Professional Documents

Culture Documents

Preliminary FS - SELOG ESTATE

Preliminary FS - SELOG ESTATE

Uploaded by

bob.muttaharaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Preliminary FS - SELOG ESTATE

Preliminary FS - SELOG ESTATE

Uploaded by

bob.muttaharaCopyright:

Available Formats

SELOG ESTATE Feasibility Study

For Cengkareng Channel

FOR INTERNAL DISCUSSION PURPOSES ONLY

STRICTLY PRIVATE AND CONFIDENTIAL

Details of Location

FOR INTERNAL DISCUSSION PURPOSES ONLY 2

STRICTLY PRIVATE AND CONFIDENTIAL

Map of the Location

Halim Perdana Kusuma

LT: 6,400 m2

Subject of this

Rp 7,836,990/m2 Feasibility Study

FOR INTERNAL DISCUSSION PURPOSES ONLY 3

STRICTLY PRIVATE AND CONFIDENTIAL

View of the Area

FOR INTERNAL DISCUSSION PURPOSES ONLY 4

STRICTLY PRIVATE AND CONFIDENTIAL

View of the Area

FOR INTERNAL DISCUSSION PURPOSES ONLY 5

STRICTLY PRIVATE AND CONFIDENTIAL

Feasibility Study Assumptions

FOR INTERNAL DISCUSSION PURPOSES ONLY 6

STRICTLY PRIVATE AND CONFIDENTIAL

Estimated Investment

FOR INTERNAL DISCUSSION PURPOSES ONLY 7

STRICTLY PRIVATE AND CONFIDENTIAL

Business Assumptions (1/2)

Rental assumptions HMU Assumptions

Total area size 6,400 m2 HMU Storage rate fee Rp45,000/m2/month. Increase

5% per 2 years

Total Net Leasable Area 2,250 m2 warehouse area

(NLA) 2,000 m2 open yard Utilisation 100% rented to SELOG

Asset owner HMU Asset Depreciation 20 years for building

5 years for LVA

Tenant Warehouse area:

a) SELOG Express 1,500m2 Other cost components Securities: Rp300,000,000

b) SELOG FF 500 m2 Utilities, insurance, and other

Open yard: SELOG FF 2,000 m2 operational cost: 5% revenue

Discounted Cash Flow Assumptions

Project Period 20 Years

Income tax 10% final tax on storage fee;

25% income tax on non-

storage EBT

Debt : Equity ratio 45 : 55

Debt cost 10%, 10 year loan periods

Equity cost 20%

WACC 14.38%

FOR INTERNAL DISCUSSION PURPOSES ONLY 8

STRICTLY PRIVATE AND CONFIDENTIAL

Business Assumptions (2/2)

SEF assumptions SELOG FF assumptions

Current target KG/year JKT 1,512,618 (89% national) Charging rate Rp80,000 /m2/month includes

= Rp39 billion revenue; storage and handling fees;

Next target volume depends on Increase 2.5% per 2 years

scenarios development

Utilisation Depends on scenarios development

Price per KG Rp26,000;

Increase 2.5% per 2 years Cost of sales for storage Rent cost from HMU + 35% variable

and handling fee cost of revenue storage & handling

Cakung portion % JKT ± 75% (Rp30 billion revenue)

Transportation fee Truck type = CDD;

Kamal portion % JKT ± 25% (Rp9 billion revenue) Capacity = 24 CBM;

Rate/shipment: Rp1.5 million;

Cost of sales 82% of Revenue; Percentage Formula = area utilization x goods

decrease as volume increase turnover x revenue per shipment;

Operating Expense 12.2% of Revenue; Percentage Rate increase 2.5% per 2 years

decreases as volume increase Cost of sales % 90% of transportation fee

Income tax 25% of EBT transportation fee

ToP 30 Days Operating Expense 5% of revenue; percentage decrease

as volume increase

Income tax 25% of EBT

VAT 1% of Revenue;

VAT-In can’t be credited

ToP 30 days

FOR INTERNAL DISCUSSION PURPOSES ONLY 9

STRICTLY PRIVATE AND CONFIDENTIAL

Scenario Developments (SEF)

