Professional Documents

Culture Documents

CH 13

CH 13

Uploaded by

chengezen0414Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CH 13

CH 13

Uploaded by

chengezen0414Copyright:

Available Formats

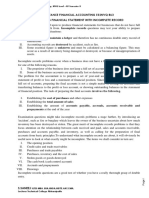

Chapter X

Chapter 13:

Chapter of

The Final Financial Statements Title

Sole Traders (Introductory)

An

Introduction to

Financial

Accounting

9th edition

Andrew Thomas & Anne Marie

Ward

© McGraw-Hill Education 2019

Objectives

By the end of the lecture (and with private study) students

should be able to:

• Explain the purpose and structure of the statement of profit or loss

and the statement of financial position

• Describe the nature of administrative expenses, selling and

distribution expenses, non-current assets, current assets, current

liabilities, non-current liabilities and capital

• Explain the relevance of inventory and the cost of sales in the

determination of gross profit

• Prepare a simple statement of profit or loss and statement of financial

position from a trial balance

• Make ledger and journal entries when preparing financial statements

© McGraw-Hill Education 2019

The purpose of a

statement of profit or loss

RECAP: The statement of profit or loss provides

a summary of the results of a business's trading

activities during a given accounting year. It

shows the profit or loss for the year.

The purpose of a statement of profit or loss is to

enable users, such as the owner(s), to evaluate

the financial performance of a business.

© McGraw-Hill Education 2019

Statement of comprehensive income

• The statement of comprehensive income has

2 main parts

1. Statement of profit or loss (trading and

other realised transactions)

2. Other comprehensive income (unrealised

gains)

– The sum of which gives total

comprehensive income

© McGraw-Hill Education 2019

The purpose of trading accounts

The first stage in determining the profit for the year

involves calculating the gross profit.

It is usually carried out in the statement or profit or

loss.

This part of the statement of profit or loss is sometimes

presented as a separate account referred to as the

trading account.

© McGraw-Hill Education 2019

The structure of trading accounts

ABC

Trading account for the year ended..

£ £

Revenue X

Less: cost of sales/goods sold -

Inventory at start of year X

Add: purchases X

Cost of goods available for sale X

Less: Inventory at end of year X

X

Gross profit X

Note: sales and purchases are after deducting returns.

© McGraw-Hill Education 2019

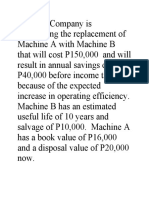

Worked Example 13.1

S. Mann, whose accounting year ends on 30 April, buys

and sells one type of aluminium engine head for sports

cars.

On 1 May 20X8 there were 50 units in inventory which

had cost £100 each. During the subsequent accounting

year he purchased a further 500 units at a cost of £100

each and sold 450 units at a price of £150 each. There

were 100 units which cost £100 each that had not been

sold at 30 April 20X9.

You are required to compute the gross profit for the

year.

© McGraw-Hill Education 2019

Worked Example 13.1

S.Mann

Trading account for the year ended 30 April 20X9

Units £ £

450 Revenue 67,500

Less: Cost of goods sold:

50 Inventory of goods at 01/05/X8 5,000

Add: Goods purchased

500 during the year 50,000

550 Cost of goods available for sale 55,000

Less: inventory of goods

100 at 30 April 20X9 10,000

450 Cost of sales 45,000

Gross profit 22,500

Note: the number of units are not usually shown in a trading account.

They have been included in the above to demonstrate that the cost of

sales relates to the number of units that were sold.

© McGraw-Hill Education 2019

The preparation of final financial

statements: the trading account

The trading account is an account in the ledger

and is thus a part of the double entry system.

It is used to ascertain the gross profit for the

period, and is prepared by transferring the

balances on the sales, purchases and returns

accounts to the trading account.

