Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

130 viewsInvestment Portfolio Template

Investment Portfolio Template

Uploaded by

Nishith RanjanThe document provides investment portfolio recommendations for two clients - Frugal Tim and Spendthrift Elizabeth.

For Frugal Tim, the portfolio composition includes 15% in domestic equities, 5% in overseas equities, 15% in nominal bonds, 35% in inflation-linked bonds, 25% in real estate, and 5% in cash equivalents. This portfolio aims to generate sufficient returns while minimizing risk so the client's funds last indefinitely.

For Spendthrift Elizabeth, the portfolio is more aggressively allocated with 35% in domestic equities, 15% in overseas equities, 10% in nominal bonds, 20% in inflation-linked bonds, 20% in real estate, and 0% in

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You might also like

- Advices of Abu Ad Dardaa Sh. Saalih Aali ShaykhDocument78 pagesAdvices of Abu Ad Dardaa Sh. Saalih Aali ShaykhOmais SyedNo ratings yet

- Investment Portfolio Template 1Document2 pagesInvestment Portfolio Template 1NikHil SharmaNo ratings yet

- Brigada Dos and DontsDocument15 pagesBrigada Dos and DontsNoel PolaronNo ratings yet

- Graduation Message 2019 Psds Anacleta IncognitoDocument1 pageGraduation Message 2019 Psds Anacleta IncognitoPaity DimeNo ratings yet

- Department of Education: Republic of The PhilippinesDocument31 pagesDepartment of Education: Republic of The PhilippinesRichie MayorNo ratings yet

- Action Plan For C. JournalismDocument12 pagesAction Plan For C. JournalismMario DailegNo ratings yet

- Awards Committee (Ac) : Kasiglahan Village Elementary SchoolDocument2 pagesAwards Committee (Ac) : Kasiglahan Village Elementary SchoolSonny MatiasNo ratings yet

- School Based Action Plan On Reading Activities For Struggling Learners 2022-2023Document3 pagesSchool Based Action Plan On Reading Activities For Struggling Learners 2022-2023Kirapan ESNo ratings yet

- Letter For Resource Speaker PDFDocument1 pageLetter For Resource Speaker PDFANNE ARNET YSABEL PAGUIRIGANNo ratings yet

- University of Caloocan City Camarin Campus Graduate School MAED 305Document2 pagesUniversity of Caloocan City Camarin Campus Graduate School MAED 305Silvester CardinesNo ratings yet

- English Language Curriculum BUDGET OF WORK FOR SUMMATIVE ASSESSMENT AND INSTRUCTION Grade 9 1st 4th 1Document45 pagesEnglish Language Curriculum BUDGET OF WORK FOR SUMMATIVE ASSESSMENT AND INSTRUCTION Grade 9 1st 4th 1bhebheNo ratings yet

- Signed DM Ouci 2021 253 Joint Memo Qa of q1 and q2 Slms 1Document20 pagesSigned DM Ouci 2021 253 Joint Memo Qa of q1 and q2 Slms 1Roxanne CabilinNo ratings yet

- New Format ProposalDocument3 pagesNew Format ProposalMC Smith100% (1)

- Department of Education: Republic of The PhilippinesDocument22 pagesDepartment of Education: Republic of The PhilippinesRUTH KLARIBELLE VILLACERANNo ratings yet

- Campus Journ Action Plan 2022Document2 pagesCampus Journ Action Plan 2022Perry Amatorio Delos Reyes Jr.100% (1)

- Library Action PlanDocument2 pagesLibrary Action Planmemory gasparNo ratings yet

- The Chat Box. Please Wait For The Facilitator To Recognize You Before Speaking. Ideas in The Chat Box and The Facilitator Will RaiseDocument68 pagesThe Chat Box. Please Wait For The Facilitator To Recognize You Before Speaking. Ideas in The Chat Box and The Facilitator Will RaisesheenaNo ratings yet

- The Garden of PhrasesDocument8 pagesThe Garden of PhrasesSamy Rajoo100% (1)

- Mentoring PortfolioDocument47 pagesMentoring PortfolioRichard TamayoNo ratings yet

