Professional Documents

Culture Documents

ABC Fashion PVT LTD

ABC Fashion PVT LTD

Uploaded by

Payal JainOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ABC Fashion PVT LTD

ABC Fashion PVT LTD

Uploaded by

Payal JainCopyright:

Available Formats

Performance Highlight

ABC FASHION PRIVATE LIMITED FY 2021–2022

Index

Key Performance Highlight

Liquidity Analysis

Reflection of Financial position

Finance Agenda FY 2022 -2023

Way forward Business Plan

Key Performance Highlight

YOY TO Growth 76% Revenue Analysis

Turnover

Rs 23,999 Lakhs Turnover Total Revenue 75% YOY

Rs 10,335 Lakhs Core Revenue from operations

• Volume

Gross

EBITDA Net profiit EPS • Price

Profit

• Product Mix

37.5% 12.8% 8.7% 99.52 Other Income (short term loans)

87% YoY,

0.55% YoY Margin by 0.53% 86% YOY

Cost 75% YOY

Total Cost 88% of revenue:- - Employee benefit exp 28%

COGS margin of 62.5 %, Other exp 19%, Depn 0.45% Employee benefit exp 5%, (scale up in operations)

finance cost 0.04%. int coverage ratio – 281 times (No risk to the lenders) - Other expenses 77%

- Finance cost 84%

- Depn 21%

Increase in revenue by 76% & net profit margin has increased

by 0.53% only – need implementation of cost optimisation & - Deferred tax asset in CY 99.85 L

savings techniques

Liquidity Analysis

Current ratio 1.15:1 Liquidity ratio 0.6:1

Working capital Improvement required:-

Working capital 2559 Lakhs Payment terms are well managed and

Working Capital Rs 2059 Lakhs YOY defined

Efficient Inventory management

Total asset TO 1.31 Times AR days 0.55 days policies needs to be implemented with

right ROQ and ROL levels

Efficiency Inventory TO days 212

Inventory TO 1.7 times Test days Better DOH management

Fixed asset TO 154 times AP days 353 Days Short term investments needs to be

strengthened for better liquidity

Operationally the company is efficient. However, better working capital

management techniques needs to be implemented

Reflection of Financial Position

Debt Equity

ROCE Net Capital Return on NW

Ratio

TO ratio

2021-2022 5:1

2021-2022 80 % 2021-2022 9 times 2021-2022 60% 2020- 2021 10:1

2020- 2021 108% 2020- 2021 82%

2020- 2021 27 times Compared to LY the

Compared to LY capital Compared to LY WC capital gearing has

efficiency has reduced Compared to LY WC capital efficiency has reduced improved.

efficiency has reduced

Key Action Plan for fair reflection of financial position

Better working capital

Efficiency in operations: Optimise capital structure –

management- negotiations

Cost optimisation/ savings leverage

wherever requried

Finance Agenda FY 2022 - 2023

Efficient working capital management Stewardship

Strengthening Operations & Governance

• Optimum Inventory level • Governance of the Balance sheet

• Value addition in the processes (ROQ ,ROL & DOH through timely reviews –

management) Integrity of accounts

• Driving Cost savings

• Better Negotiation with • Fair maintenance of records, fair

• Distribution cost optimisation stakeholders for price, timely reflection of financial position

delivery & payment terms

• MSME payments and statutory

• Savings for fixed assets compliances

investments

• Strong Controls and timely risk

identification process

Revenue Cost Savings & Build the Core

Optimisation reduction

Strategic sourcing Compelling strategy

Market penetration

Cost optimisation Strengthen the core products

Increase the No of times of

Leverage distribution cost Build innovation capabilities

product - trends

Defend PL against Inflation Right Segregation and focus on

Focus of Different future

Efficient production premium, mass or popular

channels (E-com, D2C) products without cannibalization

capabilities

Communication capabilities Portfolio transformation

(advertisements & Focus on seasonality

promotions) New Variant – differentiation

factor

Way Forward Business Plan

You might also like

- POLAND'S A2 Motorway - FinalDocument12 pagesPOLAND'S A2 Motorway - FinalAbinash Behera100% (2)

- Solutions Prada PDFDocument28 pagesSolutions Prada PDFneoss1190% (1)

