Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

2 viewsPractice Asgn

Practice Asgn

Uploaded by

Leo Raheelnil

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You might also like

- CHAPTER 5 (1st Part) - ANNUAL CASH FLOW ANALYSISDocument6 pagesCHAPTER 5 (1st Part) - ANNUAL CASH FLOW ANALYSISSandipNo ratings yet

- PracticeDocument5 pagesPracticearif khanNo ratings yet

- Literature Review 1 PageDocument9 pagesLiterature Review 1 PageMahbub HussainNo ratings yet

- Lec 6Document17 pagesLec 6abbas96pkNo ratings yet

- GGFGGDocument12 pagesGGFGGkarimNo ratings yet

- Ch. 6 - Annual Worth AnalysisDocument7 pagesCh. 6 - Annual Worth AnalysisSidra IqbalNo ratings yet

- WRD720S-2022 - Engineering Feasibility Econ - Examples 1 - 4 & Solutions RevDocument11 pagesWRD720S-2022 - Engineering Feasibility Econ - Examples 1 - 4 & Solutions RevMeg TNo ratings yet

- Quiz Model AnswerDocument4 pagesQuiz Model Answerفن ميكسNo ratings yet

- Economy OK.2016 MS.CDocument3 pagesEconomy OK.2016 MS.Cabdullah 3mar abou reashaNo ratings yet

- Economy OK.2022 MS.CDocument4 pagesEconomy OK.2022 MS.Cabdullah 3mar abou reashaNo ratings yet

- Soal EtkDocument2 pagesSoal EtkNiswatun ChasanahNo ratings yet

- 10 Nomor EkotekDocument18 pages10 Nomor EkotekNurman WibisanaNo ratings yet

- Homework 3 Egr OumaimaDocument6 pagesHomework 3 Egr Oumaimaoumaidi123No ratings yet

- Assignment 3Document8 pagesAssignment 3octoNo ratings yet

- 06 Annual Worth AnalysisDocument19 pages06 Annual Worth Analysis王泓鈞No ratings yet

- Energy System Analysis (Ryoichi Komiyama) : Plan A (Emergency Generator) Plan B (Solar PV) Plan C (Thermal Power Gen.)Document2 pagesEnergy System Analysis (Ryoichi Komiyama) : Plan A (Emergency Generator) Plan B (Solar PV) Plan C (Thermal Power Gen.)adehidNo ratings yet

- Ch-06 Cost AllocationDocument1 pageCh-06 Cost AllocationEbsa AbdiNo ratings yet

- 1 Mutually Exclusive and Independent ProjectsDocument34 pages1 Mutually Exclusive and Independent ProjectsAngel NaldoNo ratings yet

- Group 6 Revised (ABC)Document11 pagesGroup 6 Revised (ABC)Jeremiah NcubeNo ratings yet

- DownloadDocument18 pagesDownloadGaurav MandotNo ratings yet

- Comparing InvestmentsDocument59 pagesComparing InvestmentsKondeti Harsha VardhanNo ratings yet

- Module 8 Benefit Cost RatioDocument13 pagesModule 8 Benefit Cost Ratiozulma siregarNo ratings yet

- BreakevenDocument3 pagesBreakevenMae Florizel FalculanNo ratings yet

- 610 HWset 9 S14Document2 pages610 HWset 9 S14deepikaNo ratings yet

- Engineering Economy Homework 3: Student Name: Student IDDocument4 pagesEngineering Economy Homework 3: Student Name: Student IDMinh TríNo ratings yet

- Chapter 5 ExercisesDocument12 pagesChapter 5 ExercisesIsaiah BatucanNo ratings yet

- 30 Year 10% 0%: Q. Use The Present Worth Method To Determine The Total Cost (LCC) of The Three Alternatives BelowDocument13 pages30 Year 10% 0%: Q. Use The Present Worth Method To Determine The Total Cost (LCC) of The Three Alternatives BelowPMPNo ratings yet

- UY. ProjMgtExer3Document2 pagesUY. ProjMgtExer3Young BloodNo ratings yet

- Solution Assigment Chapter 5Document11 pagesSolution Assigment Chapter 5Hoang Thao NhiNo ratings yet

- Engineering Economy Alday Ric Harold MDocument6 pagesEngineering Economy Alday Ric Harold MHarold AldayNo ratings yet

- Chap. 6Document8 pagesChap. 6Khuram MaqsoodNo ratings yet

- Economy Exam - .2016 Final MSCDocument3 pagesEconomy Exam - .2016 Final MSCabdullah 3mar abou reashaNo ratings yet

- AAADocument7 pagesAAAHamis Mohamed100% (1)

- Assignment 2 SolutionDocument7 pagesAssignment 2 SolutionMahmoud El-GarhyNo ratings yet

