Professional Documents

Culture Documents

Audit ppt4

Audit ppt4

Uploaded by

gvkarthik8880 ratings0% found this document useful (0 votes)

6 views16 pagesCopyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

0 ratings0% found this document useful (0 votes)

6 views16 pagesAudit ppt4

Audit ppt4

Uploaded by

gvkarthik888Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

You are on page 1of 16

SRI JCBM COLLEGE,

SRINGERI

CLASS : III B.COM

SUBJECT: PRINCIPLES AND PRACTICE OF

AUDITING

LECTURER : RAJARAM H G

Principles and Practice of

Auditing

Chapter 1: Objectives Auditing

(15 marks)

Objectives of Auditing

The objectives of the auditing have

been classified under two heads:

1) Main objective /Primary

objectives

2) Subsidiary/Secondary objectives

Primary or Main objectives of Auditing

The main objective of the auditing is

To find reliability of financial position and profit and loss

statements.

To ensure that the accounts reveal a true and fair view of the

business and its transactions.

To verify and establish that at a given date balance sheet presents

true and fair view of financial position of the business and the profit

and loss account gives the true and fair view of profit or loss for the

accounting period.

To be established that accounting statements satisfy certain degree

of reliability.

To form an independent judgement and opinion about the

reliability of accounts and truth and fairness of financial state of

affairs and working results.

Secondary Objectives

1. Detection and prevention of errors: is another important

objective of auditing. Auditing ensures that there is no mis-

statement in the financial statements.

Errors can be detected through checking and vouching

thoroughly books of accounts, ledger accounts, vouchers and

other relevant information.

Meaning of Error:-Error means unintentional mistakes or

misrepresentation of facts.

Types of Errors

A. Clerical Errors : Clerical errors are those

which result on account of wrong posting

that is posting an item to a wrong account,

totalling and balancing. Such errors may be

subdivided into:

(i) Errors of Omission :

(ii) Errors of Commission :

Types of Clerical error

(i) Errors of Omission : An error of omission takes place

when a transaction is completely or partially not recorded

in books of account. For example, goods purchased from

Narendra Kumar were not recorded any where in account

books.

(ii) Errors of Commission : Errors of commission take

place when some transaction in incorrectly recorded

( wrongly entered) in books of account

For e.g. Error in writing amount in an account. For

example debiting Prem Chand' s Account with Rs. 107-

instead of Rs. 1007/-.

B. Errors of principle :

Errors of Principle take place when a

transaction is recorded without having

regard to the fundamental principles of

book-keeping and accountancy.

For example if there is incorrect allocation

of Expenditure or Receipt between Capital

& Revenue

C. Compensating Errors / off

setting Errors :-

Compensating errors arise when an error is counter

balanced or compensated by any other error so that

the adverse effect of one on debit (or credit) side is

neutralised by that of another on credit (or debit)

side.

For example Anil's account was to be debited

with Rs. 500, was credited for Rs. 500 similarly

Sunil's account which was to be credited for Rs.

500 was debited for Rs. 500. Both these errors

compensate each other's deficiency

D. Errors of Duplication

D. Errors of Duplication

Such errors arise when an entry in a book

of original entry has been made twice & had

also been posted twice.

Types of Frauds

Meaning of Fraud :These are intentional

errors and wanted misrepresentations and

failure to disclose the materialistic facts to

the transactions in the books of accounts.

Such as.

1.Misappropriation of Cash:

2. Misappropriation of Goods:

3. Fraudulent Manipulation of Accounts

/Forgery Vouchers:

1.Misappropriation of Cash:

Cash is the highly exploitation asset in the business, auditor

check receipts and payments of cash in order to detect and

prevent cash embezzlement (Misappropriation) of cash.

Cash may be misappropriated by,

(a) Omitting to enter any cash which has been received; or

(b) Entering less account than what has been actually

received; or

(c) making fictitious entries on the payment side of the cash

book; or

(d) entering more amount on the payment side of the Cash

Book than what has been actually paid.

2. Misappropriation of Goods:

Fraudulent application of goods by those who

handle them e.g. recording purchase of large

quantities receiving less quantity & than

receiving the balance amount privately.

Proper methods of keeping accounts in

regard to purchases and sales, stock,

periodical checking of stocks, will help to

avoid misappropriation of goods.

