Professional Documents

Culture Documents

Machine Learning Presentation Richa

Machine Learning Presentation Richa

Uploaded by

Peter StarkCopyright:

Available Formats

You might also like

- Loan Eligibility Prediction: Machine LearningDocument8 pagesLoan Eligibility Prediction: Machine LearningJeet MaruNo ratings yet

- Thera Bank - Project - Submission - V1 PDFDocument26 pagesThera Bank - Project - Submission - V1 PDFRamachandran VenkataramanNo ratings yet

- Credit Card Fraud Detection Proposal RedoneDocument5 pagesCredit Card Fraud Detection Proposal RedoneadaneNo ratings yet

- Credit Approval Data Analysis Using Classification and Regression ModelsDocument2 pagesCredit Approval Data Analysis Using Classification and Regression Modelsaman guptaNo ratings yet

- Features Common To All ForecastsDocument5 pagesFeatures Common To All ForecastsGeneVive Mendoza40% (5)

- Assessment Report RichaDocument12 pagesAssessment Report RichaPeter StarkNo ratings yet

- Bank LoanPredic-WPS OfficeDocument8 pagesBank LoanPredic-WPS OfficeCHARAN SAI MUSHAMNo ratings yet

- Abhay Seminar PapersDocument16 pagesAbhay Seminar PapersHARRY POTTERNo ratings yet

- Prediction of Modernized Loan Approval System Based On Machine Learning ApproachDocument22 pagesPrediction of Modernized Loan Approval System Based On Machine Learning ApproachMandara ManjunathNo ratings yet

- T 0 Report Masina Niranjan KumarDocument10 pagesT 0 Report Masina Niranjan KumarNiranjan KumarNo ratings yet

- Predicting Personal Loan Approval Using Machine Learning HandbookDocument31 pagesPredicting Personal Loan Approval Using Machine Learning HandbookEzhilarasiNo ratings yet

- Loan ForwardDocument15 pagesLoan ForwardDerrick KimaniNo ratings yet

- Credit Card Fraud Dectection Machine LearningDocument62 pagesCredit Card Fraud Dectection Machine LearningranjithNo ratings yet

- Computerized Billing System Thesis DocumentationDocument6 pagesComputerized Billing System Thesis Documentationafbtegwly100% (1)

- UntitledDocument14 pagesUntitledLakhvir KaurNo ratings yet

- Cashiering System PDFDocument8 pagesCashiering System PDFChristian David Comilang CarpioNo ratings yet

- Machine LearningDocument17 pagesMachine LearningRishab Jain 2027203No ratings yet

- Hasan Rabbani ResumeDocument4 pagesHasan Rabbani ResumeGuar GumNo ratings yet

- UntitledDocument1 pageUntitledBhanu ParchuriNo ratings yet

- Loan Eligibility PredictionDocument12 pagesLoan Eligibility PredictionUddhav ChaliseNo ratings yet

- Data Analyst Interview QnADocument8 pagesData Analyst Interview QnAhemant moreNo ratings yet

- Synopsis GilluDocument12 pagesSynopsis Gillustifler joeNo ratings yet

- Sample Questionnaire For Thesis About Enrollment SystemDocument5 pagesSample Questionnaire For Thesis About Enrollment SystemafkneafpzNo ratings yet

- Thesis On Internet Banking ServicesDocument4 pagesThesis On Internet Banking Servicesrehyfnugg100% (2)

- Bank AllianceDocument18 pagesBank AlliancevisheshNo ratings yet

- Literature Review On Loan Management SystemDocument7 pagesLiterature Review On Loan Management Systemc5p7mv6j100% (1)

- Techniacl Answers To Real World Problems: Team 4 Topic:Real Time Face Mask DetectionDocument23 pagesTechniacl Answers To Real World Problems: Team 4 Topic:Real Time Face Mask Detectionsiva suryaNo ratings yet