- Activity Based Costing - SolutionDocument19 pagesActivity Based Costing - Solutionsyedsajid1990No ratings yet

- Mcgraw-Hill, Inc: Lecture Notes 5Document6 pagesMcgraw-Hill, Inc: Lecture Notes 5Hassan ShehadiNo ratings yet

- Replacement Theory: 20P204 - ASHWIN R 20P217 - Prithivirajan V 20P220 - Vijay Vignesh S 21P402 - Gurumoorthy DDocument20 pagesReplacement Theory: 20P204 - ASHWIN R 20P217 - Prithivirajan V 20P220 - Vijay Vignesh S 21P402 - Gurumoorthy D21P410 - VARUN MNo ratings yet

- EE - Assignment Chapter 5 SolutionDocument10 pagesEE - Assignment Chapter 5 SolutionXuân ThànhNo ratings yet

- Module - II (Session 6,7,8)Document12 pagesModule - II (Session 6,7,8)test twotestNo ratings yet

- FinalDocument6 pagesFinalRoronoa ZoroNo ratings yet

- Activity 4 8Document7 pagesActivity 4 8Dinah Fe Tabaranza-OlitanNo ratings yet

- Reviewer in Departmentalization of Factory OverheadDocument6 pagesReviewer in Departmentalization of Factory OverheadMirasolNo ratings yet

- PR Pertemuan 8 Chapter 13 Breakeven and Payback Analysis: Courses Jessica ChresstellaDocument14 pagesPR Pertemuan 8 Chapter 13 Breakeven and Payback Analysis: Courses Jessica ChresstellaArsyil AkhirbanyNo ratings yet

- b2cb53 - Lecture 06 EEDocument13 pagesb2cb53 - Lecture 06 EEMuhammad SalmanNo ratings yet

- BEPDocument8 pagesBEPHARMANJOT SINGHNo ratings yet

- Engineering Economy and System AnalysisDocument35 pagesEngineering Economy and System AnalysisNurul BussinessNo ratings yet

- Cee3 CH 15Document32 pagesCee3 CH 15Sushant Dhital100% (1)

- Replacement AnalysisDocument15 pagesReplacement AnalysisVishal Soni100% (2)

- ABC Analysis Questions With AnswersDocument25 pagesABC Analysis Questions With AnswerslokendraNo ratings yet

- Chapter II Methods of Comparing Alternative ProposalsDocument17 pagesChapter II Methods of Comparing Alternative ProposalsJOHN100% (1)

- ENGT3600 HW 3 - Abdulrahman Aldawsari Fall 2023Document7 pagesENGT3600 HW 3 - Abdulrahman Aldawsari Fall 2023jearsonsanderNo ratings yet

- Final Exam SolutionDocument6 pagesFinal Exam SolutionRoronoa ZoroNo ratings yet

- Assignment IiDocument5 pagesAssignment IiusmanjalaliNo ratings yet

- Annual Worth Analysis: Principles of Engineering Economic Analysis, 5th EditionDocument28 pagesAnnual Worth Analysis: Principles of Engineering Economic Analysis, 5th EditionnorahNo ratings yet

- Engineering Economy ENC3310 F18 Ch5Document14 pagesEngineering Economy ENC3310 F18 Ch5ako.rashedNo ratings yet

- Lecture 10Document16 pagesLecture 10Muhammad UsmanNo ratings yet

- 1 Property, Plant and Equipment IAS 16 Slides 2022Document49 pages1 Property, Plant and Equipment IAS 16 Slides 2022Tuyakula ShipadiNo ratings yet

- 4 Evaluation of Engineering ProjectDocument6 pages4 Evaluation of Engineering Projectarno assassinNo ratings yet

- Engineering Economics Tutorial Chapter Five (1) - 2Document4 pagesEngineering Economics Tutorial Chapter Five (1) - 2saugat pandeyNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

Practice Asgn

Practice Asgn

Uploaded by

Leo Raheel0 ratings0% found this document useful (0 votes)

2 views2 pagesnil

Original Title

Practice asgn

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentnil

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

2 views2 pagesPractice Asgn

Practice Asgn

Uploaded by

Leo Raheelnil

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 2

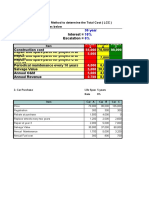

PRACTICE - ANNUAL CASH FLOW

Example: Three alternatives are being considered for improving an

operation on the assembly line along with the “do nothing” alternative.

Equipment costs vary, as do the annual benefits of each in comparison to

the present situation. Each of plans A, B, and C has a 10 year life and a

scrap value equal to 10% of its original cost. If interest is 8%, which plan, if

any, should be adopted?

