Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

11 viewsSession 7 - Compensation, Benefits and Motivation

Session 7 - Compensation, Benefits and Motivation

Uploaded by

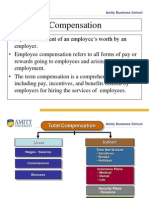

n.demarin1. Employee compensation and benefits come in both intrinsic and extrinsic forms. Intrinsic rewards come from the job itself while extrinsic rewards are offered by management and include financial compensation as well as non-financial perks.

2. When designing compensation plans, organizations must consider various types including those based on performance versus membership, as well as financial versus non-financial rewards. Government regulations also influence compensation administration.

3. Job evaluation and establishing an organizational pay structure involves determining the relative worth of positions, using methods like point-based systems, and setting wage ranges. Incentive plans can further reward individual, group or company-wide performance.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You might also like

- HRM Job EvaluationDocument13 pagesHRM Job EvaluationVickey Verma0% (1)

- Sintering. Mechanisims of Convention Nanodensification and Fiels Assisted Processes. Castro BenthemDocument245 pagesSintering. Mechanisims of Convention Nanodensification and Fiels Assisted Processes. Castro Benthemceliamr42100% (1)

- Ch-8. Compensation MGTDocument25 pagesCh-8. Compensation MGTTamiru BeyeneNo ratings yet

- Module 4 PPT 1Document54 pagesModule 4 PPT 1Subhasish mahapatraNo ratings yet

- Compensationpractices 100821113421 Phpapp01Document46 pagesCompensationpractices 100821113421 Phpapp01Shuvo SubrataNo ratings yet

- HR Unit VDocument43 pagesHR Unit VPrabin ChaudharyNo ratings yet

- HRM 7 - CompensationDocument30 pagesHRM 7 - CompensationSonal Khurana100% (1)

- Compensation ManagementDocument10 pagesCompensation ManagementKaylia EdwardsNo ratings yet

- Compensation FinalDocument63 pagesCompensation FinalhemantlivesinNo ratings yet

- Compensation: Amity Business SchoolDocument35 pagesCompensation: Amity Business SchoolIshita KunduNo ratings yet

- CompensarionDocument18 pagesCompensarionSalahuddin SultanNo ratings yet

- Human Resource Management: Wage, Salary and Reward AdministrationDocument34 pagesHuman Resource Management: Wage, Salary and Reward AdministrationMOHAMMED ALI CHOWDHURY100% (1)

- Compensation Establishing Strategic Pay PlansDocument46 pagesCompensation Establishing Strategic Pay PlansSunil SinghNo ratings yet

- Unit V - WAGES AND INCENTIVES - 09 - 03 - 2015 PDFDocument41 pagesUnit V - WAGES AND INCENTIVES - 09 - 03 - 2015 PDFNitin NischalNo ratings yet

- Chapter 11: Strategic Pay PlansDocument8 pagesChapter 11: Strategic Pay PlansHam XaNo ratings yet

- Position Description Questionnaire (PDQ) - Creation of Effective Job DescriptionsDocument43 pagesPosition Description Questionnaire (PDQ) - Creation of Effective Job Descriptionsapritul3539No ratings yet

- Compensation & Reward ManagementDocument227 pagesCompensation & Reward ManagementjitendersharmajiNo ratings yet

- Job Analysis and Design Chapter Overview: AutonomyDocument25 pagesJob Analysis and Design Chapter Overview: AutonomyJosenia ConstantinoNo ratings yet

- Compensation SlidesDocument48 pagesCompensation SlidesGaurav GopalNo ratings yet

- Job Evaluation Managers Guide 2Document8 pagesJob Evaluation Managers Guide 2rrrurayNo ratings yet

- Session 15,16,17 - Managing CompensationDocument50 pagesSession 15,16,17 - Managing CompensationJimit ShahNo ratings yet

- Compensation: Presented by Hardik Bhavsar Rahul Samant Roshith G KDocument49 pagesCompensation: Presented by Hardik Bhavsar Rahul Samant Roshith G KRahul SamantNo ratings yet

- Job Evaluation Is A Process of Finding Out The Relative Worth of A Job As Compared To Other JobsDocument5 pagesJob Evaluation Is A Process of Finding Out The Relative Worth of A Job As Compared To Other JobsfaiziaaaNo ratings yet

- Case Study TrainingDocument1 pageCase Study TrainingAmmar HussainNo ratings yet

- Presentation On Attrition Rate of DeloitteDocument13 pagesPresentation On Attrition Rate of DeloitteRohit GuptaNo ratings yet

- Direct Compensation-Human Resource Management by Wayne MondyDocument11 pagesDirect Compensation-Human Resource Management by Wayne MondyMaqsood BrohiNo ratings yet