Revenue (IDR Billion – Jakarta Branch Operating Profit Margin

200 16.0%

182 184

174 176

180 166 168 13.4%

159 161 14.0% 13.0%

152 154 12.6%

160 145 147 11.8%

12.2%

139 140 12.0% 11.4%

11.0%

140 129 12.0% 12.3%

11.6%

139 140 9.8% 11.2%

115 133 134 10.0% 10.8%

120 127 128 10.0%

10.4%

121 123 9.85% 9.95%

116 117 7.8% 9.51% 9.71%

100 95

107 111

112

108 111

112 9.0% 8.91% 9.11% 9.31%

106 103 107 8.0%

102 98 102 8.21%

75 94 94 97

80 89 90 93 5.8% 7.4%

80 78 82 85 86 6.0% 7.01%

55 5.8%

60 67 70

60 5.81%

39

52

4.0%

40 49

39

20 2.0%

- 0.0%

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20

High Case Medium Case Low Case High Case Medium Case Low Case

FOR INTERNAL DISCUSSION PURPOSES ONLY 10

STRICTLY PRIVATE AND CONFIDENTIAL

Scenario Developments (SELOG FF)

Space Utilization (of 2,750 m2)

120%

100% 100% 100% 100% 100% 100% 100% 100% 100%

100%

90% 90% 90% 90% 90% 90% 90% 90%

80% 75%

80% 80.0% 80.0% 80.0% 80.0% 80.0% 80.0% 80.0%

70.0%

60% 65%

50% 60.0%

50% 50.0%

40%

40.0%

25% 35%

30.0%

20%

20% 20.0%

10.0%

0%

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20

High Case Medium Case Low Case

FOR INTERNAL DISCUSSION PURPOSES ONLY 11

STRICTLY PRIVATE AND CONFIDENTIAL

Feasibility Study Results

FOR INTERNAL DISCUSSION PURPOSES ONLY 12

STRICTLY PRIVATE AND CONFIDENTIAL

Executive Summaries

A. Exclude Land Investment In Discounted Cash Flow Analysis (WACC 14.38%)

Case (Scenario) NPV IRR Discounted Payback

Period

High Case (1A) Rp104.0 billion 48.22% 3.75 Years

Medium Case (1B) Rp51.0 billion 34.40% 5.40 Years

Low Case (1C) Rp24.6 billion 25.87% 7.34 Years

B. Include Land Investment In Discounted Cash Flow Analysis (WACC 14.38%)

NPV IRR Discounted NPV IRR Discounted

Rp Billion Payback Period Rp Billion Payback Period

Land value increase 5% per year Land value increase 2.5% per year

High Case (2A) 73.8 25.78% 7.46 Years High Case 71.3 25.67% 7.46 Years

Medium Case (2B) 20.8 18.01% 13.73 Years Medium Case 18.3 17.71% 13.73 Years

Low Case (2C) (5.6) 13.30% 20.00 Years Low Case (8.15) 12.72% 20.00 Years

FOR INTERNAL DISCUSSION PURPOSES ONLY 13

STRICTLY PRIVATE AND CONFIDENTIAL

High Case Scenario – Income Statement

FOR INTERNAL DISCUSSION PURPOSES ONLY 14

STRICTLY PRIVATE AND CONFIDENTIAL

High Case Scenario – Discounted Cash Flow (Include Land)

FOR INTERNAL DISCUSSION PURPOSES ONLY 15

STRICTLY PRIVATE AND CONFIDENTIAL

Medium Case Scenario – Income Statement

FOR INTERNAL DISCUSSION PURPOSES ONLY 16

STRICTLY PRIVATE AND CONFIDENTIAL

Medium Case Scenario – Discounted Cash Flow (Include Land)

FOR INTERNAL DISCUSSION PURPOSES ONLY 17

STRICTLY PRIVATE AND CONFIDENTIAL

Low Case Scenario – Income Statement

FOR INTERNAL DISCUSSION PURPOSES ONLY 18

STRICTLY PRIVATE AND CONFIDENTIAL

Low Case Scenario – Discounted Cash Flow (Include Land)

FOR INTERNAL DISCUSSION PURPOSES ONLY 19

STRICTLY PRIVATE AND CONFIDENTIAL

Income Statement HMU

FOR INTERNAL DISCUSSION PURPOSES ONLY 20

STRICTLY PRIVATE AND CONFIDENTIAL

You might also like

- Excel Tutorial - (B) - Changiz - KhanDocument26 pagesExcel Tutorial - (B) - Changiz - KhanchkhannbsNo ratings yet

- Outline For Informative SpeechDocument3 pagesOutline For Informative Speechrobazantout100% (1)

- Ultratech Cement Limited: Outlook Remains ChallengingDocument5 pagesUltratech Cement Limited: Outlook Remains ChallengingamitNo ratings yet

- Ciptadana Sekuritas PTPP - Lower TP Post Weak ResultsDocument6 pagesCiptadana Sekuritas PTPP - Lower TP Post Weak ResultsKPH BaliNo ratings yet

