Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

6 viewsCommercial Banks Lecture (ARS Baloch)

Commercial Banks Lecture (ARS Baloch)

Uploaded by

allah rakhioCommercial banks accept deposits, offer checking and savings accounts, and provide loans and basic financial services to individuals and businesses. They operate by taking deposits from customers and using those funds to issue loans and make investments. The key functions of commercial banks are receiving deposits, providing loans and advances, offering check and credit card services, managing funds transfers, and acting as financial agents. Profitability, liquidity, and minimizing risk guide how commercial banks structure their assets.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You might also like

- Capital Markets Chapter 3Document11 pagesCapital Markets Chapter 3Faith FajarilloNo ratings yet

- Lecture 1Document9 pagesLecture 1Rafsun HimelNo ratings yet

- Unit II: Banking Products and Services (Credit Facility)Document38 pagesUnit II: Banking Products and Services (Credit Facility)darshan lamaNo ratings yet

- Unit 3 EnglishDocument7 pagesUnit 3 Englishshayaquezafar777No ratings yet

- Idris AssignmentDocument8 pagesIdris AssignmentMuhammad IdrisNo ratings yet

- Introduction To Commercial BanksDocument9 pagesIntroduction To Commercial BanksAtharva AlokNo ratings yet

- Module 1.2Document9 pagesModule 1.2meet daftaryNo ratings yet

- Module 11 Compiled PptsDocument46 pagesModule 11 Compiled PptsNashebah A. BatuganNo ratings yet

- Investment Management: Banks and Financial InstitutionsDocument15 pagesInvestment Management: Banks and Financial InstitutionsDaisy KetchNo ratings yet

- Financial Institutions and Market: Commercial BankDocument60 pagesFinancial Institutions and Market: Commercial BankJayashree KowtalNo ratings yet

- Econon Paper BanklendingDocument61 pagesEconon Paper BanklendingDaipayan MajumderNo ratings yet

- Extra I - Retail Banking & Banking Arrangements PDFDocument15 pagesExtra I - Retail Banking & Banking Arrangements PDFrizzzNo ratings yet

- FIN 2024 AnswersDocument6 pagesFIN 2024 AnswersBee LNo ratings yet

- Bank and Banking PerspectiveDocument10 pagesBank and Banking PerspectiveDennilyn TanchicoNo ratings yet

- Money & Banking PresentationDocument54 pagesMoney & Banking PresentationmehmooddharalaNo ratings yet

- Ubfb3023 CBM Lecture 1Document70 pagesUbfb3023 CBM Lecture 1zijun 008 sawNo ratings yet

- Presentation GROUP FINALDocument19 pagesPresentation GROUP FINALGurpreet kaurNo ratings yet

- Topic 2 Financia System and Commerical Bank ManagementDocument60 pagesTopic 2 Financia System and Commerical Bank Managementtalalalmintakh05No ratings yet

- UNIt 1 BODocument38 pagesUNIt 1 BORakshitha. A GedamNo ratings yet

- C6 BankingDocument16 pagesC6 BankingKavyansh SharmaNo ratings yet

- UNIT 2 - 16th September 2020Document42 pagesUNIT 2 - 16th September 2020GracyNo ratings yet

- Banking and Financial InstitutionDocument4 pagesBanking and Financial InstitutionPrincess Alay-ayNo ratings yet

- Money Banking MonetaryDocument6 pagesMoney Banking MonetaryMohit WaniNo ratings yet

- Banking Theory and Practice Chapter FiveDocument23 pagesBanking Theory and Practice Chapter Fivemubarek oumerNo ratings yet

- Fin 370 Chapter 1Document24 pagesFin 370 Chapter 1my chimchimNo ratings yet

- Bank Management - Snap Shot: Chapter ObjectivesDocument44 pagesBank Management - Snap Shot: Chapter ObjectivesNoor QamarNo ratings yet

- Lecture ThreeDocument10 pagesLecture ThreeHassan HaibeNo ratings yet

- Merchant BankingDocument29 pagesMerchant BankingramrattangNo ratings yet

- 5th Sem BR&ODocument111 pages5th Sem BR&Oshree harsha cNo ratings yet

- What Are The Basic Principals of Banking? Discuss BrieflyDocument19 pagesWhat Are The Basic Principals of Banking? Discuss BrieflyNihathamanie PereraNo ratings yet

