Professional Documents

Culture Documents

Lecture 6

Lecture 6

Uploaded by

Nesma Hussein0 ratings0% found this document useful (0 votes)

18 views18 pagesCopyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

18 views18 pagesLecture 6

Lecture 6

Uploaded by

Nesma HusseinCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 18

Second Welfare Theorem

Dr. Noha Nagi Elboghdadly

ESPS , Alexandria University

Second Semester 2021

Noha Nagi Welfare Economics

Lecture 6 Outline

In this lecture, we will cover:

• Recap of the First Welfare Theorem

• The Second Welfare Theorem

• Efficiency and Equity trade-off

• Implications of Second Welfare Theorem

Noha Nagi Welfare Economics

Recap: First Welfare Theorem

• Given certain conditions/assumptions (no externalities, perfect competition, full

information,..), the First Welfare Theorem guarantees that a competitive market

will exhaust all of the gains from trade: an equilibrium allocation achieved by a

set of competitive markets will necessarily be Pareto efficient. In other words, the

First Welfare Theorem says that the equilibrium in a set of competitive markets is

Pareto efficient.

• In pure exchange economy, the market mechanism automatically distributes goods

among people in an optimal way. The person who likes coffee will end up with a

lot of coffee, while the one who likes tea will end up with a lot of tea. Each

consumer will get the bundle of goods he likes best (given his budget constraint),

and those consumption bundles are consistent such that total demand of each good

is equal to total available supply.

Noha Nagi Welfare Economics

Recap: First Welfare Theorem

• Note that the competitive equilibrium depends on the initial endowment

allocation. Why?

• That is, the competitive allocation is determined by the initial allocation as well as by

preferences, and if, for example, the initial allocation is very unequal, so will be the competitive

allocation.

• The Question Now: Does the First Welfare Theorem guarantees that the market

allocation will be “fair” or equitable?

• Some people have lots of capital to rent, and some people have very valuable labor to sell. (think of football

players, and movie stars) . And some people have no capital to lend or rent, and very little valuable labor to sell.

The free competitive market mechanism will produce a distribution of goods that gives homes in rich new cities to

movie stars. But it will give poverty and hunger to those with no skills or talents. And the result will very likely be

Pareto optimal.

• First Welfare Theorem says nothing about the distribution of economic benefits of

trade. An allocation might be efficient but is not fair.

Noha Nagi Welfare Economics

Choosing a desirable allocation

Any general competitive equilibrium is Pareto efficient.

Yet, there can be many possible Pareto efficient allocations of resources and

not all of them may be equally "desirable" by society.

Is it possible for the policymaker to choose a desirable allocation, implement

an appropriate economic policy, then let the markets freely work and obtain

the desired allocation?

The answer is: yes, under certain conditions.

Noha Nagi Welfare Economics

Efficiency Vs Equality

Is there a trade-off between efficiency and equality?

• Given a Pareto efficient allocation, can we find prices such that it is a market

equilibrium? In other words, can any Pareto efficient allocation be supported

as a competitive equilibrium?

If the answer to the above questions is yes, then there is no trade-off between efficiency

and equality.

If the answer is no, then clearly there is a trade-off.

According to the second welfare theorem, the answer to the above question yes.

Noha Nagi Welfare Economics

Second Welfare Theorem

Second Welfare Theorem says:

If all agents have convex preferences, then there will always be a set

of prices such that each Pareto efficient allocation (i.e., any point on

the contract curve) is a market equilibrium provided that endowments

are first appropriately rearranged among the consumers.

In other words:

For any Pareto optimal allocation there are prices and an allocation of

the total endowment that makes the Pareto optimal allocation

implementable by trading in competitive markets.

Noha Nagi Welfare Economics

Second Welfare Theorem

Show the second welfare theorem graphically using Edgeworth box.

Steps:

1. Let us pick a Pareto efficient allocation X. (This implies that the two ICs are tangent)

2. Let us draw in the straight line that is their common tangent,

3. Suppose that the straight line represents the agents’ budget sets. (We know that each agent

chooses the best bundle on his or her budget set)

4. The slope of this line gives us the relative prices.

5. Calculate the corresponding equilibrium prices to the considered allocation

6. Redistribute endowments to anywhere along the (constructed) budget line.

7. Any endowment that puts the two agents on this line will lead to the final market equilibrium

being X. That is market trade will automatically achieve efficiency (by the first theorem).

Noha Nagi Welfare Economics

Second Welfare Theorem

Show the second welfare theorem graphically using Edgeworth box.

