Professional Documents

Culture Documents

Chapter 2 The Need For Financial Analysis (Autosaved)

Chapter 2 The Need For Financial Analysis (Autosaved)

Uploaded by

ayelelemmaCopyright:

Available Formats

You might also like

- CPJE Display - Bulletin 2023Document22 pagesCPJE Display - Bulletin 2023SNo ratings yet

- 2022 Spyderco Product GuideDocument220 pages2022 Spyderco Product Guidegordonsanwey0% (1)

- NEW TUTORIAL INSTALMENT PURCHASES - AnsSchemeDocument7 pagesNEW TUTORIAL INSTALMENT PURCHASES - AnsSchemeDiana Yunus DianaNo ratings yet

- Chapter 12 Forecasting and Short - Term Financial PlanningDocument33 pagesChapter 12 Forecasting and Short - Term Financial PlanningherrajohnNo ratings yet

- Project Report On Dubai Property ScamDocument13 pagesProject Report On Dubai Property ScamRajkamal GuchhaitNo ratings yet

- Financial Analysis and PlanningDocument75 pagesFinancial Analysis and PlanningTewodros SetargieNo ratings yet

- Contract Administration 3Document12 pagesContract Administration 3BinduNo ratings yet

- MCS-035 2018-19Document9 pagesMCS-035 2018-19Jatin AgarwalNo ratings yet

- Chapter 4 Financial Statement AnalysisDocument54 pagesChapter 4 Financial Statement AnalysisDemelash Agegnhu BeleteNo ratings yet

- Financial Management 2Document75 pagesFinancial Management 2Ali ShehbazNo ratings yet

- Selection of Location For A ProjectDocument35 pagesSelection of Location For A ProjectTushar PatilNo ratings yet

- Financial Management (1 Day, P.M.)Document12 pagesFinancial Management (1 Day, P.M.)simon berksNo ratings yet

- Group 4 Summary AgribusinessDocument4 pagesGroup 4 Summary AgribusinessJoyce DuranaNo ratings yet

- Financial Ratio AnalysisDocument11 pagesFinancial Ratio AnalysisAnkitaBansalNo ratings yet

- Chapter 2 Financial Analysis and PlanningDocument43 pagesChapter 2 Financial Analysis and Planningmedrek100% (1)

- Module 5 Preparing A Financial AnalysisDocument4 pagesModule 5 Preparing A Financial AnalysisOlive Jon KatipunanNo ratings yet

- Receivable Managemen1Document78 pagesReceivable Managemen1dileepkumarNo ratings yet

- Planning and Working Capital ManagementDocument4 pagesPlanning and Working Capital ManagementSheena Mari Uy ElleveraNo ratings yet

- Chapter TWO FM I1Document65 pagesChapter TWO FM I1Embassy and NGO jobsNo ratings yet

- FM II - Chapter 03, Financial Planning & ForecastingDocument28 pagesFM II - Chapter 03, Financial Planning & ForecastingHace Adis100% (1)

- Research Methodology-3Document7 pagesResearch Methodology-3amuliya v.sNo ratings yet

- Ratio Formula ExplanationDocument6 pagesRatio Formula ExplanationSazid Murshid100% (1)

- MB0045 - Mba 2 SemDocument19 pagesMB0045 - Mba 2 SemacorneleoNo ratings yet

- FAPDocument12 pagesFAPAnokye AdamNo ratings yet

- Ratios AnalysisDocument48 pagesRatios AnalysisfranskasangaNo ratings yet

- Planning Working Capital ManagementDocument39 pagesPlanning Working Capital ManagementRonn RaymundoNo ratings yet

- Top 30 Investment Banking Interview Questions and AnswersDocument7 pagesTop 30 Investment Banking Interview Questions and AnswersVidit ParuthiNo ratings yet

- SLM - Ratio AnalysisDocument19 pagesSLM - Ratio AnalysisNaman KankarwalNo ratings yet

- Management Chapter 19Document14 pagesManagement Chapter 19buihoahaiyena1.c3hn2020No ratings yet

- FM Pointers For ReviewDocument12 pagesFM Pointers For ReviewAngelyne GumabayNo ratings yet

- Financial Ratio AnalysisDocument14 pagesFinancial Ratio AnalysisBijay MantryNo ratings yet

- ADL 03 Accounting For Managers V3Document21 pagesADL 03 Accounting For Managers V3Amit RaoNo ratings yet

- BCO 10 Block 02 1Document52 pagesBCO 10 Block 02 1Madhumitha ANo ratings yet

- Ratio Analysis ProjectDocument21 pagesRatio Analysis Projectdhruvagarwal12No ratings yet

- L2 Financial Statements Analysis and Interpretation P2Document29 pagesL2 Financial Statements Analysis and Interpretation P2Kent ChinNo ratings yet

- Unit 4 Ratio AnalysisDocument17 pagesUnit 4 Ratio AnalysisApurva JarwalNo ratings yet

- Financial RatiosDocument27 pagesFinancial RatiosVenz LacreNo ratings yet

- Budgeting and Budgetary Control 2019Document10 pagesBudgeting and Budgetary Control 2019Kerrice RobinsonNo ratings yet

- Lecture 3 - Applying For FinanceDocument22 pagesLecture 3 - Applying For FinanceJad ZoghaibNo ratings yet

