Professional Documents

Culture Documents

Dokumen - Tips r12 Overview of Oracle Asset Management

Dokumen - Tips r12 Overview of Oracle Asset Management

Uploaded by

Cuong Thai HuyCopyright:

Available Formats

You might also like

- McKinsey Academy4 PDFDocument1 pageMcKinsey Academy4 PDFAhad IlyasNo ratings yet

- CIO Leads - DelDocument41 pagesCIO Leads - DelNithin N Nayak38% (8)

- EBS ECC 12.2 V2 L2 Use Enterprise Command CenterDocument42 pagesEBS ECC 12.2 V2 L2 Use Enterprise Command Centerray685100% (1)

- Overview of Oracle Application Integration Cloud ServicesDocument18 pagesOverview of Oracle Application Integration Cloud ServicessusomNo ratings yet

- Columbia Knowledge Management APQC BookDocument77 pagesColumbia Knowledge Management APQC BookRun Ryan Mao100% (2)

- Excel Formulas & FunctionsDocument74 pagesExcel Formulas & FunctionsStefos Pepes100% (1)

- Oracle Assets OverviewDocument14 pagesOracle Assets OverviewappsloaderNo ratings yet

- Overview of Oracle Project CostingDocument16 pagesOverview of Oracle Project CostingbassembwaNo ratings yet

- Fusion OverviewDocument48 pagesFusion OverviewlistoNo ratings yet

- Les04 Procurement Common Applications Configuration - FinalDocument57 pagesLes04 Procurement Common Applications Configuration - FinalmittalanubhavNo ratings yet

- Managed Service Providers: Oracle Cloud PlatformDocument17 pagesManaged Service Providers: Oracle Cloud Platformta cloudNo ratings yet

- A Glimpse of The Topics Around Oracle's Business IntelligenceDocument22 pagesA Glimpse of The Topics Around Oracle's Business IntelligencepratapsettyNo ratings yet

- BPEL Lessons 1 - 9Document80 pagesBPEL Lessons 1 - 9Abraham Rougerio UnzuetaNo ratings yet

- SSI OAF TrainingDocument28 pagesSSI OAF TrainingMagedNo ratings yet

- OBA Brochure Package by ICE ConsultingDocument1 pageOBA Brochure Package by ICE ConsultingWijana NugrahaNo ratings yet

- Accounting Hub PDFDocument54 pagesAccounting Hub PDFVinita BhatiaNo ratings yet

- © 2008 Oracle Corporation - Proprietary and ConfidentialDocument66 pages© 2008 Oracle Corporation - Proprietary and ConfidentialrpillzNo ratings yet

- Overview of Order Management Suite-1Document94 pagesOverview of Order Management Suite-1bommakanti.shivaNo ratings yet

- BIApps ArchitectureDocument31 pagesBIApps ArchitectureVăn Tiến HồNo ratings yet

- Prerequisite E-Business Setups and IntegrationsDocument27 pagesPrerequisite E-Business Setups and Integrationsmohammed achatNo ratings yet

- ObieeDocument3 pagesObieenelson eliNo ratings yet

- Eoug 99Document29 pagesEoug 99midhungbabu88No ratings yet

- Asset Control Groups.Document64 pagesAsset Control Groups.MUHAMMAD ALI AHMEDNo ratings yet

- ApplicationManagementPackforOracleE BusinessSuiteDocument70 pagesApplicationManagementPackforOracleE BusinessSuiteLeonardoNo ratings yet

- PPTDocument55 pagesPPTMag MarinaNo ratings yet

- Accounting Hub Cloud PDFDocument58 pagesAccounting Hub Cloud PDFVinita BhatiaNo ratings yet

- CJVERP Cloud IntegrationsDocument8 pagesCJVERP Cloud IntegrationsjrparidaNo ratings yet

- Basic Journal Entries: 11i General Ledger Management FundamentalsDocument85 pagesBasic Journal Entries: 11i General Ledger Management FundamentalsVenkat100% (1)

- Getting Started With Smart ViewDocument27 pagesGetting Started With Smart ViewMahesh PrasadNo ratings yet

- 1a TOGAF ArchiMate Cats Mats and DgrmsDocument117 pages1a TOGAF ArchiMate Cats Mats and DgrmsIvan Rosenvinge FrederiksenNo ratings yet

- FA Student GuideDocument107 pagesFA Student GuideASHUTOSH UPADHYAYNo ratings yet

- Oracle Inventory: Manufacturing Functional FoundationDocument59 pagesOracle Inventory: Manufacturing Functional Foundationmohammed achatNo ratings yet

- Projects in Oracle ApplicationsDocument251 pagesProjects in Oracle Applicationssiva_lordNo ratings yet