- Principles of Bank Lending & Priority Sector LendingDocument22 pagesPrinciples of Bank Lending & Priority Sector LendingSheejaVarghese100% (8)

- Commercial Bankes in Sri LankaDocument15 pagesCommercial Bankes in Sri LankaRaashed RamzanNo ratings yet

- Assignment 1Document4 pagesAssignment 1Sanjida Ashrafi AnanyaNo ratings yet

- Basics of Commercial Banking Group 6 Handout 2Document12 pagesBasics of Commercial Banking Group 6 Handout 2Daniela Kian AyalaNo ratings yet

- Chapter01 Introduction To Commercial BanksDocument35 pagesChapter01 Introduction To Commercial BanksĐoàn Trần Ngọc AnhNo ratings yet

- CHAPTER I Principles of Lending Types of Credit FacilitiesDocument6 pagesCHAPTER I Principles of Lending Types of Credit Facilitiesanand.action0076127No ratings yet

- MT1 Preparation Quesiton For Money and Banking Midterm Part1Document8 pagesMT1 Preparation Quesiton For Money and Banking Midterm Part1talalalmintakh05No ratings yet

- Bank LendingDocument77 pagesBank Lendinghaarrisali7No ratings yet

- Commercial Bank: Bank Operations Bank Management Bank PerformanceDocument24 pagesCommercial Bank: Bank Operations Bank Management Bank PerformanceurviNo ratings yet

- BaselDocument27 pagesBaselSimran MehrotraNo ratings yet

- 1.1 Background of The StudyDocument5 pages1.1 Background of The StudySocialist GopalNo ratings yet

- Lecture 4 - Bank's Assets and Liability ManagementDocument16 pagesLecture 4 - Bank's Assets and Liability ManagementLeyli MelikovaNo ratings yet

- Balance SheetDocument11 pagesBalance SheetTrifan_DumitruNo ratings yet

- Banking SlideDocument11 pagesBanking SlideRabbi Munsi 201-11-1093No ratings yet

- Module - 2 Banking System and Operations: Rajneesh MishraDocument51 pagesModule - 2 Banking System and Operations: Rajneesh MishramarianmadhurNo ratings yet

- Chap-11 Business Finance and Fundamentals of AccountingDocument23 pagesChap-11 Business Finance and Fundamentals of AccountingSiffat Bin AyubNo ratings yet

- Banks and Other Financial IntermediariesDocument3 pagesBanks and Other Financial IntermediariesMary Elleonice Franchette QuiambaoNo ratings yet

- Unit 10 MRECHANT BANKINGDocument33 pagesUnit 10 MRECHANT BANKINGGinu George VargheseNo ratings yet

- 05 Bank ManagementDocument17 pages05 Bank ManagementMohammed MustansirNo ratings yet

- Commercial Lendings by BanksDocument65 pagesCommercial Lendings by Banksvivek satviNo ratings yet

- Detail of Treasury FunctionsDocument4 pagesDetail of Treasury Functionsgabutac aivlysNo ratings yet

- MGMT of Financial Institution Ch1Document9 pagesMGMT of Financial Institution Ch1nahomnahomnahom147No ratings yet

- Bank Lending and Credit A DministrationDocument5 pagesBank Lending and Credit A Dministrationolikagu patrickNo ratings yet

- M2 IFS Jan2024Document42 pagesM2 IFS Jan2024navyagoyal23No ratings yet

- Money and BankingDocument9 pagesMoney and BankingThisath DissanayakeNo ratings yet

- Introduction To Bank Credit ManagementDocument26 pagesIntroduction To Bank Credit ManagementNeeRaz KunwarNo ratings yet

- Combo CompressedDocument549 pagesCombo CompressedAlexis ParrisNo ratings yet

- Commercial BankDocument11 pagesCommercial BankVaibhavi BorhadeNo ratings yet

- Fee Based ServicesDocument2 pagesFee Based ServicesGurwinder SinghNo ratings yet

- Bank Fundamentals: An Introduction to the World of Finance and BankingFrom EverandBank Fundamentals: An Introduction to the World of Finance and BankingRating: 4.5 out of 5 stars4.5/5 (4)

- Nike, Inc. Cost of Capital - A Case Study. IA2.Document6 pagesNike, Inc. Cost of Capital - A Case Study. IA2.TineNo ratings yet

