Professional Documents

Culture Documents

Debit Card Presen

Debit Card Presen

Uploaded by

Pankaj ShuklaCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Drop 1Document9 pagesDrop 1Lukinha100% (1)

- UntitledDocument2 pagesUntitledAhmed Lord50% (2)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 定时福利1126Document5 pages定时福利1126Ozzy Lina100% (3)

- 17 03 2021Document3 pages17 03 2021OjjkkoNo ratings yet

- Uyr Wsi M5 Mrziz UWDocument12 pagesUyr Wsi M5 Mrziz UWDikesh JaiswalNo ratings yet

- Cryptocurrency Market Capitalizations - CoinMarketCap PDFDocument2 pagesCryptocurrency Market Capitalizations - CoinMarketCap PDFÉmànuel Arcan'jo TarginoNo ratings yet

- (CCPA) PLI - Credit - Card - Payment - Authorization - FormDocument1 page(CCPA) PLI - Credit - Card - Payment - Authorization - FormJan Reonell Reginald ObozaNo ratings yet

- Blockchain MagazineDocument10 pagesBlockchain MagazinePooja chaudharyNo ratings yet

- TPoints Fee AirMilesDocument1 pageTPoints Fee AirMilesDolphin LipNo ratings yet

- Sales Kza7ihj 1657241262009Document17 pagesSales Kza7ihj 1657241262009MARCELO TAVARESNo ratings yet

- First 7 PagesDocument8 pagesFirst 7 PagesAndali AliNo ratings yet

- 1560857335587Document13 pages1560857335587Shivabala JamadarNo ratings yet

- Rekening Koran 3Document10 pagesRekening Koran 3Farahdilla LovianeNo ratings yet

- e-StatementBRImo 009101071595506 Nov2023 20240123 125803Document4 pagese-StatementBRImo 009101071595506 Nov2023 20240123 125803yolandasri040No ratings yet

- Spbu 24.306.139Document6 pagesSpbu 24.306.139fernandotariganNo ratings yet

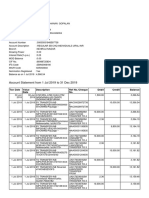

- Note: Posted Transactions Until The Last Working Day Are ShownDocument5 pagesNote: Posted Transactions Until The Last Working Day Are ShownKaleem AhmadNo ratings yet

- Pivotal Payments: Total Funded ToDocument5 pagesPivotal Payments: Total Funded ToSadie BuilterNo ratings yet

- Program btc2bDocument2 pagesProgram btc2bbtc2b2No ratings yet

- Idoc - Pub - New Freebitcoin ScripttxtDocument1 pageIdoc - Pub - New Freebitcoin ScripttxtSree ProsantoNo ratings yet

- Parcial Resuelto Ingles Tecnico 1 Adm. Emp. Preguntas 1-2-3Document4 pagesParcial Resuelto Ingles Tecnico 1 Adm. Emp. Preguntas 1-2-3Valentin MacagnoNo ratings yet

- Torrent Electricity BillDocument2 pagesTorrent Electricity BillSaiyad MoinmiyaNo ratings yet

- Edwin Pratomo Wibowo: IDR 9,618,181.22 IDR 0.00Document2 pagesEdwin Pratomo Wibowo: IDR 9,618,181.22 IDR 0.00Edwin Wibowo GhepengNo ratings yet

- 1577786160969BcF9eaIss9xkmGva PDFDocument10 pages1577786160969BcF9eaIss9xkmGva PDFGovarthanan GopalanNo ratings yet

- Bookmyshow Offer Debit Cards Tncs PDFDocument3 pagesBookmyshow Offer Debit Cards Tncs PDFnggNo ratings yet

- Unbilled Transactions PDFDocument2 pagesUnbilled Transactions PDFArjun NkNo ratings yet

- Iwan Pratama: IDR 2,418,071.32 IDR 2,575,789.00Document2 pagesIwan Pratama: IDR 2,418,071.32 IDR 2,575,789.00iwan pratamaNo ratings yet

- Momo Statement ReportDocument6 pagesMomo Statement ReportLeonard Kakyire Amooh GyanNo ratings yet

- Customer Inquiry ReportDocument2 pagesCustomer Inquiry ReportHardy WijayaNo ratings yet

- Codigo Tipo de Movimiento ServicioDocument30 pagesCodigo Tipo de Movimiento Serviciomackarena gomezNo ratings yet

- Cimb April2024Document2 pagesCimb April2024afauzinoNo ratings yet

Debit Card Presen

Debit Card Presen

Uploaded by

Pankaj ShuklaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Debit Card Presen

Debit Card Presen

Uploaded by

Pankaj ShuklaCopyright:

Available Formats

INTRODUCTI ON

Debit cards are also known as check cards. Debit cards look like credit cards or ATM (automated teller machine) cards, but operate like cash or a personal check. Debit cards are different from credit cards. While a credit card is a way to "pay later," a debit card is a way to "pay now." When you use a debit card, your 4/22/12