- CET351 Research Project Plan Subash Adhikari Pokhara Evaluation of Current Research On Credit Card Fraud Detection Methods Word Count:2161Document13 pagesCET351 Research Project Plan Subash Adhikari Pokhara Evaluation of Current Research On Credit Card Fraud Detection Methods Word Count:2161Prakash PokhrelNo ratings yet

- Ihic-2022 PPT Paper - Id 100Document11 pagesIhic-2022 PPT Paper - Id 100prashantrinkuNo ratings yet

- Loan Approval - PPTDocument19 pagesLoan Approval - PPTVishal LabdeNo ratings yet

- Credit Card Approval Prediction Using Machine LearningDocument2 pagesCredit Card Approval Prediction Using Machine LearningHemantNo ratings yet

- Name - Santoshi Devi Nayudubathula Reg No - 2021Pgp220Document4 pagesName - Santoshi Devi Nayudubathula Reg No - 2021Pgp220Santoshi SatyanarayanaNo ratings yet

- Adult Income PredictionDocument9 pagesAdult Income PredictionMR.NAITIK PATEL0% (1)

- Case Study2Document6 pagesCase Study2Marvin CincoNo ratings yet

- Internet Banking DissertationDocument7 pagesInternet Banking Dissertationsupnilante1980100% (1)

- Unit I - BigDataDocument47 pagesUnit I - BigDataFarhan SjNo ratings yet

- BAPM Sandeep 110720 PDFDocument3 pagesBAPM Sandeep 110720 PDFNihal SinghNo ratings yet

- Karnataka State Open University Manasa Gangothri, Mysore-570006Document55 pagesKarnataka State Open University Manasa Gangothri, Mysore-570006Kannan SNo ratings yet

- Bharath University B.Tech / CSE: Financial Predictions With Machine LearningDocument34 pagesBharath University B.Tech / CSE: Financial Predictions With Machine LearningSampath TNo ratings yet

- Presentation On Data ScienceDocument15 pagesPresentation On Data ScienceadddataNo ratings yet

- Brain-A-Lytics 3.0 Case: A One-Stop Career CatalystDocument5 pagesBrain-A-Lytics 3.0 Case: A One-Stop Career Catalystxilox67632No ratings yet

- Credit Scoring and Data MiningDocument170 pagesCredit Scoring and Data MiningSiau Shuang100% (1)

- Link For Google Colab Note Book: Pa GeDocument17 pagesLink For Google Colab Note Book: Pa Gesid pNo ratings yet

- Auto InsuranceDocument19 pagesAuto InsuranceUmaNo ratings yet

- Internet Banking and Customer Satisfaction ThesisDocument4 pagesInternet Banking and Customer Satisfaction Thesisfbyhhh5r100% (1)

- Payment System Thesis DocumentationDocument7 pagesPayment System Thesis Documentationangelarobertswilmington100% (2)

- 2022 V13i1198Document12 pages2022 V13i1198yousragaidNo ratings yet

- Review of Literature On Payroll SystemsDocument8 pagesReview of Literature On Payroll Systemsc5haeg0n100% (1)

- Credit Card Fraud DetectionDocument89 pagesCredit Card Fraud DetectionRahul RepalaNo ratings yet

- Cluster Credit Risk R PDFDocument13 pagesCluster Credit Risk R PDFFabian ChahinNo ratings yet

- Software Engineeing Project: Payroll Management SystemDocument23 pagesSoftware Engineeing Project: Payroll Management SystemanshakhilNo ratings yet

- Financial Status Analysis of Credit Score Rating UsingDocument18 pagesFinancial Status Analysis of Credit Score Rating UsingAnonymous pKxfg8NNo ratings yet

- Project Proposal No. 1 Project Title: Project BackgroundDocument4 pagesProject Proposal No. 1 Project Title: Project BackgroundsHiegelah00100% (2)