- PFA 3e 2021 SM CH 01 - Accounting in BusinessDocument57 pagesPFA 3e 2021 SM CH 01 - Accounting in Businesscalista sNo ratings yet

- Concept Questions:: Net WorthDocument30 pagesConcept Questions:: Net WorthRutuja KhotNo ratings yet

- Sergiu Fundamentals of Business Finance Case Study ReportDocument11 pagesSergiu Fundamentals of Business Finance Case Study Reportsergiu bNo ratings yet

- Essentials of Financial Statement AnalysisDocument30 pagesEssentials of Financial Statement AnalysisChristina KarakatsaniNo ratings yet

- FMAC227 Financial Analysis and Reporting Midterm Exam PDFDocument12 pagesFMAC227 Financial Analysis and Reporting Midterm Exam PDFEnalyn AldeNo ratings yet

- Asodl Accounts Sol 1st SemDocument17 pagesAsodl Accounts Sol 1st SemIm__NehaThakurNo ratings yet

- Financial Reporting and AnalysisDocument13 pagesFinancial Reporting and AnalysisvvvvvvvvvvvvvvNo ratings yet

- Amity AssignmentDocument4 pagesAmity Assignmentrakesh92joshiNo ratings yet

- Cases in Finance Assignment FinalDocument22 pagesCases in Finance Assignment FinalIbrahimNo ratings yet

- Important Notes FinanceDocument6 pagesImportant Notes FinanceNishchay SaxenaNo ratings yet

- New Research 2017Document19 pagesNew Research 2017SAKSHI GUPTANo ratings yet

- Financially Yours Induction 2023 Study MaterialDocument12 pagesFinancially Yours Induction 2023 Study MaterialVaishali GargNo ratings yet

- Financial Management Module 6Document17 pagesFinancial Management Module 6Armand Robles100% (1)

- Funds Analysis, Cash-Flow Analysis, and Financial PlanningDocument31 pagesFunds Analysis, Cash-Flow Analysis, and Financial Planningmyasir1992100% (1)

- Study On Profitability Analysis of Birla CementDocument56 pagesStudy On Profitability Analysis of Birla Cementvaishalipress1978No ratings yet

- Working Capital Management Notes PDFDocument40 pagesWorking Capital Management Notes PDFBarakaNo ratings yet

- Ratio Kotak Mahindra BankDocument64 pagesRatio Kotak Mahindra Bankdk6666No ratings yet

- Comprehensive Finance Guide v1.2Document74 pagesComprehensive Finance Guide v1.2sacd.wizomoonNo ratings yet

- Financial Statements AnalysisDocument42 pagesFinancial Statements AnalysisSulle DadyNo ratings yet

- Discounted Cash Flow Budgeting: Simplified Your Path to Financial ExcellenceFrom EverandDiscounted Cash Flow Budgeting: Simplified Your Path to Financial ExcellenceNo ratings yet

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet

- New ch4-1Document67 pagesNew ch4-1ayelelemmaNo ratings yet

- Unit I. Nature & Scope of HRMDocument21 pagesUnit I. Nature & Scope of HRMayelelemmaNo ratings yet

- Chapter 1 Introduction To Financial ManagementDocument24 pagesChapter 1 Introduction To Financial ManagementayelelemmaNo ratings yet

- Chapter 2. MANAGEMENT THOUGHTS-1Document5 pagesChapter 2. MANAGEMENT THOUGHTS-1ayelelemmaNo ratings yet

- TPL - FP Ic 18Document1 pageTPL - FP Ic 18Structures ProductionNo ratings yet

- Mba 1 Sem Managerial Economics RMB 102 2016 17Document3 pagesMba 1 Sem Managerial Economics RMB 102 2016 17Aakash YadavNo ratings yet

- Contoh Tugasan AccountDocument20 pagesContoh Tugasan AccountMuhammad IddinNo ratings yet

- Economics Commentary (Macro - Economics)Document4 pagesEconomics Commentary (Macro - Economics)ariaNo ratings yet

- ARCADIS 2022 Global Construction Disputes Report PDFDocument28 pagesARCADIS 2022 Global Construction Disputes Report PDFJawad AhammadNo ratings yet

- 15 Uploader FINAL - CDLDocument45 pages15 Uploader FINAL - CDLMuhammad AliNo ratings yet

- Investment TheoryDocument12 pagesInvestment TheoryIndra PurnamaNo ratings yet

- FINC 536 Case Study 2Document9 pagesFINC 536 Case Study 2karimNo ratings yet

- CA Pak-Saudi RelationsDocument11 pagesCA Pak-Saudi RelationsMehwish AwaanNo ratings yet

- CH 8 Derivatives Analysis & Valuation PDFDocument44 pagesCH 8 Derivatives Analysis & Valuation PDFrbmjainNo ratings yet

- Guidance For Ship InspectionsDocument26 pagesGuidance For Ship InspectionsFr BNo ratings yet

- Grove GMK3050 1Document15 pagesGrove GMK3050 1Muthana JalladNo ratings yet

- Certificate QualityDocument26 pagesCertificate QualitygenialvaradopantojaNo ratings yet

