Professional Documents

Culture Documents

CH 02

CH 02

Uploaded by

anne putri0 ratings0% found this document useful (0 votes)

1 views34 pagesOriginal Title

ch02

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

0 ratings0% found this document useful (0 votes)

1 views34 pagesCH 02

CH 02

Uploaded by

anne putriCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

You are on page 1of 34

Intermediate Accounting, 10th Edition

Kieso, Weygandt, and Warfield

Chapter 2: The Conceptual

Framework

Prepared by

Drs.Gusnardi.SE.,Ak

Pekanbaru

Introduction

• Users of financial statements need relevant and

reliable information.

• To provide such information, the profession

has developed a set of principles and guidelines.

• These principles and guidelines are

collectively called the Conceptual Framework.

• In short, the Framework is like a constitution

for the profession.

05/15/24 Intermediate Accounting, 10th Editio 2

n, Ch. 2 (Kieso et al.)

Objectives of the Conceptual

Framework

• The Framework is to be the foundation for

building a set of coherent accounting

standards and rules.

• The Framework is to be a reference of basic

accounting theory for solving emerging

practical problems of reporting.

05/15/24 Intermediate Accounting, 10th Editio 3

n, Ch. 2 (Kieso et al.)

Statements of Financial Accounting

Concepts

• The FASB has issued seven Statements of

Financial Accounting Concepts (SFACs) to

date (Statements 1 through 7.)

• These statements set forth major recognition

and reporting issues.

• Statement 4 pertains to reporting by

nonbusiness entities.

• The other six statements pertain to reporting

by business enterprises.

05/15/24 Intermediate Accounting, 10th Editio 4

n, Ch. 2 (Kieso et al.)

Statements of Financial Accounting

Concepts

Statement Brief Title

• Statement 1 • Objectives of Financial

Reporting (Business)

• Statement 2 • Qualitative Characteristics

• Statement 6 • Elements of Financial

Statements (replaces 3)

• Statement 4 • Objectives of Financial

Reporting (Nonbusiness)

• Statement 5 • Recognition and

Measurement Criteria

• Statement 7 • Using Cash Flows

05/15/24 Intermediate Accounting, 10th Editio 5

n, Ch. 2 (Kieso et al.)

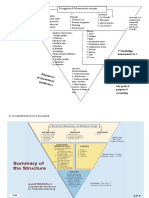

Overview of the Conceptual

Framework (1 of 2)

• The Framework has three levels of

objectives, elements and criteria.

• The first level consists of objectives.

• The second level explains financial

elements and characteristics of information

• The third level incorporates recognition and

measurement criteria.

05/15/24 Intermediate Accounting, 10th Editio 6

n, Ch. 2 (Kieso et al.)

Overview of the Conceptual Framework (2

of 2)

Level 3: Recognition and

Implemen- Measurement Concepts

tation

Level 2: Elements of

Qual Financial Statements and

Elements

Charac. Qualitative Characteristics

of Accounting Information

Objectives Level 1: Objectives of

Financial Reporting

05/15/24 Intermediate Accounting, 10th Editio 7

n, Ch. 2 (Kieso et al.)

Basic Objectives of Financial

Reporting

•• To

To provide

provide information

information::

•• about economic resources

abouteconomic resources,,the

theclaims

claimson

onthose

those

resourcesand

resources andchanges

changesininthem

them

•• thatisisuuseful

that tothose

sefulto thosemaking

makinginvestment

investmentand

andcredit

credit

decisions

decisions

•• thatisisuseful

that usefulto topresent

presentand

andfuture

futureinvestors,

investors,creditors

creditorsin

in

assessing future

assessing future cash

cash flows

flows

•• to

toindividuals

individualswho

whoreasonably

reasonablyunderstand

understandbusiness

businessand

and

economicactivities.

economic activities.

05/15/24 Intermediate Accounting, 10th Editio 8

n, Ch. 2 (Kieso et al.)

