Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

4 viewsCapital Budgeting

Capital Budgeting

Uploaded by

Akanksha AdarshThis document discusses capital budgeting and methods for measuring financial performance in retail. It provides information on capital budgeting, including that it is the process of evaluating long-term investments. It also outlines key factors that affect capital budgeting, the importance of capital budgeting, and the typical steps in the capital budgeting process. Additionally, the document describes several common methods for capital budgeting, including payback period, net present value, internal rate of return, profitability index, accounting rate of return, and modified internal rate of return.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You might also like

- 03 Quiz 3 Questions and AnswersDocument10 pages03 Quiz 3 Questions and AnswersamamasaNo ratings yet

- FM Unit 2Document24 pagesFM Unit 2Tanmay PrajapatiNo ratings yet

- Capital BudgetingDocument20 pagesCapital BudgetingHazel MigalbinNo ratings yet

- Cost Benefit Analysis (Cba)Document41 pagesCost Benefit Analysis (Cba)Zemariyam BizuayehuNo ratings yet

- Plant Design and Economics: Lecture - 5Document39 pagesPlant Design and Economics: Lecture - 5Sky LightsNo ratings yet

- Dr. Sandeep Malu Associate Professor SVIM, IndoreDocument14 pagesDr. Sandeep Malu Associate Professor SVIM, Indorechaterji_aNo ratings yet

- Dr. Sandeep Malu Associate Professor SVIM, IndoreDocument14 pagesDr. Sandeep Malu Associate Professor SVIM, Indorechaterji_aNo ratings yet

- 42-Shubham Hanbar-Sybaf A (Business Economics 2)Document11 pages42-Shubham Hanbar-Sybaf A (Business Economics 2)shubham hanbarNo ratings yet

- Sneha Sip Final 2Document46 pagesSneha Sip Final 2rajitasharma17No ratings yet

- IV FM Capital Budgeting Techniques Dr. Nagesh ParasharDocument3 pagesIV FM Capital Budgeting Techniques Dr. Nagesh ParasharRitesh KumarNo ratings yet

- Prashant ProjectDocument58 pagesPrashant ProjectPrashant raskarNo ratings yet

- BHEL Capital Budgeting ProjectDocument58 pagesBHEL Capital Budgeting ProjectRoyal Projects75% (12)

- Final New SipDocument42 pagesFinal New SipSushant KumarNo ratings yet

- Topic IV - Economic Study MethodsDocument13 pagesTopic IV - Economic Study MethodsMc John PobleteNo ratings yet

- Individual PE&FMDocument18 pagesIndividual PE&FMBadmaw MinuyeNo ratings yet

- Capital Budgeting-1Document46 pagesCapital Budgeting-1sagarharbandhupalNo ratings yet

- AilDocument75 pagesAil044Lohar Veena GUNI VMPIMNo ratings yet

- Reddy's ProjectDocument96 pagesReddy's ProjectP.lakshmanareddyNo ratings yet

- Capital Budget Impact in Banking SectorDocument85 pagesCapital Budget Impact in Banking SectorVickram JainNo ratings yet

- Capital BudgetingDocument28 pagesCapital BudgetingM SameerNo ratings yet

- TazebDocument41 pagesTazebFasiko AsmaroNo ratings yet

- Cost Benefit Analysis of State Bank of India and Its AssociatesDocument8 pagesCost Benefit Analysis of State Bank of India and Its Associateschandan singhNo ratings yet

- Chanakya National LAW University: Subject: Financial ManagementDocument20 pagesChanakya National LAW University: Subject: Financial Managementakanksha dipankarNo ratings yet

- E00b4 Capital Budgeting - BhelDocument80 pagesE00b4 Capital Budgeting - BhelwebstdsnrNo ratings yet

- Final Project WorkDocument114 pagesFinal Project Worka NaniNo ratings yet

- Punjab Agricultural UniversityDocument6 pagesPunjab Agricultural UniversitySheetal NagpalNo ratings yet

- Ratio Analysis 1012Document74 pagesRatio Analysis 1012Sakhamuri Ram'sNo ratings yet

- Financial Planning and ForecastingDocument8 pagesFinancial Planning and ForecastingRohit PatilNo ratings yet