- Date/s Grade Level/Section Teacher/s Focus /subject RemarksDocument1 pageDate/s Grade Level/Section Teacher/s Focus /subject RemarksEleanor BoticarioNo ratings yet

- Endorsement-Letter-Lgu RizalDocument2 pagesEndorsement-Letter-Lgu RizalArdy Pamintuan0% (1)

- PRAISE Narrative Report - 1Document2 pagesPRAISE Narrative Report - 1CJ Degayo100% (1)

- Strategic Intervention ACPlan in English - AshguifilesDocument2 pagesStrategic Intervention ACPlan in English - AshguifilesBeaulah Rose ValdezNo ratings yet

- JHS Omnibus-Certification-Of-Authenticity-And-Veracity-Of-DocumentsDocument2 pagesJHS Omnibus-Certification-Of-Authenticity-And-Veracity-Of-DocumentsAnna Lou Keshia100% (1)

- Criteria For Outstanding SPAsDocument7 pagesCriteria For Outstanding SPAsDom Ricafranca CuetoNo ratings yet

- Paaralang Sentral Elementarya NG F. BustamanteDocument3 pagesPaaralang Sentral Elementarya NG F. BustamanteNimfa AsuqueNo ratings yet

- Reading Action Plan On Struggling LearnerDocument5 pagesReading Action Plan On Struggling LearnerEvelyn ObedencioNo ratings yet

- Orientation On SBM FrameworkDocument26 pagesOrientation On SBM FrameworkRoland CamposNo ratings yet

- LRMDS HandbookDocument14 pagesLRMDS HandbookJerry G. GabacNo ratings yet

- WinS Agreed School SDO TA Plan Template - 2 Dec. 18Document5 pagesWinS Agreed School SDO TA Plan Template - 2 Dec. 18MarlynNo ratings yet

- Layout Artist TORDocument3 pagesLayout Artist TORricohizon99No ratings yet

- Department of Education: Accomplishment ReportDocument4 pagesDepartment of Education: Accomplishment Reportarmand resquir jrNo ratings yet

- Tisa National High School Tisa National High SchoolDocument1 pageTisa National High School Tisa National High SchoolWinstonEnriquezFernandezNo ratings yet

- LisDocument97 pagesLisEd S. Biolena50% (2)

- Supervisory Report For Teachers SY 2014-2015: Don Severo Felismino Elementary School Sta. Lucia Dolores, QuezonDocument3 pagesSupervisory Report For Teachers SY 2014-2015: Don Severo Felismino Elementary School Sta. Lucia Dolores, Quezonana karylle100% (1)

- Transfer Memo 101 S. 2015Document3 pagesTransfer Memo 101 S. 2015Ram Amin Candelaria100% (3)

- Innovation of Vocational Technology EducationDocument15 pagesInnovation of Vocational Technology EducationRiskohottuaNo ratings yet

- Receiving Log BookDocument1 pageReceiving Log Booklindon1107No ratings yet

- Department of Education: Republic of The PhilippinesDocument6 pagesDepartment of Education: Republic of The PhilippinesGLORYLYN ECHOGANo ratings yet

- Week 4 DLL Reading and WritingDocument6 pagesWeek 4 DLL Reading and WritingJULIE CRIS CORPUZNo ratings yet

- Strategic Planning: Training DesignDocument19 pagesStrategic Planning: Training DesignBenjie Modelo ManilaNo ratings yet

- Pardo Es - Best Practices 2019Document15 pagesPardo Es - Best Practices 2019grace nacmanNo ratings yet

- Domain 2 Financial ManagementDocument12 pagesDomain 2 Financial ManagementTine CristineNo ratings yet

- Reading Observation 1Document4 pagesReading Observation 1api-311037110No ratings yet

- Progress Monitoring and CoachingDocument6 pagesProgress Monitoring and CoachingAMANDA ESPINOZANo ratings yet

- Annual Supervisory Plan: " The First Filipino School and Your Child's Second Home in Dubai "Document5 pagesAnnual Supervisory Plan: " The First Filipino School and Your Child's Second Home in Dubai "Mars CabanaNo ratings yet

