Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

3 viewsClassification of Tax Payers

Classification of Tax Payers

Uploaded by

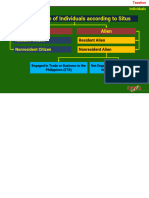

Hilarie Jean1) The document classifies taxpayers into five categories: resident citizen, non-resident citizen, resident alien, non-resident alien engaged in trade or business, and non-resident alien not engaged in trade or business.

2) It provides definitions for each category, such as a resident citizen is a Filipino citizen who permanently resides in the Philippines, while a non-resident citizen is a citizen of the Philippines who establishes residence abroad.

3) Examples are given to illustrate the definitions, such as a foreign computer expert staying in the Philippines for 6 months to assist with a computer installation would be considered a resident alien.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You might also like

- Reviewer Chapter 2Document6 pagesReviewer Chapter 2Ken NavarroNo ratings yet

- Income Taxation Lecture Notes.5.Classifications of Individual TaxpayersDocument5 pagesIncome Taxation Lecture Notes.5.Classifications of Individual Taxpayerseinel dc100% (1)

- Lesson 2 Taxation of IndividualsDocument40 pagesLesson 2 Taxation of IndividualsQuenie De la CruzNo ratings yet

- Income Recognition, Measurement and Reporting and Taxpayer ClassificationsDocument27 pagesIncome Recognition, Measurement and Reporting and Taxpayer ClassificationsAries Queencel Bernante BocarNo ratings yet

- Basergo, Lovers Mae B. General Classification of Individual TaxpayersDocument2 pagesBasergo, Lovers Mae B. General Classification of Individual Taxpayerslavender kayeNo ratings yet

- Introduction To Income Taxation - 625041052Document21 pagesIntroduction To Income Taxation - 625041052ANGELA JOY FLORESNo ratings yet

- InTax Unit 2Document3 pagesInTax Unit 2ElleNo ratings yet

- Handout TaxationDocument2 pagesHandout TaxationJohn Oicemen RocaNo ratings yet

- Types of Income Tax PayersDocument3 pagesTypes of Income Tax PayersAce Fati-igNo ratings yet

- (TAX) Income Taxation Updated Jan 9 2022Document133 pages(TAX) Income Taxation Updated Jan 9 2022Reginald ValenciaNo ratings yet

- Train Individual INCOME TAXDocument48 pagesTrain Individual INCOME TAXMeireen Ann100% (2)

- Individual Taxpayers (Ordinary Income and Fringe Benefits)Document86 pagesIndividual Taxpayers (Ordinary Income and Fringe Benefits)ipbsalanguitNo ratings yet

- Introduction To Individual Income Taxation Chapter Overview and ObjectivesDocument25 pagesIntroduction To Individual Income Taxation Chapter Overview and ObjectivesMatta, Jherrie MaeNo ratings yet

- Classification of Individual Taxpayers - AlienDocument32 pagesClassification of Individual Taxpayers - AlienMarria FrancezcaNo ratings yet

- Template Taxation Unit IIDocument29 pagesTemplate Taxation Unit IINacion, Jaime G.No ratings yet

- What Are The Kinds of TaxpayersDocument4 pagesWhat Are The Kinds of TaxpayersALee Bud100% (1)

- Prelim Income TaxationDocument55 pagesPrelim Income TaxationclytemnestraNo ratings yet

- Taxation of IndividualsDocument49 pagesTaxation of IndividualsAnastasha Grey100% (1)

- Taxation Ass 2Document1 pageTaxation Ass 2Jazon GotanghoNo ratings yet

- Gross Income (Classification of Taxpayers)Document12 pagesGross Income (Classification of Taxpayers)Michael Thom MacabuhayNo ratings yet

- MODULE 5 Individual TaxationDocument3 pagesMODULE 5 Individual TaxationCEDRICK MARX ABRIGARNo ratings yet

- 2 Classification of Individual TaxpayersDocument2 pages2 Classification of Individual TaxpayersDiana SheineNo ratings yet

- TAX-5.0 - Individual Income TaxDocument65 pagesTAX-5.0 - Individual Income TaxCharmaine RosalesNo ratings yet

- TAX Reviewer FINALSDocument9 pagesTAX Reviewer FINALSLalaine SantiagoNo ratings yet