- Lecture 5Document33 pagesLecture 5faisalhzNo ratings yet

- FD Accounts 2830Document24 pagesFD Accounts 2830PRIYANSHU RAJNo ratings yet

- Capital BudgetingDocument28 pagesCapital BudgetingDivya AgarwalNo ratings yet

- Capitalbudgeting 1227282768304644 8Document27 pagesCapitalbudgeting 1227282768304644 8Sumi LatheefNo ratings yet

- Cost Accounting (Theory) (16CCCCM7) : Is, The Classifying, RecordingDocument29 pagesCost Accounting (Theory) (16CCCCM7) : Is, The Classifying, RecordingMayank GargNo ratings yet

- Abdissa Dida - Presented Editing...Document23 pagesAbdissa Dida - Presented Editing...Abdissa DidaNo ratings yet

- Capital BudgetingDocument36 pagesCapital BudgetingShweta SaxenaNo ratings yet

- BudgetingDocument37 pagesBudgetingMompoloki MontiNo ratings yet

- BEVCON WAYORS Cost AnalysisDocument54 pagesBEVCON WAYORS Cost AnalysisKishore SNo ratings yet

- Narayana Engineering College: Nellore: A Study On Capital Budgeting in Sagar Cements PVT LTD, HyderbadDocument65 pagesNarayana Engineering College: Nellore: A Study On Capital Budgeting in Sagar Cements PVT LTD, Hyderbadsaryumba5538No ratings yet

- Joyce T - Using The Payback Method, IRR, and NPVDocument5 pagesJoyce T - Using The Payback Method, IRR, and NPVlizzieNo ratings yet

- Final Dissertation 2020 - RUTUJADocument35 pagesFinal Dissertation 2020 - RUTUJARaisa KokateNo ratings yet

- ACADEMIC YEAR 2023-24: Shreya Hiraman Ghorpade Roll No:11Document35 pagesACADEMIC YEAR 2023-24: Shreya Hiraman Ghorpade Roll No:11PratikNo ratings yet

- MDP Brochure Fnfe Feb-March 23Document4 pagesMDP Brochure Fnfe Feb-March 23Ancient IntellectNo ratings yet

- Decision Making Using Engineering Economic Tools A Real Case StudyDocument7 pagesDecision Making Using Engineering Economic Tools A Real Case StudyProto literateNo ratings yet

- Blackbook Draft-KrutikaDocument40 pagesBlackbook Draft-KrutikaimsakshibajajNo ratings yet

- 17mgt032 CMDocument14 pages17mgt032 CMTanverNo ratings yet

- ECE 201 Unit 3 Basic Economy Study MethodsDocument19 pagesECE 201 Unit 3 Basic Economy Study Methodsjethrocunanan04No ratings yet

- BRM ProjectDocument23 pagesBRM ProjectimaalNo ratings yet

- Year, Financial Management: Capital BudgetingDocument9 pagesYear, Financial Management: Capital BudgetingPooja KansalNo ratings yet

- The Basics of Capital Budgeting: Should We Build This Plant?Document10 pagesThe Basics of Capital Budgeting: Should We Build This Plant?Anupriya MisraNo ratings yet

- Dr. Babasaheb Ambedkar Marthwada University, AurangabadDocument78 pagesDr. Babasaheb Ambedkar Marthwada University, Aurangabadabhinavk420100% (2)

- CombinepdfDocument38 pagesCombinepdfmosharaf hossainNo ratings yet

- (Deemed To Be University) in Partial Fulfillment of The Requirements For The Award of The Degree of Bachelor of Business Administration (BBA)Document21 pages(Deemed To Be University) in Partial Fulfillment of The Requirements For The Award of The Degree of Bachelor of Business Administration (BBA)Subhankar SamalNo ratings yet

- A Study On Capital Budgeting in Heritage Foods Inida LTD., KasipentlaDocument8 pagesA Study On Capital Budgeting in Heritage Foods Inida LTD., Kasipentlasree anugraphics100% (1)

- SynopsisDocument13 pagesSynopsisSwapnil KothavadeNo ratings yet

- Application of Marginal Costing Technique & Its LimitationDocument25 pagesApplication of Marginal Costing Technique & Its LimitationAjayPatilNo ratings yet

- Cap Bud - HeroDocument13 pagesCap Bud - HeroMohmmedKhayyumNo ratings yet

- Master Budgeting and Forecasting for Hospitality Industry-Teaser: Financial Expertise series for hospitality, #1From EverandMaster Budgeting and Forecasting for Hospitality Industry-Teaser: Financial Expertise series for hospitality, #1No ratings yet

