Professional Documents

Culture Documents

DTA Agreement India and Hongkong Pritesh

DTA Agreement India and Hongkong Pritesh

Uploaded by

pritesh.ks14090 ratings0% found this document useful (0 votes)

8 views5 pagesCopyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

8 views5 pagesDTA Agreement India and Hongkong Pritesh

DTA Agreement India and Hongkong Pritesh

Uploaded by

pritesh.ks1409Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 5

DTA Agreement between

India & Hong Kong

Article 8 : Shipping Income

DTA Agreement between India and Hong Kong with

respect to Article 8

1) Profits of an enterprise of a Contracting Party from the operation of ships or aircraft in

international traffic shall be taxable only in that Party.

2) Notwithstanding the provisions of paragraph 1, profits of an enterprise of a Contracting

Party derived in the other Contracting Party from the operation of ships in

international traffic may also be taxed in the other Contracting Party, but the tax

imposed in that other Contracting Party shall be reduced by an amount equal to 50 per

cent thereof.

3) The provisions of paragraphs 1 and 2 shall also apply to profits from the participation in

a pool, a joint business or an international operating agency.

As per Article 8 – Operation of Ships or Aircraft in

International traffic shall include

a) Revenues and gross receipts from the operation of ships or aircraft for the transport of

persons, livestock, goods, mail or merchandise in international traffic, including

income derived from the sale of tickets and the provision of services connected with

such transport whether for the enterprise itself or for any other enterprise, provided

that in the case of provision of services, such provision is incidental to the operation of

ships or aircraft in international traffic;

b) Interest on funds directly connected with the operation of ships or aircraft in

international traffic;

c) Profits from the lease of containers by the enterprise, when such lease is incidental to

the operation of ships or aircraft in international traffic.

Income Tax on the Shipping Business

Section 44B contains presumptive tax provisions for non-residents engaged in

shipping business.

Notwithstanding anything to the contrary contained in sections 28 to 43A, in the case

of an assessee, being a non-resident, engaged in the business of operating of ships, a

sum equal to 7.5% of the aggregate of the –

a) amount paid or payable (whether in or outside India) to the non – resident or to

any other person on his behalf on account of the carriage of passengers, livestock,

mail or goods shipped at any India port and,

b) The amount received or deemed to be received in India on account of the carriage

of passengers, livestock, mail or goods shipped at any port outside India.

Shall be deemed to be the profits and gains of such business chargeable to tax under

the head “Profits and gains of business or profession”.

Example of Income Tax of Shipping Business

Example: A foreign company engaged in shipping business made the following transportations:

Livestock for Rs. 45 lakh from Chennai port to Singapore.

Payment of Rs. 1 crore received in India for goods being carried from Malaysia to Singapore.

Goods worth Rs. 2 crore shipped from Mumbai to Malaysia. Freight charges are to be received

in Malaysia.

Answer: This company’s total taxable income would be

7.5% of Rs. 45,00,000 = Rs. 3,37,500

7.5% of Rs. 1 crore = Rs. 7,50,000

7.5% of Rs. 2 crore = Rs. 15,00,000

The total taxable income would be Rs. 25,87,500. Now, the applicable corporate tax rate in

India is 40% for a foreign company. So, the tax payable would be Rs. 10,35,000, excluding the

cess and surcharge.

You might also like

- PPL Exam Secrets Guide: Aviation Law & Operational ProceduresFrom EverandPPL Exam Secrets Guide: Aviation Law & Operational ProceduresRating: 4.5 out of 5 stars4.5/5 (3)

- Oneplus BillDocument1 pageOneplus BillRitesh Yawakar100% (1)

- RMC 46-2008Document12 pagesRMC 46-2008pja_14100% (4)

- Business Profit Tax Act FinalDocument34 pagesBusiness Profit Tax Act FinalsamaanNo ratings yet

- COMPARISON of SEC 222 and 203 - CABUSOGDocument2 pagesCOMPARISON of SEC 222 and 203 - CABUSOGKristine Jay Perez-CabusogNo ratings yet

- RMC No. 46-2008Document13 pagesRMC No. 46-2008Jourd MagbanuaNo ratings yet

- Association of International Shipping Lines Vs Sec of Finance, CIR (2020)Document31 pagesAssociation of International Shipping Lines Vs Sec of Finance, CIR (2020)Joshua DulceNo ratings yet