- Human Resource Management: TERM-3 Instructor-Kirti MishraDocument22 pagesHuman Resource Management: TERM-3 Instructor-Kirti MishraAnya JainNo ratings yet

- 04 McKinsey 7SDocument7 pages04 McKinsey 7Ssunshine4u5No ratings yet

- Potential AppraisalDocument22 pagesPotential Appraisalricha928No ratings yet

- Motivating Employees: Chapter 16 Richard DaftDocument28 pagesMotivating Employees: Chapter 16 Richard DaftKatherine ZMNo ratings yet

- 04 Components of Performance Management SystemDocument6 pages04 Components of Performance Management SystemAshrazorNo ratings yet

- Performance Appraisal Checklist For Employees PDFDocument2 pagesPerformance Appraisal Checklist For Employees PDFErnestNo ratings yet

- Job Evaluation AssignmentDocument4 pagesJob Evaluation AssignmentRichard DeniranNo ratings yet

- Performance Appraisal Method in Indian Organization: Appraisal System Attributes: Clarity, Openness, and FairnessDocument11 pagesPerformance Appraisal Method in Indian Organization: Appraisal System Attributes: Clarity, Openness, and Fairnessrecruiter63No ratings yet

- Job EvaluationDocument18 pagesJob EvaluationAbhijaat SahuNo ratings yet

- Job Analysis - Models and Other InfoDocument23 pagesJob Analysis - Models and Other InfoharidhraNo ratings yet

- What Is Job Analysis? Why Is Job Analysis Important?Document18 pagesWhat Is Job Analysis? Why Is Job Analysis Important?Aljunex LibreaNo ratings yet

- Job EvaluationDocument19 pagesJob EvaluationRowena InocentesNo ratings yet

- Job Analisis NowDocument276 pagesJob Analisis Nowencep iik muzakirNo ratings yet

- Job Evaluation: Prepared by Narendra Singh ChaudharyDocument24 pagesJob Evaluation: Prepared by Narendra Singh ChaudharyYogpatterNo ratings yet

- 3.job EvaluationDocument12 pages3.job EvaluationEllen NegrilloNo ratings yet

- JOb Evaluation and Job Grade3Document3 pagesJOb Evaluation and Job Grade3Tamer Maher100% (1)

- Labour Legislations in INDIADocument43 pagesLabour Legislations in INDIAAbhinav RanaNo ratings yet

- Job Evaluation MethodsDocument12 pagesJob Evaluation MethodsdivyasahalNo ratings yet

- Performance ManagementDocument8 pagesPerformance Managementmaricar mesaNo ratings yet

- SN 21 - Incentives and Performance PayDocument47 pagesSN 21 - Incentives and Performance PaySangeetha ManikkamNo ratings yet

- Job Analysis: Job Analysis Is The Process of Collecting Job Related InformationDocument49 pagesJob Analysis: Job Analysis Is The Process of Collecting Job Related InformationBhasker JorwalNo ratings yet

- How Committed Am I To My OrganizationDocument2 pagesHow Committed Am I To My OrganizationAbdifatah SaidNo ratings yet

- CompensationDocument16 pagesCompensationrishu jainNo ratings yet

- 11 - Chapter 6 On Reward System PDFDocument103 pages11 - Chapter 6 On Reward System PDFHusban KhanNo ratings yet

- Compensation & Benefits MGMT - Equity, Pay Structure.Document41 pagesCompensation & Benefits MGMT - Equity, Pay Structure.rashmi_shantikumarNo ratings yet

- CH 5 - Compensation MGTDocument28 pagesCH 5 - Compensation MGTGetnat BahiruNo ratings yet

- HR AuditQuestioonnaire HelikxDocument8 pagesHR AuditQuestioonnaire Helikxapi-387067350% (2)

- Job EvaluationDocument15 pagesJob EvaluationAnkur DubeyNo ratings yet

- Comp Dictionary PayscaleDocument33 pagesComp Dictionary PayscalePhuong Tran100% (1)

- Benchmarking HR Practices - 1994 PDFDocument20 pagesBenchmarking HR Practices - 1994 PDFsilenceindigoNo ratings yet

- Compensation ManagementDocument45 pagesCompensation ManagementAjjarapu JaikaliprasadNo ratings yet

- oAGDXthe Transformative Leader - Complete Ebook Series-2 PDFDocument52 pagesoAGDXthe Transformative Leader - Complete Ebook Series-2 PDFjmsantamaria1975No ratings yet

- Job Evaluation MethodsDocument45 pagesJob Evaluation MethodsmikeNo ratings yet

- Biology EssayDocument8 pagesBiology Essayglzhcoaeg100% (1)

- A Software For Gravity Dam Stability AnalysisDocument9 pagesA Software For Gravity Dam Stability Analysislemi celemenNo ratings yet

