Professional Documents

Culture Documents

Partnership Operations Seatworks

Partnership Operations Seatworks

Uploaded by

cali cd0 ratings0% found this document useful (0 votes)

9 views6 pagesThe document discusses accounting information for a partnership including sales, costs, expenses, allocations to partners, and drawings. It then provides information on the capital accounts of three partners (Rizz, Izza, Lyn) in their partnership including beginning balances, contributions, withdrawals, and investments over the year. Several problems are presented involving calculating partnership net income and distributing income to partners based on different allocation agreements.

Original Description:

Original Title

Partnership-Operations-Seatworks

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses accounting information for a partnership including sales, costs, expenses, allocations to partners, and drawings. It then provides information on the capital accounts of three partners (Rizz, Izza, Lyn) in their partnership including beginning balances, contributions, withdrawals, and investments over the year. Several problems are presented involving calculating partnership net income and distributing income to partners based on different allocation agreements.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

9 views6 pagesPartnership Operations Seatworks

Partnership Operations Seatworks

Uploaded by

cali cdThe document discusses accounting information for a partnership including sales, costs, expenses, allocations to partners, and drawings. It then provides information on the capital accounts of three partners (Rizz, Izza, Lyn) in their partnership including beginning balances, contributions, withdrawals, and investments over the year. Several problems are presented involving calculating partnership net income and distributing income to partners based on different allocation agreements.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 6

Partnership

John Patrick S. Desepida CPA, CTT

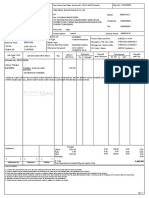

Discussion Problem 1:

A partnership has the following accounting amounts:

Sales 700,000

Cost of good sold 400,000

Operating expenses 100,000

Salary allocation to partners 130,000

Interest paid to banks 20,000

Partners’ drawings 80,000

What is the partnership net income (loss)?

2 Presentation title 20XX

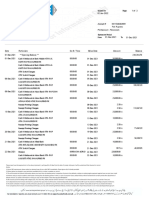

Discussion Problem 2:

The ABC Partnership reports net income of 60,000. If partners A, B, and C

have income ratio of 50%, 30% and 20% respectively. What is the share of

Partner C from the net income of the partnership, if he was given a capital

ratio of 25%

3 Presentation title 20XX

Problem Discussion 3:

RIZZ, IZZA and LYN are partners in a wholesale business. Their capital

accounts in the RIZZALYN Partnership for 2030 were as follow:

RIZZ IZZA LYN

January 1, balance 135,000 180,000 75,000

March 1, withdrawal 36,000

April 1, investment 30,000

May 1, investment 72,000

June 1, investment 27,000

August 1, withdrawal 9,000

October 1, withdrawal 54,000

December 1, investment 18,000

4 Presentation title 20XX

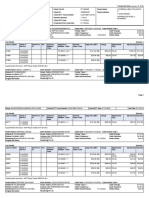

For each of the following income-sharing agreements, prepare an income

distribution schedule:

a. Monthly salaries are P30,000 to Rizz, P50,000 to Izza and P45,000 to

Lyn. Rizz receives a bonus of 5% of net income after deducting her bonus.

Interest is 12% of ending capital balances. Any remainder is divided by

Rizz, Izza, and Lyn in a 25:40:35 ratio. Net income as of period end is

P2,835,000

b. Interest is 10% of weighted average capital balances. Annual salaries are

P480,000 to Rizz, P630,000 to Izza and P510,000 to Lyn. Izza received a

bonus of 25% of net income after deducting the bonus and his salary. Any

remainder is divided in a 2:3:4 ratio by Rizz, Izza, and Lyn, respectively.

Net income was 1,050,000before any allocations.

5 Presentation title 20XX

c. Lyn receives a bonus of net income after deducting the bonus and the

salaries. Annual salaries are P600,000 to Rizz, P540,000 to Izza and

P750,000 to Lyn. Interest is 15% of the ending capital in excess of

P140,000. Any remainder is to be divided by Rizz, Izza and Lyn in the ratio

of their beginning capital balances. Net income was P1,470,000 before any

allocation.

d. Monthly salaries are P32,000 to Rizz, P40,000 to Izza and P42,000 to

Lyn. Izza receives a bonus of 10% of net income after deducting her bonus.