- Daily Time Record Daily Time RecordDocument4 pagesDaily Time Record Daily Time RecordCharlotte Gayle SolanoNo ratings yet

- Application Letter For SchoolDocument1 pageApplication Letter For SchoolNattanniel TormonNo ratings yet

- Action Research WriteshopDocument1 pageAction Research WriteshopCy DacerNo ratings yet

- 503 - Comprehensive ExaminationDocument4 pages503 - Comprehensive ExaminationJomaj Dela CruzNo ratings yet

- DepEd SHS Forms Data Elements DescriptionDocument22 pagesDepEd SHS Forms Data Elements DescriptionNheru VeraflorNo ratings yet

- Action Plan in Campus Journalism 2015 2016Document7 pagesAction Plan in Campus Journalism 2015 2016jein_amNo ratings yet

- Program Executive Pta MeetingDocument1 pageProgram Executive Pta MeetingpheyvinuyaNo ratings yet

- Program EvaluationDocument2 pagesProgram EvaluationKuya Ken Manozon100% (3)

- Results - Based Performance Management System (RPMS) For DepedDocument92 pagesResults - Based Performance Management System (RPMS) For DepedIrvin EcalnirNo ratings yet

- Career Fun Day (Invitation Letter)Document1 pageCareer Fun Day (Invitation Letter)Arnel AvilaNo ratings yet

- Ecw Short OrientationDocument69 pagesEcw Short OrientationJohny Sarangay100% (2)

- Project Etv Significant AccomplishmentDocument8 pagesProject Etv Significant AccomplishmentRollyNo ratings yet

- Gen Assembly Meeting PRogramme InvitationDocument2 pagesGen Assembly Meeting PRogramme InvitationmichelleNo ratings yet

- Rosita R. Bucoy: Strategic Intervention Materials in EnglishDocument29 pagesRosita R. Bucoy: Strategic Intervention Materials in EnglishRosita BucoyNo ratings yet

- Investment Portfolio TemplateDocument2 pagesInvestment Portfolio TemplateSanam TNo ratings yet

- Indigo Revolt in BengalDocument17 pagesIndigo Revolt in BengalNishat Mahmud100% (1)

- Chapter 2 Working With Project TeamsDocument20 pagesChapter 2 Working With Project TeamsAshley Quinn MorganNo ratings yet

- Psychosocial Assessment SWK Practice IIIDocument7 pagesPsychosocial Assessment SWK Practice IIIapi-628734736No ratings yet

- Build VisionDocument36 pagesBuild VisionBlasinav IvanovskiNo ratings yet

- History Class 9 IcseDocument5 pagesHistory Class 9 IcseUnknown 404No ratings yet

- Employee Wellbeing Effectiveness On Motivation and Organizational PerformanceDocument18 pagesEmployee Wellbeing Effectiveness On Motivation and Organizational Performanceswaviman100% (1)

- Law299 4r GP AssignmentDocument10 pagesLaw299 4r GP AssignmentAIZAT ALIFF BIN AZAHARNo ratings yet

- California Bar Journal-Avoiding Unauthorized Practice of Law - California Attorney General - Supreme Court of California - California State BarDocument3 pagesCalifornia Bar Journal-Avoiding Unauthorized Practice of Law - California Attorney General - Supreme Court of California - California State BarCalifornia Judicial Branch News Service - Investigative Reporting Source Material & Story IdeasNo ratings yet

- 4 Sinf Bilimlar Bellashuvi 1Document6 pages4 Sinf Bilimlar Bellashuvi 1mmmNo ratings yet

- Penjeleasan Tiap Baris Dalam LCDocument14 pagesPenjeleasan Tiap Baris Dalam LCGaluh WhendayatiNo ratings yet

- Chapter 4 - Quiz EnglishDocument2 pagesChapter 4 - Quiz EnglishFitri-ssiNo ratings yet

- India - WikipediaDocument67 pagesIndia - WikipediaRonaldbrzNo ratings yet

- Health: Quarter 4 - Module 2Document11 pagesHealth: Quarter 4 - Module 2Gian IlagaNo ratings yet