- Internship ReportDocument8 pagesInternship Reporteasy medicineNo ratings yet

- Blowing The Lid On World History and The Hidden PowersDocument129 pagesBlowing The Lid On World History and The Hidden PowersSeoirse DionysosNo ratings yet

- Risk and Rates of Return - DemoDocument10 pagesRisk and Rates of Return - DemoKen ZyuNo ratings yet

- Finman Midterms Part 1Document7 pagesFinman Midterms Part 1JerichoNo ratings yet

- Op Transaction History 03!09!2023Document2 pagesOp Transaction History 03!09!2023Kuljinder SinghNo ratings yet

- Accounting & Excel Assignment - ExperiencedDocument21 pagesAccounting & Excel Assignment - Experienceddivyaparashar10No ratings yet

- Asistensi Akm 3 Pertemuan 3 Cash Flow Indirect MethodDocument3 pagesAsistensi Akm 3 Pertemuan 3 Cash Flow Indirect Methodaldo sinagaNo ratings yet

- Money and Banking Q&ADocument9 pagesMoney and Banking Q&AKrrish WaliaNo ratings yet

- PneumaticDocument15 pagesPneumaticDesign ErNo ratings yet

- Gte Financial Matrix: (LESS Any Scholarship/s)Document2 pagesGte Financial Matrix: (LESS Any Scholarship/s)mahmudNo ratings yet

- Tax On Presumptive Basis in Case of Certain Eligible BusinessesDocument15 pagesTax On Presumptive Basis in Case of Certain Eligible BusinessesSeemant GuptaNo ratings yet

- Invoice Receipt: Orchards Residents AssociationDocument1 pageInvoice Receipt: Orchards Residents Association4mxzfppvfnNo ratings yet

- Lev 2Document4 pagesLev 2biniamNo ratings yet

- CBSE Class 12 Accountancy Question Paper Solution SET 1 Series 2Document18 pagesCBSE Class 12 Accountancy Question Paper Solution SET 1 Series 2Mehul JindalNo ratings yet

- 654 Internal Rate of Return and Net Present ValueDocument4 pages654 Internal Rate of Return and Net Present ValueGEMPFNo ratings yet

- RFM Annual Report Financial StatementDocument7 pagesRFM Annual Report Financial StatementMarceline AbadeerNo ratings yet

- UNESCODocument70 pagesUNESCOPaa JoeNo ratings yet

- E StatmentDocument2 pagesE StatmentShekhar BathawNo ratings yet

- Entrepreneur Grade 9Document17 pagesEntrepreneur Grade 9Anne GimoteaNo ratings yet

- Bob 4Document11 pagesBob 4Raj KuruhuriNo ratings yet

- Negotiable Instruments Act 1881Document40 pagesNegotiable Instruments Act 1881Tanvir PrantoNo ratings yet

- Tle6 Q1 Week2Document6 pagesTle6 Q1 Week2Roy Bautista Manguyot100% (1)

- What Is NPA?: Banking Businesses Is Mainly That of Borrowing From The Public and LendingDocument5 pagesWhat Is NPA?: Banking Businesses Is Mainly That of Borrowing From The Public and LendingbhagatamitNo ratings yet

- Course Outline - METP - Kalpana - Final - October 2020Document8 pagesCourse Outline - METP - Kalpana - Final - October 2020KaranNo ratings yet

- Approaches of Working Capital ManagementDocument3 pagesApproaches of Working Capital ManagementSwati KunwarNo ratings yet

- Account Statement Account Statement ﺣ ﺴ ﺎ ب ﺣ ﺴ ﺎ ب ﻛ ﺸ ﻒ ﻛ ﺸ ﻒDocument2 pagesAccount Statement Account Statement ﺣ ﺴ ﺎ ب ﺣ ﺴ ﺎ ب ﻛ ﺸ ﻒ ﻛ ﺸ ﻒMohammed Al-DawoudiNo ratings yet

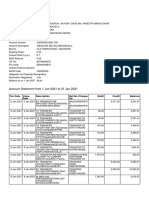

- Sbi Account Jan 2021Document2 pagesSbi Account Jan 2021Manoj GaurNo ratings yet

- Int Acc 1Document49 pagesInt Acc 1kookie bunnyNo ratings yet

Commercial Banks Lecture (ARS Baloch)

Commercial Banks Lecture (ARS Baloch)

Uploaded by

allah rakhio0 ratings0% found this document useful (0 votes)

6 views8 pagesCommercial banks accept deposits, offer checking and savings accounts, and provide loans and basic financial services to individuals and businesses. They operate by taking deposits from customers and using those funds to issue loans and make investments. The key functions of commercial banks are receiving deposits, providing loans and advances, offering check and credit card services, managing funds transfers, and acting as financial agents. Profitability, liquidity, and minimizing risk guide how commercial banks structure their assets.