Interest is 25% on the excess of the ending capital balances over the

beginning capital balances. Any remainder is to be divided by Rizz, Izza

and Lyn in a 3:2:1 ratio. The income summary account has a debit balance

of P750,000 before closing.

6 Presentation title 20XX

You might also like

- Accounting For Special Transactions Part 3 Course AssessmentDocument31 pagesAccounting For Special Transactions Part 3 Course AssessmentRAIN ALCANTARA ABUGANNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Get Rich with Dividends: A Proven System for Earning Double-Digit ReturnsFrom EverandGet Rich with Dividends: A Proven System for Earning Double-Digit ReturnsNo ratings yet

- Acctg122 Chapter 2 ExercisesDocument5 pagesAcctg122 Chapter 2 ExercisesIce James Pachano100% (1)

- Partnership Operations Enabling AssessmentDocument6 pagesPartnership Operations Enabling AssessmentVon Andrei MedinaNo ratings yet

- B.) CC, P25,000: PP, P21,000 Aa, P38,000Document22 pagesB.) CC, P25,000: PP, P21,000 Aa, P38,000Wendelyn TutorNo ratings yet

- Motor World Private Limited.: NANDI TOYOTA, 69/5, Bommanahalli, BangaloreDocument1 pageMotor World Private Limited.: NANDI TOYOTA, 69/5, Bommanahalli, BangaloreSheik SalmanNo ratings yet

- Partnership Operation Part 1 PDFDocument2 pagesPartnership Operation Part 1 PDFazzenethfaye.delacruz.mnlNo ratings yet

- You Can Do This!: TheoriesDocument3 pagesYou Can Do This!: Theoriesbae joohyunNo ratings yet

- Activity 1.2.1Document1 pageActivity 1.2.1De Nev OelNo ratings yet

- Partnership OperationDocument3 pagesPartnership OperationBianca Iyiyi0% (1)

- Quiz OperationsDocument4 pagesQuiz OperationsAngelo VilladoresNo ratings yet

- Part Op ProbsDocument2 pagesPart Op ProbsdmiahalNo ratings yet

- PUNZALANDocument16 pagesPUNZALANAngelique Kate Tanding DuguiangNo ratings yet

- Special Transaction 1Document7 pagesSpecial Transaction 1Josua PagcaliwaganNo ratings yet

- Part 5555Document2 pagesPart 5555RhoizNo ratings yet

- Part 5555Document2 pagesPart 5555Rhoiz80% (5)

- Part3333Document2 pagesPart3333Vince Raeden AmaranteNo ratings yet

- Part 3333Document2 pagesPart 3333Rhoiz100% (2)

- 1st Year ExamDocument9 pages1st Year ExamMark Domingo MendozaNo ratings yet

- A 2 OperationsDocument6 pagesA 2 OperationsAngela DucusinNo ratings yet

- CMPC 131 2-Partneship-OperationsDocument4 pagesCMPC 131 2-Partneship-OperationsGab IgnacioNo ratings yet

- Accounting For Special TransactionsDocument1 pageAccounting For Special TransactionsElvira AriolaNo ratings yet

- Review On Partnership OperationDocument2 pagesReview On Partnership OperationPhilip Zamaico SerenioNo ratings yet

- 1st Quiz Afar2 Q PDFDocument2 pages1st Quiz Afar2 Q PDFAnonymous 7HGskNNo ratings yet

- Activity 1.2.2Document1 pageActivity 1.2.2De Nev Oel0% (1)

- 02Document3 pages02Jodel Castro100% (1)

- CH 018Document2 pagesCH 018Joana TrinidadNo ratings yet

- Quiz 1 AFAR ReviewDocument7 pagesQuiz 1 AFAR ReviewPrankyJellyNo ratings yet

- Problem On AdmissionDocument2 pagesProblem On AdmissionSam Rae LimNo ratings yet

