Professional Documents

Culture Documents

Email Case 2 - Credit Rating Research W Vid

Email Case 2 - Credit Rating Research W Vid

Uploaded by

Johnathan SandersOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Email Case 2 - Credit Rating Research W Vid

Email Case 2 - Credit Rating Research W Vid

Uploaded by

Johnathan SandersCopyright:

Available Formats

Case 2: Research on Credit Rating Agency

Brandon Crook, Lora Helmich, Danielle Holt, Danny Kruoch, and Johnathan Sanders

What is a Credit Rating Agency?

A potential source of information for market participants who are trying to determine the creditworthiness of borrowers

History of Credit Rating Agency

First Published in 1909 SEC changed the rules in 1975

Introduction of the NRSRO

What Factors Determine a Companys Bond Rating?

Likelihood of default Repayment priority ranking History of payments Ability to overcome past difficulties Risk Taking philosophy Industry default patterns

Global Credit Rating Agencies

Global credit rating agencies assign ratings to governments and countries based upon sovereign risk Creditworthiness as an issuer and credit quality of debt issues; Probability of default capacity and willingnessto service its debt with maturity dates and in accordance with the conditions agreed with the creditors

What Factors Determine a Countrys Bond Rating?

Macroeconomic Variables Available stock of foreign currency reserves Balance of payment flows Economic growth prospects Capacity to generate tax receipts Budget deficit, measures, burden Economic state Effective government

Country Risk

Broader term; includes political, social, transfer, exchange rate risk

S&P Sovereign Credit Ratings

Credit Rating Agencies Role in 2008 Financial Crisis

From 2002-2007 - Home Mortgage Loans

F-rated securities to Arated securities without reason.

given to homeowners with bad credit and undocumented incomes.

Sacrificed quality ratings for large share of structured products business.

Until 2008, their earnings were up

Millions of dollars in revenue from structured finance.

Credit Rating Agencies Role in 2008 Financial Crisis

In 2008

Estimated Loan Amounts

Agencies downgraded almost all securities from AAA to F

Blamed Agencies Over Banks

$3 trillion.

Banks need approval from agencies to loan money CRA failed to publish any verifiable data about their rating performance Just very complex models

Securities and Credit Rating Agencies

Must Register Securities

Long, tedious process

Short Forms Dodd-Frank Wall Street Consumer Protection Act

Improve financial accountability Protect Tax payers from bailouts Required Credit Rating Agencies

Short Form Registration

Two Types of Short Forms

S-3 for domestic companies F-3 for foreign private users

Previous Requirements for Short Forms

Must have investment grade by NRSRO

Allow companies to use SEC filed reports for future registration

For non-asset backed securities

Timely SEC reporting for 1 year Meet minimum of 1 transactional requirements

New Rules : Short Form Registration

July 26, 2011 Remove Credit Ratings to Determine Eligibility Replaced with Four Tests

Issued at least $1 billion over the prior three years. Has outstanding at least $750 million of nonconvertible securities other than common equity, A wholly-owned subsidiary of a well-known seasoned issuer as defined under the Securities Act. A majority-owned operating partnership of a real estate investment trust that qualifies as a well-known seasoned issuer.

Benefits of the New Short Form Rule

Tremendous Cost and Time Saving

Easier to register securities

Shelf Registration

Register future or multiple offerings on the same registration

Issuing Securities

Flexibility

New Rules : Large Trader Reporting

Unanimous Vote : July 26, 2011 Establish large trader reporting requirements

Identify large market participants Collect information on trading Analyze trading activity

SEC assigns ID number Benefits

SEC accurately monitor market events

Impact of U.S. Credit Rating Downgrade

Questions?