- Module 2Document13 pagesModule 2Ghillian Mae GuiangNo ratings yet

- Pacific Textiles Annual Report PDFDocument142 pagesPacific Textiles Annual Report PDFMinNo ratings yet

- Kashato Practice SetDocument53 pagesKashato Practice SetLolli PopNo ratings yet

- Assignment of IBF Case Study 1Document6 pagesAssignment of IBF Case Study 1Hunain NadeemNo ratings yet

- MT2 Assignment 2Document3 pagesMT2 Assignment 2adnan_zisan008No ratings yet

- Selected Answer: Tru e Correct Answer: Tru E: 2 Out of 2 PointsDocument24 pagesSelected Answer: Tru e Correct Answer: Tru E: 2 Out of 2 PointsKesarapu Venkata ApparaoNo ratings yet

- CHAPTER 12 mgt361Document27 pagesCHAPTER 12 mgt361syaiera aqilahNo ratings yet

- Public Company and Private Company by Prof. ReyazuddinDocument6 pagesPublic Company and Private Company by Prof. ReyazuddinSiddhesh BhosleNo ratings yet

- Study Id13642 Energy-Prices-WorldwideDocument40 pagesStudy Id13642 Energy-Prices-WorldwideBel NochuNo ratings yet

- Fasil Bill EleDocument2 pagesFasil Bill Elemohdu1636No ratings yet

- Examination, 2015 Commerce Specialized Accounting: (Printed Pages 7) Roll. No.Document4 pagesExamination, 2015 Commerce Specialized Accounting: (Printed Pages 7) Roll. No.AbhishekNo ratings yet

- PDF Format Quotation Q B H 2122 167 1Document1 pagePDF Format Quotation Q B H 2122 167 1Gunjan PatelNo ratings yet

- QSPM (Quantitative Strategic Planning Matrix) For Xyz CompanyDocument3 pagesQSPM (Quantitative Strategic Planning Matrix) For Xyz CompanySubham PatraNo ratings yet

Chapter 2 The Need For Financial Analysis (Autosaved)

Chapter 2 The Need For Financial Analysis (Autosaved)

Uploaded by

ayelelemmaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 2 The Need For Financial Analysis (Autosaved)

Chapter 2 The Need For Financial Analysis (Autosaved)

Uploaded by

ayelelemmaCopyright:

Available Formats

Chapter 2:

The Need For Financial Analysis And

Planning

1 The Need For Financial Analysis And Planning 04/30/2024

Financial Analysis and planning

Financial analysis and planning is carried out for the purpose of obtaining

material and relevant information necessary for ascertaining the financial

strength and weakness of an enterprise and is necessary to analyse the data

depicted in the financial statements.

The main tools are

ratio analysis,

cash flow and

fund flow analysis.

Ratio analysis:

it is based on the fact that a single figure by itself may not communicate

any meaningful information but when expressed as a relative to some other

figure, it may definitely provide some significant information.

It is a comparison of different numbers from the balance sheet , income

statement and cash flow statement against the figures of previous years,

other companies, the industryfor the purpose of financial analysis.

2 The Need For Financial Analysis And Planning 04/30/2024

Objectives of financial forecasting

1) Reduce cost of responding to emergencies by anticipating the

future occurrences

2) Prepare to take advantage of future opportunities

3) Prepare contingency and emergency plans

4) Prepare to deal with possible outcomes

Planning Documents:

There are three types of documents that are to be prepared while

making a financial plan. These are

1) Cash Budget

2) Pro Forma Balance Sheet

3) Pro Forma Income Statement

Here, the term ‘pro forma’ refers to forecasting. These pro forma

statements are prepared on the basis of certain estimates.

3 The Need For Financial Analysis And Planning 04/30/2024

Sources Of Financial Data

Balance Sheet

Income Statement

Statement of Retained Earnings

Statement of Cash Flows

4 The Need For Financial Analysis And Planning 04/30/2024

Approaches To Financial Planning And Interpretation

Financial Statement Analysis

Ratio Analysis

Liquidity ratios

Asset management ratios

Debt management ratios

Profitability ratios

Market value ratios

Du Pont System

Expense control

ROA

Asset utilization

ROE Debt utilization

5 The Need For Financial Analysis And Planning 04/30/2024

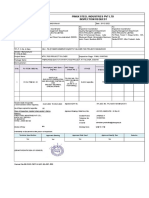

Micro Drive Inc.:

Balance Sheets and Income Statements for Years Ending December 31 (Millions of Dollars,

Except for Per Share Data)

6 The Need For Financial Analysis And Planning 04/30/2024

7 The Need For Financial Analysis And Planning 04/30/2024

1.Liquidity ratios

Liquidity of short term solvency means ability of the

business to pay its short-term liabilities.

Current ratio:

It is one of the best known measures of financial

strength

CR=Current asset/current liabilities

=$1000/310=3.2, industry average is 4.2

Current assets normally include cash, marketable

securities, accounts receivable, and inventories.

Current liabilities consist of accounts payable, short-term

notes payable, current maturities of long-term debt,

accrued taxes, and other accrued expenses.

8 The Need For Financial Analysis And Planning 04/30/2024

The Quick, or Acid Test, Ratio

It is more conservative than the current ratio.

Quick; or acid test; ratio = Current assets −

Inventories/Current liabilities

=385/310= 1.2, industry average is 2.1

A liquid asset is one that trades in an active market and hence can

be converted quickly to cash at the going market price.

