Professional Documents

Culture Documents

CH-2 Ethiopian Banking Sector

CH-2 Ethiopian Banking Sector

Uploaded by

addisu beza0 ratings0% found this document useful (0 votes)

7 views20 pagesOriginal Title

CH-2 Ethiopian Banking Sector (1)

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

7 views20 pagesCH-2 Ethiopian Banking Sector

CH-2 Ethiopian Banking Sector

Uploaded by

addisu bezaCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 20

CHAPTER TWO

Ethiopian Banking Sector

Organization and Structure of Ethiopian

Banking Industry

The banking sector of Ethiopia composed of the central bank, the

National Bank of Ethiopia (NBE), and 31 commercial/private

banks.

Ethiopia has allowed foreign banks to provide liaison service for

their country of origins. E.g; Chanies, Germeny, Turkish, Keneya

and South Africa.

CBE was legally established as a share company in 1963.

CBE has more than 37.9 million account holders in its more than

1900 branches.

he National Bank of Ethiopia was established in 1963 by

proclamation 206 of 1963.

The Bank used to carry out dual activities, i.e. commercial banking

and central banking.

Other Financial Institution in Ethiopia

Micro finance Institutions:

MFIs are provide small loans to people who do not have any access

to banking facilities.

Currently in Ethiopia there are about 45 microfinance institutions.

(E.g. Amhara, oromia, Dedebit Credit and Saving Institutions)

Vision fund, Omo…etc.

The major objectives of microfinance are to help in generating

income for low-income households and help in alleviating poverty.

Initial capital required by the National Bank of Ethiopia

has 75 million Birr on the replaced 2015 legislation, became

effective as of Jan 16, 2023.

Major challenge of MFIs in Ethiopia are ow outreach, fund

shortage, limited product diversification, limited research and

innovation, and weak internal control system.

Other Financial Institution in Ethiopia

Saving and Credit Associations:

SACCOs are voluntary associations where by members regularly

pool their savings, and subsequently obtain loans which they use

for different purposes.

A cooperative society is a form of a business organization or a

group of people who agree to voluntarily associate.

Savings and Credit Cooperatives (SACCOs) in Ethiopia - over

21,000 in total - can play an important role in financial inclusion.

In Ethiopia there are three types of saving and credit

cooperatives, Institution based SACCOs; Community based

SACCOs; and sponsored by NGOs SACCOs.

The objective of SACCos are bringing broad-based development

and poverty alleviation in Urban and Rural area as they were

permitted to take deposit from and grant loan to members.

Central Banks

A central bank, reserve bank, or monetary authority is a

banking institution granted the exclusive privilege to lend

a government its currency.

It is the entity responsible for overseeing the monetary

system for a nation (or group of nations).

Central banks have a wide range of responsibilities,

from overseeing monetary policy to implementing

specific goals such as currency stability, low inflation

and full employment. Central banks also generally issue

currency, function as the bank of the government, regulate

the credit system, oversee commercial banks, manage

exchange reserves and act as a lender of last resort.

Nature of Central Banks

A bank which is entrusted with the functions of guiding

and regulating the banking system of a country is known

as Central bank.

Such a bank does not deal with the general public. It acts

essentially as Government’s banker; maintain deposit

accounts of all other banks and advances money to other

banks, when needed. The Central Bank provides

guidance to other banks whenever they face any problem.

It is therefore known as the banker’s bank. The central

bank also has the function of controlling commercial

banks and various other economic activities.

Objectives of Central Banks

For the economic interests of the nation, consistent with government

economic policy.

Monetary policy :- stability in the domestic purchasing power of

the currency

Financial stability: - mitigate financial risks and provide stability

Payment System:- supervise the smooth operation of the clearing

and payment system

Employment, growth and welfare objectives

Support policies of government

Achieve surplus or profits

To regulate the supply, availability and cost of money and credit.

