Professional Documents

Culture Documents

Ab - Az ch06

Ab - Az ch06

Uploaded by

evanofaresta030820Copyright:

Available Formats

You might also like

- Comments On Past Exam Question PracticeDocument9 pagesComments On Past Exam Question Practicetcqing1012No ratings yet

- Business Analyst Role GuidelineDocument4 pagesBusiness Analyst Role GuidelineVijayakanth100% (1)

- (David Harvey) Spaces of HopeDocument151 pages(David Harvey) Spaces of HopeGerardo Rosales Carranza100% (1)

- Gujarat State Road TransportationDocument19 pagesGujarat State Road TransportationRahul GargNo ratings yet

- CH 05Document16 pagesCH 05Aamir Akber AliNo ratings yet

- Strategic MRKT Chap 4-2Document19 pagesStrategic MRKT Chap 4-2Sania YousafNo ratings yet

- L09 Agile PerspectiveDocument91 pagesL09 Agile Perspectivemegha singhNo ratings yet

- Integration of Innovation: Business Process ExcellenceDocument14 pagesIntegration of Innovation: Business Process Excellenceapi-19949728No ratings yet

- Operational Performance Improvement in Industrial CompaniesDocument20 pagesOperational Performance Improvement in Industrial Companieskrishna100% (1)

- Process Manager WorkshopDocument58 pagesProcess Manager WorkshopHamada AhmedNo ratings yet

- Chp2 PreplanningDocument59 pagesChp2 PreplanningNOR SYAZWANI ABDUL RAHMANNo ratings yet

- Training Session 3Document42 pagesTraining Session 3Nguyễn Như DuyNo ratings yet

- Chapter 2Document17 pagesChapter 2Mizan SezwanNo ratings yet

- Chapter Five: Environmental Analysis and Strategic UncertaintyDocument15 pagesChapter Five: Environmental Analysis and Strategic UncertaintySoniya ZahidNo ratings yet

- Implementing A Segmentation Strategy 1204653860293754 3Document33 pagesImplementing A Segmentation Strategy 1204653860293754 3Zunaira AzharNo ratings yet

- Fast Food Organizational StructureDocument33 pagesFast Food Organizational StructureSaid Al Jaafari0% (1)

- Harvard Simulation Explanation SheetDocument2 pagesHarvard Simulation Explanation SheetBansil GhodasaraNo ratings yet

- HR Om11 ch05Document80 pagesHR Om11 ch05FADHIA AULYA NOVIANTYNo ratings yet

- NYIF Williams Credit Risk Analysis II 2018Document106 pagesNYIF Williams Credit Risk Analysis II 2018jojozie100% (1)

- OPM Heizer CH05 Design of Goods and Services 1 18032022 113749amDocument67 pagesOPM Heizer CH05 Design of Goods and Services 1 18032022 113749amJahanzeb KhokharNo ratings yet

- IsO 50001Document48 pagesIsO 50001Dante Andres Garcia MenesesNo ratings yet

- Chapter 3Document58 pagesChapter 3Danial AliNo ratings yet

- 10 BSC ConceptDocument34 pages10 BSC ConceptindahNo ratings yet

- Chapter 4Document22 pagesChapter 4ibtisamurrehman47No ratings yet

- Strategic Management 2021Document43 pagesStrategic Management 2021Sanjay P DhaneshNo ratings yet

- Internal Scanning: Organizational Analysis: Strategic Management & Business PolicyDocument32 pagesInternal Scanning: Organizational Analysis: Strategic Management & Business PolicypaceNo ratings yet

- Vision MissionDocument24 pagesVision MissionSeema KhanNo ratings yet

- Swot and Pest AnalysisDocument18 pagesSwot and Pest AnalysisKenisha PanganibanNo ratings yet

- Operations Strategy in A Global Environment: Prof: Dr. Sadam Wedyan Student: AREEJ KHRAIMDocument19 pagesOperations Strategy in A Global Environment: Prof: Dr. Sadam Wedyan Student: AREEJ KHRAIMDania Al-ȜbadiNo ratings yet