Inventories are typically the least liquid of a firm’s current assets;

hence they are the current assets on which losses are most likely

to occur in a bankruptcy.

Therefore, a measure of the firm’s ability to pay off short-term

obligations without relying on the sale of inventories is

important.

11 The Need For Financial Analysis And Planning 04/30/2024

2. Asset management ratio

Asset management ratios measure how effectively a firm is

managing its assets.

If a company has excessive investments in assets, then its

operating capital will be unduly high, which will reduce its

free cash flow and ultimately its stock price.

On the other hand, if a company does not have enough

assets then it will lose sales, which will hurt profitability,

free cash flow, and the stock price.

Therefore, it is important to have the right amount invested

in assets.

12 The Need For Financial Analysis And Planning 04/30/2024

Evaluating Inventories: The Inventory Turnover Ratio

Inventory turnover ratio =Sales/Inventories

=$3,000/$615 = 4.9, Industry average = 9.0

As a rough approximation, each item of Micro Drive’s inventory

is sold out and restocked, or “turned over,” 4.9 times per year,

much lower than the industry average.

This suggests that Micro Drive is holding too much inventory.

High levels of inventory add to net operating working capital

(NOWC), which reduces FCF, which leads to lower stock prices.

In addition, Micro Drive’s low inventory turnover ratio makes us

wonder whether the firm is actually holding obsolete goods not

worth their stated value.

13 The Need For Financial Analysis And Planning 04/30/2024

Evaluating Receivables: The Days Sales Outstanding

Days sales outstanding (DSO), also called the “average collection period”

(ACP), is used to appraise accounts receivable.

DSO = Receivables

Annual sales /365

Thus, the DSO represents the average length of time that the firm must wait

after making a sale before receiving cash, which is the average collection

period. Micro Drive has 46 DSO, well above the 36-day industry average:

Receivables

DSO = Annual sales /365

=375

3000/365

= 45.6 days = 46 days

15 The Need For Financial Analysis And Planning 04/30/2024

Cont’d

Micro Drive’s sales terms call for payment within 30 days.

The fact that 46 days of sales are outstanding indicates that

customers, on average, are not paying their bills on time.

As with inventory, high levels of accounts receivable cause high

levels of NOWC, which hurts FCF and stock price.

A customer who is paying late may well be in financial trouble, in

which case Micro Drive may have a hard time ever collecting the

receivable.

Therefore, if the trend in DSO has been rising but the credit policy

has not been changed, steps should be taken to review credit

standards and to expedite the collection of accounts receivable.

16 The Need For Financial Analysis And Planning 04/30/2024

Evaluating Fixed Assets: The Fixed Assets Turnover Ratio

The fixed assets turnover ratio measures how

effectively the firm uses its plant and equipment.

Fixed assets turnover ratio = Sales

Net fixed assets

=$3,000/$1,000 = 3.0

Industry average = 3.0

17 The Need For Financial Analysis And Planning 04/30/2024

Cont’d

Micro Drive’s ratio of 3.0 is equal to the industry average,

indicating that the firm is using its fixed assets about as

intensively as are other firms in its industry.

Therefore, Micro Drive seems to have about the right amount of

fixed assets in relation to other firms.

A potential problem can exist when interpreting the fixed assets

turnover ratio.

Recall from accounting that fixed assets reflect the historical

costs of the assets.

Inflation has caused the current value of many assets that were

purchased in the past to be seriously understated.

18 The Need For Financial Analysis And Planning 04/30/2024

Evaluating Total Assets: The Total Assets Turnover Ratio

Total assets turnover ratio = Sales /Total assets

=$3,000/$2,000 = 1.5

Industry average = 1.8

Micro Drive’s ratio is somewhat below the industry average,

indicating that the company is not generating a sufficient

volume of business given its total asset investment.

Sales should be increased, some assets should be sold, or a

combination of these steps should be taken.

20 The Need For Financial Analysis And Planning 04/30/2024

3. Debt management ratio

The extent to which a firm uses debt financing, or financial

leverage, has three important implications:

(1) By raising funds through debt, stockholders can maintain control of a

firm without increasing their investment.

(2) If the firm earns more on investments financed with borrowed funds

than it pays in interest, then its shareholders’ returns are magnified, or

“leveraged,” but their risks are also magnified.

(3) Creditors look to the equity, or owner-supplied funds, to provide a

margin of safety, so the higher the proportion of funding supplied by

stockholders, the less risk creditors face.

22 The Need For Financial Analysis And Planning 04/30/2024

How the Firm is Financed: Total Liabilities to Total Assets

The ratio of total liabilities to total assets is called the debt

ratio, or sometimes the total debt ratio.

It measures the percentage of funds provided by current

liabilities and long-term debt:

Debt ratio = Total liabilities/Total assets

=$310 + $754

$2,000

= 53.2%, Industry average = 40.0%

23 The Need For Financial Analysis And Planning 04/30/2024

Cont’d

Creditors prefer low debt ratios because the lower the ratio, the

greater the cushion against creditors’ losses in the event of

liquidation.

Stockholders, on the other hand, may want more leverage because

it magnifies their return.