To manage and administer the country's international reserves

To license & supervise banks & hold commercial banks reserves

& lend money to them.

Functions of Central Bank

In the monetary and banking setup of a country, central

bank occupies central position and perhaps, it is because

of this fact that this called as the central bank. In this

way, this bank works as an institution whose main

objective is to control and regulate money supply

keeping in view the welfare of the people.

Central bank is an institution that fulfills the credit needs

of banks and other credit institution, which woks as

banker to the banks and the government and which work

for the economic interest of the country. The following

are functions of central bank;

1. Monetary Stability Functions

Monetary policy: refers to credit control measures

adopted by central banks of a country. It also refers

to a policy employing central bank’s control of the

supply of money as an instrument for achieving the

objective of general economic policy.

Any conscious action undertaken by the monetary

authorities to change the quantity, availability, or

cost … of money.

Financial stability policy

Monetary Policy

Exchange Rate Policy

Monetary Policy Objectives

Principal objectives of Monetary Policy:

Price Stability

Balance of Payment

Economic Growth

Full Employment

Central Bank and objectives of Credit

Control

The credit control is the means to control the lending

policy of Commercial banks by the central bank to

achieve the following objectives

To stabilize the internal price level

To stabilize the rate of foreign exchange

To protect the outflow of gold

To control business cycles

To meet business needs

To have growth with stability.

Controller of Credit

This is the most important function of the bank in order

to control inflation and deflation through adopting

quantitative and qualitative methods.

Quantitative methods aim at controlling the cost and

quantity of credit by adopting:

Bank rate policy

Open market operation and

By variation in reserve ratio of commercial banks

Qualitative methods control the use and direction of

credit through:

Selective credit control and

Direct action

2. Regulatory Functions

Financial stability policy and oversight of the financial system.

Involved in licensing, supervision and in intervention (of

financial institutions) to require corrective action

Additional controlling functions of Central banks include

regulation of branch expansion, to see that every bank maintains

the minimum paid up capital and reserve as provided by law ,

inspection or auditing the accounts of banks, control and

recommend merger of weak banks in order to avoid their

failures and to protect interest of depositors, and recommend

nationalization of certain banks to the government in public

interest.

Prudential policy development

Supervision and Oversight

3. Policy Operation Functions

Operations to support policy are

prominent among the functions of central

banks

Foreign Exchange (FX) reserve management

(Reserve and Intervention)

Liquidity Management (overall market

liquidity)

Lender of Last Resort (Individual institution's

liquidity)

4. Financial Infrastructure Provision Functions

Provision of infrastructure for the financial system is a

dominating function of central banking

Issuance of currency (Design, Print and Mint) and the

management of its circulation; the provision of banking

services to commercial banks and the government; and

the provision of a system for the exchange of central

bank money in settlement of transactions.

Banking/account management services

Payment System (Inter-Bank)

Settlement system for central bank money

Other settlement systems

Registry provision (recording the ownership of assets (primarily securities) and for

recording debts)

5. Other Public Good Functions

Central banks act as the government’s

banker

Central banks provide extensive

account management services to

government and agencies of the state

Maintain accounts

Make and receive payments

6. Responsibility for debt and asset management and

other public good functions

Agent role to the government

Asset management

Debt management

Development Functions

Research

Consumer services

To approve the appointment of chairpersons

and directors of such banks in accordance

with the rules and qualifications

To control and recommend merger of weak

banks in order to avoid their failures and to

protect interest of depositors

To recommend nationalization of certain

banks to the government in public interest

To publish periodical reports relating to

different aspects of monetary and economic

policies

You might also like

- Understand Banks & Financial Markets: An Introduction to the International World of Money & FinanceFrom EverandUnderstand Banks & Financial Markets: An Introduction to the International World of Money & FinanceRating: 4 out of 5 stars4/5 (9)