- E-Business Suite Applications - WebCast Part3Document109 pagesE-Business Suite Applications - WebCast Part3mouse.lenova mouseNo ratings yet

- Hyperion Planning Budgeting For FusionDocument25 pagesHyperion Planning Budgeting For Fusionلويس روسيندوNo ratings yet

- Oracle Asset DepreciationDocument43 pagesOracle Asset DepreciationAli x100% (1)

- Fusion Introduction Training v1Document24 pagesFusion Introduction Training v1saikumar padakanti100% (1)

- R12 Oracle Assets 1 (1) .0Document43 pagesR12 Oracle Assets 1 (1) .0iymanbNo ratings yet

- Project Billing OverviewDocument29 pagesProject Billing OverviewVIJAYNo ratings yet

- Deep Drive - Customer Interface in AR - Oracle Apps EpicenterDocument38 pagesDeep Drive - Customer Interface in AR - Oracle Apps Epicenterjeetu_87No ratings yet

- Oracle Assets Concepts & SetupDocument142 pagesOracle Assets Concepts & SetupappsloaderNo ratings yet

- Oracle ERP CloudDocument57 pagesOracle ERP CloudЭльнур ТагиевNo ratings yet

- 01.3 CJVDay1Document44 pages01.3 CJVDay1JAN2909No ratings yet

- 5 Steps Oracle EBS 2017 NB 01Document10 pages5 Steps Oracle EBS 2017 NB 01AmreeshNo ratings yet

- Oracle Fusion Applications Best Practices in IntegrationDocument43 pagesOracle Fusion Applications Best Practices in Integrationrichiet2009No ratings yet

- Introduction To Flexnet Manager Suite: © Flexera / Company ConfidentialDocument42 pagesIntroduction To Flexnet Manager Suite: © Flexera / Company ConfidentialKadirNo ratings yet

- Oracle Database 11g New Features For Administrators Vol1Document388 pagesOracle Database 11g New Features For Administrators Vol1MarkNo ratings yet

- Oracle Hyperion Smart View For Planning 11.1.1Document14 pagesOracle Hyperion Smart View For Planning 11.1.1Ivan Gutierrez AngelesNo ratings yet

- Noetix PresDocument40 pagesNoetix PressanmoreNo ratings yet

- Oracle Fusion Middle Ware BasicsDocument35 pagesOracle Fusion Middle Ware BasicsDeepak MuraliNo ratings yet

- ELM and HCM IntegrationDocument41 pagesELM and HCM IntegrationPrakashNo ratings yet

- Inventory Tech DetailsDocument86 pagesInventory Tech DetailsMahantesh SalunkheNo ratings yet

- EBS HighlightsDocument60 pagesEBS HighlightsCA Vara ReddyNo ratings yet

- IntroDocument19 pagesIntroAbdul BstNo ratings yet

- Regio STG Scherbach IamDocument38 pagesRegio STG Scherbach IamDang Huu AnhNo ratings yet

- Oracle Database 19c OverviewDocument40 pagesOracle Database 19c OverviewGiovedy MarmolejoNo ratings yet

- EAM PresentationDocument27 pagesEAM PresentationasadnawazNo ratings yet

- 02 - Designing Applications and DatabasesDocument30 pages02 - Designing Applications and DatabasesMahesh PrasadNo ratings yet

- EDU4072YDSDocument30 pagesEDU4072YDStariqbashirNo ratings yet

- Docs OracleDocument22 pagesDocs OracleOdndksmjddnd333No ratings yet

- Oracle Exalogic: A Brief IntroductionDocument35 pagesOracle Exalogic: A Brief Introductionngole ngoleNo ratings yet

- Lesson 02 - Introduction To Oracle Supply Chain ManagementDocument18 pagesLesson 02 - Introduction To Oracle Supply Chain ManagementRafay HaqqaniNo ratings yet

- Oracle Information Integration, Migration, and ConsolidationFrom EverandOracle Information Integration, Migration, and ConsolidationNo ratings yet

- EDU3FCAYDocument29 pagesEDU3FCAYCuong Thai HuyNo ratings yet

- EDU3FC7YDocument70 pagesEDU3FC7YCuong Thai HuyNo ratings yet

- EDU3FC9YDocument131 pagesEDU3FC9YCuong Thai HuyNo ratings yet

- EDU3FC6YDocument57 pagesEDU3FC6YCuong Thai HuyNo ratings yet

- EDU3FCBYDocument121 pagesEDU3FCBYCuong Thai HuyNo ratings yet

- Research and Innovation in Higher Education-EPP-1-2018-1-AT-EPPKA1-JMD-MOBDocument2 pagesResearch and Innovation in Higher Education-EPP-1-2018-1-AT-EPPKA1-JMD-MOBTabah Ghifary Diniya (Ghif)No ratings yet

