Professional Documents

Culture Documents

Beams11 ppt14

Beams11 ppt14

Uploaded by

Nihayasti DefitriOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Beams11 ppt14

Beams11 ppt14

Uploaded by

Nihayasti DefitriCopyright:

Available Formats

Chapter 14

Foreign Currency

Financial Statements

to accompany

Advanced Accounting, 11th edition

by Beams, Anthony, Bettinghaus, and Smith

Copyright ©2012 Pearson Education, In 14-1

c. Publishing as Prentice Hall

Foreign Currency Financial Statements:

Objectives

1. Identify the factors that should be considered

when determining an entity’s functional

currency.

2. Understand how functional currency

assignment determines the way the foreign

entity’s financial statements are converted into

its parent’s reporting currency.

3. Understand how a foreign subsidiary’s

economy is determined to be highly inflationary

and how this affects the conversion of its

financial statements to its parent’s reporting

currency. Copyright ©2012 Pearson Education, In 14-2

c. Publishing as Prentice Hall

Foreign Currency Financial Statements:

Objectives (Cont.)

4. Understand how the investment in a

foreign subsidiary is accounted for at

acquisition.

5. Understand which rates are used to

translate balance sheet and income

statement accounts under the current rate

method and the temporal method on a

translation/ remeasurement worksheet.

6. Know how the translation gain or loss, or

remeasurement gain or loss, is reported

under the current rate and temporal

methods. Copyright ©2012 Pearson Education, In 14-3

c. Publishing as Prentice Hall

Foreign Currency Financial Statements:

Objectives (Cont.)

7. Know how a parent accounts for its

investment in a subsidiary using the

equity method depending on the

subsidiary’s functional currency

determination.

8. Understand consolidation under the

temporal and current rate methods.

9. Understand how a hedge of the net

investment in a subsidiary is accounted

for under the current rate and temporal

methods.

Copyright ©2012 Pearson Education, In 14-4

c. Publishing as Prentice Hall

Foreign Currency Financial Statements

1: FUNCTIONAL CURRENCY

Copyright ©2012 Pearson Education, In 14-5

c. Publishing as Prentice Hall

Functional Currency

Definition: Currency of the primary economic

environment in which the entity operates.

Primarily, this means the currency received

from customers and used to pay liabilities.

Other factors include the currency:

Used in setting sales prices

That is dominant in the sales market

Used to pay operating expenses

Financing the company

Used in intercompany transactions

Copyright ©2012 Pearson Education, In 14-6

c. Publishing as Prentice Hall

Foreign Currency Financial Statements

2: FUNCTIONAL CURRENCY

DETERMINES CONVERSION

METHOD

Copyright ©2012 Pearson Education, In 14-7

c. Publishing as Prentice Hall

Restatement Method Selection

If the functional currency is the U.S. dollar, use

the Temporal method.

If the functional currency is the local currency,

use the Current Rate method.

Examples:

1. A Mexican subsidiary of a U.S. firm has the

peso as its functional currency.

2. A Japanese subsidiary of a U.S. firm has the

U.S. dollar as its functional currency.

3. An Australian subsidiary of a U.S. firm,

keeping its own records in Australian

dollars, determines its functional currency is

the euro. Copyright ©2012 Pearson Education, In 14-8

c. Publishing as Prentice Hall

Selecting the Method

Local Functional Reporting

currency currency currency

Translation

Method

Ex 1 Peso Peso U.S.$ Current rate

Translate (current rate method) from Peso to US$

Ex 2 Yen U.S.$ U.S.$ Temporal

Remeasure (temporal method) from Yen to US$

Ex 3 Aus$ Euro U.S.$ Temporal

Remeasure from Aus$ to Euros,

then Translate from Euros to U.S.$

Copyright ©2012 Pearson Education, In 14-9

c. Publishing as Prentice Hall

Exchange Rates

Translation (the Current Rate method) will

convert financial statements using

Assets, Liabilities : Current (FYE)

Equity, Dividends : Historical (retained earnings is not

translated)

Revenues, Expenses : Current (average)