- Zangi TestDocument20 pagesZangi TestEng Hinji RudgeNo ratings yet

- Banking Financial Institutions By: Jessica Ong: 1. Define Central BankDocument5 pagesBanking Financial Institutions By: Jessica Ong: 1. Define Central BankJessica Cabanting OngNo ratings yet

- Central Bankig and Its Funtions NewDocument21 pagesCentral Bankig and Its Funtions NewnadeemhumdardNo ratings yet

- Hid - Chapter 3 2015Document91 pagesHid - Chapter 3 2015hizkel hermNo ratings yet

- Central Bank FunctionsDocument3 pagesCentral Bank FunctionsPrithi Agarwal50% (2)

- L 012 - Banking SystemDocument5 pagesL 012 - Banking SystemFelix OkinyiNo ratings yet

- Central Bank's FunctionsDocument14 pagesCentral Bank's FunctionsH-Sam PatoliNo ratings yet

- The Evolution of Central BankingDocument6 pagesThe Evolution of Central Bankingdamenegasa21No ratings yet

- 3 Chapter 3 Financial Institutions and Their Operations Lecture NotesDocument133 pages3 Chapter 3 Financial Institutions and Their Operations Lecture NotesAnimaw Yayeh100% (4)

- Central Bank: Presented By: Zara (1711332) Bba - 5BDocument14 pagesCentral Bank: Presented By: Zara (1711332) Bba - 5BWajeeha RizwanNo ratings yet

- Central BankingDocument3 pagesCentral BankingVenkat IyerNo ratings yet

- Central Bank and Its FunctionsDocument4 pagesCentral Bank and Its FunctionsHassan Sardar Khattak100% (4)

- Tutorial 3 AnswersDocument10 pagesTutorial 3 Answerskung siew houngNo ratings yet

- Banking Chapter 2Document7 pagesBanking Chapter 2Tilahun MikiasNo ratings yet

- Central Banking and Functions of Central BankDocument82 pagesCentral Banking and Functions of Central Bankjoshjeth100% (1)

- Chapter 2Document8 pagesChapter 2Muhammed YismawNo ratings yet

- Banking Notes The Primary Function of A Central BankDocument4 pagesBanking Notes The Primary Function of A Central Banknatafilip10No ratings yet

- Chapter 6 BDocument25 pagesChapter 6 Bbirook27No ratings yet

- MacroDocument3 pagesMacroHani AmirNo ratings yet

- Law and Practice of Banking Assignment - 1Document4 pagesLaw and Practice of Banking Assignment - 1SALIM SHARIFUNo ratings yet

- Unit 5 - Central BankDocument21 pagesUnit 5 - Central Banktempacc9322No ratings yet

- Level Two Unit TwoDocument12 pagesLevel Two Unit Twodawitesayas0No ratings yet

- A Central Bank or Reserve Bank, or Monetary Authority Is An InstitutionDocument14 pagesA Central Bank or Reserve Bank, or Monetary Authority Is An InstitutionVEDANT BASNYATNo ratings yet

- Functions of Central Bank PDFDocument27 pagesFunctions of Central Bank PDFPuja BhardwajNo ratings yet

- Banking Law 5-6Document32 pagesBanking Law 5-6q22jvm6qpfNo ratings yet

- Differences Between A Central Bank and Commercial BankDocument4 pagesDifferences Between A Central Bank and Commercial BankMuhammadZariyan AsifNo ratings yet

- Financial Markets and Resource MobilizationDocument13 pagesFinancial Markets and Resource MobilizationFred Raphael Ilomo100% (3)

- Functions of Central BankDocument6 pagesFunctions of Central Bankshaan19No ratings yet

- FE Chapter 3Document36 pagesFE Chapter 3dehinnetagimasNo ratings yet

- Chapter Two Central BankDocument6 pagesChapter Two Central BankMeaza BalchaNo ratings yet

- 2.1.1 The Concepts of Central BankingDocument9 pages2.1.1 The Concepts of Central Bankingjoel minaniNo ratings yet