- 4KA Bahasa InggrisDocument5 pages4KA Bahasa InggrisDimas Amiluhur DwikromoNo ratings yet

- Summary Internship Report: Deportment of Business AdministrationDocument20 pagesSummary Internship Report: Deportment of Business Administrationgayaatri onlineNo ratings yet

- Palestine Israel ConflictDocument6 pagesPalestine Israel ConflictajeehaniaziNo ratings yet

- Cms Application FormDocument5 pagesCms Application FormShyam VimalKumarNo ratings yet

- Midterm Exam UCSP 20192020Document5 pagesMidterm Exam UCSP 20192020Jhong Sacapaño Delgado100% (1)

- Minimising Pollution Intakes: Technical MemorandaDocument27 pagesMinimising Pollution Intakes: Technical MemorandaAmando GonzalesNo ratings yet

- Samsung 6.2 KG With Monsoon Feature Fully Automatic Top Load GreyDocument1 pageSamsung 6.2 KG With Monsoon Feature Fully Automatic Top Load GreyDhruv GohelNo ratings yet

- Contracts Sem 2Document20 pagesContracts Sem 2Zeeshan Ahmad R-67No ratings yet

- SABIS - Students Achieve Outstanding Results On External ExamsDocument1 pageSABIS - Students Achieve Outstanding Results On External Examsawesley5844No ratings yet

- Reflection in (Are Men Born Evil or Made Evil)Document3 pagesReflection in (Are Men Born Evil or Made Evil)Cristine GorubatNo ratings yet

- Pym 2022 OrientaitonDocument3 pagesPym 2022 OrientaitonCogie PeraltaNo ratings yet

- SIPOC TemplateDocument2 pagesSIPOC Templatehaz002No ratings yet

- Feasib - CHAPTER 2 1Document37 pagesFeasib - CHAPTER 2 1MaritesNo ratings yet

- Industry Requirement Anlaysis For Corporate Gifting in FMCGDocument19 pagesIndustry Requirement Anlaysis For Corporate Gifting in FMCGPrinceCharmIngMuthilyNo ratings yet

- Tax Brief - June 2012Document8 pagesTax Brief - June 2012Rheneir MoraNo ratings yet

- Liverpool BullEyes 04Document11 pagesLiverpool BullEyes 04Angelica NavarroNo ratings yet

Investment Portfolio Template

Investment Portfolio Template

Uploaded by

Nishith Ranjan0 ratings0% found this document useful (0 votes)

130 views2 pagesThe document provides investment portfolio recommendations for two clients - Frugal Tim and Spendthrift Elizabeth.

For Frugal Tim, the portfolio composition includes 15% in domestic equities, 5% in overseas equities, 15% in nominal bonds, 35% in inflation-linked bonds, 25% in real estate, and 5% in cash equivalents. This portfolio aims to generate sufficient returns while minimizing risk so the client's funds last indefinitely.

For Spendthrift Elizabeth, the portfolio is more aggressively allocated with 35% in domestic equities, 15% in overseas equities, 10% in nominal bonds, 20% in inflation-linked bonds, 20% in real estate, and 0% in

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides investment portfolio recommendations for two clients - Frugal Tim and Spendthrift Elizabeth.

For Frugal Tim, the portfolio composition includes 15% in domestic equities, 5% in overseas equities, 15% in nominal bonds, 35% in inflation-linked bonds, 25% in real estate, and 5% in cash equivalents. This portfolio aims to generate sufficient returns while minimizing risk so the client's funds last indefinitely.

For Spendthrift Elizabeth, the portfolio is more aggressively allocated with 35% in domestic equities, 15% in overseas equities, 10% in nominal bonds, 20% in inflation-linked bonds, 20% in real estate, and 0% in

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

130 views2 pagesInvestment Portfolio Template

Investment Portfolio Template

Uploaded by

Nishith RanjanThe document provides investment portfolio recommendations for two clients - Frugal Tim and Spendthrift Elizabeth.