- Factors Influenced Loan Amount - A Case StudyDocument11 pagesFactors Influenced Loan Amount - A Case Studyrabiamajeed22199No ratings yet

- Loan Prediction Using MachineDocument1 pageLoan Prediction Using Machine3201313No ratings yet

- Sample Thesis Computerized Payroll SystemDocument5 pagesSample Thesis Computerized Payroll Systemmarystevensonbaltimore100% (2)

- Name: Sitte Alma B. Sultan Course: BBSBA-HRM Subject: RECRUITMENT AND SELECTION (TTH-8:00-9:00PM) Case Study: E-RecruitmentDocument8 pagesName: Sitte Alma B. Sultan Course: BBSBA-HRM Subject: RECRUITMENT AND SELECTION (TTH-8:00-9:00PM) Case Study: E-Recruitmentadarose romaresNo ratings yet

- Natural Language Processing Lec 2Document30 pagesNatural Language Processing Lec 2Touseef sultanNo ratings yet

- Case StudyDocument8 pagesCase StudyAmol AdhangaleNo ratings yet

- Data Analytics Using R (DA-R)Document67 pagesData Analytics Using R (DA-R)RiturajPaul100% (1)

- Payment Application Data Security A Complete Guide - 2020 EditionFrom EverandPayment Application Data Security A Complete Guide - 2020 EditionNo ratings yet

- Cap. 4 Competing On Analytics With Internal ProcessesDocument21 pagesCap. 4 Competing On Analytics With Internal ProcessesJuan WolfNo ratings yet

- HATS: A Hierarchical Graph Attention Network For Stock Movement PredictionDocument16 pagesHATS: A Hierarchical Graph Attention Network For Stock Movement PredictionNguyen Xuan MaoNo ratings yet

- Orientations InventoryDocument4 pagesOrientations InventoryJonaisa CasanguanNo ratings yet

- BP Macondo Estimate 2Document106 pagesBP Macondo Estimate 2Simone SebastianNo ratings yet

- Coetsee Meditari Vol 18 No 1 2010Document16 pagesCoetsee Meditari Vol 18 No 1 2010HientnNo ratings yet

- Ch01 AnswersDocument10 pagesCh01 Answershiteshsoft100% (2)

- W D Gann On The Master Time Factor PDFDocument52 pagesW D Gann On The Master Time Factor PDFebook fee100% (1)

- Design World Jun 2021 1623854653Document182 pagesDesign World Jun 2021 1623854653Nahual ORNo ratings yet

- Introduction To Jeffrey M. Kern's SKI Gold Stock Prediction System (9 P.)Document9 pagesIntroduction To Jeffrey M. Kern's SKI Gold Stock Prediction System (9 P.)shahvshahNo ratings yet

- Stroop 1 Lecture Slides (2023-24)Document39 pagesStroop 1 Lecture Slides (2023-24)NusaibahNo ratings yet

- Machine Learning For Networking - Workflow, Advances and Opportunities PDFDocument8 pagesMachine Learning For Networking - Workflow, Advances and Opportunities PDFAhmad BilalNo ratings yet

- A Taxonomy and Treatment of Uncertainty For Ecology and Conservation BiologyDocument11 pagesA Taxonomy and Treatment of Uncertainty For Ecology and Conservation BiologyJorge LopRomNo ratings yet

- Bulkowski - PERFORMANCE RANKINGS - Encyclopedia-of-Candlestick-ChartsDocument3 pagesBulkowski - PERFORMANCE RANKINGS - Encyclopedia-of-Candlestick-ChartsardwinNo ratings yet

- Reserving 3-04-2020 Revised v4Document29 pagesReserving 3-04-2020 Revised v4rai nowNo ratings yet

- Astrologer Professor H. Spencer Lewis (1907)Document1 pageAstrologer Professor H. Spencer Lewis (1907)Clymer777No ratings yet