- Employee Survey Data AnalysisDocument12 pagesEmployee Survey Data Analysisbatman jonasNo ratings yet

- JDA Why S&OP Get StuckDocument28 pagesJDA Why S&OP Get StuckAhmadNo ratings yet

- Transformation in The Internal Audit Function: Neil WhiteDocument12 pagesTransformation in The Internal Audit Function: Neil WhiteAlexchandar Anbalagan100% (1)

- Chapter 8 Organizational Design and Strategy in A Changing Global EnvironmentDocument42 pagesChapter 8 Organizational Design and Strategy in A Changing Global EnvironmentHaritaa Varshini BalakumaranNo ratings yet

- 5 - 2.1-Udemy-Course-v3-Qualitative-AnalysisDocument13 pages5 - 2.1-Udemy-Course-v3-Qualitative-AnalysisnewscollectingNo ratings yet

- Design of Goods and ServicesDocument39 pagesDesign of Goods and ServicesARDI SETIYAWANNo ratings yet

- Session 3 - Concept Review & Final ProjectDocument28 pagesSession 3 - Concept Review & Final ProjectRBNo ratings yet

- Session 4 - Managing Key Accounts - Structures and Account MappingDocument11 pagesSession 4 - Managing Key Accounts - Structures and Account MappingAyushi GuptaNo ratings yet

- Ab - Az ch03Document16 pagesAb - Az ch03evanofaresta030820No ratings yet

- Scientific Method 4 WPC 480Document15 pagesScientific Method 4 WPC 480Umer Hassan KhanNo ratings yet

- Profitability Ratio Analysis: Purpose: Return On AssetsDocument15 pagesProfitability Ratio Analysis: Purpose: Return On AssetsshawonNo ratings yet

- Chapter 2 Forecasting - FinalDocument66 pagesChapter 2 Forecasting - FinalBảo ThiênNo ratings yet

- CH - 5Document43 pagesCH - 5ende workuNo ratings yet

- Implementing Strategies-Management IssuesDocument27 pagesImplementing Strategies-Management IssuesTelvin GwengweNo ratings yet

- CH 5Document77 pagesCH 5mariam yanalsNo ratings yet

- Powerpoint Slides - Thesis Proposal - MultiDiscriminant Analysis Financial RatiosDocument3 pagesPowerpoint Slides - Thesis Proposal - MultiDiscriminant Analysis Financial RatiosRizaldy MenorNo ratings yet

- University of North-West Graduate School of Business and Government LeadershipDocument58 pagesUniversity of North-West Graduate School of Business and Government LeadershipTom HankNo ratings yet

- Product Development Regal Marine RevDocument41 pagesProduct Development Regal Marine RevIlhamChaniefNo ratings yet

- Developing and Testing The Business ConceptDocument17 pagesDeveloping and Testing The Business ConceptKristian OllierNo ratings yet

- Business Research Method My DraftDocument11 pagesBusiness Research Method My DraftF.T. BhuiyanNo ratings yet

- CH 2Document38 pagesCH 2msoNo ratings yet

- CH 07Document22 pagesCH 07Sheikh HasanNo ratings yet

- Product Management For BAsDocument11 pagesProduct Management For BAsKevin BrennanNo ratings yet

- Chapter 2 Roles and ResponsibilitiesDocument23 pagesChapter 2 Roles and ResponsibilitiesKaranShindeNo ratings yet

- Chapter Three: Competitor AnalysisDocument18 pagesChapter Three: Competitor AnalysisAamir Akber AliNo ratings yet

- Introduction To Problrm SolvingDocument52 pagesIntroduction To Problrm Solvingdharmendraparwar24No ratings yet

- BA449 - Chap005 - Fall 2020Document49 pagesBA449 - Chap005 - Fall 2020mashalerahNo ratings yet

- Ch3-Design of Goods and ServicesDocument29 pagesCh3-Design of Goods and Servicesreema8alothmanNo ratings yet

- CH 07Document26 pagesCH 07aliNo ratings yet

- BE FrameworkDocument30 pagesBE FrameworkAlhassan AliNo ratings yet

- ForecastingDocument139 pagesForecastingAsh LyNo ratings yet

- You Exec - Process Optimization Methodologies CompleteDocument35 pagesYou Exec - Process Optimization Methodologies CompleteRajasekar PonnaiahNo ratings yet

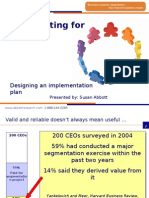

- Driving Your Company's Value: Strategic Benchmarking for ValueFrom EverandDriving Your Company's Value: Strategic Benchmarking for ValueRating: 3 out of 5 stars3/5 (1)

- Stepping Up From Paper F6 (UK) To Paper P6 (UK) - P6 Advanced Taxation - ACCA Qualification - Students - ACCA GlobalDocument3 pagesStepping Up From Paper F6 (UK) To Paper P6 (UK) - P6 Advanced Taxation - ACCA Qualification - Students - ACCA GlobalLouise HurrellNo ratings yet

- Office Automation Systems PDFDocument2 pagesOffice Automation Systems PDFBrian50% (2)

- Valuation - NotesDocument41 pagesValuation - NotessreginatoNo ratings yet

- WESCO NA ProgramDocument12 pagesWESCO NA Programkaustubh_dec17No ratings yet

- Reading Comprehension: Our Expert Team Has Years of ExperienceDocument20 pagesReading Comprehension: Our Expert Team Has Years of ExperienceSaurabhNo ratings yet

- Syed Usama AliDocument12 pagesSyed Usama AliSarmad MehmoodNo ratings yet

- Bsi BS en 60286-4 - 2013Document20 pagesBsi BS en 60286-4 - 2013alferedNo ratings yet

- The Role of Communities in Conservation of ArchitectureDocument8 pagesThe Role of Communities in Conservation of ArchitectureCyril Kaye DolorzoNo ratings yet

- Chapter 5 - Communication ProcessDocument42 pagesChapter 5 - Communication Processnaa znlNo ratings yet

- Gratuity CalculationDocument4 pagesGratuity CalculationmeetushekhawatNo ratings yet

- Gea Refrigeration Technology North America Service Brochure 98252Document20 pagesGea Refrigeration Technology North America Service Brochure 98252aeropheeNo ratings yet

- Copyrights FormDocument1 pageCopyrights FormIlham Mulya Putra PradanaNo ratings yet

- Private Label Rights PDFDocument2 pagesPrivate Label Rights PDFNilesh ShahNo ratings yet

- JSA Formwork Rebar Dan Puring at SB#1Document7 pagesJSA Formwork Rebar Dan Puring at SB#1Yosua SitumorangNo ratings yet

- Security Analysis and Portfolio ManagementDocument4 pagesSecurity Analysis and Portfolio ManagementSrinita MishraNo ratings yet

- Using Volume Trading Strategy To Win 77% of TradesDocument7 pagesUsing Volume Trading Strategy To Win 77% of TradesVikas Sharma100% (1)

- Rich-Con Steel: A Case On Implementing IT SolutionDocument10 pagesRich-Con Steel: A Case On Implementing IT SolutionSubhangkar BanikNo ratings yet

- Health & Safety Policy: (Including Business Continuity and Accident Management Plan)Document65 pagesHealth & Safety Policy: (Including Business Continuity and Accident Management Plan)rafiq0% (1)

- M Com Sem IV 1-1Document72 pagesM Com Sem IV 1-1Sandip TajaneNo ratings yet

- Joshi Bedekar PG PART 1 ADM NOTICE 22-23 REVISEDDocument2 pagesJoshi Bedekar PG PART 1 ADM NOTICE 22-23 REVISEDfadowo7272No ratings yet

- National Corporate Law in GlobalizationsDocument237 pagesNational Corporate Law in GlobalizationspurwaamidjayaNo ratings yet

- IAS 23 - SemDocument3 pagesIAS 23 - SemMeo MeoNo ratings yet

- Desalination Study Report - WebsiteDocument251 pagesDesalination Study Report - Websitewissem3No ratings yet

- Strategy Management: Group 8Document19 pagesStrategy Management: Group 8Củ Khoai Xấu TínhNo ratings yet

- CL14 - ROSE - MOOE - February 2021Document54 pagesCL14 - ROSE - MOOE - February 2021Rose Diesta-SolivioNo ratings yet

- Sbas For Csec Agricultural Science An IntroductionDocument11 pagesSbas For Csec Agricultural Science An Introductionapi-262572717No ratings yet

- Introduction To Operations ManagementDocument4 pagesIntroduction To Operations ManagementMARY GRACE VARGASNo ratings yet

- GST Certificate KanpurDocument3 pagesGST Certificate KanpurPorush (Fintech 19-21)No ratings yet

Ab - Az ch06

Ab - Az ch06

Uploaded by

evanofaresta030820Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ab - Az ch06

Ab - Az ch06

Uploaded by

evanofaresta030820Copyright:

Available Formats

Chapter Six

Internal Analysis

© 2007 John Wiley & Sons

Copyright © 2010 John Wiley & Sons, Inc. All rights reserved. Reproduction or translation of this work beyond that permitted in

Section 117 of the 1976 United States Copyright Act without the express written permission of the copyright owner is unlawful.

Requests for further information should be addressed to the Permissions Department, John Wiley & Sons, Inc. The purchaser

may make back-up copies for his/her own use only and not for distribution or resale. The Publisher assumes no responsibility

for errors, omissions, or damages, caused by the use of these programs or from the use of the information contained herein.

Chapter 6 - Internal Analysis PPT 6-1

Financial Performance – Sales and

Profitability

• Sales and Market Share

• Profitability

• Measuring Performance: Shareholder Value

Analysis

© 2007 John Wiley & Sons

Chapter 6 - Internal Analysis PPT 6-2

Shareholder Value Analysis

• Cost of equity—weighted average of cost of

capital and cost of debt

– e.g. Capital $1 billion (12%); Debt $3 billion (4%) then

the cost of capital is 6%

• Each business aims at ROA to exceed cost of

© 2007 John Wiley & Sons

equity so shareholder can improve stock

investment

Chapter 6 - Internal Analysis PPT 6-3

Shareholder Value Risks

• ROA estimate requires knowing the cash flow of

any investment and the assets employed—could

encourage short term results

• Reducing assets employed by outsourcing could

result in loss of control of business

• Reducing investment could affect offering

• Increasing debt to reduce cost of equity could be

© 2007 John Wiley & Sons

risky

Chapter 6 - Internal Analysis PPT 6-4

Performance Measures Reflecting

Long-Term Profitability

CustomerSatisfaction/

Customer Satisfaction/

BrandLoyalty

Brand Loyalty

Product/ServiceQuality

Product/Service Quality

Current

Brand/FirmAssociations

Brand/Firm Associations

Performance

RelativeCost

Relative Cost Long

Term

© 2007 John Wiley & Sons

NewProduct

New ProductActivity

Activity Profits

Manager/Employee

Manager/Employee

Capability/Performance

Capability/Performance

Heritageand

Heritage andValues

Values

Chapter 6 - Internal Analysis Figure 6.1 PPT 6-5

Relative Cost vs. Relative Performance

- Strategic Implications

More

MoreExpensive

Expensive

Change Value Analysis

• Design • Raise prices

• Manufacturing/Systems • Promote

Ignore Cost Reduction

Inferior

Inferior Superior

Our Component is Superior

© 2007 John Wiley & Sons

Value Analysis Value Analysis

• De-emphasize • Emphasize/promote

• Upgrade • Leave it alone

Less

LessExpensive

Expensive

Chapter 6 - Internal Analysis Figure 6.2 PPT 6-6

Strengths and Weaknesses

• Strategies leverage strengths and neutralize

weaknesses

• Point of advantage vs. points of parity vs. liability

© 2007 John Wiley & Sons

Chapter 6 - Internal Analysis PPT 6-7

Threats & Opportunities

• Key output of external analysis

• Evaluate as to:

– Immediacy

– Impact

© 2007 John Wiley & Sons

Chapter 6 - Internal Analysis PPT 6-8

Structuring Strategic Decisions

Organizational

Competitor Strengths

Strengths and

and Weaknesses

Weaknesses

StrategyDecisions

Strategy Decisions

••Strategic

StrategicInvestment

Investment

••Value

ValueProposition

Proposition

••Assets

Assetsand

andCompetencies

Competencies

••Functional

FunctionalStrategies

Strategiesand

andPrograms

Programs

© 2007 John Wiley & Sons

Market Needs,

Attractiveness, and

Key Success Factors

Chapter 6 - Internal Analysis PPT 6-9

Figure 6.3

Key Learnings

• Sales and profitability analysis provide an evaluation of past strategies and an

indication of the current market viability of a product line.

• Shareholder value holds that the flow of profits emanating from an investment

should exceed the cost of capital (which is the weighted average of the cost of

equity and cost of debt). Routes to achieving shareholder value – such as

downsizing, reducing assets employed, and outsourcing – can be risky when they

undercut assets and competencies.

• Performance assessment should go beyond financials to include such

© 2007 John Wiley & Sons

dimensions as customer satisfaction/brand loyalty, product/service quality,

brand/firms associations, relative cost, new product activity, and

manager/employee capability and performance.

• Assets and competences can represent a point of advantage, a point of parity, or

a liability. Threats and opportunities that are both imminent and important should

trigger strategic imperatives, programs with high priority.

Chapter 6 - Internal Analysis PPT 6-10

Ancillary Slides

© 2007 John Wiley & Sons

Chapter 6 - Internal Analysis PPT 6-11

“We have met the enemy and he is us.”

- Pogo

© 2007 John Wiley & Sons

Chapter 6 - Internal Analysis PPT 6-12

“Self-conceit may lead to self-destruction.”

-Aesop,

“The Frog and the Ox”

© 2007 John Wiley & Sons

Chapter 6 - Internal Analysis PPT 6-13

“The fish is the last to know if it swims

in water.”

-Chinese proverb

© 2007 John Wiley & Sons

Chapter 6 - Internal Analysis PPT 6-14

“The successful man is the one who

finds out what is the matter with his

business before his competitors do.”

- Roy L. Smith

© 2007 John Wiley & Sons

Chapter 6 - Internal Analysis PPT 6-15

Six Rules for Success

1. Face reality as it is, not as it was or as you wish it

were.

2. Be candid with everyone.

3. Don’t manage, lead.

4. Change before you have to.

5. If you don’t have a competitive advantage, don’t

compete.

6. Control your own destiny, or someone else will.

© 2007 John Wiley & Sons

- Jack Welch

former Chairman, General Electric

Chapter 6 - Internal Analysis PPT 6-16

“It’s not companies that fail, it’s their

leaders who fail.”

- Warren Bennis

© 2007 John Wiley & Sons

Chapter 6 - Internal Analysis PPT 6-17

You might also like

- Comments On Past Exam Question PracticeDocument9 pagesComments On Past Exam Question Practicetcqing1012No ratings yet

- Business Analyst Role GuidelineDocument4 pagesBusiness Analyst Role GuidelineVijayakanth100% (1)

- (David Harvey) Spaces of HopeDocument151 pages(David Harvey) Spaces of HopeGerardo Rosales Carranza100% (1)

- Gujarat State Road TransportationDocument19 pagesGujarat State Road TransportationRahul GargNo ratings yet

- CH 05Document16 pagesCH 05Aamir Akber AliNo ratings yet

- Strategic MRKT Chap 4-2Document19 pagesStrategic MRKT Chap 4-2Sania YousafNo ratings yet

- L09 Agile PerspectiveDocument91 pagesL09 Agile Perspectivemegha singhNo ratings yet

- Integration of Innovation: Business Process ExcellenceDocument14 pagesIntegration of Innovation: Business Process Excellenceapi-19949728No ratings yet

- Operational Performance Improvement in Industrial CompaniesDocument20 pagesOperational Performance Improvement in Industrial Companieskrishna100% (1)

- Process Manager WorkshopDocument58 pagesProcess Manager WorkshopHamada AhmedNo ratings yet

- Chp2 PreplanningDocument59 pagesChp2 PreplanningNOR SYAZWANI ABDUL RAHMANNo ratings yet

- Training Session 3Document42 pagesTraining Session 3Nguyễn Như DuyNo ratings yet

- Chapter 2Document17 pagesChapter 2Mizan SezwanNo ratings yet

- Chapter Five: Environmental Analysis and Strategic UncertaintyDocument15 pagesChapter Five: Environmental Analysis and Strategic UncertaintySoniya ZahidNo ratings yet

- Implementing A Segmentation Strategy 1204653860293754 3Document33 pagesImplementing A Segmentation Strategy 1204653860293754 3Zunaira AzharNo ratings yet

- Fast Food Organizational StructureDocument33 pagesFast Food Organizational StructureSaid Al Jaafari0% (1)

- Harvard Simulation Explanation SheetDocument2 pagesHarvard Simulation Explanation SheetBansil GhodasaraNo ratings yet

- HR Om11 ch05Document80 pagesHR Om11 ch05FADHIA AULYA NOVIANTYNo ratings yet

- NYIF Williams Credit Risk Analysis II 2018Document106 pagesNYIF Williams Credit Risk Analysis II 2018jojozie100% (1)

- OPM Heizer CH05 Design of Goods and Services 1 18032022 113749amDocument67 pagesOPM Heizer CH05 Design of Goods and Services 1 18032022 113749amJahanzeb KhokharNo ratings yet

- IsO 50001Document48 pagesIsO 50001Dante Andres Garcia MenesesNo ratings yet

- Chapter 3Document58 pagesChapter 3Danial AliNo ratings yet

- 10 BSC ConceptDocument34 pages10 BSC ConceptindahNo ratings yet

- Chapter 4Document22 pagesChapter 4ibtisamurrehman47No ratings yet

- Strategic Management 2021Document43 pagesStrategic Management 2021Sanjay P DhaneshNo ratings yet

- Internal Scanning: Organizational Analysis: Strategic Management & Business PolicyDocument32 pagesInternal Scanning: Organizational Analysis: Strategic Management & Business PolicypaceNo ratings yet

- Vision MissionDocument24 pagesVision MissionSeema KhanNo ratings yet

- Swot and Pest AnalysisDocument18 pagesSwot and Pest AnalysisKenisha PanganibanNo ratings yet

- Operations Strategy in A Global Environment: Prof: Dr. Sadam Wedyan Student: AREEJ KHRAIMDocument19 pagesOperations Strategy in A Global Environment: Prof: Dr. Sadam Wedyan Student: AREEJ KHRAIMDania Al-ȜbadiNo ratings yet

- Employee Survey Data AnalysisDocument12 pagesEmployee Survey Data Analysisbatman jonasNo ratings yet

- JDA Why S&OP Get StuckDocument28 pagesJDA Why S&OP Get StuckAhmadNo ratings yet

- Transformation in The Internal Audit Function: Neil WhiteDocument12 pagesTransformation in The Internal Audit Function: Neil WhiteAlexchandar Anbalagan100% (1)

- Chapter 8 Organizational Design and Strategy in A Changing Global EnvironmentDocument42 pagesChapter 8 Organizational Design and Strategy in A Changing Global EnvironmentHaritaa Varshini BalakumaranNo ratings yet

- 5 - 2.1-Udemy-Course-v3-Qualitative-AnalysisDocument13 pages5 - 2.1-Udemy-Course-v3-Qualitative-AnalysisnewscollectingNo ratings yet

- Design of Goods and ServicesDocument39 pagesDesign of Goods and ServicesARDI SETIYAWANNo ratings yet

- Session 3 - Concept Review & Final ProjectDocument28 pagesSession 3 - Concept Review & Final ProjectRBNo ratings yet

- Session 4 - Managing Key Accounts - Structures and Account MappingDocument11 pagesSession 4 - Managing Key Accounts - Structures and Account MappingAyushi GuptaNo ratings yet

- Ab - Az ch03Document16 pagesAb - Az ch03evanofaresta030820No ratings yet

- Scientific Method 4 WPC 480Document15 pagesScientific Method 4 WPC 480Umer Hassan KhanNo ratings yet

- Profitability Ratio Analysis: Purpose: Return On AssetsDocument15 pagesProfitability Ratio Analysis: Purpose: Return On AssetsshawonNo ratings yet

- Chapter 2 Forecasting - FinalDocument66 pagesChapter 2 Forecasting - FinalBảo ThiênNo ratings yet

- CH - 5Document43 pagesCH - 5ende workuNo ratings yet

- Implementing Strategies-Management IssuesDocument27 pagesImplementing Strategies-Management IssuesTelvin GwengweNo ratings yet

- CH 5Document77 pagesCH 5mariam yanalsNo ratings yet

- Powerpoint Slides - Thesis Proposal - MultiDiscriminant Analysis Financial RatiosDocument3 pagesPowerpoint Slides - Thesis Proposal - MultiDiscriminant Analysis Financial RatiosRizaldy MenorNo ratings yet

- University of North-West Graduate School of Business and Government LeadershipDocument58 pagesUniversity of North-West Graduate School of Business and Government LeadershipTom HankNo ratings yet

- Product Development Regal Marine RevDocument41 pagesProduct Development Regal Marine RevIlhamChaniefNo ratings yet

- Developing and Testing The Business ConceptDocument17 pagesDeveloping and Testing The Business ConceptKristian OllierNo ratings yet

- Business Research Method My DraftDocument11 pagesBusiness Research Method My DraftF.T. BhuiyanNo ratings yet

- CH 2Document38 pagesCH 2msoNo ratings yet

- CH 07Document22 pagesCH 07Sheikh HasanNo ratings yet

- Product Management For BAsDocument11 pagesProduct Management For BAsKevin BrennanNo ratings yet

- Chapter 2 Roles and ResponsibilitiesDocument23 pagesChapter 2 Roles and ResponsibilitiesKaranShindeNo ratings yet

- Chapter Three: Competitor AnalysisDocument18 pagesChapter Three: Competitor AnalysisAamir Akber AliNo ratings yet

- Introduction To Problrm SolvingDocument52 pagesIntroduction To Problrm Solvingdharmendraparwar24No ratings yet

- BA449 - Chap005 - Fall 2020Document49 pagesBA449 - Chap005 - Fall 2020mashalerahNo ratings yet

- Ch3-Design of Goods and ServicesDocument29 pagesCh3-Design of Goods and Servicesreema8alothmanNo ratings yet

- CH 07Document26 pagesCH 07aliNo ratings yet

- BE FrameworkDocument30 pagesBE FrameworkAlhassan AliNo ratings yet

- ForecastingDocument139 pagesForecastingAsh LyNo ratings yet

- You Exec - Process Optimization Methodologies CompleteDocument35 pagesYou Exec - Process Optimization Methodologies CompleteRajasekar PonnaiahNo ratings yet

- Driving Your Company's Value: Strategic Benchmarking for ValueFrom EverandDriving Your Company's Value: Strategic Benchmarking for ValueRating: 3 out of 5 stars3/5 (1)

- Stepping Up From Paper F6 (UK) To Paper P6 (UK) - P6 Advanced Taxation - ACCA Qualification - Students - ACCA GlobalDocument3 pagesStepping Up From Paper F6 (UK) To Paper P6 (UK) - P6 Advanced Taxation - ACCA Qualification - Students - ACCA GlobalLouise HurrellNo ratings yet

- Office Automation Systems PDFDocument2 pagesOffice Automation Systems PDFBrian50% (2)

- Valuation - NotesDocument41 pagesValuation - NotessreginatoNo ratings yet

- WESCO NA ProgramDocument12 pagesWESCO NA Programkaustubh_dec17No ratings yet

- Reading Comprehension: Our Expert Team Has Years of ExperienceDocument20 pagesReading Comprehension: Our Expert Team Has Years of ExperienceSaurabhNo ratings yet

- Syed Usama AliDocument12 pagesSyed Usama AliSarmad MehmoodNo ratings yet

- Bsi BS en 60286-4 - 2013Document20 pagesBsi BS en 60286-4 - 2013alferedNo ratings yet

- The Role of Communities in Conservation of ArchitectureDocument8 pagesThe Role of Communities in Conservation of ArchitectureCyril Kaye DolorzoNo ratings yet

- Chapter 5 - Communication ProcessDocument42 pagesChapter 5 - Communication Processnaa znlNo ratings yet

- Gratuity CalculationDocument4 pagesGratuity CalculationmeetushekhawatNo ratings yet

- Gea Refrigeration Technology North America Service Brochure 98252Document20 pagesGea Refrigeration Technology North America Service Brochure 98252aeropheeNo ratings yet

- Copyrights FormDocument1 pageCopyrights FormIlham Mulya Putra PradanaNo ratings yet

- Private Label Rights PDFDocument2 pagesPrivate Label Rights PDFNilesh ShahNo ratings yet

- JSA Formwork Rebar Dan Puring at SB#1Document7 pagesJSA Formwork Rebar Dan Puring at SB#1Yosua SitumorangNo ratings yet

- Security Analysis and Portfolio ManagementDocument4 pagesSecurity Analysis and Portfolio ManagementSrinita MishraNo ratings yet

- Using Volume Trading Strategy To Win 77% of TradesDocument7 pagesUsing Volume Trading Strategy To Win 77% of TradesVikas Sharma100% (1)

- Rich-Con Steel: A Case On Implementing IT SolutionDocument10 pagesRich-Con Steel: A Case On Implementing IT SolutionSubhangkar BanikNo ratings yet

- Health & Safety Policy: (Including Business Continuity and Accident Management Plan)Document65 pagesHealth & Safety Policy: (Including Business Continuity and Accident Management Plan)rafiq0% (1)

- M Com Sem IV 1-1Document72 pagesM Com Sem IV 1-1Sandip TajaneNo ratings yet

- Joshi Bedekar PG PART 1 ADM NOTICE 22-23 REVISEDDocument2 pagesJoshi Bedekar PG PART 1 ADM NOTICE 22-23 REVISEDfadowo7272No ratings yet

- National Corporate Law in GlobalizationsDocument237 pagesNational Corporate Law in GlobalizationspurwaamidjayaNo ratings yet

- IAS 23 - SemDocument3 pagesIAS 23 - SemMeo MeoNo ratings yet

- Desalination Study Report - WebsiteDocument251 pagesDesalination Study Report - Websitewissem3No ratings yet

- Strategy Management: Group 8Document19 pagesStrategy Management: Group 8Củ Khoai Xấu TínhNo ratings yet

- CL14 - ROSE - MOOE - February 2021Document54 pagesCL14 - ROSE - MOOE - February 2021Rose Diesta-SolivioNo ratings yet

- Sbas For Csec Agricultural Science An IntroductionDocument11 pagesSbas For Csec Agricultural Science An Introductionapi-262572717No ratings yet

- Introduction To Operations ManagementDocument4 pagesIntroduction To Operations ManagementMARY GRACE VARGASNo ratings yet

- GST Certificate KanpurDocument3 pagesGST Certificate KanpurPorush (Fintech 19-21)No ratings yet