- Application of Polymerase Chain Reaction For Detection of Camels' Milk Adulteration by Milk of CowDocument1 pageApplication of Polymerase Chain Reaction For Detection of Camels' Milk Adulteration by Milk of CowMihaelaOlaruNo ratings yet

- Principles of TaxationDocument11 pagesPrinciples of TaxationJay GamboaNo ratings yet

- PHECC Field Guide 2011Document125 pagesPHECC Field Guide 2011Michael B. San JuanNo ratings yet

- Gender and Unpaid WorkDocument12 pagesGender and Unpaid Work2013makedonijaNo ratings yet

- Controller Xy wth1 Temperature and Humidity Manual OptimizedDocument6 pagesController Xy wth1 Temperature and Humidity Manual Optimizedsakemoto2No ratings yet

- Lecture 4-5-240 - Fraud - Compatibility ModeDocument35 pagesLecture 4-5-240 - Fraud - Compatibility ModeSourav MahadiNo ratings yet

- Pre-Writing ProcessDocument31 pagesPre-Writing ProcessDemi BarrancoNo ratings yet

- Political Public Relations: Meaning, Importance and AnalysisDocument3 pagesPolitical Public Relations: Meaning, Importance and AnalysisUpadhayayAnkurNo ratings yet

- Kathrikkadavu High Court of KeralaDocument6 pagesKathrikkadavu High Court of KeralaNikhil Viswam MenonNo ratings yet

- Almocera Vs OngDocument1 pageAlmocera Vs OngKaren Joy RaymundoNo ratings yet

- Philippines: 2016/4/8 News No. Date Comment PE0-MC-160025 Apr.,1,2016 COR:FIG.32 FLASHER LIGHT LIST CORRECTIONDocument53 pagesPhilippines: 2016/4/8 News No. Date Comment PE0-MC-160025 Apr.,1,2016 COR:FIG.32 FLASHER LIGHT LIST CORRECTIONLK JoaquinNo ratings yet

- Ottawa Passport Re Issue Checklist June 2019 PDFDocument4 pagesOttawa Passport Re Issue Checklist June 2019 PDFSreeman MypatiNo ratings yet

- The Experimental Model of The Pipe Made PDFDocument4 pagesThe Experimental Model of The Pipe Made PDFGhassan ZeinNo ratings yet

- List of Illegal Projects, Schemes & Societies in Malir, KarachiDocument7 pagesList of Illegal Projects, Schemes & Societies in Malir, KarachiMuhammad Hanef ShaikhNo ratings yet

- PhenomenologyDocument27 pagesPhenomenologyMerasol Matias Pedrosa100% (1)

- Homelite Chain Saw Parts Manual For 20 Chain Saw UT 10782 ADocument14 pagesHomelite Chain Saw Parts Manual For 20 Chain Saw UT 10782 AJoe EisentragerNo ratings yet

- Anand Balachandran Nair Jelaja - ResumeDocument6 pagesAnand Balachandran Nair Jelaja - ResumeSaradh ThotaNo ratings yet

- Fill-A-Pix SamplerDocument7 pagesFill-A-Pix SamplerJavier Abarca ObregonNo ratings yet

- TATA Nano Owners Manual-4Document9 pagesTATA Nano Owners Manual-4NikhitaNo ratings yet

- Shopping Cart - Regatta - Great OutdoorsDocument3 pagesShopping Cart - Regatta - Great OutdoorsMinchel MesquitaNo ratings yet

- List of Minority Students Awarded For PRE-MATRIC SCHOLARSHIP 2010-11 (List-3) PDFDocument134 pagesList of Minority Students Awarded For PRE-MATRIC SCHOLARSHIP 2010-11 (List-3) PDFraes fathimaNo ratings yet

- Guidance Settlement Application SET (O)Document13 pagesGuidance Settlement Application SET (O)Amir FarooquiNo ratings yet

- Chennai Bus RoutesDocument69 pagesChennai Bus RoutesAakash SrivastavaNo ratings yet

- Legal FormsDocument29 pagesLegal FormsRiyu Jan Raztech100% (1)

- HALL TICKET FOR SUMMER 2021 of 2000130177Document1 pageHALL TICKET FOR SUMMER 2021 of 2000130177Tejas ShivalkarNo ratings yet

- Product Description of A Harrier Jump JetDocument6 pagesProduct Description of A Harrier Jump Jetapi-584335700No ratings yet

- Workplace Software and Skills - WEB IlfJtcPDocument1,101 pagesWorkplace Software and Skills - WEB IlfJtcPlkeremoieltonNo ratings yet

Session 7 - Compensation, Benefits and Motivation

Session 7 - Compensation, Benefits and Motivation

Uploaded by

n.demarin0 ratings0% found this document useful (0 votes)

11 views34 pages1. Employee compensation and benefits come in both intrinsic and extrinsic forms. Intrinsic rewards come from the job itself while extrinsic rewards are offered by management and include financial compensation as well as non-financial perks.