- TSA Using MatlabDocument30 pagesTSA Using MatlabHesham BassioniNo ratings yet

- Year 4 Science OverviewDocument2 pagesYear 4 Science Overviewapi-458784164No ratings yet

- Water Uptake by Poultry Carcasses During Cooling by Water ImmersionDocument8 pagesWater Uptake by Poultry Carcasses During Cooling by Water ImmersionkeshunaNo ratings yet

- Optimisation and Forecasting of Building Maintenance and Renewals For Various Types of Local Government BuildingsDocument143 pagesOptimisation and Forecasting of Building Maintenance and Renewals For Various Types of Local Government Buildingsmuhammad auliaNo ratings yet

- Crime in 2030 PDFDocument7 pagesCrime in 2030 PDFdescarccevaNo ratings yet

- BCO01-02 - Stability of Steel Arches PDFDocument25 pagesBCO01-02 - Stability of Steel Arches PDFSiva Prasad MamillapalliNo ratings yet

- Module 14 Sensitivity AnalysisDocument14 pagesModule 14 Sensitivity AnalysisRhonita Dea AndariniNo ratings yet

- Deep Reinforcement Learning in High Frequency TradDocument6 pagesDeep Reinforcement Learning in High Frequency TradankithornyNo ratings yet

- Simulation and Prediction of Suprapermafrost Groundwater Level Variation in Response To Climate Change Using A Neural Network ModelDocument24 pagesSimulation and Prediction of Suprapermafrost Groundwater Level Variation in Response To Climate Change Using A Neural Network ModelMuhamad IrvanNo ratings yet

- Critical Review of Flexible Pavement Performance Models: Ankit Gupta, Praveen Kumar, and Rajat RastogiDocument7 pagesCritical Review of Flexible Pavement Performance Models: Ankit Gupta, Praveen Kumar, and Rajat RastogiKeke RizqiNo ratings yet

- Python MP Report PDFDocument61 pagesPython MP Report PDFB A SiddarthaNo ratings yet

- Financial Astrology An Unexplored Tool of Security AnalysisDocument9 pagesFinancial Astrology An Unexplored Tool of Security AnalysisIAEME PublicationNo ratings yet

- Car Price Prediction Using Machine Learning TechniquesDocument6 pagesCar Price Prediction Using Machine Learning Techniquessreeja maragoni100% (1)

- Calculation of Road Traffic Noise (Size Reduced) 1988Document100 pagesCalculation of Road Traffic Noise (Size Reduced) 1988edNo ratings yet

Machine Learning Presentation Richa

Machine Learning Presentation Richa

Uploaded by

Peter StarkOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Machine Learning Presentation Richa

Machine Learning Presentation Richa

Uploaded by

Peter StarkCopyright:

Available Formats

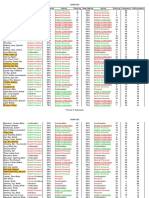

Loan Prediction Using Machine Learning.

Name:- Richa Srivastava, Sem III, Data Science, Roll:-(2101331540086)

Problem Statement:- Most of the time Banks, Home Loan Companies,

Government takes a lot of time in validating the customer’s eligibility for a

loan. They want to automate this process based on customer details like

education, dependents, etc.

Tools and Technology:- Python,Machine Learning, Bivariate analysis, Data

Cleaning, Model Building, Model Planning, Regression, Model Predicting,

NumPy Library, Pandas, Matplotlib, etc.

Project Process:- Intermediate

Introduction To The Project.

• In this project, I have taken two CSV files “train_ctrUa4K.csv"

test="test_lAUu6dG.csv“, one for training the module and one for testing the

data and making the module predict.

• The training dataset contains these attributes Loan ID', 'Gender', 'Married',

'Dependents', 'Education', 'Self Employed', 'Applicant Income', ‘Co-applicant

Income', 'Loan Amount', 'Loan Amount Term', 'Credit History', 'Property Area',

'Loan Status.