Copyright © 2019 Hal R. Varian

Noha Nagi Welfare Economics

Second Welfare Theorem

• The following three figures explains in more details how the second

welfare theorem works.

Noha Nagi Welfare Economics

Second Welfare Theorem

Copyright © 2019 Hal R. Varian

Noha Nagi Welfare Economics

Second Welfare Theorem

Copyright © 2019 Hal R. Varian

Noha Nagi Welfare Economics

Second Welfare Theorem

Copyright © 2019 Hal R. Varian

Noha Nagi Welfare Economics

Implications of the Second Welfare Theorem

• The Second Theorem of Welfare Economics asserts that under certain conditions, every Pareto

efficient allocation can be achieved as a competitive equilibrium.

What is the meaning of this result?

• The Second Welfare Theorem implies that the problems of distribution and efficiency can be

separated.

Whatever Pareto efficient allocation you want can be supported by the market mechanism.

• Prices play two roles in the market system: an allocative role and a distributive role.

The allocative role of prices is to indicate relative scarcity;

the distributive role is to determine how much of different goods different agents can purchase.

The Second Welfare Theorem says that these two roles can be separated: we can redistribute

endowments of goods to determine how much wealth agents have, and then use prices to indicate

relative scarcity.

Noha Nagi Welfare Economics

Implications of the Second Welfare Theorem

If we don’t like the distribution of wealth in the market equilibrium, how do we change it?

Lump-sum redistribution (transfers) (Lump-sum tax/subsidy)

In the case of a tax, this means that the government takes away some fixed amount of money,

regardless of the individual’s behavior.

• According to the Second Welfare Theorem, this kind of lump-sum taxation would be non-

distortionary (i.e. doesn’t lead to efficiency loss).

• Essentially any Pareto efficient allocation could be achieved by such lump-sum redistribution

Manipulation of price ratios

• Ex: senior citizens should have access to less expensive telephone service, or that small users

of electricity should pay lower rates than large users.

• These are basically attempts to redistribute income through the price system by offering some

people lower prices than others.

• Taxation which changes the price-ratio is distortionary, (i.e. leads to efficiency loss)

Noha Nagi Welfare Economics

Notes for your information (Read)

• Lump-sum tax and transfers are neutral with respect to efficiency, in the sense

that they will not result in any behavior distortions which prevent consumers

from maximizing gain from trade at the new distribution of income.

• The key feature of lump-sum tax (transfers) is that they don’t influence relative

prices, in the sense that they don’t provide incentives for individual to substitute

one good for another.

• Lump-sum taxes (subsidies) are neutral in the sense that they result only in

change in income (i.e. results only in income effect not substitution effect).

• Lump-sum transfers can be used to reach a new efficient allocation

Noha Nagi Welfare Economics

Appendix (Read only )

• A situation where a Pareto-

efficient allocation is not an

equilibrium because non-

convex indifference curve

Noha Nagi Welfare Economics

Summary of Efficiency in Pure Exchange

Economy

• Pareto-efficiency condition in a Pure exchange economy is that MRS of consumers are equal.

• The contract curve is the set of Pareto-optima allocations.

• Pareto-improving allocations depend on the initial endowment allocation

• General equilibrium refers to the study of how the economy can adjust to have demand equal

supply in all markets at the same time.

• If the demand for each good varies continuously as prices vary, then there will always be some

set of prices where demand equals supply in every market; that is, a competitive (Walrasian)

equilibrium.

• The First Theorem of Welfare Economics states that a competitive equilibrium is Pareto

efficient.

• The Second Theorem of Welfare Economics states that as long as preferences are convex, then

every Pareto efficient allocation can be supported as a competitive equilibrium.

Noha Nagi Welfare Economics

You might also like

- Welfare EconomicsDocument4 pagesWelfare Economicshariyono21No ratings yet

- CH 10Document60 pagesCH 10Mohammed AljabriNo ratings yet

- Session 4Document20 pagesSession 4kushagra agrawalNo ratings yet

- Welfare EconomicsDocument6 pagesWelfare EconomicsVincent CariñoNo ratings yet

- Economic Efficiency - A Critical AppraisalDocument21 pagesEconomic Efficiency - A Critical AppraisalPriyankaNo ratings yet

- First Fundamental Theorem of Welfare EconomicsDocument9 pagesFirst Fundamental Theorem of Welfare EconomicsChander VeerNo ratings yet