- Inroduction To Income TaxationDocument20 pagesInroduction To Income TaxationW-304-Bautista,PreciousNo ratings yet

- Intax ExerciseDocument26 pagesIntax ExerciseJosh CruzNo ratings yet

- TAX-601: Income TAX - Individuals, Estates AND Trusts: - T R S ADocument12 pagesTAX-601: Income TAX - Individuals, Estates AND Trusts: - T R S AVaughn TheoNo ratings yet

- Types of TaxpayerDocument23 pagesTypes of TaxpayerReina Rose LebrillaNo ratings yet

- Features of Philippine Income Tax SystemDocument9 pagesFeatures of Philippine Income Tax SystemPATRICIA ANGELICA VINUYANo ratings yet

- Mary Joy P. Junio, Cpa Notre Dame of Midsayap College Midsayap, CotabatoDocument8 pagesMary Joy P. Junio, Cpa Notre Dame of Midsayap College Midsayap, CotabatoJonathan JunioNo ratings yet

- 03 Individuals. Study Notes. LectureDocument54 pages03 Individuals. Study Notes. Lecturemarvin.cpa.cmaNo ratings yet

- Quickie PreFi Tax PDFDocument12 pagesQuickie PreFi Tax PDFJoesil Dianne Sempron100% (1)

- PreFi Tax PDFDocument21 pagesPreFi Tax PDFJoesil Dianne SempronNo ratings yet

- Income Tax For IndividualsDocument90 pagesIncome Tax For IndividualsRubyjane Kim100% (1)

- Kinds of Taxpayers and Situs of IncomeDocument2 pagesKinds of Taxpayers and Situs of IncomeMelanie SamsonaNo ratings yet

- HO 1 INDIVIDUAL ESTATE AND TRUST TAXATION AND SOURCES OF INCOME Version 2.0Document5 pagesHO 1 INDIVIDUAL ESTATE AND TRUST TAXATION AND SOURCES OF INCOME Version 2.0Erine ContranoNo ratings yet

- BAC103A-02a Income Tax For IndividualsDocument8 pagesBAC103A-02a Income Tax For IndividualsNovelyn Duyogan100% (1)

- 3 - Income Tax On IndividualsDocument22 pages3 - Income Tax On IndividualsRylleMatthanCorderoNo ratings yet

- Income Taxation IndividualsDocument19 pagesIncome Taxation IndividualsJenniNo ratings yet

- Tax601 Individual Itx Lecture Notes 122Document12 pagesTax601 Individual Itx Lecture Notes 122Justine JaymaNo ratings yet

- Module TX003 Types On Income TaxpayersDocument3 pagesModule TX003 Types On Income TaxpayersErvin Ray FernandezNo ratings yet

- M2u Classification Individual Taxation P1Document30 pagesM2u Classification Individual Taxation P1Xehdrickke FernandezNo ratings yet

- Classification of Individual TaxpayerDocument31 pagesClassification of Individual TaxpayerPatrick BituinNo ratings yet

- Income Taxation Week 3Document20 pagesIncome Taxation Week 3Hannah Rae ChingNo ratings yet

- Income Tax On Individuals PDFDocument20 pagesIncome Tax On Individuals PDFKaren Joy MagsayoNo ratings yet

- Taxation Week 3Document8 pagesTaxation Week 3Jurian Jaan PeligroNo ratings yet

- Individual TaxpayerDocument10 pagesIndividual TaxpayerLL. yangzNo ratings yet

- Tax 601Document11 pagesTax 601C.J. Clarisse FranciscoNo ratings yet

- Taxation of IndividualsDocument22 pagesTaxation of IndividualsTurksNo ratings yet

- Taxation of IndividualsDocument9 pagesTaxation of IndividualsBrielle GabNo ratings yet

- Module 2 - Income Taxes For Individuals - Lecture NotesDocument52 pagesModule 2 - Income Taxes For Individuals - Lecture NotesRina Bico Advincula100% (1)

- 2nd Semester Income Taxation Module 5 Classification of TaxpayersDocument5 pages2nd Semester Income Taxation Module 5 Classification of TaxpayersMaryrose SumulongNo ratings yet