- Micro or Small Goat Entrepreneurship Development in IndiaFrom EverandMicro or Small Goat Entrepreneurship Development in IndiaNo ratings yet

- Macroeconomics TranscriptDocument4 pagesMacroeconomics TranscriptIsabelle ManaloNo ratings yet

- An Economic Analysis of Financial StructureDocument15 pagesAn Economic Analysis of Financial Structurevetushi123No ratings yet

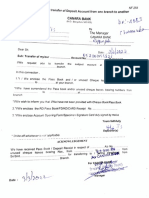

- Usha 4083 Account TransferDocument3 pagesUsha 4083 Account TransferLakshmanan SNo ratings yet

- Capital RationingDocument2 pagesCapital Rationingmuhammad farhanNo ratings yet

- B Company BSG FinalDocument16 pagesB Company BSG FinalMafernanda GRNo ratings yet

- Jeopardy SolutionsDocument14 pagesJeopardy SolutionsMirkan OrdeNo ratings yet

- Report On Overview of DisneyDocument14 pagesReport On Overview of DisneyAnkit ChoudharyNo ratings yet

- Financial Instruments Notes + TutorialDocument14 pagesFinancial Instruments Notes + TutorialVenessa YongNo ratings yet

- McDowell Homefinder March 2013Document11 pagesMcDowell Homefinder March 2013MarshaGreeneNo ratings yet

- Building Research & InformationDocument24 pagesBuilding Research & InformationAjeng LidyaNo ratings yet

- J Parmar - D Gilmartin O&M PaperDocument14 pagesJ Parmar - D Gilmartin O&M PaperjparmarNo ratings yet

- Risk Management Surveillance at Ludhiana Stock ExchangeDocument99 pagesRisk Management Surveillance at Ludhiana Stock Exchangepritpal singhNo ratings yet

- Forex&Derivative HODocument7 pagesForex&Derivative HOMarielle SidayonNo ratings yet

- CH 10 Revision 1Document4 pagesCH 10 Revision 1Deeb. DeebNo ratings yet

- Taxation Law Mock BarDocument8 pagesTaxation Law Mock BarKC ManglapusNo ratings yet

- 123456Document54 pages123456sripriyaNo ratings yet

- Data-Snooping Biases in Financial Analysis, Andrew W. LoDocument8 pagesData-Snooping Biases in Financial Analysis, Andrew W. LoQuoc Minh TaiNo ratings yet

- Texana Petroleum CorpDocument7 pagesTexana Petroleum CorpmeharaliNo ratings yet

- Std11 Secretarial PracticeDocument14 pagesStd11 Secretarial PracticeVaril PereiraNo ratings yet

- Understanding FloatDocument2 pagesUnderstanding FloatDarmin Kaye PalayNo ratings yet

- CitiDocument2 pagesCitiPink HayleeNo ratings yet

- Wallstreetjournal 20200114 TheWallStreetJournal PDFDocument28 pagesWallstreetjournal 20200114 TheWallStreetJournal PDFAyoub BenqassouNo ratings yet

- 2011 Exam 9 Financial Risk and Rate of Return: Options, Futures and Other Derivatives (SeventhDocument13 pages2011 Exam 9 Financial Risk and Rate of Return: Options, Futures and Other Derivatives (Seventh97036795No ratings yet

- Computing Returns: Price Beginning Dividends Price Beginning - Price Ending Return +Document5 pagesComputing Returns: Price Beginning Dividends Price Beginning - Price Ending Return +Jitendu DixitNo ratings yet

- Taxation ReviewerDocument19 pagesTaxation ReviewerjwualferosNo ratings yet

- Crypto Mega Theses - MulticoinDocument12 pagesCrypto Mega Theses - MulticointempvjNo ratings yet

- Investment Management Saa 3Document7 pagesInvestment Management Saa 3Sean Hanjaya PrasetyaNo ratings yet

- 21 Cost Volume Profit AnalysisDocument31 pages21 Cost Volume Profit AnalysisBillal Hossain ShamimNo ratings yet

- Sample Exam 1Document13 pagesSample Exam 1Hemang PatelNo ratings yet

Capital Budgeting

Capital Budgeting

Uploaded by

Akanksha Adarsh0 ratings0% found this document useful (0 votes)

4 views11 pagesThis document discusses capital budgeting and methods for measuring financial performance in retail. It provides information on capital budgeting, including that it is the process of evaluating long-term investments. It also outlines key factors that affect capital budgeting, the importance of capital budgeting, and the typical steps in the capital budgeting process. Additionally, the document describes several common methods for capital budgeting, including payback period, net present value, internal rate of return, profitability index, accounting rate of return, and modified internal rate of return.