- Lecture Notes On General Equilibrium Analysis and Resource AllocationDocument13 pagesLecture Notes On General Equilibrium Analysis and Resource AllocationYolanda TshakaNo ratings yet

- Fundamental Theories and Theorems of Welfare Economics: Chapter SixDocument17 pagesFundamental Theories and Theorems of Welfare Economics: Chapter SixTata AkyNo ratings yet

- Chapter 3. Welfare Economics: BritneyDocument4 pagesChapter 3. Welfare Economics: BritneySushila BihaniNo ratings yet

- EconomicsDocument6 pagesEconomicsmeighantoffeeNo ratings yet

- SM Econ 05 Micro Ch05Document24 pagesSM Econ 05 Micro Ch05senrucatNo ratings yet

- 1.efficiency, Coordination and Economic OrganizationDocument104 pages1.efficiency, Coordination and Economic OrganizationChiara GirardiNo ratings yet

- ExchangeDocument21 pagesExchangeAhmed NurNo ratings yet

- Chapter 5 - General EquilibrumDocument23 pagesChapter 5 - General EquilibrumbashatigabuNo ratings yet

- Econ611 Unit 5Document24 pagesEcon611 Unit 5shadrick malamaNo ratings yet

- MicroeconmicsDocument12 pagesMicroeconmicsArpit YadavNo ratings yet

- Lecture Four-1Document12 pagesLecture Four-1Nyamweya Webster JuniorNo ratings yet

- Microeconomics Intro Preferences Rationality 2023 0307Document21 pagesMicroeconomics Intro Preferences Rationality 2023 0307팜브엉닥 / 학생 / 화학생물공학부No ratings yet

- Nudging Intervention PropositionDocument38 pagesNudging Intervention PropositionRitzzNo ratings yet

- Price Discrimination Notes: 1 PreliminariesDocument12 pagesPrice Discrimination Notes: 1 Preliminarieserdoo17No ratings yet

- The Theory of Second Best: Pareto OptimalityDocument5 pagesThe Theory of Second Best: Pareto OptimalityBasil Irfan Muhammed AslamNo ratings yet

- Efficiency and Equity in A Competitive MarketDocument29 pagesEfficiency and Equity in A Competitive MarketMd MasumNo ratings yet

- SURJADI PE-Akt Salemba 2021 GeneralEquilibriumDocument37 pagesSURJADI PE-Akt Salemba 2021 GeneralEquilibriumauliaNo ratings yet

- Welfare EconomicsDocument6 pagesWelfare EconomicsBernardokpeNo ratings yet

- EC204 Topic 4 - General Equilibrium PDFDocument12 pagesEC204 Topic 4 - General Equilibrium PDFKareena TekwaniNo ratings yet

- Chapter 1 & 2: Normal Good Elasticity 1 Inferior Good Elasticity 1Document7 pagesChapter 1 & 2: Normal Good Elasticity 1 Inferior Good Elasticity 1Assetou SinkaNo ratings yet

- Public Economics NotesDocument15 pagesPublic Economics NotesAnuj AlmeidaNo ratings yet

- Lecture-4-Welfare EconomicsDocument13 pagesLecture-4-Welfare EconomicsGideon MukuiNo ratings yet

- Possible To Do This in The Private Sector of The Economy. The Conclusion Is Correct. Specifically Relevant To The Information GivenDocument5 pagesPossible To Do This in The Private Sector of The Economy. The Conclusion Is Correct. Specifically Relevant To The Information GivenNikhil RamtohulNo ratings yet

- Ans 1 Walras' Law Is A Principle In: General Equilibrium Theory Excess Market DemandsDocument7 pagesAns 1 Walras' Law Is A Principle In: General Equilibrium Theory Excess Market DemandskoolzubNo ratings yet

- Latian CH 5Document17 pagesLatian CH 5kezia yulinaNo ratings yet

- Lecture Notes: 1: What Is Economics?Document3 pagesLecture Notes: 1: What Is Economics?Adarsh SudheerNo ratings yet

- Answers To Review Quizzes & Problems - CH 05 PDFDocument16 pagesAnswers To Review Quizzes & Problems - CH 05 PDFPrajna MelittaNo ratings yet

- Econ 100.2 - LE 1 CoverageDocument11 pagesEcon 100.2 - LE 1 CoverageRed TigerNo ratings yet

