Professional Documents

Culture Documents

5 SM - Corp - Strategy Tom Tat

5 SM - Corp - Strategy Tom Tat

Uploaded by

Mỹ VõCopyright:

Available Formats

You might also like

- HBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)From EverandHBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)Rating: 4.5 out of 5 stars4.5/5 (25)

- English For Academic and Professional Purposes: Quarter 1Document22 pagesEnglish For Academic and Professional Purposes: Quarter 1Ramwen Jamero100% (1)

- A Grade Ruchi Copy 2Document9 pagesA Grade Ruchi Copy 2Poorni PereraNo ratings yet

- Corporate Level StrategyDocument19 pagesCorporate Level StrategyMargaretta LiangNo ratings yet

- Babette E Bensoussan Craig S Fleisher Analysi B-ODocument274 pagesBabette E Bensoussan Craig S Fleisher Analysi B-OAngela Simoes67% (3)

- Becker, B. E., & Huselid, M. A. 1998. High Performance Work PDFDocument25 pagesBecker, B. E., & Huselid, M. A. 1998. High Performance Work PDFÁtila de AssisNo ratings yet

- Horizontal Integration and Vertical IntegrationDocument17 pagesHorizontal Integration and Vertical IntegrationAmit Jaglan100% (1)

- Chapter Nine: Strategy at The Corporate LevelDocument22 pagesChapter Nine: Strategy at The Corporate LevelTanim TarakNo ratings yet

- Theory of Strategic Management With Cases, 8e: Hills, JonesDocument17 pagesTheory of Strategic Management With Cases, 8e: Hills, JonesAdnan Ahmad Al-NasserNo ratings yet

- Chapter Nine: Corporate Strategy: Horizontal Integration, Vertical Integration, and Strategic OutsourcingDocument22 pagesChapter Nine: Corporate Strategy: Horizontal Integration, Vertical Integration, and Strategic OutsourcingPromiti SarkerNo ratings yet

- Hill 8e Basic Ch10Document30 pagesHill 8e Basic Ch10Adnan Ahmad Al-NasserNo ratings yet

- Corporate-Level Strategy:: Formulating and Implementing Related and Unrelated DiversificationDocument48 pagesCorporate-Level Strategy:: Formulating and Implementing Related and Unrelated DiversificationPromiti SarkerNo ratings yet

- Chapter 9Document40 pagesChapter 9tracy.ptt1111No ratings yet

- Chapter Ten: Corporate-Level StrategyDocument34 pagesChapter Ten: Corporate-Level StrategyDrSivasundaram Anushan SvpnsscNo ratings yet

- Corporatestrpart 1Document15 pagesCorporatestrpart 1api-228377429No ratings yet

- Chapter Ten: Corporate-Level StrategyDocument31 pagesChapter Ten: Corporate-Level StrategyPulkit SinghalNo ratings yet

- Module 7 Corporate Level StrategiesDocument18 pagesModule 7 Corporate Level StrategiesAlberto LiNo ratings yet

- Unit-5: Business Planning in Different EnvironmentsDocument60 pagesUnit-5: Business Planning in Different EnvironmentsVishwa NatarajNo ratings yet

- Chap 10Document30 pagesChap 10manojbhatia1220No ratings yet

- Supplementing The Chosen Competitive Strategy: Strategic ManagementDocument49 pagesSupplementing The Chosen Competitive Strategy: Strategic Managementjunaid_kkhan2157No ratings yet

- Strategic Management An Integrated Approach 10th Edition Hill Solutions ManualDocument13 pagesStrategic Management An Integrated Approach 10th Edition Hill Solutions Manualequally.ungown.q5sgg100% (17)

- Corporate Strategy: Horizontal Integration, Vertical Integration, and Strategic OutsourcingDocument23 pagesCorporate Strategy: Horizontal Integration, Vertical Integration, and Strategic OutsourcingMinh KhoaNo ratings yet

- Strategic - Chap 7 NotesDocument7 pagesStrategic - Chap 7 NotesMirna Bachir Al KhatibNo ratings yet

- Chapter 5Document49 pagesChapter 5project manajement2013No ratings yet

- 6 Chosen Competitive Strategy-UpdatedDocument46 pages6 Chosen Competitive Strategy-UpdatedAmmarah KhanNo ratings yet

- VII. Strategic Options For Diversified Corporations Diversify Into Related or Unrelated Businesses Strategy and Resource Fit Corporate RestructuringDocument17 pagesVII. Strategic Options For Diversified Corporations Diversify Into Related or Unrelated Businesses Strategy and Resource Fit Corporate Restructuringgwyneth aquinoNo ratings yet

- Business Policy & Strategy: Unit 4Document73 pagesBusiness Policy & Strategy: Unit 4Harsh y.No ratings yet

- Acquisition & Mergers 2021Document40 pagesAcquisition & Mergers 2021Sasha MacNo ratings yet

- Integrating HR Strategy With Business Strategy: Strategic HRMDocument50 pagesIntegrating HR Strategy With Business Strategy: Strategic HRMTarun KumarNo ratings yet

- Unit 12 Strategic Option PDFDocument15 pagesUnit 12 Strategic Option PDFPradip HamalNo ratings yet

- Chapter 6Document34 pagesChapter 6然No ratings yet

- Increasing Profitability Through Diversification: Diversified CompanyDocument23 pagesIncreasing Profitability Through Diversification: Diversified CompanyTasfia Tamanna TiflaNo ratings yet

- ENT 202 - Note 9Document5 pagesENT 202 - Note 9Akinyemi IbrahimNo ratings yet

- Chapter 5Document44 pagesChapter 5እማሸንኮሮ በአማራNo ratings yet

- Corporate-Level Strategy: Related and Unrelated DiversificationDocument27 pagesCorporate-Level Strategy: Related and Unrelated DiversificationTanvir Ahmad ShourovNo ratings yet