3. Fraudulent Manipulation of Accounts

/Forgery Vouchers:

Manupulation has made less or no profit without disclosing that fact to the

shareholders etc. These are the fake evidences produced to auditor in the

process of auditing. Such must be identified by the auditor.

This type of fraud is more difficult to discover as it is usually committed

by directors or managers or other responsible officials. That is why the

auditor should be very careful in detecting such frauds. He should carry out

the routine checking and vouching most carefully and make searching,

tactful and intelligent enquiries

The accounts may be manipulated in a number of ways which are as

follows:

1. by not providing any depreciation or less depreciation or more

depreciation; or

2. by under valuation or over-valuation of assets and liabilities; or

3. by the utilization of secret reserves during a period when the concer

Conclusion of objectives in simple words:

According to the section 143 of companies act 2013,

Primary Objective of auditing is to report

the owners whether the financial statement

provides true and fair view of financial

matters of the company.

Secondary Objective is to Detection and

prevention of frauds and detection and

prevention of errors.

Thank You

You might also like

- The Objective of An Audit Is To Express An Opinion On Financial StatementsDocument10 pagesThe Objective of An Audit Is To Express An Opinion On Financial StatementsB. AnbarasuNo ratings yet

- Sybcom Sem Iv - Audit Chapter 1 & 2Document24 pagesSybcom Sem Iv - Audit Chapter 1 & 2Pravin KharateNo ratings yet

- Auditing Notes.Document50 pagesAuditing Notes.Taskeen ZafarNo ratings yet

- Objectives of AuditingDocument22 pagesObjectives of AuditingArjun M JimmyNo ratings yet

- Objectives of AuditDocument4 pagesObjectives of AuditSana ShafiqNo ratings yet

- Unit IDocument17 pagesUnit IThiri PhwayNo ratings yet

- Material Auditing1 5Document86 pagesMaterial Auditing1 5Akshat RanaNo ratings yet

- Unit 1 Meaning and Definition of AuditingDocument88 pagesUnit 1 Meaning and Definition of AuditingsdfghjkNo ratings yet

- AdtngDocument34 pagesAdtngRizwana BegumNo ratings yet

- Bba203 Financial AccountingDocument14 pagesBba203 Financial AccountingAshish JoshiNo ratings yet

- AuditingDocument85 pagesAuditingAiyub Uddin100% (1)

- Audit ppt3Document12 pagesAudit ppt3gvkarthik888No ratings yet

- Auditing Notes Explained PDFDocument50 pagesAuditing Notes Explained PDFImran khanNo ratings yet

- Chapter # 1: Introduction To AuditingDocument2 pagesChapter # 1: Introduction To AuditingGhalib HussainNo ratings yet

- Auditing Notes.Document50 pagesAuditing Notes.Vicky MemonNo ratings yet

- Unit 1 Introduction To AuditingDocument33 pagesUnit 1 Introduction To AuditingyashwanthbnyashwanthNo ratings yet

- Principles and Practices of Auditing. III Bcom V Sem (Nep)Document111 pagesPrinciples and Practices of Auditing. III Bcom V Sem (Nep)sagarasbushisNo ratings yet

- Unit I (A) Notes Meaning of AuditingDocument5 pagesUnit I (A) Notes Meaning of AuditingsdddNo ratings yet

- Principles of Auditing - Chapter - 1Document36 pagesPrinciples of Auditing - Chapter - 1Wijdan Saleem EdwanNo ratings yet

- What Is Auditing? What Are The Objectives of Auditing?Document3 pagesWhat Is Auditing? What Are The Objectives of Auditing?rs9999No ratings yet

- Unit 1Document25 pagesUnit 1Ram KrishnaNo ratings yet

- PURPOSE, Merits and Demerits of AuditingDocument7 pagesPURPOSE, Merits and Demerits of AuditingJoe Fernandes100% (3)

- Explain Objectives of AuditingDocument44 pagesExplain Objectives of AuditingsdfghjkNo ratings yet

- Introduction To AuditingDocument8 pagesIntroduction To AuditingsamyogforuNo ratings yet

- Answers 142-162Document19 pagesAnswers 142-162AKHLAK UR RASHID CHOWDHURYNo ratings yet

- Objectives of AuditDocument11 pagesObjectives of AuditpoojaNo ratings yet

- Mod 5 - AuditingDocument51 pagesMod 5 - AuditingInchara S Dept of MBANo ratings yet