- HH Poll 2009Document6 pagesHH Poll 2009Venky VenkateshNo ratings yet

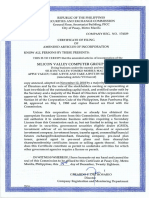

- Gerson B. GringcoDocument20 pagesGerson B. GringcoKim Sollano50% (2)

- Dap An Ke Toan Quoc Te 2 UehDocument165 pagesDap An Ke Toan Quoc Te 2 UehLoki Luke100% (1)

- Ratio Analysis Q&a MAFDocument23 pagesRatio Analysis Q&a MAFmohedNo ratings yet

- Financial Statements Meaning and CharacteristicsDocument64 pagesFinancial Statements Meaning and CharacteristicsAbhishek Sinha100% (1)

- Business Analysis and Valuation 3 4Document23 pagesBusiness Analysis and Valuation 3 4Budi Yuda PrawiraNo ratings yet

- F2-17 Capital Budgeting and Discounted Cash Flows PDFDocument28 pagesF2-17 Capital Budgeting and Discounted Cash Flows PDFJaved ImranNo ratings yet

- M1 Lesson 4 Finance Basics What Does Financial Sustainability MeanDocument16 pagesM1 Lesson 4 Finance Basics What Does Financial Sustainability MeanAcelerest JeffreyNo ratings yet

- Economic Value AddedDocument25 pagesEconomic Value AddedSagar KansalNo ratings yet

- Working Capital Summary Pronlems Part 1Document8 pagesWorking Capital Summary Pronlems Part 1hencika07No ratings yet

- Interpretation of Financial Statements & Ratio AnalysisDocument35 pagesInterpretation of Financial Statements & Ratio Analysisamitsinghslideshare50% (2)

- FinacctDocument13 pagesFinacctIcuwootNo ratings yet

- Transaction ManagementDocument58 pagesTransaction ManagementhalimabiNo ratings yet

- IDirect BoI ShubhNivesh 15jan24Document4 pagesIDirect BoI ShubhNivesh 15jan24Naveen KumarNo ratings yet

- Free Cash Flow Introduction TrainingDocument130 pagesFree Cash Flow Introduction Trainingashrafhussein100% (5)

- Financial_Statements[1]Document30 pagesFinancial_Statements[1]bpsc08No ratings yet

- Caltron Ratio Analysis: Managerial AccountingDocument6 pagesCaltron Ratio Analysis: Managerial AccountingkaryalNo ratings yet

- Finc8019 S12Document27 pagesFinc8019 S12mcahya82No ratings yet

- Week 02 - Ratios - SDocument6 pagesWeek 02 - Ratios - STeresa ManNo ratings yet

- Previous Business LessonDocument49 pagesPrevious Business LessonsumuzmNo ratings yet

- Unit 5. Financial Statement Analysis IIDocument32 pagesUnit 5. Financial Statement Analysis IIsikute kamongwaNo ratings yet

- Analysis & Interpretation: Prepared By: Sir Hamza Abdul HaqDocument10 pagesAnalysis & Interpretation: Prepared By: Sir Hamza Abdul HaqSrabon BaruaNo ratings yet

- MS11 - Capital BudgetingDocument8 pagesMS11 - Capital BudgetingElsie GenovaNo ratings yet

- Cost Controller & ImprovementDocument11 pagesCost Controller & ImprovementSaid Abu khaulaNo ratings yet

- Manajemen Keuangan& Keuangan Internasional: Pengantar Manajemen KeuanganDocument50 pagesManajemen Keuangan& Keuangan Internasional: Pengantar Manajemen KeuanganDWITA MAYA PUSPITASARI S2No ratings yet

- Chapter 26 Working Capital ManagementDocument15 pagesChapter 26 Working Capital ManagementsankadheerajNo ratings yet

- Aig 2022 Annual Report - Pdf.coredownloadDocument304 pagesAig 2022 Annual Report - Pdf.coredownloadAliceadriana SoimuNo ratings yet