- PartoDocument28 pagesPartoSheidaHaNo ratings yet

- Chap 2 M1Document9 pagesChap 2 M1science boyNo ratings yet

- UNIT-I - ECONOMY & CENTRAL PROBLEM Powerpoint Presentation (Repaired)Document75 pagesUNIT-I - ECONOMY & CENTRAL PROBLEM Powerpoint Presentation (Repaired)cpawan_699508100% (4)

- Intl Trade 09-12-2020Document41 pagesIntl Trade 09-12-2020Mustansar saeedNo ratings yet

- General EquilibriumDocument61 pagesGeneral EquilibriumRaisa Yuliana FitranieNo ratings yet

- Review Questions Principles of Macroeconomics: Chapters 1 and 2Document36 pagesReview Questions Principles of Macroeconomics: Chapters 1 and 2Martin HusseinNo ratings yet

- WEEK 6 Supply and Demand Analysis ExpandedDocument2 pagesWEEK 6 Supply and Demand Analysis ExpandedAlipio Desuyo LaDjarNo ratings yet

- Lecture 10Document14 pagesLecture 10yusufaldemir3455No ratings yet

- Chapter-1 XBJDDVBDDocument3 pagesChapter-1 XBJDDVBDVipin SinghNo ratings yet

- Theory of Consumer BehaviorDocument3 pagesTheory of Consumer BehaviorJose DennisNo ratings yet

- W 32135Document70 pagesW 32135Gabriel JangNo ratings yet

- Economics TheoryDocument19 pagesEconomics TheoryadiNo ratings yet

- NotesDocument26 pagesNotesEwa PateckaNo ratings yet

- Welfare Economics: Two ApproachesDocument9 pagesWelfare Economics: Two ApproachesstriiderNo ratings yet

- Industrial Economics NotesDocument11 pagesIndustrial Economics NotesswajihulhassanNo ratings yet

- Subject: Class: Year:: Economics B.A. IDocument7 pagesSubject: Class: Year:: Economics B.A. IRasmita NayakNo ratings yet

- Economic AnalysisDocument24 pagesEconomic AnalysisVanessa Bernardino100% (1)

- Engineering Economics Imon11Document7 pagesEngineering Economics Imon1181No ratings yet

- Block 2 MEC 008 Unit 4Document19 pagesBlock 2 MEC 008 Unit 4Adarsh Kumar GuptaNo ratings yet

- By: Group 3: Dian Vitasari Ayu Lestari Ari Pandowo Anasta Ensenanda WDocument34 pagesBy: Group 3: Dian Vitasari Ayu Lestari Ari Pandowo Anasta Ensenanda WIrfan Rakhman HidayatNo ratings yet

- Approaches: Welfare Economics Is A Branch of Economics That UsesDocument3 pagesApproaches: Welfare Economics Is A Branch of Economics That UsesDhaval AsharNo ratings yet

- Final Efm Jayesh DesaiDocument19 pagesFinal Efm Jayesh Desaishivam networkNo ratings yet

- Chapter Review 7Document3 pagesChapter Review 7Tória RajabecNo ratings yet

- Summary Principles of Economics (Mankiw)Document5 pagesSummary Principles of Economics (Mankiw)ScribdTranslationsNo ratings yet

- Microeconomics Principles and Applications 6th Edition Hall Solutions Manual DownloadDocument15 pagesMicroeconomics Principles and Applications 6th Edition Hall Solutions Manual DownloadGerald Washing100% (20)

- Basic Microeconomics - Group 2 Version 2 Draft 1Document18 pagesBasic Microeconomics - Group 2 Version 2 Draft 1zytraniumNo ratings yet

- NIR Press Release March 2022Document1 pageNIR Press Release March 2022Nesma HusseinNo ratings yet

- FunctionsssDocument23 pagesFunctionsssNesma HusseinNo ratings yet

- Financial Development and Economic Growth in Egypt 22Document18 pagesFinancial Development and Economic Growth in Egypt 22Nesma HusseinNo ratings yet

- AD - Money&Banking MishkinDocument6 pagesAD - Money&Banking MishkinNesma HusseinNo ratings yet

- Lecture - 5 - AudioDocument13 pagesLecture - 5 - AudioNesma HusseinNo ratings yet

- Middle East - Lecture 8Document21 pagesMiddle East - Lecture 8Nesma HusseinNo ratings yet

- Lecture 3Document22 pagesLecture 3Nesma HusseinNo ratings yet

- Theories Lec 3Document23 pagesTheories Lec 3Nesma HusseinNo ratings yet

- Financial Structure of EgyptDocument28 pagesFinancial Structure of EgyptNesma HusseinNo ratings yet