Qualitative Characteristics of

Accounting Information

• Primary qualities are Relevance and

Reliability of accounting information.

• Secondary qualities are comparability and

consistency of reported information.

05/15/24 Intermediate Accounting, 10th Editio 9

n, Ch. 2 (Kieso et al.)

Qualitative Characteristics of

Accounting Information: Relevance

• Relevance of information means “information

capable of making a difference in a decision

context.”

• The information must be timely to be relevant.

• The information should have predictive value: (be

helpful in making predictions about ultimate

outcomes of past, present and future events).

• The information should have feedback value

(helps users to confirm prior expectations.)

05/15/24 Intermediate Accounting, 10th Editio 10

n, Ch. 2 (Kieso et al.)

Primary Characteristic: Reliability

• Information is reliable, when it can be relied on to

represent the true, underlying situation.

• To be reliable, information must be:

1 * verifiable

2 * representationally faithful, and

3 * neutral

05/15/24 Intermediate Accounting, 10th Editio 11

n, Ch. 2 (Kieso et al.)

Primary Characteristic: Reliability

• Information is verifiable, when, given the

same information, independent users can

arrive at the same conclusion.

• Information is faithful, when it represents

what really existed or happened.

• Information is neutral, when it is free from

bias.

05/15/24 Intermediate Accounting, 10th Editio 12

n, Ch. 2 (Kieso et al.)

Secondary Characteristics

• Secondary characteristics are: comparability and

consistency of reported information.

• For information to be comparable, it must be:

1 measured and reported in a similar manner for different

enterprises.

2 useful in the allocation of resources to the areas of

greatest benefit.

3 useful to users in identifying real differences between

enterprises.

05/15/24 Intermediate Accounting, 10th Editio 13

n, Ch. 2 (Kieso et al.)

Secondary Characteristics

• Accounting information is consistent, if the same

accounting principles are applied in a similar

manner from one period to the next.

• Accounting principles may be changed, if the

change results in better reporting.

• If principles are changed, the justification for, and

the nature and effect of the change, must be

disclosed.

05/15/24 Intermediate Accounting, 10th Editio 14

n, Ch. 2 (Kieso et al.)

Hierarchy of Accounting Qualities

Decision Makers What are their characteristics?

Constraints Cost benefit & Materiality

User specific Qualities Understandability

Pervasive Criterion Decision Usefulness

Primary Qualities Relevance & Reliability

Secondary Qualities Comparability & Consistency

05/15/24 Intermediate Accounting, 10th Editio 15

n, Ch. 2 (Kieso et al.)

Ingredients of Primary Qualities

Relevance Reliability

Predictive Feedback Represent.

Verifiability Neutrality

Faithfulness

Value Value

Timeliness

05/15/24 Intermediate Accounting, 10th Editio 16

n, Ch. 2 (Kieso et al.)

Basic Elements of Financial Statements

Balance Sheet Income Statement

• Assets: Probable future • Comprehensive Income:

economic benefits Changes in equity from non-

• Liabilities: Probable future owner sources

sacrifices of economic benefits • Revenues: Inflows from

• Equity: Residual or ownership entity’s ongoing operations

interest • Expenses: Outflows from

• Investment by Owners: entity’s ongoing operations

Increases in net assets • Gains: Increases in equity from

• Distributions to Owners: incidental transactions

Decreases in net assets • Losses: Decreases in equity

from incidental transactions

05/15/24 Intermediate Accounting, 10th Editio 17

n, Ch. 2 (Kieso et al.)

Recognition and Measurement

Criteria

Basic

Principles Constraints

Assumptions

1. Economic 1. Historical cost 1. Cost Benefit

entity 2. Revenue 2. Materiality

2. Going recognition 3. Industry

concern 3. Matching practices

3. Monetary 4. Full Disclosure 4. Conservatism

Unit

4. Periodicity

05/15/24 Intermediate Accounting, 10th Editio 18

n, Ch. 2 (Kieso et al.)