- RR 15-02Document5 pagesRR 15-02matinikkiNo ratings yet

- Digest RR 13-2018Document9 pagesDigest RR 13-2018Maria Rose Ann BacilloteNo ratings yet

- Revenue Memorandum Circular No. 046-08: February 1, 2008Document14 pagesRevenue Memorandum Circular No. 046-08: February 1, 2008Kitty ReyesNo ratings yet

- Export Promotion Capital Goods Scheme PresentationDocument32 pagesExport Promotion Capital Goods Scheme PresentationDakshata SawantNo ratings yet

- 2031rr15 02Document8 pages2031rr15 02KatharosJaneNo ratings yet

- 39660rmc No. 31-2008 PDFDocument15 pages39660rmc No. 31-2008 PDFJohn Paulo Q. PartacalaoNo ratings yet

- SEC. 28. Rates of Income Tax On Foreign Corporations.Document4 pagesSEC. 28. Rates of Income Tax On Foreign Corporations.Lavil KiuNo ratings yet

- Computation of Income On Presumptive BasisDocument3 pagesComputation of Income On Presumptive Basischandu varmaNo ratings yet

- EPCGDocument10 pagesEPCGJay PatelNo ratings yet

- Association of International Shipping Lines VS Sec of Finance GR 222239 15jan2020Document24 pagesAssociation of International Shipping Lines VS Sec of Finance GR 222239 15jan2020CJNo ratings yet

- Percentage Tax: Percentage Tax Is A Business Tax Imposed On Persons, Entities, or TransactionsDocument16 pagesPercentage Tax: Percentage Tax Is A Business Tax Imposed On Persons, Entities, or TransactionsDon CabasiNo ratings yet

- Percentage Tax CTBDocument16 pagesPercentage Tax CTBDon CabasiNo ratings yet

- Income Tax On CorporationDocument64 pagesIncome Tax On CorporationShane MagnoNo ratings yet

- Section - 80HHC Income-Tax Act 1961 - FA 2022 Deduction in Respect of Profits Retained For Export BusinessDocument6 pagesSection - 80HHC Income-Tax Act 1961 - FA 2022 Deduction in Respect of Profits Retained For Export BusinessPriyank GalaNo ratings yet

- FieoDocument31 pagesFieoparidhi9No ratings yet

- RR 15-2013Document4 pagesRR 15-2013crazykid12345No ratings yet

- Export Promotion SchemesDocument45 pagesExport Promotion Schemesasifanis100% (1)

- Global System of Trade PreferencesDocument24 pagesGlobal System of Trade PreferencesamubineNo ratings yet

- Association of International Shipping Lines, Inc. vs. Secretary of Finance, GR No. 222239 Dated January 15, 2020 PDFDocument24 pagesAssociation of International Shipping Lines, Inc. vs. Secretary of Finance, GR No. 222239 Dated January 15, 2020 PDFAbbey Agno PerezNo ratings yet

- Capital Goods As NotifiedDocument74 pagesCapital Goods As NotifiedRamesh RamNo ratings yet

- Importation, Exportation and Transportation of Goods: After Studying This Chapter, You Would Be Able ToDocument78 pagesImportation, Exportation and Transportation of Goods: After Studying This Chapter, You Would Be Able ToAbhishek SrivastavaNo ratings yet

- Custom 4Document80 pagesCustom 4shree varanaNo ratings yet

- E-Way Bill For Import TransactionsDocument6 pagesE-Way Bill For Import TransactionsKrishna Chaitanya DammalapatiNo ratings yet

- Custom DutyDocument40 pagesCustom DutyVijayasarathi VenugopalNo ratings yet

- 2024.03.28 - Legal Opinion - JointDocument22 pages2024.03.28 - Legal Opinion - Jointvlogwithfun06No ratings yet

- Tax CorporateDocument5 pagesTax CorporateJorenz ObiedoNo ratings yet

- Importation, Exportation and Transportation of GoodsDocument67 pagesImportation, Exportation and Transportation of Goodsdipesh shahNo ratings yet