- SM 7Document28 pagesSM 7Ayesha TariqNo ratings yet

- Growth Strategies For SMEsDocument82 pagesGrowth Strategies For SMEsLong BunNo ratings yet

- Advantages of DiversificationDocument4 pagesAdvantages of DiversificationbijayNo ratings yet

- Week 16 Business Strategy Lesson FilesDocument39 pagesWeek 16 Business Strategy Lesson Filessudo suNo ratings yet

- 2eIM LN Chapter6Document10 pages2eIM LN Chapter6Resful Islam RazuNo ratings yet

- Group 13 Quiz Ae 24Document4 pagesGroup 13 Quiz Ae 24Shane Aberie Villaroza AmidaNo ratings yet

- M1 MergersDocument15 pagesM1 MergersBhavanams RaoNo ratings yet

- Grand Strategies N Strategy Selection ModelsDocument42 pagesGrand Strategies N Strategy Selection ModelsJoshua LaryeaNo ratings yet

- Strategic Alliances and Collaborative PartnershipsDocument33 pagesStrategic Alliances and Collaborative PartnershipscgurbaniNo ratings yet

- Chapter 7 StrategicDocument6 pagesChapter 7 StrategicAnoraNo ratings yet

- 5 - Corporate Strategy - 2020Document72 pages5 - Corporate Strategy - 2020Md HimelNo ratings yet

- Corporate Level StrategyDocument55 pagesCorporate Level StrategyTeerra100% (1)

- Corporate Strategy - Plan For A Diversified CompanyDocument49 pagesCorporate Strategy - Plan For A Diversified CompanyRavi GuptaNo ratings yet

- Lecture 12 Strategies in Action Continuation Version 2Document45 pagesLecture 12 Strategies in Action Continuation Version 2Catherine LeroNo ratings yet

- Session XDocument31 pagesSession XJemmyEKONo ratings yet

- EsDocument94 pagesEsrose llarNo ratings yet

- Strategic ManagementDocument17 pagesStrategic ManagementKECEBONG ALBINONo ratings yet

- CH 8 Types of StrategyDocument10 pagesCH 8 Types of StrategyPrabhjot Kaur100% (1)

- Parenting (The Building of Corporate Synergies Through Resource Sharing andDocument8 pagesParenting (The Building of Corporate Synergies Through Resource Sharing andMalikNo ratings yet

- Michael Ceasar B. Abarca: BS Business Economics IIDocument14 pagesMichael Ceasar B. Abarca: BS Business Economics IIapi-26604549No ratings yet

- SFMDocument10 pagesSFMSoorajKrishnanNo ratings yet

- Team 5 Kristen Hodge Katelyn Reed Venessa Rodriguez Monica LongerDocument34 pagesTeam 5 Kristen Hodge Katelyn Reed Venessa Rodriguez Monica LongerSam DariNo ratings yet

- Strategic MGMT Lec Quiz 5Document3 pagesStrategic MGMT Lec Quiz 5Wennie NgNo ratings yet

- International Business 2Document12 pagesInternational Business 2K RajuNo ratings yet

- DiversificationDocument56 pagesDiversificationvarsha27k4586No ratings yet

- Corporate-Level Strategy:: What Business Are We In?Document5 pagesCorporate-Level Strategy:: What Business Are We In?Chitral PatelNo ratings yet

- The Profit Zone (Review and Analysis of Slywotzky and Morrison's Book)From EverandThe Profit Zone (Review and Analysis of Slywotzky and Morrison's Book)No ratings yet

- Strategic Analysis of Internal Environment of a Business OrganisationFrom EverandStrategic Analysis of Internal Environment of a Business OrganisationNo ratings yet

- Andrew Mayo Added Value From HR MetricsDocument28 pagesAndrew Mayo Added Value From HR MetricsVinita SeshadriNo ratings yet

- Plan Marketing (GB) 2019 - Mode de CompatibilitéDocument19 pagesPlan Marketing (GB) 2019 - Mode de CompatibilitéPhan J. NghiaNo ratings yet

- Strategic Management 10.2023Document69 pagesStrategic Management 10.2023minhkhanhwm2203No ratings yet

- Morgan Motor Company - 2Document10 pagesMorgan Motor Company - 2Md. Nazmul Huda100% (2)

- OM Batch-29 PPTDocument194 pagesOM Batch-29 PPTManjushaNo ratings yet

- Strategy ManagementDocument17 pagesStrategy Managementsubin100% (2)

- Quiz 3 Final Chapter 10 13Document4 pagesQuiz 3 Final Chapter 10 13Bea DatingNo ratings yet

- Hill Jones CH 7Document25 pagesHill Jones CH 7Tanvir Ahmad ShourovNo ratings yet

- Ashley Homestore AssignmentDocument13 pagesAshley Homestore Assignmenthtetwai yanNo ratings yet

- Competitive Advantage and Simultaneous Mutual Influences Between Information Tech Adoption and Service InnovationDocument29 pagesCompetitive Advantage and Simultaneous Mutual Influences Between Information Tech Adoption and Service InnovationJoão F.No ratings yet

- Task 1Document8 pagesTask 1PataviNo ratings yet

- What Is Vertical IntegrationDocument5 pagesWhat Is Vertical IntegrationNyadroh Clement MchammondsNo ratings yet

- BUSS 420 Strategic Management NotesDocument101 pagesBUSS 420 Strategic Management NotesKelvin TetoNo ratings yet

- Aligning Human Resources and Business Strategy 3rd Edition by Linda Holbeche - Bibis - IrDocument509 pagesAligning Human Resources and Business Strategy 3rd Edition by Linda Holbeche - Bibis - IrahnisNo ratings yet