TYPES OF DEBIT CARDS

ONLINE DEBIT CARD OFFLINE DEBIT CARD PREPAID DEBIT CARD ELECTRONIC PURSE CARD

4/22/12

ONLINE DEBIT CARD

Online debit cards require electronic authorization of every transaction and the debits are reflected in the users account immediately. The transaction may be additionally secured with the personal identification number (PIN) authentication system and some online cards require such authentication for every transaction, essentially becoming enhanced automatic teller machine (ATM) cards. One difficulty in using online debit cards is the necessity of an electronic authorization device at the point of sale (POS) and sometimes also a separate PIN pad to enter the PIN, although this is becoming commonplace for all card transactions in many 4/22/12 countries. Overall, the online debit card is

OFFLINE DEBIT CARD

Offline debit cards have the logos of major credit cards (e.g. Visa or MasterCard) or major debit cards (e.g. Maestro in the United Kingdom and other countries, but not the United States) and are used at the point of sale like a credit card. This type of debit card may be subject to a daily limit, and/or a maximum limit equal to the current/checking account balance from which it draws funds. Transactions conducted with offline debit cards require 23 days to be reflected on users account balances. In some countries and with some banks and merchant service organizations, a "credit" or offline debit transaction is without cost to the purchaser beyond the face value of the transaction, while a 4/22/12 small fee may be charged for a "debit" or online

PREPAID DEBIT CARDS

Prepaid debit cards, also called reloadable debit cards or reloadable prepaid cards, are often used for recurring payments. The payer loads funds to the cardholder's card account. Particularly for US-based companies with a large number of payment recipients abroad, prepaid debit cards allow the delivery of international payments without the delays and fees associated with 4/22/12 international checks and bank

ELECTRONIC PURSE CARD

Smart-card-based electronic purse systems (in which value is stored on the card chip, not in an externally recorded account, so that machines accepting the card need no network connectivity) were tried throughout Europe from the mid-1990s, most notably in Germany (Geldkarte), Austria (Quick), Belgium (Proton), France (Moneo), the Netherlands (Chipknip and Chipper), Switzerland ("Cash"), Norway ("Mondex"), Sweden ("Cash"), Finland ("Avant"), UK 4/22/12

ADVANTAG ES

It is often easier to get than a credit card. You don't have to get your check approved or show identification at stores. You don't have to carry cash, a checkbook or traveler's checks. Debit cards are more readily

4/22/12

Convenience

Use the card for purchases anywhere that accepts Visa Reliable Use the card for cash at ATM machines Have access to your funds 24 hours a day Avoid check-cashing hassles

Safety

Avoid carrying large amounts of cash Prevent the risk of a paper check being 4/22/12 lost or stolen in the mail

DISADVANTAGES

You need enough money in your bank account to cover each purchase. Since you paid for the purchase at checkout and the money is out of your account, you have less protection if something goes wrong with the purchase. Your bank won't put money back into your account for items that are never delivered, don't work or were misrepresented. 4/22/12

PROTECTING YOUR DEBIT CARDS

A debit card is like a blank check, so you need to guard the card and the account number carefully against loss or misuse. A thief can clear out your bank account before you even know your card is missing. If your debit card is lost or stolen, or if you think someone is using it fraudulently, call your bank immediately. Follow the phone call with a letter. Thieves 4/22/12 don't even need your card. As long as they have your name and card number, they

WHAT IF YOUR DEBIT CARD IS STOLEN, LOST OR MISUSED

A debit card is like a blank check, so you need to guard the card and the account number carefully against loss or misuse. A thief can clear out your bank account before you even know your card is missing. If your debit card is lost or stolen, or if you think someone is using it 4/22/12

BENEFITS OF DEBIT CARDS

Accepted at all eligible health care merchants or IIAS merchants Eliminates substantiation at IIAS Merchants Saves time theres no waiting for reimbursement Makes transactions more convenient Improves cash flow

4/22/12

BE AWARE!

While some issuers give customers separate cards for ATM and on-line transactions and another for off-line uses, others combine the two on one card. If your card handles both off-line and on-line debits and the store accepts both, you will choose the function when you use the card. If you 4/22/12

SEVEN TIPS FOR USING DEBIT CARDS RESPONSIBLY

If your card is lost or stolen, report the loss immediately to your financial institution. If you suspect your card is being fraudulently used, report this immediately to your financial institution. Take your receipts. Dont leave them for others to see. Your account number may be all someone needs to order merchandise through the mail or over the phone at your expense, especially if the card can be used without a PIN. If you have a PIN number, memorize it. Do not keep your PIN number with your card. Also, dont choose a PIN number that a smart thief could figure out, such as your phone number or birthday.

4/22/12 Never

give your PIN number to anyone. Keep your

WH

Obtaining a debit card is 4/22/12

12

4/22/12

Memorize your PIN, and do not write it on your card. Don't choose a PIN a smart thief could figure out, such as numbers corresponding to your birth date or your phone number. Never give your PIN to anyone. Keep it private. Always know how much money you have in your account, and review bank statements carefully. Don't forget that 4/22/12 your debit card may allow you to

PIN

USING A DEBIT CARD AT A POINT OF SALE

You need to key in your PIN at the

4/22/12

BEFORE YOU USE A DEBIT CARDS

Know if it is a credit or a debit card. Ask the card issuer about your options. Understand whether they are providing you with just a debit card only for local ATM cash withdrawal, or one which may also be used for making purchases at local merchants, or a debit card that 4/22/12 can even be used internationally

DEBIT CARDS ISSUERS

The banks issuing debit cards include:

Bank of America Citibank American Express Deutsche bank

4/22/12

Capital One

HI

A Brief Introduction to the History of Debit Card.

