Professional Documents

Culture Documents

Foreign Exchange Management Act, 1999

Foreign Exchange Management Act, 1999

Uploaded by

Shivangi Chandak0 ratings0% found this document useful (0 votes)

3 views9 pagesFEMA replaced FERA as the key legislation governing foreign exchange in India. FERA was passed in 1973 to regulate foreign exchange transactions and securities during a time when India's foreign reserves were low. However, FERA did not align with India's post-liberalization policies. FEMA was introduced in 1999 to relax foreign exchange controls in India and make regulations more suitable to the changing economic environment. FEMA empowers the RBI to regulate foreign exchange and allows the government to pass supporting rules.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFEMA replaced FERA as the key legislation governing foreign exchange in India. FERA was passed in 1973 to regulate foreign exchange transactions and securities during a time when India's foreign reserves were low. However, FERA did not align with India's post-liberalization policies. FEMA was introduced in 1999 to relax foreign exchange controls in India and make regulations more suitable to the changing economic environment. FEMA empowers the RBI to regulate foreign exchange and allows the government to pass supporting rules.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

3 views9 pagesForeign Exchange Management Act, 1999

Foreign Exchange Management Act, 1999

Uploaded by

Shivangi ChandakFEMA replaced FERA as the key legislation governing foreign exchange in India. FERA was passed in 1973 to regulate foreign exchange transactions and securities during a time when India's foreign reserves were low. However, FERA did not align with India's post-liberalization policies. FEMA was introduced in 1999 to relax foreign exchange controls in India and make regulations more suitable to the changing economic environment. FEMA empowers the RBI to regulate foreign exchange and allows the government to pass supporting rules.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 9

FOREIGN EXCHANGE

MANAGEMENT ACT, 1999

QUICK FACTS

• What is FEMA?

• It is a set of regulations that empowers the

Reserve Bank of India to pass regulations and

enables the Government of India to pass rules

relating to foreign exchange in tune with the

foreign trade policy of India.

• Which Act did FEMA replace?

• FEMA replaced an act called Foreign Exchange

Regulation Act (FERA).

CONTD.

• What is FERA and when was it passed?

• FERA (Foreign Exchange Regulation Act) legislation

was passed in 1973. It came into effect on January 1,

1974. FERA was passed to regulate the financial

transactions concerning foreign exchange and

securities. FERA was introduced when the Forex

reserves of the country were very low.

• Why was FERA replaced?

• FERA did not comply with the post-liberalization

policies of the Government.

BACKGROUND

• Foreign Exchange Regulation Act, 1973 (FERA)

was replaced by the Foreign Management Act,

1999 (FEMA).

• FEMA was enacted by Parliament of India and it

came into force on 1st June, 2000.

• The reason for the replacement emerged because

it was not suitable for the prevailing

environment and was harsh as it contained a

provision for imprisonment.

• On the other hand, FEMA was introduced with

the changes because of the new, liberal and

changing environment.

• Also, earlier FERA was passed due to the

insufficient foreign exchange in the country and

FEMA was passed with the objective to relax the

controls on foreign exchange in India.

• The head office of FEMA is situated in New

Delhi known as Enforcement Directorate and is

headed by a Director.

OBJECTIVES

• To reinforce and amend the law relating to foreign

exchange.

• To simplify and ease the external trade and payments.

• To promote the systematized development and

maintenance of a healthy foreign exchange market in

India.

• To remove disparity of payments.

• To control and direct the employment business and

investment of the non-residents.

• To utilise the foreign exchange resources effectively for

the country.

FEATURES

• FEMA does not apply to the Indian citizens who resides outside

India. This criteria is checked by the number of days a person

stays in India for more than 182 days in the preceding financial

year.

• Central Government has the authority given by FEMA to

impose restrictions on and supervise three things which are-

payments made to any person outside India or receipts from

them, forex and foreign security deals.

• It specified the areas for holding of forex that required specific

permission of the Reserve Bank of India (RBI) or the

government.

• FEMA classified the transaction into a current and capital

account.

APPLICABILITY OF FEMA ACT

FEMA is applicable to:

• Foreign exchange.

• Foreign security.

• Exportation of any commodity and/or service from India to a

country outside India.

