Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

6 viewsDecision

Decision

Uploaded by

Urooj Alam FarooquiOpportunity loss is the difference between the actual payoff from an action and the optimal payoff given an event. The document provides an example using investment choices - large, average, and small factory - and economic events - strong, stable, and weak economy. It calculates the expected monetary value (EMV) and expected opportunity loss (EOL) for each investment choice to help evaluate which choice maximizes expected value and minimizes expected opportunity loss.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You might also like

- Managerial Statistics-Notes On All ChapterDocument73 pagesManagerial Statistics-Notes On All ChapterNati PUFFxKID100% (1)

- Cat WheelabratorDocument62 pagesCat WheelabratorGabriel RangelNo ratings yet

- LeDucThinh BABAIU14255 DecisionAnalysisDocument6 pagesLeDucThinh BABAIU14255 DecisionAnalysisVô ThườngNo ratings yet

- Cromwell Center Replacement Feasibility StudyDocument18 pagesCromwell Center Replacement Feasibility StudyDNAinfoNewYork100% (1)

- Classification of IndustriesDocument8 pagesClassification of IndustriesOm Panchal100% (1)

- Decision Making Under RiskDocument15 pagesDecision Making Under RiskJamie Arquiro100% (2)

- QBA03Document45 pagesQBA03maitha alrNo ratings yet

- Elenco Apparati AvioniciDocument53 pagesElenco Apparati AvioniciStrawichDaniel25% (4)

- Siebel Communications 8.1Document258 pagesSiebel Communications 8.1Oscar Garcia80% (5)

- Basic Business Statistics: 11 EditionDocument43 pagesBasic Business Statistics: 11 EditionAuliaPuspitaNo ratings yet

- eda2b2701fe1a9829930e6b05033dffe (5)Document6 pageseda2b2701fe1a9829930e6b05033dffe (5)saumya tiwariNo ratings yet

- 4 Decision Under RiskDocument36 pages4 Decision Under RiskEdie SilvergunsNo ratings yet

- Decision Making Under Risk: Expected Monetary Value (EMV)Document36 pagesDecision Making Under Risk: Expected Monetary Value (EMV)Edie SilvergunsNo ratings yet

- Decision AnalysisDocument34 pagesDecision AnalysisunknownNo ratings yet

- Session 2 ClassPPTDocument24 pagesSession 2 ClassPPTAmit BhagatNo ratings yet

- 4 Decision Making Under RiskDocument49 pages4 Decision Making Under RiskMohammad Raihanul HasanNo ratings yet

- APK - Minggu I & IIDocument19 pagesAPK - Minggu I & IIthe laskarNo ratings yet

- Decision MakingDocument48 pagesDecision MakingMiiss CathymiaoNo ratings yet

- Session 2 ClassPPTDocument39 pagesSession 2 ClassPPTSiddharth Shankar BebartaNo ratings yet

- An Introduction To Decision TheoryDocument14 pagesAn Introduction To Decision TheoryMohammad Raihanul HasanNo ratings yet

- Decision Theory - Part 2Document15 pagesDecision Theory - Part 2Helaena Ruvie Quitoras PallayaNo ratings yet

- Financial Data Cash Outflow Detail Year One (Note Year Two (Note Year Three Note Company Expense (Fixed Cost)Document1 pageFinancial Data Cash Outflow Detail Year One (Note Year Two (Note Year Three Note Company Expense (Fixed Cost)inn. tanNo ratings yet

- Teoria de Decision 1Document54 pagesTeoria de Decision 1Eleida SalgadoNo ratings yet

- Chapter 3: Decision Analysis: Instructor: Dr. Huynh Thi Ngoc Hien Email: Htnhien@hcmiu - Edu.vnDocument45 pagesChapter 3: Decision Analysis: Instructor: Dr. Huynh Thi Ngoc Hien Email: Htnhien@hcmiu - Edu.vnQúi Phan ThọNo ratings yet

- Calculate Your Risk of RuinDocument3 pagesCalculate Your Risk of Ruinsourabh6chakrabort-1No ratings yet

