Professional Documents

Culture Documents

3 The Accounting Equation

3 The Accounting Equation

Uploaded by

Andruey Espiritu0 ratings0% found this document useful (0 votes)

15 views35 pagesCopyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

0 ratings0% found this document useful (0 votes)

15 views35 pages3 The Accounting Equation

3 The Accounting Equation

Uploaded by

Andruey EspirituCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

You are on page 1of 35

Basic Accounting

The Accounting Equation

Instructor: Ms. Mara Mae E. Gutierrez, RCA, MICB

Learning Outcomes

At the end of the lesson, you should be able to:

solve problems applying the accounting equation

define, identify, and classify accounts according to the

five major types

Accounts

The accounting system uses Accounts to keep track

of information. Here is a simple way to understand

what accounts are. In your office, you usually keep a

filing cabinet. In this filing cabinet, you have

multiple file folders. Each file folder gives

information for a specific topic only.

Accounts

For example you may have a file for utility bills,

phone bills, employee wages, bank deposits, bank

loans, etc. A Chart of Accounts is like a filing

cabinet. Each account in this chart is like a file

folder. Accounts keep track of money spent, earned,

owned, or owed. Each account keeps track of a

specific topic only.

Assets

An Asset is a property of value owned by a

business. Physical objects and intangible rights such

as cash,

cash accounts receivable,

receivable merchandise,

merchandise

machinery,

machinery buildings,

buildings and inventories for sale are

common examples of business assets as they have

economic value for the owner. Accounts receivable

is an unwritten promise by a client to pay later for

goods sold or services rendered.

Assets

Assets are generally divided into three main groups:

Current

Fixed

Intangible

Current Assets

Refer to cash and other items that can be turned back

into cash within a year are considered a current asset

such as:

Cash includes funds in checking and savings accounts.

Marketable Securities such as stocks, bonds, and similar

investments.

Accounts Receivables which are amounts due from

customers.

Notes Receivables which are promissory notes by

customers to pay a definite sum plus interest on a certain

date at a certain place.

Current Assets

Inventories such as raw materials or merchandise on

hand.

Prepaid Expenses are supplies on hand and services paid

for but not yet used (e.g. prepaid insurance)

Fixed Assets

Refer to tangible assets that are used in the business.

Commonly, fixed assets are long-lived resources that

are used in the production of finished goods such as:

Buildings

Land

Equipment

Furniture

Fixed Assets

Certain long-lived assets such as machinery, cars, or

equipment slowly wear out or become obsolete. The

cost of such as assets is systematically spread over

its estimated useful life. This process is called

depreciation if the asset involved is a tangible

object such as a building or amortization if the

asset involved is an intangible asset such as a patent.

Of the different kinds of fixed assets, only land does

not depreciate.

Intangible Assets

Refers to assets that are not physical assets like

equipment and machinery but are valuable because

they can be licensed or sold outright to others, such

as:

Copyrights

Patents

Trademarks

Goodwill

Goodwill is not entered as an asset unless the business has been

purchased. It is the least tangible of all the assets because it is the

price a purchaser is willing to pay for a company's reputation

especially in its relations with customers.

Liabilities

A Liability is a legal obligation of a business to pay

a debt. Debt can be paid with money, goods, or

services, but is usually paid in cash. The most

common liabilities are notes payable and accounts

payable.

payable

Accounts payable is an unwritten promise to pay

suppliers or lenders specified sums of money at a

definite future date.

Current Liabilities

Current Liabilities are liabilities that are due within

a relatively short period of time. The term Current

Liability is used to designate obligations whose

payment is expected to require the use of existing

current assets. Among current liabilities are

Accounts Payable,

Payable Notes Payable,

Payable and Accrued

Expenses.

Expenses

Long-Term Liabilities

Long-Term Liabilities are obligations that will not

become due for a comparatively long period of time.

The usual rule of thumb is that long-term liabilities

are not due within one year. These include such

things as bonds payable,

payable mortgage note payable,

payable

and any other debts that do not have to be paid

within one year.

You should note that as the long-term obligations

come within the one-year range they become

Current Liabilities.

Capital

Capital,

Capital also called net worth, is essentially what is

yours – what would be left over if you paid off

everyone the company owes money to. If there are

no business liabilities, the Capital, Net Worth, or

Owner Equity is equal to the total amount of the

Assets of the business.