© McGraw-Hill Education 2019

Inventory double entry

In addition, certain entries are required in respect of inventory as

follows:

Inventory at the start of the period:

Debit Trading account

Credit Inventory account

Inventory at the end of the period:

Debit Inventory account

Credit Trading account

Note: the inventory at the start of the period will be the inventory

at the end of the previous period.

© McGraw-Hill Education 2019

The preparation of final financial

statements: the trading account

The trading account is prepared in:

1. Account form in the ledger (as shown in

Example 13.2 and the next slide); and

2. Vertical form for presentation to the owner(s)

of a business (as shown in Example 13.1 –

slide 15).

In examinations, only the vertical form is

usually expected.

© McGraw-Hill Education 2019

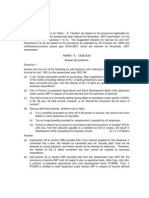

Trading account: ledger format

© McGraw-Hill Education 2019

Worked Example 13.2

Prior to the preparation of the trading account the relevant ledger

accounts will appear as follows:

Sales revenue

20X9

Apl 30 Bal b/d 67,500

Purchases

20X9

Apl 30 Balance b/d 50,000

Inventory

20X9

Apl 30 Balance b/d 5,000

© McGraw-Hill Education 2019

Worked Example 13.2 continued

The trading account will then be prepared as follows:

Sales revenue

20X9 20X9

Apr 30 Trading a/c 67,500 Apr 30 Balance b/d 67,500

Purchases

Apr 30 Balance b/d 50,000 Apr 30 Trading a/c 50,000

Inventory

20X8 20X9

Apr 30 Balance b/d 5,000 Apr 30 Trading a/c 5,000

20X9

Apr 30 Trading a/c 10,000

© McGraw-Hill Education 2019

Worked Example 13.2 continued

© McGraw-Hill Education 2019

The preparation of final financial

statements: the statement of profit or loss

The statement of profit or loss is also an

account in the ledger and is thus a part of the

double entry system.

It is used to ascertain the net profit (or loss) for

the period, and is prepared by transferring the

balances on all the income and expense

accounts in the ledger to the statement of profit

or loss account (can be a T account in its own

right – though normally this is not prepared).

© McGraw-Hill Education 2019

The structure of statements of profit or loss

– vertical format

ABC

Statement of profit or loss for the year ended..

£

Revenue X

Less: cost of sales/goods sold X

Gross profit X

Less: other costs and expenses -

Selling and distribution costs X

Administrative expenses X

Interest payable on loans X

X

Profit/(Loss) for the period X

© McGraw-Hill Education 2019

The purpose of statements of financial

position

RECAP: The statement of financial position is a

list of the assets, liabilities and capital of a

business at the end of a given accounting year.

It provides information about the resources

and debts of the reporting entity. This enables

users to evaluate its financial position, in

particular whether the business is likely to be

unable to pay its debts.

© McGraw-Hill Education 2019

The contents of statements of financial

position

Non-current assets:

Items not specifically bought for resale

Items to be used in the production or distribution of

those goods normally sold by the business.

Durable goods that usually last for several years

There must be an intention to keep them for more than

one accounting year

Examples

Land and buildings; plant and machinery; motor

vehicles; office equipment; furniture, fixtures and

fittings.

© McGraw-Hill Education 2019

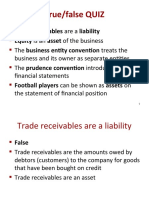

The contents of statements of financial

position

Current assets:

Items that are normally kept by a business for less than

one accounting year and/or support the operating

activities of the entity.

The composition of each type of current asset is usually

continually changing.

Examples

Inventories, trade receivables, short term investments,

bank account and cash.

© McGraw-Hill Education 2019

The contents of statements of financial

position

Current liabilities:

Debts owed by a business that are payable within one

year (often considerably less) of the reporting period

date; e.g. trade payables and bank overdrafts.

Non-current liabilities:

These are debts owed by a business that are not due

until after one year (often much longer) of the reporting

period date; e.g. loans and mortgages.