- Abnormal Psychology: Shiba Saeed Assistant Professor Govt. College, Township, LahoreDocument36 pagesAbnormal Psychology: Shiba Saeed Assistant Professor Govt. College, Township, LahoreM.Fizan JavedNo ratings yet

- Parreño, 2023Document22 pagesParreño, 2023Angela Mae SuyomNo ratings yet

- Windows Server ChecklistDocument116 pagesWindows Server Checklistravichandran_mcpNo ratings yet

- HR Score CardDocument16 pagesHR Score Cardvijay77777No ratings yet

- L&T Aquaseal Butterfly Check Valves PDFDocument24 pagesL&T Aquaseal Butterfly Check Valves PDFnagtummalaNo ratings yet

- (English (Auto-Generated) ) My Life As A Traditional Healer in The 21st Century - Amanda Gcabashe - TEDxJohannesburg (DownSub - Com)Document9 pages(English (Auto-Generated) ) My Life As A Traditional Healer in The 21st Century - Amanda Gcabashe - TEDxJohannesburg (DownSub - Com)Pool TorresNo ratings yet

- Gmail - Request For Candidates Recruitment To The Structural Engg Dept - Kindly Consider This As Most Urgent - 05-02-2022Document2 pagesGmail - Request For Candidates Recruitment To The Structural Engg Dept - Kindly Consider This As Most Urgent - 05-02-2022Sreeelakshmi P NNo ratings yet

- Oms SrsDocument16 pagesOms SrsVivek278No ratings yet

- 360rsw05 WKB Ca09 Ak PDFDocument50 pages360rsw05 WKB Ca09 Ak PDFErnesto Rodriguez67% (3)

- Merton On Structural FunctionalismDocument6 pagesMerton On Structural FunctionalismJahnaviSinghNo ratings yet

- Chapter 20: Electrochemistry: Homework QuestionsDocument2 pagesChapter 20: Electrochemistry: Homework Questionservaldi0% (1)

- 6CH04 01 Que 20130612Document24 pages6CH04 01 Que 20130612nathaaaaNo ratings yet

- DLL - Science 6 - Q4 - W7Document10 pagesDLL - Science 6 - Q4 - W7Jefferson Beralde50% (2)

- MNS University of Agriculture Multan: Project Assigned ToDocument13 pagesMNS University of Agriculture Multan: Project Assigned ToRana DilawarNo ratings yet

- List of SOC Related DocumentsDocument1 pageList of SOC Related DocumentsRavi Yadav0% (1)

- A REVIEW OF SOIL ERODIBILITY Case Study of UGBOJU Settlement of OTURKPO Local Government Area of Benue State NigeriaDocument9 pagesA REVIEW OF SOIL ERODIBILITY Case Study of UGBOJU Settlement of OTURKPO Local Government Area of Benue State NigeriaTIZA MICHAEL B.Engr., BBS, MBA, Aff. M. ASCE, ASS.M. UACSE, M. IAENG. M.ITE.No ratings yet

- XII - Bus - St. Chapter 3 BSENVDocument28 pagesXII - Bus - St. Chapter 3 BSENVVaishnavi SajidhasNo ratings yet

- LocationDocument12 pagesLocationPavithra GowthamNo ratings yet

- Pensamento Do Design Urbano Contemporâneo - Roggema RobDocument340 pagesPensamento Do Design Urbano Contemporâneo - Roggema RobLuana LuNo ratings yet

- Anterior Chamber Angle Assessment Technique - CH 17Document20 pagesAnterior Chamber Angle Assessment Technique - CH 17riveliNo ratings yet

- BEGS 185 AssignmentDocument4 pagesBEGS 185 AssignmentPrachi BadhwarNo ratings yet

- Lesson 1 Measurement in PhysicsDocument11 pagesLesson 1 Measurement in PhysicsVea AnadonNo ratings yet

- Jesus Orozco ResumeDocument2 pagesJesus Orozco Resumeapi-397705879No ratings yet

- Decribing Connections Between Historical EventsDocument4 pagesDecribing Connections Between Historical Eventsapi-334916201No ratings yet

- Level 6 Advanced - A Room With A ViewDocument117 pagesLevel 6 Advanced - A Room With A View01.wawiwawi100% (1)

Dokumen - Tips r12 Overview of Oracle Asset Management

Dokumen - Tips r12 Overview of Oracle Asset Management

Uploaded by

Cuong Thai HuyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dokumen - Tips r12 Overview of Oracle Asset Management

Dokumen - Tips r12 Overview of Oracle Asset Management

Uploaded by

Cuong Thai HuyCopyright:

Available Formats

Overview of Oracle Asset Management

Release 12 Oracle Asset Management Fundamentals

Copyright © 2007, Oracle. All rights reserved.