Remeasurement (the Temporal Method) will

convert financial statements using

Monetary Assets, Liabilities : Current (FYE)

Other Assets, Liabilities : Historical

Equity, Dividends : Historical (retained earnings is not

remeasured)

Revenues, Expenses : Current (average) & Historical

Copyright ©2012 Pearson Education,

14-10

Inc. Publishing as Prentice Hall

Foreign Currency Financial Statements

3: HIGHLY INFLATIONARY

ECONOMIES

Copyright ©2012 Pearson Education, In 14-11

c. Publishing as Prentice Hall

Inflation and Functional Currency

For subsidiaries of U.S. firms in highly

inflationary economies, assume that the

functional currency is the U.S. dollar.

Remeasure the statements

using the Temporal method.

Highly inflationary = cumulative inflation of

100% or more over 3 years.

Copyright ©2012 Pearson Education, In 14-12

c. Publishing as Prentice Hall

Foreign Currency Financial Statements

4: BUSINESS COMBINATIONS

Copyright ©2012 Pearson Education, In 14-13

c. Publishing as Prentice Hall

Translation at Acquisition

Foreign assets & liabilities are translated

using the current rate at the date of

acquisition.

If functional currency = local currency

Translation is appropriate

Analysis of fair value/book value differentials is

performed in local currency

Results are translated at current rates

Copyright ©2012 Pearson Education, In 14-14

c. Publishing as Prentice Hall

Remeasurement at Acquisition

Foreign assets and liabilities are translated using the

current rate at the date of acquisition

If functional currency = US$ or reporting currency

Remeasurement is appropriate

Analysis of fair value/book value differentials is

performed in U.S.$

The 'earliest' historical rate generally used in

remeasurement is the date of the acquisition.

Copyright ©2012 Pearson Education, In 14-15

c. Publishing as Prentice Hall

Noncontrolling Interest

For both, remeasurement and translation,

the consolidation process is applied to the

financial statements as restated in U.S.$.

Measures of NCI, NCI share, & CI share are

computed in U.S.$.

Copyright ©2012 Pearson Education, In 14-16

c. Publishing as Prentice Hall

Foreign Currency Financial Statements

5: CURRENT RATE METHOD

AND TEMPORAL METHOD

Copyright ©2012 Pearson Education, In 14-17

c. Publishing as Prentice Hall

Assets

Copyright ©2012 Pearson Education, 14-18

Inc. Publishing as Prentice Hall

Liabilities and Equity

Copyright ©2012 Pearson Education, In 14-19

c. Publishing as Prentice Hall

Revenues and Expenses

Note that "current" rate, as used for income

statement items, is usually the average rate for

the year. Firms with seasonal business

fluctuations would use a weighted average rate.

Copyright ©2012 Pearson Education, In 14-20

c. Publishing as Prentice Hall

Foreign Currency Financial Statements

6: TRANSLATION

ADJUSTMENTS AND

REMEASUREMENT

GAIN/LOSS

Copyright ©2012 Pearson Education, In 14-21

c. Publishing as Prentice Hall

Current Rate Method: Example

Translate the adjusted trial balance:

Assets and Liabilities at the year-end

(“current”) rate

Equity at the historical rate (from the date of

the related transaction)

Except Retained Earnings which is a

composite rate from each year

Revenues and Expenses will be at the average

rate for the related period

The entry needed to balance the trial balance

after the translation is complete will be an entry

to Accumulated Other Comprehensive Income,

Copyright ©2012 Pearson Education, In 14-22

and thus will appear on the balance sheet.

c. Publishing as Prentice Hall

Current Rate Method: Example (cont.)

See calculation, next slide…

Copyright ©2012 Pearson Education, In 14-23

c. Publishing as Prentice Hall

Current Rate Method: Example (cont.)

Because all debit and credit balances are not translated

using the same exchange rate, the trial balance will not

balance at the end of the translation. In this example, the

debits happen to be $28,600 less than the credits. This is

the debit to accumulated OCI at the end of the year.