- VI. Decision AnalysisDocument5 pagesVI. Decision AnalysisGalang, Princess T.No ratings yet

- Economic Solution PDFDocument11 pagesEconomic Solution PDFNazia JadoonNo ratings yet

- BBFH 302 Ass 1Document5 pagesBBFH 302 Ass 1Godie MaraNo ratings yet

- To Accompany: Quantitative Analysis For Management, Tenth EditionDocument27 pagesTo Accompany: Quantitative Analysis For Management, Tenth EditionSyaz AmriNo ratings yet

- Decision Making ToolsDocument11 pagesDecision Making ToolsATticFistNo ratings yet

- Decision TheoryDocument36 pagesDecision Theorythea gabriellaNo ratings yet

- Indifference CurveDocument22 pagesIndifference CurveRahul sardanaNo ratings yet

- Decision Makers & Objectives: Utility Function Risk Averse Risk Neutral Risk LoverDocument10 pagesDecision Makers & Objectives: Utility Function Risk Averse Risk Neutral Risk Loverscribed_fanNo ratings yet

- Lecture 5-1 Midterm ReviewDocument26 pagesLecture 5-1 Midterm ReviewaytansingNo ratings yet

- Chapter 3-Decision Analysis - 06mayDocument7 pagesChapter 3-Decision Analysis - 06mayTabassum Hossain MrittikaNo ratings yet

- Problem Solving Decision Analysis Problem No. 1Document2 pagesProblem Solving Decision Analysis Problem No. 1Mj Ong Pierson Garbo100% (2)

- Risk 2Document33 pagesRisk 2Alba María Carreño GarcíaNo ratings yet

- IM - Chapter 2 AnswersDocument4 pagesIM - Chapter 2 AnswersEileen WongNo ratings yet

- FM - Risk and Rates of ReturnDocument10 pagesFM - Risk and Rates of ReturnMaxine SantosNo ratings yet

- LeveragesDocument50 pagesLeveragesPrem KishanNo ratings yet

- Financial ManagementDocument2 pagesFinancial ManagementJenny LaiNo ratings yet

- Chapter 20 PowerPointDocument18 pagesChapter 20 PowerPointfitriawasilatulastifahNo ratings yet

- Alvina Risk Simulation ClassDocument16 pagesAlvina Risk Simulation Classtaneer.gameNo ratings yet

- Exercise - FIN5100 Exercise RISK N RETURN QnADocument6 pagesExercise - FIN5100 Exercise RISK N RETURN QnAIzzah IzzatiNo ratings yet

- Decision TheoryDocument20 pagesDecision TheoryJehezkiel Ivan LinardyNo ratings yet

- Decision Making Under UncertaintyDocument51 pagesDecision Making Under UncertaintyRavneet SinghNo ratings yet

- Economics HandoutDocument60 pagesEconomics Handoutyeeyeelwin181079No ratings yet

- Economics of Risk ManagementDocument29 pagesEconomics of Risk ManagementRoman RoscaNo ratings yet

- F0-Project Opp Risk RegisterDocument7 pagesF0-Project Opp Risk RegisterVinit Kant MajumdarNo ratings yet

- Probability Distributions: G N PatelDocument37 pagesProbability Distributions: G N PatelA.k. AdityaNo ratings yet

- Risk Ppt. Chapter 5Document54 pagesRisk Ppt. Chapter 5Jmae GaufoNo ratings yet

- Decision TheoryDocument37 pagesDecision TheorysunflowerNo ratings yet

- CIC 3019 Tutorial Ch3 - SolutionsDocument5 pagesCIC 3019 Tutorial Ch3 - SolutionsYen Yen BiiNo ratings yet

- Week 5 Decision Tree - Revised ProbabilityDocument51 pagesWeek 5 Decision Tree - Revised ProbabilityNhư NgNo ratings yet

- 1.decision AnalysisDocument27 pages1.decision Analysismanu192No ratings yet

- UncertaintyDocument20 pagesUncertaintySaji JimenoNo ratings yet

- Risk, Return, and The Capital Asset Pricing ModelDocument52 pagesRisk, Return, and The Capital Asset Pricing ModelFaryal ShahidNo ratings yet

- Random VariableDocument1 pageRandom VariableaniketpaladhiNo ratings yet

- Module A: Discussion QuestionsDocument10 pagesModule A: Discussion Questionskaranjangid17No ratings yet

- Quiz 5Document115 pagesQuiz 5LEKHAN GAVINo ratings yet

- Ifm-Chapter 2 - Risk and Return 1 (Slide)Document56 pagesIfm-Chapter 2 - Risk and Return 1 (Slide)minhhien222No ratings yet

- Pertemuan 2 - Decison Making On Risk & Uncertainty ConditionDocument19 pagesPertemuan 2 - Decison Making On Risk & Uncertainty ConditionBisma Wicaksana AlbahriNo ratings yet

- Problem 16Document11 pagesProblem 16Anjan kunduNo ratings yet

- Pertemuan 3 Decision Making Tools V 2018Document27 pagesPertemuan 3 Decision Making Tools V 2018Iwayan Aikyam SuyancaNo ratings yet

- ECOMMERCE Unit 3Document195 pagesECOMMERCE Unit 3Urooj Alam FarooquiNo ratings yet

- Literary Arts - ResultsDocument1 pageLiterary Arts - ResultsUrooj Alam FarooquiNo ratings yet

- IBS Sem - VDocument44 pagesIBS Sem - VUrooj Alam FarooquiNo ratings yet

- Production ManagementDocument20 pagesProduction ManagementUrooj Alam FarooquiNo ratings yet

- 2nd SESSIONAL EXAM NOTICE BBA DEPT (DEC 2022)Document2 pages2nd SESSIONAL EXAM NOTICE BBA DEPT (DEC 2022)Urooj Alam FarooquiNo ratings yet

- Production ManagementDocument6 pagesProduction ManagementUrooj Alam FarooquiNo ratings yet

- Auditing - Unit - IDocument71 pagesAuditing - Unit - IUrooj Alam FarooquiNo ratings yet

- PWC Basics of Mining 4 Som Mine Waste ManagementDocument46 pagesPWC Basics of Mining 4 Som Mine Waste Managementakm249No ratings yet

- Lower Modi Khola Hydroelectric Project (20 MW) : Parbat District, Western Nepal Karthik 2073Document19 pagesLower Modi Khola Hydroelectric Project (20 MW) : Parbat District, Western Nepal Karthik 2073Sandeep LamsalNo ratings yet

- ICOM IC-R6 Manual (EN)Document96 pagesICOM IC-R6 Manual (EN)Mandu CerianoNo ratings yet

- Fill-A-Pix SamplerDocument7 pagesFill-A-Pix SamplerJavier Abarca ObregonNo ratings yet

- Biology EssayDocument8 pagesBiology Essayglzhcoaeg100% (1)

- Gender and Diversity in Social AdministrationDocument10 pagesGender and Diversity in Social AdministrationKrishian Erl AndogNo ratings yet

- Chapter 3Document18 pagesChapter 3shams221No ratings yet

- Bar Bending Schedule (BBS) Estimate of Steel in Building ConstructionDocument7 pagesBar Bending Schedule (BBS) Estimate of Steel in Building Constructionဒုကၡ သစၥာNo ratings yet

- Document Management System Use Case DiagramDocument5 pagesDocument Management System Use Case Diagramgn.venkat27No ratings yet

- Ranklist of BBA G 4TH Semester E.T. Exam May 2012Document53 pagesRanklist of BBA G 4TH Semester E.T. Exam May 2012Aman KukrejaNo ratings yet

- Write-Up - GraphDocument17 pagesWrite-Up - GraphMartha AntonNo ratings yet

- Toolbox Talks: Forklift FatalitiesDocument1 pageToolbox Talks: Forklift Fatalitiesserdar yücelNo ratings yet