• Importation of any commodity and/or services from outside India.

• Securities as defined under Public Debt Act 1994.

• Purchase, sale and exchange of any kind (i.e. Transfer).

• Banking, financial and insurance services.

• Any overseas company owned by an NRI (Non-Resident Indian)

and the owner is 60% or more.

• Any citizen of India, residing in the country or outside (NRI).

You might also like

- Construction CompaniesDocument24 pagesConstruction Companiesmanup1980100% (1)

- Fera and Fema: Foreign Exchange Regulation Act & Foreign Exchange Management ActDocument8 pagesFera and Fema: Foreign Exchange Regulation Act & Foreign Exchange Management ActMayank JainNo ratings yet

- Foreign Exchange Management Act 1999Document20 pagesForeign Exchange Management Act 1999Ishpreet Singh BaggaNo ratings yet

- FEMADocument14 pagesFEMAricha.mahajan1205No ratings yet

- Forex Roll No 28 Ty Bba IbDocument11 pagesForex Roll No 28 Ty Bba IbsayaliNo ratings yet

- "Fera and FemaDocument32 pages"Fera and FemaYadNo ratings yet

- Foreign Exchange Management Act 2000Document19 pagesForeign Exchange Management Act 2000Gurvinder AroraNo ratings yet

- 02 Fera & Fema-1Document40 pages02 Fera & Fema-1Gyanendra TiwariNo ratings yet

- Fema 1999Document13 pagesFema 1999SHEKHAWAT FAMILYNo ratings yet

- Foreign Exchange Management Act 2000Document24 pagesForeign Exchange Management Act 2000mukeshshivranNo ratings yet

- Fera and Fema: Guided By: Vaishali MaamDocument12 pagesFera and Fema: Guided By: Vaishali MaamHarsh PurohitNo ratings yet

- 06) Fema & FeraDocument17 pages06) Fema & FeraNishil DesaiNo ratings yet

- Salient Features of Fema GuidelinesDocument14 pagesSalient Features of Fema GuidelinesMikNo ratings yet

- (Origin and Scope) : Heena M. ShaikhDocument14 pages(Origin and Scope) : Heena M. ShaikhHeena ShaikhNo ratings yet

- Investment Law Project Nisha Gupta Rajshri Singh and Raj Vardhan Agarwal (BBA - LLB (H) ) 8th SemesterDocument20 pagesInvestment Law Project Nisha Gupta Rajshri Singh and Raj Vardhan Agarwal (BBA - LLB (H) ) 8th Semesterraj vardhan agarwalNo ratings yet

- Foreign Exchange Management Act (FEMA) ANKITA DUTTADocument10 pagesForeign Exchange Management Act (FEMA) ANKITA DUTTAAnkita DuttaNo ratings yet

- FemaDocument21 pagesFemaAditi SinghNo ratings yet

- CH:11 FEMA-1999: Foreign Exchange Management ActDocument19 pagesCH:11 FEMA-1999: Foreign Exchange Management ActpratikshyahuiNo ratings yet

- Fera Fema12Document21 pagesFera Fema12arunsanskritiNo ratings yet

- An Introduction To FERADocument27 pagesAn Introduction To FERAAshish DupareNo ratings yet

- Fema FeraDocument9 pagesFema FeraJaya Geet KwatraNo ratings yet

- Transcript of "Fera and Fema"Document8 pagesTranscript of "Fera and Fema"tukuNo ratings yet

- Economics Omkar JoshiDocument7 pagesEconomics Omkar JoshiYash AgarwalNo ratings yet

- Foreign Exchange Management ActDocument7 pagesForeign Exchange Management ActAravind sidharthaNo ratings yet

- Fin656 UiiiDocument64 pagesFin656 UiiiElora madhusmita BeheraNo ratings yet

- Seminar On FemaDocument13 pagesSeminar On FemaworkNo ratings yet

- Foreign Exchange ManagementDocument11 pagesForeign Exchange ManagementMohit KumarNo ratings yet

- Chapter 6Document41 pagesChapter 6Shekhar SinghNo ratings yet

- Fera and FemaDocument18 pagesFera and FemaNiladri BiswasNo ratings yet

- Foreign Exchange Management Act 2000Document15 pagesForeign Exchange Management Act 2000Vidushi GautamNo ratings yet