Copyright ©2012 Pearson Education, In 14-24

c. Publishing as Prentice Hall

Temporal Method: Example

Remeasure the adjusted trial balance:

Monetary Assets and Liabilities at the year-end (“current”) rate

Non-monetary Assets and Liabilities at the rate from the date of

transaction (“historical”)

Equity at the historical rate (from the date of the related transaction)

Except Retained Earnings which is a composite rate

Revenues and most Expenses will be at the average rate for the

related period

Cost of Goods Sold, Depreciation and Amortization Expense at the

historical rate of the related asset

The entry needed to balance the trial balance after the translation is

complete will be an Exchange Gain/(Loss), and thus will appear on the

income statement.

Copyright ©2012 Pearson Education,

Copyright ©2012 Pearson Education, In 14-25

Inc. Publishing

c. Publishing as Prentice

as Prentice Hall Hall

Temporal Method: Example (cont.)

See calculation, next slide…

Copyright ©2012 Pearson Education, In 14-26

c. Publishing as Prentice Hall

Temporal Method: Example (cont.)

Because all debit and credit balances are not translated

using the same exchange rate, the trial balance will not

balance at the end of the translation. In this example, the

debits happen to be $3,300 less than the credits. This is

the exchange loss for the year.

Copyright ©2012 Pearson Education, In 14-27

c. Publishing as Prentice Hall

Adjustment Summary

Remeasurement results in

Exchange gains or losses on the income statement

Credit to balance = exchange gain

Debit to balance = exchange loss

Include the gain or loss in calculating net income in

U.S. dollars.

Translation results in

Translation adjustment, part of accumulated other

comprehensive income

Include as part of stockholders' equity

Debit to balance = deduct from equity

Credit to balance = add to equity

Copyright ©2012 Pearson Education, In 14-28

c. Publishing as Prentice Hall

The Difference in Methodology

The ultimate goal is consolidation .

Use the Temporal method when the U.S. dollar is the

functional currency of the subsidiary, to best reflect

the relationship of the subsidiary as an extension of

the parent, and thus the remeasurement adjustment

is part of the current period income.

Use the Current Rate method when the local currency

is the functional currency of the subsidiary, to best

reflect the subsidiary’s status as a free-standing

company in whom the parent is merely invested, thus

the translation adjustment is shown in the equity

section of the parent’s balance sheet.

Copyright ©2012 Pearson Education, In 14-29

c. Publishing as Prentice Hall

Foreign Currency Financial Statements

7: EQUITY METHOD FOR

FOREIGN INVESTMENTS

Copyright ©2012 Pearson Education, In 14-30

c. Publishing as Prentice Hall

Equity Method Investee

A U.S. firm has a foreign investment it accounts

for under the equity method.

If functional currency is the local currency, then

translation is appropriate

At acquisition

Analyze fair value and book value, compute goodwill –

in local/functional currency

Annually

Translate statements into U.S. dollars

Record other comprehensive income for translation

adjustment

Copyright ©2012 Pearson Education, In 14-31

c. Publishing as Prentice Hall

Equity Method Entries

12/31/11 Investment in Star 525,000

Cash 525,000

Acquisition cost

12/1/12 Cash 42,600

Investment in Star 42,600

Dividends received, at current exchange rate

12/31/1

2 Investment in Star 93,200

OCI, translation

adjustment 28,600

Income from Star 121,800

Year-end adjustment for income

The income is from the translated income

statement, with appropriate amortizations

for fair value/book value differences.

Copyright ©2012 Pearson Education, In 14-32

c. Publishing as Prentice Hall

Amortization of Differentials

On 12/31/11, Pat acquired Star. Star had

unrecorded patent of £100,000. The exchange

rate was $1.50.

The patent is amortized over 10 years. The

average and year-end exchange rates are $1.45

and $1.40.

12/31/11 Patent £100,000 $1.50 $150,000

2012 Amortization expense £10,000 $1.45 $14,500

12/31/1

2 Patent £90,000 $1.40 $126,000

OCI translation adjustment for patent is $9,500.

$150,000 – 14,500 – 126,000 = $9,500

The adjustment brings the net value of the patent to its

translated year-end amount of $126,000.