Original Description:

commercial bank lectures

Original Title

Commercial Banks Lecture (ARS Baloch )

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCommercial banks accept deposits, offer checking and savings accounts, and provide loans and basic financial services to individuals and businesses. They operate by taking deposits from customers and using those funds to issue loans and make investments. The key functions of commercial banks are receiving deposits, providing loans and advances, offering check and credit card services, managing funds transfers, and acting as financial agents. Profitability, liquidity, and minimizing risk guide how commercial banks structure their assets.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

6 views8 pagesCommercial Banks Lecture (ARS Baloch)

Commercial Banks Lecture (ARS Baloch)

Uploaded by

allah rakhioCommercial banks accept deposits, offer checking and savings accounts, and provide loans and basic financial services to individuals and businesses. They operate by taking deposits from customers and using those funds to issue loans and make investments. The key functions of commercial banks are receiving deposits, providing loans and advances, offering check and credit card services, managing funds transfers, and acting as financial agents. Profitability, liquidity, and minimizing risk guide how commercial banks structure their assets.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 8

Commercial Banks

Commercial Banks and its Operations

Banking and Management of Financial Institutions

General Principles of Bank Management.

What Is a Commercial Bank? The term

commercial bank refers to a financial

institution that accepts deposits, offers

Commercial checking account services, makes

Banks various loans, and offers basic

financial products like certificates of

deposit and savings accounts to

individuals and businesses.

Banking means the accepting for the purpose of lending or investment

of deposits of money from the public, repayable on demand or

otherwise, and withdrawal by cheque, draft, order or otherwise”. From

the above definitions we can analyze that the primary functions of

banks are accepting of deposits, lending of these deposits, allowing

deposits to withdraw through cheque whenever they demand. The

business of commercial banks is primarily to keep deposits and make

loan and advances for short period up to one or two years made to

Functions of industry and trade either by the system of overdrafts of an agreed

Commercial amount to make profit to the shareholders.

Receiving deposits from the public

Banks Giving loans and advances

Use of cheque system and credit cards

Credit creation

Financing foreign trade.

Transfer of funds.

Agency functions

Miscellaneous functions

Safety and Security

MOTIVES OF Liquidity of funds in

INVESTMENT banks

POLICY

Profitability of the

Bank

Assets structure will reflect the deployment of sources of funds

of commercial banks. The main source of funds of commercial

banks is deposits. The other sources of funds are borrowings

from other banks, capital, reserves and surplus. The deposits of

commercial banks are from savings deposits, current account

Asset Structure deposits and term deposits

The assets structure of the banks is governed by certain

of Commercial principles, like liquidity, profitability, and risklessness. The

Banks other factors which influence the assets structure of

Commercial Banks are nature of money market, economic

growth of the country, policies and vision of the governments.

In the countries like India, China, Russia, North Korea and

Brazil there is a boom in the growth of the economy hence

naturally there will be heavy demand for the credit

Important assets of the commercial bank..

Cash in hand and balances with Central Bank

Money at Call and Short Notice

Investments

Loans and Advances

Fixed Assets and other assets

Profitability of Commercial Banks

Profitability is a key parameter in assessing the performance of any business firm. Even in the banking sector after the banking sector reforms the priorities in

banking operations underwent far reaching changes. There had been a shift in the emphasis from development or social banking to commercially viable banking.

Profitability became the prime mover of the financial strength and performance of banks; hence the performance of the bank is measured on the basis of its

profitability.