- PHINMA University of Pangasinan and PHINMA Upang College of UrdanetaDocument46 pagesPHINMA University of Pangasinan and PHINMA Upang College of Urdanetaanor.aquino.upNo ratings yet

- Airport Service Charge ActDocument6 pagesAirport Service Charge ActTito MnyenyelwaNo ratings yet

- Air Canada V CIR GR 169507Document4 pagesAir Canada V CIR GR 169507Loi Villarin100% (1)

- Facilitation: (Annex 9) Definitions:: Any Property Carried On An Aircraft Other Than Mail, and AccompaniedDocument9 pagesFacilitation: (Annex 9) Definitions:: Any Property Carried On An Aircraft Other Than Mail, and AccompaniedSherįl AlexxNo ratings yet

- Post ExpotDocument8 pagesPost ExpotaditibrijptlNo ratings yet

- Philippine Ports AuthorityDocument9 pagesPhilippine Ports AuthorityFarina R. SalvadorNo ratings yet

- ExportDocument2 pagesExportruby402sharonNo ratings yet

- Assoc. of International Shipping Vs Secretary of FinanceDocument23 pagesAssoc. of International Shipping Vs Secretary of FinanceRhinnell RiveraNo ratings yet

- Revenue Memorandum Circular No. 31-2008Document16 pagesRevenue Memorandum Circular No. 31-2008d-fbuser-49417072No ratings yet

- RR No. 13-2018 (VAT Refund)Document23 pagesRR No. 13-2018 (VAT Refund)Hailin QuintosNo ratings yet

- Title V: - Other Percentage TaxesDocument9 pagesTitle V: - Other Percentage TaxesArnold BernasNo ratings yet

- Income Tax Rules, 2002 PDFDocument244 pagesIncome Tax Rules, 2002 PDFAli Minhas100% (1)

- G.R. No. 182045. September 19, 2012Document16 pagesG.R. No. 182045. September 19, 2012kimNo ratings yet

- FY20-21 Summary of Airport ChargesDocument22 pagesFY20-21 Summary of Airport Chargesghostdonald01No ratings yet

- Taxguru - In-Presumptive Taxation Scheme Under Section 44AEDocument13 pagesTaxguru - In-Presumptive Taxation Scheme Under Section 44AETAX FILLINGNo ratings yet

- Question 1-Page 198: Chapter 27 - Income of Nonresident Air & Water Transport Operator and Telecommunication OperatorDocument3 pagesQuestion 1-Page 198: Chapter 27 - Income of Nonresident Air & Water Transport Operator and Telecommunication OperatorBashu GuragainNo ratings yet

- Association of Intl Shipping Lines Vs SOFDocument5 pagesAssociation of Intl Shipping Lines Vs SOFMia abarquezNo ratings yet

- 4 Air Canada vs. Commissioner of Internal RevenueDocument44 pages4 Air Canada vs. Commissioner of Internal RevenueNia Coline Macala MendozaNo ratings yet

- Customs& GST Ii Assignment-2: U P & E S SDocument15 pagesCustoms& GST Ii Assignment-2: U P & E S SRaman SahotaNo ratings yet

- 10 June 2016Document7 pages10 June 2016Rory RivanovNo ratings yet

- 11.tax Free Incomes FinalDocument40 pages11.tax Free Incomes FinalKARTHIK ANo ratings yet

- Export Promotion Capital Goods (Epcg) Scheme: Submitted By: Rama Sangal Mba, Ib-Sec B A1802010277Document21 pagesExport Promotion Capital Goods (Epcg) Scheme: Submitted By: Rama Sangal Mba, Ib-Sec B A1802010277Khushi Sagar AhujaNo ratings yet

- E. Other Percentage TaxesDocument49 pagesE. Other Percentage TaxesNatalie SerranoNo ratings yet

- Tax For Aviation and Shipping IndustriesDocument23 pagesTax For Aviation and Shipping IndustriesClarisa MaharaniNo ratings yet

- Air Canada vs. CIRDocument4 pagesAir Canada vs. CIRPio MathayNo ratings yet

- A Treatise on Indian Transfer Pricing Regulations - Part II: A Treatise on Indian Transfer Pricing Regulations, #2From EverandA Treatise on Indian Transfer Pricing Regulations - Part II: A Treatise on Indian Transfer Pricing Regulations, #2No ratings yet

