Professional Documents

Culture Documents

Pledge

Pledge

Uploaded by

tanujdeswal270 ratings0% found this document useful (0 votes)

3 views28 pagesOriginal Title

5. Pledge

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

3 views28 pagesPledge

Pledge

Uploaded by

tanujdeswal27Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 28

Pledge

Sec. 172: "Pledge", "Pawnor", and

"Pawnee" defined

The bailment of goods as security for payment of a

debt or performance of a promise is called

"pledge". The bailor is in this case called

"pawnor". The bailee is called "pawnee".

Difference between Bailment and Pledge

Bailment is a wider term Pledge is a kind of

and it includes pledge. bailment.

Purpose of delivery of Purpose of delivery of

goods may be any. goods in pledge is

always securing the

payment of a debt

Pledgee has right of lien

Bailor has right of lien

as well as right to sell

the goods in default of

payment by pawnor.

Essentials of pledge

1. There should be bailment of the goods.

2. The purpose of bailment is to made the

goods bailed to serve as security for the

payment of a debt.

Delivery of the goods:

Delivery may be actual or constructive.

Morvi Merchantile Bank v. Union of India AIR 1965 SC

1954.

A Business firm consigned certain goods through railway

from bombay to Okhla and to be delivered to ‘self’.

Firm took a loan of Rs. 20,000 and pledged the goods by

giving the reciept to bank.

And the goods were lost in the transit.

Bank sued the railway in the capacity of pledgee.

Court held that giving receipt not only mean delivery of

receipt but also the goods, and held railway liable

accordingly.

Purpose of the bailment is securing the

payment of a debt.

For general purposes (except security for a debt)

delivery of goods constituted bailment but if the

purpose is securing the payment of any debt, such

bailment converted to pledge.

Bank of India v. Binod Steel Ltd. AIR 1977 MP 188,

court rightly held that once the goods has been pledged

they can not further attached or sold to satisfy other

creditors of the pawnor .

Hypothecation

Though hypothecation is not defined in the Indian Contract Act but it

is recognised as usage in the business transactions.

Hypothecation is a kind of pledge where delivery of the goods is

relaxed, i.e. Pawnor need not to deliver the goods to pawnee but he

can still furnish those very goods as security for the payment of any

loan.

Since in hypothecation possession is not given to the pawnee so no

right of lien arises in this case.

Hypothecatee can not demand the possession but he can sell the

goods in case of default only with the intervention of the court

(Tarun Bhargave v. State of Haryana AIR 2003 P&H 98)

Who can pledge?

Generally it is the owner who can pledge. So a tenant

has no right to pledge the rented house.

But in exceptional cases the person who is not the

owner of the goods can also pledge the goods.

1. Pledge by Mercantile agent (sec. 178)

2. Pledge by person in possession under voidable

contract (sec. 178A)

3. Pledge by a person having limited interest (sec. 179)

4. Pledge by seller in possession after sale (sec. 30(1)

Sales of Goods Act)

5. Pledge by buyer in possession before payment. (sec.

30(2) Sales of Goods Act)

1. Pledge by Mercantile Agent

Sec. 178: Pledge by mercantile agent: Where a

mercantile agent is, with the consent of the owner, in

possession of goods or the documents of title to goods, any

pledge made by him, when acting in the ordinary course of

business of a mercantile agent, shall be as valid as if he

were expressly authorised by the owner of the goods to

make the same; provided that the pawnee acts in good faith

and has not at the time of the pledge notice that the pawnor

has no authority to pledge.

Explanation : In this section, the expression "mercantile

agent" and "documents of title" shall have the meanings

assigned to them in the Indian Sale of Goods Act, 1930 (3

of 1930).

Essentials

1. The pledge should be by mercantile agent

2. Mercantile agent should have obtained the

possession of the goods or documents of title:

a. In his capacity as mercantile agent.

b. With the consent of the owner.

3. He must pledge the goods while acting in the

ordinary course of his business as mercantile agent.

4. the plegdee should have acted in good faith.

2. Pledge by person in possession under

voidable contract.

Sec. 178-A: Pledge by person in possession under

voidable contract: When the pawnor has obtained

possession of the goods pledged by him under a

contract voidable under section 19 or section 19A, but

the contract has not been rescinded at the time of the

pledge, the pawnee acquires a goods title to the goods,

provided he acts in good faith and without notice of

the pawnor's defect of title.

Nature of voidable contract

Voidable contracts are valid contracts until declared

void.

Phillips v. Brooks ltd. (1919) 2 KB 243

A person went to a jewellers shop and falsely

represented himself to be “Sir George Bullough”, a

man of credit.

Jeweller believed the person and handed over the ring

to person and accepted cheque as the payment.

Person further pledged the ring to some other person

who acted in good faith.

Meanwhile Cheque was dishonoured.

Whether this pledge is valid or not?

Court held that as this contract is voidable at the option

of jeweller and not declared void before the pawnor

pledges the ring and also pawnee acted in good faith,

pledge is valid.

3. Pledge by a person of limited interest

Sec. 179: Pledge where pawnor has only a limited

interest: Where person pledges goods in which he has

only a limited interest, the pledge is valid to the extent

of that interest.

Ex: A pledges goods for Rs.5000 to B, B is entitled to

sub pledge the same goods to the extent of amount Rs.

5000 only.

4. Pledge by seller in possession after sale

Sec. 30 Seller or buyer in possession after sale : (1)

Where a person, having sold goods, continues or is in

possession of the goods or of the documents of title to

the goods, the delivery or transfer by that person or by

a mercantile agent acting for him of the goods or

documents of title under any sale, pledge or other

disposition thereof to any person receiving the same in

good faith and without notice of the previous sale shall

have the same effect as if the person making the

delivery to transfer were expressly authorised by the

owner of the gods to make the same.

5. Pledge by buyer in possession before

payment

Sec. 30 (2): Where a person, having bought or agreed

to buy goods, obtains with the consent of the seller,

possession of the goods or the documents of title to the

goods, the delivery or transfer by that person or by a

mercantile agent acting for him, of the goods or

documents of title under any sale, pledge or other

disposition thereof to any person receiving the same in

good faith and without notice of any lien or other right

of the original seller in respect of the goods shall have

effect as if such lien or right did not exist.

Rights of Pledgee or Pawnee

1. Right to retain the goods pledged (sec. 173-174)

2. Right to recover extraordinary expenses incurred by

him (sec. 175)

3. Right to suit to procure the debt and sale of the

pledged goods (Sec. 176)

Right to retain the goods pledged

Sec 173: Pawnee's right of retainer -

The pawnee may retain the goods pledged, not only for

payment of the debt or the performance of the promise,

but for the interests of the debt, and all necessary

expenses incurred by him in respect to the possession

or for the preservation of the goods pledged.

Sec 174: . Pawnee not to retain for debt or promise

other than for which goods pledged - presumption

in case of subsequent advances - The pawnee shall

not, in the absence of a contract to that effect, retain

the goods pledged for any debt or promise of other

than the debt or promise for which they are pledged;

but such contract, in the absence of anything to the

contrary, shall be presumed in regard to subsequent

advances made by the pawnee.

Right to recover extraordinary expenses

incurred by him

Sec. 175: Pawnee's right as to extraordinary

expenses incurred -

The pawnee is entitled to receive from the pawnor

extraordinary expenses incurred by him for the

preservation of the goods pledged.

For ex: Pawnee insured the goods, or hired a locker for

the goods.

Right to suit to procure the debt and sale of

the pledged goods

Sec. 176: Pawnee's right where pawnor makes default - If

the pawnor makes default in payment of the debt, or

performance, at the stipulated time, or the promise, in respect

of which the goods were pledged, the pawnee may bring a

suit against the pawnor upon the debt or promise, and retain

the goods pledged as a collateral security; or he may sell the

thing pledged, on giving the pawnor reasonable notice of the

sale.

If the proceeds of such sale are less than the amount due in

respect of the debt or promise, the pawnor is still liable to pay

the balance. If the proceeds of the sale are greater that the

amount so due, the pawnee shall pay over the surplus to the

pawnor

Right of Pawnee will prevails over other

creditors

Central Bank of India v. Sirigupta Sugars and

Chemicals Ltd. AIR 2007 SC 2804.

Court held that pawnee has a special right over the

goods, and so long as his claim was not satisfied no

other creditor had any right to take away the goods.

No right to recover the amount if goods

pledged lost.

Central Bank of India v. Grains and gunny

Agencies AIR 1989 MP 28

Pledged goods were lost due to the negligence of bank.

And Pawnor requested the bank to sell the goods and

release the balance. Bank failed to do so. It was held

that bank was responsible for the goods.

Notice of sale is must

Prabhat Bank Ltd. v. Babu Ram AIR 1966 ALL

134.

Court held that even if there is a contract to sale the

pledged goods without giving notice, then also sale

without notice is bad in law.

Pawner’s Right to Redeem

Sec. 177: Defaulting pawnor's right to redeem -

If a time is stipulated for the payment of the debt, or

performance of the promise, for which the pledged is

made, and the pawnor makes default in payment of the

debt or performance of the promise at the stipulated

time, he may redeem the goods pledged at any

subsequent time before the actual sale of them; but he

must, on that case, pay, in addition, any expenses

which have arisen from his default.

Legal heirs are entitled to redeem

State Bank of India v. Mangalabai G. Deshmukh

AIR 2005 BOM 221.

Legal heirs are entitled to redeem the ornaments of the

deceased borrower before the sale of the same.

You might also like

- Cape Law: Texts and Cases - Contract Law, Tort Law, and Real PropertyFrom EverandCape Law: Texts and Cases - Contract Law, Tort Law, and Real PropertyNo ratings yet

- Market Research Survey Sample QuestionnaireDocument4 pagesMarket Research Survey Sample QuestionnaireKhenan James Narisma100% (1)

- BS 2655-4 - Specification For Lifes, Escalators, Passenger Conveyors and PaternostersDocument22 pagesBS 2655-4 - Specification For Lifes, Escalators, Passenger Conveyors and PaternostersTrần Khắc Độ100% (2)

- Modes of Creating ChargeDocument22 pagesModes of Creating ChargeAdharsh Venkatesan100% (1)

- PLEDGE (Sec. 172-179) 1. Concept and Definition:: in Lallan Prasad v. Rahmat AliDocument5 pagesPLEDGE (Sec. 172-179) 1. Concept and Definition:: in Lallan Prasad v. Rahmat AliKrishna AhujaNo ratings yet

- ContractDocument10 pagesContractDhruvika JainNo ratings yet

- SyllabousDocument5 pagesSyllabousDinesh ShuklaNo ratings yet

- Contract of PledgeDocument25 pagesContract of PledgeBTS x ARMYNo ratings yet

- What Is PledgeDocument5 pagesWhat Is PledgerabiatussalehaNo ratings yet

- PledgeDocument38 pagesPledgeManjeev Singh SahniNo ratings yet

- Contract of PledgeDocument14 pagesContract of PledgeSIDDHI LIKHMANINo ratings yet

- Pledge - BailmentDocument3 pagesPledge - BailmentSaurabh SrirupNo ratings yet

- Bailment and Pledge (AutoRecovered)Document8 pagesBailment and Pledge (AutoRecovered)mitali1419No ratings yet

- PledgeDocument6 pagesPledgedee deeNo ratings yet

- Chanakya National Law University: Topic-Pledge and Hypothecation Subject - Law of Contract IiDocument23 pagesChanakya National Law University: Topic-Pledge and Hypothecation Subject - Law of Contract IiashishNo ratings yet

- Central University of South Bihar: Department of Law & GovernanceDocument10 pagesCentral University of South Bihar: Department of Law & GovernanceAman Kumar100% (1)

- PledgeDocument2 pagesPledgeDharna SinglaNo ratings yet

- Contracts of Bailment and PledgeDocument14 pagesContracts of Bailment and PledgeAkhil KrishnanNo ratings yet

- Pledge Study NotesDocument3 pagesPledge Study NotesJason MarquezNo ratings yet

- Contract of Bailment and PledgeDocument31 pagesContract of Bailment and Pledgeabdullah ahmadNo ratings yet

- Mercantile Bank LTD v. Union of IndiaDocument9 pagesMercantile Bank LTD v. Union of IndiaAayushNo ratings yet

- Contract of PledgeDocument13 pagesContract of PledgesupreemsrivastavaNo ratings yet

- PledgeDocument14 pagesPledgeShareen AnwarNo ratings yet

- Pledge: 1. Delivery of Possession - As in Bailment, The Delivery of Possession Is EssentialDocument12 pagesPledge: 1. Delivery of Possession - As in Bailment, The Delivery of Possession Is Essentialdeepak singhalNo ratings yet

- PledgeDocument24 pagesPledgeUjjwal AnandNo ratings yet

- Assignment V - Special Contract Riya Singh 19FLICDDN01106 Bba - LLB (Hons) Sec BDocument3 pagesAssignment V - Special Contract Riya Singh 19FLICDDN01106 Bba - LLB (Hons) Sec BRiya SinghNo ratings yet

- Module 2-PledgeDocument26 pagesModule 2-PledgeRitesh AnandNo ratings yet

- Laws Relating To BankingDocument40 pagesLaws Relating To Bankingshamar debnathNo ratings yet

- LienDocument7 pagesLienBikram PradhanNo ratings yet

- 18bco45s U2Document7 pages18bco45s U2Tushar PaygudeNo ratings yet

- Bailment and PledgeDocument8 pagesBailment and Pledgemuazzamali533100% (1)

- PledgeDocument10 pagesPledgeKanwar Keerat BediNo ratings yet

- Pldedge 1Document5 pagesPldedge 1pravin awalkondeNo ratings yet

- Bailment & PladgeDocument3 pagesBailment & PladgeborivaliwestNo ratings yet

- PledgeDocument13 pagesPledgeDulon ChakrabortyNo ratings yet

- Questions On Indemnity and GuaranteeDocument11 pagesQuestions On Indemnity and Guaranteekmldeep100% (3)

- CDR Contracts ProjectDocument7 pagesCDR Contracts ProjectrahulNo ratings yet

- Week 7 - PledgeDocument29 pagesWeek 7 - PledgePrateek KhandelwalNo ratings yet

- BailmentDocument8 pagesBailmentGautami KumariNo ratings yet

- Bailment and PledgeDocument10 pagesBailment and PledgeVijayKumar NishadNo ratings yet

- Plegde Under Indian Contract ActDocument5 pagesPlegde Under Indian Contract ActAnshuman SrivastavaNo ratings yet

- Difference Between General Lien and Particular Lien With IllustrationsDocument5 pagesDifference Between General Lien and Particular Lien With IllustrationssrishtiNo ratings yet

- Bailment and PledgeDocument16 pagesBailment and PledgeDevadarshini MNo ratings yet

- Contract One LinerDocument7 pagesContract One LineraasmomodakNo ratings yet

- What Is A Pledge?: or Property That Are Been PledgedDocument5 pagesWhat Is A Pledge?: or Property That Are Been PledgedCoc RushNo ratings yet

- Unit III Contract of Pledge and PawnDocument16 pagesUnit III Contract of Pledge and PawnHemanta PahariNo ratings yet

- Contract 2Document5 pagesContract 2Sujit JadhavNo ratings yet

- Welcome To One & AllDocument33 pagesWelcome To One & AllgurudarshanNo ratings yet

- What Is PledgeDocument5 pagesWhat Is Pledgeovkgascrediff100% (1)

- What Is Contract of Indemnity?Document7 pagesWhat Is Contract of Indemnity?Adan HoodaNo ratings yet

- Bailment & Pledge-FinalDocument11 pagesBailment & Pledge-FinalAbhishek JainNo ratings yet

- Unit 2 Special ContractDocument12 pagesUnit 2 Special ContractKanishkaNo ratings yet

- Business Law Unit 5 Indian Sale of Goods Act, 1930Document17 pagesBusiness Law Unit 5 Indian Sale of Goods Act, 1930Deepak AroraNo ratings yet

- Bailment Part 2Document25 pagesBailment Part 2tanujdeswal27No ratings yet

- Law of ContractDocument12 pagesLaw of ContractShaghil NasidNo ratings yet

- Bailment and Pledge Are Two Special Contracts That Are Often ConfusedDocument9 pagesBailment and Pledge Are Two Special Contracts That Are Often ConfusedMohammed ShahnawazNo ratings yet

- T2 Condition and WarrantiesDocument8 pagesT2 Condition and WarrantiesJoshua CabinasNo ratings yet

- Section 168 "Right To Finder of Goods May Sue For Specified Reward Offered "Document3 pagesSection 168 "Right To Finder of Goods May Sue For Specified Reward Offered "Saloni SanghaviNo ratings yet

- Contract of Pledge: O N LIN E LECTU RE 30/03/2021 BY Muhammad Fahd AminDocument13 pagesContract of Pledge: O N LIN E LECTU RE 30/03/2021 BY Muhammad Fahd AminShezadi dollNo ratings yet

- Assignment OF Legal Aspects of BusinessDocument13 pagesAssignment OF Legal Aspects of BusinessBhavishya GuptaNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Cdd105148-Ford Escort 1995 Service Manual (1.8 16V, 1.9 8V) - 387pags-English - MuestraDocument35 pagesCdd105148-Ford Escort 1995 Service Manual (1.8 16V, 1.9 8V) - 387pags-English - MuestraJose Luis Islas GarciaNo ratings yet

- MKH Annual ReportDocument150 pagesMKH Annual ReportAjay ArunNo ratings yet

- Vibration Severity ChartsDocument4 pagesVibration Severity ChartsallmcbeallNo ratings yet

- Measures of VariabilityDocument7 pagesMeasures of VariabilityAngelica FloraNo ratings yet

- Point of View SortDocument1 pagePoint of View Sortapi-407328150No ratings yet

- SM Piko-MpDocument92 pagesSM Piko-MpSamuel JACOBBONo ratings yet

- Faa Form 8070-1Document2 pagesFaa Form 8070-1api-520948779No ratings yet

- Ligia - Balbino Assignment 1 Version 2Document4 pagesLigia - Balbino Assignment 1 Version 2liesil100% (1)

- 4 Effect of Acceleration On Static FluidDocument15 pages4 Effect of Acceleration On Static FluidNordiana IdrisNo ratings yet

- Pe BLSDocument4 pagesPe BLSchn pastranaNo ratings yet

- Complete Guide For Ultrasonic Sensor HC-SR04 With Arduino: DescriptionDocument10 pagesComplete Guide For Ultrasonic Sensor HC-SR04 With Arduino: DescriptionfloodfreakNo ratings yet

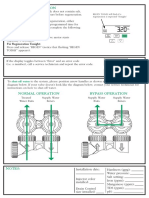

- Manual Regeneration: Shut-Off Water Bypass OperationDocument2 pagesManual Regeneration: Shut-Off Water Bypass OperationcaroNo ratings yet

- AgricultureDocument4 pagesAgricultureDibakar BhattacharjeeNo ratings yet

- Alstom Malaysia FactsheetDocument6 pagesAlstom Malaysia FactsheetChan Yee ChooNo ratings yet

- MS Excel Practical QuestionsDocument5 pagesMS Excel Practical QuestionsStricker ManNo ratings yet

- Abcam Adhesion and MethastasisDocument1 pageAbcam Adhesion and MethastasisJosé Jiménez VillegasNo ratings yet

- N-1000-III/IV: Installation and Programming ManualDocument121 pagesN-1000-III/IV: Installation and Programming ManualCristian GonzalezNo ratings yet

- Circulation 2013 14Document723 pagesCirculation 2013 14Ayush KhandeliaNo ratings yet

- Chelsio Unified Wire Adapter Product Selection GuideDocument2 pagesChelsio Unified Wire Adapter Product Selection Guidejohndude28No ratings yet

- Howto Configurethe Authoringand DWHModelsDocument156 pagesHowto Configurethe Authoringand DWHModelsAnand KumarNo ratings yet

- AssignmentDocument4 pagesAssignmentDenzel ChiuseniNo ratings yet

- Gened 1098 Eqn SheetDocument10 pagesGened 1098 Eqn Sheetbenjy321No ratings yet

- JL - Langkat 88 Singgahan-Pelem Pare - Kediri - Jawa Timur 64213 Phone: 0354-396 561 Moblie: 0852 3111 1117-0858 8888 1117Document2 pagesJL - Langkat 88 Singgahan-Pelem Pare - Kediri - Jawa Timur 64213 Phone: 0354-396 561 Moblie: 0852 3111 1117-0858 8888 1117Mita KusniasariNo ratings yet

- 1701722483.roksim Alone in Space and No Suits at AllDocument28 pages1701722483.roksim Alone in Space and No Suits at AlllolyeetwutNo ratings yet

- STARBOOKS Named As Priority Program For 2018: Press ReleaseDocument2 pagesSTARBOOKS Named As Priority Program For 2018: Press ReleaseArnoNo ratings yet

- Phy Lab PDFDocument4 pagesPhy Lab PDFAlisha AgarwalNo ratings yet

- 02 - CTFL - 2018 - Exercises - Eng - V 0 3 - WatermarkDocument36 pages02 - CTFL - 2018 - Exercises - Eng - V 0 3 - Watermarknina.razmedNo ratings yet