Professional Documents

Culture Documents

Investment Programming

Investment Programming

Uploaded by

DILG NagaCopyright:

Available Formats

You might also like

- 2024 SGLGB Technical NotesDocument73 pages2024 SGLGB Technical NotesEwyn Saulog100% (5)

- Bills of Lading PDFDriveDocument873 pagesBills of Lading PDFDriveDallace Mirza100% (2)

- Step 4 - Formulating or Revisiting The Barangay VisionDocument16 pagesStep 4 - Formulating or Revisiting The Barangay VisionDILG Naga100% (3)

- Step 4 - Formulating or Revisiting The Barangay VisionDocument16 pagesStep 4 - Formulating or Revisiting The Barangay VisionDILG Naga100% (3)

- Eo Kasambahay 2022Document2 pagesEo Kasambahay 2022Joshua Regalado100% (7)

- SECURITIES REGULATION CODE (My Own ReviewerDocument18 pagesSECURITIES REGULATION CODE (My Own ReviewerMaritesCatayong100% (5)

- Barangay Bilad Capacity Development Agenda (Capdev) C.Y. 2022-2024Document15 pagesBarangay Bilad Capacity Development Agenda (Capdev) C.Y. 2022-2024Albert JoseNo ratings yet

- 7 Dilg BLGD Lgu DTP GuidelinesDocument23 pages7 Dilg BLGD Lgu DTP GuidelinesDILG Naga50% (2)

- Schedule of Implementation Source of FUNDS General Funds, SK Funds, BADAC Funds, External Sources Remarks Starting Date Completion DateDocument2 pagesSchedule of Implementation Source of FUNDS General Funds, SK Funds, BADAC Funds, External Sources Remarks Starting Date Completion DateOliver Banlos100% (2)

- Brgy Devt PlanningDocument50 pagesBrgy Devt PlanningJeprox Lora100% (1)

- T. MATTHEW PHILLIPS Plaintiff vs. ANDREW LIEBICH DefendantDocument1 pageT. MATTHEW PHILLIPS Plaintiff vs. ANDREW LIEBICH DefendantWAKESHEEP Marie RNNo ratings yet

- Step 9 - Writing - Packaging The BDPDocument10 pagesStep 9 - Writing - Packaging The BDPTherese Mae Auman100% (1)

- Step 7 - Investment ProgrammingDocument14 pagesStep 7 - Investment ProgrammingTherese Mae AumanNo ratings yet

- Step 5 - Goal and Objective SettingDocument18 pagesStep 5 - Goal and Objective SettingDILG PATNANUNGAN QUEZON100% (5)

- Writing and Packaging The BDPDocument10 pagesWriting and Packaging The BDPDILG Naga100% (1)

- Step 6 - Determining The PPAs - CapDev AgendaDocument58 pagesStep 6 - Determining The PPAs - CapDev AgendaMark Angelo GofredoNo ratings yet

- Step 1 - Organizing The Barangay Planning TeamDocument21 pagesStep 1 - Organizing The Barangay Planning TeamYang Rhea100% (12)

- The Barangay Development Planning (BDP) and CapDev Agenda Formulation ProcessDocument24 pagesThe Barangay Development Planning (BDP) and CapDev Agenda Formulation ProcessTherese Mae AumanNo ratings yet

- Step 10 - Adoption and Approval of The BDPDocument5 pagesStep 10 - Adoption and Approval of The BDPMPDO SANTOLNo ratings yet

- Enhanced BDP, Investment & BudgetingDocument24 pagesEnhanced BDP, Investment & BudgetingMicky MoranteNo ratings yet

- Updating The Barangay DatabaseDocument33 pagesUpdating The Barangay DatabaseDILG Naga100% (9)

- Barangay Peace and Order and Public Safety Plan Bpops Annex ADocument3 pagesBarangay Peace and Order and Public Safety Plan Bpops Annex AImee CorreaNo ratings yet

- Database of ChildrenDocument20 pagesDatabase of ChildrenjomarNo ratings yet

- Session 3 - The Barangay Development Planning (BDP) and CapDev Agenda Formulation ProcessDocument24 pagesSession 3 - The Barangay Development Planning (BDP) and CapDev Agenda Formulation ProcessDILG Naga100% (1)

- Session 2 - Bases and Principles For Barangay Development PlanningDocument33 pagesSession 2 - Bases and Principles For Barangay Development PlanningDILG Naga100% (2)

- Barangay Budget Ordinance - Barangay Budget Authorization Form No. 1Document3 pagesBarangay Budget Ordinance - Barangay Budget Authorization Form No. 1Marco AglibotNo ratings yet

- Barangay Form 5 & 6Document4 pagesBarangay Form 5 & 6nilo bia100% (1)

- SB Resolution Adopting The BDPDocument2 pagesSB Resolution Adopting The BDPKING ENMA100% (3)