Original Description:

Original Title

Capital Budgeting Ppt.pptx (1)

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses capital budgeting and methods for measuring financial performance in retail. It provides information on capital budgeting, including that it is the process of evaluating long-term investments. It also outlines key factors that affect capital budgeting, the importance of capital budgeting, and the typical steps in the capital budgeting process. Additionally, the document describes several common methods for capital budgeting, including payback period, net present value, internal rate of return, profitability index, accounting rate of return, and modified internal rate of return.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

4 views11 pagesCapital Budgeting

Capital Budgeting

Uploaded by

Akanksha AdarshThis document discusses capital budgeting and methods for measuring financial performance in retail. It provides information on capital budgeting, including that it is the process of evaluating long-term investments. It also outlines key factors that affect capital budgeting, the importance of capital budgeting, and the typical steps in the capital budgeting process. Additionally, the document describes several common methods for capital budgeting, including payback period, net present value, internal rate of return, profitability index, accounting rate of return, and modified internal rate of return.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 11

BANARAS HINDU UNIVERSITY

INSTITUTE OF AGRICULTURAL SCIENCES

Department of Agricultural Economics,

MABM

Presentation On Capital Budgeting and Measurement of Financial Performance in

Retail

Submitted By,

Submitted To, Akanksha, Amit Rathour

Professor P.S. Badal, MABM,2nd Year

22412ABM003,22412ABM004

Department of Agricultural Economics

Department of Agricultural Economics

Institute of Agricultural Sciences

Institute of Agricultural Sciences

Banaras Hindu University

Capital Budgeting

• Capital budgeting is the process of evaluating and selecting long-term

investments.

• It involves estimating the costs and benefits of a project, and then deciding

whether or not to proceed with it.

• The term capital budgeting refers to expenditure on capital assets.

• It helps to determine the company’s investment in the long-term fixed assets

such as the addition or replacement of the plant and machinery, new

equipment, research, development, etc.

• This capital budgeting process is the decision regarding the sources of

finance and then calculating the return earned from the investment.

Features of Capital Budgeting

• There is a long duration between the initial investments and the expected

returns.

• The organizations usually estimate large profits.

• The process involves high risks.

• It is a fixed investment over the long run.

• Investments made in a project determine the future financial condition of

an organization.

• All projects require significant amounts of funding.

• The amount of investment made in the project determines the

profitability of a company

Factors Affecting Capital Budgeting

• Capital Return

• Accounting Methods

• Structure of Capital

• Availability of Funds

• Management decisions

• Government Policies

• Working Capital

• Need of the project

• Lending terms of financial institutions

• Earnings

• Taxation Policies

• The economic value of the project

Importance of Capital Budgeting

• It increases accountability among employees and improves

measurability of success in projects

• It gives you a better understanding of risks and returns in investments

• Better chances of surviving in a competitive market space

• Better resource allocation–workforce, capital, and labor hours

• Creates a strong outline and roadmap for a project

Steps to Capital Budgeting Process

• Generation of Investment

Ideas and To Identify

Investment Opportunities

• Gathering of the Investment

Proposals

• Estimating Cash Flows

• Evaluating Cash Flows

• Selecting a Project

• Execution and Monitoring

Methods of Capital Budgeting

1. Payback Period Method

It refers to the time taken by a proposed project to

generate enough income to cover the initial investment.

The project with the quickest payback is chosen by the

company.

Payback Period = Initial Cash Investment /Annual Cash

Flow

2. Net Present Value Method (NPV)

This method compares the present value of a project’s

cash inflows to the present value of its cash

outflows, taking into account the time value of

money.

Methods of Capital Budgeting

NPV = Cash flow / (1+i)t - initial investment

where:

i = Required return or discount rate

t = Number of time periods

3. Internal Rate of Return (IRR)

IRR helps businesses understand just how profitable their investment could

be.