- Company ValuationDocument10 pagesCompany ValuationJia MakhijaNo ratings yet

- Business PerformanceDocument19 pagesBusiness PerformanceSaumyaNo ratings yet

- T10 - Financial Reporting QualityDocument30 pagesT10 - Financial Reporting QualityJhonatan Perez VillanuevaNo ratings yet

- This Study Resource Was: RequiredDocument2 pagesThis Study Resource Was: RequiredNguyễn GiangNo ratings yet

- Puva 04Document7 pagesPuva 04Juan LamasNo ratings yet

- MAS - 2.1 & 2.2.1 - With AnswersDocument18 pagesMAS - 2.1 & 2.2.1 - With AnswersZekken XinnNo ratings yet

- Tugas 2 Analisis Laporan KeuanganDocument11 pagesTugas 2 Analisis Laporan Keuangangestinalia55No ratings yet

- Week 6 - Introduction To Financial Statement AnalysisDocument23 pagesWeek 6 - Introduction To Financial Statement AnalysisObed Darko BaahNo ratings yet

- Heritage Foods CaseDocument14 pagesHeritage Foods CasePriya DurejaNo ratings yet

- Safkopsnin Fin201 PresentatiomDocument15 pagesSafkopsnin Fin201 PresentatiomjakioulhasanomiNo ratings yet

- Ms09 - Capital Budgeting (Reviewer's Copy)Document19 pagesMs09 - Capital Budgeting (Reviewer's Copy)Mikka Aira Sardeña100% (1)

- Results Presentation Q1FY21Document36 pagesResults Presentation Q1FY21saurabhNo ratings yet

- 02 Working Capital ManagementDocument30 pages02 Working Capital ManagementKenneth Marcial EgeNo ratings yet

- Ratios IpapaprintDocument2 pagesRatios IpapaprintcoleenNo ratings yet

- Petroleum Economics Part 1 Oct 2009Document3 pagesPetroleum Economics Part 1 Oct 2009boisvertljNo ratings yet

- Earnings PDFDocument17 pagesEarnings PDFArpit KumarNo ratings yet

- Capital Budgeting - WorksheetDocument32 pagesCapital Budgeting - WorksheetnerieroseNo ratings yet

- ALK Kelompok 2 Finale DAY 2Document44 pagesALK Kelompok 2 Finale DAY 2IrmaRenatariaSiregarNo ratings yet

- Synergies and ValuationDocument16 pagesSynergies and ValuationPaul GhanimehNo ratings yet

- Introduction To NFRS - UnlockedDocument25 pagesIntroduction To NFRS - UnlockedAviTvNo ratings yet

- Liquidity Debt Management Asset Management Profitability Return To InvestorsDocument5 pagesLiquidity Debt Management Asset Management Profitability Return To InvestorsJayNo ratings yet

- Company Valuation - Course NotesDocument10 pagesCompany Valuation - Course NotesAfonsoNo ratings yet

- Pre 23083013Document26 pagesPre 23083013maryjanetNo ratings yet

- Investor Presentation Q1 FY 23Document35 pagesInvestor Presentation Q1 FY 23aakash urangapuliNo ratings yet

- Goals, Value and PerformanceDocument18 pagesGoals, Value and PerformanceSamridh AgarwalNo ratings yet

- Session8 - 13 NewDocument24 pagesSession8 - 13 NewAbhishek KashyapNo ratings yet

- Case Study Responsibility AccountingDocument6 pagesCase Study Responsibility Accountingmonika thakur100% (1)

- Financial Statement Analysis II - Part 1Document26 pagesFinancial Statement Analysis II - Part 1Helen BalmesNo ratings yet

- Return On Invested Capital and Profitability Analysis: Semester 1 2020/2021 Art, PatDocument21 pagesReturn On Invested Capital and Profitability Analysis: Semester 1 2020/2021 Art, PatElfrida YulianaNo ratings yet

- CH Audit IFRS 9 BrochureDocument12 pagesCH Audit IFRS 9 BrochurelinaNo ratings yet

- BE 601 Class 4Document57 pagesBE 601 Class 4Chan DavidNo ratings yet

- Iowalean Files 2020 05 Introduction-to-Lean-Accounting-2020Document33 pagesIowalean Files 2020 05 Introduction-to-Lean-Accounting-2020arbaazshaikh043No ratings yet