Micro Drive’s debt ratio is 53.2% but its debt ratio in the previous

year was 47.6%, which means that creditors are now supplying

more than half the total financing.

In addition to an upward trend, the level of the debt ratio is well

above the industry average.

Creditors may be reluctant to lend the firm more money because a

high debt ratio is associated with a greater risk of bankruptcy.

24 The Need For Financial Analysis And Planning 04/30/2024

Cont’d

Some sources report the debt-to-equity ratio, defined as:

Debt-to-equity ratio =Total liabilities/Total assets − Total liabilities

=$310 +$754

($2,000 − ($310 + $754)

= 1.14

Industry average = 0.67

The debt-to-equity ratio and the debt ratio contain the same information but

present that information slightly differently.

The debt-to-equity ratio shows that Micro Drive has $1.14 of debt for every

dollar of equity, whereas the debt ratio shows that 53.2% of Micro Drive’s

financing is in the form of liabilities.

25 The Need For Financial Analysis And Planning 04/30/2024

Ability to Pay Interest: Times-Interest-

Earned Ratio

The times-interest-earned (TIE) ratio, also called the

interest coverage ratio.

Times-interest-earned (TIE) ratio = EBIT/Interest expense

=$283.8/$88 =3.2 times, Industry average = 6.0

The TIE ratio measures the extent to which operating

income can decline before the firm is unable to meet its

annual interest costs.

Failure to meet this obligation can bring legal action by the

firm’s creditors, possibly resulting in bankruptcy.

26 The Need For Financial Analysis And Planning 04/30/2024

Ability to Service Debt: EBITDA Coverage Ratio

The TIE ratio is useful for assessing a company’s ability to meet

interest charges on its debt, but this ratio has two shortcomings:

(1) Interest is not the only fixed financial charge—companies must

also reduce debt on schedule, and many firms lease assets

and thus must make lease payments.

If they fail to repay debt or meet lease payments, they can be

forced into bankruptcy.

(2) EBIT does not represent all the cash flow available to service

debt, especially if a firm has high depreciation and/or amortization

charges.

The EBITDA coverage ratio accounts for these deficiencies.

28 The Need For Financial Analysis And Planning 04/30/2024

Cont’d

EBITDA coverage ratio=

EBITDA + Lease payments

Interest + Principal payments +Lease payments

=$383.8 + $28

$88 + $20 + $28

=$411.8

$136

= 3.0 times, Industry average = 4.3

29 The Need For Financial Analysis And Planning 04/30/2024

cont’d

The EBITDA coverage ratio is most useful for relatively short-

term lenders such as banks, which rarely make loans (except

real estate-backed loans) for longer than about 5 years.

Over a relatively short period, depreciation-generated funds

can be used to service debt.

Over a longer time, those funds must be reinvested to maintain

the plant and equipment or else the company cannot remain in

business.

Therefore, banks and other relatively short-term lenders focus

on the EBITDA coverage ratio, whereas long-term bondholders

focus on the TIE ratio.

31 The Need For Financial Analysis And Planning 04/30/2024

4. Profitability ratios

Profitability is the net result of a number of policies and

decisions.

The ratios examined thus far provide useful clues as to the

effectiveness of a firm’s operations, but the profitability ratios

go on to show the combined effects of liquidity, asset

management, and debt on operating results.

Net Profit Margin:

The net profit margin, which is also called the profit margin on

sales.

Net profit margin =Net income available to common

stockholders/Sales

=$113.5/$3,000 = 3.8%, Industry average = 5.0%

33 The Need For Financial Analysis And Planning 04/30/2024

Cont’d

Micro Drive’s net profit margin is below the industry average of 5%, but why is

this so?

Is it due to inefficient operations, high interest expenses, or both?

Instead of just comparing net income to sales, many analysts also break the income

statement into smaller parts to identify the sources of a low net profit margin.

For example, the operating profit margin is defined as

Operating profit margin =EBIT/sales

The operating profit margin identifies how a company is performing with respect

to its operations before the impact of interest expenses is considered.

Some analysts drill even deeper by breaking operating costs into their components.

For example, the gross profit margin is defined as

Gross profit margin = (Sales − Cost of goods sold)/ Sales

34 The Need For Financial Analysis And Planning 04/30/2024

Basic Earning Power (BEP) Ratio

Basic earning power (BEP) ratio =

EBIT/ Total assets

=$283.8/$2,000 =14.2%, Industry average= 17.2%

This ratio shows the raw earning power of the firm’s assets

before the influence of taxes and leverage, and it is useful for

comparing firms with different tax situations and different

degrees of financial leverage.

Because of its low turnover ratios and low profit margin on

sales, Micro Drive is not getting as high a return on its assets as

is the average company in its industry.

35 The Need For Financial Analysis And Planning 04/30/2024

Return on Total Assets

The ratio of net income to total assets measures the return on total

assets (ROA) after interest and taxes.

This ratio is also called the return on asset.

Return on total assets = ROA = Net income available to

common stockholders/Total assets

=$113.5/ $2,000 = 5.7%, Industry average = 9.0%

Micro Drive’s 5.7% return is well below the 9% average for the

industry.

This low return is due to

(1) the company’s low basic earning power and

(2) high interest costs resulting from its above-average use of debt; both

of these factors cause Micro Drive’s net income to be relatively low.