The history of debit card implies that the concept of debit card is not new. History of debit card dates back around 20 years ago which highlighted the introduction of ecommerce and alternative means of 4/22/12 payment.

The Magic of Numbers:

History of debit card shows that back in 1990, the count of debit cards in circulation was around 19 million. History of debit card also has it, that the initial years of the debit card era witnessed steep growth and by the year 2006 there were as many as 27.8 million debit cards.

4/22/12

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Drop 1Document9 pagesDrop 1Lukinha100% (1)

- UntitledDocument2 pagesUntitledAhmed Lord50% (2)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 定时福利1126Document5 pages定时福利1126Ozzy Lina100% (3)

- 17 03 2021Document3 pages17 03 2021OjjkkoNo ratings yet

- Uyr Wsi M5 Mrziz UWDocument12 pagesUyr Wsi M5 Mrziz UWDikesh JaiswalNo ratings yet

- Cryptocurrency Market Capitalizations - CoinMarketCap PDFDocument2 pagesCryptocurrency Market Capitalizations - CoinMarketCap PDFÉmànuel Arcan'jo TarginoNo ratings yet

- (CCPA) PLI - Credit - Card - Payment - Authorization - FormDocument1 page(CCPA) PLI - Credit - Card - Payment - Authorization - FormJan Reonell Reginald ObozaNo ratings yet

- Blockchain MagazineDocument10 pagesBlockchain MagazinePooja chaudharyNo ratings yet

- TPoints Fee AirMilesDocument1 pageTPoints Fee AirMilesDolphin LipNo ratings yet

- Sales Kza7ihj 1657241262009Document17 pagesSales Kza7ihj 1657241262009MARCELO TAVARESNo ratings yet

- First 7 PagesDocument8 pagesFirst 7 PagesAndali AliNo ratings yet

- 1560857335587Document13 pages1560857335587Shivabala JamadarNo ratings yet

- Rekening Koran 3Document10 pagesRekening Koran 3Farahdilla LovianeNo ratings yet

- e-StatementBRImo 009101071595506 Nov2023 20240123 125803Document4 pagese-StatementBRImo 009101071595506 Nov2023 20240123 125803yolandasri040No ratings yet

- Spbu 24.306.139Document6 pagesSpbu 24.306.139fernandotariganNo ratings yet

- Note: Posted Transactions Until The Last Working Day Are ShownDocument5 pagesNote: Posted Transactions Until The Last Working Day Are ShownKaleem AhmadNo ratings yet

- Pivotal Payments: Total Funded ToDocument5 pagesPivotal Payments: Total Funded ToSadie BuilterNo ratings yet

- Program btc2bDocument2 pagesProgram btc2bbtc2b2No ratings yet

- Idoc - Pub - New Freebitcoin ScripttxtDocument1 pageIdoc - Pub - New Freebitcoin ScripttxtSree ProsantoNo ratings yet

- Parcial Resuelto Ingles Tecnico 1 Adm. Emp. Preguntas 1-2-3Document4 pagesParcial Resuelto Ingles Tecnico 1 Adm. Emp. Preguntas 1-2-3Valentin MacagnoNo ratings yet

- Torrent Electricity BillDocument2 pagesTorrent Electricity BillSaiyad MoinmiyaNo ratings yet

- Edwin Pratomo Wibowo: IDR 9,618,181.22 IDR 0.00Document2 pagesEdwin Pratomo Wibowo: IDR 9,618,181.22 IDR 0.00Edwin Wibowo GhepengNo ratings yet

- 1577786160969BcF9eaIss9xkmGva PDFDocument10 pages1577786160969BcF9eaIss9xkmGva PDFGovarthanan GopalanNo ratings yet

- Bookmyshow Offer Debit Cards Tncs PDFDocument3 pagesBookmyshow Offer Debit Cards Tncs PDFnggNo ratings yet

- Unbilled Transactions PDFDocument2 pagesUnbilled Transactions PDFArjun NkNo ratings yet

- Iwan Pratama: IDR 2,418,071.32 IDR 2,575,789.00Document2 pagesIwan Pratama: IDR 2,418,071.32 IDR 2,575,789.00iwan pratamaNo ratings yet

- Momo Statement ReportDocument6 pagesMomo Statement ReportLeonard Kakyire Amooh GyanNo ratings yet

- Customer Inquiry ReportDocument2 pagesCustomer Inquiry ReportHardy WijayaNo ratings yet

- Codigo Tipo de Movimiento ServicioDocument30 pagesCodigo Tipo de Movimiento Serviciomackarena gomezNo ratings yet

- Cimb April2024Document2 pagesCimb April2024afauzinoNo ratings yet