- 50PADDocument1 page50PADtfmfszrpsfNo ratings yet

- Republic V RicarteDocument1 pageRepublic V RicarteReena MaNo ratings yet

- Axis Bank LTD Payslip For The Month of May - 2021Document2 pagesAxis Bank LTD Payslip For The Month of May - 2021Suman DasNo ratings yet

- Presentation On Income TaxDocument9 pagesPresentation On Income TaxUnnati GuptaNo ratings yet

- DT 0108 Annual Paye Deductions Return Form v1 2Document2 pagesDT 0108 Annual Paye Deductions Return Form v1 2Kwasi DankwaNo ratings yet

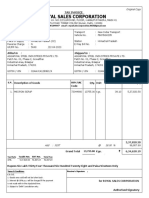

- Royal Sales Corporation: Tax InvoiceDocument2 pagesRoyal Sales Corporation: Tax InvoiceKailash GoyalNo ratings yet

- Tybms Indirect Taxes Sem 6 Internals Sample QuestionsDocument6 pagesTybms Indirect Taxes Sem 6 Internals Sample QuestionsSarvesh MishraNo ratings yet

- Artifact 5 PF Withdrawal Application PDFDocument1 pageArtifact 5 PF Withdrawal Application PDFRamesh BabuNo ratings yet

- W2 DataDocument2 pagesW2 Dataahasgahsg031No ratings yet

- Milk BrandDocument3 pagesMilk BrandJosephine MercadoNo ratings yet

- Chapt 11+Income+Tax+ +individuals2013fDocument13 pagesChapt 11+Income+Tax+ +individuals2013fiamjan_10180% (15)

- De Minimis BenefitsDocument2 pagesDe Minimis BenefitsClaudine SumalinogNo ratings yet

- DR Ashutosh Kumar-22809Document1 pageDR Ashutosh Kumar-22809K D HERBAL & UNANINo ratings yet

- Fin - Accounts Objective2Document3 pagesFin - Accounts Objective2Swarup MukherjeeNo ratings yet

- Document Pay SlipDocument3 pagesDocument Pay SlipAfaq AnwarNo ratings yet

- Idt MCQ - QuestionsDocument3 pagesIdt MCQ - QuestionsKhader MohammedNo ratings yet

- PF CalculatorDocument3 pagesPF CalculatorMdshajiNo ratings yet

- CIR vs. Isabela Cultural Corp.Document1 pageCIR vs. Isabela Cultural Corp.Natsu DragneelNo ratings yet

- PF Withdrawal FormDocument1 pagePF Withdrawal FormSankalp BhardwajNo ratings yet

- Britgo AdpDocument1 pageBritgo Adpesteysi775No ratings yet

- Mio SoulDocument1 pageMio SoulWel GadayanNo ratings yet

- My Payslip - A4Document1 pageMy Payslip - A4Pie AlarifNo ratings yet

- Solved Jennifer Is Single and Has The Following Income and ExpensesDocument1 pageSolved Jennifer Is Single and Has The Following Income and ExpensesAnbu jaromiaNo ratings yet

- ACFrOgDrfk9wT 7y1 fbRMiv4xjP7hNTGwqfzNJ1G27r3eTgtVDid9F7RrBmpGFgcOsGtPT0J6IIB0RUl JaXR7YG0rDWVbPsPWL0 - H4w111trlgzjhfck669j7oooo PDFDocument3 pagesACFrOgDrfk9wT 7y1 fbRMiv4xjP7hNTGwqfzNJ1G27r3eTgtVDid9F7RrBmpGFgcOsGtPT0J6IIB0RUl JaXR7YG0rDWVbPsPWL0 - H4w111trlgzjhfck669j7oooo PDFAmitNo ratings yet

- Convergys Philippines Services CorpDocument4 pagesConvergys Philippines Services CorpJuvy San JuanNo ratings yet

- Annex C RR 11-2018Document1 pageAnnex C RR 11-2018Rheneir MoraNo ratings yet

- TAX QuizzesDocument2 pagesTAX Quizzesnichols greenNo ratings yet

- Jio FiberDocument1 pageJio FiberBalachandar PNo ratings yet