36 The Need For Financial Analysis And Planning 04/30/2024

Return on Common Equity

The ratio of net income to common equity measures the return

on common equity (ROE):

Return on common equity = ROE = Net income available

to common stockholders/Common equity

=$113.5/$896 = 12.7%, Industry average =15.0%

Stockholders invest to earn a return on their money, and this

ratio tells how well they are doing in an accounting sense.

Micro Drive’s 12.7% return is below the 15% industry

average, but not as far below as its return on total assets.

This somewhat better result is due to the company’s greater

use of debt.

37 The Need For Financial Analysis And Planning 04/30/2024

5.Market value ratios

Market value ratios relate a firm’s stock price to its

earnings, cash flow, and book value per share.

Market value ratios are a way to measure the value of a company’s stock

relative to that of another company.

Price/Earnings (P/E) Ratio:

shows how much investors are willing to pay per dollar of reported profits/

earnings.

Micro Drive’s stock sells for $23, with an earnings per share (EPS) of $2.27.

P/E ratio = Price per share/ Earnings per share=

$23.00/ $2.27 = 10.1, Industry average = 12.5

P/E ratios are higher for firms with strong growth prospects, other things held

constant, but they are lower for riskier firms.

Because Micro Drive’s P/E ratio is below the average, this suggests that the

company is regarded as being somewhat riskier than most, as having poorer

growth prospects, or both.

39 The Need For Financial Analysis And Planning 04/30/2024

Price/Cash Flow Ratio

Stock prices depend on a company’s ability to generate cash

flows.

Consequently, investors often look at the price/cash flow ratio,

where cash flow is defined as net income plus depreciation

and amortization:

Price/cash flow ratio = Price per share/ Cash flow per share

=$23.00/$4.27 = 5.4, Industry average = 6.8

Micro Drive’s price/cash flow ratio is also below the industry

average, once again suggesting that its growth prospects are

below average, its risk is above average, or both.

40 The Need For Financial Analysis And Planning 04/30/2024

Market/Book Ratio

The ratio of a stock’s market price to its book value gives another

indication of how investors regard the company.

Companies with relatively high rates of return on equity generally

sell at higher multiples of book value than those with low returns.

First, we find Micro Drive’s book value per share:

Book value per share = Common equity/Shares outstanding

=$896/50 = $17.92

Now we divide the market price by the book value to get a

market/book (M/B) ratio of 1.3 times:

Market/book ratio = M/B = Market price per share/Book value

per share

= $23.00/ $17.92 = 1.3, Industry average = 1.7

41 The Need For Financial Analysis And Planning 04/30/2024

Cont’d

Investors are willing to pay relatively little for a dollar of Micro Drive’s book

value.

The average company in the S&P 500 had a market/book ratio of about 2.50 in

early 2009.

Since M/B ratios typically exceed 1.0, this means that investors are willing to

pay more for stocks than their accounting book values.

The book value is a record of the past, showing the cumulative amount that

stockholders have invested, either directly by purchasing newly issued shares

or indirectly through retaining earnings.

In contrast, the market price is forward-looking, incorporating investors’

expectations of future cash flows.

For example, in early 2009 Alaska Air had a market/book ratio of only 0.81,

reflecting the airline industry’s problems, whereas Apple’s market/book ratio

was 3.45, indicating that investors expected Apple’s past successes to continue.

42 The Need For Financial Analysis And Planning 04/30/2024

Financial Planning/Forecasting And Its

Process

Plans: strategic, operating, and financial

Pro forma financial statements

Sales forecasts

Percent of sales method

Additional Funds Needed (AFN) formula

48 The Need For Financial Analysis And Planning 04/30/2024

You might also like

- CPJE Display - Bulletin 2023Document22 pagesCPJE Display - Bulletin 2023SNo ratings yet

- 2022 Spyderco Product GuideDocument220 pages2022 Spyderco Product Guidegordonsanwey0% (1)

- NEW TUTORIAL INSTALMENT PURCHASES - AnsSchemeDocument7 pagesNEW TUTORIAL INSTALMENT PURCHASES - AnsSchemeDiana Yunus DianaNo ratings yet

- Chapter 12 Forecasting and Short - Term Financial PlanningDocument33 pagesChapter 12 Forecasting and Short - Term Financial PlanningherrajohnNo ratings yet

- Project Report On Dubai Property ScamDocument13 pagesProject Report On Dubai Property ScamRajkamal GuchhaitNo ratings yet

- Financial Analysis and PlanningDocument75 pagesFinancial Analysis and PlanningTewodros SetargieNo ratings yet

- Contract Administration 3Document12 pagesContract Administration 3BinduNo ratings yet

- MCS-035 2018-19Document9 pagesMCS-035 2018-19Jatin AgarwalNo ratings yet

- Chapter 4 Financial Statement AnalysisDocument54 pagesChapter 4 Financial Statement AnalysisDemelash Agegnhu BeleteNo ratings yet

- Financial Management 2Document75 pagesFinancial Management 2Ali ShehbazNo ratings yet

- Selection of Location For A ProjectDocument35 pagesSelection of Location For A ProjectTushar PatilNo ratings yet

- Financial Management (1 Day, P.M.)Document12 pagesFinancial Management (1 Day, P.M.)simon berksNo ratings yet