Revenue

It means the amount which, as a result of operations,

is added to the capital. It is defined as the inflow of

assets which result in an increase in the owner's

equity. It includes all incomes like sales receipts

interest, commission, brokerage, etc. However,

receipts of capital nature like additional capital, sale

of assets, etc., are not a pant of revenue.

Expense

The terms “expense‟

expense refers to the amount incurred

in the process of earning revenue. If the benefit of an

expenditure is limited to one year, it is treated as an

expense (also known is as revenue expenditure) such

as payment of salaries and rent.

The Accounting Equation

Now let us discuss the accounting equation,

equation which

keeps all the business accounts in balance.

Assets = Liabilities + Owner’s Equity

The Accounting Equation

Now the Assets of the company consist of the cash

invested by the owner, (i.e. Owner's Equity), and for

example a loan taken from the bank, (i.e. a

Liability). The company's liabilities are placed

before the owner’s equity because creditors have

first claim on assets.

If the business were to close down, after the

liabilities are paid off, anything left over (assets)

would belong to the owner.

The Accounting Equation

Assets = Liabilities + Owner’s Equity

P500,000 = P200,000 + P300,000

OR

Assets – Liabilities = Owner’s Equity

P500,000 - P200,000 = P300,000

The Accounting Equation

The Accounting Equation

The two sides of the equation should always

balance.

The effect of every transaction is an increase or

decrease in one or more of the accounting equation

elements.

The owner’s equity is increased by the amount

invested by the owner and decreased by

withdrawals. In addition, the owner’s equity is

increased by revenues and is decreased by expenses.

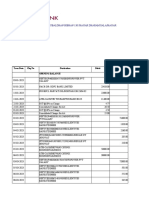

The Accounting Equation

1. J. Cruz, invested P200,000 to start an auto repair

business.

The Accounting Equation

1. J. Cruz, invested P200,000 to start an auto repair

business.

ASSETS LIABILITIES OWNER'S EQUITY

Ac c o unts Ac c o unts J.C.

Ca sh Sup p lie s Eq uip m e nt Ba nk Lo a n J.C. Ca p ita l Re ve nue s Exp e nse s

Re c e iva b le Pa ya b le Dra wing

1 Php 200,000.00 Php 200,000.00

The Accounting Equation

2. Cruz bought repair equipment from X Co. on

credit, P100,000.

The Accounting Equation

2. Cruz bought repair equipment from X Co. on

credit, P100,000.

ASSETS LIABILITIES OWNER'S EQUITY

Ac c o unts Ac c o unts J.C.

Ca sh Supplie s Equipme nt Ba nk Lo a n J.C. Ca pita l Re ve nue s Expe nse s

Re c e iva ble Pa ya ble Dra wing

1 Php 200,000.00 Php 200,000.00

2 Php 100,000.00 Php 100,000.00

The Accounting Equation

3. Cruz bought Shop Supplies for cash, P62,000.

The Accounting Equation

3. Cruz bought Shop Supplies for cash, P62,000.

ASSETS LIABILITIES OWNER'S EQUITY

Ac c o unts Ac c o unts J.C.

Ca sh Sup p lie s Eq uip me nt Ba nk Lo a n J.C. Ca p ita l Re ve nue s Exp e nse s

Re c e iva b le Pa ya b le Dra wing

1 Php 200,000.00 Php 200,000.00

2 Php 100,000.00 Php 100,000.00

3 (62,000.00) Php 62,000.00

The Accounting Equation

4. Paid X Co. partially, P60,000.

The Accounting Equation

4. Paid X Co. partially, P60,000.

ASSETS LIABILITIES OWNER'S EQUITY

Ac c o unts Ac c o unts J.C.

Ca sh Sup p lie s Eq uip me nt Ba nk Lo a n J.C. Ca p ita l Re ve nue s Exp e nse s

Re c e iva b le Pa ya b le Dra wing

1 Php 200,000.00 Php 200,000.00

2 Php 100,000.00 Php 100,000.00

3 (62,000.00) Php 62,000.00

4 (60,000.00) (60,000.00)

The Accounting Equation

5. Cruz received a bank loan for business use,

P100,000.

The Accounting Equation

5. Cruz received a bank loan for business use,

P100,000.

ASSETS LIABILITIES OWNER'S EQUITY

Ac c o unts Ac c o unts J.C.