- Quality MGT Practices and Impact On PerformanceDocument28 pagesQuality MGT Practices and Impact On PerformanceMizaa Jamali0% (1)

- Mat 060 Ve01 Syllabus Fa12Document6 pagesMat 060 Ve01 Syllabus Fa12educareNo ratings yet

- Lesson 5 SoftwareDocument18 pagesLesson 5 SoftwareRomar BrionesNo ratings yet

- Cash Flows AccountingDocument9 pagesCash Flows AccountingRosa Villaluz BanairaNo ratings yet

- List of Illegal Projects, Schemes & Societies in Malir, KarachiDocument7 pagesList of Illegal Projects, Schemes & Societies in Malir, KarachiMuhammad Hanef ShaikhNo ratings yet

- Hay Pitch Deck - Https://howareyou - WorkDocument18 pagesHay Pitch Deck - Https://howareyou - WorkMarius StankiewiczNo ratings yet

- Appendix D-2 ASTM D5084 Hydraulic ConductivityDocument3 pagesAppendix D-2 ASTM D5084 Hydraulic ConductivityomerNo ratings yet

- 1.8L - Engine - Motronic Multiport Fuel Injection (MFI) 132 KDocument18 pages1.8L - Engine - Motronic Multiport Fuel Injection (MFI) 132 KSteeven RodriguezNo ratings yet

- Python Programming LanguageDocument11 pagesPython Programming LanguageLoser To WinnerNo ratings yet

- Muhammad Aqlan Rusaydi S2 Group Assignment MKT2013Document36 pagesMuhammad Aqlan Rusaydi S2 Group Assignment MKT2013kl2204010823No ratings yet

- Algorithms For Data Science: CSOR W4246Document44 pagesAlgorithms For Data Science: CSOR W4246EarthaNo ratings yet

- BV Rules - Nr529Document144 pagesBV Rules - Nr529Vasiljka Đordan JelacaNo ratings yet

Decision

Decision

Uploaded by

Urooj Alam Farooqui0 ratings0% found this document useful (0 votes)

6 views8 pagesOpportunity loss is the difference between the actual payoff from an action and the optimal payoff given an event. The document provides an example using investment choices - large, average, and small factory - and economic events - strong, stable, and weak economy. It calculates the expected monetary value (EMV) and expected opportunity loss (EOL) for each investment choice to help evaluate which choice maximizes expected value and minimizes expected opportunity loss.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentOpportunity loss is the difference between the actual payoff from an action and the optimal payoff given an event. The document provides an example using investment choices - large, average, and small factory - and economic events - strong, stable, and weak economy. It calculates the expected monetary value (EMV) and expected opportunity loss (EOL) for each investment choice to help evaluate which choice maximizes expected value and minimizes expected opportunity loss.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

0 ratings0% found this document useful (0 votes)

6 views8 pagesDecision

Decision

Uploaded by

Urooj Alam FarooquiOpportunity loss is the difference between the actual payoff from an action and the optimal payoff given an event. The document provides an example using investment choices - large, average, and small factory - and economic events - strong, stable, and weak economy. It calculates the expected monetary value (EMV) and expected opportunity loss (EOL) for each investment choice to help evaluate which choice maximizes expected value and minimizes expected opportunity loss.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

You are on page 1of 8

Opportunity Loss

Opportunity loss is the difference between an actual payoff for an

action and the optimal payoff, given a particular event

Investment Choice

Profit in $1,000’s (Action)

Payoff

(Events)

Large Factory Average Small Factory

Table

Factory

Strong Economy 200 90 40

Stable Economy 50 120 30

Weak Economy -120 -30 20

The action “Average factory” has payoff 90 for “Strong Economy”. Given “Strong Economy”,

the choice of “Large factory” would have given a payoff of 200, or 110 higher. Opportunity

loss = 110 for this cell.