- BusinessPolicy ZahidRiaz24Document33 pagesBusinessPolicy ZahidRiaz24he20003009No ratings yet

- Starbucks 4Document59 pagesStarbucks 4Amirul Irfan100% (3)

- Strategic ManagementDocument96 pagesStrategic ManagementMohit KumarNo ratings yet

- Effect of Strategic Management On The Performance of SmallDocument12 pagesEffect of Strategic Management On The Performance of SmallBekam BekeeNo ratings yet

- Asante 2018 The-Impact-of-a-Sustainable-Competitive-Advantage-on-a-Firm's-PerformanceDocument17 pagesAsante 2018 The-Impact-of-a-Sustainable-Competitive-Advantage-on-a-Firm's-PerformanceayuNo ratings yet

- Lafarge CaseDocument17 pagesLafarge Casesabwyw80% (5)

- Strategic Management: T. Hani Handoko, PH.DDocument5 pagesStrategic Management: T. Hani Handoko, PH.DAgeng Cahya Kurnia PutriNo ratings yet

- Strategic ManagenmentDocument51 pagesStrategic ManagenmentRaushni BoseNo ratings yet

- Strategic Management AnalysisDocument18 pagesStrategic Management Analysisfatemah zahid100% (1)

- Strategic Customer Management: Designing A Profitable Future For Your Sales OrganizationDocument10 pagesStrategic Customer Management: Designing A Profitable Future For Your Sales OrganizationellasnowNo ratings yet

- Delivering Desired Outcomes Efficiently:: The Creative Key T O Competitive StrategyDocument19 pagesDelivering Desired Outcomes Efficiently:: The Creative Key T O Competitive StrategyOrlando RamosNo ratings yet

- Business Innovation Design White PaperDocument35 pagesBusiness Innovation Design White PaperBusiness Innovation by Design100% (2)

5 SM - Corp - Strategy Tom Tat

5 SM - Corp - Strategy Tom Tat

Uploaded by

Mỹ VõOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

5 SM - Corp - Strategy Tom Tat

5 SM - Corp - Strategy Tom Tat

Uploaded by

Mỹ VõCopyright:

Available Formats

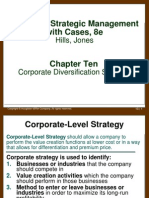

Corporate-Level Strategy should allow a company, or its

business units, to perform the value-creation functions at lower cost

or in a way that allows for differentiation and premium price.

Corporate strategy is used to identify:

1. Businesses or industries that the company should

compete in

2. Value creation activities that the company should

perform in those businesses

3. Method to enter or leave businesses or industries

in order to maximize its long-run

profitability

Companies must adopt a long-term perspective

Consider how changes in the industry and its products,

technology, customers, and competitors will affect its

current business model and future strategies.

Copyright © Houghton Mifflin Company. All rights reserved. 9|2

Corporate-Level Strategy:

The Multi-Business Model

A company’s corporate-level strategies

should be chosen to promote the success of

a company’s business model – and to allow

it to achieve a sustainable competitive

advantage at the business level.

A multi-business company must construct its

business model at two levels:

1. Business models and strategies

for each business unit or division in every industry in

which it competes

2. Higher-level multi-business model that

justifies its entry into different businesses and industries

Copyright © Houghton Mifflin Company. All rights reserved. 9|3

Corporate Strategy asks

Two Questions

1.Should we compete in our current

business by engaging in closely-related

businesses?

2.Should we compete in new related or

unrelated businesses ?

Copyright © Houghton Mifflin Company. All rights reserved. 9|4

Corporate Strategy

Core Challenge of Corporate Strategy:

How do we manage diversity?

How do we manage different

businesses?

(Different businesses may compete in

different environments and require

different resources and capabilities)

Copyright © Houghton Mifflin Company. All rights reserved. 9|5

Corporate Strategy asks

Two Questions

1.Should we compete in our current

business by engaging in closely-related

businesses?

2.Should we compete in new related or

unrelated businesses ?

Copyright © Houghton Mifflin Company. All rights reserved. 9|6

Core question: Relatedness

Closely-related = directly related to a

firm’s core business

• Suppliers

• Buyers

• Competitors

Related: shares some strategic

characteristic with core business

• Value chain resources, capabilities

Unrelated: no logical or complementary

relationship to core business

Copyright © Houghton Mifflin Company. All rights reserved. 9|7

Repositioning and Redefining

A Company’s Business Model

Corporate-level strategies are primarily directed

toward improving a company’s competitive advantage

and profitability in its present business or product line:

1. Horizontal Integration

• The process of acquiring or merging with industry

competitors

2. Vertical Integration

• Expanding operations backward into an industry that

produces inputs for the company or forward into an

industry that distributes the company’s products

3. Strategic Outsourcing

• Letting some value creation activities within a business

be performed by an independent entity

Copyright © Houghton Mifflin Company. All rights reserved. 9|8

Related Business Diversification

1. Horizontal Integration

2. Vertical Integration

3. Strategic Outsourcing

Copyright © Houghton Mifflin Company. All rights reserved. 9|9

Horizontal Integration

Single-Industry Strategy

Horizontal Integration is the process of acquiring or merging

with industry competitors in an effort to achieve the

competitive advantages that come with large scale and scope.

Staying inside a single industry

allows a company to:

Focus resources

Its total managerial,

technological, financial and functional

resources and capabilities are

devoted to competing

successfully in one area.