Plan A ($) Plan B ($) Plan C ($)

Installed cost of equipment 15000 25000 33000

Material and labor savings / year 14000 9000 14000

Annual operating expenses 8000 6000 6000

End of useful life scrap value 1500 2500 3300

1

PRACTICE - ANNUAL CASH FLOW

Plan A ($) Plan B ($) Plan C ($)

Installed cost of equipment 15000 25000 33000

Material and labor savings / year 14000 9000 14000

Annual operating expenses 8000 6000 6000

End of useful life scrap value 1500 2500 3300

Plan A Plan B Plan C

EUAB (Material/ labor) + 14000+ 1500 9000+2500(0. 14000+3300(0.06

Scrap Value (A/F, 8%,10) (0.0690)=14104 0690)= 9172 90) = 14228

EUAC (Installed cost 15000(0.1490)+8000 3725+6000 = 4917+6000 =

(A/P,8%,10) + Annual = 10235 9725 10917

Operating Expenses)

EUAW=EUAB-EUAC 3869 (Best Option) -553 3311 2

You might also like

- CHAPTER 5 (1st Part) - ANNUAL CASH FLOW ANALYSISDocument6 pagesCHAPTER 5 (1st Part) - ANNUAL CASH FLOW ANALYSISSandipNo ratings yet

- PracticeDocument5 pagesPracticearif khanNo ratings yet

- Literature Review 1 PageDocument9 pagesLiterature Review 1 PageMahbub HussainNo ratings yet

- Lec 6Document17 pagesLec 6abbas96pkNo ratings yet

- GGFGGDocument12 pagesGGFGGkarimNo ratings yet

- Ch. 6 - Annual Worth AnalysisDocument7 pagesCh. 6 - Annual Worth AnalysisSidra IqbalNo ratings yet

- WRD720S-2022 - Engineering Feasibility Econ - Examples 1 - 4 & Solutions RevDocument11 pagesWRD720S-2022 - Engineering Feasibility Econ - Examples 1 - 4 & Solutions RevMeg TNo ratings yet

- Quiz Model AnswerDocument4 pagesQuiz Model Answerفن ميكسNo ratings yet

- Economy OK.2016 MS.CDocument3 pagesEconomy OK.2016 MS.Cabdullah 3mar abou reashaNo ratings yet

- Economy OK.2022 MS.CDocument4 pagesEconomy OK.2022 MS.Cabdullah 3mar abou reashaNo ratings yet

- Soal EtkDocument2 pagesSoal EtkNiswatun ChasanahNo ratings yet

- 10 Nomor EkotekDocument18 pages10 Nomor EkotekNurman WibisanaNo ratings yet

- Homework 3 Egr OumaimaDocument6 pagesHomework 3 Egr Oumaimaoumaidi123No ratings yet

- Assignment 3Document8 pagesAssignment 3octoNo ratings yet

- 06 Annual Worth AnalysisDocument19 pages06 Annual Worth Analysis王泓鈞No ratings yet

- Energy System Analysis (Ryoichi Komiyama) : Plan A (Emergency Generator) Plan B (Solar PV) Plan C (Thermal Power Gen.)Document2 pagesEnergy System Analysis (Ryoichi Komiyama) : Plan A (Emergency Generator) Plan B (Solar PV) Plan C (Thermal Power Gen.)adehidNo ratings yet

- Ch-06 Cost AllocationDocument1 pageCh-06 Cost AllocationEbsa AbdiNo ratings yet

- 1 Mutually Exclusive and Independent ProjectsDocument34 pages1 Mutually Exclusive and Independent ProjectsAngel NaldoNo ratings yet

- Group 6 Revised (ABC)Document11 pagesGroup 6 Revised (ABC)Jeremiah NcubeNo ratings yet

- DownloadDocument18 pagesDownloadGaurav MandotNo ratings yet

- Comparing InvestmentsDocument59 pagesComparing InvestmentsKondeti Harsha VardhanNo ratings yet

- Module 8 Benefit Cost RatioDocument13 pagesModule 8 Benefit Cost Ratiozulma siregarNo ratings yet

- BreakevenDocument3 pagesBreakevenMae Florizel FalculanNo ratings yet

- 610 HWset 9 S14Document2 pages610 HWset 9 S14deepikaNo ratings yet

- Engineering Economy Homework 3: Student Name: Student IDDocument4 pagesEngineering Economy Homework 3: Student Name: Student IDMinh TríNo ratings yet

- Chapter 5 ExercisesDocument12 pagesChapter 5 ExercisesIsaiah BatucanNo ratings yet

- 30 Year 10% 0%: Q. Use The Present Worth Method To Determine The Total Cost (LCC) of The Three Alternatives BelowDocument13 pages30 Year 10% 0%: Q. Use The Present Worth Method To Determine The Total Cost (LCC) of The Three Alternatives BelowPMPNo ratings yet