Provisioning for loan losses, loan quality improvements or non-Performing Assets

Interest rate movements

Rigidity of the operating cost structure

Banking structure

Size of Bank

Branch network or Franchise strength

Interest expense

Non-interest expenses

The Bank Balance Sheet

Liabilities

• Checkable deposits

• Non transaction deposits

• Borrowings

Banking and • Bank capital

Management Assets

of Financial Reserves

Institutions Cash items in process of collection

Deposits at other banks

Securities

Loans

Other assets

Liquidity Management

Asset Management

General Liability Management

Principles of

Capital Adequacy Management

Bank

Credit Risk

Management

Interest-rate Risk

Maintenance of Cash Reserve Requirement (CRR)

During the reserve maintenance period, Cash Reserves shall be maintained at an average of 6% of total of demand

liabilities and time deposits with tenor of less than 1 year.

You might also like

- Capital Markets Chapter 3Document11 pagesCapital Markets Chapter 3Faith FajarilloNo ratings yet

- Lecture 1Document9 pagesLecture 1Rafsun HimelNo ratings yet

- Unit II: Banking Products and Services (Credit Facility)Document38 pagesUnit II: Banking Products and Services (Credit Facility)darshan lamaNo ratings yet

- Unit 3 EnglishDocument7 pagesUnit 3 Englishshayaquezafar777No ratings yet

- Idris AssignmentDocument8 pagesIdris AssignmentMuhammad IdrisNo ratings yet

- Introduction To Commercial BanksDocument9 pagesIntroduction To Commercial BanksAtharva AlokNo ratings yet

- Module 1.2Document9 pagesModule 1.2meet daftaryNo ratings yet

- Module 11 Compiled PptsDocument46 pagesModule 11 Compiled PptsNashebah A. BatuganNo ratings yet

- Investment Management: Banks and Financial InstitutionsDocument15 pagesInvestment Management: Banks and Financial InstitutionsDaisy KetchNo ratings yet

- Financial Institutions and Market: Commercial BankDocument60 pagesFinancial Institutions and Market: Commercial BankJayashree KowtalNo ratings yet

- Econon Paper BanklendingDocument61 pagesEconon Paper BanklendingDaipayan MajumderNo ratings yet

- Extra I - Retail Banking & Banking Arrangements PDFDocument15 pagesExtra I - Retail Banking & Banking Arrangements PDFrizzzNo ratings yet

- FIN 2024 AnswersDocument6 pagesFIN 2024 AnswersBee LNo ratings yet

- Bank and Banking PerspectiveDocument10 pagesBank and Banking PerspectiveDennilyn TanchicoNo ratings yet

- Money & Banking PresentationDocument54 pagesMoney & Banking PresentationmehmooddharalaNo ratings yet

- Ubfb3023 CBM Lecture 1Document70 pagesUbfb3023 CBM Lecture 1zijun 008 sawNo ratings yet

- Presentation GROUP FINALDocument19 pagesPresentation GROUP FINALGurpreet kaurNo ratings yet

- Topic 2 Financia System and Commerical Bank ManagementDocument60 pagesTopic 2 Financia System and Commerical Bank Managementtalalalmintakh05No ratings yet

- UNIt 1 BODocument38 pagesUNIt 1 BORakshitha. A GedamNo ratings yet

- C6 BankingDocument16 pagesC6 BankingKavyansh SharmaNo ratings yet

- UNIT 2 - 16th September 2020Document42 pagesUNIT 2 - 16th September 2020GracyNo ratings yet

- Banking and Financial InstitutionDocument4 pagesBanking and Financial InstitutionPrincess Alay-ayNo ratings yet

- Money Banking MonetaryDocument6 pagesMoney Banking MonetaryMohit WaniNo ratings yet

- Banking Theory and Practice Chapter FiveDocument23 pagesBanking Theory and Practice Chapter Fivemubarek oumerNo ratings yet

- Fin 370 Chapter 1Document24 pagesFin 370 Chapter 1my chimchimNo ratings yet

- Bank Management - Snap Shot: Chapter ObjectivesDocument44 pagesBank Management - Snap Shot: Chapter ObjectivesNoor QamarNo ratings yet

- Lecture ThreeDocument10 pagesLecture ThreeHassan HaibeNo ratings yet

- Merchant BankingDocument29 pagesMerchant BankingramrattangNo ratings yet

- 5th Sem BR&ODocument111 pages5th Sem BR&Oshree harsha cNo ratings yet

- What Are The Basic Principals of Banking? Discuss BrieflyDocument19 pagesWhat Are The Basic Principals of Banking? Discuss BrieflyNihathamanie PereraNo ratings yet