‘Stick to its knitting’

Company stays focused on what it does best,

rather than entering new industries where its existing

resources

Copyright and capabilities

© Houghton Mifflin Company. All rights reserved. add little value. 9 | 10

Benefits of

Horizontal Integration

Profits and profitability increase when horizontal

integration:

1. Lowers the cost structure

• Creates increasing economies of scale

• Reduces the duplication of resources between two companies

2. Increases product differentiation

• Product bundling – broader range at single combined price

• Total solution – saving customers time and money

• Cross-selling – leveraging established customer relationships

3. Replicates the business model

• In new market segments within same industry

4. Reduces industry rivalry

• Eliminate excess capacity in an industry

• Easier to implement tacit price coordination among rivals

5. Increases bargaining power

• Increased market power over suppliers and buyers

• Gain greater control

Copyright © Houghton Mifflin Company. All rights reserved. 9 | 11

Problems with

Horizontal Integration

A wealth of data suggests that the majority of mergers

and acquisitions DO NOT create value and that many

may actually DESTROY value.

Implementing a horizontal integration is not an easy

task.

• Problems associated with merging very different company

cultures

• High management turnover in the acquired company when

the acquisition is a hostile one

• Tendency of managers to overestimate the benefits to be had

in the merger

• Tendency of managers to underestimate the problems

involved in merging their operations

The merger may be blocked if merger is perceived to:

• Create a dominant competitor

• Create too much industry consolidation

• Have the potential for future abuse of market power

Copyright © Houghton Mifflin Company. All rights reserved. 9 | 12

Related Business Diversification

1. Horizontal Integration

2. Vertical Integration

3. Strategic Outsourcing

Copyright © Houghton Mifflin Company. All rights reserved. 9 | 13

Vertical Integration

Entering New Industries

A company may expands its operations backward into

industries that produces inputs to its products or forward

into industries that utilize, distribute or sell it products.

Backward Vertical Integration

• Company expands its operations into an industry

that produces inputs to the company’s products.

Forward Vertical Integration

• Company expands into an industry that uses,

distributes, or sells the company’s products.

Full Integration

• Company produces all of a particular input

from its own operations.

• Disposes of all of its completed products through its own outlets.

Taper Integration

• In addition to company-owned suppliers, the company will also use

other suppliers for inputs or independent outlets in addition to

company-owned outlets.

Copyright © Houghton Mifflin Company. All rights reserved. 9 | 14

Increasing Profitability Through

Vertical Integration

A company pursues vertical integration to strengthen

the business model of its original or core business

or to improve its competitive position:

1. Facilitates investments in efficiency-enhancing

specialized assets

• Allows company to lower the cost structure or

• Better differentiate its products

2. Enhances or protects product quality

• To strengthen its differentiation advantage through either

forward or backward integration

3. Results in improved scheduling

• Makes it easier and more cost-effective to plan, coordinate,

and schedule the transfer of product within the value-added

chain

• Enables a company to respond better to changes in demand

Copyright © Houghton Mifflin Company. All rights reserved. 9 | 15

Problems with

Vertical Integration

Companies may disintegrate or exit industries adjacent

to the industry value chain when encountering

disadvantages from the vertical integration:

Cost structure is increasing.

• Company-owned suppliers develop a higher cost structure

than those of the independent suppliers

• Bureaucratic costs of solving transaction difficulties

The technology is changing fast.

• Vertical integration may lock into old or inefficient technology

• Prevent company from changing to a new technology that

could strengthen the business model

Demand is unpredictable.

Creates risk in vertical integration investments.

Vertical integration can weaken business model when:

• Company-owned suppliers lack incentive to reduce costs

• Changing demand or technology reduces ability to be competitive

Copyright © Houghton Mifflin Company. All rights reserved. 9 | 16

Alternatives to Vertical Integration:

Cooperative Relationships

Strategic Alliances are long-term agreement between two or

more companies to jointly develop new products or processes

that benefit all companies concerned.

Short-term contracts and competitive bidding

• May signal a company’s lack of commitment to its supplier

Strategic alliances and long-term contracting

• Enables creation of a stable long-term relationship

• Becomes a substitute for vertical integration

• Avoids the problems of having to manage a company located in an

adjacent industry

Copyright © Houghton Mifflin Company. All rights reserved. 9 | 17

Related Business Diversification

1. Horizontal Integration

2. Vertical Integration

3. Strategic Outsourcing

Copyright © Houghton Mifflin Company. All rights reserved. 9 | 18

Strategic Outsourcing

Strategic Outsourcing allows one or more of a company’s

value-chain activities or functions to be performed by

independent specialized companies that focus all their

skills and knowledge on just one kind of activity.

Company is choosing to focus on a fewer

number of value-creation activities

In order to strengthen its business model

Companies typically focus on noncore or

nonstrategic activities

In order to determine if they can be performed more

effectively and efficiently by independent specialized

companies

Virtual Corporation

Describes companies that have pursued extensive

strategic outsourcing

Copyright © Houghton Mifflin Company. All rights reserved. 9 | 19

Strategic Outsourcing of Primary

Value Creation Functions

Figure 9.4

Copyright © Houghton Mifflin Company. All rights reserved. 9 | 20

Benefits of Outsourcing

1. Reducing the cost structure

• The specialist company cost is less than what it would cost

to perform the activity internally.

2. Enhanced differentiation

• The quality of the activity performed by the specialist is

greater than if the activity were performed by the company.

3. Focus on the core business

• Distractions are removed.

• The company can focus attention and resources on

activities important for value creation and competitive

advantage.

Strategic outsourcing may be detrimental when:

• Holdup – company becomes too dependent on specialist provider

• Loss of information – company loses important customer contact or

competitive information

Copyright © Houghton Mifflin Company. All rights reserved. 9 | 21

Related Business Diversification

1. Horizontal Integration

2. Vertical Integration

3. Strategic Outsourcing

Copyright © Houghton Mifflin Company. All rights reserved. 9 | 22

Corporate Strategy asks

Two Questions

1.Should we compete in our current

business by engaging in closely-related

businesses?

2.Should we compete in new related or

unrelated businesses ?