2. When designing compensation plans, organizations must consider various types including those based on performance versus membership, as well as financial versus non-financial rewards. Government regulations also influence compensation administration.

3. Job evaluation and establishing an organizational pay structure involves determining the relative worth of positions, using methods like point-based systems, and setting wage ranges. Incentive plans can further reward individual, group or company-wide performance.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. Employee compensation and benefits come in both intrinsic and extrinsic forms. Intrinsic rewards come from the job itself while extrinsic rewards are offered by management and include financial compensation as well as non-financial perks.

2. When designing compensation plans, organizations must consider various types including those based on performance versus membership, as well as financial versus non-financial rewards. Government regulations also influence compensation administration.

3. Job evaluation and establishing an organizational pay structure involves determining the relative worth of positions, using methods like point-based systems, and setting wage ranges. Incentive plans can further reward individual, group or company-wide performance.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

11 views34 pagesSession 7 - Compensation, Benefits and Motivation

Session 7 - Compensation, Benefits and Motivation

Uploaded by

n.demarin1. Employee compensation and benefits come in both intrinsic and extrinsic forms. Intrinsic rewards come from the job itself while extrinsic rewards are offered by management and include financial compensation as well as non-financial perks.

2. When designing compensation plans, organizations must consider various types including those based on performance versus membership, as well as financial versus non-financial rewards. Government regulations also influence compensation administration.

3. Job evaluation and establishing an organizational pay structure involves determining the relative worth of positions, using methods like point-based systems, and setting wage ranges. Incentive plans can further reward individual, group or company-wide performance.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 34

Session 7

Compensation, Benefits and Motivation

Human Resource Management 17 thedition, Dessler, Gary 2023

Contemporary Human Resource Management 6 th edition, Wilkinson, Adrian and Dundon, Tony

2021

Programme Coordinator Dr. Dorra Yahiaoui & Dr. Ghulam Murtaza Guidance Materials

Introduction

• Employee perform their job responsibilities and in return they look for a

payoff or reward.

• The most obvious reward is pay, but there are many others, including:

• Promotions

• Desirable work assignments

• Peer recognition

• Work freedom

Rewards

Types of Reward Plans

Intrinsic versus Extrinsic Rewards

• Intrinsic rewards (personal satisfactions) come from the job itself, such

as:

• pride in one’s work

• feelings of accomplishment

• being part of a work team

Types of Reward Plans

Intrinsic versus Extrinsic Rewards

• Extrinsic rewards come from some source i.e., Financial or Nonfinancial

• include rewards offered mainly by management

• Money

• Promotions

• Benefits

Types of Reward Plans

Financial Versus Nonfinancial Rewards

• Financial rewards include:

• wages

• bonuses

• profit sharing

• pension plans

• paid leaves

• purchase discounts

• Nonfinancial rewards emphasize making life on the job more attractive; employees

vary greatly on what types of rewards they find desirable / prefer.

Types of Reward Plans

Performance-based versus Membership-Based Rewards

• Performance-based rewards are tied to specific job performance criteria.

• Commissions

• Incentive systems

• Performance bonuses

• Merit pay plans

• Membership-based rewards such as Monthly living budget increases,

Labor market adjustment, time in rank increase, Protection programs and

pay for the time not worked to employees.

Difference between Compensation and

Benefits

• Compensation refers to pay or the exchange in monetary terms of the

work performed by the employees and is paid by the employer. This can

be in the form of wages, salary, or tips.

• Benefits refer to the exchange in value to the employees as part of their

packages for the work that has been performed. In other words, benefits

do not involve money but are presented in the form of value.

Compensation Administration

• The process of managing a compensation program so that the organization

can attract, motivate and retain competent employees who perceive that

the program is fair.

Compensation Administration

Job evaluation

• The process used to determine each job’s appropriate worth within

the organization.

• Based on job analysis information.

Compensation Administration

Government Influence on Compensation Administration

Fair Labor Standards Act 1938 act which requires

• minimum wage

• overtime pay

• record-keeping

• child labor restrictions

Compensation Administration

Government Influence on Compensation Administration

Equal Pay Act of 1963 act requires that men and women hired for the same

job, should be paid the same.

Civil Rights Act

• broader than Equal Pay Act

• prohibits discrimination on the basis of gender

• Salaries should be established on the basis of skill, responsibility, effort, and

working conditions.

Job Evaluation and Pay Structure

Job Evaluation

• Use of job analysis information to determine the relative value of each job

in relation to all jobs within the organization.