- F.E.R.A - and F.E.M.A. (Foreign Exchange Regulation Act and Foreign Exchange Management Act)Document23 pagesF.E.R.A - and F.E.M.A. (Foreign Exchange Regulation Act and Foreign Exchange Management Act)Smriti SinghNo ratings yet

- Fema Notes BE Business EnvDocument16 pagesFema Notes BE Business Envoshimo.tokuNo ratings yet

- Unit II Session IIIDocument13 pagesUnit II Session IIIRUDRAKSH KARNIKNo ratings yet

- Foreign Exchange Management Act (Fema)Document22 pagesForeign Exchange Management Act (Fema)Livin VargheseNo ratings yet

- BL A FemaDocument31 pagesBL A Femaruputrip1981No ratings yet

- The Foreign Exchange Regulation Act (FERA) of 1973 Deals With Post Independence There and This Led To AnDocument10 pagesThe Foreign Exchange Regulation Act (FERA) of 1973 Deals With Post Independence There and This Led To AnRakesh Kumar LenkaNo ratings yet

- Administration of Exchange Control in IndiaDocument9 pagesAdministration of Exchange Control in IndiaHarshpreet KaurNo ratings yet

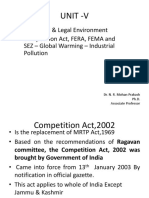

- Unit - V: Ecological & Legal Environment Competition Act, FERA, FEMA and SEZ - Global Warming - Industrial PollutionDocument36 pagesUnit - V: Ecological & Legal Environment Competition Act, FERA, FEMA and SEZ - Global Warming - Industrial PollutionUnknown NameNo ratings yet

- Foreign Exchange Management Act, 2000: Presented By: Akanksha MalhotraDocument19 pagesForeign Exchange Management Act, 2000: Presented By: Akanksha MalhotraGaurav KumarNo ratings yet

- Magadh Mahila College: Foreign Exchange Management Act (FEMA)Document17 pagesMagadh Mahila College: Foreign Exchange Management Act (FEMA)Navoditya PalNo ratings yet

- Assignment On Fera and FemaDocument6 pagesAssignment On Fera and FemaSurbhi SinghNo ratings yet

- Role of Foreign Exchange Management Act 2000Document34 pagesRole of Foreign Exchange Management Act 2000Ronaldo Louis100% (1)

- 36.foreign Exchange Management ActDocument2 pages36.foreign Exchange Management ActmercatuzNo ratings yet

- Foreign Exchange Management ActDocument28 pagesForeign Exchange Management ActGandharv ChopraNo ratings yet

- Fema (Foreign Exchange Management ActDocument25 pagesFema (Foreign Exchange Management ActMayank GargNo ratings yet

- India Foreign Exchange Securities Currency: Switch From FERADocument83 pagesIndia Foreign Exchange Securities Currency: Switch From FERASejal SinghNo ratings yet

- Fera and FemaDocument26 pagesFera and FemamusaddekNo ratings yet

- Chapter 5 - FEMADocument6 pagesChapter 5 - FEMAtherealsnehadsouzaNo ratings yet

- Foreign Exchange Management ActDocument6 pagesForeign Exchange Management ActRadhika BhartiNo ratings yet

- Liberalised Remittance Scheme of USD 200,000Document3 pagesLiberalised Remittance Scheme of USD 200,000hakecNo ratings yet

- Fera HistoricalDocument30 pagesFera HistoricalMinal SharmaNo ratings yet

- Introduction 11Document1 pageIntroduction 11aswathisunilNo ratings yet

- Fera and Fema2Document31 pagesFera and Fema2Sudhir Kumar YadavNo ratings yet

- Forex Manageme NTDocument19 pagesForex Manageme NTkarthikaNo ratings yet

- Foreign Exchange Management Act - WikipediaDocument29 pagesForeign Exchange Management Act - WikipediaMoon SandNo ratings yet

- Fera To FemaDocument53 pagesFera To FemaJay BarchhaNo ratings yet

- Seminarppt 160408024740Document23 pagesSeminarppt 160408024740MIHIR PARMARNo ratings yet