- Role of Central Bank & Credit Creation of Commercial BanksDocument44 pagesRole of Central Bank & Credit Creation of Commercial Banksdua tanveerNo ratings yet

- Central BankDocument17 pagesCentral BankSania ZaheerNo ratings yet

- Central Banking PDFDocument112 pagesCentral Banking PDFSK Mishra100% (2)

- Central BankDocument9 pagesCentral BanksakibNo ratings yet

- FIN 004 Module 2Document5 pagesFIN 004 Module 2lianna marieNo ratings yet

- BankingDocument168 pagesBankingVaishnav Kumar100% (1)

- CB Chapter 1Document26 pagesCB Chapter 1bikesNo ratings yet

- Week 1 Week 2 NotesDocument30 pagesWeek 1 Week 2 NotesNourhan KhaterNo ratings yet

- Functions of Central BankDocument4 pagesFunctions of Central BankK8suser JNo ratings yet

- Regulation of Financial Institutions7Document6 pagesRegulation of Financial Institutions7Jacy VykeNo ratings yet

- Central Bank (2 Files Merged)Document8 pagesCentral Bank (2 Files Merged)Atika ParvazNo ratings yet

- Chapter TwoDocument26 pagesChapter Twodamenegasa21No ratings yet

- Role of Central Bank With Special Reference To The Nepal Rastra BankDocument2 pagesRole of Central Bank With Special Reference To The Nepal Rastra BankShambhav Lama100% (1)

- Theory of Central BankingDocument5 pagesTheory of Central BankingR SURESH KUMAR IINo ratings yet

- Chapter Two: Banking SystemDocument45 pagesChapter Two: Banking Systemዝምታ ተሻለNo ratings yet

- Reserve Bank of IndiaDocument25 pagesReserve Bank of IndiaUdayan SamirNo ratings yet

- Chapter 3.3Document6 pagesChapter 3.3Jimmy LojaNo ratings yet

- Subsidiaries of SBP: Banking Service Corporation (SBP-BSC)Document17 pagesSubsidiaries of SBP: Banking Service Corporation (SBP-BSC)hunzakhalidNo ratings yet

- Answer 8: Difference Between Central Bank and Commercial Banks in IndiaDocument8 pagesAnswer 8: Difference Between Central Bank and Commercial Banks in IndiaEsha WaliaNo ratings yet

- Overview of Financial System: Prof. Mishu Tripathi Asst. Professor-FinanceDocument16 pagesOverview of Financial System: Prof. Mishu Tripathi Asst. Professor-FinanceAashutosh SinghNo ratings yet

- Chapter Two Financial Institutions and Their Operations LectureDocument147 pagesChapter Two Financial Institutions and Their Operations LectureAbdiNo ratings yet

- What Is Central Banking System?Document52 pagesWhat Is Central Banking System?Anosh khanNo ratings yet

- Part BDocument4 pagesPart Blucxu2003No ratings yet

- Role of Reserve Bank of IndiaDocument17 pagesRole of Reserve Bank of IndiaLovelymaryNo ratings yet

- CH 5 Central BankDocument5 pagesCH 5 Central Bankሔርሞን ይድነቃቸውNo ratings yet

- Eco Project 2Document25 pagesEco Project 2siddharthNo ratings yet

- SoC Retail Deposits 08 11 2022Document6 pagesSoC Retail Deposits 08 11 2022Dihan AbdullahNo ratings yet

- Financial Awareness Capsule PDF For SBI Clerk Mains 2024Document40 pagesFinancial Awareness Capsule PDF For SBI Clerk Mains 2024ssimu6967No ratings yet

- Indian Income Tax Return Acknowledgement: Acknowledgement Number:566129350221223 Date of Filing: 22-Dec-2023Document1 pageIndian Income Tax Return Acknowledgement: Acknowledgement Number:566129350221223 Date of Filing: 22-Dec-2023Rajesh DasNo ratings yet