Ca sh Supplie s Equipme nt Ba nk Lo a n J.C. Ca pita l Re ve nue s Expe nse s

Re c e iva ble Pa ya ble Dra wing

1 Php 200,000.00 Php 200,000.00

2 Php 100,000.00 Php 100,000.00

3 (62,000.00) Php 62,000.00

4 (60,000.00) (60,000.00)

5 100,000.00 Php 100,000.00

The Accounting Equation

6. Customers paid cash for auto repairs services

rendered, P25,000.

7. Repair services rendered on account, P50,000.

8. Paid a month’s rent, P10,000.

9. Cruz made partial collections from customers’

accounts, P30,000.

10. Cruz paid the salaries and wages of laborers,

P15,000.

11. Billed a customer, P6,000, and received a partial

payment of P2,000.

The Accounting Equation

12. Shop supplies purchased, P15,000, and made a

down payment of P5,000.

13. Shop supplies bought for cash and used, P18,000.

14. Cruz withdrew P20,000 for his personal use.

You might also like

- HW 1 2Document11 pagesHW 1 2api-506813505100% (1)

- Pre ClassDocument4 pagesPre Classnavjot2k2No ratings yet

- Module 1 - Lesson 4Document6 pagesModule 1 - Lesson 4Mai RuizNo ratings yet

- Bsa Department: Philippine School of Business Administration-ManilaDocument8 pagesBsa Department: Philippine School of Business Administration-ManilaKendrew SujideNo ratings yet

- Chapter 18Document16 pagesChapter 18Faisal AminNo ratings yet

- Balance SheetDocument29 pagesBalance SheetGrow GlutesNo ratings yet

- Financial Accounting & Analysis - N (1A)Document10 pagesFinancial Accounting & Analysis - N (1A)Tajinder MatharuNo ratings yet

- Financial AccountingDocument8 pagesFinancial AccountingHimani SachdevNo ratings yet

- Financial Accounting AnalysisDocument11 pagesFinancial Accounting AnalysisRajni KumariNo ratings yet

- Financial Accounting NotesDocument14 pagesFinancial Accounting NotesLex XuNo ratings yet

- Assets Liability +owner's EquityDocument11 pagesAssets Liability +owner's Equitydark roseNo ratings yet

- Lesson Plan in Abm: Curriculum Guide)Document5 pagesLesson Plan in Abm: Curriculum Guide)Laarni GomezNo ratings yet

- Accounting EquationDocument10 pagesAccounting EquationMimi Adriatico JaranillaNo ratings yet

- Financial Accounting BasicsDocument4 pagesFinancial Accounting BasicsDemoNo ratings yet

- Engineering EconomicsDocument12 pagesEngineering EconomicsAwais SiddiqueNo ratings yet

- Module 1 - Business Transaction and Their Analysis Part 1Document12 pagesModule 1 - Business Transaction and Their Analysis Part 11BSA5-ABM Espiritu, CharlesNo ratings yet

- Exam Revision - Chapter 9 10Document7 pagesExam Revision - Chapter 9 10Vũ Thị NgoanNo ratings yet

- Exam Revision - 9 & 10 SolDocument7 pagesExam Revision - 9 & 10 SolNguyễn Minh ĐứcNo ratings yet

- Financial Accounting & AnalysisDocument7 pagesFinancial Accounting & Analysisneha bakshiNo ratings yet

- Notes Midterm 1Document18 pagesNotes Midterm 1SatyaNo ratings yet

- Financial Accounting AnalysisDocument12 pagesFinancial Accounting AnalysisSamyak GargNo ratings yet

- Sample - Financial-Accounting-Analysis-V-ST-8cjfveDocument11 pagesSample - Financial-Accounting-Analysis-V-ST-8cjfvesushainkapoor photoNo ratings yet

- Chapter 3 Analyzing Transactions To Start A BusinessDocument3 pagesChapter 3 Analyzing Transactions To Start A BusinessPaw VerdilloNo ratings yet

- Chap 3 Accounting Classification & Equation (Basic+Expended) - ClassDocument37 pagesChap 3 Accounting Classification & Equation (Basic+Expended) - Classnabkill100% (1)

- Basic AccountingDocument46 pagesBasic AccountingMD LeeNo ratings yet

- Basic Accounting EquationDocument42 pagesBasic Accounting Equationlily smithNo ratings yet

- Acctgchap 2Document15 pagesAcctgchap 2Anjelika ViescaNo ratings yet

- Double Entry System & Accounting Equation: by - Mrs. Dilshad D. JalnawallaDocument34 pagesDouble Entry System & Accounting Equation: by - Mrs. Dilshad D. JalnawallaTufail GanaieNo ratings yet