Copyright © Houghton Mifflin Company. All rights reserved. 9 | 23

Expanding

Beyond a Single Industry

Staying inside a single industry allows a company to:

• Focus its resources ‘Stick to its knitting’

BUT a company’s fortunes are tied closely to

the profitability of its original industry:

Can be dangerous if the industry matures and goes into

decline

May be missing the opportunity to leverage their

distinctive competencies in new industries

Tendency to rest on their laurels and not engage in

constant learning

To stay agile, companies must leverage –

find new ways to take advantage of their distinctive

competencies and core business model in new

markets and industries.

Copyright © Houghton Mifflin Company. All rights reserved. 10 | 24

Corporate-Level Strategy

of Diversification

Diversification Strategy is the company’s decision to

enter one or more new industries (that are distinct from

its established operations) to take advantage of its

existing distinctive competencies and business model.

Types of diversification:

Related diversification

Unrelated diversification

Methods to implement a

diversification

strategy:

Internal new ventures

Acquisitions

Joint ventures

Copyright © Houghton Mifflin Company. All rights reserved. 10 | 25

A Company as a Portfolio of

Distinctive Competencies

Reconceptualize the company as a

portfolio of distinctive

competencies . . . rather than a portfolio

of products:

Consider how those competencies

might be leveraged to create

opportunities in new industries

Existing competencies versus new

competencies that would need to be

developed

Existing industries in which a

company competes versus new

industries

Copyright © Houghton Mifflin Company. All rights reserved. 10 | 26

Establishing a

Competency Agenda

Figure 10.1

Source: Reprinted by permission of Harvard Business School Press. From Competing for the Future: Breakthrough Strategies for

Seizing Control of Your Industry and Creating the Markets of Tomorrow by Gary Hamel and C. K. Prahalad, Boston, MA. Copyright ©

1994 by Gary Hamel and C. K. Prahalad. All rights reserved.

Copyright © Houghton Mifflin Company. All rights reserved. 10 | 27

Increasing Profitability

Through Diversification

A diversified company can create value by:

Transferring competencies among

existing businesses

Leveraging competencies

to create new businesses

Sharing resources

to realize economies of scope

Using product bundling

Managing rivalry by

using diversification as a means in one or more industries

Exploiting general organizational competencies that

enhance performance within all business units

Managers often consider diversification when their

company is generating free cash flow – with resources in

excess of those needed to maintain competitive advantage.

Copyright © Houghton Mifflin Company. All rights reserved. 10 | 28

2 Types of Diversification

Related diversification

Entry into a new business activity in a different industry that:

• Is related to a company’s existing business activity or

activities and

• Has commonalities between one or more components of

each activity’s value chain

Based on transferring and leveraging competencies, sharing

resources, and bundling products

Unrelated diversification

Entry into industries that have no obvious connection to any

of a company’s value-chain activities in its present industry or

industries

Based on using only general organizational competencies to

increase profitability of each business unit

Copyright © Houghton Mifflin Company. All rights reserved. 10 | 29

“Fit between a parent and its

businesses is a two-edged sword:

a good fit can create value,

a bad one can destroy it.”

- Andrew Campbell,

Michael Gould &

Marcus Alexander

Copyright © Houghton Mifflin Company. All rights reserved. 10 | 30

Commonalities Between Value

Chains of Three Business Units

Figure 10.4

Copyright © Houghton Mifflin Company. All rights reserved. 10 | 31

Disadvantages and

Limits of Diversification

Conditions that can make diversification

disadvantageous:

1. Changing Industry and Firm-Specific Conditions

• Future success of this strategy is hard to predict.

• Over time, changing situations may require businesses

to be divested.

2. Diversification for the Wrong Reasons

• Must have clear vision as to how value will be created.

• Extensive diversification tends to reduce rather than improve

profitability.

3. Bureaucratic Costs of Diversification

• Costs are a function of the number of business units in a

company’s portfolio, and the

• Extent to which coordination is required to gain the benefits.

Copyright © Houghton Mifflin Company. All rights reserved. 10 | 32

Coordination Among

Related Business Units

Figure 10.5

Copyright © Houghton Mifflin Company. All rights reserved. 10 | 33

Choosing a Strategy

The choice of strategy depends on a comparison of the

benefits of each strategy versus the cost of pursuing it:

Related diversification

• When company’s competencies can be applied across a

greater number of industries and

• Company has superior capabilities to keep bureaucratic

costs under control

Unrelated diversification

• When functional competencies have few useful applications

across industries and

• Company has good organizational design skills to build

distinctive competencies

Web of corporate level strategy

• May pursue both related and unrelated diversification

• As well as other strategies that improve long-term profitability

Copyright © Houghton Mifflin Company. All rights reserved. 10 | 34

Sony’s Web of

Corporate-Level Strategy

Figure 10.6

Copyright © Houghton Mifflin Company. All rights reserved. 10 | 35

Diversification That

Dissipates Value

Diversifying to pool risks

• Stockholders can diversify their own portfolios at lower costs

than the company can.

• This represents an unproductive use of resources as profits

can be returned to shareholders as dividends.

• Research suggests that corporate diversification is not an

effective way to pool risks.

Diversifying to achieve greater growth

• Growth on its own does not create value.

• Business cycles of different industries are inherently difficult

to predict.

Based on a large number of academic studies:

Extensive diversification tends to reduce,

rather than improve, company profitability.

Copyright © Houghton Mifflin Company. All rights reserved. 10 | 36

Entry Strategies to

Implement Multibusiness Model

Various entry strategies may be employed based on

the company’s competencies and capabilities:

Internal New Ventures

• Company has a set of valuable competencies in its existing

businesses.

• Competences leveraged or recombined to enter new business

areas.

Acquisitions

• Company lacks important competencies to compete in an area.

• Company can purchase an incumbent company that has those

competencies at a reasonable price.