• The ranking of jobs

• Labor market conditions

• Collective bargaining

• Individual skill differences

Job Evaluation and Pay Structure

Isolating Job Evaluation Criteria

• Judgment is involved in defining what factors should be used to compare jobs.

• Typical criteria:

• mental requirements

• supervisory control

• complexity

• physical demands

• personal contacts

• Jobs are grouped according to type and compared within their group. For example, Clerical Jobs,

Sales Job and Professional jobs.

Job Evaluation and Pay Structure

Job Evaluation Methods

Ordering Method A committee places jobs in a simple rank order from highest

(worth highest pay) to lowest.

Classification method Evaluating jobs based on predetermined job grades

• Jobs are placed in classification grades

• Look for a common denominator such as skills, knowledge, or responsibility to create

distinct classes or grades of jobs. Examples may include shop jobs, clerical jobs, technical

jobs and sale jobs.

• Chemical engineer in Engineering Department and Accountant in Finance Department are

considered in Grade 7.

Job Evaluation and Pay Structure

Job Evaluation Methods

Point method

• Jobs are rated and then allocating points on several identifiable criteria (such as

skills, effort and responsibilities)

• Appropriate weights are given, depending on the importance of each criterion to

performing the job, points are summed, and jobs with similar point totals are placed

in similar pay grades.

Job Evaluation and Pay Structure

Establishing the Pay Structure

Compensation surveys

• Used to gather factual data on pay rates from other organizations

• Information is often collected on employee benefits as well

Wage curves

• Drawn by plotting job evaluation data (such as job points or grades) against pay rates

(actual or from survey data).

• Indicate whether the pay structure is logical

Job Evaluation and Pay Structure

Establishing the Pay Structure

Wage structure

• Designates pay ranges for groups of jobs which are

• similar in value to the organization

• grouped by their classifications, grades or points.

• Results in a logical hierarchy of wages

Special Cases of Compensation

Incentive Compensation Plans

• Incentives can be added to the basic pay structure to provide rewards for

performance.

• Clear objectives are set.

Individual Incentives include

• Merit pay plans (annual increase, based on performance)

• Piecework plans (pay based on number of units produced typically in a specified

time period.)

• Time-savings bonuses and commissions

Special Cases of Compensation

Incentive Compensation Plans

Group Incentives

• Incentives can be offered to groups, rather than individuals, when employees' tasks require

cooperation.

Organization wide Incentives:

• Direct employee efforts toward achieving overall organizational goals (such as cost reduction).

One of best-known organization wide incentives are

Scanlon Plan - supervisor and employee make a mutual committee and suggest savings /

improvements and then productivity gains are shared by all employees and not just the individual

who suggested the cost saving.

IMPROSHARE - formula is used to determine bonuses based on each Individual contribution in

cost savings for organization. Specific employee get his/her share.

Special Cases of Compensation

Paying for Performance

• Pay is based on some measure of performance.

• Common performance measures are:

• piece-rate plans

• gainsharing

• wage incentive plans

• profit sharing

• lump sum bonuses.

Special Cases of Compensation

Paying for Performance

Competency-based compensation Rewarded employees for skills,

knowledge and behaviors. These behaviors and skills may include

• leadership

• problem solving

• decision making

• strategic planning .

Special Cases of Compensation

Team-Based Compensation

• Pay based on how well the team performed.

It Depends on:

• Clarity of team purpose and goals

• Resources available to team to fulfill their specific goals.

• Trust among all team members is very important.

Executives Compensation Programs

Salaries of Top Managers

• Executive salaries, bonuses and stock options may seem high.

• Competition for executive talent raises the price of hiring an executive.

• High salaries can be a motivator for executives and lower-level managers.

Executives Compensation Programs

Supplemental Financial Compensation

• Deferred bonuses – paid to executives over extended time periods, to encourage

them to stay with the company.

• Stock options – allow executives to purchase stock in the future at a fixed price.

• Hiring bonuses – compensate new executive because of leaving a former company /

loss of pension rights.

Executives Compensation Programs

Supplemental Nonfinancial Compensation: Perquisites

Perquisites also known as Perks (offered to executives) may include:

• Paid life insurance

• Club memberships

• Company cars

• Expense accounts

• Interest-free loans

• Legal and tax counseling

• Mortgage assistance

Executives Compensation Programs

Supplemental Nonfinancial Compensation: Perquisites

• Golden parachutes protect executives when a merger or hostile

takeover occurs by providing severance pay or a guaranteed position.

International Compensation

• Important to understand the statutory requirements of each country.

• International compensation packages generally utilize the “balance-sheet

approach,” using the four factors below:

• Base Pay

• Differentials

• Incentives

• Assistance Programs

International Compensation

• Base Pay: The pay of employees in comparable jobs at home.