Opportunity Loss

Investment Choice (Action)

Profit in $1,000’s Payoff

(Events) Large Average Small

Factory Factory Factory Table

Strong Economy 200 90 40

Stable Economy

Weak Economy

50

-120

120

-30

30

20

Opportunity

Loss Table

Investment Choice (Action)

Opportunity Loss in

$1,000’s Large Average Small

(Events) Factory Factory Factory

Strong Economy 0 110 160

Stable Economy 70 0 90

Weak Economy 140 50 0

Decision Criteria

Expected Monetary Value (EMV)

The expected profit for taking action Aj

Expected Opportunity Loss (EOL)

The expected opportunity loss for taking action Aj

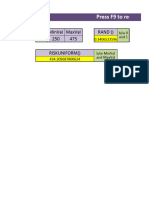

Expected Monetary Value

Goal: Maximize expected value

The expected monetary value is the weighted average

payoff, given specified probabilities for each event

N

EMV ( j ) X ij Pi

i 1

Where EMV(j) = expected monetary value of action j

Xij = payoff for action j when event i occurs

Pi = probability of event i

Expected Monetary Value

The expected value is the weighted average

payoff, given specified probabilities for

each event

Investment Choice Suppose these

Profit in $1,000’s (Action) probabilities

(Events)

Large Average Small Factory have been

Factory Factory assessed for

these three

Strong Economy (0.3) 200 90 40 events

Stable Economy (0.5) 50 120 30

Weak Economy (0.2) -120 -30 20

Expected Monetary Value

Payoff Table:

Investment Choice

Profit in $1,000’s (Action)

(Events)

Large Average Small Factory

Factory Factory

Strong Economy (0.3) 200 90 40

Stable Economy (0.5) 50 120 30

Weak Economy (0.2) -120 -30 20

EMV (Expected Values) 61 81 31

Example: EMV (Average factory) = 90(.3) + 120(.5)

+ (-30)(.2) = 81

Expected Opportunity Loss

Goal: Minimize expected opportunity loss

The expected opportunity loss is the weighted average

loss, given specified probabilities for each event

N

EOL(j) L ijPi

i 1

Where EOL(j) = expected monetary value of action j

Lij = opportunity loss for action j when event i occurs

Pi = probability of event i

Expected Opportunity Loss

Opportunity Loss Table

Investment Choice (Action)

Opportunity Loss in

$1,000’s Large Average Small

Factory Factory Factory

(Events)

Strong Economy (0.3) 0 110 160

Stable Economy (0.5) 70 0 90

Weak Economy (0.2) 140 50 0

Expected Opportunity Loss 63 43 93

(EOL)

Example: EOL (Large factory) = 0(.3) + 70(.5) +

(140)(.2) = 63

You might also like

- Managerial Statistics-Notes On All ChapterDocument73 pagesManagerial Statistics-Notes On All ChapterNati PUFFxKID100% (1)

- Cat WheelabratorDocument62 pagesCat WheelabratorGabriel RangelNo ratings yet

- LeDucThinh BABAIU14255 DecisionAnalysisDocument6 pagesLeDucThinh BABAIU14255 DecisionAnalysisVô ThườngNo ratings yet

- Cromwell Center Replacement Feasibility StudyDocument18 pagesCromwell Center Replacement Feasibility StudyDNAinfoNewYork100% (1)

- Classification of IndustriesDocument8 pagesClassification of IndustriesOm Panchal100% (1)

- Decision Making Under RiskDocument15 pagesDecision Making Under RiskJamie Arquiro100% (2)

- QBA03Document45 pagesQBA03maitha alrNo ratings yet

- Elenco Apparati AvioniciDocument53 pagesElenco Apparati AvioniciStrawichDaniel25% (4)

- Siebel Communications 8.1Document258 pagesSiebel Communications 8.1Oscar Garcia80% (5)

- Basic Business Statistics: 11 EditionDocument43 pagesBasic Business Statistics: 11 EditionAuliaPuspitaNo ratings yet

- eda2b2701fe1a9829930e6b05033dffe (5)Document6 pageseda2b2701fe1a9829930e6b05033dffe (5)saumya tiwariNo ratings yet