• Then understanding the data has been done with the help of the column

feature, head feature, types, and info feature.

• At this point, I have done a Univariate analysis of the Loan status, where I

found that 422 counts were yes and 192 were no, then normalizes this

value between 0 to 1 and got values Y 0.687296 N 0.312704.

• The approval rate of trained data was 69%.

• Then we count the categorical values and normalize their value we got that 80

percent are male, 65% married,15% self-employed and 85%have

repaid their dept.

• Then plotted a distplot of the numerical variable which is applicant income, we

noticed that graduates have more outliers income than non-graduates.

• Co-applicant incomes vary from -0-5000.

• Then I have done missing value treatment with fillna and feature engineering

like combining the applicant and co-applicant incomes and then building the

model.

• Conclusion:-

• People who had repaid their debt had higher chances to get the loan.

• Applicant income does not affect the chances of having a loan.

• Credit history more, semiurban area:- high chances

• Married People have a higher chance of getting loans.

• Co-applicant income less, higher the chances of getting a loan.

Project Summary:- This project is used to automate the prediction of

chances of getting a loan before going in process.

Technology and Tools.

• Technology:- Machine learning, Variate Analysis,

Correlation, Supervised learning.

• Tools:- Python, Jupiter notebook, CSV Files, Libraries etc.

How does it work?

Future Scope and Monetization.

With the help of loan predictors, the process of providing a fair loan will get faster

and more start-ups and growth will be there.

This model can also work as 3rd party in predicting the loan for any particular

organization.

The more complex the model, the better the prediction, more money is there.

You might also like

- Loan Eligibility Prediction: Machine LearningDocument8 pagesLoan Eligibility Prediction: Machine LearningJeet MaruNo ratings yet

- Thera Bank - Project - Submission - V1 PDFDocument26 pagesThera Bank - Project - Submission - V1 PDFRamachandran VenkataramanNo ratings yet

- Credit Card Fraud Detection Proposal RedoneDocument5 pagesCredit Card Fraud Detection Proposal RedoneadaneNo ratings yet

- Credit Approval Data Analysis Using Classification and Regression ModelsDocument2 pagesCredit Approval Data Analysis Using Classification and Regression Modelsaman guptaNo ratings yet

- Features Common To All ForecastsDocument5 pagesFeatures Common To All ForecastsGeneVive Mendoza40% (5)

- Assessment Report RichaDocument12 pagesAssessment Report RichaPeter StarkNo ratings yet

- Bank LoanPredic-WPS OfficeDocument8 pagesBank LoanPredic-WPS OfficeCHARAN SAI MUSHAMNo ratings yet

- Abhay Seminar PapersDocument16 pagesAbhay Seminar PapersHARRY POTTERNo ratings yet

- Prediction of Modernized Loan Approval System Based On Machine Learning ApproachDocument22 pagesPrediction of Modernized Loan Approval System Based On Machine Learning ApproachMandara ManjunathNo ratings yet

- T 0 Report Masina Niranjan KumarDocument10 pagesT 0 Report Masina Niranjan KumarNiranjan KumarNo ratings yet

- Predicting Personal Loan Approval Using Machine Learning HandbookDocument31 pagesPredicting Personal Loan Approval Using Machine Learning HandbookEzhilarasiNo ratings yet

- Loan ForwardDocument15 pagesLoan ForwardDerrick KimaniNo ratings yet

- Credit Card Fraud Dectection Machine LearningDocument62 pagesCredit Card Fraud Dectection Machine LearningranjithNo ratings yet

- Computerized Billing System Thesis DocumentationDocument6 pagesComputerized Billing System Thesis Documentationafbtegwly100% (1)

- UntitledDocument14 pagesUntitledLakhvir KaurNo ratings yet

- Cashiering System PDFDocument8 pagesCashiering System PDFChristian David Comilang CarpioNo ratings yet

