Professional Documents

Culture Documents

Presentation 1

Presentation 1

Uploaded by

Ritu0 ratings0% found this document useful (0 votes)

7 views16 pages1. The document provides details of the calculation of taxable income from business or profession for an individual.

2. Key additions to the net profit as per P&L account include disallowed expenses like personal expenses, donations, life insurance premium etc. Key deductions include allowed depreciation expenses and disallowed income like salary, interest income and profit from sale of old car.

3. After making additions and deductions, the taxable income from business or profession is calculated to be Rs. 5,45,226. Working notes provide details of depreciation calculation for car, books, and computer.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. The document provides details of the calculation of taxable income from business or profession for an individual.

2. Key additions to the net profit as per P&L account include disallowed expenses like personal expenses, donations, life insurance premium etc. Key deductions include allowed depreciation expenses and disallowed income like salary, interest income and profit from sale of old car.

3. After making additions and deductions, the taxable income from business or profession is calculated to be Rs. 5,45,226. Working notes provide details of depreciation calculation for car, books, and computer.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

7 views16 pagesPresentation 1

Presentation 1

Uploaded by

Ritu1. The document provides details of the calculation of taxable income from business or profession for an individual.

2. Key additions to the net profit as per P&L account include disallowed expenses like personal expenses, donations, life insurance premium etc. Key deductions include allowed depreciation expenses and disallowed income like salary, interest income and profit from sale of old car.

3. After making additions and deductions, the taxable income from business or profession is calculated to be Rs. 5,45,226. Working notes provide details of depreciation calculation for car, books, and computer.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 16

PRESTIGE INSTITUTE OF MANAGEMENT AND RESEARCH, INDORE

(An Autonomous Institution Established in 1994, Accredited with Grade ‘A++’ NAAC (UGC) ISO 9001: 2008 Certified Institute, AICTE / UGC Approved Programs affiliated to DAVV, Indore)

TAX PLANNING AND MANAGEMENT

2022-2024

GROUP – 5

Submitted By - Submitted To -

Aman Patel -1121214725 CA Deepti Jain

Abhash Singhai -1121214480

Akanksha Patidar -1121214893

Mahima Singh -1121214898

Rakesh Randhawe -1121214883

PROFIT AND GAINS

OF

BUSINESS OR PROFESSION

INTRODUCTION:

Income from business and profession refers to the financial returns earned through commercial

activities or professional services. In the business context, income is generated from trading,

manufacturing, or providing services. It includes various types of profits, such as gross,

operating, and net profits, reflecting the surplus after deducting relevant costs. Professionals,

engaged in specialized fields like law, medicine, or consultancy, earn income through their

expertise. This income is subject to taxation, and tax liability is calculated based on the net profit

after considering allowable deductions and exemptions. Proper financial record-keeping is

essential for tax compliance and evaluating the financial health of both businesses and

professional practices.

FORMAT OF PROFIT & LOSS A/C

AND

INCOME & EXPENDITURE A/C

Profit & Loss Account or Income & Expenditure Account

Net profit as per the P&L Account

or

Net Surplus as per Income & Expenditure Account

Add: Disallowed Expenses included directly or indirectly in debit side of P&L account

1.Any type of donation, charity, gift ect. Which not related to business or profession -

2. Personal gifts, present, or assistance. -

3. Income tax. -

4. Personal Expenses, domestic expenses, drawings, expenses on relatives. -

5. Any other expenses with is not related to business or profession is to be added. - -

Less: Allowed Expenses:

1. Allowed Depreciation. -

2. Allowed bad debts. -

3. Due bonus to employees. - -

Add: Allowed Income:

1. Any kind of income which allowed and not shown in the P&L or Income & expenditure account. - -

Less: Disallowed Income:

1. Any Kind of Incomes and receipts which are not related to business or profession. -

2. Rent from property. -

3. Interest & Dividend from Investments. -

4. Personal Gifts. - -

Taxable Income from Business or Professions …..................

