Professional Documents

Culture Documents

Suspensive Sales

Suspensive Sales

Uploaded by

Thembela Mkandla0 ratings0% found this document useful (0 votes)

4 views7 pagesCopyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

4 views7 pagesSuspensive Sales

Suspensive Sales

Uploaded by

Thembela MkandlaCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 7

SUSPENSIVE SALES AND

CREDIT SALES (SECT 17 & 18)

• Section 17 and section 18 of the Income Tax Act outline the basis of

taxation of amounts accruing under hire purchase and under credit sales.

• Under these agreements the full amount of sale is receivable in

instalments, which may stretch into years.

• for tax purposes the full sale price is deemed to accrue on the date of

signing of the sale agreement.

• This would mean that taxpayers are “taxable” on amounts not yet

received.

• However, sections 17 and 18 provide deductions which enable taxpayers

to be taxable on profit which relate to amounts which have become due

and payable in each tax year.

• A calculation of the profit relating to amounts which are not yet due is

made and deducted.

• A calculation of the profit relating to amounts

which are not yet due is made and deducted.

• This amount is added back to gross income in

the subsequent year when a fresh calculation

is then made.

• In the case of hire purchase sales (section 17)

the allowance is calculated in accordance with

the following formula

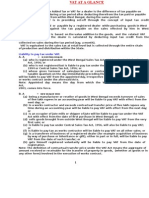

Example:

• Alpha Electronics (Pvt) Ltd is a retail shop, selling televisions on credit to

approved customers. Each Television cost Alpha Electronics (Pvt) Ltd

$400. The 50 television sets were bought in 2011.

• You are given the following information for the year ended 31

December 2013.

• 20 sets sold in April 2011 at $600 each

• 16 sets sold in October 2011 at $600 each

• 14 sets sold in March 2012 at $600 each

• The terms of agreement require the customer to pay a deposit of 25%

on date of sale and the remainder payable over 20 months in equal

instalments commencing the month following that of sale.

• Required: Compute the taxpayer’s taxable income for each year during

the credit period

soln

Debtors schedule

You might also like

- Taxes On Commercial LeaseDocument8 pagesTaxes On Commercial Leasebelbel08100% (1)

- Value Added Tax (Vat) .PPT FinalDocument57 pagesValue Added Tax (Vat) .PPT FinalNick254No ratings yet

- P - 3 Taxation-Kavitha Que.&AnsDocument48 pagesP - 3 Taxation-Kavitha Que.&AnsPrabhat TejaNo ratings yet

- Hire PurchaseDocument22 pagesHire PurchaseThami KNo ratings yet

- Steps in Transfer of TitleDocument2 pagesSteps in Transfer of TitleApril Joy Ortilano- CajiloNo ratings yet

- Value Added TaxDocument20 pagesValue Added Taxrpd2509No ratings yet

- Wealth Management PPT FinalDocument42 pagesWealth Management PPT FinalCyvita VeigasNo ratings yet

- 2022 FinalsDocument49 pages2022 FinalsJane GaliciaNo ratings yet

- Procedure To Be Followed For Delhi Value Added TaxDocument6 pagesProcedure To Be Followed For Delhi Value Added TaxChirag MalhotraNo ratings yet

- Business and Income TaxationDocument58 pagesBusiness and Income TaxationFrancisNo ratings yet

- Hire Purchase: RequiredDocument2 pagesHire Purchase: RequiredTawanda Tatenda HerbertNo ratings yet

- PRSN / VVK / Rad Indirect Taxes Dept. - HQDocument107 pagesPRSN / VVK / Rad Indirect Taxes Dept. - HQprabhu85No ratings yet

- Banas JR Vs CADocument3 pagesBanas JR Vs CAJopet EstolasNo ratings yet

- Acting For VendorDocument23 pagesActing For VendorPuteri QaleesyaNo ratings yet

- As 9Document35 pagesAs 9Thanos The titanNo ratings yet

- Bir Ruling Da 381-04Document9 pagesBir Ruling Da 381-04vhbautistaNo ratings yet

- Optional Standard Deduction OSDDocument28 pagesOptional Standard Deduction OSDLes EvangeListaNo ratings yet

- RE 01 03 Office Acquisition Case StudyDocument3 pagesRE 01 03 Office Acquisition Case StudyAnonymous bf1cFDuepPNo ratings yet

- Acc 303 Module 3 - Hire AccountsDocument3 pagesAcc 303 Module 3 - Hire Accountsjimoh kamiludeenNo ratings yet

- TDS On Real Estate IndustryDocument5 pagesTDS On Real Estate IndustryKirti SanghaviNo ratings yet

- A Step-By-Step Guide To Land Title Transferring in The Philippines (INFOGRAPHIC)Document5 pagesA Step-By-Step Guide To Land Title Transferring in The Philippines (INFOGRAPHIC)May YellowNo ratings yet

- Citibank vs. CA, 280 SCRA 459Document1 pageCitibank vs. CA, 280 SCRA 459SURITA, FLOR DE MAE PNo ratings yet

- 10 42 Vat at GlanceDocument19 pages10 42 Vat at Glanceemmanuel JohnyNo ratings yet