- Prepared By: Mark Vincent B. Bantog, LPTDocument40 pagesPrepared By: Mark Vincent B. Bantog, LPTLilyfhel VenturaNo ratings yet

- Analysis of Financial Statements: Made Gitanadya, Se., MSMDocument18 pagesAnalysis of Financial Statements: Made Gitanadya, Se., MSMLilia LiaNo ratings yet

- L1R32 - Financial Reporting and Analysis - IDocument38 pagesL1R32 - Financial Reporting and Analysis - IJuan Carlos Eulogio CcaccyaNo ratings yet

- Chapter - 10: Determining Cash Flows For Investment AnalysisDocument15 pagesChapter - 10: Determining Cash Flows For Investment AnalysisAkash saxenaNo ratings yet

- 2E. Investment Decisions: E.1. Capital Budgeting Process 3 E.2. Capital Investment Analysis Methods 13Document30 pages2E. Investment Decisions: E.1. Capital Budgeting Process 3 E.2. Capital Investment Analysis Methods 13Karan GoelNo ratings yet

- Syllabus M. ComDocument44 pagesSyllabus M. ComAbhinandan PahadiNo ratings yet

- Quan Ly Danh Muc Dau Tu Kiem Tra Giua Ky Tieng AnhDocument20 pagesQuan Ly Danh Muc Dau Tu Kiem Tra Giua Ky Tieng AnhVinh Lâm LêNo ratings yet

- IndivAssignNo2 MK331Document3 pagesIndivAssignNo2 MK331Sarah MitraNo ratings yet

- Group AssignmentDocument2 pagesGroup AssignmentibsaashekaNo ratings yet

- KMG Valuation ReportDocument30 pagesKMG Valuation ReportAmanksvNo ratings yet

- MBA 4th SemDocument14 pagesMBA 4th SemMahbobullah RahmaniNo ratings yet

- Company LawDocument2 pagesCompany LawJ DebosmitaNo ratings yet

- Practice 1 - Copy-2Document12 pagesPractice 1 - Copy-2MaggieNo ratings yet

- International Parity ConditionsDocument37 pagesInternational Parity ConditionsSonia Laksita ErbianitaNo ratings yet

- Accounting C2 Lesson 1 PDFDocument5 pagesAccounting C2 Lesson 1 PDFJake ShimNo ratings yet

- Silicon Sec Amended 2018 AcsDocument20 pagesSilicon Sec Amended 2018 AcsSir AronNo ratings yet

- Product Management Chap. 1Document11 pagesProduct Management Chap. 1Sean CataliaNo ratings yet

- Financial Statement of IntelDocument4 pagesFinancial Statement of IntelSaleh RehmanNo ratings yet

- FY23 Factsheet VFFDocument2 pagesFY23 Factsheet VFFJL ChuaNo ratings yet

- Types of Investment-1Document7 pagesTypes of Investment-1Shubham SaxenaNo ratings yet

- 2 4 RevaluationDocument29 pages2 4 RevaluationFe ValenciaNo ratings yet

- University of Tunis Tunis Business SchoolDocument2 pagesUniversity of Tunis Tunis Business Schoolmolka ben mahmoudNo ratings yet

- Fortress Annual Report 2011 - FINALDocument193 pagesFortress Annual Report 2011 - FINALrajscribdNo ratings yet

- PerformanceMeasures GradedQuiz SolutionsDocument3 pagesPerformanceMeasures GradedQuiz Solutionsphuongdungnguyen2412No ratings yet

- Interim Financial ReportingDocument4 pagesInterim Financial Reportingbelle crisNo ratings yet

- C2-Org StrategyProj select-ISB-elDocument23 pagesC2-Org StrategyProj select-ISB-elNgoc Nguyen Thi MinhNo ratings yet

- Permission LetterDocument1 pagePermission LettermanuNo ratings yet

- Fibria Celulose S.A.: Valores, Mercadorias e FuturosDocument4 pagesFibria Celulose S.A.: Valores, Mercadorias e FuturosFibriaRINo ratings yet

![Financial_Statements[1]](https://imgv2-1-f.scribdassets.com/img/document/749889133/149x198/becbcf7e0f/1720769886?v=1)