- Machine LearningDocument17 pagesMachine LearningRishab Jain 2027203No ratings yet

- Hasan Rabbani ResumeDocument4 pagesHasan Rabbani ResumeGuar GumNo ratings yet

- UntitledDocument1 pageUntitledBhanu ParchuriNo ratings yet

- Loan Eligibility PredictionDocument12 pagesLoan Eligibility PredictionUddhav ChaliseNo ratings yet

- Data Analyst Interview QnADocument8 pagesData Analyst Interview QnAhemant moreNo ratings yet

- Synopsis GilluDocument12 pagesSynopsis Gillustifler joeNo ratings yet

- Sample Questionnaire For Thesis About Enrollment SystemDocument5 pagesSample Questionnaire For Thesis About Enrollment SystemafkneafpzNo ratings yet

- Thesis On Internet Banking ServicesDocument4 pagesThesis On Internet Banking Servicesrehyfnugg100% (2)

- Bank AllianceDocument18 pagesBank AlliancevisheshNo ratings yet

- Literature Review On Loan Management SystemDocument7 pagesLiterature Review On Loan Management Systemc5p7mv6j100% (1)

- Techniacl Answers To Real World Problems: Team 4 Topic:Real Time Face Mask DetectionDocument23 pagesTechniacl Answers To Real World Problems: Team 4 Topic:Real Time Face Mask Detectionsiva suryaNo ratings yet

- CET351 Research Project Plan Subash Adhikari Pokhara Evaluation of Current Research On Credit Card Fraud Detection Methods Word Count:2161Document13 pagesCET351 Research Project Plan Subash Adhikari Pokhara Evaluation of Current Research On Credit Card Fraud Detection Methods Word Count:2161Prakash PokhrelNo ratings yet

- Ihic-2022 PPT Paper - Id 100Document11 pagesIhic-2022 PPT Paper - Id 100prashantrinkuNo ratings yet

- Loan Approval - PPTDocument19 pagesLoan Approval - PPTVishal LabdeNo ratings yet

- Credit Card Approval Prediction Using Machine LearningDocument2 pagesCredit Card Approval Prediction Using Machine LearningHemantNo ratings yet

- Name - Santoshi Devi Nayudubathula Reg No - 2021Pgp220Document4 pagesName - Santoshi Devi Nayudubathula Reg No - 2021Pgp220Santoshi SatyanarayanaNo ratings yet

- Adult Income PredictionDocument9 pagesAdult Income PredictionMR.NAITIK PATEL0% (1)

- Case Study2Document6 pagesCase Study2Marvin CincoNo ratings yet

- Internet Banking DissertationDocument7 pagesInternet Banking Dissertationsupnilante1980100% (1)

- Unit I - BigDataDocument47 pagesUnit I - BigDataFarhan SjNo ratings yet

- BAPM Sandeep 110720 PDFDocument3 pagesBAPM Sandeep 110720 PDFNihal SinghNo ratings yet

- Karnataka State Open University Manasa Gangothri, Mysore-570006Document55 pagesKarnataka State Open University Manasa Gangothri, Mysore-570006Kannan SNo ratings yet

- Bharath University B.Tech / CSE: Financial Predictions With Machine LearningDocument34 pagesBharath University B.Tech / CSE: Financial Predictions With Machine LearningSampath TNo ratings yet

- Presentation On Data ScienceDocument15 pagesPresentation On Data ScienceadddataNo ratings yet

- Brain-A-Lytics 3.0 Case: A One-Stop Career CatalystDocument5 pagesBrain-A-Lytics 3.0 Case: A One-Stop Career Catalystxilox67632No ratings yet

- Credit Scoring and Data MiningDocument170 pagesCredit Scoring and Data MiningSiau Shuang100% (1)

- Link For Google Colab Note Book: Pa GeDocument17 pagesLink For Google Colab Note Book: Pa Gesid pNo ratings yet