Capital (Equity):

This refers to the amount of money invested in the

business by the owner(s).

© McGraw-Hill Education 2019

The preparation of final financial statements:

the statement of financial position

The statement of financial position is a list of the

balances remaining in the ledger after the trading and

statement of profit or loss have been prepared.

The statement of financial position may prepared in:

1. Account/horizontal form; or

2. Vertical form.

The vertical form is usually expected in examinations

and for presentation to the owner(s) of a business.

© McGraw-Hill Education 2019

The preparation of final financial statements:

the statement of financial position

When the account/horizontal form is used, there are

two possible formats:

1. Assets/debit balances on the left-hand side and

liabilities/credit balances on the right-hand side;

2. Assets/debit balances on the right-hand side and

liabilities/credit balances on the left-hand side.

The latter is the most common (despite its being the

opposite of that used in the ledger and trial balance)

– which is confusing.

© McGraw-Hill Education 2019

Example

• For examples of the horizontal format

see example 13.3

• The vertical is shown in the next slide

© McGraw-Hill Education 2019

The structure of statements of

financial position: vertical

ABC

Statement of financial position as at ...

Non-current assets

+

Current assets

=

Total assets

Equity and Reserves

+

Non-current liabilities

+

Current liabilities

=

Total equity and liabilities

© McGraw-Hill Education 2019

Summary – some key points

• Final financial statements include a statement of

profit or loss (performance) and a statement of

financial position (financial position).

• The statement of profit or loss (income, expenditure

and resultant profit or loss) can be split into 3 parts

and disclosed in two different ways.

• Part 1 (trading account) and 2 (other income and

expenses) form the statement of profit or loss. Part

3 (other comprehensive income) can be combined

with the statement of profit or loss, or shown as a

separate statement.

© McGraw-Hill Education 2019

Summary – some key points

• The statement of financial position

splits the entities assets into non-

current and current.

• It also records equity, as distinct from

other liabilities.

• Liabilities are split into non-current and

current.

• Both statements are presented in

vertical format for users.

© McGraw-Hill Education 2019

Student - study action

• Read chapter 13

• Then - try to explain the key terms and concepts

(check your answer with the chapter and the online

glossary)

• Try the review questions (check your answers with

the chapter)

• Try the exercise questions with an asterisk (solutions

are available in the appendix)

• Try the exercise questions required by your tutor

(solutions to be provided by the tutor at their

discretion)

• Try the learning activities on the student online

learning centre (www.mcgraw-hill.co.uk/textbooks/thomas)

© McGraw-Hill Education 2019

You might also like

- Fabm2 SLK Week 2 - 3 SCIDocument11 pagesFabm2 SLK Week 2 - 3 SCIMylene SantiagoNo ratings yet

- Liquidation Preference Calculation (English Version)Document4 pagesLiquidation Preference Calculation (English Version)api-376449667% (3)

- Left Column For Inner Computation - Right Column For Totals - Peso Sign at The Beginning Amount and at Final Answer TwoDocument6 pagesLeft Column For Inner Computation - Right Column For Totals - Peso Sign at The Beginning Amount and at Final Answer Twoamberle smithNo ratings yet

- E-Book - Final Accounts - PDF OnlyDocument34 pagesE-Book - Final Accounts - PDF OnlyAshish GuptaNo ratings yet

- Fabm ReviewerDocument16 pagesFabm Reviewersab lightningNo ratings yet

- 15 1312MH CH09 PDFDocument17 pages15 1312MH CH09 PDFAntora HoqueNo ratings yet

- Basic Financial ReportsDocument28 pagesBasic Financial ReportsNguyễn Loan AnhNo ratings yet

- 9 Financial Statement - Part ADocument33 pages9 Financial Statement - Part AMariam AhmedNo ratings yet

- FUNDAMENTALS OF ACCOUNTANCY BUSINESS AND MANAGEMENT PPP 1Document185 pagesFUNDAMENTALS OF ACCOUNTANCY BUSINESS AND MANAGEMENT PPP 1Janelle Dela Cruz100% (1)