For Frugal Tim, the portfolio composition includes 15% in domestic equities, 5% in overseas equities, 15% in nominal bonds, 35% in inflation-linked bonds, 25% in real estate, and 5% in cash equivalents. This portfolio aims to generate sufficient returns while minimizing risk so the client's funds last indefinitely.

For Spendthrift Elizabeth, the portfolio is more aggressively allocated with 35% in domestic equities, 15% in overseas equities, 10% in nominal bonds, 20% in inflation-linked bonds, 20% in real estate, and 0% in

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 2

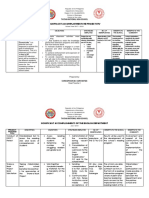

Portfolio for Individual #1

• Client: Frugal Tim “I am hoping that your

• Portfolio Composition suggested investment portfolio

would generate sufficient

Asset Class % invested Rationale

returns so that I never run out

Domestic Equities 15% Buy Blue Chip Stocks with high dividend payment and growth of of money at the beaches of

average 10%.

Mauritius!”

Overseas Equities 5% Buy stocks of top companies with average previous growth and

dividend payment

Fixed-Income Nominal 15% Buy nominal bonds as volatility is low and decent return is there.

Bonds

Inflation-Linked Bonds 35% Buy maximum linked bonds as they are inflation protected and

volatility is low and and return rate is preety good with 4.5%.

Real Estate 25% Buy real state because they are inflation protected with average

return of 10% to 12%.

Cash and Cash Equivalent 5% Average return of cash and cash equivalent is 3.5% so we will

invest in that too.

Total 100%

Portfolio for Individual #2

• Client: Spendthrift Elizabeth

“I am hoping that your

• Portfolio Composition suggested investment portfolio

Asset Class % invested Rationale would generate 1,000% annual

Domestic Equities 35 Average return of domestic equities is 10% to 12% so I will invest return every year until I retire!”

in that according to costumer need.

Overseas Equities 15 Since costumer is risk taker so I will invest in overseas equity too

as it has annual return of around 7%.

Fixed Income Nominal 10 Will invest here too as it has annual return of around 5%.

Bonds

Inflation Linked Bonds 20 Will invest highly in linked bonds as it inflation protected and

good growth.

Real Estate 20 Will invest in real state as it has annual return of around 10%

with inflation protection.

Cash and Cash equivalent 0 I will not invest in cash equivalents as it didn’t match costumer

profile.

Total 100%

You might also like

- Advices of Abu Ad Dardaa Sh. Saalih Aali ShaykhDocument78 pagesAdvices of Abu Ad Dardaa Sh. Saalih Aali ShaykhOmais SyedNo ratings yet

- Investment Portfolio Template 1Document2 pagesInvestment Portfolio Template 1NikHil SharmaNo ratings yet

- Brigada Dos and DontsDocument15 pagesBrigada Dos and DontsNoel PolaronNo ratings yet

- Graduation Message 2019 Psds Anacleta IncognitoDocument1 pageGraduation Message 2019 Psds Anacleta IncognitoPaity DimeNo ratings yet

- Department of Education: Republic of The PhilippinesDocument31 pagesDepartment of Education: Republic of The PhilippinesRichie MayorNo ratings yet

- Action Plan For C. JournalismDocument12 pagesAction Plan For C. JournalismMario DailegNo ratings yet

- Awards Committee (Ac) : Kasiglahan Village Elementary SchoolDocument2 pagesAwards Committee (Ac) : Kasiglahan Village Elementary SchoolSonny MatiasNo ratings yet

- School Based Action Plan On Reading Activities For Struggling Learners 2022-2023Document3 pagesSchool Based Action Plan On Reading Activities For Struggling Learners 2022-2023Kirapan ESNo ratings yet

- Letter For Resource Speaker PDFDocument1 pageLetter For Resource Speaker PDFANNE ARNET YSABEL PAGUIRIGANNo ratings yet

- University of Caloocan City Camarin Campus Graduate School MAED 305Document2 pagesUniversity of Caloocan City Camarin Campus Graduate School MAED 305Silvester CardinesNo ratings yet