Joint Ventures

• Company can increase the probability of success by teaming

up with another company with complementary skills.

• Joint ventures are preferred when risks and costs of setting up

a new business unit are more than company can assume.

Copyright © Houghton Mifflin Company. All rights reserved. 10 | 37

Pitfalls of New Ventures

Scale of entry

• Large-scale entry is initially

more expensive than small-

scale entry, but it brings

higher returns in the long run.

Commercialization

• Technological possibilities

should not overshadow

market needs and opportunities.

Poor implementation

• Demands on cash flow

• Need clear strategic objectives

• Anticipate time and costs

Copyright © Houghton Mifflin Company. All rights reserved. 10 | 38

Scale of Entry and Profitability

Figure 10.7

Copyright © Houghton Mifflin Company. All rights reserved. 10 | 39

Guidelines for Successful

Internal New Venturing

Structured approach to managing internal

new venturing:

Research aimed at advancing basic science

and technology

Development research aimed at finding and

refining commercial applications for the

technology

Foster close links between R&D and

marketing; between R&D and manufacturing

Selection process for choosing ventures

Monitor progress

Copyright © Houghton Mifflin Company. All rights reserved. 10 | 40

The Attractions of Acquisition

Acquisitions are the principal strategy

used to implement horizontal integration:

Used to achieve diversification when the

company lacks important competencies

Enable a company to move quickly

Perceived as less risky than internal new

ventures

An attractive way to enter a new industry

that is protected by high barriers to entry

Copyright © Houghton Mifflin Company. All rights reserved. 10 | 41

Acquisition Pitfalls

There is ample evidence that many acquisitions fail to

create value or to realize their anticipated benefits:

Integrating the acquired company

• Difficulty in integrating value-chain and management activities

• High management and employee turnover in acquired

company

Overestimating the economic benefits

• Overestimate the competitive advantages and value-added that

can be derived from the acquisition

• Pay too much for the target company

The expense of acquisitions

• Premium paid for publicly traded companies

• Premium cancels out the prospective value-creating gains

Inadequate preacquisition screening

• Weaknesses of acquisitions’ business model are not clear

Copyright © Houghton Mifflin Company. All rights reserved. 10 | 42

Guidelines for

Successful Acquisition

Target identification and preacquisition

screening for:

1. Financial position

2. Distinctive competencies and competitive advantage

3. Changing industry boundaries

4. Management capabilities

5. Corporate culture

Bidding strategy

• Avoid hostile takeovers and speculative bidding.

• Encourage friendly takeover with amicable merger.

Integration

• Eliminate duplication of facilities and functions.

• Divest unwanted business units included in acquisition.

Learning from experience

• Conduct post-acquisition audits.

Copyright © Houghton Mifflin Company. All rights reserved. 10 | 43

Joint Ventures

Attractions:

Helps avoid the risks and costs of building a new

operation from the ground floor

Teaming with another company that has

complementary skills and assets may increase the

probability of success

Pitfalls:

Requires the sharing of profits if the new business

succeeds

Venture partners must share control – conflicts on

how to run the joint venture can cause failure

Run the risk of giving critical know-how away to

joint venture partner

Copyright © Houghton Mifflin Company. All rights reserved. 10 | 44

“Growth does not always lead a

business to build on success.

All too often it converts a highly

successful business into a

mediocre large business.”

- Richard Branson

“The corporate strategies of

most companies have

dissipated instead of created

shareholder value.” - Michael Porter

Copyright © Houghton Mifflin Company. All rights reserved. 10 | 45

What if diversification doesn’t work?

Restructuring: alter portfolio by

1. Divesting businesses

2. Exiting industries

Restructuring is the process of divesting businesses and

exiting industries to focus on core distinctive competencies

in order to increase company profitability.

Copyright © Houghton Mifflin Company. All rights reserved. 9 | 46

Restructuring

Why restructure?

• Diversification discount: investors see highly

diversified companies as less attractive

» Complexity and lack of transparency in financial

statements

» Too much diversification

» Diversification for the wrong reasons

• Response to failed acquisitions

• Innovations in strategic management have

diminished the advantages of vertical integration

or diversification

Copyright © Houghton Mifflin Company. All rights reserved. 10 | 47

You might also like

- HBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)From EverandHBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)Rating: 4.5 out of 5 stars4.5/5 (25)

- English For Academic and Professional Purposes: Quarter 1Document22 pagesEnglish For Academic and Professional Purposes: Quarter 1Ramwen Jamero100% (1)

- A Grade Ruchi Copy 2Document9 pagesA Grade Ruchi Copy 2Poorni PereraNo ratings yet

- Corporate Level StrategyDocument19 pagesCorporate Level StrategyMargaretta LiangNo ratings yet

- Babette E Bensoussan Craig S Fleisher Analysi B-ODocument274 pagesBabette E Bensoussan Craig S Fleisher Analysi B-OAngela Simoes67% (3)

- Becker, B. E., & Huselid, M. A. 1998. High Performance Work PDFDocument25 pagesBecker, B. E., & Huselid, M. A. 1998. High Performance Work PDFÁtila de AssisNo ratings yet

- Horizontal Integration and Vertical IntegrationDocument17 pagesHorizontal Integration and Vertical IntegrationAmit Jaglan100% (1)

- Chapter Nine: Strategy at The Corporate LevelDocument22 pagesChapter Nine: Strategy at The Corporate LevelTanim TarakNo ratings yet

- Theory of Strategic Management With Cases, 8e: Hills, JonesDocument17 pagesTheory of Strategic Management With Cases, 8e: Hills, JonesAdnan Ahmad Al-NasserNo ratings yet

- Chapter Nine: Corporate Strategy: Horizontal Integration, Vertical Integration, and Strategic OutsourcingDocument22 pagesChapter Nine: Corporate Strategy: Horizontal Integration, Vertical Integration, and Strategic OutsourcingPromiti SarkerNo ratings yet