- 4 Decision Under RiskDocument36 pages4 Decision Under RiskEdie SilvergunsNo ratings yet

- Decision Making Under Risk: Expected Monetary Value (EMV)Document36 pagesDecision Making Under Risk: Expected Monetary Value (EMV)Edie SilvergunsNo ratings yet

- Decision AnalysisDocument34 pagesDecision AnalysisunknownNo ratings yet

- Session 2 ClassPPTDocument24 pagesSession 2 ClassPPTAmit BhagatNo ratings yet

- 4 Decision Making Under RiskDocument49 pages4 Decision Making Under RiskMohammad Raihanul HasanNo ratings yet

- APK - Minggu I & IIDocument19 pagesAPK - Minggu I & IIthe laskarNo ratings yet

- Decision MakingDocument48 pagesDecision MakingMiiss CathymiaoNo ratings yet

- Session 2 ClassPPTDocument39 pagesSession 2 ClassPPTSiddharth Shankar BebartaNo ratings yet

- An Introduction To Decision TheoryDocument14 pagesAn Introduction To Decision TheoryMohammad Raihanul HasanNo ratings yet

- Decision Theory - Part 2Document15 pagesDecision Theory - Part 2Helaena Ruvie Quitoras PallayaNo ratings yet

- Financial Data Cash Outflow Detail Year One (Note Year Two (Note Year Three Note Company Expense (Fixed Cost)Document1 pageFinancial Data Cash Outflow Detail Year One (Note Year Two (Note Year Three Note Company Expense (Fixed Cost)inn. tanNo ratings yet

- Teoria de Decision 1Document54 pagesTeoria de Decision 1Eleida SalgadoNo ratings yet

- Chapter 3: Decision Analysis: Instructor: Dr. Huynh Thi Ngoc Hien Email: Htnhien@hcmiu - Edu.vnDocument45 pagesChapter 3: Decision Analysis: Instructor: Dr. Huynh Thi Ngoc Hien Email: Htnhien@hcmiu - Edu.vnQúi Phan ThọNo ratings yet

- Calculate Your Risk of RuinDocument3 pagesCalculate Your Risk of Ruinsourabh6chakrabort-1No ratings yet

- VI. Decision AnalysisDocument5 pagesVI. Decision AnalysisGalang, Princess T.No ratings yet

- Economic Solution PDFDocument11 pagesEconomic Solution PDFNazia JadoonNo ratings yet

- BBFH 302 Ass 1Document5 pagesBBFH 302 Ass 1Godie MaraNo ratings yet

- To Accompany: Quantitative Analysis For Management, Tenth EditionDocument27 pagesTo Accompany: Quantitative Analysis For Management, Tenth EditionSyaz AmriNo ratings yet

- Decision Making ToolsDocument11 pagesDecision Making ToolsATticFistNo ratings yet

- Decision TheoryDocument36 pagesDecision Theorythea gabriellaNo ratings yet

- Indifference CurveDocument22 pagesIndifference CurveRahul sardanaNo ratings yet

- Decision Makers & Objectives: Utility Function Risk Averse Risk Neutral Risk LoverDocument10 pagesDecision Makers & Objectives: Utility Function Risk Averse Risk Neutral Risk Loverscribed_fanNo ratings yet

- Lecture 5-1 Midterm ReviewDocument26 pagesLecture 5-1 Midterm ReviewaytansingNo ratings yet

- Chapter 3-Decision Analysis - 06mayDocument7 pagesChapter 3-Decision Analysis - 06mayTabassum Hossain MrittikaNo ratings yet

- Problem Solving Decision Analysis Problem No. 1Document2 pagesProblem Solving Decision Analysis Problem No. 1Mj Ong Pierson Garbo100% (2)

- Risk 2Document33 pagesRisk 2Alba María Carreño GarcíaNo ratings yet

- IM - Chapter 2 AnswersDocument4 pagesIM - Chapter 2 AnswersEileen WongNo ratings yet

- FM - Risk and Rates of ReturnDocument10 pagesFM - Risk and Rates of ReturnMaxine SantosNo ratings yet