Basic Assumptions

05/15/24 Intermediate Accounting, 10th Editio 19

n, Ch. 2 (Kieso et al.)

Basic Assumptions

• Economic Entity Assumption

1 The economic entity can be identified with a particular

unit of accountability.

2 The business is separate and distinct from its owners

3 Entity’s assets and other financial elements are not

commingled with those of the owners.

4 The economic entity assumption is an accounting

concept, and not a legal construct.

5 Departments or divisions of an entity may be

considered separate entities.

05/15/24 Intermediate Accounting, 10th Editio 20

n, Ch. 2 (Kieso et al.)

Basic Assumptions

• Going Concern Assumption

– The business is assumed to continue

indefinitely unless terminated by owners.

– The basis of recording financial elements is

historical accounting.

– Liquidation accounting (based on liquidation

values) is not followed unless so indicated.

05/15/24 Intermediate Accounting, 10th Editio 21

n, Ch. 2 (Kieso et al.)

Basic Assumptions

• Monetary Unit

– Money is the common unit of measure of

economic transactions.

– Use of a monetary unit is relevant, and simple

to understand.

– The dollar is assumed to remain relatively

stable in value.

05/15/24 Intermediate Accounting, 10th Editio 22

n, Ch. 2 (Kieso et al.)

Basic Assumptions

• Periodicity (Time Period) Assumption

– Economic activity of an entity may be

artificially divided into time periods for

reporting purposes.

– Shorter time periods are subject to revisions but

may be more timely.

05/15/24 Intermediate Accounting, 10th Editio 23

n, Ch. 2 (Kieso et al.)

Basic Principles

05/15/24 Intermediate Accounting, 10th Editio 24

n, Ch. 2 (Kieso et al.)

The Cost Principle

• Historical Cost Principle

– Transaction is recorded at its acquisition price.

– It is not changed to reflect market price.

– The principle applies to assets and liabilities.

– Users of financial statements may find current fair

value information to be useful as well.

– A “mixed attribute” system reports historical cost, fair

value, and lower of cost or market values.

05/15/24 Intermediate Accounting, 10th Editio 25

22

n, Ch. 2 (Kieso et al.)

The Revenue Recognition Principle

• Revenue Recognition Principle

– Revenue is recognized when it is earned and the

amount can be objectively determined.

– Revenue is recognized at time of sale. There are

exceptions:

1 In long-term construction (completed) contracts (revenue is

recognized only on completion of contract).

2 Where active markets exist for the product (revenue is

recognized end of production and before sale)

3 In installment sales contracts (revenue is recognized only on

receipt of cash)

05/15/24 Intermediate Accounting, 10th Editio 26

n, Ch. 2 (Kieso et al.)

The Matching Principle

• Expenses in one period are matched to revenues of

the same period.

• There should be a logical, rational association of

revenues and expenses.

• If an expense does not benefit future periods, it is

recorded in the current period.

• Both product and period costs must be

appropriately matched.

05/15/24 Intermediate Accounting, 10th Editio 27

24

n, Ch. 2 (Kieso et al.)

The Full Disclosure Principle

• Financial statements must report what a

reasonable person would need to know to make

an informed decision.

• Disclosure may be made:

1 within the body of the financial statements,

2 as notes to those statements, or

3 as supplementary information.

05/15/24 Intermediate Accounting, 10th Editio 28

n, Ch. 2 (Kieso et al.)

Constraints

05/15/24 Intermediate Accounting, 10th Editio 29

n, Ch. 2 (Kieso et al.)

Constraints: The Cost Benefit Rule

• Cost-Benefit Relationship

– The cost of providing information should not outweigh

the benefit derived.

– Costs and benefits are not always obvious or

quantifiable.

– Sound judgment must be used in providing information.

05/15/24 Intermediate Accounting, 10th Editio 30

n, Ch. 2 (Kieso et al.)

Constraints: Materiality

• Materiality refers to an item’s importance to a

firm’s overall financial operations.