Profit & Loss Account or Income & Expenditure Account

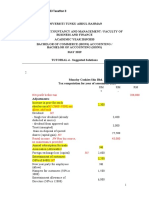

Net Surplus as per Income & Expenditure Account 4,52,600

Add: Disallowed Expenses included directly or indirectly in debit side of P&L account

1.Personal Expenses 6,000

2. Car Purchased 2,90,000

3. Muncipal Tax(2,000 x 2/3) 1,333

4. Donation to N.D.F 4,000

5. Computer Purchased 18,600

6. Furniture Purchased 4,000

7. Books Purchased 9,000

8. Repairs(5,000 x 2/3) 3,333

9. Life Insurance Premium 3,700

10. Telephone Expenses(2,000 x 30%) 600 3,40,566

Less: Allowed Expenses:

1. Depreciation on Car -42,900

2. Depreciation on Books -3,600

3. Depreciation on Computer Purchased -7,440

4. Depreciation on Professional Assets -8,000 -61,940

Add: Allowed Income:

1. Nil - -

Less: Disallowed Income:

1. Old Car Sold -1,32,000

2. Salary as a part time lecture -45,000

3. Interest on bond F.D.R -9,000 -1,86,000

Taxable Income from Business or Professions 5,45,226

WORKNIG NOTE:

CALCULATION OF DEPRECIATION ON CAR

Depreciation on Car

Amt

Written Down Value 1,28,000

Add: New Car Purchased 2,90,000

Less: Old Car Sold -1,32,000

Amount Eligible for Depreciation 2,86,000

Depreciation Rate 15%

Depreciation Allowed(2,84,000 x 15/100) 42,900

Profit & Loss Account or Income & Expenditure Account

Net Surplus as per Income & Expenditure Account 4,52,600

Add: Disallowed Expenses included directly or indirectly in debit side of P&L account

1.Personal Expenses 6,000

2. Car Purchased 2,90,000

3. Muncipal Tax(2,000 x 2/3) 1,333

4. Donation to N.D.F 4,000

5. Computer Purchased 18,600

6. Furniture Purchased 4,000

7. Books Purchased 9,000

8. Repairs(5,000 x 2/3) 3,333

9. Life Insurance Premium 3,700

10. Telephone Expenses(2,000 x 30%) 600 3,40,566

Less: Allowed Expenses:

1. Depreciation on Car -42,900

2. Depreciation on Books -3,600

3. Depreciation on Computer Purchased -7,440

4. Depreciation on Professional Assets -8,000 -61,940

Add: Allowed Income:

1. Nil - -

Less: Disallowed Income:

1. Old Car Sold -1,32,000

2. Salary as a part time lecture -45,000

3. Interest on bond F.D.R -9,000 -1,86,000

Taxable Income from Business or Professions 5,45,226

CALCULATION OF DEPRECIATION ON BOOKS Amt

Books 9,000

Depreciation Rate 40%

Depreciation Allowed 3,600

CALCULATION OF DEPRECIATION ON COMPUTERS Amt

Computer Purchased 18,600

Depreciation Rate 40%

Depreciation Allowed 7,440

Profit & Loss Account or Income & Expenditure Account

Net Surplus as per Income & Expenditure Account 4,52,600

Add: Disallowed Expenses included directly or indirectly in debit side of P&L account

1.Personal Expenses 6,000

2. Car Purchased 2,90,000

3. Muncipal Tax(2,000 x 2/3) 1,333

4. Donation to N.D.F 4,000

5. Computer Purchased 18,600

6. Furniture Purchased 4,000

7. Books Purchased 9,000

8. Repairs(5,000 x 2/3) 3,333

9. Life Insurance Premium 3,700

10. Telephone Expenses(2,000 x 30%) 600 3,40,566

Less: Allowed Expenses:

1. Depreciation on Car -42,900

2. Depreciation on Books -3,600

3. Depreciation on Computer Purchased -7,440

4. Depreciation on Professional Assets -8,000 -61,940

Add: Allowed Income:

1. Nil - -

Less: Disallowed Income:

1. Old Car Sold -1,32,000

2. Salary as a part time lecture -45,000

3. Interest on bond F.D.R -9,000 -1,86,000

Taxable Income from Business or Professions 5,45,226

OLD TAX REGIME Amt

Taxable Income 5,45,226

Tax Rate upto 2.5 Lakhs -

Tax Rate 2.5 Lakhs - 5 Lakhs 5%

(2,50,000 x 5/100) 12,500

Tax Rate 5 Lakhs - 10 lakhs 20%

(45,226 x 20/100) 9,045

Tax liability 21,545

Add: Surcharge -

Total Tax Liability 21,545

Add: Cess 4%

Final Tax Liability 22,407

New TAX REGIME Amt

Taxable Income 5,45,226

Tax Rate upto 3 lakhs -

Tax Rate 3 lakhs - 6 laksh 5%

Tax liability (2,45,226 x 5/100) 12,261

Add: Surcharge -

Total Tax Liability 12,261

Add: Cess 4%

Final Tax Liability 12,752

THANK

YOU

You might also like

- Larson12e 04Document60 pagesLarson12e 04samas7480No ratings yet

- WBS Creation in PS ModuleDocument145 pagesWBS Creation in PS ModuleSDOT Ashta100% (1)

- IA 3 Final Assessment PDFDocument5 pagesIA 3 Final Assessment PDFJoy Miraflor Alinood100% (1)

- CLWTAXN MODULE 5 Income Taxation of Individuals Notes v022023-1-1Document7 pagesCLWTAXN MODULE 5 Income Taxation of Individuals Notes v022023-1-1kdcngan162No ratings yet

- AccountingDocument26 pagesAccountingHaris AliNo ratings yet

- Income TaxDocument31 pagesIncome TaxUday KumarNo ratings yet

- Chap 4 (Fix)Document11 pagesChap 4 (Fix)Misu NguyenNo ratings yet

- It 2Document44 pagesIt 2Business RecoveryNo ratings yet

- Lesson 1 Week 1 FABM 2Document14 pagesLesson 1 Week 1 FABM 2Mikel Nelson AmpoNo ratings yet

- IFRS - 2017 - Solved QPDocument15 pagesIFRS - 2017 - Solved QPSharan ReddyNo ratings yet

- Direct Tax Solution PDFDocument8 pagesDirect Tax Solution PDFGaurav SoniNo ratings yet

- W4 Module 4-Concept of Income and Gross IncomeDocument24 pagesW4 Module 4-Concept of Income and Gross IncomeElmeerajh JudavarNo ratings yet

- Acc 1 QuizDocument7 pagesAcc 1 QuizAyat MukahalNo ratings yet

- Value Added Tax Lecture Summary 2020Document72 pagesValue Added Tax Lecture Summary 2020Tatenda RamsNo ratings yet

- Week 6 - Deduction From Gross IncomeDocument5 pagesWeek 6 - Deduction From Gross IncomeJuan FrivaldoNo ratings yet

- Income From Profits and Gains of Business or ProfessionDocument10 pagesIncome From Profits and Gains of Business or ProfessionPraveen EkkaNo ratings yet

- ABFT2020 Tutorial 12 Busines ExpenseDocument6 pagesABFT2020 Tutorial 12 Busines ExpensePUI TUNG CHONGNo ratings yet

- Accounts Home Test 2Document7 pagesAccounts Home Test 2Ashish RaiNo ratings yet

- Income Tax 11-14 PDFDocument1 pageIncome Tax 11-14 PDFJemna AryanaNo ratings yet

- 4 A TUTORIAL 4 AnswerDocument6 pages4 A TUTORIAL 4 AnswerLee HansNo ratings yet

- Financial and Managerial Accounting 11th Edition Warren Solutions ManualDocument10 pagesFinancial and Managerial Accounting 11th Edition Warren Solutions Manualcharlesdrakejth100% (20)

- Tax Reviewer (Mfp-2)Document13 pagesTax Reviewer (Mfp-2)Mikaela Pamatmat100% (1)

- Learning Module In: Grade 11Document12 pagesLearning Module In: Grade 11Esvee TyNo ratings yet

- Learning Module In: Grade 11Document12 pagesLearning Module In: Grade 11Esvee TyNo ratings yet

- Individual Assignment 2A - Aisyah Nuralam 29123362Document4 pagesIndividual Assignment 2A - Aisyah Nuralam 29123362Aisyah NuralamNo ratings yet

- Adjusted Trial BalanceDocument4 pagesAdjusted Trial BalanceMonir HossainNo ratings yet

- 2208 IS and Balance SheetDocument8 pages2208 IS and Balance SheetHAHAHANo ratings yet

- Value Added Tax Lecture Summary 2020Document73 pagesValue Added Tax Lecture Summary 2020precious mountainsNo ratings yet