Objectives

After completing this module, you should be able to do

the following:

• Describe the overall Oracle Asset Management

process from Setup through asset data flow to the

General Ledger

• Identify the key functional areas that are part of

Oracle Asset Management

Copyright © 2007, Oracle. All rights reserved.

Agenda

• Asset Management Process Overview

• Key Areas within Asset Management

Copyright © 2007, Oracle. All rights reserved.

Overview of Oracle Assets

Adjustments Asset Additions Transfers

Manual External CIP

Retirements

Online inquiry

Depreciation

Reports Taxes

Journal Entries

Copyright © 2007, Oracle. All rights reserved.

E-Business Suite Integration

Oracle

Projects

Invoice Lines

Suppliers

CIP assets

Oracle Payables Oracle Purchasing

Physical Inventory

Budget Information Web

Asset Additions

ADI

Oracle

Spreadsheet Assets/iAssets

Journal Entries

Units of Measure

Employees Item Information

Oracle

Oracle Human Inventory

Resources Oracle General Ledger

Copyright © 2007, Oracle. All rights reserved.

Implementation Considerations

for Oracle Financials

Oracle Applications Future Oracle

without customization upgrades

Costly future

upgrades

Copyright © 2007, Oracle. All rights reserved.

The Best Project Team for the Job

Client experts

Implementation End users

consultants

Implementation team

Copyright © 2007, Oracle. All rights reserved.

Critical Implementation Issues

Identify critical implementation issues that affect

multiple business areas:

• Shared information

• Information flows

• Open interfaces

• Non-Oracle systems

Copyright © 2007, Oracle. All rights reserved.

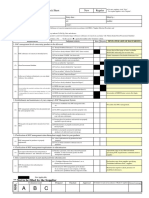

Oracle Assets Setup Steps

Optional

Unit of Measure

Classes

Required Units of Measure

Required w/Defaults Employees

Ledger Account Generator Descriptive FF

Numbering

Asset Key Flexfield QuickCodes

Suppliers

Asset Category Depreciation

Locations

Flexfield Methods Combinations

Location Flexfield Asset Keys

Combinations

System Controls

Security

Fiscal Years Investment Tax

Credits

Calendars

Price Indexes

Book Controls

Distribution Sets

Prorate/Retirement Leases

Conventions

Warranties

Asset Categories Profile Options

Insurance

Copyright © 2007, Oracle. All rights reserved.

Oracle Assets Key Flexfields

To run the application, three key flexfields must be set up.

Asset Category Asset Location Asset Key

Key Flexfield Key Flexfield Key Flexfield

Copyright © 2007, Oracle. All rights reserved.

Implementing Oracle Assets

1 2

Plan Implementation Setup Asset Mgmt

including iAssets

3 4

Convert Existing Reconcile With

Asset Information Previous System

Copyright © 2007, Oracle. All rights reserved.

Asset Books Positioning

New assets are assigned

to a Category then to a

Book Corporate

Tax

Budget

Asset Books

Assets

Assigned

to

Asset Asset Calendars

Categories

Assigned

to Depreciation Methods

Copyright © 2007, Oracle. All rights reserved.

Asset Categories Positioning

Assign Added to

to

Assets

Corporate Book

Copied to

Attached to Tax Book A

Asset

Tax Book B

Categories

Copyright © 2007, Oracle. All rights reserved.

Asset Life Cycle

Oracle Oracle Other/ WebADI

Manual Additions Payables Projects Legacy

Quick Additions Systems

Detail Additions

Birth of an

Asset

FA_MASS_ADDITIONS

Asset

Books

Asset Retired

Asset

Depreciates

Copyright © 2007, Oracle. All rights reserved.

Adding Assets Manually

Quick Additions Detail Additions

Assets added Assets that

applying default require more

rules information

Oracle Assets

Copyright © 2007, Oracle. All rights reserved.

Mass Asset Additions Process

Oracle

Projects

Oracle Other

Payables Systems

FA_MASS_ADDITIONS

Legacy Web

System ADI

Asset Books

Copyright © 2007, Oracle. All rights reserved.

Adding and Capitalizing

a CIP Asset

Add a CIP asset Build a CIP asset

Depreciate the asset Capitalize a CIP asset

Copyright © 2007, Oracle. All rights reserved.

Acquire and Build CIP Assets

Asset

Lines

Oracle

Projects

FA_MASS_ADDITIONS Manual

Additions

Mass

Additions

Oracle

CIP

Payables

ASSET

Copyright © 2007, Oracle. All rights reserved.

Asset Adjustments

Unit

Change Change

Reclass Financial

Info

Oracle Changes

Transfer

Assets/iAssets via APIs

Copyright © 2007, Oracle. All rights reserved.