- Fera & FemaDocument14 pagesFera & FemaPraveen NairNo ratings yet

- Business Success in India: A Complete Guide to Build a Successful Business Knot with Indian FirmsFrom EverandBusiness Success in India: A Complete Guide to Build a Successful Business Knot with Indian FirmsNo ratings yet

- Bridget Wisnewski ResumeDocument2 pagesBridget Wisnewski Resumeapi-425692010No ratings yet

- Ut L III Study GuideDocument97 pagesUt L III Study GuideManikandanNo ratings yet

- Community Forest 1Document20 pagesCommunity Forest 1Ananta ChaliseNo ratings yet

- SADP User Manual (V2.0)Document10 pagesSADP User Manual (V2.0)tehixazNo ratings yet

- 11thsamplebooklet PDFDocument200 pages11thsamplebooklet PDFSoumyodeep ChowdhuryNo ratings yet

- Implementation of Restructuring of The NcrpoDocument1 pageImplementation of Restructuring of The Ncrpojames antonioNo ratings yet

- The State of Structural Engineering in The US - IDEA StatiCaDocument6 pagesThe State of Structural Engineering in The US - IDEA StatiCaluisNo ratings yet

- The Role of IRCTC Train Booking AgentsDocument7 pagesThe Role of IRCTC Train Booking AgentsRahul officalNo ratings yet

- ROLAND ct304Document161 pagesROLAND ct304SERGE MACIANo ratings yet

- Portarlington Parish NewsletterDocument2 pagesPortarlington Parish NewsletterJohn HayesNo ratings yet

- HT Motors Data SheetDocument3 pagesHT Motors Data SheetSE ESTNo ratings yet

- Layug V IACDocument1 pageLayug V IACYasser MambuayNo ratings yet

- Tristanmarzeski Com ResumeDocument1 pageTristanmarzeski Com Resumeapi-235468779No ratings yet

- Construct The Relational Model of The Following Scenario. (6 MARKS) System DescriptionDocument2 pagesConstruct The Relational Model of The Following Scenario. (6 MARKS) System DescriptionBushra ShahzadNo ratings yet

- Using Emtp RVDocument263 pagesUsing Emtp RVshotorbari100% (1)

- Electrical Engineering Software PDFDocument12 pagesElectrical Engineering Software PDFAkd Deshmukh50% (2)

- Cambridge Ordinary Level: Cambridge Assessment International EducationDocument20 pagesCambridge Ordinary Level: Cambridge Assessment International EducationJack KowmanNo ratings yet

- With Reference To MedimattersDocument3 pagesWith Reference To MedimattersGema Saltos ToalaNo ratings yet

- Abubakar 2014Document13 pagesAbubakar 2014tommy maulanaNo ratings yet

- First AId Notes - UpdatedDocument54 pagesFirst AId Notes - UpdatedewawireNo ratings yet

- City Gas DistributionDocument22 pagesCity Gas DistributionMohit Pandey100% (1)

- 행복란DrumsDocument2 pages행복란Drumsbin8663No ratings yet

- Lab 10 - Proximity Sensors and Switches: FormatDocument5 pagesLab 10 - Proximity Sensors and Switches: FormatHasrat Ahmad AbdullahNo ratings yet

- Occupational Health and Safety of Hydrogen Sulphide (H2S)Document20 pagesOccupational Health and Safety of Hydrogen Sulphide (H2S)hitm357100% (1)

- R1600H Sistema ImplementosDocument31 pagesR1600H Sistema ImplementosLuis Angel Pablo Juan de Dios100% (1)

- Mycoplasma Infection PDFDocument3 pagesMycoplasma Infection PDFPrirodna Kozmetika Brem100% (1)

- Communication LettersDocument18 pagesCommunication LettersMichael Stephen GraciasNo ratings yet

- 3dea2029ed9eb115091e9ea026cbba8fDocument3 pages3dea2029ed9eb115091e9ea026cbba8fJamie Cea100% (1)

- ION-Evolution - ERA PANOS-RSDocument29 pagesION-Evolution - ERA PANOS-RSSokratesNo ratings yet