Copyright ©2012 Pearson Education, In 14-33

c. Publishing as Prentice Hall

Foreign Currency Financial Statements

8: CONSOLIDATION OF

FOREIGN SUBSIDIARIES

Copyright ©2012 Pearson Education, In 14-34

c. Publishing as Prentice Hall

Consolidating Foreign Subsidiaries

The parent uses the appropriately

translated or remeasured subsidiary

financial statements in its consolidation

worksheet.

Income from the subsidiary and

Investment in subsidiary are eliminated.

Subsidiary equity accounts are

eliminated (including accumulated OCI).

Worksheet procedures are similar to

that for domestic subsidiaries.

Copyright ©2012 Pearson Education, In 14-35

c. Publishing as Prentice Hall

Worksheet – Income Statement

Star's balances come

from the translated

statements. Current

amortization for the

patent is recorded.

Copyright ©2012 Pearson Education, In 14-36

c. Publishing as Prentice Hall

Worksheet – Retained Earnings

Star's beginning retained

earnings and current

dividends are eliminated.

Copyright ©2012 Pearson Education, In 14-37

c. Publishing as Prentice Hall

Worksheet - Assets

The Investment in Star

and intercompany

receivables are

eliminated. Differentials

from acquisition are

recorded – the patent

and its current

amortization.

Copyright ©2012 Pearson Education, In 14-38

c. Publishing as Prentice Hall

Worksheet – Liabilities & Equity

Intercompany payable is

eliminated. All of the subsidiary

equity is eliminated, including

Accumulated OCI. Parent's

Accumulated OCI contains impact

of translation adjustments.

Copyright ©2012 Pearson Education, In 14-39

c. Publishing as Prentice Hall

Foreign Currency Financial Statements

9: HEDGE OF NET

INVESTMENT

Copyright ©2012 Pearson Education, In 14-40

c. Publishing as Prentice Hall

Hedge a Foreign Investment

Investee's functional currency = local

currency

Effective hedges qualify for hedge treatment

"Gains or losses" are translation adjustments

which are included in accumulated OCI

Investee's functional currency = reporting

currency

"Hedging" is treated as speculative

Gains or losses are recognized in income for the

current financial period

Copyright ©2012 Pearson Education, In 14-41

c. Publishing as Prentice Hall

This work is protected by United States copyright laws and

is provided solely for the use of instructors in teaching

!

their courses and assessing student learning.

Dissemination or sale of any part of this work

(including on the World Wide Web) will destroy the

integrity of the work and is not permitted. The

work and materials from it is should never be made available to

students except by instructors using the accompanying text in their

classes. All recipients of this work are expected to abide by these

restrictions and to honor the intended pedagogical purposes and the

needs of other instructors who rely on these materials.

All rights reserved. No part of this publication may be reproduced,

stored in a retrieval system, or transmitted, in any form or by any

means, electronic, mechanical, photocopying, recording, or otherwise,

without the prior written permission of the publisher. Printed in the

United States of America.

Copyright ©2012 Pearson Education, In 14-42

c. Publishing as Prentice Hall

You might also like

- Translation of Financial Statements of Foreign AffiliatesDocument15 pagesTranslation of Financial Statements of Foreign Affiliatesayu wanasari100% (2)

- What is Financial Accounting and BookkeepingFrom EverandWhat is Financial Accounting and BookkeepingRating: 4 out of 5 stars4/5 (10)

- Accounting Survival Guide: An Introduction to Accounting for BeginnersFrom EverandAccounting Survival Guide: An Introduction to Accounting for BeginnersNo ratings yet

- Solution Manual Advanced CH 12Document78 pagesSolution Manual Advanced CH 12Marietha Ayu SafitriNo ratings yet

- Chapter 2 - Measuring Income To Assess PerformanceDocument4 pagesChapter 2 - Measuring Income To Assess PerformanceArmanNo ratings yet

- Alliance Concrete ForecastingDocument7 pagesAlliance Concrete ForecastingS r kNo ratings yet