- 8 - Deductions From Gross Income 1Document14 pages8 - Deductions From Gross Income 1RylleMatthanCorderoNo ratings yet

- FMA Assgnments - EX 2022Document12 pagesFMA Assgnments - EX 2022Natnael BelayNo ratings yet

- Cash Flow StatementDocument22 pagesCash Flow Statementshrestha.aryxnNo ratings yet

- Jenjen 2Document11 pagesJenjen 2Kim FloresNo ratings yet

- Deductions From Gross Income: (Sec. 65, Rev. Reg. No. 2)Document69 pagesDeductions From Gross Income: (Sec. 65, Rev. Reg. No. 2)Brian TorresNo ratings yet

- UNIT-4 - Income-From-BusinessDocument114 pagesUNIT-4 - Income-From-BusinessGuinevereNo ratings yet

- Intermediate ACC - Assignment No .O1Document5 pagesIntermediate ACC - Assignment No .O1Zubair AhmedNo ratings yet

- Oho Shop CoiDocument5 pagesOho Shop CoiJAY K SHAH & ASSOCIATESNo ratings yet

- FNSACC501 Provide Financial and Business Performance InformationDocument6 pagesFNSACC501 Provide Financial and Business Performance InformationDaranee TrakanchanNo ratings yet

- Advance Taxation Chp. 5Document6 pagesAdvance Taxation Chp. 5Rohan ThakkarNo ratings yet

- Chapter 7 Business IncomeDocument30 pagesChapter 7 Business IncomeKailing KhowNo ratings yet

- Fabm2 Law q1 Week 1 To 9Document21 pagesFabm2 Law q1 Week 1 To 9Karen, Togeno CabusNo ratings yet

- Deductions and Exemptions: Tel. Nos. (043) 980-6659Document22 pagesDeductions and Exemptions: Tel. Nos. (043) 980-6659MaeNo ratings yet

- R17 Understanding Income Statements IFT NotesDocument21 pagesR17 Understanding Income Statements IFT Notessubhashini sureshNo ratings yet

- Written Report in Income TaxationDocument24 pagesWritten Report in Income TaxationRonron De ChavezNo ratings yet

- Net Business IncomeDocument21 pagesNet Business IncomedonawajNo ratings yet

- Trading Income - July 2023Document8 pagesTrading Income - July 2023maharajabby81No ratings yet

- Lecture 4 - Income Statement - Adjusting EntriesDocument2 pagesLecture 4 - Income Statement - Adjusting EntriesMaham FarooquiNo ratings yet

- Final Accounts Notes and Numericals 2023 To Be Solved in ClassDocument8 pagesFinal Accounts Notes and Numericals 2023 To Be Solved in ClassDishuNo ratings yet

- Financial Reporting and Analysis 7th Edition by Gibson ISBN Solution ManualDocument46 pagesFinancial Reporting and Analysis 7th Edition by Gibson ISBN Solution Manualphyllis100% (37)

- Lecture 5 - Corporate Tax 2022Document23 pagesLecture 5 - Corporate Tax 2022Jasne OczyNo ratings yet

- Preparing Financial Statements: Key Terms and Concepts To KnowDocument27 pagesPreparing Financial Statements: Key Terms and Concepts To KnowTrisha Monique VillaNo ratings yet

- Preparing Financial Statements: Key Terms and Concepts To KnowDocument27 pagesPreparing Financial Statements: Key Terms and Concepts To KnowMohammed AkramNo ratings yet

- PGBPDocument32 pagesPGBPMr UniqueNo ratings yet

- ComputationDocument1 pageComputationsneh.officialworkNo ratings yet

- AccountingDocument5 pagesAccountingAndrea Joy PekNo ratings yet

- Module 9 Deductions From Gross IncomeDocument13 pagesModule 9 Deductions From Gross IncomeNineteen AùgùstNo ratings yet

- Sdoc 05 04 SiDocument17 pagesSdoc 05 04 SiIchyy BoiNo ratings yet

- 助教課講義 Ch.3 (A4雙面)Document10 pages助教課講義 Ch.3 (A4雙面)5213adamNo ratings yet

- Regular Income Taxation: Inclusion in Gross Income: Chan, John Mark Juganas, Hazel Madayag, Jovie AnnDocument43 pagesRegular Income Taxation: Inclusion in Gross Income: Chan, John Mark Juganas, Hazel Madayag, Jovie AnnAngelica PagaduanNo ratings yet