- English Language Curriculum BUDGET OF WORK FOR SUMMATIVE ASSESSMENT AND INSTRUCTION Grade 9 1st 4th 1Document45 pagesEnglish Language Curriculum BUDGET OF WORK FOR SUMMATIVE ASSESSMENT AND INSTRUCTION Grade 9 1st 4th 1bhebheNo ratings yet

- Signed DM Ouci 2021 253 Joint Memo Qa of q1 and q2 Slms 1Document20 pagesSigned DM Ouci 2021 253 Joint Memo Qa of q1 and q2 Slms 1Roxanne CabilinNo ratings yet

- New Format ProposalDocument3 pagesNew Format ProposalMC Smith100% (1)

- Department of Education: Republic of The PhilippinesDocument22 pagesDepartment of Education: Republic of The PhilippinesRUTH KLARIBELLE VILLACERANNo ratings yet

- Campus Journ Action Plan 2022Document2 pagesCampus Journ Action Plan 2022Perry Amatorio Delos Reyes Jr.100% (1)

- Library Action PlanDocument2 pagesLibrary Action Planmemory gasparNo ratings yet

- The Chat Box. Please Wait For The Facilitator To Recognize You Before Speaking. Ideas in The Chat Box and The Facilitator Will RaiseDocument68 pagesThe Chat Box. Please Wait For The Facilitator To Recognize You Before Speaking. Ideas in The Chat Box and The Facilitator Will RaisesheenaNo ratings yet

- The Garden of PhrasesDocument8 pagesThe Garden of PhrasesSamy Rajoo100% (1)

- Mentoring PortfolioDocument47 pagesMentoring PortfolioRichard TamayoNo ratings yet

- Date/s Grade Level/Section Teacher/s Focus /subject RemarksDocument1 pageDate/s Grade Level/Section Teacher/s Focus /subject RemarksEleanor BoticarioNo ratings yet

- Endorsement-Letter-Lgu RizalDocument2 pagesEndorsement-Letter-Lgu RizalArdy Pamintuan0% (1)

- PRAISE Narrative Report - 1Document2 pagesPRAISE Narrative Report - 1CJ Degayo100% (1)

- Strategic Intervention ACPlan in English - AshguifilesDocument2 pagesStrategic Intervention ACPlan in English - AshguifilesBeaulah Rose ValdezNo ratings yet

- JHS Omnibus-Certification-Of-Authenticity-And-Veracity-Of-DocumentsDocument2 pagesJHS Omnibus-Certification-Of-Authenticity-And-Veracity-Of-DocumentsAnna Lou Keshia100% (1)

- Criteria For Outstanding SPAsDocument7 pagesCriteria For Outstanding SPAsDom Ricafranca CuetoNo ratings yet

- Paaralang Sentral Elementarya NG F. BustamanteDocument3 pagesPaaralang Sentral Elementarya NG F. BustamanteNimfa AsuqueNo ratings yet

- Reading Action Plan On Struggling LearnerDocument5 pagesReading Action Plan On Struggling LearnerEvelyn ObedencioNo ratings yet

- Orientation On SBM FrameworkDocument26 pagesOrientation On SBM FrameworkRoland CamposNo ratings yet

- LRMDS HandbookDocument14 pagesLRMDS HandbookJerry G. GabacNo ratings yet

- WinS Agreed School SDO TA Plan Template - 2 Dec. 18Document5 pagesWinS Agreed School SDO TA Plan Template - 2 Dec. 18MarlynNo ratings yet

- Layout Artist TORDocument3 pagesLayout Artist TORricohizon99No ratings yet

- Department of Education: Accomplishment ReportDocument4 pagesDepartment of Education: Accomplishment Reportarmand resquir jrNo ratings yet

- Tisa National High School Tisa National High SchoolDocument1 pageTisa National High School Tisa National High SchoolWinstonEnriquezFernandezNo ratings yet

- LisDocument97 pagesLisEd S. Biolena50% (2)