- Whittington Audit Chapter 17 Solutions ManualDocument16 pagesWhittington Audit Chapter 17 Solutions ManualIam AbdiwaliNo ratings yet

- (CPA Sample) MAMMA JILL Pizza QuestionDocument2 pages(CPA Sample) MAMMA JILL Pizza QuestionMuhaddisaNo ratings yet

- PrelimQ1 - Conceptual Framework AnsKeyDocument5 pagesPrelimQ1 - Conceptual Framework AnsKeychevel dosdosNo ratings yet

- Foreign Currency Financial StatementsDocument42 pagesForeign Currency Financial StatementsResky AndikaNo ratings yet

- Chapter 13: Foreign Currency Financial Statements: Advanced AccountingDocument42 pagesChapter 13: Foreign Currency Financial Statements: Advanced AccountingMad JayaNo ratings yet

- Beams10e Ch13Document42 pagesBeams10e Ch13TFI Student CommunityNo ratings yet

- Bandi: Bandi - Staff.fe - Uns.ac - Id Atau 3/10/2018Document44 pagesBandi: Bandi - Staff.fe - Uns.ac - Id Atau 3/10/2018luxion botNo ratings yet

- CH 08Document37 pagesCH 08川流No ratings yet

- Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity StatementsDocument53 pagesMultinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity StatementsMostafa Monsur AhmedNo ratings yet

- Beams Adv Acc CH 14Document21 pagesBeams Adv Acc CH 14Josua PranataNo ratings yet

- (Download PDF) International Accounting 7th Edition Choi Solutions Manual Full ChapterDocument35 pages(Download PDF) International Accounting 7th Edition Choi Solutions Manual Full Chapteremerabornet100% (7)

- International Accounting 7th Edition Choi Solutions Manual instant download all chapterDocument36 pagesInternational Accounting 7th Edition Choi Solutions Manual instant download all chapterdaubieporga100% (2)

- Translation of Financial Statements of Foreign AffiliatesDocument37 pagesTranslation of Financial Statements of Foreign AffiliateschristoperedwinNo ratings yet

- FOREX and Derivative AccountingDocument67 pagesFOREX and Derivative AccountingKurt Morin CantorNo ratings yet

- IPPTChap 0010Document24 pagesIPPTChap 0010lanyufansNo ratings yet

- IPPTChap 0010Document46 pagesIPPTChap 0010Carbonite AnonymousNo ratings yet

- Chapter 10 IFDocument25 pagesChapter 10 IFcuteserese roseNo ratings yet

- Foreign Currency Financial Statements: Answers To Questions 1Document21 pagesForeign Currency Financial Statements: Answers To Questions 1nandaseptNo ratings yet

- Foreign Currency Financial Statements: Answers To Questions 1Document21 pagesForeign Currency Financial Statements: Answers To Questions 1Puspita DewiNo ratings yet

- International Accounting 7th Edition Choi Solutions ManualDocument13 pagesInternational Accounting 7th Edition Choi Solutions Manualsaintcuc9jymi8100% (23)

- Multinational Business Finance 12th Edition Slides Chapter 13Document31 pagesMultinational Business Finance 12th Edition Slides Chapter 13Alli Tobba100% (1)

- Chapter 6-Foreign Currency Translation Introduction and BackgroundDocument21 pagesChapter 6-Foreign Currency Translation Introduction and BackgroundRakeshNo ratings yet

- Beams Aa13e SM 14Document21 pagesBeams Aa13e SM 14Valencia AnggieNo ratings yet

- ACC4100Chapter10 Spring2024Document10 pagesACC4100Chapter10 Spring2024nissimsteinbergNo ratings yet

- Translation of Foreign Currency Financial StatementsDocument27 pagesTranslation of Foreign Currency Financial StatementsSurip BachtiarNo ratings yet

- Worldwide Financial Procedures: Foreign Currency TranslationDocument14 pagesWorldwide Financial Procedures: Foreign Currency TranslationCésar FloresNo ratings yet

- Chapter 6: Foreign Currency Translation: International Accounting, 6/eDocument29 pagesChapter 6: Foreign Currency Translation: International Accounting, 6/eSylvia Al-a'maNo ratings yet