- DRC 20230717 EarningsFlashDocument5 pagesDRC 20230717 EarningsFlashnguyenlonghaihcmutNo ratings yet

- Akra Corporate Presentation: November 2017Document35 pagesAkra Corporate Presentation: November 2017Mohammad Nizar AriefNo ratings yet

- Public Investment Bank: Dayang Enterprise HoldingsDocument4 pagesPublic Investment Bank: Dayang Enterprise Holdingsumyatika92No ratings yet

- Kim Eng SekuritasDocument9 pagesKim Eng SekuritasefendidutaNo ratings yet

- CIV4041F Presentation Eng Economics and Project Appraisal - 2022 PDFDocument29 pagesCIV4041F Presentation Eng Economics and Project Appraisal - 2022 PDFGOATNo ratings yet

- Ril 1qfy23Document12 pagesRil 1qfy23Deepak KhatwaniNo ratings yet

- Equity Reserach 2Document8 pagesEquity Reserach 2SBNo ratings yet

- Airasia Group Berhad: Analyst Presentation First Quarter Results For The Financial Year 2020 30 June 2020Document22 pagesAirasia Group Berhad: Analyst Presentation First Quarter Results For The Financial Year 2020 30 June 2020hayo ipwueNo ratings yet

- RIL 3Q FY20 Analyst Presentation 17jan20Document94 pagesRIL 3Q FY20 Analyst Presentation 17jan20prince9sanjuNo ratings yet

- 7204 D&O KENANGA 2023-08-24 SELL 2.30 DOGreenTechnologiesSluggishNewOrders - 167722211Document4 pages7204 D&O KENANGA 2023-08-24 SELL 2.30 DOGreenTechnologiesSluggishNewOrders - 167722211Nicholas ChehNo ratings yet

- 7204 - D&O - PUBLIC BANK - 2023-08-24 - BUY - 4.37 - DOGreenTechnologiesExpectingaVShapeRecovery - 1840691060Document5 pages7204 - D&O - PUBLIC BANK - 2023-08-24 - BUY - 4.37 - DOGreenTechnologiesExpectingaVShapeRecovery - 1840691060Nicholas ChehNo ratings yet

- Long Awaited China Revenues Get Booked But FV Reduced As Restrictions TightenDocument8 pagesLong Awaited China Revenues Get Booked But FV Reduced As Restrictions TightenJajahinaNo ratings yet

- 3Q19 - ENG - FinalDocument18 pages3Q19 - ENG - FinalTung NgoNo ratings yet

- Dialog Group: Company ReportDocument5 pagesDialog Group: Company ReportBrian StanleyNo ratings yet

- Case StudyDocument17 pagesCase StudyMukesh LakhotiaNo ratings yet

- Earnings ReleaseDocument5 pagesEarnings Releaseamira alyNo ratings yet

- Raising FV Estimate To Php857 On Higher GLO FV: Ayala CorporationDocument7 pagesRaising FV Estimate To Php857 On Higher GLO FV: Ayala CorporationKirby Lanz RosalesNo ratings yet

- VRL L L: Ogistics TDDocument8 pagesVRL L L: Ogistics TDAnkush SarkarNo ratings yet

- Supportive 20100701 KenangaDocument2 pagesSupportive 20100701 Kenangalimml63No ratings yet

- FPT (BUY +33%) - Software/Telecom Dynamic Duo To Accelerate EPS GrowthDocument8 pagesFPT (BUY +33%) - Software/Telecom Dynamic Duo To Accelerate EPS GrowthTrac Ngoc Van AnNo ratings yet

- Stock Update: Petronet LNGDocument4 pagesStock Update: Petronet LNGRejo JohnNo ratings yet

- Third Quarter Results: Philippine Stock Exchange Ticker: CHPDocument8 pagesThird Quarter Results: Philippine Stock Exchange Ticker: CHPJep TangNo ratings yet

- Kuala Lumpur Ke Pong A Good StartDocument3 pagesKuala Lumpur Ke Pong A Good StartMohdNo ratings yet

- Serba Dinamik Holdings Outperform: Dynamic PlayDocument21 pagesSerba Dinamik Holdings Outperform: Dynamic PlayAng SHNo ratings yet

- Presentation (Company Update)Document16 pagesPresentation (Company Update)Shyam SunderNo ratings yet

- Mirae Asset Sekuritas Indonesia Indocement Tunggal PrakarsaDocument7 pagesMirae Asset Sekuritas Indonesia Indocement Tunggal PrakarsaekaNo ratings yet

- 2023 05 29 PH e PgoldDocument7 pages2023 05 29 PH e PgoldexcA1996No ratings yet