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5835)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 4.a.b (MM) Monthly Fund Focus ListDocument13 pages4.a.b (MM) Monthly Fund Focus Listmark.qianNo ratings yet

- Formula For Ratio AnalysisDocument8 pagesFormula For Ratio AnalysiszainNo ratings yet

- SMC Summer Internship ProjectDocument13 pagesSMC Summer Internship ProjectSahil KhannaNo ratings yet

- Problems Ch. 9Document3 pagesProblems Ch. 9altaf01No ratings yet

- Acca F7 Revision Notes PDFDocument65 pagesAcca F7 Revision Notes PDFSaurabh Kaushik71% (7)

- Buyback PPTDocument16 pagesBuyback PPTSubham MundhraNo ratings yet

- The Journal Oct-Dec 2022Document106 pagesThe Journal Oct-Dec 2022zoey thakuriiNo ratings yet

- Vce Smart Task 2 Project Finance Modelling and AnalysisDocument4 pagesVce Smart Task 2 Project Finance Modelling and AnalysisMd FarmanNo ratings yet

- Techniques of ValuationDocument2 pagesTechniques of ValuationrojaNo ratings yet

- Share Based Payments-ExercisesDocument6 pagesShare Based Payments-ExercisesReign TambasacanNo ratings yet

- S'Well Bottles: Strategic ManagementDocument10 pagesS'Well Bottles: Strategic ManagementRupil GoyalNo ratings yet

- Econ310 - Test 1Document6 pagesEcon310 - Test 1Jimmy TengNo ratings yet

- Touradji Capital v. Gentry Beach and Robert VolleroDocument55 pagesTouradji Capital v. Gentry Beach and Robert Vollerobess6159No ratings yet

- International Financial Reporting Standard 2 Share-Based PaymentDocument6 pagesInternational Financial Reporting Standard 2 Share-Based PaymentIzzy BNo ratings yet

- Beml Project Print OUTDocument144 pagesBeml Project Print OUTanon_196360629100% (1)

- CHAPTER 9 StandardDocument6 pagesCHAPTER 9 Standardsarahayeesha1No ratings yet

- Private BankingDocument7 pagesPrivate BankingAnonymous VMklPt25% (4)

- Market Segmenting Targeting and PositioningDocument45 pagesMarket Segmenting Targeting and PositioningJustine Elissa Arellano MarceloNo ratings yet

- Pyramiding and Ponzi Scheme Investment Scams and Their Mechanics PDFDocument4 pagesPyramiding and Ponzi Scheme Investment Scams and Their Mechanics PDFJaylordPataotaoNo ratings yet

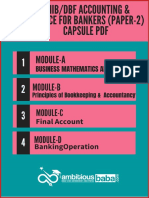

- JAIIB Paper 2 CAPSULE PDF Accounting Finance For BankersDocument168 pagesJAIIB Paper 2 CAPSULE PDF Accounting Finance For BankerspraveenampilliNo ratings yet

- DuPont System of Analysis-HODocument1 pageDuPont System of Analysis-HOSyed Noman AhmedNo ratings yet

- 10 Price Action Bar Patterns You Must KnowDocument22 pages10 Price Action Bar Patterns You Must KnowSudipto PaulNo ratings yet

- Financial Management - PROBLEMS FROM UNIT - 4Document5 pagesFinancial Management - PROBLEMS FROM UNIT - 4jeganrajraj100% (1)

- Case 15-1 (Private Fitness, LCC)Document12 pagesCase 15-1 (Private Fitness, LCC)janella manaliliNo ratings yet

- EMH Corporate FinanceDocument38 pagesEMH Corporate FinanceIsma NizamNo ratings yet

- Option Trading WorkbookDocument12 pagesOption Trading WorkbookanbuNo ratings yet

- Shree Cement Financial Model Projections BlankDocument10 pagesShree Cement Financial Model Projections Blankrakhi narulaNo ratings yet

- Session3 Chapter1Document26 pagesSession3 Chapter1Bec AkiNo ratings yet

- Statement of Financial PositionDocument9 pagesStatement of Financial PositionIsye NingrumNo ratings yet

- Capital Adequacy (Test)Document25 pagesCapital Adequacy (Test)Kshitij Prasad100% (1)