- Management of Translation ExposureDocument19 pagesManagement of Translation Exposurevijay vighneshNo ratings yet

- Foreign Currency TranslationDocument3 pagesForeign Currency TranslationMarietzaNo ratings yet

- Ifm Module 6 TheoryDocument5 pagesIfm Module 6 TheoryAlissa BarnesNo ratings yet

- Chapter 13 Test Bank Foreign Currency Financial StatementsDocument31 pagesChapter 13 Test Bank Foreign Currency Financial StatementsjeankoplerNo ratings yet

- Solution Chapter 10Document48 pagesSolution Chapter 10Mike Alexander100% (1)

- CH 13Document31 pagesCH 13Natasha GraciaNo ratings yet

- Advanced Accounting Hoyle 10th Edition Solutions ManualDocument50 pagesAdvanced Accounting Hoyle 10th Edition Solutions ManualBrentBrowncgwzm100% (82)

- International: Financial ManagementDocument28 pagesInternational: Financial ManagementfatimamahamNo ratings yet

- CH 13Document45 pagesCH 13Licia SalimNo ratings yet

- Chapter 11 - Translation of Foreign Financial Statements PPT SlidesDocument25 pagesChapter 11 - Translation of Foreign Financial Statements PPT Slidesgilli1tr100% (1)

- Corporate Finance 02Document4 pagesCorporate Finance 02anupsorenNo ratings yet

- Advanced Accounting 6th Edition Jeter Solutions Manual Full Chapter PDFDocument67 pagesAdvanced Accounting 6th Edition Jeter Solutions Manual Full Chapter PDFpucelleheliozoa40wo100% (15)

- Advanced Accounting 6th Edition Jeter Solutions ManualDocument47 pagesAdvanced Accounting 6th Edition Jeter Solutions Manualbacksideanywheremrifn100% (32)

- Translation of Foreign Currency Financial StatementsDocument49 pagesTranslation of Foreign Currency Financial Statementssepri24100% (1)

- Chap 010Document64 pagesChap 010Hemali MehtaNo ratings yet

- CHP 11Document41 pagesCHP 11SUBA NANTINI A/P M.SUBRAMANIAMNo ratings yet

- Advanced Accounting 13th Edition Hoyle Solutions Manual DownloadDocument65 pagesAdvanced Accounting 13th Edition Hoyle Solutions Manual DownloadMay Madrigal100% (23)

- Chapter 13 Translation of Financial Statements of Foreign Affiliates - 2ndDocument41 pagesChapter 13 Translation of Financial Statements of Foreign Affiliates - 2ndMuhammad Za'far SiddiqNo ratings yet

- Translation of Foreign Financial Statements (IAS 21)Document6 pagesTranslation of Foreign Financial Statements (IAS 21)misonim.eNo ratings yet

- The Importance of Liquidity RatiosDocument12 pagesThe Importance of Liquidity Ratiosjma_msNo ratings yet

- Hoyle 11e Chapter 10Document57 pagesHoyle 11e Chapter 10bliska100% (2)

- Translation of Foreign Currency Financial Statements: Chapter OutlineDocument62 pagesTranslation of Foreign Currency Financial Statements: Chapter OutlineJordan YoungNo ratings yet

- Fin254 Ch05 NNH TVM UpdatedDocument80 pagesFin254 Ch05 NNH TVM Updatedamir khanNo ratings yet

- Foreign Currency TranslationDocument2 pagesForeign Currency Translationprajay birlaNo ratings yet

- CH 5 Time Value of MoneyDocument94 pagesCH 5 Time Value of MoneyTarannum TahsinNo ratings yet

- Pertemuan 2 PPT CH 14 BeamsDocument44 pagesPertemuan 2 PPT CH 14 BeamsArya SetiawanNo ratings yet

- 10 Chap10Document33 pages10 Chap10hoang nguyen dangNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Judul-Judul Makalah ProquestDocument1,097 pagesJudul-Judul Makalah ProquestAgus SukaryaNo ratings yet