Asset Adjustment Overview

Mass

Adjustment Action Performed Transaction

Available

Reclassification Change Asset Category Yes

Unit Change Change Number of Asset No

Units

Financial Change Asset Cost and/or Yes (Prorate

Information Depreciation Information Convention,

Method, Life

only)

Transfer Change Asset Assignment Yes

Information

Copyright © 2007, Oracle. All rights reserved.

Performing Physical Inventory

Enter physical Run inventory View

inventory comparison comparison

Reconcile

differences

Update assets

manually

Copyright © 2007, Oracle. All rights reserved.

Elements of Depreciation

Prorate

Convention

Prorate

Asset Books

Calendar

Depreciation Depreciation

Method Calendar

Depreciation Depreciation Units of

Ceilings Measure

Investment Price

Optional

Tax Credits Indexes Elements

Copyright © 2007, Oracle. All rights reserved.

Basic Depreciation Calculation

Prorate Prorate

Convention Calendar

Prorate

FOL Month Period

May

Apr 1

15

Prorate Date

Date Placed in Get

Service Rate

Journal

Entry R = 20%

Depreciation

Expense per

period

Rate Table

Depreciation Calendar,

Divide Depreciation Annual

flag, and Depreciate Depreciation Multiply by Cost

When Placed in Service or Net Book Value

flag

Copyright © 2007, Oracle. All rights reserved.

Tracking Asset Retirements

Asset Life

Automated Manual

addition addition

Invoice

Adjustment Transfer

Depreciation

Create

journal entries

Copyright © 2007, Oracle. All rights reserved.

Assets Journal Entries Flow

Run Create

Accounting

Run Depreciation to

Set up SLA Generate Accounts

Send entries

to General

In Asset Books: No Ledger

-Allow GL Posting

Yes

-GL Ledger Name

Post entries

Run Transfer Journal

Entries to GL

Copyright © 2007, Oracle. All rights reserved.

Default Account Generator Process for Oracle

Assets

For example, the Operations Accounting flexfield structure

from the Vision demo database is used.

Company-Cost Center-Account-Product-SubAccount

Segment Name Default Segment Sources

Company (Balancing Distribution CCID

Segment) (Assignments screen)

Cost Center (Cost Center Default CCID (Book

Segment) Controls screen)

Account (Natural Account Account Segment Value

Segment)

Product Default CCID (Book

Controls screen)

Sub-Account Default CCID (Book

Controls screen)

CCID = Code Combination ID

Copyright © 2007, Oracle. All rights reserved.

Reconciling Data in Oracle Assets

Oracle General Ledger

Oracle Assets

Oracle Payables

Oracle Projects

Copyright © 2007, Oracle. All rights reserved.

Viewing Asset Information Online

Inquiry

Financial Depreciation

Information Book

Employee Purchasing Location

Information

Invoice Supplier

Copyright © 2007, Oracle. All rights reserved.

Oracle Assets Reporting

Oracle Assets Reports

Standard Variable Format Report Manager

Reports Reports (RXi)

Copyright © 2007, Oracle. All rights reserved.

Assets Reports Groupings

Budget CIP Asset Maintenance

Reports Reports Listings Reports

Setup Data Depreciation Accounting Responsibility

Listings Reports Reports Reports

Tax Transaction Additions Mass Addition

Reports History Reports Reports

Adjustment Transfers Retirement

Reports Reports Reports

Mass Transaction Reclassification

Reports Reports

Copyright © 2007, Oracle. All rights reserved.

Creating a Tax Book

Assets in Independent Asset Books

FURNITURE.DESKS

Corporate

Straight-line 5 years

book

MID- Asset 325

MONTH

VEHICLE.OWNLUXURY

Monthly

Straight-line 4 years

calendar

MID-MONTH Asset 843

FURNITURE.DESKS

Tax MACRS 5 years

book HALF-YEAR

Asset 325

VEHICLE.OWNLUXURY

Quarterly MACRS 4 years

calendar HALF-YEAR

Asset 843

Copyright © 2007, Oracle. All rights reserved.

Entering Information in Tax Books

Corporate Book

Initial Mass Copy Periodic Mass Copy Manual Entry

Tax Book Tax Book Tax Book

Copyright © 2007, Oracle. All rights reserved.

Transaction APIs

Submit transactions directly thru PL/SQL using APIs.

• Additions

• Adjustments

• Retirements and Reinstatements

• Transfer and Unit Adjustments

• Reclassifications

• Capitalizations

• Unplanned Depreciation

• Asset Description

Copyright © 2007, Oracle. All rights reserved.