- Auto InsuranceDocument19 pagesAuto InsuranceUmaNo ratings yet

- Internet Banking and Customer Satisfaction ThesisDocument4 pagesInternet Banking and Customer Satisfaction Thesisfbyhhh5r100% (1)

- Payment System Thesis DocumentationDocument7 pagesPayment System Thesis Documentationangelarobertswilmington100% (2)

- 2022 V13i1198Document12 pages2022 V13i1198yousragaidNo ratings yet

- Review of Literature On Payroll SystemsDocument8 pagesReview of Literature On Payroll Systemsc5haeg0n100% (1)

- Credit Card Fraud DetectionDocument89 pagesCredit Card Fraud DetectionRahul RepalaNo ratings yet

- Cluster Credit Risk R PDFDocument13 pagesCluster Credit Risk R PDFFabian ChahinNo ratings yet

- Software Engineeing Project: Payroll Management SystemDocument23 pagesSoftware Engineeing Project: Payroll Management SystemanshakhilNo ratings yet

- Financial Status Analysis of Credit Score Rating UsingDocument18 pagesFinancial Status Analysis of Credit Score Rating UsingAnonymous pKxfg8NNo ratings yet

- Project Proposal No. 1 Project Title: Project BackgroundDocument4 pagesProject Proposal No. 1 Project Title: Project BackgroundsHiegelah00100% (2)

- Factors Influenced Loan Amount - A Case StudyDocument11 pagesFactors Influenced Loan Amount - A Case Studyrabiamajeed22199No ratings yet

- Loan Prediction Using MachineDocument1 pageLoan Prediction Using Machine3201313No ratings yet

- Sample Thesis Computerized Payroll SystemDocument5 pagesSample Thesis Computerized Payroll Systemmarystevensonbaltimore100% (2)

- Name: Sitte Alma B. Sultan Course: BBSBA-HRM Subject: RECRUITMENT AND SELECTION (TTH-8:00-9:00PM) Case Study: E-RecruitmentDocument8 pagesName: Sitte Alma B. Sultan Course: BBSBA-HRM Subject: RECRUITMENT AND SELECTION (TTH-8:00-9:00PM) Case Study: E-Recruitmentadarose romaresNo ratings yet

- Natural Language Processing Lec 2Document30 pagesNatural Language Processing Lec 2Touseef sultanNo ratings yet

- Case StudyDocument8 pagesCase StudyAmol AdhangaleNo ratings yet

- Data Analytics Using R (DA-R)Document67 pagesData Analytics Using R (DA-R)RiturajPaul100% (1)

- Payment Application Data Security A Complete Guide - 2020 EditionFrom EverandPayment Application Data Security A Complete Guide - 2020 EditionNo ratings yet

- Cap. 4 Competing On Analytics With Internal ProcessesDocument21 pagesCap. 4 Competing On Analytics With Internal ProcessesJuan WolfNo ratings yet

- HATS: A Hierarchical Graph Attention Network For Stock Movement PredictionDocument16 pagesHATS: A Hierarchical Graph Attention Network For Stock Movement PredictionNguyen Xuan MaoNo ratings yet

- Orientations InventoryDocument4 pagesOrientations InventoryJonaisa CasanguanNo ratings yet

- BP Macondo Estimate 2Document106 pagesBP Macondo Estimate 2Simone SebastianNo ratings yet

- Coetsee Meditari Vol 18 No 1 2010Document16 pagesCoetsee Meditari Vol 18 No 1 2010HientnNo ratings yet

- Ch01 AnswersDocument10 pagesCh01 Answershiteshsoft100% (2)

- W D Gann On The Master Time Factor PDFDocument52 pagesW D Gann On The Master Time Factor PDFebook fee100% (1)

- Design World Jun 2021 1623854653Document182 pagesDesign World Jun 2021 1623854653Nahual ORNo ratings yet