– An item must make a difference to be material and be

disclosed.

– It is a matter of the relative significance of the element.

– Both quantitative and qualitative factors are to be

considered in determining relative significance.

05/15/24 Intermediate Accounting, 10th Editio 31

n, Ch. 2 (Kieso et al.)

Constraints: Industry Practices

• Industry Practices

– The nature of some industries may sometimes

require departures from basic accounting

theory.

– If application of accounting theory results in

statements that are not comparable or

consistent, then industry practices must

examined for possible explanations.

05/15/24 Intermediate Accounting, 10th Editio 32

n, Ch. 2 (Kieso et al.)

Constraints: Conservatism

• Conservatism suggests that the preparer, when in

doubt, choose a conservative solution.

• This solution will be least likely to overstate assets

and income.

• Conservatism does not suggest that net assets or

net income be deliberately understated.

05/15/24 Intermediate Accounting, 10th Editio 33

n, Ch. 2 (Kieso et al.)

COPYRIGHT

Copyright © 2001 John Wiley & Sons, Inc. All rights

reserved. Reproduction or translation of this work

beyond that permitted in Section 117 of the 1976

United States Copyright Act without the express

written permission of the copyright owner is unlawful.

Request for further information should be addressed

to the Permissions Department, John Wiley & Sons,

Inc. The purchaser may make back-up copies for

his/her own use only and not for distribution or

resale. The Publisher assumes no responsibility for

errors, omissions, or damages, caused by the use of

these programs or from the use of the information

contained herein.

05/15/24 Intermediate Accounting, 10th Editio 34

n, Ch. 2 (Kieso et al.)

You might also like

- The Filipino Value System and Its Effects On BusinessDocument2 pagesThe Filipino Value System and Its Effects On BusinessDominick Discarga75% (157)

- Cfas Chapter 2Document55 pagesCfas Chapter 2Lance Lenard Divinagracia Calimpos100% (1)

- Theory of Health PromotionDocument3 pagesTheory of Health Promotionrocs De GuzmanNo ratings yet

- Chapter 2: The Conceptual FrameworkDocument36 pagesChapter 2: The Conceptual FrameworkNida Mohammad Khan AchakzaiNo ratings yet

- Chapter 5: The Conceptual FrameworkDocument40 pagesChapter 5: The Conceptual FrameworkHui QingNo ratings yet

- Chapter 2: The Conceptual Framework: Fundamentals of Intermediate Accounting Weygandt, Kieso, and WarfieldDocument36 pagesChapter 2: The Conceptual Framework: Fundamentals of Intermediate Accounting Weygandt, Kieso, and WarfieldMohammed Akhtab Ul HudaNo ratings yet

- Chapter 2: The Conceptual Framework: Fundamentals of Intermediate Accounting Weygandt, Kieso, and WarfieldDocument36 pagesChapter 2: The Conceptual Framework: Fundamentals of Intermediate Accounting Weygandt, Kieso, and WarfieldAppu KhanNo ratings yet

- Accounting 1Document146 pagesAccounting 1Touhidul IslamNo ratings yet

- Framework For Accounting & ReportingDocument32 pagesFramework For Accounting & ReportingJason InufiNo ratings yet

- Lecture 1Document38 pagesLecture 1Preet LohanaNo ratings yet

- 2 Financial Reporting Theory UpdatedDocument52 pages2 Financial Reporting Theory UpdatedSiham OsmanNo ratings yet

- Cfas ReadingDocument11 pagesCfas ReadingMaricar CachilaNo ratings yet

- Accounting ProjectDocument18 pagesAccounting ProjectAlexander GrifordNo ratings yet

- Status and Purpose of The Framework, Objective and Qualitative CharacteristicsDocument35 pagesStatus and Purpose of The Framework, Objective and Qualitative CharacteristicsCharmaine Mari OlmosNo ratings yet

- Chapter 2: The Conceptual FrameworkDocument17 pagesChapter 2: The Conceptual FrameworkMohammad MustafaNo ratings yet