- LeveragesDocument50 pagesLeveragesPrem KishanNo ratings yet

- Financial ManagementDocument2 pagesFinancial ManagementJenny LaiNo ratings yet

- Chapter 20 PowerPointDocument18 pagesChapter 20 PowerPointfitriawasilatulastifahNo ratings yet

- Alvina Risk Simulation ClassDocument16 pagesAlvina Risk Simulation Classtaneer.gameNo ratings yet

- Exercise - FIN5100 Exercise RISK N RETURN QnADocument6 pagesExercise - FIN5100 Exercise RISK N RETURN QnAIzzah IzzatiNo ratings yet

- Decision TheoryDocument20 pagesDecision TheoryJehezkiel Ivan LinardyNo ratings yet

- Decision Making Under UncertaintyDocument51 pagesDecision Making Under UncertaintyRavneet SinghNo ratings yet

- Economics HandoutDocument60 pagesEconomics Handoutyeeyeelwin181079No ratings yet

- Economics of Risk ManagementDocument29 pagesEconomics of Risk ManagementRoman RoscaNo ratings yet

- F0-Project Opp Risk RegisterDocument7 pagesF0-Project Opp Risk RegisterVinit Kant MajumdarNo ratings yet

- Probability Distributions: G N PatelDocument37 pagesProbability Distributions: G N PatelA.k. AdityaNo ratings yet

- Risk Ppt. Chapter 5Document54 pagesRisk Ppt. Chapter 5Jmae GaufoNo ratings yet

- Decision TheoryDocument37 pagesDecision TheorysunflowerNo ratings yet

- CIC 3019 Tutorial Ch3 - SolutionsDocument5 pagesCIC 3019 Tutorial Ch3 - SolutionsYen Yen BiiNo ratings yet

- Week 5 Decision Tree - Revised ProbabilityDocument51 pagesWeek 5 Decision Tree - Revised ProbabilityNhư NgNo ratings yet

- 1.decision AnalysisDocument27 pages1.decision Analysismanu192No ratings yet

- UncertaintyDocument20 pagesUncertaintySaji JimenoNo ratings yet

- Risk, Return, and The Capital Asset Pricing ModelDocument52 pagesRisk, Return, and The Capital Asset Pricing ModelFaryal ShahidNo ratings yet

- Random VariableDocument1 pageRandom VariableaniketpaladhiNo ratings yet

- Module A: Discussion QuestionsDocument10 pagesModule A: Discussion Questionskaranjangid17No ratings yet

- Quiz 5Document115 pagesQuiz 5LEKHAN GAVINo ratings yet

- Ifm-Chapter 2 - Risk and Return 1 (Slide)Document56 pagesIfm-Chapter 2 - Risk and Return 1 (Slide)minhhien222No ratings yet

- Pertemuan 2 - Decison Making On Risk & Uncertainty ConditionDocument19 pagesPertemuan 2 - Decison Making On Risk & Uncertainty ConditionBisma Wicaksana AlbahriNo ratings yet

- Problem 16Document11 pagesProblem 16Anjan kunduNo ratings yet

- Pertemuan 3 Decision Making Tools V 2018Document27 pagesPertemuan 3 Decision Making Tools V 2018Iwayan Aikyam SuyancaNo ratings yet

- ECOMMERCE Unit 3Document195 pagesECOMMERCE Unit 3Urooj Alam FarooquiNo ratings yet

- Literary Arts - ResultsDocument1 pageLiterary Arts - ResultsUrooj Alam FarooquiNo ratings yet

- IBS Sem - VDocument44 pagesIBS Sem - VUrooj Alam FarooquiNo ratings yet

- Production ManagementDocument20 pagesProduction ManagementUrooj Alam FarooquiNo ratings yet

- 2nd SESSIONAL EXAM NOTICE BBA DEPT (DEC 2022)Document2 pages2nd SESSIONAL EXAM NOTICE BBA DEPT (DEC 2022)Urooj Alam FarooquiNo ratings yet