- Assignment 3Document8 pagesAssignment 3Denny ChakauyaNo ratings yet

- Tax On A PageDocument34 pagesTax On A PagezrmrdnndxrNo ratings yet

- Payback AnalysisDocument14 pagesPayback Analysisrabbit_39No ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- QuizesDocument74 pagesQuizestaimoorkhan85100% (1)

- Monopolistic CompetitionDocument3 pagesMonopolistic CompetitionAkshay RathiNo ratings yet

- Hunter DouglasDocument2 pagesHunter DouglasDisha KhatiNo ratings yet

- Activity - Statement of Comprehensive IncomeDocument6 pagesActivity - Statement of Comprehensive IncomeGrace HernandezNo ratings yet

- The Effect of Company Size and Leverage Towards Company Performance After Malaysian Economic CrisisDocument18 pagesThe Effect of Company Size and Leverage Towards Company Performance After Malaysian Economic CrisisIwan SetiawanNo ratings yet

- Capital Structure, Cost of Capital and Value-Question BankDocument8 pagesCapital Structure, Cost of Capital and Value-Question Bankkaran30No ratings yet

- GYB Workbook (Final Draft)Document26 pagesGYB Workbook (Final Draft)Maricres BiandoNo ratings yet

- Risk and Rate of Returns in Financial ManagementDocument50 pagesRisk and Rate of Returns in Financial ManagementReaderNo ratings yet

- BM2 Chapter 1Document23 pagesBM2 Chapter 1Lowela KasandraNo ratings yet

- Habib Oil MillsDocument17 pagesHabib Oil MillsNabeel Raja100% (7)

- Social and Political StratificationDocument4 pagesSocial and Political Stratificationthepathfinderformercury100% (8)

- Charity Business PlanDocument47 pagesCharity Business Planjesicalarson123No ratings yet

- Audit of General Insurance CompaniesDocument20 pagesAudit of General Insurance CompaniesZiniaKhanNo ratings yet

- Month End ActivitiesDocument30 pagesMonth End ActivitiesRaju BothraNo ratings yet

- Application For Certificate of Compliance General RequirementsDocument3 pagesApplication For Certificate of Compliance General RequirementsDan SantosNo ratings yet

- Liberty Media Corporation Annual Report Proxy Statement BookmarkedDocument232 pagesLiberty Media Corporation Annual Report Proxy Statement BookmarkedWillNo ratings yet

- Tendernotice 1Document82 pagesTendernotice 1N5207ACCESSORIES MGRNo ratings yet

- Ch2-Analyzing Financial Statements and Cashflows CFIN7Document61 pagesCh2-Analyzing Financial Statements and Cashflows CFIN7RIANE PADIERNOSNo ratings yet

- SWOT ANALYSIS - Docx PearlDocument6 pagesSWOT ANALYSIS - Docx PearlPamela Joyce RiambonNo ratings yet

- Clogging The ChannelsDocument4 pagesClogging The ChannelsHarsh ParasrampuriaNo ratings yet

- Building The Future: Case StudyDocument7 pagesBuilding The Future: Case StudyBTS V OFFICIALNo ratings yet

- PRN MKT Q3 W3Document38 pagesPRN MKT Q3 W3John Paul SykiocoNo ratings yet

- Final ExamDocument5 pagesFinal ExamJamera LabialNo ratings yet

- Multiurban Infra Services Pvt. Ltd. Salary Slip: This Is A Computer Generated Document and Does Not Require Any SignatureDocument1 pageMultiurban Infra Services Pvt. Ltd. Salary Slip: This Is A Computer Generated Document and Does Not Require Any Signaturesurya gtiblyNo ratings yet

- Business Ethics and Relevance in Modern TimesDocument21 pagesBusiness Ethics and Relevance in Modern TimesPooja DaxiniNo ratings yet

- Paper The Prophet of InnovationDocument11 pagesPaper The Prophet of InnovationDiogo FidelesNo ratings yet

- Bombardier Annual Report 2000Document84 pagesBombardier Annual Report 2000bombardierwatchNo ratings yet

- CF MKT500 Part A Marketing Plan TemplateDocument11 pagesCF MKT500 Part A Marketing Plan TemplateAsma AliNo ratings yet