• Differentials: Compensation given to offset higher costs of living abroad.

• Incentives: Inducements given to encourage employees to accept

overseas assignments.

• Assistance Programs: Payment for expenses involved in moving a family

abroad and in providing some services overseas.

Employee Benefits

• Have grown in importance and variety

• Typically, membership-based rewards offered to attract and keep

employees

• Do not directly affect a worker’s performance, but inadequate benefits

lead to employee dissatisfaction.

Legally Required Benefits

• Social Security

• Unemployment Compensation

• Workers’ Compensation (Losses from work-related incidents)

• Family and Medical Leave

Retirements Benefits

• Pension Benefits (Can be Based on Years of Service)

• Individual Retirement Accounts (for lower-income workers who don’t

have pension programs at work).

• 401(k)s (Permit workers to set aside a specified amount of income on a

tax-deferred basis).

Paid Time Off

• Vacation and Holiday Leave

• Disability Insurance programs

Thanks

Any Questions!!

You might also like

- HRM Job EvaluationDocument13 pagesHRM Job EvaluationVickey Verma0% (1)

- Sintering. Mechanisims of Convention Nanodensification and Fiels Assisted Processes. Castro BenthemDocument245 pagesSintering. Mechanisims of Convention Nanodensification and Fiels Assisted Processes. Castro Benthemceliamr42100% (1)

- Ch-8. Compensation MGTDocument25 pagesCh-8. Compensation MGTTamiru BeyeneNo ratings yet

- Module 4 PPT 1Document54 pagesModule 4 PPT 1Subhasish mahapatraNo ratings yet

- Compensationpractices 100821113421 Phpapp01Document46 pagesCompensationpractices 100821113421 Phpapp01Shuvo SubrataNo ratings yet

- HR Unit VDocument43 pagesHR Unit VPrabin ChaudharyNo ratings yet

- HRM 7 - CompensationDocument30 pagesHRM 7 - CompensationSonal Khurana100% (1)

- Compensation ManagementDocument10 pagesCompensation ManagementKaylia EdwardsNo ratings yet

- Compensation FinalDocument63 pagesCompensation FinalhemantlivesinNo ratings yet

- Compensation: Amity Business SchoolDocument35 pagesCompensation: Amity Business SchoolIshita KunduNo ratings yet

- CompensarionDocument18 pagesCompensarionSalahuddin SultanNo ratings yet

- Human Resource Management: Wage, Salary and Reward AdministrationDocument34 pagesHuman Resource Management: Wage, Salary and Reward AdministrationMOHAMMED ALI CHOWDHURY100% (1)

- Compensation Establishing Strategic Pay PlansDocument46 pagesCompensation Establishing Strategic Pay PlansSunil SinghNo ratings yet

- Unit V - WAGES AND INCENTIVES - 09 - 03 - 2015 PDFDocument41 pagesUnit V - WAGES AND INCENTIVES - 09 - 03 - 2015 PDFNitin NischalNo ratings yet

- Chapter 11: Strategic Pay PlansDocument8 pagesChapter 11: Strategic Pay PlansHam XaNo ratings yet

- Position Description Questionnaire (PDQ) - Creation of Effective Job DescriptionsDocument43 pagesPosition Description Questionnaire (PDQ) - Creation of Effective Job Descriptionsapritul3539No ratings yet

- Compensation & Reward ManagementDocument227 pagesCompensation & Reward ManagementjitendersharmajiNo ratings yet

- Job Analysis and Design Chapter Overview: AutonomyDocument25 pagesJob Analysis and Design Chapter Overview: AutonomyJosenia ConstantinoNo ratings yet

- Compensation SlidesDocument48 pagesCompensation SlidesGaurav GopalNo ratings yet

- Job Evaluation Managers Guide 2Document8 pagesJob Evaluation Managers Guide 2rrrurayNo ratings yet

- Session 15,16,17 - Managing CompensationDocument50 pagesSession 15,16,17 - Managing CompensationJimit ShahNo ratings yet

- Compensation: Presented by Hardik Bhavsar Rahul Samant Roshith G KDocument49 pagesCompensation: Presented by Hardik Bhavsar Rahul Samant Roshith G KRahul SamantNo ratings yet

- Job Evaluation Is A Process of Finding Out The Relative Worth of A Job As Compared To Other JobsDocument5 pagesJob Evaluation Is A Process of Finding Out The Relative Worth of A Job As Compared To Other JobsfaiziaaaNo ratings yet

- Case Study TrainingDocument1 pageCase Study TrainingAmmar HussainNo ratings yet

- Presentation On Attrition Rate of DeloitteDocument13 pagesPresentation On Attrition Rate of DeloitteRohit GuptaNo ratings yet