Business Events

Business Events were first introduced in Oracle

Workflow to:

• Provide subscription-based & cross-system

processing for streamlined cross-product

integration

• Eliminate trigger-based solutions or modification of

standard code

• Simplifies implementation of custom programs

Define post-event actions in the Event Subscription to:

• Pass information back to the system that originates

the transaction

• Generate exception reports for trouble-shooting

• Send notifications to users

Copyright © 2007, Oracle. All rights reserved.

Asset Business Event Triggers

Asset Addition

Asset Transfer

Asset Retirement

Copyright © 2007, Oracle. All rights reserved.

Summary

After completing this module, you should now be able

to:

• Describe the overall Oracle Asset Management

process from Setup through asset data flow to the

General Ledger

• Identify the key functional areas that are part of

Oracle Asset Management

Copyright © 2007, Oracle. All rights reserved.

You might also like

- McKinsey Academy4 PDFDocument1 pageMcKinsey Academy4 PDFAhad IlyasNo ratings yet

- CIO Leads - DelDocument41 pagesCIO Leads - DelNithin N Nayak38% (8)

- EBS ECC 12.2 V2 L2 Use Enterprise Command CenterDocument42 pagesEBS ECC 12.2 V2 L2 Use Enterprise Command Centerray685100% (1)

- Overview of Oracle Application Integration Cloud ServicesDocument18 pagesOverview of Oracle Application Integration Cloud ServicessusomNo ratings yet

- Columbia Knowledge Management APQC BookDocument77 pagesColumbia Knowledge Management APQC BookRun Ryan Mao100% (2)

- Excel Formulas & FunctionsDocument74 pagesExcel Formulas & FunctionsStefos Pepes100% (1)

- Oracle Assets OverviewDocument14 pagesOracle Assets OverviewappsloaderNo ratings yet

- Overview of Oracle Project CostingDocument16 pagesOverview of Oracle Project CostingbassembwaNo ratings yet

- Fusion OverviewDocument48 pagesFusion OverviewlistoNo ratings yet

- Les04 Procurement Common Applications Configuration - FinalDocument57 pagesLes04 Procurement Common Applications Configuration - FinalmittalanubhavNo ratings yet

- Managed Service Providers: Oracle Cloud PlatformDocument17 pagesManaged Service Providers: Oracle Cloud Platformta cloudNo ratings yet

- A Glimpse of The Topics Around Oracle's Business IntelligenceDocument22 pagesA Glimpse of The Topics Around Oracle's Business IntelligencepratapsettyNo ratings yet

- BPEL Lessons 1 - 9Document80 pagesBPEL Lessons 1 - 9Abraham Rougerio UnzuetaNo ratings yet

- SSI OAF TrainingDocument28 pagesSSI OAF TrainingMagedNo ratings yet

- OBA Brochure Package by ICE ConsultingDocument1 pageOBA Brochure Package by ICE ConsultingWijana NugrahaNo ratings yet

- Accounting Hub PDFDocument54 pagesAccounting Hub PDFVinita BhatiaNo ratings yet

- © 2008 Oracle Corporation - Proprietary and ConfidentialDocument66 pages© 2008 Oracle Corporation - Proprietary and ConfidentialrpillzNo ratings yet

- Overview of Order Management Suite-1Document94 pagesOverview of Order Management Suite-1bommakanti.shivaNo ratings yet

- BIApps ArchitectureDocument31 pagesBIApps ArchitectureVăn Tiến HồNo ratings yet

- Prerequisite E-Business Setups and IntegrationsDocument27 pagesPrerequisite E-Business Setups and Integrationsmohammed achatNo ratings yet

- ObieeDocument3 pagesObieenelson eliNo ratings yet

- Eoug 99Document29 pagesEoug 99midhungbabu88No ratings yet

- Asset Control Groups.Document64 pagesAsset Control Groups.MUHAMMAD ALI AHMEDNo ratings yet

- ApplicationManagementPackforOracleE BusinessSuiteDocument70 pagesApplicationManagementPackforOracleE BusinessSuiteLeonardoNo ratings yet

- PPTDocument55 pagesPPTMag MarinaNo ratings yet

- Accounting Hub Cloud PDFDocument58 pagesAccounting Hub Cloud PDFVinita BhatiaNo ratings yet

- CJVERP Cloud IntegrationsDocument8 pagesCJVERP Cloud IntegrationsjrparidaNo ratings yet

- Basic Journal Entries: 11i General Ledger Management FundamentalsDocument85 pagesBasic Journal Entries: 11i General Ledger Management FundamentalsVenkat100% (1)

- Getting Started With Smart ViewDocument27 pagesGetting Started With Smart ViewMahesh PrasadNo ratings yet

- 1a TOGAF ArchiMate Cats Mats and DgrmsDocument117 pages1a TOGAF ArchiMate Cats Mats and DgrmsIvan Rosenvinge FrederiksenNo ratings yet