- Hill 8e Basic Ch10Document30 pagesHill 8e Basic Ch10Adnan Ahmad Al-NasserNo ratings yet

- Corporate-Level Strategy:: Formulating and Implementing Related and Unrelated DiversificationDocument48 pagesCorporate-Level Strategy:: Formulating and Implementing Related and Unrelated DiversificationPromiti SarkerNo ratings yet

- Chapter 9Document40 pagesChapter 9tracy.ptt1111No ratings yet

- Chapter Ten: Corporate-Level StrategyDocument34 pagesChapter Ten: Corporate-Level StrategyDrSivasundaram Anushan SvpnsscNo ratings yet

- Corporatestrpart 1Document15 pagesCorporatestrpart 1api-228377429No ratings yet

- Chapter Ten: Corporate-Level StrategyDocument31 pagesChapter Ten: Corporate-Level StrategyPulkit SinghalNo ratings yet

- Module 7 Corporate Level StrategiesDocument18 pagesModule 7 Corporate Level StrategiesAlberto LiNo ratings yet

- Unit-5: Business Planning in Different EnvironmentsDocument60 pagesUnit-5: Business Planning in Different EnvironmentsVishwa NatarajNo ratings yet

- Chap 10Document30 pagesChap 10manojbhatia1220No ratings yet

- Supplementing The Chosen Competitive Strategy: Strategic ManagementDocument49 pagesSupplementing The Chosen Competitive Strategy: Strategic Managementjunaid_kkhan2157No ratings yet

- Strategic Management An Integrated Approach 10th Edition Hill Solutions ManualDocument13 pagesStrategic Management An Integrated Approach 10th Edition Hill Solutions Manualequally.ungown.q5sgg100% (17)

- Corporate Strategy: Horizontal Integration, Vertical Integration, and Strategic OutsourcingDocument23 pagesCorporate Strategy: Horizontal Integration, Vertical Integration, and Strategic OutsourcingMinh KhoaNo ratings yet

- Strategic - Chap 7 NotesDocument7 pagesStrategic - Chap 7 NotesMirna Bachir Al KhatibNo ratings yet

- Chapter 5Document49 pagesChapter 5project manajement2013No ratings yet

- 6 Chosen Competitive Strategy-UpdatedDocument46 pages6 Chosen Competitive Strategy-UpdatedAmmarah KhanNo ratings yet

- VII. Strategic Options For Diversified Corporations Diversify Into Related or Unrelated Businesses Strategy and Resource Fit Corporate RestructuringDocument17 pagesVII. Strategic Options For Diversified Corporations Diversify Into Related or Unrelated Businesses Strategy and Resource Fit Corporate Restructuringgwyneth aquinoNo ratings yet

- Business Policy & Strategy: Unit 4Document73 pagesBusiness Policy & Strategy: Unit 4Harsh y.No ratings yet

- Acquisition & Mergers 2021Document40 pagesAcquisition & Mergers 2021Sasha MacNo ratings yet

- Integrating HR Strategy With Business Strategy: Strategic HRMDocument50 pagesIntegrating HR Strategy With Business Strategy: Strategic HRMTarun KumarNo ratings yet

- Unit 12 Strategic Option PDFDocument15 pagesUnit 12 Strategic Option PDFPradip HamalNo ratings yet

- Chapter 6Document34 pagesChapter 6然No ratings yet

- Increasing Profitability Through Diversification: Diversified CompanyDocument23 pagesIncreasing Profitability Through Diversification: Diversified CompanyTasfia Tamanna TiflaNo ratings yet

- ENT 202 - Note 9Document5 pagesENT 202 - Note 9Akinyemi IbrahimNo ratings yet

- Chapter 5Document44 pagesChapter 5እማሸንኮሮ በአማራNo ratings yet

- Corporate-Level Strategy: Related and Unrelated DiversificationDocument27 pagesCorporate-Level Strategy: Related and Unrelated DiversificationTanvir Ahmad ShourovNo ratings yet

- SM 7Document28 pagesSM 7Ayesha TariqNo ratings yet

- Growth Strategies For SMEsDocument82 pagesGrowth Strategies For SMEsLong BunNo ratings yet

- Advantages of DiversificationDocument4 pagesAdvantages of DiversificationbijayNo ratings yet

- Week 16 Business Strategy Lesson FilesDocument39 pagesWeek 16 Business Strategy Lesson Filessudo suNo ratings yet

- 2eIM LN Chapter6Document10 pages2eIM LN Chapter6Resful Islam RazuNo ratings yet

- Group 13 Quiz Ae 24Document4 pagesGroup 13 Quiz Ae 24Shane Aberie Villaroza AmidaNo ratings yet

- M1 MergersDocument15 pagesM1 MergersBhavanams RaoNo ratings yet

- Grand Strategies N Strategy Selection ModelsDocument42 pagesGrand Strategies N Strategy Selection ModelsJoshua LaryeaNo ratings yet

- Strategic Alliances and Collaborative PartnershipsDocument33 pagesStrategic Alliances and Collaborative PartnershipscgurbaniNo ratings yet

- Chapter 7 StrategicDocument6 pagesChapter 7 StrategicAnoraNo ratings yet

- 5 - Corporate Strategy - 2020Document72 pages5 - Corporate Strategy - 2020Md HimelNo ratings yet

- Corporate Level StrategyDocument55 pagesCorporate Level StrategyTeerra100% (1)

- Corporate Strategy - Plan For A Diversified CompanyDocument49 pagesCorporate Strategy - Plan For A Diversified CompanyRavi GuptaNo ratings yet

- Lecture 12 Strategies in Action Continuation Version 2Document45 pagesLecture 12 Strategies in Action Continuation Version 2Catherine LeroNo ratings yet