- Chapter 2: The Conceptual Framework: Intermediate Accounting, 11th Edition Kieso, Weygandt, and WarfieldDocument17 pagesChapter 2: The Conceptual Framework: Intermediate Accounting, 11th Edition Kieso, Weygandt, and WarfieldAnonymous eDf7Q9No ratings yet

- Chapter 2: The Conceptual FrameworkDocument17 pagesChapter 2: The Conceptual FrameworkNu RuNo ratings yet

- EC1 Module-4 2023Document5 pagesEC1 Module-4 2023Reymond MondoñedoNo ratings yet

- Basic Accounting Concept 1Document45 pagesBasic Accounting Concept 1孔垂文No ratings yet

- Conceptual FrameworkDocument38 pagesConceptual FrameworkShannon MojicaNo ratings yet

- 2nd Lecture-Ch. 2Document37 pages2nd Lecture-Ch. 2otaku25488No ratings yet

- Establish and Maintain Accrual Accounting SystemDocument28 pagesEstablish and Maintain Accrual Accounting SystemTegene TesfayeNo ratings yet

- Principles of Accounting CP 2Document8 pagesPrinciples of Accounting CP 2Dipika tasfannum salamNo ratings yet

- Conceptual FrameworkDocument4 pagesConceptual FrameworkDaisy Rose PadilloNo ratings yet

- The Pursuit of Conceptual FrameworkDocument24 pagesThe Pursuit of Conceptual FrameworkbananaNo ratings yet

- Conceptual Framework of Financial Reporting-2021-MbaDocument22 pagesConceptual Framework of Financial Reporting-2021-MbasurangauorNo ratings yet

- Teori Akuntansi: Modul Ini Membahas Kerangka Konseptual Pelaporan KeuanganDocument9 pagesTeori Akuntansi: Modul Ini Membahas Kerangka Konseptual Pelaporan KeuanganVeronicaNo ratings yet

- Updated Slides Introducing The Conceptual FrameworkDocument24 pagesUpdated Slides Introducing The Conceptual FrameworkHunal Kumar MautadinNo ratings yet

- Chapter 2: The Conceptual Framework: Intermediate Accounting, 11th Edition Kieso, Weygandt, and WarfieldDocument12 pagesChapter 2: The Conceptual Framework: Intermediate Accounting, 11th Edition Kieso, Weygandt, and WarfieldKAOSAR AHMEDNo ratings yet

- Welcome To Acc721: Framework For Accounting & ReportingDocument30 pagesWelcome To Acc721: Framework For Accounting & ReportingJason InufiNo ratings yet

- ACF 1101 Financial Accounting: Revised Conceptual FrameworkDocument12 pagesACF 1101 Financial Accounting: Revised Conceptual FrameworkKogularamanan NithiananthanNo ratings yet

- Kieso, Weygandt, WarfieldDocument56 pagesKieso, Weygandt, WarfieldShevina Maghari shsnohsNo ratings yet

- AKM I Week 1 - Pur - IfrsDocument67 pagesAKM I Week 1 - Pur - IfrsAldo JanuarNo ratings yet

- Conceptual Framework of Financial ReportingDocument14 pagesConceptual Framework of Financial ReportinghudaNo ratings yet

- Part 1 CONCEPTUAL FRAMEWORK FOR FINANCIAL REPORTINGDocument66 pagesPart 1 CONCEPTUAL FRAMEWORK FOR FINANCIAL REPORTINGAliaa HabibNo ratings yet

- Fundamentals of Accounting MODULE 3Document31 pagesFundamentals of Accounting MODULE 3amnesia girlNo ratings yet

- AK1 Chapter 2Document57 pagesAK1 Chapter 2rajwa rana amandaNo ratings yet

- Topic 2 - Conceptual FrameworkDocument36 pagesTopic 2 - Conceptual FrameworkA2T5 Haziqah HousnaNo ratings yet