- Production ManagementDocument6 pagesProduction ManagementUrooj Alam FarooquiNo ratings yet

- Auditing - Unit - IDocument71 pagesAuditing - Unit - IUrooj Alam FarooquiNo ratings yet

- PWC Basics of Mining 4 Som Mine Waste ManagementDocument46 pagesPWC Basics of Mining 4 Som Mine Waste Managementakm249No ratings yet

- Lower Modi Khola Hydroelectric Project (20 MW) : Parbat District, Western Nepal Karthik 2073Document19 pagesLower Modi Khola Hydroelectric Project (20 MW) : Parbat District, Western Nepal Karthik 2073Sandeep LamsalNo ratings yet

- ICOM IC-R6 Manual (EN)Document96 pagesICOM IC-R6 Manual (EN)Mandu CerianoNo ratings yet

- Fill-A-Pix SamplerDocument7 pagesFill-A-Pix SamplerJavier Abarca ObregonNo ratings yet

- Biology EssayDocument8 pagesBiology Essayglzhcoaeg100% (1)

- Gender and Diversity in Social AdministrationDocument10 pagesGender and Diversity in Social AdministrationKrishian Erl AndogNo ratings yet

- Chapter 3Document18 pagesChapter 3shams221No ratings yet

- Bar Bending Schedule (BBS) Estimate of Steel in Building ConstructionDocument7 pagesBar Bending Schedule (BBS) Estimate of Steel in Building Constructionဒုကၡ သစၥာNo ratings yet

- Document Management System Use Case DiagramDocument5 pagesDocument Management System Use Case Diagramgn.venkat27No ratings yet

- Ranklist of BBA G 4TH Semester E.T. Exam May 2012Document53 pagesRanklist of BBA G 4TH Semester E.T. Exam May 2012Aman KukrejaNo ratings yet

- Write-Up - GraphDocument17 pagesWrite-Up - GraphMartha AntonNo ratings yet

- Toolbox Talks: Forklift FatalitiesDocument1 pageToolbox Talks: Forklift Fatalitiesserdar yücelNo ratings yet

- Quality MGT Practices and Impact On PerformanceDocument28 pagesQuality MGT Practices and Impact On PerformanceMizaa Jamali0% (1)

- Mat 060 Ve01 Syllabus Fa12Document6 pagesMat 060 Ve01 Syllabus Fa12educareNo ratings yet

- Lesson 5 SoftwareDocument18 pagesLesson 5 SoftwareRomar BrionesNo ratings yet

- Cash Flows AccountingDocument9 pagesCash Flows AccountingRosa Villaluz BanairaNo ratings yet

- List of Illegal Projects, Schemes & Societies in Malir, KarachiDocument7 pagesList of Illegal Projects, Schemes & Societies in Malir, KarachiMuhammad Hanef ShaikhNo ratings yet

- Hay Pitch Deck - Https://howareyou - WorkDocument18 pagesHay Pitch Deck - Https://howareyou - WorkMarius StankiewiczNo ratings yet

- Appendix D-2 ASTM D5084 Hydraulic ConductivityDocument3 pagesAppendix D-2 ASTM D5084 Hydraulic ConductivityomerNo ratings yet

- 1.8L - Engine - Motronic Multiport Fuel Injection (MFI) 132 KDocument18 pages1.8L - Engine - Motronic Multiport Fuel Injection (MFI) 132 KSteeven RodriguezNo ratings yet

- Python Programming LanguageDocument11 pagesPython Programming LanguageLoser To WinnerNo ratings yet

- Muhammad Aqlan Rusaydi S2 Group Assignment MKT2013Document36 pagesMuhammad Aqlan Rusaydi S2 Group Assignment MKT2013kl2204010823No ratings yet

- Algorithms For Data Science: CSOR W4246Document44 pagesAlgorithms For Data Science: CSOR W4246EarthaNo ratings yet

- BV Rules - Nr529Document144 pagesBV Rules - Nr529Vasiljka Đordan JelacaNo ratings yet