- Income Tax ConDocument2 pagesIncome Tax ConMaricon EstradaNo ratings yet

- Lesson 5 Inclusions Exclusions From Gi Final TaxDocument17 pagesLesson 5 Inclusions Exclusions From Gi Final TaxOrduna Mae AnnNo ratings yet

- Module TX003 Types On Income TaxpayersDocument3 pagesModule TX003 Types On Income TaxpayersErwin TorresNo ratings yet

- TAX Outline 2 1Document18 pagesTAX Outline 2 1Master GTNo ratings yet

- TAX Outline 2 1Document18 pagesTAX Outline 2 1Master GTNo ratings yet

- Share Taxpayer and Elements of Gross IncomeDocument24 pagesShare Taxpayer and Elements of Gross IncomeJessa Mae IgotNo ratings yet

- ACC311 3rd Exam CoverageDocument108 pagesACC311 3rd Exam CoverageHilarie JeanNo ratings yet

- Deductions From Gross Income - 020807Document9 pagesDeductions From Gross Income - 020807Hilarie JeanNo ratings yet

- Computation of Corporate Tax PayersDocument14 pagesComputation of Corporate Tax PayersHilarie JeanNo ratings yet

- Practice ACC 311 Competency ExamDocument2 pagesPractice ACC 311 Competency ExamHilarie JeanNo ratings yet

- ACCExpanded Opportunity Part 1Document4 pagesACCExpanded Opportunity Part 1Hilarie JeanNo ratings yet

- SM07 4thExamReview 054702Document4 pagesSM07 4thExamReview 054702Hilarie JeanNo ratings yet

- Corpuz vs. Sto. TomasDocument3 pagesCorpuz vs. Sto. TomasSarah Monique Nicole Antoinette GolezNo ratings yet

- Transcript Req ProseDocument2 pagesTranscript Req ProseMasterReader99No ratings yet

- Gorospe Vs People - HomicideDocument4 pagesGorospe Vs People - HomicidegeorjalynjoyNo ratings yet

- Works of Defence Act 1903 1Document21 pagesWorks of Defence Act 1903 1Eighteenth JulyNo ratings yet

- Answers EvidenceDocument5 pagesAnswers EvidenceAmiza Abd KaharNo ratings yet

- 7.1lao v. Yao Bio Lim20210423-12-1v6ji2vDocument16 pages7.1lao v. Yao Bio Lim20210423-12-1v6ji2vSeok Gyeong KangNo ratings yet

- Philippine Airlines V NLRCDocument2 pagesPhilippine Airlines V NLRCCedricNo ratings yet

- HOW DOD, VA, and Military Industrial Complex (Deep State) : Lock Acceptable Claims in The Army & DOD's Safe ServerDocument172 pagesHOW DOD, VA, and Military Industrial Complex (Deep State) : Lock Acceptable Claims in The Army & DOD's Safe ServeradaadvocatesuebozgozNo ratings yet

- Declaration Form FINALDocument1 pageDeclaration Form FINALAnonymous TlYmhkNo ratings yet

- Opening Brief 22CA77 Emily Cohen AppealDocument54 pagesOpening Brief 22CA77 Emily Cohen AppealEmily CohenNo ratings yet

- 1740 CRPC Project SubmissionDocument12 pages1740 CRPC Project SubmissionMEHULANo ratings yet

- People v. Serrano G.R. No. L 7973Document2 pagesPeople v. Serrano G.R. No. L 7973Tootsie GuzmaNo ratings yet

- Substantive and Procedural LawDocument8 pagesSubstantive and Procedural LawNaif OmarNo ratings yet

- OCA Circular No. 01-2024Document7 pagesOCA Circular No. 01-2024RTC FortetoNo ratings yet

- Case LawDocument10 pagesCase LawKirti DNo ratings yet

- Defendant's Motion To Disqualify Judge Edward L. ScottDocument42 pagesDefendant's Motion To Disqualify Judge Edward L. ScottNeil GillespieNo ratings yet

- Chronological Case Summary Trenton-Ivy WIDocument1 pageChronological Case Summary Trenton-Ivy WIGrizzly DocsNo ratings yet