- Statement of Financial Position (SFP) : Lesson 1Document29 pagesStatement of Financial Position (SFP) : Lesson 1Dianne Saragena100% (1)

- Topic 1 - The Accounting EquationDocument10 pagesTopic 1 - The Accounting Equationgabriellemorgan714No ratings yet

- Balance Sheet Dimasaka & JaranillaDocument56 pagesBalance Sheet Dimasaka & JaranillaShaneBattierNo ratings yet

- Basic Financial Statements NotesDocument6 pagesBasic Financial Statements NotesNNo ratings yet

- Chapter 4Document38 pagesChapter 4Haidee Sumampil67% (3)

- Fundamentals of Accountancy, Business and Management 1: Quarter 1 - Module 3: Week 3 The Accounting EquationDocument18 pagesFundamentals of Accountancy, Business and Management 1: Quarter 1 - Module 3: Week 3 The Accounting EquationMark Anthony Garcia50% (2)

- Chapter 3Document15 pagesChapter 3clara2300181No ratings yet

- Presentation On Accounting BasicDocument20 pagesPresentation On Accounting BasicKrishna Kumar SinghNo ratings yet

- Notas Contabilidad para Trabajos 3 y 4Document12 pagesNotas Contabilidad para Trabajos 3 y 4jorgeNo ratings yet

- Balance Sheet Analysis - TourismDocument10 pagesBalance Sheet Analysis - TourismMarieNo ratings yet

- Trial Day 3Document7 pagesTrial Day 3seemaNo ratings yet

- Accounting For A Service BusinessDocument7 pagesAccounting For A Service BusinessAndrea Joy ReyNo ratings yet

- What Is Accounting???Document15 pagesWhat Is Accounting???Modassar NazarNo ratings yet

- Introduction To AccountingDocument39 pagesIntroduction To AccountingRazib KhanNo ratings yet

- Lesson 2. Chapter 3. Journal Entries and Prepare Trial BalanceDocument14 pagesLesson 2. Chapter 3. Journal Entries and Prepare Trial BalanceColleen GuimbalNo ratings yet

- Chapter 2 LectureDocument60 pagesChapter 2 LectureAlex Lau100% (1)

- ACCT1111 Chapter 2 LectureDocument61 pagesACCT1111 Chapter 2 LectureWky Jim100% (1)

- Accounting ProjectDocument25 pagesAccounting ProjectLidianny CastilloNo ratings yet

- Enter Pre NerDocument26 pagesEnter Pre NerAbiy AliyeNo ratings yet

- What Is A Financial Instrument - ACCA Qualification - Students - ACCA GlobalDocument11 pagesWhat Is A Financial Instrument - ACCA Qualification - Students - ACCA Globalfaiez jamilNo ratings yet

- Module 2 - Double Entry Bookkeeping System and The Accounting EquationDocument9 pagesModule 2 - Double Entry Bookkeeping System and The Accounting EquationPrincess Joy CabreraNo ratings yet

- Financial Accounting 2Document31 pagesFinancial Accounting 2Umurbey GençNo ratings yet

- Handouts Chapter 4 56 7 CombinedDocument21 pagesHandouts Chapter 4 56 7 CombinedShane Khezia Abriol BaclayonNo ratings yet

- Chapter 2 - Accounting Equation and Double EntryDocument10 pagesChapter 2 - Accounting Equation and Double EntrykundiarshdeepNo ratings yet

- Business Transactions and The Accounting EquationDocument30 pagesBusiness Transactions and The Accounting EquationKen LatiNo ratings yet

- Accounting Concepts and Terminologies: Debit CreditDocument94 pagesAccounting Concepts and Terminologies: Debit CreditEsminaj321No ratings yet

- QuestionsDocument3 pagesQuestionsRaca DesuNo ratings yet

- Module 8Document99 pagesModule 8Arnel De Los SantosNo ratings yet

- SWE2028 - Software Engineering Economics: Accounting, Controlling, Cash FlowDocument19 pagesSWE2028 - Software Engineering Economics: Accounting, Controlling, Cash FlowSri ChakriNo ratings yet

- Chapter 2 Basic Financial StatementsDocument34 pagesChapter 2 Basic Financial StatementsJunaid Ashraf100% (1)

- Week 1 Fundamentals and The Statement of Financial Position - The Balance SheetDocument43 pagesWeek 1 Fundamentals and The Statement of Financial Position - The Balance SheetJohn SmithNo ratings yet

- Topic 2 (Acc)Document48 pagesTopic 2 (Acc)Nur Adnin KhairaniNo ratings yet

- The Accounting Equation and Double-Entry SystemDocument17 pagesThe Accounting Equation and Double-Entry SystemPATRICIA COLINANo ratings yet

- AfarDocument6 pagesAfarRolando PasamonteNo ratings yet

- XXXX96 01 01 2023to28 08 2023Document18 pagesXXXX96 01 01 2023to28 08 2023dabu choudharyNo ratings yet

- Reset Selection What's This?: Answer: DDocument7 pagesReset Selection What's This?: Answer: DJust ForNo ratings yet

- ECOMMERCEDocument5 pagesECOMMERCEMAMILONo ratings yet

- Powers of Corp.Document21 pagesPowers of Corp.Iyarna YasraNo ratings yet

- Introduction To Financial InstrumentsDocument21 pagesIntroduction To Financial InstrumentsSky SoronoiNo ratings yet

- Inventories ThoeryDocument10 pagesInventories ThoeryAltessa Lyn ContigaNo ratings yet

- Mayes 8e CH01 Problem SetDocument12 pagesMayes 8e CH01 Problem SetRamez AhmedNo ratings yet

- RKG Imp Q (CH 1 & 2) DoneDocument3 pagesRKG Imp Q (CH 1 & 2) Donepriyanshi.bansal25No ratings yet

- About SapDocument34 pagesAbout SapKotireddy DeviNo ratings yet

- Project Report Implementation of IFRS in India Hopes & ChallengesDocument18 pagesProject Report Implementation of IFRS in India Hopes & ChallengesKhyatiNo ratings yet

- Anna University MBA - All Year, Semester Syllabus Ordered Lecture Notes and Study Material For College StudentsDocument69 pagesAnna University MBA - All Year, Semester Syllabus Ordered Lecture Notes and Study Material For College StudentsM.V. TVNo ratings yet

- Kan Taxes and Accounting ServicesDocument28 pagesKan Taxes and Accounting Servicessean.lloyd1124No ratings yet

- Course Title: Fundamentals of Banking Subject Code: BNK-201Document23 pagesCourse Title: Fundamentals of Banking Subject Code: BNK-201Shaon Chandra Saha 181-11-5802No ratings yet

- Daf1301 Fundamentals of Accounting Ii - Digital AssignmentDocument6 pagesDaf1301 Fundamentals of Accounting Ii - Digital AssignmentcyrusNo ratings yet

- Opap 2010 Annual ReportDocument115 pagesOpap 2010 Annual ReportkasipetNo ratings yet

- Chapter 27 The Basic Tools of FinanceDocument30 pagesChapter 27 The Basic Tools of Financephuonguyen062005No ratings yet

- A Study On Awareness of Mutual Fund in Bachelor Students of Navsari RegionDocument17 pagesA Study On Awareness of Mutual Fund in Bachelor Students of Navsari RegionPriyanka PandeyNo ratings yet

- Module-3 IFSS-NoteDocument29 pagesModule-3 IFSS-NoteAbhisekNo ratings yet

- Case Study On IBDocument18 pagesCase Study On IBOm ProkashNo ratings yet

- Phillips Carbon Black (PHICAR) : Growth Momentum To Sustain..Document9 pagesPhillips Carbon Black (PHICAR) : Growth Momentum To Sustain..hashximNo ratings yet

- Solving - Business Finance 1-6Document28 pagesSolving - Business Finance 1-6Samson, Ma. Louise Ren A.No ratings yet

- Goodwill Accounting ThesisDocument32 pagesGoodwill Accounting ThesisNica Cunanan100% (1)

- American Laser Inc Reported The Following Account Balances On January PDFDocument1 pageAmerican Laser Inc Reported The Following Account Balances On January PDFHassan JanNo ratings yet

- Rev 1Document1 pageRev 1Jessa BeloyNo ratings yet

- SV - DTUE401 - Chapter 1 (Lecture 1+2)Document72 pagesSV - DTUE401 - Chapter 1 (Lecture 1+2)Duong Ha ThuyNo ratings yet

- Analysis of Dhaka Stock ExchangeDocument25 pagesAnalysis of Dhaka Stock ExchangeSaima Haque EmaNo ratings yet