- Group 4 Summary AgribusinessDocument4 pagesGroup 4 Summary AgribusinessJoyce DuranaNo ratings yet

- Financial Ratio AnalysisDocument11 pagesFinancial Ratio AnalysisAnkitaBansalNo ratings yet

- Chapter 2 Financial Analysis and PlanningDocument43 pagesChapter 2 Financial Analysis and Planningmedrek100% (1)

- Module 5 Preparing A Financial AnalysisDocument4 pagesModule 5 Preparing A Financial AnalysisOlive Jon KatipunanNo ratings yet

- Receivable Managemen1Document78 pagesReceivable Managemen1dileepkumarNo ratings yet

- Planning and Working Capital ManagementDocument4 pagesPlanning and Working Capital ManagementSheena Mari Uy ElleveraNo ratings yet

- Chapter TWO FM I1Document65 pagesChapter TWO FM I1Embassy and NGO jobsNo ratings yet

- FM II - Chapter 03, Financial Planning & ForecastingDocument28 pagesFM II - Chapter 03, Financial Planning & ForecastingHace Adis100% (1)

- Research Methodology-3Document7 pagesResearch Methodology-3amuliya v.sNo ratings yet

- Ratio Formula ExplanationDocument6 pagesRatio Formula ExplanationSazid Murshid100% (1)

- MB0045 - Mba 2 SemDocument19 pagesMB0045 - Mba 2 SemacorneleoNo ratings yet

- FAPDocument12 pagesFAPAnokye AdamNo ratings yet

- Ratios AnalysisDocument48 pagesRatios AnalysisfranskasangaNo ratings yet

- Planning Working Capital ManagementDocument39 pagesPlanning Working Capital ManagementRonn RaymundoNo ratings yet

- Top 30 Investment Banking Interview Questions and AnswersDocument7 pagesTop 30 Investment Banking Interview Questions and AnswersVidit ParuthiNo ratings yet

- SLM - Ratio AnalysisDocument19 pagesSLM - Ratio AnalysisNaman KankarwalNo ratings yet

- Management Chapter 19Document14 pagesManagement Chapter 19buihoahaiyena1.c3hn2020No ratings yet

- FM Pointers For ReviewDocument12 pagesFM Pointers For ReviewAngelyne GumabayNo ratings yet

- Financial Ratio AnalysisDocument14 pagesFinancial Ratio AnalysisBijay MantryNo ratings yet

- ADL 03 Accounting For Managers V3Document21 pagesADL 03 Accounting For Managers V3Amit RaoNo ratings yet

- BCO 10 Block 02 1Document52 pagesBCO 10 Block 02 1Madhumitha ANo ratings yet

- Ratio Analysis ProjectDocument21 pagesRatio Analysis Projectdhruvagarwal12No ratings yet

- L2 Financial Statements Analysis and Interpretation P2Document29 pagesL2 Financial Statements Analysis and Interpretation P2Kent ChinNo ratings yet

- Unit 4 Ratio AnalysisDocument17 pagesUnit 4 Ratio AnalysisApurva JarwalNo ratings yet

- Financial RatiosDocument27 pagesFinancial RatiosVenz LacreNo ratings yet

- Budgeting and Budgetary Control 2019Document10 pagesBudgeting and Budgetary Control 2019Kerrice RobinsonNo ratings yet

- Lecture 3 - Applying For FinanceDocument22 pagesLecture 3 - Applying For FinanceJad ZoghaibNo ratings yet

- PFA 3e 2021 SM CH 01 - Accounting in BusinessDocument57 pagesPFA 3e 2021 SM CH 01 - Accounting in Businesscalista sNo ratings yet

- Concept Questions:: Net WorthDocument30 pagesConcept Questions:: Net WorthRutuja KhotNo ratings yet

- Sergiu Fundamentals of Business Finance Case Study ReportDocument11 pagesSergiu Fundamentals of Business Finance Case Study Reportsergiu bNo ratings yet

- Essentials of Financial Statement AnalysisDocument30 pagesEssentials of Financial Statement AnalysisChristina KarakatsaniNo ratings yet

- FMAC227 Financial Analysis and Reporting Midterm Exam PDFDocument12 pagesFMAC227 Financial Analysis and Reporting Midterm Exam PDFEnalyn AldeNo ratings yet

- Asodl Accounts Sol 1st SemDocument17 pagesAsodl Accounts Sol 1st SemIm__NehaThakurNo ratings yet

- Financial Reporting and AnalysisDocument13 pagesFinancial Reporting and AnalysisvvvvvvvvvvvvvvNo ratings yet

- Amity AssignmentDocument4 pagesAmity Assignmentrakesh92joshiNo ratings yet

- Cases in Finance Assignment FinalDocument22 pagesCases in Finance Assignment FinalIbrahimNo ratings yet

- Important Notes FinanceDocument6 pagesImportant Notes FinanceNishchay SaxenaNo ratings yet

- New Research 2017Document19 pagesNew Research 2017SAKSHI GUPTANo ratings yet

- Financially Yours Induction 2023 Study MaterialDocument12 pagesFinancially Yours Induction 2023 Study MaterialVaishali GargNo ratings yet

- Financial Management Module 6Document17 pagesFinancial Management Module 6Armand Robles100% (1)

- Funds Analysis, Cash-Flow Analysis, and Financial PlanningDocument31 pagesFunds Analysis, Cash-Flow Analysis, and Financial Planningmyasir1992100% (1)

- Study On Profitability Analysis of Birla CementDocument56 pagesStudy On Profitability Analysis of Birla Cementvaishalipress1978No ratings yet

- Working Capital Management Notes PDFDocument40 pagesWorking Capital Management Notes PDFBarakaNo ratings yet

- Ratio Kotak Mahindra BankDocument64 pagesRatio Kotak Mahindra Bankdk6666No ratings yet

- Comprehensive Finance Guide v1.2Document74 pagesComprehensive Finance Guide v1.2sacd.wizomoonNo ratings yet

- Financial Statements AnalysisDocument42 pagesFinancial Statements AnalysisSulle DadyNo ratings yet

- Discounted Cash Flow Budgeting: Simplified Your Path to Financial ExcellenceFrom EverandDiscounted Cash Flow Budgeting: Simplified Your Path to Financial ExcellenceNo ratings yet

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet

- New ch4-1Document67 pagesNew ch4-1ayelelemmaNo ratings yet

- Unit I. Nature & Scope of HRMDocument21 pagesUnit I. Nature & Scope of HRMayelelemmaNo ratings yet

- Chapter 1 Introduction To Financial ManagementDocument24 pagesChapter 1 Introduction To Financial ManagementayelelemmaNo ratings yet

- Chapter 2. MANAGEMENT THOUGHTS-1Document5 pagesChapter 2. MANAGEMENT THOUGHTS-1ayelelemmaNo ratings yet

- TPL - FP Ic 18Document1 pageTPL - FP Ic 18Structures ProductionNo ratings yet

- Mba 1 Sem Managerial Economics RMB 102 2016 17Document3 pagesMba 1 Sem Managerial Economics RMB 102 2016 17Aakash YadavNo ratings yet

- Contoh Tugasan AccountDocument20 pagesContoh Tugasan AccountMuhammad IddinNo ratings yet

- Economics Commentary (Macro - Economics)Document4 pagesEconomics Commentary (Macro - Economics)ariaNo ratings yet

- ARCADIS 2022 Global Construction Disputes Report PDFDocument28 pagesARCADIS 2022 Global Construction Disputes Report PDFJawad AhammadNo ratings yet

- 15 Uploader FINAL - CDLDocument45 pages15 Uploader FINAL - CDLMuhammad AliNo ratings yet

- Investment TheoryDocument12 pagesInvestment TheoryIndra PurnamaNo ratings yet

- FINC 536 Case Study 2Document9 pagesFINC 536 Case Study 2karimNo ratings yet

- CA Pak-Saudi RelationsDocument11 pagesCA Pak-Saudi RelationsMehwish AwaanNo ratings yet

- CH 8 Derivatives Analysis & Valuation PDFDocument44 pagesCH 8 Derivatives Analysis & Valuation PDFrbmjainNo ratings yet

- Guidance For Ship InspectionsDocument26 pagesGuidance For Ship InspectionsFr BNo ratings yet

- Grove GMK3050 1Document15 pagesGrove GMK3050 1Muthana JalladNo ratings yet

- Certificate QualityDocument26 pagesCertificate QualitygenialvaradopantojaNo ratings yet

- Module 2Document13 pagesModule 2Ghillian Mae GuiangNo ratings yet

- Pacific Textiles Annual Report PDFDocument142 pagesPacific Textiles Annual Report PDFMinNo ratings yet

- Kashato Practice SetDocument53 pagesKashato Practice SetLolli PopNo ratings yet

- Assignment of IBF Case Study 1Document6 pagesAssignment of IBF Case Study 1Hunain NadeemNo ratings yet

- MT2 Assignment 2Document3 pagesMT2 Assignment 2adnan_zisan008No ratings yet

- Selected Answer: Tru e Correct Answer: Tru E: 2 Out of 2 PointsDocument24 pagesSelected Answer: Tru e Correct Answer: Tru E: 2 Out of 2 PointsKesarapu Venkata ApparaoNo ratings yet

- CHAPTER 12 mgt361Document27 pagesCHAPTER 12 mgt361syaiera aqilahNo ratings yet

- Public Company and Private Company by Prof. ReyazuddinDocument6 pagesPublic Company and Private Company by Prof. ReyazuddinSiddhesh BhosleNo ratings yet

- Study Id13642 Energy-Prices-WorldwideDocument40 pagesStudy Id13642 Energy-Prices-WorldwideBel NochuNo ratings yet

- Fasil Bill EleDocument2 pagesFasil Bill Elemohdu1636No ratings yet

- Examination, 2015 Commerce Specialized Accounting: (Printed Pages 7) Roll. No.Document4 pagesExamination, 2015 Commerce Specialized Accounting: (Printed Pages 7) Roll. No.AbhishekNo ratings yet

- PDF Format Quotation Q B H 2122 167 1Document1 pagePDF Format Quotation Q B H 2122 167 1Gunjan PatelNo ratings yet

- QSPM (Quantitative Strategic Planning Matrix) For Xyz CompanyDocument3 pagesQSPM (Quantitative Strategic Planning Matrix) For Xyz CompanySubham PatraNo ratings yet