- Supervisory Report For Teachers SY 2014-2015: Don Severo Felismino Elementary School Sta. Lucia Dolores, QuezonDocument3 pagesSupervisory Report For Teachers SY 2014-2015: Don Severo Felismino Elementary School Sta. Lucia Dolores, Quezonana karylle100% (1)

- Transfer Memo 101 S. 2015Document3 pagesTransfer Memo 101 S. 2015Ram Amin Candelaria100% (3)

- Innovation of Vocational Technology EducationDocument15 pagesInnovation of Vocational Technology EducationRiskohottuaNo ratings yet

- Receiving Log BookDocument1 pageReceiving Log Booklindon1107No ratings yet

- Department of Education: Republic of The PhilippinesDocument6 pagesDepartment of Education: Republic of The PhilippinesGLORYLYN ECHOGANo ratings yet

- Week 4 DLL Reading and WritingDocument6 pagesWeek 4 DLL Reading and WritingJULIE CRIS CORPUZNo ratings yet

- Strategic Planning: Training DesignDocument19 pagesStrategic Planning: Training DesignBenjie Modelo ManilaNo ratings yet

- Pardo Es - Best Practices 2019Document15 pagesPardo Es - Best Practices 2019grace nacmanNo ratings yet

- Domain 2 Financial ManagementDocument12 pagesDomain 2 Financial ManagementTine CristineNo ratings yet

- Reading Observation 1Document4 pagesReading Observation 1api-311037110No ratings yet

- Progress Monitoring and CoachingDocument6 pagesProgress Monitoring and CoachingAMANDA ESPINOZANo ratings yet

- Annual Supervisory Plan: " The First Filipino School and Your Child's Second Home in Dubai "Document5 pagesAnnual Supervisory Plan: " The First Filipino School and Your Child's Second Home in Dubai "Mars CabanaNo ratings yet

- Daily Time Record Daily Time RecordDocument4 pagesDaily Time Record Daily Time RecordCharlotte Gayle SolanoNo ratings yet

- Application Letter For SchoolDocument1 pageApplication Letter For SchoolNattanniel TormonNo ratings yet

- Action Research WriteshopDocument1 pageAction Research WriteshopCy DacerNo ratings yet

- 503 - Comprehensive ExaminationDocument4 pages503 - Comprehensive ExaminationJomaj Dela CruzNo ratings yet

- DepEd SHS Forms Data Elements DescriptionDocument22 pagesDepEd SHS Forms Data Elements DescriptionNheru VeraflorNo ratings yet

- Action Plan in Campus Journalism 2015 2016Document7 pagesAction Plan in Campus Journalism 2015 2016jein_amNo ratings yet

- Program Executive Pta MeetingDocument1 pageProgram Executive Pta MeetingpheyvinuyaNo ratings yet

- Program EvaluationDocument2 pagesProgram EvaluationKuya Ken Manozon100% (3)

- Results - Based Performance Management System (RPMS) For DepedDocument92 pagesResults - Based Performance Management System (RPMS) For DepedIrvin EcalnirNo ratings yet

- Career Fun Day (Invitation Letter)Document1 pageCareer Fun Day (Invitation Letter)Arnel AvilaNo ratings yet

- Ecw Short OrientationDocument69 pagesEcw Short OrientationJohny Sarangay100% (2)

- Project Etv Significant AccomplishmentDocument8 pagesProject Etv Significant AccomplishmentRollyNo ratings yet

- Gen Assembly Meeting PRogramme InvitationDocument2 pagesGen Assembly Meeting PRogramme InvitationmichelleNo ratings yet

- Rosita R. Bucoy: Strategic Intervention Materials in EnglishDocument29 pagesRosita R. Bucoy: Strategic Intervention Materials in EnglishRosita BucoyNo ratings yet

- Investment Portfolio TemplateDocument2 pagesInvestment Portfolio TemplateSanam TNo ratings yet

- Indigo Revolt in BengalDocument17 pagesIndigo Revolt in BengalNishat Mahmud100% (1)

- Chapter 2 Working With Project TeamsDocument20 pagesChapter 2 Working With Project TeamsAshley Quinn MorganNo ratings yet