- 823 F.2d 548 Unpublished Disposition: United States Court of Appeals, Fourth CircuitDocument6 pages823 F.2d 548 Unpublished Disposition: United States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- Rule 58 Preliminary InjunctionDocument77 pagesRule 58 Preliminary InjunctionJan Igor GalinatoNo ratings yet

- Fencing and Anti-Carnapping Case DigestsDocument16 pagesFencing and Anti-Carnapping Case DigestsCarla January OngNo ratings yet

- (Day 29) (Final) The Hindu Minority and Guardianship Act, 1956Document4 pages(Day 29) (Final) The Hindu Minority and Guardianship Act, 1956Deb DasNo ratings yet

- Rivera V ChuaDocument2 pagesRivera V ChuaLarraine FallongNo ratings yet

- 196-737-1-PB-Malaysia Case Study PDFDocument16 pages196-737-1-PB-Malaysia Case Study PDFGM KendraNo ratings yet

- Andamo Vs IACDocument6 pagesAndamo Vs IACArmen MagbitangNo ratings yet

- Okeke v. INS, 4th Cir. (1996)Document6 pagesOkeke v. INS, 4th Cir. (1996)Scribd Government DocsNo ratings yet

- Kilosbayan Vs MoratoDocument3 pagesKilosbayan Vs MoratoRmLyn MclnaoNo ratings yet

- Alternative Dispute ResolutionDocument27 pagesAlternative Dispute ResolutionAnil Patel100% (1)

- A.M. No. 99-10-05-0 Procedure in Extra-Judicial Foreclosure of MortgageDocument2 pagesA.M. No. 99-10-05-0 Procedure in Extra-Judicial Foreclosure of Mortgagechill21ggNo ratings yet

- Chua Vs CA PolidoDocument2 pagesChua Vs CA PolidoJohnde MartinezNo ratings yet

- Witness Cannot Be Added As An Accused Even If His Statements Are Inculpatory: Supreme CourtDocument36 pagesWitness Cannot Be Added As An Accused Even If His Statements Are Inculpatory: Supreme CourtLive Law100% (1)

Classification of Tax Payers

Classification of Tax Payers

Uploaded by

Hilarie Jean0 ratings0% found this document useful (0 votes)

3 views24 pages1) The document classifies taxpayers into five categories: resident citizen, non-resident citizen, resident alien, non-resident alien engaged in trade or business, and non-resident alien not engaged in trade or business.

2) It provides definitions for each category, such as a resident citizen is a Filipino citizen who permanently resides in the Philippines, while a non-resident citizen is a citizen of the Philippines who establishes residence abroad.

3) Examples are given to illustrate the definitions, such as a foreign computer expert staying in the Philippines for 6 months to assist with a computer installation would be considered a resident alien.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) The document classifies taxpayers into five categories: resident citizen, non-resident citizen, resident alien, non-resident alien engaged in trade or business, and non-resident alien not engaged in trade or business.

2) It provides definitions for each category, such as a resident citizen is a Filipino citizen who permanently resides in the Philippines, while a non-resident citizen is a citizen of the Philippines who establishes residence abroad.

3) Examples are given to illustrate the definitions, such as a foreign computer expert staying in the Philippines for 6 months to assist with a computer installation would be considered a resident alien.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

3 views24 pagesClassification of Tax Payers

Classification of Tax Payers

Uploaded by

Hilarie Jean1) The document classifies taxpayers into five categories: resident citizen, non-resident citizen, resident alien, non-resident alien engaged in trade or business, and non-resident alien not engaged in trade or business.

2) It provides definitions for each category, such as a resident citizen is a Filipino citizen who permanently resides in the Philippines, while a non-resident citizen is a citizen of the Philippines who establishes residence abroad.

3) Examples are given to illustrate the definitions, such as a foreign computer expert staying in the Philippines for 6 months to assist with a computer installation would be considered a resident alien.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 24

CLASSIFICATION OF TAX PAYERS

CITIZEN

– Those who are citizens of the Philippines at the

time of the adoption of the Feb. 2, 1987

Constitution.

– Those whose fathers or mothers are citizens of

the Philippines

– Those born before Jan. 17, 1973, the date of the

adoption of the 1973 Constitution, of Filipino

mothers, who elect Philippine citizenship upon

reaching the age of majority

– Those who are naturalized in accordance with law

CLASSIFICATION OF TAX PAYERS

• RESIDENT CITIZEN

• NON-RESIDENT CITIZEN

• RESIDENT ALIEN

• NON-RESIDENT ALIEN ENGAGED IN TRADE/BUSINESS

• NON-RESIDENT ALIEN NOT ENGAGED IN BUSINESS

• NON-RESIDENT ALIEN EMPLOYED BY RHQs, OBU &

PETROLEUM CONTRACTORS

RESIDENT CITIZEN

• A Filipino citizen who permanently resides in

the Philippines

NON-RESIDENT CITIZEN

• A citizen of the Philippines who establishes to the satisfaction of

the Commissioner the fact of his physical presence abroad with

a definite intention to reside therein.

• A citizen of the Philippines who leaves the Philippines during

the taxable year to reside abroad, either as an immigrant or for

employment on a permanent basis.

• A citizen of the Philippines who works and derives income from

abroad and whose employment thereat requires him to be

physically present abroad most of the time (at least 183 days)

during the taxable year.

• A citizen who has been previously considered as non-resident

citizen and who arrives in the Philippines at any time during the

taxable year to reside permanently in the Philippines shall

likewise be treated as a non-resident citizen for the taxable year

in which he arrives in the Philippines with respect to his income

derived from sources abroad until the date of his arrival in the

RESIDENT ALIEN

• An individual whose residence is within the

Philippines and who is not a citizen thereof.

NON-RESIDENT ALIEN ENGAGED IN

TRADE/BUSINESS

• The alien is carrying on a business in the

Philippines.

• The term business does not include

performance of services by the taxpayer as an

employee but it includes the performance of

the functions of a public office.

• An alien who stayed in the Philippines for more

than 180 days during any calendar year shall be

deemed doing business in the Philippines.

NON-RESIDENT ALIEN NOT ENGAGED IN

BUSINESS

• An alien who stayed in the Philippines for 180

days or less.

ILLUSTRATION

• A British computer expert was hired by a

Philippine Corporation to assist in its

computer system installation for which he

had to stay in the Philippines for 6 months. Is

he a resident alien?

• YES

• A British cultural performer was engaged to

perform in the Philippines for two weeks

after which he returned to his country. Is he

a resident alien?

• no

• An alien owns shares of stock in the

Philippines. Is he considered as engaged in

business or trade in the Philippines?

• no

• An alien temporarily serves as executive

manager of an airline in Manila. Is he

considered engaged in trade or business in

the Philippines?

• Yes

• A resident alien left the Philippines and

abandoned his residency thereof without any

intention of returning. May he still be

considered a resident alien?

• no

• A resident alien left the Philippines with a re-

entry permit. Is he still a resident alien?

• yes

• A non-resident citizen went to Manila under

the Balikbayan program. Does his return to

Manila interrupt his residence abroad?

• No

INDIVIDUAL SOURCES OF INCOME

WITHIN

WITHOUT

RC √ √

NRC √

RA √

NRAETB √

NRANEB √

You might also like

- Reviewer Chapter 2Document6 pagesReviewer Chapter 2Ken NavarroNo ratings yet

- Income Taxation Lecture Notes.5.Classifications of Individual TaxpayersDocument5 pagesIncome Taxation Lecture Notes.5.Classifications of Individual Taxpayerseinel dc100% (1)

- Lesson 2 Taxation of IndividualsDocument40 pagesLesson 2 Taxation of IndividualsQuenie De la CruzNo ratings yet

- Income Recognition, Measurement and Reporting and Taxpayer ClassificationsDocument27 pagesIncome Recognition, Measurement and Reporting and Taxpayer ClassificationsAries Queencel Bernante BocarNo ratings yet

- Basergo, Lovers Mae B. General Classification of Individual TaxpayersDocument2 pagesBasergo, Lovers Mae B. General Classification of Individual Taxpayerslavender kayeNo ratings yet

- Introduction To Income Taxation - 625041052Document21 pagesIntroduction To Income Taxation - 625041052ANGELA JOY FLORESNo ratings yet

- InTax Unit 2Document3 pagesInTax Unit 2ElleNo ratings yet

- Handout TaxationDocument2 pagesHandout TaxationJohn Oicemen RocaNo ratings yet

- Types of Income Tax PayersDocument3 pagesTypes of Income Tax PayersAce Fati-igNo ratings yet

- (TAX) Income Taxation Updated Jan 9 2022Document133 pages(TAX) Income Taxation Updated Jan 9 2022Reginald ValenciaNo ratings yet

- Train Individual INCOME TAXDocument48 pagesTrain Individual INCOME TAXMeireen Ann100% (2)

- Individual Taxpayers (Ordinary Income and Fringe Benefits)Document86 pagesIndividual Taxpayers (Ordinary Income and Fringe Benefits)ipbsalanguitNo ratings yet

- Introduction To Individual Income Taxation Chapter Overview and ObjectivesDocument25 pagesIntroduction To Individual Income Taxation Chapter Overview and ObjectivesMatta, Jherrie MaeNo ratings yet

- Classification of Individual Taxpayers - AlienDocument32 pagesClassification of Individual Taxpayers - AlienMarria FrancezcaNo ratings yet

- Template Taxation Unit IIDocument29 pagesTemplate Taxation Unit IINacion, Jaime G.No ratings yet

- What Are The Kinds of TaxpayersDocument4 pagesWhat Are The Kinds of TaxpayersALee Bud100% (1)

- Prelim Income TaxationDocument55 pagesPrelim Income TaxationclytemnestraNo ratings yet

- Taxation of IndividualsDocument49 pagesTaxation of IndividualsAnastasha Grey100% (1)

- Taxation Ass 2Document1 pageTaxation Ass 2Jazon GotanghoNo ratings yet

- Gross Income (Classification of Taxpayers)Document12 pagesGross Income (Classification of Taxpayers)Michael Thom MacabuhayNo ratings yet

- MODULE 5 Individual TaxationDocument3 pagesMODULE 5 Individual TaxationCEDRICK MARX ABRIGARNo ratings yet

- 2 Classification of Individual TaxpayersDocument2 pages2 Classification of Individual TaxpayersDiana SheineNo ratings yet

- TAX-5.0 - Individual Income TaxDocument65 pagesTAX-5.0 - Individual Income TaxCharmaine RosalesNo ratings yet

- TAX Reviewer FINALSDocument9 pagesTAX Reviewer FINALSLalaine SantiagoNo ratings yet

- Inroduction To Income TaxationDocument20 pagesInroduction To Income TaxationW-304-Bautista,PreciousNo ratings yet

- Intax ExerciseDocument26 pagesIntax ExerciseJosh CruzNo ratings yet

- TAX-601: Income TAX - Individuals, Estates AND Trusts: - T R S ADocument12 pagesTAX-601: Income TAX - Individuals, Estates AND Trusts: - T R S AVaughn TheoNo ratings yet

- Types of TaxpayerDocument23 pagesTypes of TaxpayerReina Rose LebrillaNo ratings yet

- Features of Philippine Income Tax SystemDocument9 pagesFeatures of Philippine Income Tax SystemPATRICIA ANGELICA VINUYANo ratings yet

- Mary Joy P. Junio, Cpa Notre Dame of Midsayap College Midsayap, CotabatoDocument8 pagesMary Joy P. Junio, Cpa Notre Dame of Midsayap College Midsayap, CotabatoJonathan JunioNo ratings yet

- 03 Individuals. Study Notes. LectureDocument54 pages03 Individuals. Study Notes. Lecturemarvin.cpa.cmaNo ratings yet

- Quickie PreFi Tax PDFDocument12 pagesQuickie PreFi Tax PDFJoesil Dianne Sempron100% (1)

- PreFi Tax PDFDocument21 pagesPreFi Tax PDFJoesil Dianne SempronNo ratings yet

- Income Tax For IndividualsDocument90 pagesIncome Tax For IndividualsRubyjane Kim100% (1)

- Kinds of Taxpayers and Situs of IncomeDocument2 pagesKinds of Taxpayers and Situs of IncomeMelanie SamsonaNo ratings yet

- HO 1 INDIVIDUAL ESTATE AND TRUST TAXATION AND SOURCES OF INCOME Version 2.0Document5 pagesHO 1 INDIVIDUAL ESTATE AND TRUST TAXATION AND SOURCES OF INCOME Version 2.0Erine ContranoNo ratings yet

- BAC103A-02a Income Tax For IndividualsDocument8 pagesBAC103A-02a Income Tax For IndividualsNovelyn Duyogan100% (1)

- 3 - Income Tax On IndividualsDocument22 pages3 - Income Tax On IndividualsRylleMatthanCorderoNo ratings yet

- Income Taxation IndividualsDocument19 pagesIncome Taxation IndividualsJenniNo ratings yet

- Tax601 Individual Itx Lecture Notes 122Document12 pagesTax601 Individual Itx Lecture Notes 122Justine JaymaNo ratings yet

- Module TX003 Types On Income TaxpayersDocument3 pagesModule TX003 Types On Income TaxpayersErvin Ray FernandezNo ratings yet

- M2u Classification Individual Taxation P1Document30 pagesM2u Classification Individual Taxation P1Xehdrickke FernandezNo ratings yet

- Classification of Individual TaxpayerDocument31 pagesClassification of Individual TaxpayerPatrick BituinNo ratings yet

- Income Taxation Week 3Document20 pagesIncome Taxation Week 3Hannah Rae ChingNo ratings yet

- Income Tax On Individuals PDFDocument20 pagesIncome Tax On Individuals PDFKaren Joy MagsayoNo ratings yet

- Taxation Week 3Document8 pagesTaxation Week 3Jurian Jaan PeligroNo ratings yet

- Individual TaxpayerDocument10 pagesIndividual TaxpayerLL. yangzNo ratings yet

- Tax 601Document11 pagesTax 601C.J. Clarisse FranciscoNo ratings yet

- Taxation of IndividualsDocument22 pagesTaxation of IndividualsTurksNo ratings yet

- Taxation of IndividualsDocument9 pagesTaxation of IndividualsBrielle GabNo ratings yet

- Module 2 - Income Taxes For Individuals - Lecture NotesDocument52 pagesModule 2 - Income Taxes For Individuals - Lecture NotesRina Bico Advincula100% (1)

- 2nd Semester Income Taxation Module 5 Classification of TaxpayersDocument5 pages2nd Semester Income Taxation Module 5 Classification of TaxpayersMaryrose SumulongNo ratings yet

- Income Tax ConDocument2 pagesIncome Tax ConMaricon EstradaNo ratings yet

- Lesson 5 Inclusions Exclusions From Gi Final TaxDocument17 pagesLesson 5 Inclusions Exclusions From Gi Final TaxOrduna Mae AnnNo ratings yet

- Module TX003 Types On Income TaxpayersDocument3 pagesModule TX003 Types On Income TaxpayersErwin TorresNo ratings yet

- TAX Outline 2 1Document18 pagesTAX Outline 2 1Master GTNo ratings yet

- TAX Outline 2 1Document18 pagesTAX Outline 2 1Master GTNo ratings yet

- Share Taxpayer and Elements of Gross IncomeDocument24 pagesShare Taxpayer and Elements of Gross IncomeJessa Mae IgotNo ratings yet

- ACC311 3rd Exam CoverageDocument108 pagesACC311 3rd Exam CoverageHilarie JeanNo ratings yet

- Deductions From Gross Income - 020807Document9 pagesDeductions From Gross Income - 020807Hilarie JeanNo ratings yet

- Computation of Corporate Tax PayersDocument14 pagesComputation of Corporate Tax PayersHilarie JeanNo ratings yet

- Practice ACC 311 Competency ExamDocument2 pagesPractice ACC 311 Competency ExamHilarie JeanNo ratings yet

- ACCExpanded Opportunity Part 1Document4 pagesACCExpanded Opportunity Part 1Hilarie JeanNo ratings yet

- SM07 4thExamReview 054702Document4 pagesSM07 4thExamReview 054702Hilarie JeanNo ratings yet

- Corpuz vs. Sto. TomasDocument3 pagesCorpuz vs. Sto. TomasSarah Monique Nicole Antoinette GolezNo ratings yet

- Transcript Req ProseDocument2 pagesTranscript Req ProseMasterReader99No ratings yet

- Gorospe Vs People - HomicideDocument4 pagesGorospe Vs People - HomicidegeorjalynjoyNo ratings yet

- Works of Defence Act 1903 1Document21 pagesWorks of Defence Act 1903 1Eighteenth JulyNo ratings yet

- Answers EvidenceDocument5 pagesAnswers EvidenceAmiza Abd KaharNo ratings yet

- 7.1lao v. Yao Bio Lim20210423-12-1v6ji2vDocument16 pages7.1lao v. Yao Bio Lim20210423-12-1v6ji2vSeok Gyeong KangNo ratings yet

- Philippine Airlines V NLRCDocument2 pagesPhilippine Airlines V NLRCCedricNo ratings yet

- HOW DOD, VA, and Military Industrial Complex (Deep State) : Lock Acceptable Claims in The Army & DOD's Safe ServerDocument172 pagesHOW DOD, VA, and Military Industrial Complex (Deep State) : Lock Acceptable Claims in The Army & DOD's Safe ServeradaadvocatesuebozgozNo ratings yet

- Declaration Form FINALDocument1 pageDeclaration Form FINALAnonymous TlYmhkNo ratings yet

- Opening Brief 22CA77 Emily Cohen AppealDocument54 pagesOpening Brief 22CA77 Emily Cohen AppealEmily CohenNo ratings yet

- 1740 CRPC Project SubmissionDocument12 pages1740 CRPC Project SubmissionMEHULANo ratings yet

- People v. Serrano G.R. No. L 7973Document2 pagesPeople v. Serrano G.R. No. L 7973Tootsie GuzmaNo ratings yet

- Substantive and Procedural LawDocument8 pagesSubstantive and Procedural LawNaif OmarNo ratings yet

- OCA Circular No. 01-2024Document7 pagesOCA Circular No. 01-2024RTC FortetoNo ratings yet

- Case LawDocument10 pagesCase LawKirti DNo ratings yet

- Defendant's Motion To Disqualify Judge Edward L. ScottDocument42 pagesDefendant's Motion To Disqualify Judge Edward L. ScottNeil GillespieNo ratings yet

- Chronological Case Summary Trenton-Ivy WIDocument1 pageChronological Case Summary Trenton-Ivy WIGrizzly DocsNo ratings yet

- 823 F.2d 548 Unpublished Disposition: United States Court of Appeals, Fourth CircuitDocument6 pages823 F.2d 548 Unpublished Disposition: United States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- Rule 58 Preliminary InjunctionDocument77 pagesRule 58 Preliminary InjunctionJan Igor GalinatoNo ratings yet

- Fencing and Anti-Carnapping Case DigestsDocument16 pagesFencing and Anti-Carnapping Case DigestsCarla January OngNo ratings yet

- (Day 29) (Final) The Hindu Minority and Guardianship Act, 1956Document4 pages(Day 29) (Final) The Hindu Minority and Guardianship Act, 1956Deb DasNo ratings yet

- Rivera V ChuaDocument2 pagesRivera V ChuaLarraine FallongNo ratings yet

- 196-737-1-PB-Malaysia Case Study PDFDocument16 pages196-737-1-PB-Malaysia Case Study PDFGM KendraNo ratings yet

- Andamo Vs IACDocument6 pagesAndamo Vs IACArmen MagbitangNo ratings yet

- Okeke v. INS, 4th Cir. (1996)Document6 pagesOkeke v. INS, 4th Cir. (1996)Scribd Government DocsNo ratings yet

- Kilosbayan Vs MoratoDocument3 pagesKilosbayan Vs MoratoRmLyn MclnaoNo ratings yet

- Alternative Dispute ResolutionDocument27 pagesAlternative Dispute ResolutionAnil Patel100% (1)

- A.M. No. 99-10-05-0 Procedure in Extra-Judicial Foreclosure of MortgageDocument2 pagesA.M. No. 99-10-05-0 Procedure in Extra-Judicial Foreclosure of Mortgagechill21ggNo ratings yet

- Chua Vs CA PolidoDocument2 pagesChua Vs CA PolidoJohnde MartinezNo ratings yet

- Witness Cannot Be Added As An Accused Even If His Statements Are Inculpatory: Supreme CourtDocument36 pagesWitness Cannot Be Added As An Accused Even If His Statements Are Inculpatory: Supreme CourtLive Law100% (1)