- Session XDocument31 pagesSession XJemmyEKONo ratings yet

- EsDocument94 pagesEsrose llarNo ratings yet

- Strategic ManagementDocument17 pagesStrategic ManagementKECEBONG ALBINONo ratings yet

- CH 8 Types of StrategyDocument10 pagesCH 8 Types of StrategyPrabhjot Kaur100% (1)

- Parenting (The Building of Corporate Synergies Through Resource Sharing andDocument8 pagesParenting (The Building of Corporate Synergies Through Resource Sharing andMalikNo ratings yet

- Michael Ceasar B. Abarca: BS Business Economics IIDocument14 pagesMichael Ceasar B. Abarca: BS Business Economics IIapi-26604549No ratings yet

- SFMDocument10 pagesSFMSoorajKrishnanNo ratings yet

- Team 5 Kristen Hodge Katelyn Reed Venessa Rodriguez Monica LongerDocument34 pagesTeam 5 Kristen Hodge Katelyn Reed Venessa Rodriguez Monica LongerSam DariNo ratings yet

- Strategic MGMT Lec Quiz 5Document3 pagesStrategic MGMT Lec Quiz 5Wennie NgNo ratings yet

- International Business 2Document12 pagesInternational Business 2K RajuNo ratings yet

- DiversificationDocument56 pagesDiversificationvarsha27k4586No ratings yet

- Corporate-Level Strategy:: What Business Are We In?Document5 pagesCorporate-Level Strategy:: What Business Are We In?Chitral PatelNo ratings yet

- The Profit Zone (Review and Analysis of Slywotzky and Morrison's Book)From EverandThe Profit Zone (Review and Analysis of Slywotzky and Morrison's Book)No ratings yet

- Strategic Analysis of Internal Environment of a Business OrganisationFrom EverandStrategic Analysis of Internal Environment of a Business OrganisationNo ratings yet

- Andrew Mayo Added Value From HR MetricsDocument28 pagesAndrew Mayo Added Value From HR MetricsVinita SeshadriNo ratings yet

- Plan Marketing (GB) 2019 - Mode de CompatibilitéDocument19 pagesPlan Marketing (GB) 2019 - Mode de CompatibilitéPhan J. NghiaNo ratings yet

- Strategic Management 10.2023Document69 pagesStrategic Management 10.2023minhkhanhwm2203No ratings yet

- Morgan Motor Company - 2Document10 pagesMorgan Motor Company - 2Md. Nazmul Huda100% (2)

- OM Batch-29 PPTDocument194 pagesOM Batch-29 PPTManjushaNo ratings yet

- Strategy ManagementDocument17 pagesStrategy Managementsubin100% (2)

- Quiz 3 Final Chapter 10 13Document4 pagesQuiz 3 Final Chapter 10 13Bea DatingNo ratings yet

- Hill Jones CH 7Document25 pagesHill Jones CH 7Tanvir Ahmad ShourovNo ratings yet

- Ashley Homestore AssignmentDocument13 pagesAshley Homestore Assignmenthtetwai yanNo ratings yet

- Competitive Advantage and Simultaneous Mutual Influences Between Information Tech Adoption and Service InnovationDocument29 pagesCompetitive Advantage and Simultaneous Mutual Influences Between Information Tech Adoption and Service InnovationJoão F.No ratings yet

- Task 1Document8 pagesTask 1PataviNo ratings yet

- What Is Vertical IntegrationDocument5 pagesWhat Is Vertical IntegrationNyadroh Clement MchammondsNo ratings yet

- BUSS 420 Strategic Management NotesDocument101 pagesBUSS 420 Strategic Management NotesKelvin TetoNo ratings yet

- Aligning Human Resources and Business Strategy 3rd Edition by Linda Holbeche - Bibis - IrDocument509 pagesAligning Human Resources and Business Strategy 3rd Edition by Linda Holbeche - Bibis - IrahnisNo ratings yet

- BusinessPolicy ZahidRiaz24Document33 pagesBusinessPolicy ZahidRiaz24he20003009No ratings yet

- Starbucks 4Document59 pagesStarbucks 4Amirul Irfan100% (3)

- Strategic ManagementDocument96 pagesStrategic ManagementMohit KumarNo ratings yet

- Effect of Strategic Management On The Performance of SmallDocument12 pagesEffect of Strategic Management On The Performance of SmallBekam BekeeNo ratings yet

- Asante 2018 The-Impact-of-a-Sustainable-Competitive-Advantage-on-a-Firm's-PerformanceDocument17 pagesAsante 2018 The-Impact-of-a-Sustainable-Competitive-Advantage-on-a-Firm's-PerformanceayuNo ratings yet

- Lafarge CaseDocument17 pagesLafarge Casesabwyw80% (5)

- Strategic Management: T. Hani Handoko, PH.DDocument5 pagesStrategic Management: T. Hani Handoko, PH.DAgeng Cahya Kurnia PutriNo ratings yet

- Strategic ManagenmentDocument51 pagesStrategic ManagenmentRaushni BoseNo ratings yet

- Strategic Management AnalysisDocument18 pagesStrategic Management Analysisfatemah zahid100% (1)

- Strategic Customer Management: Designing A Profitable Future For Your Sales OrganizationDocument10 pagesStrategic Customer Management: Designing A Profitable Future For Your Sales OrganizationellasnowNo ratings yet

- Delivering Desired Outcomes Efficiently:: The Creative Key T O Competitive StrategyDocument19 pagesDelivering Desired Outcomes Efficiently:: The Creative Key T O Competitive StrategyOrlando RamosNo ratings yet

- Business Innovation Design White PaperDocument35 pagesBusiness Innovation Design White PaperBusiness Innovation by Design100% (2)