- Partnership HCC CttoDocument7 pagesPartnership HCC CttoKenncy100% (1)

- OperationDocument6 pagesOperationKenncy50% (2)

- SecretDocument13 pagesSecretElla MyrrNo ratings yet

- AST Seatwork - 05 15 2021Document6 pagesAST Seatwork - 05 15 2021Joshua UmaliNo ratings yet

- Partnership Dissolution: QuizDocument8 pagesPartnership Dissolution: QuizLee SuarezNo ratings yet

- Midterm Exams - 1ST YrDocument7 pagesMidterm Exams - 1ST YrMark Domingo MendozaNo ratings yet

- Partnership DissolutionDocument7 pagesPartnership DissolutionAngel Frolen B. RacinezNo ratings yet

- Partnership Liquidation Practice Problems - W CorrectionsDocument10 pagesPartnership Liquidation Practice Problems - W CorrectionsSarah BalisacanNo ratings yet

- Prelim Exam ProblemsDocument4 pagesPrelim Exam Problemslinkin soyNo ratings yet

- Partnership Mock ExamDocument4 pagesPartnership Mock ExamCleo Meguel AbogadoNo ratings yet

- Partnership ProbsDocument3 pagesPartnership Probsmartinfaith958No ratings yet

- Partnership Operations: QuizDocument8 pagesPartnership Operations: QuizLee SuarezNo ratings yet

- 2 OperationsDocument7 pages2 Operationsmartinfaith958No ratings yet

- Afar 02 P'ship Operation QuizDocument4 pagesAfar 02 P'ship Operation QuizJohn Laurence LoplopNo ratings yet

- Other Profit Distribution ProvisionsDocument5 pagesOther Profit Distribution ProvisionssunshineNo ratings yet

- Partnership Operations ( (Exercise No. 1)Document1 pagePartnership Operations ( (Exercise No. 1)Shaira Nicole VasquezNo ratings yet

- SET A ACC 110 - CFE - SY 2023 2024 1st Sem - Answer KeyDocument19 pagesSET A ACC 110 - CFE - SY 2023 2024 1st Sem - Answer KeyJomar RabiaNo ratings yet

- Quiz 2 KeyDocument5 pagesQuiz 2 KeyRosie PosieNo ratings yet

- Problems: Volume IDocument3 pagesProblems: Volume IRafael Capunpon VallejosNo ratings yet

- MOCK BOARD May 222 Test Questions AFAR SCDocument16 pagesMOCK BOARD May 222 Test Questions AFAR SCKial PachecoNo ratings yet

- CBSE Class 12 Accountancy Accounting For Partnership Firms Sure Shot QuestionsDocument6 pagesCBSE Class 12 Accountancy Accounting For Partnership Firms Sure Shot Questionsdakshrwt06No ratings yet

- Partnership ContinuationDocument3 pagesPartnership ContinuationRhoiz100% (2)

- RESA MCQsDocument56 pagesRESA MCQsWendelyn Tutor100% (1)

- Act130: Accounting For Special Transactions Prelim Exam S.Y 2020-2021Document15 pagesAct130: Accounting For Special Transactions Prelim Exam S.Y 2020-2021Nhel AlvaroNo ratings yet

- Anas - Afar - Prelim Module - Ivisan - Bsa 4 - A B 2Document13 pagesAnas - Afar - Prelim Module - Ivisan - Bsa 4 - A B 2nisutrackerNo ratings yet

- Partnership OperationsDocument20 pagesPartnership OperationsRujean Salar AltejarNo ratings yet

- PartnershipDocument3 pagesPartnershipMark Edgar De Guzman0% (1)

- Partnership OperationsDocument4 pagesPartnership Operationsdaniella tagikNo ratings yet

- Partnership Prelims ExercisesDocument4 pagesPartnership Prelims ExercisesAngelo VilladoresNo ratings yet

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersFrom EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersNo ratings yet

- m20 ATX MYS QPDocument13 pagesm20 ATX MYS QPizzahderhamNo ratings yet

- 01-Dec-2021Document2 pages01-Dec-2021mohafiz kazinagNo ratings yet

- Myanmar Central Bank LawDocument30 pagesMyanmar Central Bank LawNelsonNo ratings yet