- Principles of Bank Lending & Priority Sector LendingDocument22 pagesPrinciples of Bank Lending & Priority Sector LendingSheejaVarghese100% (8)

- Commercial Bankes in Sri LankaDocument15 pagesCommercial Bankes in Sri LankaRaashed RamzanNo ratings yet

- Assignment 1Document4 pagesAssignment 1Sanjida Ashrafi AnanyaNo ratings yet

- Basics of Commercial Banking Group 6 Handout 2Document12 pagesBasics of Commercial Banking Group 6 Handout 2Daniela Kian AyalaNo ratings yet

- Chapter01 Introduction To Commercial BanksDocument35 pagesChapter01 Introduction To Commercial BanksĐoàn Trần Ngọc AnhNo ratings yet

- CHAPTER I Principles of Lending Types of Credit FacilitiesDocument6 pagesCHAPTER I Principles of Lending Types of Credit Facilitiesanand.action0076127No ratings yet

- MT1 Preparation Quesiton For Money and Banking Midterm Part1Document8 pagesMT1 Preparation Quesiton For Money and Banking Midterm Part1talalalmintakh05No ratings yet

- Bank LendingDocument77 pagesBank Lendinghaarrisali7No ratings yet

- Commercial Bank: Bank Operations Bank Management Bank PerformanceDocument24 pagesCommercial Bank: Bank Operations Bank Management Bank PerformanceurviNo ratings yet

- BaselDocument27 pagesBaselSimran MehrotraNo ratings yet

- 1.1 Background of The StudyDocument5 pages1.1 Background of The StudySocialist GopalNo ratings yet

- Lecture 4 - Bank's Assets and Liability ManagementDocument16 pagesLecture 4 - Bank's Assets and Liability ManagementLeyli MelikovaNo ratings yet

- Balance SheetDocument11 pagesBalance SheetTrifan_DumitruNo ratings yet

- Banking SlideDocument11 pagesBanking SlideRabbi Munsi 201-11-1093No ratings yet

- Module - 2 Banking System and Operations: Rajneesh MishraDocument51 pagesModule - 2 Banking System and Operations: Rajneesh MishramarianmadhurNo ratings yet

- Chap-11 Business Finance and Fundamentals of AccountingDocument23 pagesChap-11 Business Finance and Fundamentals of AccountingSiffat Bin AyubNo ratings yet

- Banks and Other Financial IntermediariesDocument3 pagesBanks and Other Financial IntermediariesMary Elleonice Franchette QuiambaoNo ratings yet

- Unit 10 MRECHANT BANKINGDocument33 pagesUnit 10 MRECHANT BANKINGGinu George VargheseNo ratings yet

- 05 Bank ManagementDocument17 pages05 Bank ManagementMohammed MustansirNo ratings yet

- Commercial Lendings by BanksDocument65 pagesCommercial Lendings by Banksvivek satviNo ratings yet

- Detail of Treasury FunctionsDocument4 pagesDetail of Treasury Functionsgabutac aivlysNo ratings yet

- MGMT of Financial Institution Ch1Document9 pagesMGMT of Financial Institution Ch1nahomnahomnahom147No ratings yet

- Bank Lending and Credit A DministrationDocument5 pagesBank Lending and Credit A Dministrationolikagu patrickNo ratings yet

- M2 IFS Jan2024Document42 pagesM2 IFS Jan2024navyagoyal23No ratings yet

- Money and BankingDocument9 pagesMoney and BankingThisath DissanayakeNo ratings yet

- Introduction To Bank Credit ManagementDocument26 pagesIntroduction To Bank Credit ManagementNeeRaz KunwarNo ratings yet

- Combo CompressedDocument549 pagesCombo CompressedAlexis ParrisNo ratings yet

- Commercial BankDocument11 pagesCommercial BankVaibhavi BorhadeNo ratings yet

- Fee Based ServicesDocument2 pagesFee Based ServicesGurwinder SinghNo ratings yet

- Bank Fundamentals: An Introduction to the World of Finance and BankingFrom EverandBank Fundamentals: An Introduction to the World of Finance and BankingRating: 4.5 out of 5 stars4.5/5 (4)

- Nike, Inc. Cost of Capital - A Case Study. IA2.Document6 pagesNike, Inc. Cost of Capital - A Case Study. IA2.TineNo ratings yet

- Internship ReportDocument8 pagesInternship Reporteasy medicineNo ratings yet

- Blowing The Lid On World History and The Hidden PowersDocument129 pagesBlowing The Lid On World History and The Hidden PowersSeoirse DionysosNo ratings yet

- Risk and Rates of Return - DemoDocument10 pagesRisk and Rates of Return - DemoKen ZyuNo ratings yet

- Finman Midterms Part 1Document7 pagesFinman Midterms Part 1JerichoNo ratings yet

- Op Transaction History 03!09!2023Document2 pagesOp Transaction History 03!09!2023Kuljinder SinghNo ratings yet

- Accounting & Excel Assignment - ExperiencedDocument21 pagesAccounting & Excel Assignment - Experienceddivyaparashar10No ratings yet

- Asistensi Akm 3 Pertemuan 3 Cash Flow Indirect MethodDocument3 pagesAsistensi Akm 3 Pertemuan 3 Cash Flow Indirect Methodaldo sinagaNo ratings yet

- Money and Banking Q&ADocument9 pagesMoney and Banking Q&AKrrish WaliaNo ratings yet

- PneumaticDocument15 pagesPneumaticDesign ErNo ratings yet

- Gte Financial Matrix: (LESS Any Scholarship/s)Document2 pagesGte Financial Matrix: (LESS Any Scholarship/s)mahmudNo ratings yet

- Tax On Presumptive Basis in Case of Certain Eligible BusinessesDocument15 pagesTax On Presumptive Basis in Case of Certain Eligible BusinessesSeemant GuptaNo ratings yet

- Invoice Receipt: Orchards Residents AssociationDocument1 pageInvoice Receipt: Orchards Residents Association4mxzfppvfnNo ratings yet

- Lev 2Document4 pagesLev 2biniamNo ratings yet

- CBSE Class 12 Accountancy Question Paper Solution SET 1 Series 2Document18 pagesCBSE Class 12 Accountancy Question Paper Solution SET 1 Series 2Mehul JindalNo ratings yet

- 654 Internal Rate of Return and Net Present ValueDocument4 pages654 Internal Rate of Return and Net Present ValueGEMPFNo ratings yet

- RFM Annual Report Financial StatementDocument7 pagesRFM Annual Report Financial StatementMarceline AbadeerNo ratings yet

- UNESCODocument70 pagesUNESCOPaa JoeNo ratings yet

- E StatmentDocument2 pagesE StatmentShekhar BathawNo ratings yet

- Entrepreneur Grade 9Document17 pagesEntrepreneur Grade 9Anne GimoteaNo ratings yet

- Bob 4Document11 pagesBob 4Raj KuruhuriNo ratings yet

- Negotiable Instruments Act 1881Document40 pagesNegotiable Instruments Act 1881Tanvir PrantoNo ratings yet

- Tle6 Q1 Week2Document6 pagesTle6 Q1 Week2Roy Bautista Manguyot100% (1)

- What Is NPA?: Banking Businesses Is Mainly That of Borrowing From The Public and LendingDocument5 pagesWhat Is NPA?: Banking Businesses Is Mainly That of Borrowing From The Public and LendingbhagatamitNo ratings yet

- Course Outline - METP - Kalpana - Final - October 2020Document8 pagesCourse Outline - METP - Kalpana - Final - October 2020KaranNo ratings yet

- Approaches of Working Capital ManagementDocument3 pagesApproaches of Working Capital ManagementSwati KunwarNo ratings yet

- Account Statement Account Statement ﺣ ﺴ ﺎ ب ﺣ ﺴ ﺎ ب ﻛ ﺸ ﻒ ﻛ ﺸ ﻒDocument2 pagesAccount Statement Account Statement ﺣ ﺴ ﺎ ب ﺣ ﺴ ﺎ ب ﻛ ﺸ ﻒ ﻛ ﺸ ﻒMohammed Al-DawoudiNo ratings yet

- Sbi Account Jan 2021Document2 pagesSbi Account Jan 2021Manoj GaurNo ratings yet

- Int Acc 1Document49 pagesInt Acc 1kookie bunnyNo ratings yet