- Badpa 2023-2025Document6 pagesBadpa 2023-2025Barangay PoloNo ratings yet

- Bagad SampleDocument2 pagesBagad SampleJherry MadcasimNo ratings yet

- BFDP Monitoring FormDocument7 pagesBFDP Monitoring FormMandy NoorNo ratings yet

- 3 Capacity Development Agenda For Barangays (Annex G-2)Document68 pages3 Capacity Development Agenda For Barangays (Annex G-2)Barangay Poblacion NaawanNo ratings yet

- Bdip Resolution Adopting and ApprovingDocument3 pagesBdip Resolution Adopting and ApprovingArchelaus PacenaNo ratings yet

- Barangay Annual Gender DevelopmentDocument3 pagesBarangay Annual Gender DevelopmentAmabelle Agsolid100% (2)

- Rizal Pala Pala 2 CP - BFDP - Monitoring - Forms A D - DILG MC 2022 027 Dated March 04 2022 1Document1 pageRizal Pala Pala 2 CP - BFDP - Monitoring - Forms A D - DILG MC 2022 027 Dated March 04 2022 1Villanueva YuriNo ratings yet

- 1st Sem 2021-BPOPS Accomplishment ReportDocument29 pages1st Sem 2021-BPOPS Accomplishment ReportBarangay PoblacionNo ratings yet

- Barangay Capacity Development Agenda: Republic of The Philippines City of IloiloDocument3 pagesBarangay Capacity Development Agenda: Republic of The Philippines City of IloiloYuri Villanueva100% (5)

- HALINA'T MAGTANIM NG PRUTAS AT GULAY Sa BarangayDocument12 pagesHALINA'T MAGTANIM NG PRUTAS AT GULAY Sa BarangayPonciano Alvero100% (2)

- DTP CapDev Agenda BrgyDocument40 pagesDTP CapDev Agenda BrgyRoxanne Vicedo100% (1)

- 5 BDP SectorsDocument2 pages5 BDP SectorsAbe Anshari100% (1)

- Indicative Programme: Day 1 (November 18, 2021) : Barangay Development Planning Time Topic DiscussantDocument2 pagesIndicative Programme: Day 1 (November 18, 2021) : Barangay Development Planning Time Topic DiscussantVinvin EsoenNo ratings yet

- BPOPS Plan TemplateDocument3 pagesBPOPS Plan TemplateIinday AnrymNo ratings yet

- Form Record of Barangay InhabitantDocument6 pagesForm Record of Barangay Inhabitantbarangay artacho1964 bautistaNo ratings yet

- Abiera Final FileDocument81 pagesAbiera Final FileDeo Montero OrquejoNo ratings yet

- ILIANDocument2 pagesILIANNaipah Hadji AmerNo ratings yet

- Dahilig BDP Final Draft 2024-2029Document41 pagesDahilig BDP Final Draft 2024-2029melanie llagasNo ratings yet

- Badac Plan 2022-2024Document4 pagesBadac Plan 2022-2024Ron Robin100% (2)

- Badac Accomlplishment ReportDocument1 pageBadac Accomlplishment Reportchelle100% (2)

- 4 Badac Data Capture FormsDocument13 pages4 Badac Data Capture FormsCristina Luntao82% (11)

- Annex "B" Bpops Accomplishment ReportDocument3 pagesAnnex "B" Bpops Accomplishment ReportVin Xhyne100% (1)

- BCPC Executive OrderDocument7 pagesBCPC Executive Orderdesiree joy corpuz0% (1)

- Barangay AGAD!Document9 pagesBarangay AGAD!Xerxes F BatraloNo ratings yet

- Barangay Resolution Authorizing The Municipal Treasurer To Collect Fees For Barangay ClearanceDocument3 pagesBarangay Resolution Authorizing The Municipal Treasurer To Collect Fees For Barangay Clearancempdc2713100% (1)

- Formulation/Updating OF THE Barangay Development Plan (BDP)Document15 pagesFormulation/Updating OF THE Barangay Development Plan (BDP)Operations Primus100% (1)

- Resolution Recommending AwfpDocument3 pagesResolution Recommending AwfpjomarNo ratings yet

- Barangay CapDevDocument15 pagesBarangay CapDevjosel100% (1)

- Barangay Facilities Barangay Workers/VolunteersDocument1 pageBarangay Facilities Barangay Workers/VolunteersChristy Ledesma-NavarroNo ratings yet

- Certification On Increase in Local ResourcesDocument1 pageCertification On Increase in Local Resourcesrongenjao100% (4)

- BCPC Table of ContentsDocument3 pagesBCPC Table of ContentsBarangay DitucalanNo ratings yet

- Monitoring The Functionality of Barangay Vaw DeskDocument2 pagesMonitoring The Functionality of Barangay Vaw DeskBarangay Centro UnoNo ratings yet

- BCPC ACCOMPLISHMENT REPORT 2021 - RepairedDocument1 pageBCPC ACCOMPLISHMENT REPORT 2021 - RepairedJonathanNo ratings yet

- Barangay Capacity Development Agenda: 1. HealthDocument3 pagesBarangay Capacity Development Agenda: 1. HealthAgustino Laoaguey Marcelo100% (3)

- SGLGB Technical NotesDocument9 pagesSGLGB Technical NotesJabereel Echavez100% (2)

- Step 7 - Investment ProgrammingDocument14 pagesStep 7 - Investment Programmingvina alboNo ratings yet

- Step 5 - Goal and Objective SettingDocument18 pagesStep 5 - Goal and Objective SettingBarangay PoloNo ratings yet

- Writing and Packaging The BDPDocument10 pagesWriting and Packaging The BDPDILG Naga100% (1)

- Updating The Barangay DatabaseDocument33 pagesUpdating The Barangay DatabaseDILG Naga100% (9)

- Session 3 - The Barangay Development Planning (BDP) and CapDev Agenda Formulation ProcessDocument24 pagesSession 3 - The Barangay Development Planning (BDP) and CapDev Agenda Formulation ProcessDILG Naga100% (1)

- Session 2 - Bases and Principles For Barangay Development PlanningDocument33 pagesSession 2 - Bases and Principles For Barangay Development PlanningDILG Naga100% (2)

- BGADDocument1 pageBGADDILG NagaNo ratings yet

- Employment LawDocument11 pagesEmployment LawAdedotun OmonijoNo ratings yet

- Importance of Record Keeping in SchoolsDocument2 pagesImportance of Record Keeping in SchoolsBrevington HoveNo ratings yet

- Philippine Telegraph AND Telephone Company, Petitioner, vs. National Labor Relations Commission and GRACE DE GUZMAN, RespondentsDocument82 pagesPhilippine Telegraph AND Telephone Company, Petitioner, vs. National Labor Relations Commission and GRACE DE GUZMAN, RespondentsptdwnhroNo ratings yet

- Dispute of Enforcement of Foreign Arbitral Awards in India and Its Impact On International TradeDocument5 pagesDispute of Enforcement of Foreign Arbitral Awards in India and Its Impact On International Tradenilofer shallyNo ratings yet

- Resolution Plan - Meaning, Content, Drafting and SubmissionDocument3 pagesResolution Plan - Meaning, Content, Drafting and SubmissionAnkit SinghNo ratings yet

- Fundamental Human RightDocument24 pagesFundamental Human RightyangaboytamarakuroNo ratings yet

- Ccrhpwa Bye-LowDocument11 pagesCcrhpwa Bye-Lowapi-294979872No ratings yet

- Gonzales III V Office of The President Case DigestDocument3 pagesGonzales III V Office of The President Case DigestRe doNo ratings yet

- United States Court of Appeals, For The Fourth Circuit.: No. 00-1577 No. 00-1595Document10 pagesUnited States Court of Appeals, For The Fourth Circuit.: No. 00-1577 No. 00-1595Scribd Government DocsNo ratings yet

- Bar StrategiesDocument91 pagesBar StrategiesJurilBrokaPatiño80% (5)

- Indemnity BondDocument2 pagesIndemnity BondSiddhant SinghaniaNo ratings yet

- Schultz v. American Lighting Inc Et Al - Document No. 19Document4 pagesSchultz v. American Lighting Inc Et Al - Document No. 19Justia.comNo ratings yet

- Land As CollateralDocument12 pagesLand As CollateralPatrick Lance EstremeraNo ratings yet

- Court On Its Own Motion Vs CBIDocument14 pagesCourt On Its Own Motion Vs CBIKaran TyagiNo ratings yet

- S.E.C. Lawsuit Against Penny Stock ChaserDocument19 pagesS.E.C. Lawsuit Against Penny Stock ChaserDealBook100% (1)

- Clase #1. Greetings and FerewellsDocument6 pagesClase #1. Greetings and FerewellsKristian DíazNo ratings yet

- BS EN 1559 - 2 (Founding Steel, 2000)Document27 pagesBS EN 1559 - 2 (Founding Steel, 2000)John BoranNo ratings yet

- Multi Dimension Approaches To TechnologyDocument350 pagesMulti Dimension Approaches To TechnologyParimal KashyapNo ratings yet

- Executive Order No. 200Document2 pagesExecutive Order No. 200DeniseNo ratings yet

- Condonation Application Form 2018 - 12 - 6 - 18Document2 pagesCondonation Application Form 2018 - 12 - 6 - 18tom jacobNo ratings yet

- Render Offer TemplateDocument2 pagesRender Offer TemplatevfcsenthilNo ratings yet

- Birth Certificates ExplainedDocument7 pagesBirth Certificates ExplainedKenny100% (2)

- People v. DecinaDocument10 pagesPeople v. Decinacansuzorman8No ratings yet

- LPU Presentation (CMTA, Feb 15, 2012)Document25 pagesLPU Presentation (CMTA, Feb 15, 2012)Jico Valguna BoneoNo ratings yet

- Mind MapDocument1 pageMind MapJul A.No ratings yet

- Lexoterica - SC Rulings On Civil LawDocument903 pagesLexoterica - SC Rulings On Civil Lawjade123_129No ratings yet

Investment Programming

Investment Programming

Uploaded by

DILG NagaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investment Programming

Investment Programming

Uploaded by

DILG NagaCopyright:

Available Formats

Session 3: Overview of Barangay Development Planning (BDP) and

CapDev Agenda Formulation

BDP Step 7:

INVESTMENT

PROGRAMMING

FM-LGTDD-10A Rev. 00 01/03/2018

BDP Step 7:

Investment Programming

STEP 10 STEP 1

Adoption & Organizing STEP 2

Approval of the the BPT &

Updating the

STEP 9 BDP BDC-TWG

Barangay

Writing and Databases/

Packaging the Profile

BDP

STEP 3

STEP 8 Participatory

PARTICIPATORY BDP Situational

Analysis

Crafting the

M&E Plan PROCESS

STEP 4

STEP 7

Formulating or

STEP 6 STEP 5 Revisiting the

Investment Barangay

Programming Determining Goal & Vision

the PPAs & Objective

CapDev Setting

Agenda

FM-LGTDD-10A Rev. 00 01/03/2018

PROBLEM

PRIORITIZATION CAUSE AND EFFECT

(What are the ANALYSIS

PROBLEM central problems?) (SECTORAL)

IDENTIFICATION (Finding root causes

(Initial assessment of of the problems and

problems and Summary of

their effects)

institutional Findings/ Issues

environment) & Possible

Actions

SETTING GOALS AND

OBJECTIVES VISIONING

(SECTORAL) WHERE DO WE WANT TO

Potential solutions to address the BE?

issue, maximize opportunities,

INTERVENTIONS and fulfill aspirations Community Dreams &

DETAILED PROGRAM, PROJECT, Aspirations – After knowing

ACTIVITIES their situation

IMPLEMENTATION

PLAN WITH BUDGET

FM-LGTDD-10A Rev. 00 01/03/2018

Investment Programming

• List of programs and projects that the LGU intends to

carry out to achieve the goals and objectives; typically

medium-term

• a mix of priority programs and projects which were

identified as the appropriate interventions in addressing the

development concerns of a locality and its people;

• shows how the financing is to be done with

reference to the programs and projects

FM-LGTDD-10A Rev. 00 01/03/2018

Investment Programming

Barangay Development Investment Program (BDIP) - is the main

instrument for implementing the BDP. It is a document that translates the

BDP into programs, projects, and activities with its corresponding

resource requirements that are projected to be implemented within the

timeframe of three (3) years

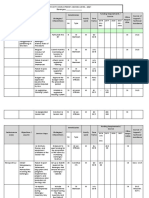

Annual Investment Program (AIP)- refers to the

annual slice of the BDIP, which constitutes the total

resource requirements for all PPAs consisting of the

annual capital expenditure and regular operating

requirements of the barangay

FM-LGTDD-10A Rev. 00 01/03/2018

Legal Bases

Section 329. Barangay Funds

• Unless otherwise provided in this Title, all the

income of the barangay from whatever source shall

accrue to its general fund and shall, at the option of

the barangay concerned, be kept as trust fund in the

custody of the city or municipal treasurer or be

deposited in a bank, preferably government-owned,

situated in or nearest to its area of jurisdiction. Such

funds shall be disbursed in accordance with the

provisions of this Title. Ten percent (10%) of the

general fund of the barangay shall be set aside for

the Sangguniang Kabataan.

FM-LGTDD-10A Rev. 00 01/03/2018

Legal Bases

Section 330. Submission of Detailed

Statements of Income and Expenditures for

the Barangay Budgets

• On or before the fifteenth (15th) day of September

of each year, the barangay treasurer shall submit to

the punong barangay a statement covering the

estimates of income and expenditures for the

ensuing fiscal year, based on a certified statement

issued by the city or municipal treasurer covering

the estimates of income from local sources for the

barangay concerned.

FM-LGTDD-10A Rev. 00 01/03/2018

Legal Bases

Section 331. Preparation of the Barangay Budget

• Upon receipt of the statement of income and expenditures from

the barangay treasurer, the punong barangay shall prepare the

barangay budget for the ensuing fiscal year in the manner and

within the period prescribed in this Title and submit the annual

barangay budget to the sangguniang barangay for legislative

enactment.

• The total annual appropriations for personal services of a

barangay for one (1) fiscal year shall not exceed fifty-five percent

(55%) of the total annual income actually realized from local

sources during the next preceding fiscal year.

• The barangay budget shall likewise be subject to the same

budgetary requirements and limitations herein above prescribed.

FM-LGTDD-10A Rev. 00 01/03/2018

Legal Bases

Section 332. Effectivity of Barangay Budgets

• The ordinance enacting the annual budget shall take

effect at the beginning of the ensuing calendar year.

An ordinance enacting a supplemental budget,

however, shall take effect upon its approval or on

the date fixed therein.

• The responsibility for the execution of the annual

and supplemental budgets and the accountability

therefore shall be vested primarily in the Punong

Barangay concerned.

FM-LGTDD-10A Rev. 00 01/03/2018

Legal Bases

Section 333. Review of the Barangay Budget

• (a) Within ten (10) days from its approval, copies of the barangay ordinance authorizing

the annual appropriations shall be furnished the sangguniang panlungsod or the

sangguniang bayan, as the case may be, through the city or municipal budget officer. The

sanggunian concerned shall have the power to review such ordinance in order to ensure

that the provisions of this Title are complied with. If within sixty (60) days after the receipt

of the ordinance, the sanggunian concerned takes no action thereon, the same shall

continue to be in full force and effect. If within the same period, the sanggunian concerned

shall have ascertained that the ordinance contains appropriations in excess of the estimates

of the income duly certified as collectible, or that the same has not complied with the

budgetary requirements set forth in this Title, the said ordinance shall be declared

inoperative in its entirety or in part. Items of appropriation contrary to, or in excess of, any

of the general limitations or the maximum amount prescribed in this Title shall be

disallowed or reduced accordingly.

FM-LGTDD-10A Rev. 00 01/03/2018

Legal Bases

Section 333. Review of the Barangay Budget

• (b) Within the period hereinabove fixed, the sangguniang panlungsod or

sangguniang bayan concerned shall return the barangay ordinance, through

the city or municipal budget officer, to the punong barangay with the advice

of action thereon for proper adjustments, in which event, the barangay shall

operate on the ordinance authorizing annual appropriations of the preceding

fiscal year until such time that the new ordinance authorizing annual

appropriations shall have met the objections raised. Upon receipt of such

advice, the barangay treasurer or the city or municipal treasurer who has

custody of the funds shall not make further disbursement from any item of

appropriation declared inoperative, disallowed, or reduced.

FM-LGTDD-10A Rev. 00 01/03/2018

Legal Bases

Section 334. Barangay Financial Procedures

• (a) The barangay treasurer shall collect all taxes, fees, and other charges due and contributions

accruing to the barangay for which he shall issue official receipts, and shall deposit all collections with

the city or municipal treasury or in the depository account maintained in the name of the barangay

within five (5) days after receipt thereof. He may collect real property taxes and such other taxes as

may be imposed by a province, city or municipality that are due in his barangay only after being

deputized by the local treasurer concerned for the purpose.

• (b) The barangay treasurer may be authorized by the Sangguniang Barangay to make direct purchases

amounting to not more than One thousand pesos (P1,000.00) at any time for the ordinary and essential

needs of the barangay. The petty cash that the barangay treasurer may be authorized to hold for the

purpose shall not exceed twenty percent (20%) of the funds available and to the credit of the barangay

treasury

FM-LGTDD-10A Rev. 00 01/03/2018

Legal Bases

Section 334. Barangay Financial Procedures

• (c) The financial records of the barangay shall be kept in the office of the city

or municipal accountant in simplified manner as prescribed by the

Commission on Audit. Representatives of the Commission on Audit shall

audit such accounts annually or as often as may be necessary and make a

report of the audit to the sangguniang panlungsod or sangguniang bayan, as

the case may be. The Commission on Audit shall prescribe and put into effect

simplified procedures for barangay finances within six (6) months following

the effectivity of this Code.

FM-LGTDD-10A Rev. 00 01/03/2018

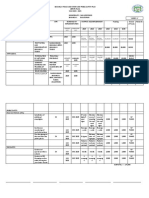

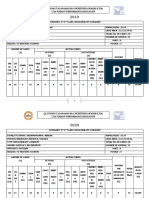

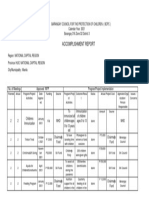

BDIP Template

FM-LGTDD-10A Rev. 00 01/03/2018

You might also like

- 2024 SGLGB Technical NotesDocument73 pages2024 SGLGB Technical NotesEwyn Saulog100% (5)

- Bills of Lading PDFDriveDocument873 pagesBills of Lading PDFDriveDallace Mirza100% (2)

- Step 4 - Formulating or Revisiting The Barangay VisionDocument16 pagesStep 4 - Formulating or Revisiting The Barangay VisionDILG Naga100% (3)

- Step 4 - Formulating or Revisiting The Barangay VisionDocument16 pagesStep 4 - Formulating or Revisiting The Barangay VisionDILG Naga100% (3)

- Eo Kasambahay 2022Document2 pagesEo Kasambahay 2022Joshua Regalado100% (7)

- SECURITIES REGULATION CODE (My Own ReviewerDocument18 pagesSECURITIES REGULATION CODE (My Own ReviewerMaritesCatayong100% (5)

- Barangay Bilad Capacity Development Agenda (Capdev) C.Y. 2022-2024Document15 pagesBarangay Bilad Capacity Development Agenda (Capdev) C.Y. 2022-2024Albert JoseNo ratings yet

- 7 Dilg BLGD Lgu DTP GuidelinesDocument23 pages7 Dilg BLGD Lgu DTP GuidelinesDILG Naga50% (2)

- Schedule of Implementation Source of FUNDS General Funds, SK Funds, BADAC Funds, External Sources Remarks Starting Date Completion DateDocument2 pagesSchedule of Implementation Source of FUNDS General Funds, SK Funds, BADAC Funds, External Sources Remarks Starting Date Completion DateOliver Banlos100% (2)

- Brgy Devt PlanningDocument50 pagesBrgy Devt PlanningJeprox Lora100% (1)

- T. MATTHEW PHILLIPS Plaintiff vs. ANDREW LIEBICH DefendantDocument1 pageT. MATTHEW PHILLIPS Plaintiff vs. ANDREW LIEBICH DefendantWAKESHEEP Marie RNNo ratings yet

- Step 9 - Writing - Packaging The BDPDocument10 pagesStep 9 - Writing - Packaging The BDPTherese Mae Auman100% (1)

- Step 7 - Investment ProgrammingDocument14 pagesStep 7 - Investment ProgrammingTherese Mae AumanNo ratings yet

- Step 5 - Goal and Objective SettingDocument18 pagesStep 5 - Goal and Objective SettingDILG PATNANUNGAN QUEZON100% (5)

- Writing and Packaging The BDPDocument10 pagesWriting and Packaging The BDPDILG Naga100% (1)

- Step 6 - Determining The PPAs - CapDev AgendaDocument58 pagesStep 6 - Determining The PPAs - CapDev AgendaMark Angelo GofredoNo ratings yet

- Step 1 - Organizing The Barangay Planning TeamDocument21 pagesStep 1 - Organizing The Barangay Planning TeamYang Rhea100% (12)

- The Barangay Development Planning (BDP) and CapDev Agenda Formulation ProcessDocument24 pagesThe Barangay Development Planning (BDP) and CapDev Agenda Formulation ProcessTherese Mae AumanNo ratings yet

- Step 10 - Adoption and Approval of The BDPDocument5 pagesStep 10 - Adoption and Approval of The BDPMPDO SANTOLNo ratings yet

- Enhanced BDP, Investment & BudgetingDocument24 pagesEnhanced BDP, Investment & BudgetingMicky MoranteNo ratings yet

- Updating The Barangay DatabaseDocument33 pagesUpdating The Barangay DatabaseDILG Naga100% (9)

- Barangay Peace and Order and Public Safety Plan Bpops Annex ADocument3 pagesBarangay Peace and Order and Public Safety Plan Bpops Annex AImee CorreaNo ratings yet

- Database of ChildrenDocument20 pagesDatabase of ChildrenjomarNo ratings yet

- Session 3 - The Barangay Development Planning (BDP) and CapDev Agenda Formulation ProcessDocument24 pagesSession 3 - The Barangay Development Planning (BDP) and CapDev Agenda Formulation ProcessDILG Naga100% (1)

- Session 2 - Bases and Principles For Barangay Development PlanningDocument33 pagesSession 2 - Bases and Principles For Barangay Development PlanningDILG Naga100% (2)

- Barangay Budget Ordinance - Barangay Budget Authorization Form No. 1Document3 pagesBarangay Budget Ordinance - Barangay Budget Authorization Form No. 1Marco AglibotNo ratings yet

- Barangay Form 5 & 6Document4 pagesBarangay Form 5 & 6nilo bia100% (1)

- SB Resolution Adopting The BDPDocument2 pagesSB Resolution Adopting The BDPKING ENMA100% (3)

- Badpa 2023-2025Document6 pagesBadpa 2023-2025Barangay PoloNo ratings yet

- Bagad SampleDocument2 pagesBagad SampleJherry MadcasimNo ratings yet

- BFDP Monitoring FormDocument7 pagesBFDP Monitoring FormMandy NoorNo ratings yet

- 3 Capacity Development Agenda For Barangays (Annex G-2)Document68 pages3 Capacity Development Agenda For Barangays (Annex G-2)Barangay Poblacion NaawanNo ratings yet

- Bdip Resolution Adopting and ApprovingDocument3 pagesBdip Resolution Adopting and ApprovingArchelaus PacenaNo ratings yet

- Barangay Annual Gender DevelopmentDocument3 pagesBarangay Annual Gender DevelopmentAmabelle Agsolid100% (2)

- Rizal Pala Pala 2 CP - BFDP - Monitoring - Forms A D - DILG MC 2022 027 Dated March 04 2022 1Document1 pageRizal Pala Pala 2 CP - BFDP - Monitoring - Forms A D - DILG MC 2022 027 Dated March 04 2022 1Villanueva YuriNo ratings yet

- 1st Sem 2021-BPOPS Accomplishment ReportDocument29 pages1st Sem 2021-BPOPS Accomplishment ReportBarangay PoblacionNo ratings yet

- Barangay Capacity Development Agenda: Republic of The Philippines City of IloiloDocument3 pagesBarangay Capacity Development Agenda: Republic of The Philippines City of IloiloYuri Villanueva100% (5)

- HALINA'T MAGTANIM NG PRUTAS AT GULAY Sa BarangayDocument12 pagesHALINA'T MAGTANIM NG PRUTAS AT GULAY Sa BarangayPonciano Alvero100% (2)

- DTP CapDev Agenda BrgyDocument40 pagesDTP CapDev Agenda BrgyRoxanne Vicedo100% (1)

- 5 BDP SectorsDocument2 pages5 BDP SectorsAbe Anshari100% (1)

- Indicative Programme: Day 1 (November 18, 2021) : Barangay Development Planning Time Topic DiscussantDocument2 pagesIndicative Programme: Day 1 (November 18, 2021) : Barangay Development Planning Time Topic DiscussantVinvin EsoenNo ratings yet

- BPOPS Plan TemplateDocument3 pagesBPOPS Plan TemplateIinday AnrymNo ratings yet

- Form Record of Barangay InhabitantDocument6 pagesForm Record of Barangay Inhabitantbarangay artacho1964 bautistaNo ratings yet

- Abiera Final FileDocument81 pagesAbiera Final FileDeo Montero OrquejoNo ratings yet

- ILIANDocument2 pagesILIANNaipah Hadji AmerNo ratings yet

- Dahilig BDP Final Draft 2024-2029Document41 pagesDahilig BDP Final Draft 2024-2029melanie llagasNo ratings yet

- Badac Plan 2022-2024Document4 pagesBadac Plan 2022-2024Ron Robin100% (2)

- Badac Accomlplishment ReportDocument1 pageBadac Accomlplishment Reportchelle100% (2)

- 4 Badac Data Capture FormsDocument13 pages4 Badac Data Capture FormsCristina Luntao82% (11)

- Annex "B" Bpops Accomplishment ReportDocument3 pagesAnnex "B" Bpops Accomplishment ReportVin Xhyne100% (1)

- BCPC Executive OrderDocument7 pagesBCPC Executive Orderdesiree joy corpuz0% (1)

- Barangay AGAD!Document9 pagesBarangay AGAD!Xerxes F BatraloNo ratings yet

- Barangay Resolution Authorizing The Municipal Treasurer To Collect Fees For Barangay ClearanceDocument3 pagesBarangay Resolution Authorizing The Municipal Treasurer To Collect Fees For Barangay Clearancempdc2713100% (1)

- Formulation/Updating OF THE Barangay Development Plan (BDP)Document15 pagesFormulation/Updating OF THE Barangay Development Plan (BDP)Operations Primus100% (1)

- Resolution Recommending AwfpDocument3 pagesResolution Recommending AwfpjomarNo ratings yet

- Barangay CapDevDocument15 pagesBarangay CapDevjosel100% (1)

- Barangay Facilities Barangay Workers/VolunteersDocument1 pageBarangay Facilities Barangay Workers/VolunteersChristy Ledesma-NavarroNo ratings yet

- Certification On Increase in Local ResourcesDocument1 pageCertification On Increase in Local Resourcesrongenjao100% (4)

- BCPC Table of ContentsDocument3 pagesBCPC Table of ContentsBarangay DitucalanNo ratings yet

- Monitoring The Functionality of Barangay Vaw DeskDocument2 pagesMonitoring The Functionality of Barangay Vaw DeskBarangay Centro UnoNo ratings yet

- BCPC ACCOMPLISHMENT REPORT 2021 - RepairedDocument1 pageBCPC ACCOMPLISHMENT REPORT 2021 - RepairedJonathanNo ratings yet

- Barangay Capacity Development Agenda: 1. HealthDocument3 pagesBarangay Capacity Development Agenda: 1. HealthAgustino Laoaguey Marcelo100% (3)

- SGLGB Technical NotesDocument9 pagesSGLGB Technical NotesJabereel Echavez100% (2)

- Step 7 - Investment ProgrammingDocument14 pagesStep 7 - Investment Programmingvina alboNo ratings yet

- Step 5 - Goal and Objective SettingDocument18 pagesStep 5 - Goal and Objective SettingBarangay PoloNo ratings yet

- Writing and Packaging The BDPDocument10 pagesWriting and Packaging The BDPDILG Naga100% (1)

- Updating The Barangay DatabaseDocument33 pagesUpdating The Barangay DatabaseDILG Naga100% (9)

- Session 3 - The Barangay Development Planning (BDP) and CapDev Agenda Formulation ProcessDocument24 pagesSession 3 - The Barangay Development Planning (BDP) and CapDev Agenda Formulation ProcessDILG Naga100% (1)

- Session 2 - Bases and Principles For Barangay Development PlanningDocument33 pagesSession 2 - Bases and Principles For Barangay Development PlanningDILG Naga100% (2)

- BGADDocument1 pageBGADDILG NagaNo ratings yet

- Employment LawDocument11 pagesEmployment LawAdedotun OmonijoNo ratings yet

- Importance of Record Keeping in SchoolsDocument2 pagesImportance of Record Keeping in SchoolsBrevington HoveNo ratings yet

- Philippine Telegraph AND Telephone Company, Petitioner, vs. National Labor Relations Commission and GRACE DE GUZMAN, RespondentsDocument82 pagesPhilippine Telegraph AND Telephone Company, Petitioner, vs. National Labor Relations Commission and GRACE DE GUZMAN, RespondentsptdwnhroNo ratings yet

- Dispute of Enforcement of Foreign Arbitral Awards in India and Its Impact On International TradeDocument5 pagesDispute of Enforcement of Foreign Arbitral Awards in India and Its Impact On International Tradenilofer shallyNo ratings yet

- Resolution Plan - Meaning, Content, Drafting and SubmissionDocument3 pagesResolution Plan - Meaning, Content, Drafting and SubmissionAnkit SinghNo ratings yet

- Fundamental Human RightDocument24 pagesFundamental Human RightyangaboytamarakuroNo ratings yet

- Ccrhpwa Bye-LowDocument11 pagesCcrhpwa Bye-Lowapi-294979872No ratings yet

- Gonzales III V Office of The President Case DigestDocument3 pagesGonzales III V Office of The President Case DigestRe doNo ratings yet

- United States Court of Appeals, For The Fourth Circuit.: No. 00-1577 No. 00-1595Document10 pagesUnited States Court of Appeals, For The Fourth Circuit.: No. 00-1577 No. 00-1595Scribd Government DocsNo ratings yet

- Bar StrategiesDocument91 pagesBar StrategiesJurilBrokaPatiño80% (5)

- Indemnity BondDocument2 pagesIndemnity BondSiddhant SinghaniaNo ratings yet

- Schultz v. American Lighting Inc Et Al - Document No. 19Document4 pagesSchultz v. American Lighting Inc Et Al - Document No. 19Justia.comNo ratings yet

- Land As CollateralDocument12 pagesLand As CollateralPatrick Lance EstremeraNo ratings yet

- Court On Its Own Motion Vs CBIDocument14 pagesCourt On Its Own Motion Vs CBIKaran TyagiNo ratings yet

- S.E.C. Lawsuit Against Penny Stock ChaserDocument19 pagesS.E.C. Lawsuit Against Penny Stock ChaserDealBook100% (1)

- Clase #1. Greetings and FerewellsDocument6 pagesClase #1. Greetings and FerewellsKristian DíazNo ratings yet

- BS EN 1559 - 2 (Founding Steel, 2000)Document27 pagesBS EN 1559 - 2 (Founding Steel, 2000)John BoranNo ratings yet

- Multi Dimension Approaches To TechnologyDocument350 pagesMulti Dimension Approaches To TechnologyParimal KashyapNo ratings yet

- Executive Order No. 200Document2 pagesExecutive Order No. 200DeniseNo ratings yet

- Condonation Application Form 2018 - 12 - 6 - 18Document2 pagesCondonation Application Form 2018 - 12 - 6 - 18tom jacobNo ratings yet

- Render Offer TemplateDocument2 pagesRender Offer TemplatevfcsenthilNo ratings yet

- Birth Certificates ExplainedDocument7 pagesBirth Certificates ExplainedKenny100% (2)

- People v. DecinaDocument10 pagesPeople v. Decinacansuzorman8No ratings yet

- LPU Presentation (CMTA, Feb 15, 2012)Document25 pagesLPU Presentation (CMTA, Feb 15, 2012)Jico Valguna BoneoNo ratings yet

- Mind MapDocument1 pageMind MapJul A.No ratings yet

- Lexoterica - SC Rulings On Civil LawDocument903 pagesLexoterica - SC Rulings On Civil Lawjade123_129No ratings yet