- Direct Compensation-Human Resource Management by Wayne MondyDocument11 pagesDirect Compensation-Human Resource Management by Wayne MondyMaqsood BrohiNo ratings yet

- Human Resource Management: TERM-3 Instructor-Kirti MishraDocument22 pagesHuman Resource Management: TERM-3 Instructor-Kirti MishraAnya JainNo ratings yet

- 04 McKinsey 7SDocument7 pages04 McKinsey 7Ssunshine4u5No ratings yet

- Potential AppraisalDocument22 pagesPotential Appraisalricha928No ratings yet

- Motivating Employees: Chapter 16 Richard DaftDocument28 pagesMotivating Employees: Chapter 16 Richard DaftKatherine ZMNo ratings yet

- 04 Components of Performance Management SystemDocument6 pages04 Components of Performance Management SystemAshrazorNo ratings yet

- Performance Appraisal Checklist For Employees PDFDocument2 pagesPerformance Appraisal Checklist For Employees PDFErnestNo ratings yet

- Job Evaluation AssignmentDocument4 pagesJob Evaluation AssignmentRichard DeniranNo ratings yet

- Performance Appraisal Method in Indian Organization: Appraisal System Attributes: Clarity, Openness, and FairnessDocument11 pagesPerformance Appraisal Method in Indian Organization: Appraisal System Attributes: Clarity, Openness, and Fairnessrecruiter63No ratings yet

- Job EvaluationDocument18 pagesJob EvaluationAbhijaat SahuNo ratings yet

- Job Analysis - Models and Other InfoDocument23 pagesJob Analysis - Models and Other InfoharidhraNo ratings yet

- What Is Job Analysis? Why Is Job Analysis Important?Document18 pagesWhat Is Job Analysis? Why Is Job Analysis Important?Aljunex LibreaNo ratings yet

- Job EvaluationDocument19 pagesJob EvaluationRowena InocentesNo ratings yet

- Job Analisis NowDocument276 pagesJob Analisis Nowencep iik muzakirNo ratings yet

- Job Evaluation: Prepared by Narendra Singh ChaudharyDocument24 pagesJob Evaluation: Prepared by Narendra Singh ChaudharyYogpatterNo ratings yet

- 3.job EvaluationDocument12 pages3.job EvaluationEllen NegrilloNo ratings yet

- JOb Evaluation and Job Grade3Document3 pagesJOb Evaluation and Job Grade3Tamer Maher100% (1)

- Labour Legislations in INDIADocument43 pagesLabour Legislations in INDIAAbhinav RanaNo ratings yet

- Job Evaluation MethodsDocument12 pagesJob Evaluation MethodsdivyasahalNo ratings yet

- Performance ManagementDocument8 pagesPerformance Managementmaricar mesaNo ratings yet

- SN 21 - Incentives and Performance PayDocument47 pagesSN 21 - Incentives and Performance PaySangeetha ManikkamNo ratings yet

- Job Analysis: Job Analysis Is The Process of Collecting Job Related InformationDocument49 pagesJob Analysis: Job Analysis Is The Process of Collecting Job Related InformationBhasker JorwalNo ratings yet

- How Committed Am I To My OrganizationDocument2 pagesHow Committed Am I To My OrganizationAbdifatah SaidNo ratings yet

- CompensationDocument16 pagesCompensationrishu jainNo ratings yet

- 11 - Chapter 6 On Reward System PDFDocument103 pages11 - Chapter 6 On Reward System PDFHusban KhanNo ratings yet

- Compensation & Benefits MGMT - Equity, Pay Structure.Document41 pagesCompensation & Benefits MGMT - Equity, Pay Structure.rashmi_shantikumarNo ratings yet

- CH 5 - Compensation MGTDocument28 pagesCH 5 - Compensation MGTGetnat BahiruNo ratings yet

- HR AuditQuestioonnaire HelikxDocument8 pagesHR AuditQuestioonnaire Helikxapi-387067350% (2)

- Job EvaluationDocument15 pagesJob EvaluationAnkur DubeyNo ratings yet

- Comp Dictionary PayscaleDocument33 pagesComp Dictionary PayscalePhuong Tran100% (1)

- Benchmarking HR Practices - 1994 PDFDocument20 pagesBenchmarking HR Practices - 1994 PDFsilenceindigoNo ratings yet

- Compensation ManagementDocument45 pagesCompensation ManagementAjjarapu JaikaliprasadNo ratings yet

- oAGDXthe Transformative Leader - Complete Ebook Series-2 PDFDocument52 pagesoAGDXthe Transformative Leader - Complete Ebook Series-2 PDFjmsantamaria1975No ratings yet

- Job Evaluation MethodsDocument45 pagesJob Evaluation MethodsmikeNo ratings yet

- Biology EssayDocument8 pagesBiology Essayglzhcoaeg100% (1)