- FA Student GuideDocument107 pagesFA Student GuideASHUTOSH UPADHYAYNo ratings yet

- Oracle Inventory: Manufacturing Functional FoundationDocument59 pagesOracle Inventory: Manufacturing Functional Foundationmohammed achatNo ratings yet

- Projects in Oracle ApplicationsDocument251 pagesProjects in Oracle Applicationssiva_lordNo ratings yet

- E-Business Suite Applications - WebCast Part3Document109 pagesE-Business Suite Applications - WebCast Part3mouse.lenova mouseNo ratings yet

- Hyperion Planning Budgeting For FusionDocument25 pagesHyperion Planning Budgeting For Fusionلويس روسيندوNo ratings yet

- Oracle Asset DepreciationDocument43 pagesOracle Asset DepreciationAli x100% (1)

- Fusion Introduction Training v1Document24 pagesFusion Introduction Training v1saikumar padakanti100% (1)

- R12 Oracle Assets 1 (1) .0Document43 pagesR12 Oracle Assets 1 (1) .0iymanbNo ratings yet

- Project Billing OverviewDocument29 pagesProject Billing OverviewVIJAYNo ratings yet

- Deep Drive - Customer Interface in AR - Oracle Apps EpicenterDocument38 pagesDeep Drive - Customer Interface in AR - Oracle Apps Epicenterjeetu_87No ratings yet

- Oracle Assets Concepts & SetupDocument142 pagesOracle Assets Concepts & SetupappsloaderNo ratings yet

- Oracle ERP CloudDocument57 pagesOracle ERP CloudЭльнур ТагиевNo ratings yet

- 01.3 CJVDay1Document44 pages01.3 CJVDay1JAN2909No ratings yet

- 5 Steps Oracle EBS 2017 NB 01Document10 pages5 Steps Oracle EBS 2017 NB 01AmreeshNo ratings yet

- Oracle Fusion Applications Best Practices in IntegrationDocument43 pagesOracle Fusion Applications Best Practices in Integrationrichiet2009No ratings yet

- Introduction To Flexnet Manager Suite: © Flexera / Company ConfidentialDocument42 pagesIntroduction To Flexnet Manager Suite: © Flexera / Company ConfidentialKadirNo ratings yet

- Oracle Database 11g New Features For Administrators Vol1Document388 pagesOracle Database 11g New Features For Administrators Vol1MarkNo ratings yet

- Oracle Hyperion Smart View For Planning 11.1.1Document14 pagesOracle Hyperion Smart View For Planning 11.1.1Ivan Gutierrez AngelesNo ratings yet

- Noetix PresDocument40 pagesNoetix PressanmoreNo ratings yet

- Oracle Fusion Middle Ware BasicsDocument35 pagesOracle Fusion Middle Ware BasicsDeepak MuraliNo ratings yet

- ELM and HCM IntegrationDocument41 pagesELM and HCM IntegrationPrakashNo ratings yet

- Inventory Tech DetailsDocument86 pagesInventory Tech DetailsMahantesh SalunkheNo ratings yet

- EBS HighlightsDocument60 pagesEBS HighlightsCA Vara ReddyNo ratings yet

- IntroDocument19 pagesIntroAbdul BstNo ratings yet

- Regio STG Scherbach IamDocument38 pagesRegio STG Scherbach IamDang Huu AnhNo ratings yet

- Oracle Database 19c OverviewDocument40 pagesOracle Database 19c OverviewGiovedy MarmolejoNo ratings yet

- EAM PresentationDocument27 pagesEAM PresentationasadnawazNo ratings yet

- 02 - Designing Applications and DatabasesDocument30 pages02 - Designing Applications and DatabasesMahesh PrasadNo ratings yet

- EDU4072YDSDocument30 pagesEDU4072YDStariqbashirNo ratings yet

- Docs OracleDocument22 pagesDocs OracleOdndksmjddnd333No ratings yet

- Oracle Exalogic: A Brief IntroductionDocument35 pagesOracle Exalogic: A Brief Introductionngole ngoleNo ratings yet

- Lesson 02 - Introduction To Oracle Supply Chain ManagementDocument18 pagesLesson 02 - Introduction To Oracle Supply Chain ManagementRafay HaqqaniNo ratings yet

- Oracle Information Integration, Migration, and ConsolidationFrom EverandOracle Information Integration, Migration, and ConsolidationNo ratings yet