- Group Structure ChartDocument1 pageGroup Structure ChartPaul ChanNo ratings yet

- Kotak BankDocument78 pagesKotak BankRupesh ShingareNo ratings yet

- Pay Period 01.01.2014 To 31.01.2014: Income Tax ComputationDocument1 pagePay Period 01.01.2014 To 31.01.2014: Income Tax ComputationSumit ChakrabortyNo ratings yet

- Bryan Maulana Ibrahim - XII AKL 2 - PT Nusa Raya - Keseluruhan JurnalDocument3 pagesBryan Maulana Ibrahim - XII AKL 2 - PT Nusa Raya - Keseluruhan JurnalBryan Maulana IbrahimNo ratings yet

- Swift Codes Sri LankaDocument1 pageSwift Codes Sri LankadilhanigalapitageNo ratings yet

- Historical Background of RHB Bank PDFDocument5 pagesHistorical Background of RHB Bank PDFtuan nasiruddinNo ratings yet

- Application of Gratuity by A NomineeDocument5 pagesApplication of Gratuity by A NomineelibinpouloseNo ratings yet

- Usaa Receipt ShareDocument8 pagesUsaa Receipt ShareRohan DuncanNo ratings yet

- Top 4 Lifetime Free Credit Cards That You Should Look Out For in JULY 2023Document3 pagesTop 4 Lifetime Free Credit Cards That You Should Look Out For in JULY 2023Anchal ChopraNo ratings yet

- Cardholder Dispute Application Form, SPDocument3 pagesCardholder Dispute Application Form, SPpichpichcambodiaNo ratings yet

- Financial Market: Interest RatesDocument18 pagesFinancial Market: Interest RatesAMNo ratings yet

- IGCSE-OL - Bus - CH - 20 - Answers To CB ActivitiesDocument3 pagesIGCSE-OL - Bus - CH - 20 - Answers To CB ActivitiesOscar WilliamsNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument11 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balanceiblfinserv0No ratings yet

- Competition and Crisis in Mortgage SecuritizationDocument63 pagesCompetition and Crisis in Mortgage Securitizationstuff8No ratings yet

- FDFD 1 FC 32 ADocument4 pagesFDFD 1 FC 32 Am5x95q92zmNo ratings yet

- Basic Long-Term Financial ConceptsDocument40 pagesBasic Long-Term Financial ConceptsBr. Ivan Karlo Umali FSCNo ratings yet

- SBA PPP Loan Calculator - CARES ActDocument2 pagesSBA PPP Loan Calculator - CARES ActJay Mike100% (3)

- Contract Grantee AgreementDocument6 pagesContract Grantee Agreementmanukar404No ratings yet

- General Mathematics Quarter 2 ExaminationDocument6 pagesGeneral Mathematics Quarter 2 ExaminationDina Jean Sombrio100% (1)

- HDB CalculationDocument11 pagesHDB CalculationMuhammad Sufian RamliNo ratings yet

- e-StatementBRImo 006401069903504 Dec2023 20240109 163527Document6 pagese-StatementBRImo 006401069903504 Dec2023 20240109 163527almukfaj88No ratings yet

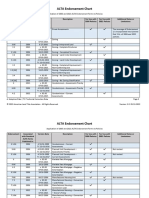

- ALTA Endorsement Chart V 02.0 05-12-2022Document11 pagesALTA Endorsement Chart V 02.0 05-12-2022Robert CastilloNo ratings yet

- SkitDocument3 pagesSkitopraghav333No ratings yet

- Lpam Practical Exercises 2024 - 1Document9 pagesLpam Practical Exercises 2024 - 1simoneeaveningNo ratings yet

- Property Law ProjectDocument19 pagesProperty Law ProjectSative Chauhan0% (1)

- Filename 3Document9 pagesFilename 3pporwal197No ratings yet

- V 6109629839424099312Document11 pagesV 6109629839424099312status upadterNo ratings yet