Professional Documents

Culture Documents

Lecture 1 Cash and Cash Equivalent - 085452

Lecture 1 Cash and Cash Equivalent - 085452

Uploaded by

Kriza CabilloCopyright:

Available Formats

You might also like

- Statement 27-DEC-19 AC 50127558 - 1 PDFDocument4 pagesStatement 27-DEC-19 AC 50127558 - 1 PDFEbuka Oye80% (5)

- Working Capital Management and FinanceFrom EverandWorking Capital Management and FinanceRating: 3.5 out of 5 stars3.5/5 (8)

- Audit of Cash: Darrell Joe O. Asuncion, Cpa MbaDocument17 pagesAudit of Cash: Darrell Joe O. Asuncion, Cpa MbaKaila Salem100% (1)

- Summer Project - Uco BNK MAHESHDocument60 pagesSummer Project - Uco BNK MAHESHSuraj Tiwari100% (1)

- Role of FinTech and Innovations For Improvising Digital Financial InclusionDocument6 pagesRole of FinTech and Innovations For Improvising Digital Financial InclusionInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Subject Codal Annotation: 1. Political Law 2. Constitutional Law 3. Election LawDocument18 pagesSubject Codal Annotation: 1. Political Law 2. Constitutional Law 3. Election LawElijahBactolNo ratings yet

- Lecture 2 Petty Cash Fund and Accounting For Cash Shortage or Overage - 082526Document12 pagesLecture 2 Petty Cash Fund and Accounting For Cash Shortage or Overage - 082526Kriza CabilloNo ratings yet

- Lecture 3 Bank Reconciliation - 082512Document17 pagesLecture 3 Bank Reconciliation - 082512Kriza CabilloNo ratings yet

- Lecture 3 The Cost Accounting CycleDocument15 pagesLecture 3 The Cost Accounting CycleHailsey WinterNo ratings yet

- Lecture 15 Investment in AssociateDocument14 pagesLecture 15 Investment in AssociateKriza CabilloNo ratings yet

- Lecture 2 Costs Concepts and Classifications 2Document19 pagesLecture 2 Costs Concepts and Classifications 2Hailsey WinterNo ratings yet

- HRM in The Public Sector 1Document51 pagesHRM in The Public Sector 1John John JavierNo ratings yet

- Lecture 9Document24 pagesLecture 9Banjo A. ReyesNo ratings yet

- PROFITABILITY POSITION OF COMMERCIAL Banks of Nepal (NABIL and NIBL)Document81 pagesPROFITABILITY POSITION OF COMMERCIAL Banks of Nepal (NABIL and NIBL)PrajwolNo ratings yet

- Allahabad BankDocument58 pagesAllahabad BankVARUN COMPUTERSNo ratings yet

- Adamson University: Budget and Operating Procedures of Barangay 66 Zone 8 Pasay City, Metro ManilaDocument30 pagesAdamson University: Budget and Operating Procedures of Barangay 66 Zone 8 Pasay City, Metro ManilaJohn Mark EsguerraNo ratings yet

- 1(iii). BOC-Prudential Easy-Choice PamphletDocument10 pages1(iii). BOC-Prudential Easy-Choice Pamphlet8dd78jcd52No ratings yet

- REO With Theories AnwerDocument21 pagesREO With Theories AnweraceNo ratings yet

- BF2 - AnswerDocument34 pagesBF2 - AnswerCherielee FabroNo ratings yet

- Research Paper On Npa of BanksDocument4 pagesResearch Paper On Npa of Banksiqfjzqulg100% (1)

- Internship-Narrative-Report-Psu PalawanDocument38 pagesInternship-Narrative-Report-Psu PalawanAian U KasimNo ratings yet

- Canara BankDocument84 pagesCanara BankKiran Chandrashekar100% (1)

- SIP Report PDFDocument66 pagesSIP Report PDFNagma ParmarNo ratings yet

- Comparitive Analysis of Public and Private Sector Banks NPA-KotakDocument6 pagesComparitive Analysis of Public and Private Sector Banks NPA-KotakMohmmedKhayyumNo ratings yet

- Quiz - Installment SalesDocument9 pagesQuiz - Installment SalesJOCIEL JOYCE DE GUZMANNo ratings yet

- EMBA-CM-DCC - Godwin Maphilipa - 2020Document77 pagesEMBA-CM-DCC - Godwin Maphilipa - 2020Jyoti PandaNo ratings yet

- Bankiq October Magazine PDFDocument49 pagesBankiq October Magazine PDFHdMovies2uNo ratings yet

- Colegio NG Lungsod NG Batangas: An Action Research Presented To The Faculty of Research and ExtensionDocument9 pagesColegio NG Lungsod NG Batangas: An Action Research Presented To The Faculty of Research and ExtensionDared KimNo ratings yet

- Adobe Scan Dec 11, 2020 LastDocument6 pagesAdobe Scan Dec 11, 2020 Lastpatrick mavNo ratings yet

- Commercial Bank FinalDocument92 pagesCommercial Bank FinalakshayNo ratings yet

- ParvatDocument67 pagesParvatparvatishinde884No ratings yet

- ACC205 SemProjectDocument4 pagesACC205 SemProjectBernice OrtegaNo ratings yet

- Research On Bad BankDocument30 pagesResearch On Bad BankVipin UpadhyayNo ratings yet

- I BankDocument5 pagesI Bankmuthu_theone6943No ratings yet

- Project Report RANJNADocument25 pagesProject Report RANJNACûtë Vijay RandhawaNo ratings yet

- A Comparative Study of Non Performing Assets in Public and Private Sector Banks in IndiaDocument5 pagesA Comparative Study of Non Performing Assets in Public and Private Sector Banks in IndiaPruthviraj RathoreNo ratings yet

- A Project Report Study of Commercial Banks in IndiaDocument8 pagesA Project Report Study of Commercial Banks in IndiaVikas KhannaNo ratings yet

- CELCO - AIS Final RequirementDocument13 pagesCELCO - AIS Final RequirementCindy EvangelistaNo ratings yet

- A Research Proposal of CASH MANAGMENT PRACTICE IN Bunna International Bank S.C (A Case Study On Arat Kilo Branch) ofDocument9 pagesA Research Proposal of CASH MANAGMENT PRACTICE IN Bunna International Bank S.C (A Case Study On Arat Kilo Branch) ofeferem100% (5)

- MXP 3 M9 F ITSh BNVK7911Document52 pagesMXP 3 M9 F ITSh BNVK7911Noshaba MaqsoodNo ratings yet

- Jfinex General Assembly & Induction of Officers 2023Document13 pagesJfinex General Assembly & Induction of Officers 2023Reyes Accounting Law OfficeNo ratings yet

- Odern Happy Graduation Instagram Post Presentation 169 1Document10 pagesOdern Happy Graduation Instagram Post Presentation 169 1ezekimacasaetNo ratings yet

- Working Capital Management of Commercial PDFDocument119 pagesWorking Capital Management of Commercial PDFKarki KrishNo ratings yet

- Dissertation On NpaDocument7 pagesDissertation On NpaOrderPaperOnlineChicago100% (1)

- Chapter OneDocument35 pagesChapter OneYoutube PremiumNo ratings yet

- Sbi Project ReportDocument113 pagesSbi Project Reportsandeep_pabbathi2020No ratings yet

- La Consolacion College Pacucoa Accredited Level IiDocument4 pagesLa Consolacion College Pacucoa Accredited Level IiitsmenatoyNo ratings yet

- Literature Review On Npa in BanksDocument6 pagesLiterature Review On Npa in Bankseowcnerke100% (1)

- Axis Bank ProjectDocument11 pagesAxis Bank ProjectKuNaL HaJaReNo ratings yet

- Final Project Financial MathematicsDocument13 pagesFinal Project Financial MathematicsScribdTranslationsNo ratings yet

- Document (15) - 1Document72 pagesDocument (15) - 1Snehal BhorkhadeNo ratings yet

- Financial PerformanceDocument23 pagesFinancial PerformanceKhanal NilambarNo ratings yet

- "Kitang Kita": A Project Advocacy of JPIA - SKSU: "To Be Human Means We Need To Care For Each Other"Document3 pages"Kitang Kita": A Project Advocacy of JPIA - SKSU: "To Be Human Means We Need To Care For Each Other"SuehNo ratings yet

- Investment Project WorkDocument18 pagesInvestment Project Workshubham kumarNo ratings yet

- final project from meDocument14 pagesfinal project from meAmshu Thakali100% (1)

- A Study On Deposit Mobilization of Muktinath Bikash Bank Limited - Np.binodDocument8 pagesA Study On Deposit Mobilization of Muktinath Bikash Bank Limited - Np.binodshresthanikhil078No ratings yet

- Partnership Liquidation QuizDocument11 pagesPartnership Liquidation QuizKatrina PetracheNo ratings yet

- Deposit Analysis ofDocument42 pagesDeposit Analysis ofshresthanikhil078No ratings yet

- Assessment of Non-Performing Assets and Its Recovery ProcessDocument92 pagesAssessment of Non-Performing Assets and Its Recovery ProcessAMIT K SINGH100% (6)

- Are Non-Performing Loans Sensitive To Macroeconomic Determinants? An Empirical Evidence From Banking Sector of SAARC CountriesDocument58 pagesAre Non-Performing Loans Sensitive To Macroeconomic Determinants? An Empirical Evidence From Banking Sector of SAARC CountriesSelim KhanNo ratings yet

