Professional Documents

Culture Documents

Ledger

Ledger

Uploaded by

clean make0 ratings0% found this document useful (0 votes)

18 views6 pagesThe document discusses ledger accounts. A ledger is a book or bundle of sheets used to record transactions from a journal. It organizes transactions under different accounts related to assets, liabilities, capital, and revenue. The ledger allows preparation of financial statements and is the main record of classified business transactions.

Original Description:

ledger ppt

Original Title

ledger

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses ledger accounts. A ledger is a book or bundle of sheets used to record transactions from a journal. It organizes transactions under different accounts related to assets, liabilities, capital, and revenue. The ledger allows preparation of financial statements and is the main record of classified business transactions.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

18 views6 pagesLedger

Ledger

Uploaded by

clean makeThe document discusses ledger accounts. A ledger is a book or bundle of sheets used to record transactions from a journal. It organizes transactions under different accounts related to assets, liabilities, capital, and revenue. The ledger allows preparation of financial statements and is the main record of classified business transactions.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 6

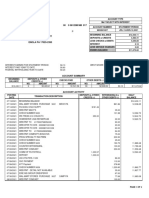

LEDGER ACCOUNTS

Ledger is in a book with pages

consecutively numbered. It can also be a

bundle of sheets.

All the items from the journal are recorded

in Ledger Accounts and this process is

known as posting entries from Journal to

Ledger Accounts.

1.ALedger book is FEATURES OF LEDGER

an Accounts bookACCOUNT

to which various transactions of an

enterprise are posted under different Accounts.

2.It follows the double-entry system.

3.Itis also known as the Principal book of Account as it is the book of final entry

of transactions after the journal or all-purpose books.

4.In

the Ledger, all the types of Accounts relating to assets, liabilities, capital and

revenue are maintained.

5.It is the only record of the business transaction classified into relevant

Accounts.

6.It facilitates the preparation of financial statements in future.

• The Different Types of Ledgers

• There are three different types of Ledgers:

• 1. Sales Ledger - A sales Ledger is a book in which a corporation records the sale

of products, services, or the cost of things to clients. The sales revenue and

income statement are depicted in this Ledger.

• 2. Purchase Ledger - A purchase Ledger is a Ledger in which a corporation

records the transactions of purchasing services, products, or goods from other

companies. It allows you to see how much money the company has paid out to

other companies.

• 3. General Ledger - There are two types of the general Ledger: nominal Ledger

and private Ledger. The nominal Ledger records spending, revenue,

depreciation, insurance, and other financial transactions. Private Ledgers contain

private information such as salary, wages, capital, and so on. A private Ledger is

not accessible to everyone.

How Do You Arrange a Trial Balance?

To develop a trial balance, you will require the closing balances of the general ledger accounts.

The trial balance is evolved after posting all financial happenings to the journals and

summarize them on the ledger affirmations. The trial balance is made to make sure that the

debits equal the credits in the scheme of accounts.

1.Ahead you drew off with the trial balance, you have to make sure that every ledger account

is properly balanced. The difference between the sum of all the debit entries and the total sum

of all the credit entries issues the balance.

2.Develop an eight-column worksheet column. The column headers must be for the account

number, account name, and correlating columns for debit and credit balance.

3.For each and every ledger account, transmit to the trial balance worksheet the account

number and account name along with the account balance in the suitable debit or credit

column

4.Stand up the amounts of the debit columns and the credit column. Preferably, the totality

should be the same in a without errors trial balance. When the totals are selfsame, you may

close the trial balance.

Importance of the Ledger Balance

Some banks display both the current and

available balances, so consumers can tell how

much they have to use at their disposal.

Similarly, don't rely on bank statements either. As

noted above, balances displayed on statements

are taken from a ledger balance on the statement

date.

You might also like

- Solution Manual For Accounting For Governmental Nonprofit Entities 19th Edition Jacqueline Reck Suzanne Lowensohn Daniel NeelyDocument30 pagesSolution Manual For Accounting For Governmental Nonprofit Entities 19th Edition Jacqueline Reck Suzanne Lowensohn Daniel NeelyPamelaSmithcxdoe100% (80)

- Extras de Cont / Account: 2. Valuta / Currency 3. Data Extras / Statement DateDocument2 pagesExtras de Cont / Account: 2. Valuta / Currency 3. Data Extras / Statement Dateesseesse76100% (3)

- Gov Acctg Solman MillanDocument69 pagesGov Acctg Solman MillanMichael Brian Torres100% (2)

- Principle of Accounting Notes PDFDocument22 pagesPrinciple of Accounting Notes PDFFahad Rizwan75% (4)

- CH-2 Financial Accounting ConceptsDocument40 pagesCH-2 Financial Accounting Conceptsnemik007No ratings yet

- Accountancy ProjectDocument14 pagesAccountancy ProjectKshitize NigamNo ratings yet

- FABM Q3 L5. SLEM 5 - W5 - 2S - Q3 - Books of AccountsDocument14 pagesFABM Q3 L5. SLEM 5 - W5 - 2S - Q3 - Books of AccountsSophia MagdaraogNo ratings yet

- Accounting ProcessDocument5 pagesAccounting Process23unnimolNo ratings yet

- Accounts (1) FinalDocument28 pagesAccounts (1) FinalManan MullickNo ratings yet

- 09 12 Fabm1 Content1Document23 pages09 12 Fabm1 Content1Vicky Ann SoriaNo ratings yet

- Unit - 1 (Hotel Accounts)Document19 pagesUnit - 1 (Hotel Accounts)Joseph Kiran ReddyNo ratings yet

- Accounting 复习提纲Document73 pagesAccounting 复习提纲Ming wangNo ratings yet

- 320 Accountancy Eng Lesson6Document17 pages320 Accountancy Eng Lesson6Hitesh MishraNo ratings yet

- Ledger: Title of An Account Dr. Cr. Dat e Particulars JF Amount Rs. Dat e Particular J F Amount RsDocument2 pagesLedger: Title of An Account Dr. Cr. Dat e Particulars JF Amount Rs. Dat e Particular J F Amount Rsazra khanNo ratings yet

- Entrepreneurship: Quarter 2: Module 7 & 8Document15 pagesEntrepreneurship: Quarter 2: Module 7 & 8Winston MurphyNo ratings yet

- The Accounting SystemDocument6 pagesThe Accounting SystemSebastian FeuersteinNo ratings yet

- Topic 1 Book of AccountsDocument5 pagesTopic 1 Book of AccountsRey ViloriaNo ratings yet

- Book of Accounts WD ActivityDocument3 pagesBook of Accounts WD ActivityChristopher SelebioNo ratings yet

- AccountingDocument13 pagesAccountingMae AroganteNo ratings yet

- CHAPTER 9-Books of AccountsDocument2 pagesCHAPTER 9-Books of AccountsRichael Ann Delubio ZapantaNo ratings yet

- 2.2 - LedgerDocument3 pages2.2 - LedgerABHAYNo ratings yet

- Ledger and Trial BalanceDocument28 pagesLedger and Trial BalanceJustine Maravilla100% (1)

- Accounts Journals TB P10Document22 pagesAccounts Journals TB P10varadu1963No ratings yet

- TLE10-books of AccountsDocument12 pagesTLE10-books of AccountsRoda ReyesNo ratings yet

- Accounting in BanksDocument27 pagesAccounting in BankssaktipadhiNo ratings yet

- CIE O Level Principals of Accounts (7110) - Theory Notes (Collected)Document22 pagesCIE O Level Principals of Accounts (7110) - Theory Notes (Collected)MyshaM09957% (7)

- Accou Levele III 4-8Document31 pagesAccou Levele III 4-8embaendo27uNo ratings yet

- QuesDocument4 pagesQuesSreejith NairNo ratings yet

- Source Document: The Accounting Process (The Accounting Cycle)Document4 pagesSource Document: The Accounting Process (The Accounting Cycle)rap_rrc75No ratings yet

- Accounting in BanksDocument27 pagesAccounting in BankssaktipadhiNo ratings yet

- Cfas 3Document10 pagesCfas 3Bea charmillecapiliNo ratings yet

- MBA SEM.1 Recording of TransactionsDocument24 pagesMBA SEM.1 Recording of Transactionsprashantmis452No ratings yet

- Unit 3 Financial AccountingDocument21 pagesUnit 3 Financial AccountingSanjeev KumarNo ratings yet

- CHAPTER 7 Lecture Notes Accounting Information SystemsDocument4 pagesCHAPTER 7 Lecture Notes Accounting Information SystemsJaredNo ratings yet

- Question SheetDocument7 pagesQuestion Sheetscientistmonster0001No ratings yet

- Faa U2Document10 pagesFaa U2kztrmfbc8wNo ratings yet

- Appendix E Subsidiary Ledger and Special JournalsDocument4 pagesAppendix E Subsidiary Ledger and Special JournalsFuyuki Maxwell ArashiNo ratings yet

- Subsidiary Ledgers and Special Ledgers Under RevisionDocument11 pagesSubsidiary Ledgers and Special Ledgers Under RevisionmikeNo ratings yet

- Fmea 4 UnitDocument50 pagesFmea 4 Unitaschandrawat357No ratings yet

- Fabm1 WK 2 Session 2 Journals and LedgersDocument43 pagesFabm1 WK 2 Session 2 Journals and LedgersDomingo Princess JoyNo ratings yet

- Accounting Introduction p20Document14 pagesAccounting Introduction p20varadu1963No ratings yet

- Accounting Cycle For ServiceDocument12 pagesAccounting Cycle For ServiceNo MoreNo ratings yet

- O Level AccountsDocument26 pagesO Level AccountstasleemfcaNo ratings yet

- Chapter 6 Books of AccountingDocument21 pagesChapter 6 Books of AccountingAina Charisse DizonNo ratings yet

- FA IntroDocument49 pagesFA Introarun krishnanNo ratings yet

- Accounting Software: Why Is The General Ledger Important?Document11 pagesAccounting Software: Why Is The General Ledger Important?Sherin ThomasNo ratings yet

- Journal Ledger Trial BalanceDocument22 pagesJournal Ledger Trial BalanceWilliam C JacobNo ratings yet

- Review of The Accounting ProcessDocument18 pagesReview of The Accounting ProcessRoyceNo ratings yet

- Books of Original EntriesDocument21 pagesBooks of Original EntriesMohamed Adil GibreelNo ratings yet

- 4TH Reviewer (Fabm)Document13 pages4TH Reviewer (Fabm)Jihane TanogNo ratings yet

- Financial Statement PreprationDocument63 pagesFinancial Statement PreprationGraceann Casundo100% (2)

- Worksheet 4Document19 pagesWorksheet 4SURBHI BATHAM Student, Jaipuria IndoreNo ratings yet

- Journal or Day BookDocument42 pagesJournal or Day BookRaviSankar100% (1)

- 7.steps in The Recording ProcessDocument13 pages7.steps in The Recording ProcessUlinaro BuatonNo ratings yet

- Accounting For JULLYDocument20 pagesAccounting For JULLYAjay SahooNo ratings yet

- Books of Original EntriesDocument27 pagesBooks of Original EntriesfunnkyarulNo ratings yet

- Books of Account and Double EntrynDocument17 pagesBooks of Account and Double EntrynNelcie BatanNo ratings yet

- Accounting Records and System: The Chart of Accounts Debit and Credit The Accounting Process Transaction AnalysisDocument27 pagesAccounting Records and System: The Chart of Accounts Debit and Credit The Accounting Process Transaction Analysiscluadine dineros100% (1)

- Creating Your Business Plan FinancialsDocument8 pagesCreating Your Business Plan FinancialsRavi KumarNo ratings yet

- Your Amazing Itty Bitty® Book of QuickBooks® TerminologyFrom EverandYour Amazing Itty Bitty® Book of QuickBooks® TerminologyNo ratings yet

- Bookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursFrom EverandBookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursNo ratings yet

- Fetch Statementand NoticesDocument3 pagesFetch Statementand NoticessweigartmarianNo ratings yet

- Pharma Business ProcessesDocument22 pagesPharma Business ProcessesMichael EmadNo ratings yet

- e-StatementBRImo 385201001647508 Nov2023 20231117 133133Document2 pagese-StatementBRImo 385201001647508 Nov2023 20231117 133133yazidfadillah2019No ratings yet

- Using Receivables Credit To CashDocument596 pagesUsing Receivables Credit To CashIloNo ratings yet

- Alfalah Visa Application FormDocument4 pagesAlfalah Visa Application Formmasoodibrahim100% (1)

- Cash Management - BeginnerDocument40 pagesCash Management - BeginnerYelmi MarianiNo ratings yet

- Accounting Activities - MerchandisingDocument6 pagesAccounting Activities - MerchandisingJoyNo ratings yet

- Oracle Receivables AccountingDocument4 pagesOracle Receivables AccountingRanjeetNo ratings yet

- Noman Internship ReportDocument55 pagesNoman Internship ReportNoman KhalidNo ratings yet

- Chapter 2 Self-Test Exam AnswerDocument6 pagesChapter 2 Self-Test Exam Answerhantu hantuNo ratings yet

- HDFC Bank Statement Apr'21 - June'21Document208 pagesHDFC Bank Statement Apr'21 - June'21Malhar LakdawalaNo ratings yet

- ACT103 - Topic 5Document4 pagesACT103 - Topic 5Juan FrivaldoNo ratings yet

- O Level Principle of Accolunts Paper 1 (2012-2018-Er)Document379 pagesO Level Principle of Accolunts Paper 1 (2012-2018-Er)Ismail BabaNo ratings yet

- LedgerDocument5 pagesLedgerHARIKIRAN PRNo ratings yet

- Solution Midterm Exam AcnDocument15 pagesSolution Midterm Exam AcnMay LunaNo ratings yet

- Accounting Principles 10th Edition Weygandt Kimmel Chapter 3 PDFDocument139 pagesAccounting Principles 10th Edition Weygandt Kimmel Chapter 3 PDFmuhammadTzNo ratings yet

- AnswersDocument15 pagesAnswersSahar KhanNo ratings yet

- Suspense Account and ErrorsDocument11 pagesSuspense Account and ErrorsshadedroseNo ratings yet

- Bsa Midterm Non Graded Exercises Journalizing Periodic and Perpetual Method FFFDocument6 pagesBsa Midterm Non Graded Exercises Journalizing Periodic and Perpetual Method FFFGarp BarrocaNo ratings yet

- Delinquent Subscription and Treasury SharesDocument15 pagesDelinquent Subscription and Treasury Sharesm_kobayashiNo ratings yet

- Chapter 9 Intercompany Bond Holdings and Miscellaneous Topics-Consolidated Financial StatementsDocument45 pagesChapter 9 Intercompany Bond Holdings and Miscellaneous Topics-Consolidated Financial StatementsAchmad RizalNo ratings yet

- FTDocumentDocument2 pagesFTDocumentGustavo UribeNo ratings yet

- HDFCLife Little Book of LegacyDocument18 pagesHDFCLife Little Book of LegacyNaresh KewalramaniNo ratings yet

- DJL-Final Manual .Document162 pagesDJL-Final Manual .Kazi NawshadNo ratings yet

- Partnership MyDocument13 pagesPartnership MyHoneylyne PlazaNo ratings yet

- Acct 551 MTermsDocument11 pagesAcct 551 MTermsSteven HannaNo ratings yet

- Fa Module 2: Accounting Equation: LECTURE 1:the Accounting Equation Assets Liabilities + Owner's EquityDocument6 pagesFa Module 2: Accounting Equation: LECTURE 1:the Accounting Equation Assets Liabilities + Owner's EquitycheskaNo ratings yet