- UY. ProjMgtExer3Document2 pagesUY. ProjMgtExer3Young BloodNo ratings yet

- Solution Assigment Chapter 5Document11 pagesSolution Assigment Chapter 5Hoang Thao NhiNo ratings yet

- Engineering Economy Alday Ric Harold MDocument6 pagesEngineering Economy Alday Ric Harold MHarold AldayNo ratings yet

- Chap. 6Document8 pagesChap. 6Khuram MaqsoodNo ratings yet

- Economy Exam - .2016 Final MSCDocument3 pagesEconomy Exam - .2016 Final MSCabdullah 3mar abou reashaNo ratings yet

- AAADocument7 pagesAAAHamis Mohamed100% (1)

- Assignment 2 SolutionDocument7 pagesAssignment 2 SolutionMahmoud El-GarhyNo ratings yet

- Activity Based Costing - SolutionDocument19 pagesActivity Based Costing - Solutionsyedsajid1990No ratings yet

- Mcgraw-Hill, Inc: Lecture Notes 5Document6 pagesMcgraw-Hill, Inc: Lecture Notes 5Hassan ShehadiNo ratings yet

- Replacement Theory: 20P204 - ASHWIN R 20P217 - Prithivirajan V 20P220 - Vijay Vignesh S 21P402 - Gurumoorthy DDocument20 pagesReplacement Theory: 20P204 - ASHWIN R 20P217 - Prithivirajan V 20P220 - Vijay Vignesh S 21P402 - Gurumoorthy D21P410 - VARUN MNo ratings yet

- EE - Assignment Chapter 5 SolutionDocument10 pagesEE - Assignment Chapter 5 SolutionXuân ThànhNo ratings yet

- Module - II (Session 6,7,8)Document12 pagesModule - II (Session 6,7,8)test twotestNo ratings yet

- FinalDocument6 pagesFinalRoronoa ZoroNo ratings yet

- Activity 4 8Document7 pagesActivity 4 8Dinah Fe Tabaranza-OlitanNo ratings yet

- Reviewer in Departmentalization of Factory OverheadDocument6 pagesReviewer in Departmentalization of Factory OverheadMirasolNo ratings yet

- PR Pertemuan 8 Chapter 13 Breakeven and Payback Analysis: Courses Jessica ChresstellaDocument14 pagesPR Pertemuan 8 Chapter 13 Breakeven and Payback Analysis: Courses Jessica ChresstellaArsyil AkhirbanyNo ratings yet

- b2cb53 - Lecture 06 EEDocument13 pagesb2cb53 - Lecture 06 EEMuhammad SalmanNo ratings yet

- BEPDocument8 pagesBEPHARMANJOT SINGHNo ratings yet

- Engineering Economy and System AnalysisDocument35 pagesEngineering Economy and System AnalysisNurul BussinessNo ratings yet

- Cee3 CH 15Document32 pagesCee3 CH 15Sushant Dhital100% (1)

- Replacement AnalysisDocument15 pagesReplacement AnalysisVishal Soni100% (2)

- ABC Analysis Questions With AnswersDocument25 pagesABC Analysis Questions With AnswerslokendraNo ratings yet

- Chapter II Methods of Comparing Alternative ProposalsDocument17 pagesChapter II Methods of Comparing Alternative ProposalsJOHN100% (1)

- ENGT3600 HW 3 - Abdulrahman Aldawsari Fall 2023Document7 pagesENGT3600 HW 3 - Abdulrahman Aldawsari Fall 2023jearsonsanderNo ratings yet

- Final Exam SolutionDocument6 pagesFinal Exam SolutionRoronoa ZoroNo ratings yet

- Assignment IiDocument5 pagesAssignment IiusmanjalaliNo ratings yet

- Annual Worth Analysis: Principles of Engineering Economic Analysis, 5th EditionDocument28 pagesAnnual Worth Analysis: Principles of Engineering Economic Analysis, 5th EditionnorahNo ratings yet

- Engineering Economy ENC3310 F18 Ch5Document14 pagesEngineering Economy ENC3310 F18 Ch5ako.rashedNo ratings yet

- Lecture 10Document16 pagesLecture 10Muhammad UsmanNo ratings yet

- 1 Property, Plant and Equipment IAS 16 Slides 2022Document49 pages1 Property, Plant and Equipment IAS 16 Slides 2022Tuyakula ShipadiNo ratings yet

- 4 Evaluation of Engineering ProjectDocument6 pages4 Evaluation of Engineering Projectarno assassinNo ratings yet

- Engineering Economics Tutorial Chapter Five (1) - 2Document4 pagesEngineering Economics Tutorial Chapter Five (1) - 2saugat pandeyNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet