Professional Documents

Culture Documents

CH 08

CH 08

Uploaded by

Kow Ryder0 ratings0% found this document useful (0 votes)

6 views37 pagesThe document discusses absorption costing and variable costing methods. It provides examples to illustrate how net operating income is calculated under each method and how the results can differ depending on whether production levels are equal to, greater than, or less than sales. Absorption costing matches all manufacturing costs, including fixed overhead, to inventory, while variable costing treats fixed costs as period costs. The document also outlines advantages and disadvantages of each approach.

Original Description:

Managerial Accounting : Variable costing

Original Title

Ch08

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses absorption costing and variable costing methods. It provides examples to illustrate how net operating income is calculated under each method and how the results can differ depending on whether production levels are equal to, greater than, or less than sales. Absorption costing matches all manufacturing costs, including fixed overhead, to inventory, while variable costing treats fixed costs as period costs. The document also outlines advantages and disadvantages of each approach.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

6 views37 pagesCH 08

CH 08

Uploaded by

Kow RyderThe document discusses absorption costing and variable costing methods. It provides examples to illustrate how net operating income is calculated under each method and how the results can differ depending on whether production levels are equal to, greater than, or less than sales. Absorption costing matches all manufacturing costs, including fixed overhead, to inventory, while variable costing treats fixed costs as period costs. The document also outlines advantages and disadvantages of each approach.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 37

© 2021 McGraw-Hill Limited 8-1

Overview of Absorption

and Variable Costing

Exhibit 8-1

© 2021 McGraw-Hill Limited 8-2

Quick Check

Which method will produce the highest

values for work in process and finished

goods inventories?

a. Absorption costing.

b. Variable costing.

c. They produce the same values for these

inventories.

d. It depends. . .

© 2021 McGraw-Hill Limited 8-3

Quick Check

Which method will produce the highest

values for work in process and finished

goods inventories?

Answer:

a. Absorption costing.

© 2021 McGraw-Hill Limited 8-4

Unit Cost Computations Part 1

Harvey Company produces a single product with the

following information available:

© 2021 McGraw-Hill Limited 8-5

Effect of Changes in Production

on Operating Income

• Units sold in year 1 are: 20,000 units

• Units sold in year 2 are: 30,000 units

© 2021 McGraw-Hill Limited 8-6

Effect of Changes in Production

Harvey Company Year One

© 2021 McGraw-Hill Limited 8-7

Unit Cost Computations for Year

One

Unit product cost is determined as follows:

© 2021 McGraw-Hill Limited 8-8

Absorption Costing: Year One

Unit product

cost.

© 2021 McGraw-Hill Limited 8-9

Variable Costing: Year One

© 2021 McGraw-Hill Limited 8-10

Effect of Changes in Production:

Harvey Company Year Two

© 2021 McGraw-Hill Limited 8-11

Unit Cost Computations for Year

Two

Unit product cost is determined as follows:

© 2021 McGraw-Hill Limited 8-12

Absorption Costing: Year Two

© 2021 McGraw-Hill Limited 8-13

Variable Costing: Year Two

Variable

manufacturing

costs only.

© 2021 McGraw-Hill Limited 8-14

Comparing the Two Methods

Conclusion:

• Net operating income is not affected by changes in

production using variable costing.

• Net operating income is affected by changes in

production using absorption costing even though the

number of units sold is the same each year.

© 2021 McGraw-Hill Limited 8-15

Explaining Changes in Operating

Income

• Variable costing income is only affected by changes

in unit sales. It is not affected by the number of units

produced. As a general rule, when sales go up, net

operating income goes up, and vice versa.

• Absorption costing income is influenced by changes

in unit sales and units of production. Net operating

income can be increased simply by producing more

units even if those units are not sold.

© 2021 McGraw-Hill Limited 8-16

Unit Cost Computations Part 1

Harvey Company produces a single product with the

following information available:

© 2021 McGraw-Hill Limited 8-

Unit Cost Computations Part 2

Unit product cost is determined as follows:

Under absorption costing, selling and administrative expenses

are always treated as period expenses and deducted from

revenue as incurred.

© 2021 McGraw-Hill Limited 8-

Variable Costing vs Absorption

Costing

© 2021 McGraw-Hill Limited 8-

Income Comparison of

Absorption and Variable Costing

• Let’s assume the following additional information for

Harvey Company:

• 20,000 units were sold during the year at a price of

$30 each.

• There were no units in beginning inventory.

Now, let’s compute net operating income using both

absorption and variable costing.

© 2021 McGraw-Hill Limited 8-

Absorption Costing

Unit product

cost.

Fixed manufacturing overhead deferred in inventory is

5,000 units × $6 = $30,000.

© 2021 McGraw-Hill Limited 8-21

Variable Costing

© 2021 McGraw-Hill Limited 8-22

Comparing the Two Methods

© 2021 McGraw-Hill Limited 8-23

Reconcile Variable Costing and

Absorption Costing

We can reconcile the difference between

absorption and variable income as follows:

Fixed mfg. Overhead $150,000

= = $6.00 per unit

Units produced 25,000 units

© 2021 McGraw-Hill Limited 8-24

Extended Comparison of Income Data:

Harvey Company Year Two

© 2021 McGraw-Hill Limited 8-25

Unit Cost Computations

Since there was no change in the variable costs

per unit, total fixed costs, or the number of

units produced, the unit costs remain unchanged.

© 2021 McGraw-Hill Limited 8-26

Absorption Costing

© 2021 McGraw-Hill Limited 8-27

Variable Costing

Variable

manufacturing

costs only.

© 2021 McGraw-Hill Limited 8-28

Comparing the Two Methods 1

We can reconcile the difference between

absorption and variable income as follows:

Fixed mfg. Overhead $150,000

= = $6.00 per unit

Units produced 25,000 units

© 2021 McGraw-Hill Limited 8-29

Comparing the Two Methods 2

© 2021 McGraw-Hill Limited 8-30

COMPARATIVE INCOME EFFECTS OF ABSORPTION AND VARIABLE COSTING

Relationship between

Relationship between Absorption and Variable

Production and Sales Costing Operating

for the Period Effect on Inventories Incomes

Production = Sales No change in inventories Absorption costing operating

income = Variable costing

operating income

Production > Sales Inventories increase Absorption costing operating

income > Variable costing

operating income*

Production < Sales Inventories decrease Absorption costing operating

income < Variable costing

operating income†

*Operating income is higher under absorption costing, since fixed manufacturing overhead

cost is deferred in inventory under absorption costing as inventories increase.

†Operating income is lower under absorption costing, since fixed manufacturing overhead

cost is released from inventory under absorption costing as inventories decrease.

© 2021 McGraw-Hill Limited 8-31

Choosing A Costing Method: Impact

on the Manager

• Opponents of absorption costing argue that

shifting fixed manufacturing overhead costs

between periods can lead to faulty decisions.

• These opponents argue that variable costing income

statements are easier to understand because net

operating income is only affected by changes in unit

sales. This produces net operating income figures that

are more consistent with managers’ expectations.

© 2021 McGraw-Hill Limited 8-32

CVP Analysis and Absorption

Costing and Decision Making

• Absorption costing treats fixed manufacturing

overhead as a variable cost by assigning a per unit

amount of the fixed overhead to each unit of

production.

• Treating fixed manufacturing overhead as a

variable cost can:

• Lead to faulty pricing decisions and keep-or drop

decisions.

• Produce positive net operating income even when the

number of units sold is less than the breakeven point.

© 2021 McGraw-Hill Limited 8-33

External Reporting and Income

Taxes

• Absorption costing is required for external reports in the

United States and is the predominant method used in

Canada. For income tax purposes in Canada, the Canada

Revenue Agency permits both variable and absorption

costing for determining taxable income.

• Since top executives are usually evaluated based on

external reports to shareholders, they may feel that day to

day decisions should be based on absorption cost income.

© 2021 McGraw-Hill Limited 8-34

Advantages of Variable Costing

and the Contribution Approach

• Consistent with CVP analysis.

• Profit is not affected by changes in inventories.

• Management finds it more useful.

• Impact of fixed costs on profits emphasized.

• Easier to estimate profitability of products and

segments.

• Consistent with standard costs and flexible budgeting.

• Net operating income is closer to net cash flow.

© 2021 McGraw-Hill Limited 8-35

Variable versus Absorption Costing

• Absorption Costing Fixed manufacturing

costs must be assigned to products to

properly match revenues and costs.

• Variable Costing Fixed manufacturing

costs are capacity costs and will be incurred

even if nothing is produced.

© 2021 McGraw-Hill Limited 8-36

Impact of Lean Production

• In a lean production (JIT) inventory system,

productions tends to be equal to sales.

• So, the difference between variable and

absorption income tends to disappear.

© 2021 McGraw-Hill Limited 8-37

You might also like

- 04 Mobile Hose Van Guide Nov 14Document186 pages04 Mobile Hose Van Guide Nov 14EDWINNo ratings yet

- GNB 07 12eDocument40 pagesGNB 07 12eAtif SaeedNo ratings yet

- Variable Costing: A Tool For Management: Chapter SevenDocument40 pagesVariable Costing: A Tool For Management: Chapter SevenUsman JavedNo ratings yet

- Managerial Accounting: Tools For Business Decision-MakingDocument69 pagesManagerial Accounting: Tools For Business Decision-MakingdavidNo ratings yet

- Variable Costing: A Decision-Making Process: Weygandt - Kieso - KimmelDocument57 pagesVariable Costing: A Decision-Making Process: Weygandt - Kieso - KimmelSyeda Fakiha AliNo ratings yet

- Session-16-17-18-CVP AnalysisDocument78 pagesSession-16-17-18-CVP Analysis020Abhisek KhadangaNo ratings yet

- CLO 3 - LGE 3503 Accounting For ManagersDocument25 pagesCLO 3 - LGE 3503 Accounting For ManagersHello WorldNo ratings yet

- Contribution Approach 2Document16 pagesContribution Approach 2kualler80% (5)

- Accounts Chap 8Document35 pagesAccounts Chap 8koutftNo ratings yet

- Variable Costing: A Tool For Management: © 2010 The Mcgraw-Hill Companies, IncDocument29 pagesVariable Costing: A Tool For Management: © 2010 The Mcgraw-Hill Companies, IncTurbo TechNo ratings yet

- Chapter 2 Marginal CostingDocument21 pagesChapter 2 Marginal CostingLan Nhi NguyenNo ratings yet

- Absorption and Variable CostingDocument5 pagesAbsorption and Variable CostingKIM RAGANo ratings yet

- Accounting PresentationDocument40 pagesAccounting PresentationhsuNo ratings yet

- 7 Variable Costing A Tool For Management Compatibility ModeDocument21 pages7 Variable Costing A Tool For Management Compatibility ModeyasirfcmaNo ratings yet

- Chap 007Document21 pagesChap 007Brooke CarterNo ratings yet

- Variable Costing: A Tool For Management: Chapter SevenDocument40 pagesVariable Costing: A Tool For Management: Chapter SevenFitzmore Peters100% (1)

- Marginal and Absorption CostingDocument21 pagesMarginal and Absorption Costingkelvin mboyaNo ratings yet

- Variable Costing: A Tool For Management: Chapter SixDocument40 pagesVariable Costing: A Tool For Management: Chapter SixFahim RezaNo ratings yet

- Absorption Costing & Variable CostingDocument20 pagesAbsorption Costing & Variable Costingsaidkhatib368No ratings yet

- Sm08-Comm 305Document97 pagesSm08-Comm 305mike100% (2)

- Ca 1 Costing TechniquesDocument6 pagesCa 1 Costing TechniquesORIYOMI KASALINo ratings yet

- Variable Costing: A Decision-Making Perspective: True-False StatementsDocument8 pagesVariable Costing: A Decision-Making Perspective: True-False StatementsJanina Marie GarciaNo ratings yet

- Chapter 9 - Marginal - Absorption CostingDocument37 pagesChapter 9 - Marginal - Absorption CostingMaha IqrarNo ratings yet

- FIM3701 - LU5Document35 pagesFIM3701 - LU5Ryan TylerNo ratings yet

- Variable Costing: A Tool For ManagementDocument25 pagesVariable Costing: A Tool For ManagementWahyu PambudiNo ratings yet

- Session 10+11 - Cost Volume Profit RelationshipDocument44 pagesSession 10+11 - Cost Volume Profit Relationshiphieucaiminh155No ratings yet

- Overview of Absorption and Variable CostingDocument5 pagesOverview of Absorption and Variable CostingJarrelaine SerranoNo ratings yet

- Chapter 3 AkmenDocument28 pagesChapter 3 AkmenRomi AlfikriNo ratings yet

- Chapter 10Document5 pagesChapter 10Ailene QuintoNo ratings yet

- Management Accounting NotesDocument212 pagesManagement Accounting NotesFrank Chinguwo100% (1)

- Absorption Costing & Marginal Costing PDFDocument33 pagesAbsorption Costing & Marginal Costing PDFNguyen Châu AnhNo ratings yet

- Lecture 4 - 5 17102022 032709am 07032023 090715pm 17102023 015148pmDocument41 pagesLecture 4 - 5 17102022 032709am 07032023 090715pm 17102023 015148pmmurtaza haiderNo ratings yet

- Maf201 Theory Jul23 - Feb21Document11 pagesMaf201 Theory Jul23 - Feb21Nor Irdina SofirnaNo ratings yet

- Variable vs. Absorption CostingDocument21 pagesVariable vs. Absorption Costingsgulay117No ratings yet

- Act 202 Chapter 6Document40 pagesAct 202 Chapter 6Shaon KhanNo ratings yet

- ACT202 - Chapter 6Document38 pagesACT202 - Chapter 6arafkhan1623No ratings yet

- Absorption & Variable CostingDocument40 pagesAbsorption & Variable CostingKaren Villafuerte100% (1)

- IWB Chapter 5 - Marginal and Absorption CostingDocument28 pagesIWB Chapter 5 - Marginal and Absorption Costingjulioruiz891No ratings yet

- Variable Costing: A Tool For ManagementDocument9 pagesVariable Costing: A Tool For ManagementNica JeonNo ratings yet

- Module 3 Variable Costing As Management Tool-1Document4 pagesModule 3 Variable Costing As Management Tool-1Haika ContiNo ratings yet

- 19 Blue Print - 1Document5 pages19 Blue Print - 1ShaoPuYuNo ratings yet

- Chapter 8 Absorption and Variable Costing and Inventory ManagementDocument49 pagesChapter 8 Absorption and Variable Costing and Inventory ManagementNatanael PakpahanNo ratings yet

- lec06-ch07Document71 pageslec06-ch07matsunhimNo ratings yet

- Cost Profit Analysis: Romnick E. Bontigao, Cpa, CTT, Mritax, Mba (O.G.)Document46 pagesCost Profit Analysis: Romnick E. Bontigao, Cpa, CTT, Mritax, Mba (O.G.)KemerutNo ratings yet

- Absorption and Variable CostingDocument13 pagesAbsorption and Variable CostingalliahnahNo ratings yet

- Variable Costing: A Decision-Making Process: Weygandt - Kieso - KimmelDocument27 pagesVariable Costing: A Decision-Making Process: Weygandt - Kieso - KimmeleeNo ratings yet

- Ch. 4 Cost of ProductionDocument26 pagesCh. 4 Cost of Productionlauravertelcanada2023No ratings yet

- Case Study On Absorption CostingDocument12 pagesCase Study On Absorption CostingTushar BallabhNo ratings yet

- Manecon Chapter 6Document52 pagesManecon Chapter 6Allyssa GabrizaNo ratings yet

- Variable and Absorption CostingDocument5 pagesVariable and Absorption CostingAllan Jay CabreraNo ratings yet

- Mas - Absorption and Variable Costing PDFDocument11 pagesMas - Absorption and Variable Costing PDFNicole Anne M. ManansalaNo ratings yet

- Abc CostingDocument82 pagesAbc Costingradha gregorioNo ratings yet

- Topic 2 Part B Lecture SlidesDocument11 pagesTopic 2 Part B Lecture SlidesLinh Le Thi ThuyNo ratings yet

- Unit 7 Cost Volume Profit AnalysisDocument22 pagesUnit 7 Cost Volume Profit AnalysisajithsubramanianNo ratings yet

- Karlan Microeconomics 2ce - Ch. 12Document28 pagesKarlan Microeconomics 2ce - Ch. 12Gurnoor KaurNo ratings yet

- 107-W7-8-Variable cost-chp05-STDocument48 pages107-W7-8-Variable cost-chp05-STmargaret mariaNo ratings yet

- Marginal and Absorption CostingDocument20 pagesMarginal and Absorption CostingSachin KumarNo ratings yet

- Variable Costing: A Tool For ManagementDocument25 pagesVariable Costing: A Tool For ManagementDHz Pangeran BringazNo ratings yet

- Wey - AP - 14e - PPT - Ch23 - Incremental-Analysis 2Document41 pagesWey - AP - 14e - PPT - Ch23 - Incremental-Analysis 2ffalghamdiNo ratings yet

- Break Even AnalysisDocument19 pagesBreak Even AnalysisananditaNo ratings yet

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- USIM Degree of AccountingDocument4 pagesUSIM Degree of AccountingNurul Ain'No ratings yet

- 2014 - Facility Management Trend Report - Emerging Opportunities For Industry Leaders - ResearchDocument26 pages2014 - Facility Management Trend Report - Emerging Opportunities For Industry Leaders - ResearchimmortalskyNo ratings yet