Here’s a general rule of thumb for IRR:

• IRR > Cost of Capital = Accept Project

• IRR < Cost of Capital = Reject Project

Methods of Capital Budgeting

4.Profitability Index (PI)

A measure of how profitable an investment is when you compare the cash

inflows (the present value of future earnings) with the initial cash outflow

for the investment.

Profitability Index = Present Value of Cash Inflows / Initial Investment

5. Accounting Rate of Return (ARR)

The ARR analyses accounting data to evaluate the ROI. It takes into

account revenue and expenses as well as depreciation.

Accounting Rate of Return = Average Annual Accounting / Profit Initial

Investment

6. Modified Internal Rate of Return (MIRR)

The Modified Internal Rate of Return (MIRR) method is a capital budgeting

technique used to determine the rate of return on investment by considering both the

cost of the investment and the reinvestment rate of future cash flows.

MIRR = [(FV of positive cash flows / PV of negative cash flows)^(1/n)] – 1

T h a n k

y ou !

You might also like

- 03 Quiz 3 Questions and AnswersDocument10 pages03 Quiz 3 Questions and AnswersamamasaNo ratings yet

- FM Unit 2Document24 pagesFM Unit 2Tanmay PrajapatiNo ratings yet

- Capital BudgetingDocument20 pagesCapital BudgetingHazel MigalbinNo ratings yet

- Cost Benefit Analysis (Cba)Document41 pagesCost Benefit Analysis (Cba)Zemariyam BizuayehuNo ratings yet

- Plant Design and Economics: Lecture - 5Document39 pagesPlant Design and Economics: Lecture - 5Sky LightsNo ratings yet

- Dr. Sandeep Malu Associate Professor SVIM, IndoreDocument14 pagesDr. Sandeep Malu Associate Professor SVIM, Indorechaterji_aNo ratings yet

- Dr. Sandeep Malu Associate Professor SVIM, IndoreDocument14 pagesDr. Sandeep Malu Associate Professor SVIM, Indorechaterji_aNo ratings yet

- 42-Shubham Hanbar-Sybaf A (Business Economics 2)Document11 pages42-Shubham Hanbar-Sybaf A (Business Economics 2)shubham hanbarNo ratings yet

- Sneha Sip Final 2Document46 pagesSneha Sip Final 2rajitasharma17No ratings yet

- IV FM Capital Budgeting Techniques Dr. Nagesh ParasharDocument3 pagesIV FM Capital Budgeting Techniques Dr. Nagesh ParasharRitesh KumarNo ratings yet

- Prashant ProjectDocument58 pagesPrashant ProjectPrashant raskarNo ratings yet

- BHEL Capital Budgeting ProjectDocument58 pagesBHEL Capital Budgeting ProjectRoyal Projects75% (12)

- Final New SipDocument42 pagesFinal New SipSushant KumarNo ratings yet

- Topic IV - Economic Study MethodsDocument13 pagesTopic IV - Economic Study MethodsMc John PobleteNo ratings yet

- Individual PE&FMDocument18 pagesIndividual PE&FMBadmaw MinuyeNo ratings yet

- Capital Budgeting-1Document46 pagesCapital Budgeting-1sagarharbandhupalNo ratings yet

- AilDocument75 pagesAil044Lohar Veena GUNI VMPIMNo ratings yet

- Reddy's ProjectDocument96 pagesReddy's ProjectP.lakshmanareddyNo ratings yet

- Capital Budget Impact in Banking SectorDocument85 pagesCapital Budget Impact in Banking SectorVickram JainNo ratings yet

- Capital BudgetingDocument28 pagesCapital BudgetingM SameerNo ratings yet

- TazebDocument41 pagesTazebFasiko AsmaroNo ratings yet

- Cost Benefit Analysis of State Bank of India and Its AssociatesDocument8 pagesCost Benefit Analysis of State Bank of India and Its Associateschandan singhNo ratings yet

- Chanakya National LAW University: Subject: Financial ManagementDocument20 pagesChanakya National LAW University: Subject: Financial Managementakanksha dipankarNo ratings yet

- E00b4 Capital Budgeting - BhelDocument80 pagesE00b4 Capital Budgeting - BhelwebstdsnrNo ratings yet

- Final Project WorkDocument114 pagesFinal Project Worka NaniNo ratings yet

- Punjab Agricultural UniversityDocument6 pagesPunjab Agricultural UniversitySheetal NagpalNo ratings yet

- Ratio Analysis 1012Document74 pagesRatio Analysis 1012Sakhamuri Ram'sNo ratings yet