- A Software For Gravity Dam Stability AnalysisDocument9 pagesA Software For Gravity Dam Stability Analysislemi celemenNo ratings yet

- Application of Polymerase Chain Reaction For Detection of Camels' Milk Adulteration by Milk of CowDocument1 pageApplication of Polymerase Chain Reaction For Detection of Camels' Milk Adulteration by Milk of CowMihaelaOlaruNo ratings yet

- Principles of TaxationDocument11 pagesPrinciples of TaxationJay GamboaNo ratings yet

- PHECC Field Guide 2011Document125 pagesPHECC Field Guide 2011Michael B. San JuanNo ratings yet

- Gender and Unpaid WorkDocument12 pagesGender and Unpaid Work2013makedonijaNo ratings yet

- Controller Xy wth1 Temperature and Humidity Manual OptimizedDocument6 pagesController Xy wth1 Temperature and Humidity Manual Optimizedsakemoto2No ratings yet

- Lecture 4-5-240 - Fraud - Compatibility ModeDocument35 pagesLecture 4-5-240 - Fraud - Compatibility ModeSourav MahadiNo ratings yet

- Pre-Writing ProcessDocument31 pagesPre-Writing ProcessDemi BarrancoNo ratings yet

- Political Public Relations: Meaning, Importance and AnalysisDocument3 pagesPolitical Public Relations: Meaning, Importance and AnalysisUpadhayayAnkurNo ratings yet

- Kathrikkadavu High Court of KeralaDocument6 pagesKathrikkadavu High Court of KeralaNikhil Viswam MenonNo ratings yet

- Almocera Vs OngDocument1 pageAlmocera Vs OngKaren Joy RaymundoNo ratings yet

- Philippines: 2016/4/8 News No. Date Comment PE0-MC-160025 Apr.,1,2016 COR:FIG.32 FLASHER LIGHT LIST CORRECTIONDocument53 pagesPhilippines: 2016/4/8 News No. Date Comment PE0-MC-160025 Apr.,1,2016 COR:FIG.32 FLASHER LIGHT LIST CORRECTIONLK JoaquinNo ratings yet

- Ottawa Passport Re Issue Checklist June 2019 PDFDocument4 pagesOttawa Passport Re Issue Checklist June 2019 PDFSreeman MypatiNo ratings yet

- The Experimental Model of The Pipe Made PDFDocument4 pagesThe Experimental Model of The Pipe Made PDFGhassan ZeinNo ratings yet

- List of Illegal Projects, Schemes & Societies in Malir, KarachiDocument7 pagesList of Illegal Projects, Schemes & Societies in Malir, KarachiMuhammad Hanef ShaikhNo ratings yet

- PhenomenologyDocument27 pagesPhenomenologyMerasol Matias Pedrosa100% (1)

- Homelite Chain Saw Parts Manual For 20 Chain Saw UT 10782 ADocument14 pagesHomelite Chain Saw Parts Manual For 20 Chain Saw UT 10782 AJoe EisentragerNo ratings yet

- Anand Balachandran Nair Jelaja - ResumeDocument6 pagesAnand Balachandran Nair Jelaja - ResumeSaradh ThotaNo ratings yet

- Fill-A-Pix SamplerDocument7 pagesFill-A-Pix SamplerJavier Abarca ObregonNo ratings yet

- TATA Nano Owners Manual-4Document9 pagesTATA Nano Owners Manual-4NikhitaNo ratings yet

- Shopping Cart - Regatta - Great OutdoorsDocument3 pagesShopping Cart - Regatta - Great OutdoorsMinchel MesquitaNo ratings yet

- List of Minority Students Awarded For PRE-MATRIC SCHOLARSHIP 2010-11 (List-3) PDFDocument134 pagesList of Minority Students Awarded For PRE-MATRIC SCHOLARSHIP 2010-11 (List-3) PDFraes fathimaNo ratings yet

- Guidance Settlement Application SET (O)Document13 pagesGuidance Settlement Application SET (O)Amir FarooquiNo ratings yet

- Chennai Bus RoutesDocument69 pagesChennai Bus RoutesAakash SrivastavaNo ratings yet

- Legal FormsDocument29 pagesLegal FormsRiyu Jan Raztech100% (1)

- HALL TICKET FOR SUMMER 2021 of 2000130177Document1 pageHALL TICKET FOR SUMMER 2021 of 2000130177Tejas ShivalkarNo ratings yet

- Product Description of A Harrier Jump JetDocument6 pagesProduct Description of A Harrier Jump Jetapi-584335700No ratings yet

- Workplace Software and Skills - WEB IlfJtcPDocument1,101 pagesWorkplace Software and Skills - WEB IlfJtcPlkeremoieltonNo ratings yet