- EDU3FCAYDocument29 pagesEDU3FCAYCuong Thai HuyNo ratings yet

- EDU3FC7YDocument70 pagesEDU3FC7YCuong Thai HuyNo ratings yet

- EDU3FC9YDocument131 pagesEDU3FC9YCuong Thai HuyNo ratings yet

- EDU3FC6YDocument57 pagesEDU3FC6YCuong Thai HuyNo ratings yet

- EDU3FCBYDocument121 pagesEDU3FCBYCuong Thai HuyNo ratings yet

- Research and Innovation in Higher Education-EPP-1-2018-1-AT-EPPKA1-JMD-MOBDocument2 pagesResearch and Innovation in Higher Education-EPP-1-2018-1-AT-EPPKA1-JMD-MOBTabah Ghifary Diniya (Ghif)No ratings yet

- Abnormal Psychology: Shiba Saeed Assistant Professor Govt. College, Township, LahoreDocument36 pagesAbnormal Psychology: Shiba Saeed Assistant Professor Govt. College, Township, LahoreM.Fizan JavedNo ratings yet

- Parreño, 2023Document22 pagesParreño, 2023Angela Mae SuyomNo ratings yet

- Windows Server ChecklistDocument116 pagesWindows Server Checklistravichandran_mcpNo ratings yet

- HR Score CardDocument16 pagesHR Score Cardvijay77777No ratings yet

- L&T Aquaseal Butterfly Check Valves PDFDocument24 pagesL&T Aquaseal Butterfly Check Valves PDFnagtummalaNo ratings yet

- (English (Auto-Generated) ) My Life As A Traditional Healer in The 21st Century - Amanda Gcabashe - TEDxJohannesburg (DownSub - Com)Document9 pages(English (Auto-Generated) ) My Life As A Traditional Healer in The 21st Century - Amanda Gcabashe - TEDxJohannesburg (DownSub - Com)Pool TorresNo ratings yet

- Gmail - Request For Candidates Recruitment To The Structural Engg Dept - Kindly Consider This As Most Urgent - 05-02-2022Document2 pagesGmail - Request For Candidates Recruitment To The Structural Engg Dept - Kindly Consider This As Most Urgent - 05-02-2022Sreeelakshmi P NNo ratings yet

- Oms SrsDocument16 pagesOms SrsVivek278No ratings yet

- 360rsw05 WKB Ca09 Ak PDFDocument50 pages360rsw05 WKB Ca09 Ak PDFErnesto Rodriguez67% (3)

- Merton On Structural FunctionalismDocument6 pagesMerton On Structural FunctionalismJahnaviSinghNo ratings yet

- Chapter 20: Electrochemistry: Homework QuestionsDocument2 pagesChapter 20: Electrochemistry: Homework Questionservaldi0% (1)

- 6CH04 01 Que 20130612Document24 pages6CH04 01 Que 20130612nathaaaaNo ratings yet

- DLL - Science 6 - Q4 - W7Document10 pagesDLL - Science 6 - Q4 - W7Jefferson Beralde50% (2)

- MNS University of Agriculture Multan: Project Assigned ToDocument13 pagesMNS University of Agriculture Multan: Project Assigned ToRana DilawarNo ratings yet

- List of SOC Related DocumentsDocument1 pageList of SOC Related DocumentsRavi Yadav0% (1)

- A REVIEW OF SOIL ERODIBILITY Case Study of UGBOJU Settlement of OTURKPO Local Government Area of Benue State NigeriaDocument9 pagesA REVIEW OF SOIL ERODIBILITY Case Study of UGBOJU Settlement of OTURKPO Local Government Area of Benue State NigeriaTIZA MICHAEL B.Engr., BBS, MBA, Aff. M. ASCE, ASS.M. UACSE, M. IAENG. M.ITE.No ratings yet

- XII - Bus - St. Chapter 3 BSENVDocument28 pagesXII - Bus - St. Chapter 3 BSENVVaishnavi SajidhasNo ratings yet

- LocationDocument12 pagesLocationPavithra GowthamNo ratings yet

- Pensamento Do Design Urbano Contemporâneo - Roggema RobDocument340 pagesPensamento Do Design Urbano Contemporâneo - Roggema RobLuana LuNo ratings yet

- Anterior Chamber Angle Assessment Technique - CH 17Document20 pagesAnterior Chamber Angle Assessment Technique - CH 17riveliNo ratings yet

- BEGS 185 AssignmentDocument4 pagesBEGS 185 AssignmentPrachi BadhwarNo ratings yet

- Lesson 1 Measurement in PhysicsDocument11 pagesLesson 1 Measurement in PhysicsVea AnadonNo ratings yet

- Jesus Orozco ResumeDocument2 pagesJesus Orozco Resumeapi-397705879No ratings yet

- Decribing Connections Between Historical EventsDocument4 pagesDecribing Connections Between Historical Eventsapi-334916201No ratings yet

- Level 6 Advanced - A Room With A ViewDocument117 pagesLevel 6 Advanced - A Room With A View01.wawiwawi100% (1)