- Financial Planning and ForecastingDocument8 pagesFinancial Planning and ForecastingRohit PatilNo ratings yet

- Lecture 5Document33 pagesLecture 5faisalhzNo ratings yet

- FD Accounts 2830Document24 pagesFD Accounts 2830PRIYANSHU RAJNo ratings yet

- Capital BudgetingDocument28 pagesCapital BudgetingDivya AgarwalNo ratings yet

- Capitalbudgeting 1227282768304644 8Document27 pagesCapitalbudgeting 1227282768304644 8Sumi LatheefNo ratings yet

- Cost Accounting (Theory) (16CCCCM7) : Is, The Classifying, RecordingDocument29 pagesCost Accounting (Theory) (16CCCCM7) : Is, The Classifying, RecordingMayank GargNo ratings yet

- Abdissa Dida - Presented Editing...Document23 pagesAbdissa Dida - Presented Editing...Abdissa DidaNo ratings yet

- Capital BudgetingDocument36 pagesCapital BudgetingShweta SaxenaNo ratings yet

- BudgetingDocument37 pagesBudgetingMompoloki MontiNo ratings yet

- BEVCON WAYORS Cost AnalysisDocument54 pagesBEVCON WAYORS Cost AnalysisKishore SNo ratings yet

- Narayana Engineering College: Nellore: A Study On Capital Budgeting in Sagar Cements PVT LTD, HyderbadDocument65 pagesNarayana Engineering College: Nellore: A Study On Capital Budgeting in Sagar Cements PVT LTD, Hyderbadsaryumba5538No ratings yet

- Joyce T - Using The Payback Method, IRR, and NPVDocument5 pagesJoyce T - Using The Payback Method, IRR, and NPVlizzieNo ratings yet

- Final Dissertation 2020 - RUTUJADocument35 pagesFinal Dissertation 2020 - RUTUJARaisa KokateNo ratings yet

- ACADEMIC YEAR 2023-24: Shreya Hiraman Ghorpade Roll No:11Document35 pagesACADEMIC YEAR 2023-24: Shreya Hiraman Ghorpade Roll No:11PratikNo ratings yet

- MDP Brochure Fnfe Feb-March 23Document4 pagesMDP Brochure Fnfe Feb-March 23Ancient IntellectNo ratings yet

- Decision Making Using Engineering Economic Tools A Real Case StudyDocument7 pagesDecision Making Using Engineering Economic Tools A Real Case StudyProto literateNo ratings yet

- Blackbook Draft-KrutikaDocument40 pagesBlackbook Draft-KrutikaimsakshibajajNo ratings yet

- 17mgt032 CMDocument14 pages17mgt032 CMTanverNo ratings yet

- ECE 201 Unit 3 Basic Economy Study MethodsDocument19 pagesECE 201 Unit 3 Basic Economy Study Methodsjethrocunanan04No ratings yet

- BRM ProjectDocument23 pagesBRM ProjectimaalNo ratings yet

- Year, Financial Management: Capital BudgetingDocument9 pagesYear, Financial Management: Capital BudgetingPooja KansalNo ratings yet

- The Basics of Capital Budgeting: Should We Build This Plant?Document10 pagesThe Basics of Capital Budgeting: Should We Build This Plant?Anupriya MisraNo ratings yet

- Dr. Babasaheb Ambedkar Marthwada University, AurangabadDocument78 pagesDr. Babasaheb Ambedkar Marthwada University, Aurangabadabhinavk420100% (2)

- CombinepdfDocument38 pagesCombinepdfmosharaf hossainNo ratings yet

- (Deemed To Be University) in Partial Fulfillment of The Requirements For The Award of The Degree of Bachelor of Business Administration (BBA)Document21 pages(Deemed To Be University) in Partial Fulfillment of The Requirements For The Award of The Degree of Bachelor of Business Administration (BBA)Subhankar SamalNo ratings yet

- A Study On Capital Budgeting in Heritage Foods Inida LTD., KasipentlaDocument8 pagesA Study On Capital Budgeting in Heritage Foods Inida LTD., Kasipentlasree anugraphics100% (1)

- SynopsisDocument13 pagesSynopsisSwapnil KothavadeNo ratings yet

- Application of Marginal Costing Technique & Its LimitationDocument25 pagesApplication of Marginal Costing Technique & Its LimitationAjayPatilNo ratings yet