- Psychosocial Assessment SWK Practice IIIDocument7 pagesPsychosocial Assessment SWK Practice IIIapi-628734736No ratings yet

- Build VisionDocument36 pagesBuild VisionBlasinav IvanovskiNo ratings yet

- History Class 9 IcseDocument5 pagesHistory Class 9 IcseUnknown 404No ratings yet

- Employee Wellbeing Effectiveness On Motivation and Organizational PerformanceDocument18 pagesEmployee Wellbeing Effectiveness On Motivation and Organizational Performanceswaviman100% (1)

- Law299 4r GP AssignmentDocument10 pagesLaw299 4r GP AssignmentAIZAT ALIFF BIN AZAHARNo ratings yet

- California Bar Journal-Avoiding Unauthorized Practice of Law - California Attorney General - Supreme Court of California - California State BarDocument3 pagesCalifornia Bar Journal-Avoiding Unauthorized Practice of Law - California Attorney General - Supreme Court of California - California State BarCalifornia Judicial Branch News Service - Investigative Reporting Source Material & Story IdeasNo ratings yet

- 4 Sinf Bilimlar Bellashuvi 1Document6 pages4 Sinf Bilimlar Bellashuvi 1mmmNo ratings yet

- Penjeleasan Tiap Baris Dalam LCDocument14 pagesPenjeleasan Tiap Baris Dalam LCGaluh WhendayatiNo ratings yet

- Chapter 4 - Quiz EnglishDocument2 pagesChapter 4 - Quiz EnglishFitri-ssiNo ratings yet

- India - WikipediaDocument67 pagesIndia - WikipediaRonaldbrzNo ratings yet

- Health: Quarter 4 - Module 2Document11 pagesHealth: Quarter 4 - Module 2Gian IlagaNo ratings yet

- 4KA Bahasa InggrisDocument5 pages4KA Bahasa InggrisDimas Amiluhur DwikromoNo ratings yet

- Summary Internship Report: Deportment of Business AdministrationDocument20 pagesSummary Internship Report: Deportment of Business Administrationgayaatri onlineNo ratings yet

- Palestine Israel ConflictDocument6 pagesPalestine Israel ConflictajeehaniaziNo ratings yet

- Cms Application FormDocument5 pagesCms Application FormShyam VimalKumarNo ratings yet

- Midterm Exam UCSP 20192020Document5 pagesMidterm Exam UCSP 20192020Jhong Sacapaño Delgado100% (1)

- Minimising Pollution Intakes: Technical MemorandaDocument27 pagesMinimising Pollution Intakes: Technical MemorandaAmando GonzalesNo ratings yet

- Samsung 6.2 KG With Monsoon Feature Fully Automatic Top Load GreyDocument1 pageSamsung 6.2 KG With Monsoon Feature Fully Automatic Top Load GreyDhruv GohelNo ratings yet

- Contracts Sem 2Document20 pagesContracts Sem 2Zeeshan Ahmad R-67No ratings yet

- SABIS - Students Achieve Outstanding Results On External ExamsDocument1 pageSABIS - Students Achieve Outstanding Results On External Examsawesley5844No ratings yet

- Reflection in (Are Men Born Evil or Made Evil)Document3 pagesReflection in (Are Men Born Evil or Made Evil)Cristine GorubatNo ratings yet

- Pym 2022 OrientaitonDocument3 pagesPym 2022 OrientaitonCogie PeraltaNo ratings yet

- SIPOC TemplateDocument2 pagesSIPOC Templatehaz002No ratings yet

- Feasib - CHAPTER 2 1Document37 pagesFeasib - CHAPTER 2 1MaritesNo ratings yet

- Industry Requirement Anlaysis For Corporate Gifting in FMCGDocument19 pagesIndustry Requirement Anlaysis For Corporate Gifting in FMCGPrinceCharmIngMuthilyNo ratings yet

- Tax Brief - June 2012Document8 pagesTax Brief - June 2012Rheneir MoraNo ratings yet

- Liverpool BullEyes 04Document11 pagesLiverpool BullEyes 04Angelica NavarroNo ratings yet