- Other Income Tax AccountingDocument19 pagesOther Income Tax AccountingHabtamu Hailemariam AsfawNo ratings yet

- Guideline in The Transfer of Titles of Real PropertyDocument4 pagesGuideline in The Transfer of Titles of Real PropertyLeolaida AragonNo ratings yet

- Recent Development of 194QDocument4 pagesRecent Development of 194QnamanojhaNo ratings yet

- Value Added TaxationDocument6 pagesValue Added Taxationapi-3822396No ratings yet

- Taxation of Partnerships (Autosaved)Document9 pagesTaxation of Partnerships (Autosaved)MosesNo ratings yet

- Income Taxation 1: Holding PeriodDocument4 pagesIncome Taxation 1: Holding PeriodKarl John Jay ValderamaNo ratings yet

- Goa VAT LawDocument23 pagesGoa VAT LawSiddesh ChimulkerNo ratings yet

- Vat at A GlanceDocument19 pagesVat at A GlanceABHIJIT MONDAL100% (1)

- White Paper ON VATDocument42 pagesWhite Paper ON VATMishal JainNo ratings yet

- Maharashtra Vat ActDocument20 pagesMaharashtra Vat ActAbhay JawaleNo ratings yet

- A Step-By-Step Guide To Land Title Transferring in The Philippines (INFOGRAPHIC)Document4 pagesA Step-By-Step Guide To Land Title Transferring in The Philippines (INFOGRAPHIC)Norma Johanna SanJuan Salamanca100% (1)

- Accounting For Special Transaction Final ReviewerDocument73 pagesAccounting For Special Transaction Final ReviewerLunaNo ratings yet

- Income Taxation Final Exam Please Show Solution (If Necessary)Document5 pagesIncome Taxation Final Exam Please Show Solution (If Necessary)E. RobertNo ratings yet

- Fringe BenefitDocument1 pageFringe Benefitvillegasprincessdiane0221No ratings yet

- The Conceptual Basis of Personal Income Tax, Classification of Income, Tax RatesDocument29 pagesThe Conceptual Basis of Personal Income Tax, Classification of Income, Tax RatesgunayNo ratings yet

- Note On TDSDocument3 pagesNote On TDSRadha KrishnaNo ratings yet

- CHP 3Document23 pagesCHP 3Laiba SadafNo ratings yet

- Chapter 5 AmponganDocument31 pagesChapter 5 AmponganMelchorCandelaria100% (1)

- BTMCQS ............Document40 pagesBTMCQS ............Rana SabNo ratings yet

- Tax RevDocument4 pagesTax RevCanapi AmerahNo ratings yet

- BT MCQSDocument29 pagesBT MCQSRana SabNo ratings yet

- Income Tax Law: Business Law Fom, MmuDocument21 pagesIncome Tax Law: Business Law Fom, MmuFaizun SekinNo ratings yet

- Hire PurchasesDocument3 pagesHire PurchasesseverinmsangiNo ratings yet

- Canara Vehicle Loan - (603) - Four Wheeler: NF-546 NF-965 NF-928 NF-990 NF-967 NF-373Document8 pagesCanara Vehicle Loan - (603) - Four Wheeler: NF-546 NF-965 NF-928 NF-990 NF-967 NF-373Santosh KumarNo ratings yet

- Quiz 1Document3 pagesQuiz 1Imthe OneNo ratings yet

- California Tax Information For City and County OfficialsDocument83 pagesCalifornia Tax Information For City and County Officialswmartin46No ratings yet

- Rent 1: - Claim For Rent Relief For Private Rented AccommodationDocument4 pagesRent 1: - Claim For Rent Relief For Private Rented AccommodationvkabatchNo ratings yet

- How To Deal With 206AADocument5 pagesHow To Deal With 206AAnamanojhaNo ratings yet

- Pre 3 Module 1Document2 pagesPre 3 Module 1lairadianaramosNo ratings yet

- CD - 39. Banas JR v. CADocument3 pagesCD - 39. Banas JR v. CACzarina CidNo ratings yet

- Gemstone 2 Sub FormDocument7 pagesGemstone 2 Sub FormSammyNo ratings yet

- Module 5 Philippine Income Taxation CorporationDocument63 pagesModule 5 Philippine Income Taxation CorporationFlameNo ratings yet

- The VAT On Imported Digital ProductsDocument16 pagesThe VAT On Imported Digital ProductsSBTelecom IndonesiaNo ratings yet

- AssignmentDocument5 pagesAssignmentsakshizanjage7888No ratings yet

- Homeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransFrom EverandHomeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransNo ratings yet

- Tax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesFrom EverandTax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesNo ratings yet

- Taxation NotesDocument131 pagesTaxation NotesThembela MkandlaNo ratings yet

- Strategic Taxation ReviewDocument122 pagesStrategic Taxation ReviewThembela MkandlaNo ratings yet

- Internal and External Analysis InfographicDocument5 pagesInternal and External Analysis InfographicThembela MkandlaNo ratings yet

- IC Online Strategy Competitive Analysis 9212Document2 pagesIC Online Strategy Competitive Analysis 9212Thembela MkandlaNo ratings yet