- Cap Bud - HeroDocument13 pagesCap Bud - HeroMohmmedKhayyumNo ratings yet

- Master Budgeting and Forecasting for Hospitality Industry-Teaser: Financial Expertise series for hospitality, #1From EverandMaster Budgeting and Forecasting for Hospitality Industry-Teaser: Financial Expertise series for hospitality, #1No ratings yet

- Micro or Small Goat Entrepreneurship Development in IndiaFrom EverandMicro or Small Goat Entrepreneurship Development in IndiaNo ratings yet

- Macroeconomics TranscriptDocument4 pagesMacroeconomics TranscriptIsabelle ManaloNo ratings yet

- An Economic Analysis of Financial StructureDocument15 pagesAn Economic Analysis of Financial Structurevetushi123No ratings yet

- Usha 4083 Account TransferDocument3 pagesUsha 4083 Account TransferLakshmanan SNo ratings yet

- Capital RationingDocument2 pagesCapital Rationingmuhammad farhanNo ratings yet

- B Company BSG FinalDocument16 pagesB Company BSG FinalMafernanda GRNo ratings yet

- Jeopardy SolutionsDocument14 pagesJeopardy SolutionsMirkan OrdeNo ratings yet

- Report On Overview of DisneyDocument14 pagesReport On Overview of DisneyAnkit ChoudharyNo ratings yet

- Financial Instruments Notes + TutorialDocument14 pagesFinancial Instruments Notes + TutorialVenessa YongNo ratings yet

- McDowell Homefinder March 2013Document11 pagesMcDowell Homefinder March 2013MarshaGreeneNo ratings yet

- Building Research & InformationDocument24 pagesBuilding Research & InformationAjeng LidyaNo ratings yet

- J Parmar - D Gilmartin O&M PaperDocument14 pagesJ Parmar - D Gilmartin O&M PaperjparmarNo ratings yet

- Risk Management Surveillance at Ludhiana Stock ExchangeDocument99 pagesRisk Management Surveillance at Ludhiana Stock Exchangepritpal singhNo ratings yet

- Forex&Derivative HODocument7 pagesForex&Derivative HOMarielle SidayonNo ratings yet

- CH 10 Revision 1Document4 pagesCH 10 Revision 1Deeb. DeebNo ratings yet

- Taxation Law Mock BarDocument8 pagesTaxation Law Mock BarKC ManglapusNo ratings yet

- 123456Document54 pages123456sripriyaNo ratings yet

- Data-Snooping Biases in Financial Analysis, Andrew W. LoDocument8 pagesData-Snooping Biases in Financial Analysis, Andrew W. LoQuoc Minh TaiNo ratings yet

- Texana Petroleum CorpDocument7 pagesTexana Petroleum CorpmeharaliNo ratings yet

- Std11 Secretarial PracticeDocument14 pagesStd11 Secretarial PracticeVaril PereiraNo ratings yet

- Understanding FloatDocument2 pagesUnderstanding FloatDarmin Kaye PalayNo ratings yet

- CitiDocument2 pagesCitiPink HayleeNo ratings yet

- Wallstreetjournal 20200114 TheWallStreetJournal PDFDocument28 pagesWallstreetjournal 20200114 TheWallStreetJournal PDFAyoub BenqassouNo ratings yet

- 2011 Exam 9 Financial Risk and Rate of Return: Options, Futures and Other Derivatives (SeventhDocument13 pages2011 Exam 9 Financial Risk and Rate of Return: Options, Futures and Other Derivatives (Seventh97036795No ratings yet

- Computing Returns: Price Beginning Dividends Price Beginning - Price Ending Return +Document5 pagesComputing Returns: Price Beginning Dividends Price Beginning - Price Ending Return +Jitendu DixitNo ratings yet

- Taxation ReviewerDocument19 pagesTaxation ReviewerjwualferosNo ratings yet

- Crypto Mega Theses - MulticoinDocument12 pagesCrypto Mega Theses - MulticointempvjNo ratings yet

- Investment Management Saa 3Document7 pagesInvestment Management Saa 3Sean Hanjaya PrasetyaNo ratings yet

- 21 Cost Volume Profit AnalysisDocument31 pages21 Cost Volume Profit AnalysisBillal Hossain ShamimNo ratings yet

- Sample Exam 1Document13 pagesSample Exam 1Hemang PatelNo ratings yet