- Chapter - I Introduction To Auditing: Meaning of AuditDocument28 pagesChapter - I Introduction To Auditing: Meaning of AuditJeeva JeevaNo ratings yet

- Module 2 Misstatement in The Financial StatementsDocument12 pagesModule 2 Misstatement in The Financial StatementsChristine CariñoNo ratings yet

- Auditing PDF 1.1Document18 pagesAuditing PDF 1.1anilanitha974No ratings yet

- Bcom 3 Audit FinalDocument17 pagesBcom 3 Audit FinalNayan MaldeNo ratings yet

- Summary Business EngDocument4 pagesSummary Business EngGuggakNo ratings yet

- Topic 6 GermicDocument47 pagesTopic 6 Germicadrianmenoza1432No ratings yet

- Despite The Many Benefits of Using RatiosDocument5 pagesDespite The Many Benefits of Using RatiosBijal JethvaNo ratings yet

- Auditing SabaDocument38 pagesAuditing SabaBhup EshNo ratings yet

- Project Auditing of A Insurance CompanyDocument42 pagesProject Auditing of A Insurance CompanyJayesh Shirodkar50% (2)

- Module 2 - Misstatements in The Financial StatementsDocument11 pagesModule 2 - Misstatements in The Financial StatementsIvan LandaosNo ratings yet

- What Is AuditingDocument23 pagesWhat Is AuditingDeepa RamanathanNo ratings yet

- Audit Unit 1 Notes RADocument14 pagesAudit Unit 1 Notes RAAniket KillekarNo ratings yet

- PRINCIPLES OF AUDITING Bharathiar University III B COM PADocument59 pagesPRINCIPLES OF AUDITING Bharathiar University III B COM PAkalpana100% (1)

- Errors & FraudsDocument27 pagesErrors & FraudsmostakNo ratings yet

- AuditingDocument54 pagesAuditingSuresh ReddyNo ratings yet

- Audit of CashDocument23 pagesAudit of CashmeseleNo ratings yet

- Auditing NotesDocument73 pagesAuditing Notesvivekrawatsingh9084No ratings yet

- Principles and Practice of Auditing - Chapter 01Document26 pagesPrinciples and Practice of Auditing - Chapter 01reddyvarshini05No ratings yet

- Auditing Notes.Document55 pagesAuditing Notes.Viraja Guru100% (1)

- Auditing Unit 1Document39 pagesAuditing Unit 1Haseeb AhmedNo ratings yet

- Auditing Principles and Practices - I: An Overview of AuditingDocument46 pagesAuditing Principles and Practices - I: An Overview of AuditingGetie TigetNo ratings yet

- Capital MarketsDocument4 pagesCapital MarketsannushindeNo ratings yet

- Introduction To Auditing by - Shubham Patti, Bcom 2, 2057Document15 pagesIntroduction To Auditing by - Shubham Patti, Bcom 2, 2057Shubham PattiNo ratings yet

- Fraud Through DefalcationDocument28 pagesFraud Through DefalcationRaj IslamNo ratings yet

- Auditing First ChapterDocument11 pagesAuditing First Chapterramu gowdaNo ratings yet

- د فوزي انشاء اسئله بعد الميد تيرمDocument12 pagesد فوزي انشاء اسئله بعد الميد تيرمomar hanyNo ratings yet

- Lecture 3 B - Errors and FraudsDocument14 pagesLecture 3 B - Errors and FraudsalooyxvNo ratings yet

- BOOKKEEPINGDocument6 pagesBOOKKEEPINGsserugo dodovicNo ratings yet

- Principles of AuditingDocument81 pagesPrinciples of AuditingSahana Sameer KulkarniNo ratings yet

- Objectivesofauditing 200715072549Document18 pagesObjectivesofauditing 200715072549hitaler.raazNo ratings yet

- Auditing Notes.Document55 pagesAuditing Notes.Viraja Guru50% (2)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 3.5 out of 5 stars3.5/5 (2)

- GAAP Vs IFRSDocument4 pagesGAAP Vs IFRSNovand DwikiNo ratings yet

- Unit - 1 Introduction To AuditingDocument10 pagesUnit - 1 Introduction To AuditingDarshan PanditNo ratings yet

- Ac417 Questions & Answers - Gzu (2020)Document96 pagesAc417 Questions & Answers - Gzu (2020)Tawanda Tatenda Herbert100% (1)