- PCASDocument28 pagesPCAStamirisaarNo ratings yet

- Asian Development Bank–Japan Scholarship Program: 2014 Annual ReportFrom EverandAsian Development Bank–Japan Scholarship Program: 2014 Annual ReportNo ratings yet

- Indonesia’s Technology Startups: Voices from the EcosystemFrom EverandIndonesia’s Technology Startups: Voices from the EcosystemNo ratings yet

- Final Year Report of BBS 4th YearDocument49 pagesFinal Year Report of BBS 4th Yearnepalfinance987100% (2)

- Company Registration DocumentsDocument54 pagesCompany Registration Documentssara24391No ratings yet

- Traders' Almanac: Soybean Oil - Breakout MoveDocument3 pagesTraders' Almanac: Soybean Oil - Breakout MovefendyNo ratings yet

- Leasing As A Form of DebtDocument24 pagesLeasing As A Form of DebtSheila Mae Guerta LaceronaNo ratings yet

- Foreign Currency ValuationDocument7 pagesForeign Currency Valuationanon_996613481No ratings yet

- Car or Auto Depreciation CalculatorDocument3 pagesCar or Auto Depreciation Calculatorapi-330343385No ratings yet

- ch9 Solutions PDFDocument38 pagesch9 Solutions PDFHussnain NaneNo ratings yet

- CFAB. Commercial Banks - Chapter 5 - Consumer LoansDocument36 pagesCFAB. Commercial Banks - Chapter 5 - Consumer LoansViet Ha HoangNo ratings yet

- Local Government UnitsDocument14 pagesLocal Government UnitsJennybabe PetaNo ratings yet

- Solution Manual For Financial Institutions Managementa Risk Management Approach Saunders Cornett 8th EditionDocument17 pagesSolution Manual For Financial Institutions Managementa Risk Management Approach Saunders Cornett 8th EditionAmandaMartinxdwj100% (44)

- BIP Design Document EOD V1Document55 pagesBIP Design Document EOD V1Esteban David Ramírez Espinoza0% (1)

- Case Against IndyMac and PaulsonDocument288 pagesCase Against IndyMac and PaulsonWho's in my Fund100% (1)

- Da 1Document1 pageDa 1Deepak JainNo ratings yet

- Business Intelligence in BankingDocument299 pagesBusiness Intelligence in Bankingsohado100% (1)

- Banking Awareness ImportantDocument30 pagesBanking Awareness ImportantThirrunavukkarasu R RNo ratings yet

- Ansbacher ReportDocument506 pagesAnsbacher Reportthestorydotie100% (1)

- Performance Management SystemDocument19 pagesPerformance Management SystemSanjeev100% (3)

- AR Technical FoundationDocument2 pagesAR Technical Foundationsandeep__27No ratings yet

- The 9 Stages of The Big Con: The Story of The Confidence Man (Reissued by Anchor Books in 1999 With AnDocument3 pagesThe 9 Stages of The Big Con: The Story of The Confidence Man (Reissued by Anchor Books in 1999 With AnRichard BakerNo ratings yet

- Welcome To Our Presentation: Topic: Management of Cash & Marketable SecuritiesDocument23 pagesWelcome To Our Presentation: Topic: Management of Cash & Marketable SecuritiesAkash BhowmikNo ratings yet

- Chapter 8Document18 pagesChapter 8Marie Sheaneth BalitangNo ratings yet

- Terms and ConditionsDocument4 pagesTerms and Conditionsvikalpsharma96No ratings yet

- Oblicon64 76digestDocument6 pagesOblicon64 76digestJennifer Rabor-MacayanaNo ratings yet

- SE - Muhammad Yunus by Anshul KhindriDocument1 pageSE - Muhammad Yunus by Anshul KhindriAnshul KhindriNo ratings yet

- ZaibatsuDocument5 pagesZaibatsuAnusua ChowdhuryNo ratings yet

- Chapter 29-The Monetary SystemDocument40 pagesChapter 29-The Monetary SystemHuy TranNo ratings yet

- Mergers and Acquisitions: A Glossary of Terms: AcquisitionDocument8 pagesMergers and Acquisitions: A Glossary of Terms: AcquisitionMussab KarjikarNo ratings yet

Lecture 1 Cash and Cash Equivalent - 085452

Lecture 1 Cash and Cash Equivalent - 085452

Uploaded by

Kriza CabilloOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lecture 1 Cash and Cash Equivalent - 085452

Lecture 1 Cash and Cash Equivalent - 085452

Uploaded by

Kriza CabilloCopyright:

Available Formats

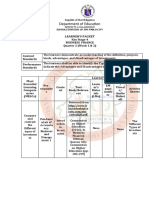

Batangas State University

Pablo Borbon Campus

The National Engineering University

LEARNING MODULE IN

ACC 205

Cash and Cash Equivalents

Leading Innovations, Transforming Lives,

Building the Nation

Batangas State University

Pablo Borbon Campus

The National Engineering University

OBJECTIVES

1. Define cash and cash equivalents

2. Identify items under cash and cash equivalents.

3. Analyze the considerations in identify cash and cash equivalents and

investments.

4. Discuss the measurement of cash and cash equivalents.

5. Describe additional items which are included and excluded to cash.

6. Solve problems involving identifying cash and cash equivalents.

Leading Innovations, Transforming Lives,

Building the Nation

Batangas State University

Pablo Borbon Campus

The National Engineering University

CASH

Cash includes money and any other negotiable instrument that is payable and acceptable by

the bank for deposit and immediate credit.

Cash is money or its equivalent that is readily available for unrestricted use.

Examples:

a. Cash on Hand

b. Cash in Bank

c. Cash fund (set aside for current purpose).

Leading Innovations, Transforming Lives,

Building the Nation

Batangas State University

Pablo Borbon Campus

The National Engineering University

CASH ON HAND

-Customer’s check awaiting deposit

-Undeposited cash collections (currencies such as bills and coins)

-Traveler’s Check

-Cashier’s/Official/Treasurer’s/Manager’s checks.

-Postal money orders (a demand credit instrument issued and payable by a

post office)

-Bank drafts (a written order addressed to the bank to pay an amount of

money to the order of the maker)

Leading Innovations, Transforming Lives,

Building the Nation

Batangas State University

Pablo Borbon Campus

The National Engineering University

CASH IN BANK

-Current account/checking account/demand deposit/commercial deposit

Generally non-interest bearing

Withdrawable by checks against bank

-Savings deposit (Savings Account-SA)

Generally interest bearing

Depositor is issued an ATM Card or passbook

Withdrawable in ATM station or within the bank

Leading Innovations, Transforming Lives,

Building the Nation

Batangas State University

Pablo Borbon Campus

The National Engineering University

CASH FUND FOR CURRENT

OPERATIONS

-Change fund

-Payroll fund

-Purchasing fund (for purchasing of inventories)

-Revolving fund (fund that is used for limited or specific purpose set by management)

-Interest Fund

-Petty Cash Fund (for small and miscellaneous disbursements)

-Dividend Fund

-Travel Fund

-Tax Fund

Leading Innovations, Transforming Lives,

Building the Nation

Batangas State University

Pablo Borbon Campus

The National Engineering University

FUND FOR NON CURRENT

OPERATIONS

These are part of noncurrent assets and SHOULD NOT BE INCLUDED as part of CASH.

Examples are as follows:

1. Pension Fund – generally, noncurrent investment but if the related liability is current, the fund is

included as cash.

2. Preferred Redemption Fund – Non current investment unless the preferred share has a

mandatory redemption and if redeemable: within 1 year from the reporting period – part of current

investment ; within 3 months from the reporting period – Cash Equivalent

3. Acquisition of PPE Fund – Always non-current even if expected to be disbursed next year.

4. Contingent Fund – Noncurrent Investment

5. Insurance – Noncurrent Investment

6. Sinking Fund – Noncurrent Investment, if the related bonds payable is current, the fund is

included as cash

Leading Innovations, Transforming Lives,

Building the Nation

Batangas State University

Pablo Borbon Campus

The National Engineering University

IMPORTANT NOTE

Classification of cash fund as current or non current should be parallel to

the classification applied to the related liability

Leading Innovations, Transforming Lives,

Building the Nation

Batangas State University

Pablo Borbon Campus

The National Engineering University

CASH EQUIVALENTS

Cash equivalent are short term, highly liquid investments that

are readily convertible to known amounts of cash and which are

subject to an insignificant risk of changes in value. (PAS 7

Statement of Cash Flows)

Only highly liquid investments that are acquired 3 months or less

before maturity can qualify as cash equivalents.

Leading Innovations, Transforming Lives,

Building the Nation

Batangas State University

Pablo Borbon Campus

The National Engineering University

CASH EQUIVALENTS

1. Three-month BSP treasury bills

2. Three-month Time deposit

3. Three-month Money Market instrument or commercial paper

4. xx years BSP treasury bills, Commercial paper or Redeemable

preference shares purchased three months before maturity

NOTE:

What is important is the DATE OF PURCHASE (which should be THREE

MONTHS OR LESS)

Leading Innovations, Transforming Lives,

Building the Nation

Batangas State University

Pablo Borbon Campus

The National Engineering University

IMPORTANT NOTE

-Ifthe item cannot be included as cash equivalent it did not qualify the cut-

off time period (i.e. 3 months), it will always be classified as

INVESTMENTS (Short-term or long-term) depending on the period up to

maturity

Leading Innovations, Transforming Lives,

Building the Nation

Batangas State University

Pablo Borbon Campus

The National Engineering University

Measurement of Cash and Cash Equivalent

- is at face value

Financial Statement Presentation

- “Cash and Cash equivalents” should be shown

as the first line item among the current assets

Leading Innovations, Transforming Lives,

Building the Nation

Batangas State University

Pablo Borbon Campus

The National Engineering University

Bank Overdraft

-when the Cash in Bank account has a credit balance, it is said to be an overdraft.

The credit balance in the cash in bank account results from the issuance of checks in

excess of deposits (deposits<disbursements).

Under PFRS overdraft should be reported as a liability and should not be offset against

other bank account with debit balances

Exception to the rule of Overdrafts

It may be offset against a positive balance, when the entity maintains two

accounts in one bank and one account results in an overdraft, such overdraft can be offset

against the other bank account with debit balance

Moreover, an overdraft can also be offset against the other bank account if the

amount is not material. However, overdrafts are not permitted in the Philippines.

Leading Innovations, Transforming Lives,

Building the Nation

Batangas State University

Pablo Borbon Campus

The National Engineering University

Compensating Balances

- are minimum amounts that a company agrees to maintain in a bank checking

or demand deposit account as support or collateral for a loan of the depositor.

• Not legally restricted- the amount is reported as part of Cash. The nature of

the arrangement is disclosed in the notes of the financial statements.

• Legally Restricted- the amount should be classified separately either as

current asset or non-current asset depending on the nature of the loan.

Leading Innovations, Transforming Lives,

Building the Nation

Batangas State University

Pablo Borbon Campus

The National Engineering University

Undelivered or Unreleased Checks

are the company’s checks drawn and recorded as disbursed but are not

actually issued or delivered to the payees as of the reporting date. These

checks should not be deducted from the company’s cash balance until they

have been mailed or otherwise delivered. Therefore, these checks should be

reverted to the cash balance. As a result, liabilities that the checks are intended

to liquidate still exist and should be reported as current payables.

Entry:

Cash xxx

Accounts Payable xxx

Leading Innovations, Transforming Lives,

Building the Nation

Batangas State University

Pablo Borbon Campus

The National Engineering University

Postdated Check

are company’s check which has been recorded as issued and delivered

to payee before or at the end of the reporting period but it bears a date

subsequent to the end of reporting period, hence should be reverted to cash

and the corresponding liability shall continue to be recognized, because there is

no actual payment yet, as of that date.

Entry:

Cash xxx

Accounts Payable xxx

Leading Innovations, Transforming Lives,

Building the Nation

Batangas State University

Pablo Borbon Campus

The National Engineering University

Stale Check or Check Long Outstanding

is a check not encashed by the payee within relatively a long period

from the time of issuance.

Entries:

• If the amount of stale check is immaterial

Cash xxx

Miscellaneous Income xxx

• If the amount is material and liability is expected to continue

Cash xxx

Accounts Payable xxx

Leading Innovations, Transforming Lives,

Building the Nation

Batangas State University

Pablo Borbon Campus

The National Engineering University

Window dressing

Is a practice of opening the books of accounts beyond the close of the reporting period for the

purpose of showing a better financial position and performance.

Window dressing is usually accomplished as follows:

a. By recording as of the last day of the reporting period collections made subsequent to the close of the

period.

b. By recording as of the last day of the reporting period payments of accounts made subsequent to the

close period.

Such practices are unacceptable and undesirable. The entries made to window dress must be

reversed to correct the statements.

• In a very broad sense, window dressing is any deliberate misstatement of the assets, liabilities,

equity, income, and expenses.

• When the statements contain any untruth or falsity, the statements are said to be window dressed.

Leading Innovations, Transforming Lives,

Building the Nation

Batangas State University

Pablo Borbon Campus

The National Engineering University

Lapping

- Is a practice used for concealing cash shortage.

- Consists of misappropriating a collection from one customer and concealing this

defalcation by applying a subsequent collection made from another customer.

- Involves a series of postponements of the entries for the collection of receivables.

- This is possible when an entity has poor internal control and especially when the bookkeeper

and cashier are one and the same person

Leading Innovations, Transforming Lives,

Building the Nation

Batangas State University

Pablo Borbon Campus

The National Engineering University

Kiting

- Is another device used to conceal a cash shortage.

- It is possible when an entity maintains current accounts in different banks. Kiting is usually

employed at the end of the month.

- It occurs when a check is drawn against a first bank and depositing the same check in a second

bank to cover the shortage in the latter bank. No entry is made for both the drawing and deposit

of the check.

Leading Innovations, Transforming Lives,

Building the Nation

Batangas State University

Pablo Borbon Campus

The National Engineering University

Problem Solving

Leading Innovations, Transforming Lives,

Building the Nation

Batangas State University

Pablo Borbon Campus

The National Engineering University

Leading Innovations, Transforming Lives,

Building the Nation

Batangas State University

Pablo Borbon Campus

The National Engineering University

Leading Innovations, Transforming Lives,

Building the Nation

Batangas State University

Pablo Borbon Campus

The National Engineering University

Leading Innovations, Transforming Lives,

Building the Nation

Batangas State University

Pablo Borbon Campus

The National Engineering University

Leading Innovations, Transforming Lives,

Building the Nation

Batangas State University

Pablo Borbon Campus

The National Engineering University

Leading Innovations, Transforming Lives,

Building the Nation

You might also like

- Statement 27-DEC-19 AC 50127558 - 1 PDFDocument4 pagesStatement 27-DEC-19 AC 50127558 - 1 PDFEbuka Oye80% (5)

- Working Capital Management and FinanceFrom EverandWorking Capital Management and FinanceRating: 3.5 out of 5 stars3.5/5 (8)

- Audit of Cash: Darrell Joe O. Asuncion, Cpa MbaDocument17 pagesAudit of Cash: Darrell Joe O. Asuncion, Cpa MbaKaila Salem100% (1)

- Summer Project - Uco BNK MAHESHDocument60 pagesSummer Project - Uco BNK MAHESHSuraj Tiwari100% (1)

- Role of FinTech and Innovations For Improvising Digital Financial InclusionDocument6 pagesRole of FinTech and Innovations For Improvising Digital Financial InclusionInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Subject Codal Annotation: 1. Political Law 2. Constitutional Law 3. Election LawDocument18 pagesSubject Codal Annotation: 1. Political Law 2. Constitutional Law 3. Election LawElijahBactolNo ratings yet

- Lecture 2 Petty Cash Fund and Accounting For Cash Shortage or Overage - 082526Document12 pagesLecture 2 Petty Cash Fund and Accounting For Cash Shortage or Overage - 082526Kriza CabilloNo ratings yet

- Lecture 3 Bank Reconciliation - 082512Document17 pagesLecture 3 Bank Reconciliation - 082512Kriza CabilloNo ratings yet

- Lecture 3 The Cost Accounting CycleDocument15 pagesLecture 3 The Cost Accounting CycleHailsey WinterNo ratings yet

- Lecture 15 Investment in AssociateDocument14 pagesLecture 15 Investment in AssociateKriza CabilloNo ratings yet

- Lecture 2 Costs Concepts and Classifications 2Document19 pagesLecture 2 Costs Concepts and Classifications 2Hailsey WinterNo ratings yet

- HRM in The Public Sector 1Document51 pagesHRM in The Public Sector 1John John JavierNo ratings yet

- Lecture 9Document24 pagesLecture 9Banjo A. ReyesNo ratings yet

- PROFITABILITY POSITION OF COMMERCIAL Banks of Nepal (NABIL and NIBL)Document81 pagesPROFITABILITY POSITION OF COMMERCIAL Banks of Nepal (NABIL and NIBL)PrajwolNo ratings yet

- Allahabad BankDocument58 pagesAllahabad BankVARUN COMPUTERSNo ratings yet

- Adamson University: Budget and Operating Procedures of Barangay 66 Zone 8 Pasay City, Metro ManilaDocument30 pagesAdamson University: Budget and Operating Procedures of Barangay 66 Zone 8 Pasay City, Metro ManilaJohn Mark EsguerraNo ratings yet

- 1(iii). BOC-Prudential Easy-Choice PamphletDocument10 pages1(iii). BOC-Prudential Easy-Choice Pamphlet8dd78jcd52No ratings yet

- REO With Theories AnwerDocument21 pagesREO With Theories AnweraceNo ratings yet

- BF2 - AnswerDocument34 pagesBF2 - AnswerCherielee FabroNo ratings yet

- Research Paper On Npa of BanksDocument4 pagesResearch Paper On Npa of Banksiqfjzqulg100% (1)

- Internship-Narrative-Report-Psu PalawanDocument38 pagesInternship-Narrative-Report-Psu PalawanAian U KasimNo ratings yet

- Canara BankDocument84 pagesCanara BankKiran Chandrashekar100% (1)

- SIP Report PDFDocument66 pagesSIP Report PDFNagma ParmarNo ratings yet

- Comparitive Analysis of Public and Private Sector Banks NPA-KotakDocument6 pagesComparitive Analysis of Public and Private Sector Banks NPA-KotakMohmmedKhayyumNo ratings yet

- Quiz - Installment SalesDocument9 pagesQuiz - Installment SalesJOCIEL JOYCE DE GUZMANNo ratings yet

- EMBA-CM-DCC - Godwin Maphilipa - 2020Document77 pagesEMBA-CM-DCC - Godwin Maphilipa - 2020Jyoti PandaNo ratings yet

- Bankiq October Magazine PDFDocument49 pagesBankiq October Magazine PDFHdMovies2uNo ratings yet

- Colegio NG Lungsod NG Batangas: An Action Research Presented To The Faculty of Research and ExtensionDocument9 pagesColegio NG Lungsod NG Batangas: An Action Research Presented To The Faculty of Research and ExtensionDared KimNo ratings yet

- Adobe Scan Dec 11, 2020 LastDocument6 pagesAdobe Scan Dec 11, 2020 Lastpatrick mavNo ratings yet

- Commercial Bank FinalDocument92 pagesCommercial Bank FinalakshayNo ratings yet

- ParvatDocument67 pagesParvatparvatishinde884No ratings yet

- ACC205 SemProjectDocument4 pagesACC205 SemProjectBernice OrtegaNo ratings yet

- Research On Bad BankDocument30 pagesResearch On Bad BankVipin UpadhyayNo ratings yet

- I BankDocument5 pagesI Bankmuthu_theone6943No ratings yet

- Project Report RANJNADocument25 pagesProject Report RANJNACûtë Vijay RandhawaNo ratings yet

- A Comparative Study of Non Performing Assets in Public and Private Sector Banks in IndiaDocument5 pagesA Comparative Study of Non Performing Assets in Public and Private Sector Banks in IndiaPruthviraj RathoreNo ratings yet

- A Project Report Study of Commercial Banks in IndiaDocument8 pagesA Project Report Study of Commercial Banks in IndiaVikas KhannaNo ratings yet

- CELCO - AIS Final RequirementDocument13 pagesCELCO - AIS Final RequirementCindy EvangelistaNo ratings yet

- A Research Proposal of CASH MANAGMENT PRACTICE IN Bunna International Bank S.C (A Case Study On Arat Kilo Branch) ofDocument9 pagesA Research Proposal of CASH MANAGMENT PRACTICE IN Bunna International Bank S.C (A Case Study On Arat Kilo Branch) ofeferem100% (5)

- MXP 3 M9 F ITSh BNVK7911Document52 pagesMXP 3 M9 F ITSh BNVK7911Noshaba MaqsoodNo ratings yet

- Jfinex General Assembly & Induction of Officers 2023Document13 pagesJfinex General Assembly & Induction of Officers 2023Reyes Accounting Law OfficeNo ratings yet

- Odern Happy Graduation Instagram Post Presentation 169 1Document10 pagesOdern Happy Graduation Instagram Post Presentation 169 1ezekimacasaetNo ratings yet

- Working Capital Management of Commercial PDFDocument119 pagesWorking Capital Management of Commercial PDFKarki KrishNo ratings yet

- Dissertation On NpaDocument7 pagesDissertation On NpaOrderPaperOnlineChicago100% (1)

- Chapter OneDocument35 pagesChapter OneYoutube PremiumNo ratings yet

- Sbi Project ReportDocument113 pagesSbi Project Reportsandeep_pabbathi2020No ratings yet

- La Consolacion College Pacucoa Accredited Level IiDocument4 pagesLa Consolacion College Pacucoa Accredited Level IiitsmenatoyNo ratings yet

- Literature Review On Npa in BanksDocument6 pagesLiterature Review On Npa in Bankseowcnerke100% (1)

- Axis Bank ProjectDocument11 pagesAxis Bank ProjectKuNaL HaJaReNo ratings yet

- Final Project Financial MathematicsDocument13 pagesFinal Project Financial MathematicsScribdTranslationsNo ratings yet

- Document (15) - 1Document72 pagesDocument (15) - 1Snehal BhorkhadeNo ratings yet

- Financial PerformanceDocument23 pagesFinancial PerformanceKhanal NilambarNo ratings yet

- "Kitang Kita": A Project Advocacy of JPIA - SKSU: "To Be Human Means We Need To Care For Each Other"Document3 pages"Kitang Kita": A Project Advocacy of JPIA - SKSU: "To Be Human Means We Need To Care For Each Other"SuehNo ratings yet

- Investment Project WorkDocument18 pagesInvestment Project Workshubham kumarNo ratings yet

- final project from meDocument14 pagesfinal project from meAmshu Thakali100% (1)

- A Study On Deposit Mobilization of Muktinath Bikash Bank Limited - Np.binodDocument8 pagesA Study On Deposit Mobilization of Muktinath Bikash Bank Limited - Np.binodshresthanikhil078No ratings yet

- Partnership Liquidation QuizDocument11 pagesPartnership Liquidation QuizKatrina PetracheNo ratings yet

- Deposit Analysis ofDocument42 pagesDeposit Analysis ofshresthanikhil078No ratings yet

- Assessment of Non-Performing Assets and Its Recovery ProcessDocument92 pagesAssessment of Non-Performing Assets and Its Recovery ProcessAMIT K SINGH100% (6)

- Are Non-Performing Loans Sensitive To Macroeconomic Determinants? An Empirical Evidence From Banking Sector of SAARC CountriesDocument58 pagesAre Non-Performing Loans Sensitive To Macroeconomic Determinants? An Empirical Evidence From Banking Sector of SAARC CountriesSelim KhanNo ratings yet

- PCASDocument28 pagesPCAStamirisaarNo ratings yet

- Asian Development Bank–Japan Scholarship Program: 2014 Annual ReportFrom EverandAsian Development Bank–Japan Scholarship Program: 2014 Annual ReportNo ratings yet

- Indonesia’s Technology Startups: Voices from the EcosystemFrom EverandIndonesia’s Technology Startups: Voices from the EcosystemNo ratings yet

- Final Year Report of BBS 4th YearDocument49 pagesFinal Year Report of BBS 4th Yearnepalfinance987100% (2)

- Company Registration DocumentsDocument54 pagesCompany Registration Documentssara24391No ratings yet

- Traders' Almanac: Soybean Oil - Breakout MoveDocument3 pagesTraders' Almanac: Soybean Oil - Breakout MovefendyNo ratings yet

- Leasing As A Form of DebtDocument24 pagesLeasing As A Form of DebtSheila Mae Guerta LaceronaNo ratings yet

- Foreign Currency ValuationDocument7 pagesForeign Currency Valuationanon_996613481No ratings yet

- Car or Auto Depreciation CalculatorDocument3 pagesCar or Auto Depreciation Calculatorapi-330343385No ratings yet

- ch9 Solutions PDFDocument38 pagesch9 Solutions PDFHussnain NaneNo ratings yet

- CFAB. Commercial Banks - Chapter 5 - Consumer LoansDocument36 pagesCFAB. Commercial Banks - Chapter 5 - Consumer LoansViet Ha HoangNo ratings yet

- Local Government UnitsDocument14 pagesLocal Government UnitsJennybabe PetaNo ratings yet

- Solution Manual For Financial Institutions Managementa Risk Management Approach Saunders Cornett 8th EditionDocument17 pagesSolution Manual For Financial Institutions Managementa Risk Management Approach Saunders Cornett 8th EditionAmandaMartinxdwj100% (44)

- BIP Design Document EOD V1Document55 pagesBIP Design Document EOD V1Esteban David Ramírez Espinoza0% (1)

- Case Against IndyMac and PaulsonDocument288 pagesCase Against IndyMac and PaulsonWho's in my Fund100% (1)

- Da 1Document1 pageDa 1Deepak JainNo ratings yet

- Business Intelligence in BankingDocument299 pagesBusiness Intelligence in Bankingsohado100% (1)

- Banking Awareness ImportantDocument30 pagesBanking Awareness ImportantThirrunavukkarasu R RNo ratings yet

- Ansbacher ReportDocument506 pagesAnsbacher Reportthestorydotie100% (1)

- Performance Management SystemDocument19 pagesPerformance Management SystemSanjeev100% (3)

- AR Technical FoundationDocument2 pagesAR Technical Foundationsandeep__27No ratings yet

- The 9 Stages of The Big Con: The Story of The Confidence Man (Reissued by Anchor Books in 1999 With AnDocument3 pagesThe 9 Stages of The Big Con: The Story of The Confidence Man (Reissued by Anchor Books in 1999 With AnRichard BakerNo ratings yet

- Welcome To Our Presentation: Topic: Management of Cash & Marketable SecuritiesDocument23 pagesWelcome To Our Presentation: Topic: Management of Cash & Marketable SecuritiesAkash BhowmikNo ratings yet

- Chapter 8Document18 pagesChapter 8Marie Sheaneth BalitangNo ratings yet

- Terms and ConditionsDocument4 pagesTerms and Conditionsvikalpsharma96No ratings yet

- Oblicon64 76digestDocument6 pagesOblicon64 76digestJennifer Rabor-MacayanaNo ratings yet

- SE - Muhammad Yunus by Anshul KhindriDocument1 pageSE - Muhammad Yunus by Anshul KhindriAnshul KhindriNo ratings yet

- ZaibatsuDocument5 pagesZaibatsuAnusua ChowdhuryNo ratings yet

- Chapter 29-The Monetary SystemDocument40 pagesChapter 29-The Monetary SystemHuy TranNo ratings yet

- Mergers and Acquisitions: A Glossary of Terms: AcquisitionDocument8 pagesMergers and Acquisitions: A Glossary of Terms: AcquisitionMussab KarjikarNo ratings yet