- Embassy Office Parks REIT: 1Q FY2022 Earnings MaterialsDocument51 pagesEmbassy Office Parks REIT: 1Q FY2022 Earnings Materialsmohit niranjaneNo ratings yet

- Impact of Brexit On Malaysians - Market News - PropertyGuru - Com.myDocument4 pagesImpact of Brexit On Malaysians - Market News - PropertyGuru - Com.myzahirzakiNo ratings yet

- IDirect CenturyPly Q3FY22Document9 pagesIDirect CenturyPly Q3FY22Tai TranNo ratings yet

- Indopremier Sector Update 3Q23 Property 10 Nov 2023 Maintain OverweightDocument7 pagesIndopremier Sector Update 3Q23 Property 10 Nov 2023 Maintain Overweightbotoy26No ratings yet

- Result Update Presentation - Q1 FY18: AUGUST 10, 2017Document10 pagesResult Update Presentation - Q1 FY18: AUGUST 10, 2017Mohit PariharNo ratings yet

- Sunway Reit: Company ReportDocument4 pagesSunway Reit: Company ReportBrian StanleyNo ratings yet

- Results-Presentation 2019Document32 pagesResults-Presentation 2019Shahin AlamNo ratings yet

- Maker MeridianDocument12 pagesMaker MeridianProperty SpecialistNo ratings yet

- Sime Darby 2021Document32 pagesSime Darby 2021Che Muhd. HanifNo ratings yet

- Wipro Q4FY09 Result UpdateDocument4 pagesWipro Q4FY09 Result UpdateHardikNo ratings yet

- GAR39 14 11 2022 Performance Update 3Q2022Document5 pagesGAR39 14 11 2022 Performance Update 3Q2022Devina Ratna DewiNo ratings yet

- Ipot DSNG q321Document6 pagesIpot DSNG q321jijokojawaNo ratings yet

- Institutional Equities: Deepak Nitrite LTDDocument6 pagesInstitutional Equities: Deepak Nitrite LTD4nagNo ratings yet

- Result Update Presentation - Q2 FY18: NOVEMBER 09, 2017Document11 pagesResult Update Presentation - Q2 FY18: NOVEMBER 09, 2017Mohit PariharNo ratings yet

- Yes SecuritiesDocument7 pagesYes SecuritiesRajesh SharmaNo ratings yet

- Volume 5 - March 2022: Descriptions FY2021 FY2020 %Document5 pagesVolume 5 - March 2022: Descriptions FY2021 FY2020 %fielimkarelNo ratings yet

- AmInv 95622347Document5 pagesAmInv 95622347Lim Chau LongNo ratings yet

- 1Q18 Earnings Drop 49.9% Y/y On Lower Revenues, Below COL ForecastDocument6 pages1Q18 Earnings Drop 49.9% Y/y On Lower Revenues, Below COL ForecastMark Angelo BustosNo ratings yet

- FY2024AnalystPresL&T Q1FY24 Analyst PresentationDocument32 pagesFY2024AnalystPresL&T Q1FY24 Analyst PresentationSHREYA NAIRNo ratings yet

- BinaPuri 100824 RN2Q10Document2 pagesBinaPuri 100824 RN2Q10limml63No ratings yet

- 3 DPR For 20 MW Solar Project at JalukieDocument2 pages3 DPR For 20 MW Solar Project at JalukieHimanshu Bhatia100% (1)

- No Quick Turnaround Seen For The San Gabriel: First Gen CorporationDocument2 pagesNo Quick Turnaround Seen For The San Gabriel: First Gen CorporationJohn Kyle LluzNo ratings yet

- Reliance Industries Limited - Investor Presentation - 2Q FY 2018-19Document76 pagesReliance Industries Limited - Investor Presentation - 2Q FY 2018-19TharunSYadlaNo ratings yet

- Ganesha Ecosphere Limited: To India L MitedDocument21 pagesGanesha Ecosphere Limited: To India L MitedSiddharth SehgalNo ratings yet

- London Sumatra Indonesia TBK: Still Positive But Below ExpectationDocument7 pagesLondon Sumatra Indonesia TBK: Still Positive But Below ExpectationHamba AllahNo ratings yet

- Reliance by Motilal OswalDocument34 pagesReliance by Motilal OswalQUALITY12No ratings yet

- Intrep 2Document46 pagesIntrep 2mailimailiNo ratings yet

- 2020 11 18 PH e Meg PDFDocument8 pages2020 11 18 PH e Meg PDFJNo ratings yet

- Samuel Company Update FY23 AKRA 21 Mar 2024 Maintain Buy TP Rp1Document3 pagesSamuel Company Update FY23 AKRA 21 Mar 2024 Maintain Buy TP Rp1botoy26No ratings yet

- Consolidated Construction Consortium LTD.: Dismal Quarter Expect Pick Up AheadDocument6 pagesConsolidated Construction Consortium LTD.: Dismal Quarter Expect Pick Up AheadVivek AgarwalNo ratings yet

- Types of Mutual FundsDocument14 pagesTypes of Mutual FundsHimanshu PorwalNo ratings yet

- Entrepreneur Grade 9Document17 pagesEntrepreneur Grade 9Anne GimoteaNo ratings yet

- Accounting Acc1 Unit 1 Financial Accounting: The Accounting Information SystemDocument16 pagesAccounting Acc1 Unit 1 Financial Accounting: The Accounting Information Systemsaffron parkesNo ratings yet

- Cerelia - Information Brochure Employee Shareholding Plan 2020 (English)Document18 pagesCerelia - Information Brochure Employee Shareholding Plan 2020 (English)Razvan ComanNo ratings yet

- Pricing Fixed Income SecuritiesDocument3 pagesPricing Fixed Income SecuritiesIrfan Sadique IsmamNo ratings yet

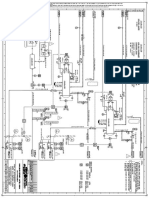

- P&ID For SRU-2Document1 pageP&ID For SRU-2Sukdeb MaityNo ratings yet

- Chapter 1 Introduction To CF - Student VersionDocument9 pagesChapter 1 Introduction To CF - Student VersionMinh Vũ Ngô LêNo ratings yet

- Can Gopal Kavalireddi Tell Us What He Looks For Before Picking A Stock For A Short Period of TimeDocument9 pagesCan Gopal Kavalireddi Tell Us What He Looks For Before Picking A Stock For A Short Period of TimeAnonymous w6TIxI0G8lNo ratings yet

- Real Estate Development Business PlanDocument5 pagesReal Estate Development Business PlanA. FranciscoNo ratings yet

- LU2 Lecturer NotesDocument23 pagesLU2 Lecturer NotesShweta SinghNo ratings yet

- Risk and Rates of Return - DemoDocument10 pagesRisk and Rates of Return - DemoKen ZyuNo ratings yet

- 12 AccountancyDocument4 pages12 AccountancygattulokhandeNo ratings yet

- Bdo V CirDocument5 pagesBdo V CirAnselmo Rodiel IVNo ratings yet

- 3Document8 pages3여자라라No ratings yet

- Section ACCA Study HubDocument1 pageSection ACCA Study HublaaybaNo ratings yet

- Bank Reconciliation - CE and DSE - AnswerDocument14 pagesBank Reconciliation - CE and DSE - AnswerKwan Yin HoNo ratings yet

- Goods Market - The Is CurveDocument4 pagesGoods Market - The Is CurveKatunga MwiyaNo ratings yet

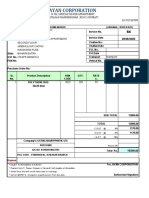

- Ayan Corp Exel PDFDocument1 pageAyan Corp Exel PDFmaharaj ( prashant dave)No ratings yet

- Bill TriDocument1 pageBill TrifajarNo ratings yet

- Hannah Knox An Architect Opened An Office On July 1Document1 pageHannah Knox An Architect Opened An Office On July 1Amit PandeyNo ratings yet

- The Chart of Accounts For Banks and Other Financial Institutions of The Republic of MoldovaDocument87 pagesThe Chart of Accounts For Banks and Other Financial Institutions of The Republic of MoldovaPedro PrietoNo ratings yet

- Tax On Presumptive Basis in Case of Certain Eligible BusinessesDocument15 pagesTax On Presumptive Basis in Case of Certain Eligible BusinessesSeemant GuptaNo ratings yet

- 5-Year Financial Plan - Manufacturing 1Document8 pages5-Year Financial Plan - Manufacturing 1tulalit008No ratings yet

- WWW Yourarticlelibrary ComDocument5 pagesWWW Yourarticlelibrary ComDhruv JoshiNo ratings yet

- Proc. TX DescriptionDocument61 pagesProc. TX DescriptionnelsonNo ratings yet

- Installment FinancingDocument10 pagesInstallment FinancingEllen Kay CacatianNo ratings yet

- Impact of Dividend On Stock PricesDocument86 pagesImpact of Dividend On Stock PricesGulshan Tomar100% (1)

- My File NameDocument1 pageMy File NameDimple QueenNo ratings yet