- Revision chung Tiếng AnhDocument4 pagesRevision chung Tiếng AnhVân Anh ĐặngNo ratings yet

- Remain Certified, Stay Informed: What Is The CTFP?Document2 pagesRemain Certified, Stay Informed: What Is The CTFP?Alex SoonNo ratings yet

- GM 016 344575 PDFDocument15 pagesGM 016 344575 PDFeunha allaybanNo ratings yet

- HSBC Project ReportDocument66 pagesHSBC Project ReportSaurabh BudhirajaNo ratings yet

- Bcom24 PDFDocument2 pagesBcom24 PDFIsmailNo ratings yet

- Finance AssignmentDocument3 pagesFinance AssignmentAnooshaNo ratings yet

- Schloss-2 408Document3 pagesSchloss-2 408Logic Gate Capital100% (1)

- De Silva Vs AboitizDocument1 pageDe Silva Vs Aboitizgianfranco0613No ratings yet

- Roque Quick Auditing Theory Chapter 7 PDFDocument138 pagesRoque Quick Auditing Theory Chapter 7 PDFSherene Faith CarampatanNo ratings yet

- CheckMultipleDetails 2024 01 18 12 06 44Document8 pagesCheckMultipleDetails 2024 01 18 12 06 44hillumbertoNo ratings yet

- Using Supply and Demand - Foreign Exchange Trade and BubblesDocument16 pagesUsing Supply and Demand - Foreign Exchange Trade and BubblesgregbaccayNo ratings yet

- Group 7 Stirling - Sir's EvalDocument4 pagesGroup 7 Stirling - Sir's EvalKenneth Jules GarolNo ratings yet

- Alternative Methods of Trade FinancingDocument4 pagesAlternative Methods of Trade Financingrahulramgoolam291193No ratings yet

- Board of DirectorsDocument7 pagesBoard of DirectorsEnvisage123No ratings yet

- Samson Chen Business FinanceDocument3 pagesSamson Chen Business Finance채문길No ratings yet

- Pest Analysis of MalaysiaDocument8 pagesPest Analysis of MalaysiaSai VasudevanNo ratings yet

- 2 Vertical Group StructureDocument3 pages2 Vertical Group StructureKamaruzzaman MohdNo ratings yet

- Course Outline Tax I Income Tax: 1. DefinitionsDocument2 pagesCourse Outline Tax I Income Tax: 1. DefinitionsJunelyn T. EllaNo ratings yet

- Safal Niveshak Stock Analysis Excel (Ver. 4.0) : How To Use This SpreadsheetDocument51 pagesSafal Niveshak Stock Analysis Excel (Ver. 4.0) : How To Use This SpreadsheetJatan ShahNo ratings yet

- Referencer For Auditing & EthicsDocument54 pagesReferencer For Auditing & EthicsgauravNo ratings yet

- Family Constitution and Family by LawsDocument12 pagesFamily Constitution and Family by LawsMike Kuria MuchokiNo ratings yet

- DONT TRUST THIS FG MINISTER, TRAITOR of The Housing Minister Simon Coveney Is A Landlord and He Is A Liar, Devious and Evil and Commodity Landlord Who Would Sell His Own Moother OutDocument603 pagesDONT TRUST THIS FG MINISTER, TRAITOR of The Housing Minister Simon Coveney Is A Landlord and He Is A Liar, Devious and Evil and Commodity Landlord Who Would Sell His Own Moother OutRita Cahill100% (1)

- GT Capital: Share SaleDocument1 pageGT Capital: Share SaleBusinessWorldNo ratings yet

- LG Polymer 08-09 - CSTDocument6 pagesLG Polymer 08-09 - CSTRajendra D AdsulNo ratings yet

- Chapter 7 CLCDocument11 pagesChapter 7 CLCVăn ThànhNo ratings yet

- A Project Report On Asset Liability Management in Andhra BankDocument89 pagesA Project Report On Asset Liability Management in Andhra Banksimran kumariNo ratings yet