- Fabm 121.week 6-10 ModuleDocument22 pagesFabm 121.week 6-10 Modulekhaizer matias100% (1)

- Accounting For Merchandising Activities: © 2019 Mcgraw-Hill EducationDocument49 pagesAccounting For Merchandising Activities: © 2019 Mcgraw-Hill EducationVinemra GautamNo ratings yet

- CHAPTER - 05 - Finacial StatementDocument12 pagesCHAPTER - 05 - Finacial StatementSaneej SamsudeenNo ratings yet

- Accounting 9706 Notes Unit 2 RevisionDocument19 pagesAccounting 9706 Notes Unit 2 RevisionNehaNo ratings yet

- Financial Accounting 16Th Edition Williams Test Bank Full Chapter PDFDocument36 pagesFinancial Accounting 16Th Edition Williams Test Bank Full Chapter PDFmary.garcia718100% (11)

- CH 2 - Incomplete Records & Non Profit OrganisationDocument56 pagesCH 2 - Incomplete Records & Non Profit OrganisationFaris IzzatNo ratings yet

- Topic 4 Basic Financial StatementsDocument25 pagesTopic 4 Basic Financial StatementsJonisNo ratings yet

- Incomplete RecordsDocument6 pagesIncomplete RecordsSaneej SamsudeenNo ratings yet

- Fundamentals of Accountancy, Business & Management 2: Quarter 1 - SLM 2 Statement of Comprehensive IncomeDocument23 pagesFundamentals of Accountancy, Business & Management 2: Quarter 1 - SLM 2 Statement of Comprehensive IncomeMark Joseph BielzaNo ratings yet

- First Semester - AY 2020-2021: C-AE13: Financial Accounting and ReportingDocument6 pagesFirst Semester - AY 2020-2021: C-AE13: Financial Accounting and Reportingfirestorm riveraNo ratings yet

- Statement of Comprehensive IncomeDocument16 pagesStatement of Comprehensive IncomeDindin Oromedlav Lorica100% (4)

- Financial Statement of Sole Proprietorship (Final Ac)Document16 pagesFinancial Statement of Sole Proprietorship (Final Ac)centmusic8No ratings yet

- CH 7Document27 pagesCH 7chengezen0414No ratings yet

- Intriioiiducintrotioniiiiiiiiiiiiiiiiiiiiiiiiiiiiii To Income StatementDocument3 pagesIntriioiiducintrotioniiiiiiiiiiiiiiiiiiiiiiiiiiiiii To Income StatementYashika RanaNo ratings yet

- CH 15Document12 pagesCH 15chengezen0414No ratings yet

- Ugbs 002 - 1Document135 pagesUgbs 002 - 1CourageNo ratings yet

- Lesson 7Document38 pagesLesson 7PoonamNo ratings yet

- Topic 2 Accounting EquationDocument27 pagesTopic 2 Accounting EquationHazmanRamleNo ratings yet

- LAS ABM - FABM12 Ic D 5 6 Week 2Document7 pagesLAS ABM - FABM12 Ic D 5 6 Week 2ROMMEL RABONo ratings yet

- CH 18Document13 pagesCH 18chengezen0414No ratings yet

- Unit 3 Student Book Outcome FDocument55 pagesUnit 3 Student Book Outcome FharvieroselangmanNo ratings yet

- CH 7Document22 pagesCH 7Zain Wahab GmNo ratings yet

- G8 Accounting Note Chapter 8 (R1)Document5 pagesG8 Accounting Note Chapter 8 (R1)Anggi Pradila PutriNo ratings yet

- Fundamentals of Accountancy Business and Management II Module 2Document5 pagesFundamentals of Accountancy Business and Management II Module 2Rafael RetubisNo ratings yet

- 16 Financial Statement of Sole ProprietorshipDocument16 pages16 Financial Statement of Sole Proprietorshipshrutichoudhary436No ratings yet