- Introduction To Jeffrey M. Kern's SKI Gold Stock Prediction System (9 P.)Document9 pagesIntroduction To Jeffrey M. Kern's SKI Gold Stock Prediction System (9 P.)shahvshahNo ratings yet

- Stroop 1 Lecture Slides (2023-24)Document39 pagesStroop 1 Lecture Slides (2023-24)NusaibahNo ratings yet

- Machine Learning For Networking - Workflow, Advances and Opportunities PDFDocument8 pagesMachine Learning For Networking - Workflow, Advances and Opportunities PDFAhmad BilalNo ratings yet

- A Taxonomy and Treatment of Uncertainty For Ecology and Conservation BiologyDocument11 pagesA Taxonomy and Treatment of Uncertainty For Ecology and Conservation BiologyJorge LopRomNo ratings yet

- Bulkowski - PERFORMANCE RANKINGS - Encyclopedia-of-Candlestick-ChartsDocument3 pagesBulkowski - PERFORMANCE RANKINGS - Encyclopedia-of-Candlestick-ChartsardwinNo ratings yet

- Reserving 3-04-2020 Revised v4Document29 pagesReserving 3-04-2020 Revised v4rai nowNo ratings yet

- Astrologer Professor H. Spencer Lewis (1907)Document1 pageAstrologer Professor H. Spencer Lewis (1907)Clymer777No ratings yet

- TSA Using MatlabDocument30 pagesTSA Using MatlabHesham BassioniNo ratings yet

- Year 4 Science OverviewDocument2 pagesYear 4 Science Overviewapi-458784164No ratings yet

- Water Uptake by Poultry Carcasses During Cooling by Water ImmersionDocument8 pagesWater Uptake by Poultry Carcasses During Cooling by Water ImmersionkeshunaNo ratings yet

- Optimisation and Forecasting of Building Maintenance and Renewals For Various Types of Local Government BuildingsDocument143 pagesOptimisation and Forecasting of Building Maintenance and Renewals For Various Types of Local Government Buildingsmuhammad auliaNo ratings yet

- Crime in 2030 PDFDocument7 pagesCrime in 2030 PDFdescarccevaNo ratings yet

- BCO01-02 - Stability of Steel Arches PDFDocument25 pagesBCO01-02 - Stability of Steel Arches PDFSiva Prasad MamillapalliNo ratings yet

- Module 14 Sensitivity AnalysisDocument14 pagesModule 14 Sensitivity AnalysisRhonita Dea AndariniNo ratings yet

- Deep Reinforcement Learning in High Frequency TradDocument6 pagesDeep Reinforcement Learning in High Frequency TradankithornyNo ratings yet

- Simulation and Prediction of Suprapermafrost Groundwater Level Variation in Response To Climate Change Using A Neural Network ModelDocument24 pagesSimulation and Prediction of Suprapermafrost Groundwater Level Variation in Response To Climate Change Using A Neural Network ModelMuhamad IrvanNo ratings yet

- Critical Review of Flexible Pavement Performance Models: Ankit Gupta, Praveen Kumar, and Rajat RastogiDocument7 pagesCritical Review of Flexible Pavement Performance Models: Ankit Gupta, Praveen Kumar, and Rajat RastogiKeke RizqiNo ratings yet

- Python MP Report PDFDocument61 pagesPython MP Report PDFB A SiddarthaNo ratings yet

- Financial Astrology An Unexplored Tool of Security AnalysisDocument9 pagesFinancial Astrology An Unexplored Tool of Security AnalysisIAEME PublicationNo ratings yet

- Car Price Prediction Using Machine Learning TechniquesDocument6 pagesCar Price Prediction Using Machine Learning Techniquessreeja maragoni100% (1)

- Calculation of Road Traffic Noise (Size Reduced) 1988Document100 pagesCalculation of Road Traffic Noise (Size Reduced) 1988edNo ratings yet