramco Inspection Checklist: Compaction Testing SAIC-A-1005 30-Apr-13 CivilDocument3 pagesSaudi Aramco Inspection Checklist: Compaction Testing SAIC-A-1005 30-Apr-13 CivilJeffrey Lipata Jr.No ratings yet

- How To Set Up and Use Candle For Roughing & Finishing PassesDocument3 pagesHow To Set Up and Use Candle For Roughing & Finishing PassesIshmael AliNo ratings yet

- Daaf006099 000Document2 pagesDaaf006099 000apsNo ratings yet

- ISPF Table ExampleDocument31 pagesISPF Table ExampleThamizharasan ANo ratings yet

- Digital Control System-1Document47 pagesDigital Control System-1Makesh MäKzNo ratings yet

- ESD 9 Operating InstructionsDocument55 pagesESD 9 Operating InstructionsKevin BaylonNo ratings yet

- Extended Abstract ExampleDocument3 pagesExtended Abstract ExampleHarzy Randhani Irdham100% (1)

- A71572Document4 pagesA71572游智麟No ratings yet

- How To Create Custom Excel Functions. User Defined Function (UDF) Examples FDocument4 pagesHow To Create Custom Excel Functions. User Defined Function (UDF) Examples FLidijaSpaseskaNo ratings yet

- 8086Document54 pages8086Pavankumar KalliNo ratings yet

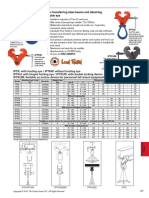

- For Transferring Steel Beams and Attaching Tackle Eye: IptkuDocument1 pageFor Transferring Steel Beams and Attaching Tackle Eye: IptkuKonstantinos SynodinosNo ratings yet

- Basic Cleanroom ProtocolDocument3 pagesBasic Cleanroom ProtocolkarengisellNo ratings yet

- Dokmee DMSDocument2 pagesDokmee DMSsandi hidayatNo ratings yet

- Case 1 sTUDYDocument3 pagesCase 1 sTUDYianiroy13No ratings yet

- Fan Coil Units Standard Type: FCU/2020/R1Document3 pagesFan Coil Units Standard Type: FCU/2020/R1Ahmed SohailNo ratings yet

- Me6505 Model Exam I QP Set A&bDocument9 pagesMe6505 Model Exam I QP Set A&bvenkatesh naiduNo ratings yet

- DS-381 - 6 UniCharge 50Document2 pagesDS-381 - 6 UniCharge 50Sajjad HussainNo ratings yet

- Assignment2 Answer-KeyDocument11 pagesAssignment2 Answer-KeyRed Crazy0% (1)