- كتاب 1Document545 pagesكتاب 1Nesma HusseinNo ratings yet

- Bacolod Amusement Places Entertainment PlacesDocument511 pagesBacolod Amusement Places Entertainment PlacesCrisant Dema-alaNo ratings yet

- Documentary Requirements For Salary Claim Other Monetary ClaimsDocument3 pagesDocumentary Requirements For Salary Claim Other Monetary ClaimsRACELNo ratings yet

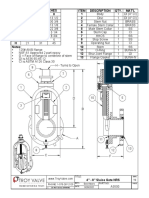

- Sluice Gate NRS 4 To 8 IN DRAWINGDocument1 pageSluice Gate NRS 4 To 8 IN DRAWINGRoberto RosasNo ratings yet

- Key Plan: C3 S2 S1 S1 C3 C3 C3 S1 - S2: Customize SofaDocument7 pagesKey Plan: C3 S2 S1 S1 C3 C3 C3 S1 - S2: Customize SofaIvan Sitorus ZvNo ratings yet

- 0455 Economics: MARK SCHEME For The May/June 2009 Question Paper For The Guidance of TeachersDocument4 pages0455 Economics: MARK SCHEME For The May/June 2009 Question Paper For The Guidance of TeachersAhmedNo ratings yet

- Pip Lord After The News Effect VenomDocument19 pagesPip Lord After The News Effect VenomFx ToolkitNo ratings yet

- Salary Certificate Format For Bank LoanDocument2 pagesSalary Certificate Format For Bank LoanAjey Kulkarni100% (1)

- Expenditure MehodDocument13 pagesExpenditure MehodAshishNo ratings yet

- Banpu One Report 2022 en 11 Apr 23Document169 pagesBanpu One Report 2022 en 11 Apr 23ผีเสื้อ ราตรีNo ratings yet

- Sintex Price List JBDocument2 pagesSintex Price List JBKapil Galwani0% (1)

- National Bamboo MissionDocument5 pagesNational Bamboo MissionMadhuri GuptaNo ratings yet

- BLACKBOOK AU Small Finance BankDocument79 pagesBLACKBOOK AU Small Finance Bankaadil shaikhNo ratings yet

- Numericals On Wind EnergyDocument7 pagesNumericals On Wind EnergyJoel JosephNo ratings yet

- HaridwarDocument14 pagesHaridwarak9772595No ratings yet

- Amit Bhatt EV GuwahatiDocument10 pagesAmit Bhatt EV GuwahatiABCDNo ratings yet

- Class 10th Development BoardPrep SolutionDocument10 pagesClass 10th Development BoardPrep SolutionABISHUA HANOK LALNo ratings yet

- Fin550 SipraDocument6 pagesFin550 Sipramadhu sudhanNo ratings yet

- 1.chapter1 Introduction To EconomicsDocument20 pages1.chapter1 Introduction To EconomicsMohd Quastan AlhakimNo ratings yet

- Din Flange SpecificationsDocument2 pagesDin Flange SpecificationsStela LjevarNo ratings yet

- PCPM Lecture 02 - Procurement in Project Life Cycle PDFDocument15 pagesPCPM Lecture 02 - Procurement in Project Life Cycle PDFHumera SulemanNo ratings yet

- UBL Internship ReportDocument58 pagesUBL Internship Reportbbaahmad89100% (1)

- MACR (2nd) May2022Document3 pagesMACR (2nd) May2022Jagjit GillNo ratings yet

- Cases For Digest Civil ProcedureDocument2 pagesCases For Digest Civil ProcedureRex Philip LucianoNo ratings yet

- Balance of Payments (BoP)Document41 pagesBalance of Payments (BoP)anindya_kundu100% (1)

- Allama Iqbal Open University, Islamabad: (Department of Commerce)Document5 pagesAllama Iqbal Open University, Islamabad: (Department of Commerce)Sohail Liaqat AliNo ratings yet

- Macroeconomics, Consumption and SavingDocument5 pagesMacroeconomics, Consumption and SavingLeLe LetzileNo ratings yet

- CH 02 Annuity - Completed and AnswersDocument22 pagesCH 02 Annuity - Completed and AnswersNiketGhelaniNo ratings yet

- 39 Trading RulesDocument2 pages39 Trading RulesZulfiqar AliNo ratings yet

- Cookie MiningDocument2 pagesCookie MiningAngelyn RabajaNo ratings yet