- Module 10 - The Financial Statements IIDocument11 pagesModule 10 - The Financial Statements IINina AlexineNo ratings yet

- Financial Accounting and The Financial StatementsDocument10 pagesFinancial Accounting and The Financial StatementsRajiv RankawatNo ratings yet

- Week 006 - Module Statement of Comprehensive Income Part IIDocument7 pagesWeek 006 - Module Statement of Comprehensive Income Part IIJulia AcostaNo ratings yet

- 61809bos50279 cp7 U1Document61 pages61809bos50279 cp7 U1Sukhmeet Singh100% (1)

- Q1 LAS 3 FABM2 12 Week 2 3Document7 pagesQ1 LAS 3 FABM2 12 Week 2 3Flare ColterizoNo ratings yet

- Incomplete RecordsDocument51 pagesIncomplete RecordssoniaNo ratings yet

- AFB Lecture 4 Completed DeckDocument41 pagesAFB Lecture 4 Completed DeckAzure Pear HaNo ratings yet

- 11 4 Indu Is in Business Buying and Selling Goods On CreditDocument2 pages11 4 Indu Is in Business Buying and Selling Goods On Creditparwez_0505No ratings yet

- Final AcountsDocument20 pagesFinal Acountskarthikeyan01No ratings yet

- Learning Module In: Grade 11Document12 pagesLearning Module In: Grade 11Esvee TyNo ratings yet

- Asset Recognition and Operating Assets: Fourth EditionDocument55 pagesAsset Recognition and Operating Assets: Fourth EditionAyush JainNo ratings yet

- Learning Module In: Grade 11Document12 pagesLearning Module In: Grade 11Esvee TyNo ratings yet

- Acctng NotesDocument13 pagesAcctng NotesJeremae EtiongNo ratings yet

- Accounting 12 Chapter 8Document30 pagesAccounting 12 Chapter 8cecilia capiliNo ratings yet

- Incomplete Records - N4 22 PDFDocument57 pagesIncomplete Records - N4 22 PDFSay SopheakneathNo ratings yet

- 8 Financial StatementDocument11 pages8 Financial StatementLin Latt Wai AlexaNo ratings yet

- Sci Multi StepDocument20 pagesSci Multi StepJoselyn AmonNo ratings yet

- Statement of Comprehensive IncomeDocument13 pagesStatement of Comprehensive IncomeJethro RafaNo ratings yet

- Final Accounts 1Document25 pagesFinal Accounts 1ken philipsNo ratings yet

- C Apre6 Spectrans Module 2 PDFDocument11 pagesC Apre6 Spectrans Module 2 PDFSittie Ainna Acmed UnteNo ratings yet

- Final Accounts of A Proprietary ConcernDocument14 pagesFinal Accounts of A Proprietary ConcernShivam MutkuleNo ratings yet

- Statement of Comprehensive Income (SCI)Document35 pagesStatement of Comprehensive Income (SCI)Jung WonnieNo ratings yet

- Module 3 Final AccountsDocument31 pagesModule 3 Final Accountskaushalrajsinhjanvar427No ratings yet

- Week 4 T3 Lectures 7 & 8 Income Statement I With SolutionsDocument59 pagesWeek 4 T3 Lectures 7 & 8 Income Statement I With SolutionsAbdullah HashmatNo ratings yet

- (ASC) Accounting For Business CombinationDocument13 pages(ASC) Accounting For Business CombinationRENZ ALFRED ASTRERONo ratings yet

- CH 5Document22 pagesCH 5chengezen0414No ratings yet

- CH 26Document25 pagesCH 26chengezen0414No ratings yet

- CH 7Document27 pagesCH 7chengezen0414No ratings yet

- CH 1Document29 pagesCH 1chengezen0414No ratings yet

- Group 2 - Derivatives Market in VietnamDocument5 pagesGroup 2 - Derivatives Market in VietnamNhật HạNo ratings yet