- Intermediate I SummaryDocument217 pagesIntermediate I Summaryhundelamesa2023No ratings yet

- FAR 02 Conceptual Framework For Financial ReportingDocument11 pagesFAR 02 Conceptual Framework For Financial ReportingKimberly NuñezNo ratings yet

- From 28.11.21 Power Point AccountingDocument191 pagesFrom 28.11.21 Power Point AccountingAbdul AzizNo ratings yet

- Conceptual FrameworkDocument40 pagesConceptual FrameworkQuennie Kate RomeroNo ratings yet

- Chapter One Conceptual FrameworkDocument39 pagesChapter One Conceptual Frameworkselman AregaNo ratings yet

- Far 02 Conceptual Framework For Financial Reporting CompressDocument11 pagesFar 02 Conceptual Framework For Financial Reporting CompressDaphnie Loise CalderonNo ratings yet

- Chap 11 AccountingDocument29 pagesChap 11 Accounting원하람No ratings yet

- Revised Conceptual Framework: Rainiel C. Soriano, CPA, MBADocument60 pagesRevised Conceptual Framework: Rainiel C. Soriano, CPA, MBAMila VeranoNo ratings yet

- Accounting Theory Godfrey Chapter 4Document65 pagesAccounting Theory Godfrey Chapter 4FELIX PANDIKANo ratings yet

- CH 01Document19 pagesCH 01anne putriNo ratings yet

- CLASS NOTES Topic 8 Conceptual Framework of AccountingDocument11 pagesCLASS NOTES Topic 8 Conceptual Framework of AccountingKiasha WarnerNo ratings yet

- ACCT 860: Financial Accounting Week 1: NZ FrameworkDocument34 pagesACCT 860: Financial Accounting Week 1: NZ FrameworkNam PhamNo ratings yet

- Conceptual Frame Work-CAP IIDocument9 pagesConceptual Frame Work-CAP IIbinuNo ratings yet

- Chapter 2: The Conceptual FrameworkDocument36 pagesChapter 2: The Conceptual FrameworkMuzammil RehmanNo ratings yet

- FAC4863, FAC4861 Class - 28 February 2023Document40 pagesFAC4863, FAC4861 Class - 28 February 2023Florence Apleni100% (1)

- CH 02Document59 pagesCH 02abdullah.h.aloibiNo ratings yet

- Crci L1Document6 pagesCrci L1Law KanasaiNo ratings yet

- Chapter One Financial and Managerial AccountingDocument52 pagesChapter One Financial and Managerial AccountingElias ZeynuNo ratings yet

- Accounting Principles Canadian Volume II 7th Edition Weygandt Test Bank Full Chapter PDFDocument50 pagesAccounting Principles Canadian Volume II 7th Edition Weygandt Test Bank Full Chapter PDFEdwardBishopacsy100% (17)

- Far410 Chapter 2 Conceptual FrameworkDocument32 pagesFar410 Chapter 2 Conceptual Frameworkmr.nazir.shahidanNo ratings yet

- Lecture 1 - Concepts and EthicsDocument10 pagesLecture 1 - Concepts and EthicsNikki MathysNo ratings yet

- Introduction To Financial AccountingDocument12 pagesIntroduction To Financial AccountingJavan NyakomittaNo ratings yet

- The Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiFrom EverandThe Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiNo ratings yet

- 3 Body ProblemDocument2 pages3 Body Problemtechward.siNo ratings yet

- Church of The Province of South East AsiaDocument6 pagesChurch of The Province of South East Asiabrian2chrisNo ratings yet

- Denisa Popescu: SAP User With German SkillsDocument3 pagesDenisa Popescu: SAP User With German Skillsi.alexpopescuNo ratings yet

- Poland's A2 Motorway Case: Abhinav - Bala - Harsh - SandeepDocument14 pagesPoland's A2 Motorway Case: Abhinav - Bala - Harsh - SandeepSuhas PothedarNo ratings yet