- Inflation Rises To 3-Month High of 4.9% in November in Festive Season, Fraud App Installations Half of TotalDocument24 pagesInflation Rises To 3-Month High of 4.9% in November in Festive Season, Fraud App Installations Half of TotalpriyanshuNo ratings yet

- Job Description - Head ChefDocument3 pagesJob Description - Head ChefberdaespassiaNo ratings yet

- Accounting & Excel Assignment - ExperiencedDocument21 pagesAccounting & Excel Assignment - Experienceddivyaparashar10No ratings yet

- Chapter 8 ProductDocument48 pagesChapter 8 Productqdrsnbk85mNo ratings yet

- 5 Times Higher Than That For Special Exhibition Visitors, Which Account For The Lowest Figure, WithDocument5 pages5 Times Higher Than That For Special Exhibition Visitors, Which Account For The Lowest Figure, WithNhi HànNo ratings yet

- Chapter 1 ThesisDocument6 pagesChapter 1 ThesisMaricel MancioNo ratings yet

- NeoClassical Growth Theory PPTs 4th ChapterDocument18 pagesNeoClassical Growth Theory PPTs 4th ChapterJayesh Mahajan100% (1)

- Indian Cement Industry: Holtec Consulting, IndiaDocument14 pagesIndian Cement Industry: Holtec Consulting, IndiaDeepakNo ratings yet

- Growing Pains at GrouponDocument18 pagesGrowing Pains at GrouponEddie Maddalena100% (3)

- Allama Iqbal Open University, Islamabad (Department of Business Administration)Document8 pagesAllama Iqbal Open University, Islamabad (Department of Business Administration)haroonsaeed12No ratings yet

- Porter's Generic StrategiesDocument2 pagesPorter's Generic StrategiesSubhan Uddin KhattakNo ratings yet

- What Are The Best Kpis For Purchasing DepartmentsDocument6 pagesWhat Are The Best Kpis For Purchasing DepartmentsAKHILESH BirlaNo ratings yet

- FAC1601 Partnership SummaryDocument7 pagesFAC1601 Partnership SummaryMary-Lou Anne MohrNo ratings yet

- ExampleDocument91 pagesExampleally gelNo ratings yet

- Impact of Liquidity On Profitability of Commercial Banks in Nepal Bijaya Prakash Shrestha Page27-38Document12 pagesImpact of Liquidity On Profitability of Commercial Banks in Nepal Bijaya Prakash Shrestha Page27-38Rajesh ShresthaNo ratings yet

- SWOT Titan FinalDocument29 pagesSWOT Titan FinalMukesh Manwani100% (1)

- Methods of Contractor Selection: Engineering and Construction Contract Specifications (CVE449)Document16 pagesMethods of Contractor Selection: Engineering and Construction Contract Specifications (CVE449)David WebNo ratings yet

- Aue2602 SummaryDocument73 pagesAue2602 SummaryDenver Cordon100% (1)

- Answer Any Four Questions. (4X6 24) : Time: 3 Hours Max. Marks:120Document5 pagesAnswer Any Four Questions. (4X6 24) : Time: 3 Hours Max. Marks:120hanumanthaiahgowdaNo ratings yet

- Friedlan4e SM Ch04 Solutions PDFDocument71 pagesFriedlan4e SM Ch04 Solutions PDFwaysNo ratings yet

- Securities Regulation Code (SRC) - ReportDocument23 pagesSecurities Regulation Code (SRC) - ReportDianne MendozaNo ratings yet

- 1.4 StakeholdersDocument12 pages1.4 StakeholdersThanh TranNo ratings yet

- Job Description Managed Services Project Support RepresentativeDocument2 pagesJob Description Managed Services Project Support RepresentativeAnil Bhard WajNo ratings yet

- Retail Banking at City BankDocument69 pagesRetail Banking at City BankSabiha Farzana Moonmoon100% (1)

- Proposed IFRS® Taxonomy Update PTU/2021/1Document25 pagesProposed IFRS® Taxonomy Update PTU/2021/1Issa BoyNo ratings yet

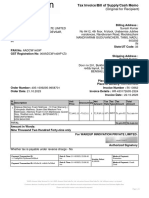

- InvoiceDocument1 pageInvoiceSuresh STNo ratings yet

- CHAPTER 6 - Managing in Competitive, Monopolistic, and Monopolistically Competitive Markets Learning ObjectivesDocument13 pagesCHAPTER 6 - Managing in Competitive, Monopolistic, and Monopolistically Competitive Markets Learning ObjectivesJericho James Madrigal CorpuzNo ratings yet