- Acctstmt DDocument2 pagesAcctstmt DSwati ChoudharyNo ratings yet

- VQR Question Bank - 1Document2 pagesVQR Question Bank - 1sairam97969No ratings yet

- Landsmith PresentationDocument20 pagesLandsmith PresentationdlitvinovNo ratings yet

- Chapter 11 Capital Budgeting Cash FlowsDocument33 pagesChapter 11 Capital Budgeting Cash FlowsShahadNo ratings yet

- Resizing Provisions PDFDocument4 pagesResizing Provisions PDFadonisghlNo ratings yet

- Group 7 Vinamilk Financial AnalysisDocument17 pagesGroup 7 Vinamilk Financial AnalysisLại Ngọc Cẩm NhungNo ratings yet

- Invoice Receipt: Orchards Residents AssociationDocument1 pageInvoice Receipt: Orchards Residents Association4mxzfppvfnNo ratings yet

- Financial Statement AnalysisDocument78 pagesFinancial Statement AnalysisdhruvNo ratings yet

- Goods Market - The Is CurveDocument4 pagesGoods Market - The Is CurveKatunga MwiyaNo ratings yet

- Convertibility of RupeeDocument14 pagesConvertibility of RupeeArun MishraNo ratings yet

- Report On Askari BankDocument64 pagesReport On Askari Bankzorish87% (15)

- Addtl Exercises 10 12Document5 pagesAddtl Exercises 10 12John Lester C AlagNo ratings yet

- Project Reports On Non Performing Assets NPAs in Banking IndustryDocument73 pagesProject Reports On Non Performing Assets NPAs in Banking IndustryNITISH CHANDRA PANDEYNo ratings yet

- Deutsche BrauereiDocument22 pagesDeutsche Brauereiusergurl0% (2)

- Tle6 Q1 Week2Document6 pagesTle6 Q1 Week2Roy Bautista Manguyot100% (1)

- RR No. 24-2020Document3 pagesRR No. 24-2020Dean Stephen CalisinNo ratings yet

- Anh Van Chuyen Nganh Đ I Trà TCNH 2022Document69 pagesAnh Van Chuyen Nganh Đ I Trà TCNH 2022asdqwffqNo ratings yet

- Eastwest Bank: Position Department/Division: Branch Banking Division Reports To SupervisesDocument10 pagesEastwest Bank: Position Department/Division: Branch Banking Division Reports To SupervisesShingieNo ratings yet

- Bob 4Document11 pagesBob 4Raj KuruhuriNo ratings yet

- T5 (Taxation) Question and Answers Dec 2014Document21 pagesT5 (Taxation) Question and Answers Dec 2014MosesNo ratings yet

- (Deutsche Bank) Inflation - Hedging It and Trading It PDFDocument48 pages(Deutsche Bank) Inflation - Hedging It and Trading It PDFcharlee_fokstrot100% (1)

- Plant Tender EZ OffDocument16 pagesPlant Tender EZ OffGowri GaneshNo ratings yet

- Taxation (Nov. 2007)Document17 pagesTaxation (Nov. 2007)P VenkatesanNo ratings yet

- IRC SET 5 - Q'sDocument10 pagesIRC SET 5 - Q'sSiti SarahNo ratings yet

- UAS Muhammad Misbahul HudaDocument6 pagesUAS Muhammad Misbahul Hudawhite shadowNo ratings yet

- RFBT 05 03 Law On Obligation For Discussion Part Two MCQs Without Answer KeyDocument12 pagesRFBT 05 03 Law On Obligation For Discussion Part Two MCQs Without Answer KeyRye Diaz-SanchezNo ratings yet

- 2A. HDFC May2018 EstatementDocument7 pages2A. HDFC May2018 EstatementNanu PatelNo ratings yet

- Ratio Table - ACCT 3BDocument10 pagesRatio Table - ACCT 3BHoàng Minh ChuNo ratings yet