- Add 7 Days To The First Day of Last Menstrual PeriodDocument16 pagesAdd 7 Days To The First Day of Last Menstrual PeriodRojean MartinezNo ratings yet

- Sogie BillDocument4 pagesSogie BillJoy YaaNo ratings yet

- Jafor SadikDocument1 pageJafor SadikTRICK WORLDNo ratings yet

- Partition Agreement: o The Portion of Two Thousand Seven Hundred Ninety (2,790) Square Meters DescribedDocument3 pagesPartition Agreement: o The Portion of Two Thousand Seven Hundred Ninety (2,790) Square Meters DescribedAidalyn MendozaNo ratings yet

- STS Middle AgesDocument29 pagesSTS Middle AgesNathaniel Karl Enin PulidoNo ratings yet

- Cisco Catalyst 9800 Series Wireless Controller Software Configuration Guide, Cisco IOS XE Bengaluru 17.6.xDocument2,136 pagesCisco Catalyst 9800 Series Wireless Controller Software Configuration Guide, Cisco IOS XE Bengaluru 17.6.xshola ogundipeNo ratings yet

- Early King ModelsDocument60 pagesEarly King ModelsOleksdemNo ratings yet

- BugkalotDocument3 pagesBugkalotADMIN OFFICERNo ratings yet

- Texas Laws About Claiming A Dead Body and Having A Family FuneralDocument3 pagesTexas Laws About Claiming A Dead Body and Having A Family Funeralclint11No ratings yet

- Redemptive Education 3Document23 pagesRedemptive Education 3kasserian.sealy4066No ratings yet

- Bible Contradictions True or FalseDocument6 pagesBible Contradictions True or Falsedlee7067No ratings yet

- Interoperability Best Practices: Testing and Validation ChecklistDocument4 pagesInteroperability Best Practices: Testing and Validation ChecklistsusNo ratings yet

- Jadwal Kuliah Ganjil 2019-2020 (Reg) BaruDocument5 pagesJadwal Kuliah Ganjil 2019-2020 (Reg) BarufikryNo ratings yet

- Tenses Exercise (Paraphrasing)Document11 pagesTenses Exercise (Paraphrasing)Avtar DhaliwalNo ratings yet

- Resume - Azhar FayyazDocument1 pageResume - Azhar FayyazAzhar Fayyaz ParachaNo ratings yet

- CONSTI II - Echegaray v. Secretary and Lim v. PeopleDocument4 pagesCONSTI II - Echegaray v. Secretary and Lim v. PeopleMariaAyraCelinaBatacanNo ratings yet

- Digital TransformationDocument21 pagesDigital TransformationSumaiya SayeediNo ratings yet

- B000048 NHWP Int WB KSU PDFDocument128 pagesB000048 NHWP Int WB KSU PDFSayed100% (1)

- Triggers of Internationalisation - UOLDocument17 pagesTriggers of Internationalisation - UOLMarlena DrzewskaNo ratings yet

- ENSC 1113 The Science of Global Challenges NotesDocument21 pagesENSC 1113 The Science of Global Challenges Notestalhahassanalvi786100% (2)

- Provas EfommDocument75 pagesProvas EfommCarlos AlvarengaNo ratings yet

- Pmsonline - Bih.nic - in Pmsedubcebc2223 (S (3fpo11xwuqnlp5xcehwxy3yb) ) PMS App StudentDetails - Aspx#Document3 pagesPmsonline - Bih.nic - in Pmsedubcebc2223 (S (3fpo11xwuqnlp5xcehwxy3yb) ) PMS App StudentDetails - Aspx#MUSKAN PRNNo ratings yet

- Proposed Rule: Pistachios Grown In— CaliforniaDocument5 pagesProposed Rule: Pistachios Grown In— CaliforniaJustia.comNo ratings yet

- NEPRA Excessive Billing Inquiry ReportDocument14 pagesNEPRA Excessive Billing Inquiry ReportKhawaja BurhanNo ratings yet