- Dedication, Discipline and Debt-Free.: Godawari Power & Ispat LimitedDocument189 pagesDedication, Discipline and Debt-Free.: Godawari Power & Ispat LimitedrkotichaNo ratings yet

- 12 x10 Financial Statement Analysis PDFDocument22 pages12 x10 Financial Statement Analysis PDFAdam SmithNo ratings yet

- Adb Am 2018proceedingsDocument171 pagesAdb Am 2018proceedingsBernie D. TeguenosNo ratings yet

- Financial Statement Analysis: K R Subramanyam John J WildDocument40 pagesFinancial Statement Analysis: K R Subramanyam John J WildGustrilimandaNo ratings yet

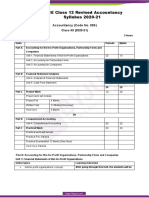

- CBSE Class 12 Revised Accountancy Syllabus 2020-21Document8 pagesCBSE Class 12 Revised Accountancy Syllabus 2020-21Harry AryanNo ratings yet

- SIP Project ReportDocument62 pagesSIP Project ReportNiharika MathurNo ratings yet

- Felix Topic 9 Accounts Audits and Investigations Set 2Document26 pagesFelix Topic 9 Accounts Audits and Investigations Set 2bb19921016No ratings yet

- Request For Information Form (RFI-II)Document5 pagesRequest For Information Form (RFI-II)miftahul ulumNo ratings yet

- Commission On Audit: Commonwealth Avenue, Quezon City, Philippines State Auditor'S Report The SecretaryDocument3 pagesCommission On Audit: Commonwealth Avenue, Quezon City, Philippines State Auditor'S Report The SecretaryEmosNo ratings yet

- Internship Report On Alpenglow Pharmaceutical222222Document44 pagesInternship Report On Alpenglow Pharmaceutical222222Afaq IffiNo ratings yet

- The Current State of The Accounting ProfessionDocument2 pagesThe Current State of The Accounting ProfessionYuliana ArceNo ratings yet

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Document23 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydNo ratings yet

- Preparing Analyzing and Forecasting Financial StatementsDocument48 pagesPreparing Analyzing and Forecasting Financial StatementsDumplings DumborNo ratings yet

- Annual Report 2015Document121 pagesAnnual Report 2015Cahyo FirliNo ratings yet

- CEOs CFOs and Accounting Fraud PDFDocument5 pagesCEOs CFOs and Accounting Fraud PDFClaire Joy CadornaNo ratings yet

- The Institute of Chartered Accountants of IndiaDocument42 pagesThe Institute of Chartered Accountants of IndiaXpacNo ratings yet

- Módulo 2: Conceptos y Principios Generales: Fundación IFRS: Material de Formación Sobre La NIIF para Las PYMESDocument53 pagesMódulo 2: Conceptos y Principios Generales: Fundación IFRS: Material de Formación Sobre La NIIF para Las PYMESMaria Kmi León GutierrezNo ratings yet

- Auditor'S ResponsibilityDocument28 pagesAuditor'S Responsibilityadarose romaresNo ratings yet

- AFAR1 Main Exam Q (Feb 2022)Document5 pagesAFAR1 Main Exam Q (Feb 2022)Alice LowNo ratings yet

- CA - Zam Dec-2017Document102 pagesCA - Zam Dec-2017Dixie CheeloNo ratings yet

- Report On Asian PaintsDocument152 pagesReport On Asian Paintsneelu sharmaNo ratings yet

- Chapter 1Document10 pagesChapter 1Ayub ChowdhuryNo ratings yet

- Corporate Board Attributes and Earnings ManagementDocument16 pagesCorporate Board Attributes and Earnings ManagementKunleNo ratings yet

- Proposal For The Merger of Its Subsidiary Novaprom Food IngredientsDocument2 pagesProposal For The Merger of Its Subsidiary Novaprom Food IngredientsJBS RINo ratings yet

- Waterfront Philippines, Inc - Sec Form 17-A - 30june2020Document233 pagesWaterfront Philippines, Inc - Sec Form 17-A - 30june2020backup cmbmpNo ratings yet