- Audit Kamal GargDocument54 pagesAudit Kamal GargBijay AgrawalNo ratings yet

- Cs Executive: Corporate & Management AccountingDocument258 pagesCs Executive: Corporate & Management AccountingAksharaNo ratings yet

- Fsa 04Document24 pagesFsa 04ferahNo ratings yet

- Audit and Assurance Concept and Application Chapter 1Document12 pagesAudit and Assurance Concept and Application Chapter 1Ceejay FrillarteNo ratings yet

- Fundamentals of Accountancy Business and ManagementDocument7 pagesFundamentals of Accountancy Business and ManagementJayNo ratings yet

- Module 7 - Completing The Accounting CycleDocument6 pagesModule 7 - Completing The Accounting CycleMJ San PedroNo ratings yet

- You Are The Management Accountant of Expand A Company IncorporatedDocument1 pageYou Are The Management Accountant of Expand A Company IncorporatedTaimour HassanNo ratings yet

- FA AssignmentDocument11 pagesFA AssignmentImran FarhanNo ratings yet

- Business Finance: Review of Financial Statement Preparation, Analysis and InterpretationDocument32 pagesBusiness Finance: Review of Financial Statement Preparation, Analysis and InterpretationAce BautistaNo ratings yet

- C Ts4fi 1909Document26 pagesC Ts4fi 1909Oriol CasesNo ratings yet

- AAA - Mock Exam 1Document42 pagesAAA - Mock Exam 1Myo NaingNo ratings yet

- Accounting 22 - Final Exam - 2023Document9 pagesAccounting 22 - Final Exam - 2023LaurenNo ratings yet

- Group 4 - Assignment #7Document20 pagesGroup 4 - Assignment #7Rhad Lester C. MaestradoNo ratings yet

- FR Practice Questions PDF-6Document16 pagesFR Practice Questions PDF-6tugaNo ratings yet

- Audit ConflictDocument17 pagesAudit Conflictshahin2014100% (1)

- Additional Financial Reporting Issues: Chapter OutlineDocument26 pagesAdditional Financial Reporting Issues: Chapter OutlineFernando III PerezNo ratings yet

- Ethical Obligations and Decision Making in Accounting Text and Cases 3Rd Edition Mintz Test Bank Full Chapter PDFDocument68 pagesEthical Obligations and Decision Making in Accounting Text and Cases 3Rd Edition Mintz Test Bank Full Chapter PDFSoniaLeecfab100% (11)

- CHapter 05 Allocation and Depreciation of Differences Between Implied and Book Values AcquisitionDocument41 pagesCHapter 05 Allocation and Depreciation of Differences Between Implied and Book Values AcquisitionAchmad RizalNo ratings yet

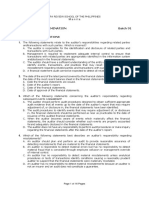

- AUD Final Preboard Examination QuestionnaireDocument16 pagesAUD Final Preboard Examination QuestionnaireJoris YapNo ratings yet

- KTQT 3 Trang 1 2353 260 Đã G PDocument261 pagesKTQT 3 Trang 1 2353 260 Đã G PKim HồngNo ratings yet

- 5038 - Assignment 2 Brief 2022Document8 pages5038 - Assignment 2 Brief 2022Hương ĐỗNo ratings yet

- Audit of Cash and Marketable SecuritiesDocument21 pagesAudit of Cash and Marketable Securitiesዝምታ ተሻለNo ratings yet

- Final Test - KPMG - A - 3.19.2018Document3 pagesFinal Test - KPMG - A - 3.19.2018ĐẶNG THỊ THU HÀNo ratings yet

- Mid Test FRC Blemba 69 Evening ClassDocument2 pagesMid Test FRC Blemba 69 Evening ClasscatatankotakkuningNo ratings yet

- Putting IFRS 9 Into Practice Presentation By: CPA Stephen Obock February 2018Document38 pagesPutting IFRS 9 Into Practice Presentation By: CPA Stephen Obock February 2018syed younasNo ratings yet

- BCOMIT AUD3T CStudyDocument5 pagesBCOMIT AUD3T CStudyMr Z AbrahamsNo ratings yet

- SEC Memorandum Circular No. 3 (Series of 2018) - 2018 Filing of Annual Financial Statements and General Information Sheet PDFDocument3 pagesSEC Memorandum Circular No. 3 (Series of 2018) - 2018 Filing of Annual Financial Statements and General Information Sheet PDFvanessa_3No ratings yet