Professional Documents

Culture Documents

Philippine Financial System

Philippine Financial System

Uploaded by

Ma'am Katrina Marie Miranda0 ratings0% found this document useful (0 votes)

3 views22 pagesOriginal Title

2. Philippine Financial System

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

3 views22 pagesPhilippine Financial System

Philippine Financial System

Uploaded by

Ma'am Katrina Marie MirandaCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 22

FINANCIAL INSTITUTIONS

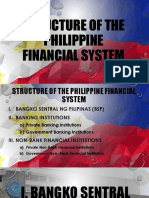

I. BSP III. Government Bank

II. Private Banks a. Development Bank of the Philippines

b. Land Bank of the Philippines

a. Universal Bank c. Al-Amanah Islamic Investment Bank

b. Commercial Bank

c. Thrift Banks (Stock Savings and IV. Private Non-Bank Financial Institutions

Mortgage Bank, Private Development

d. Investment house/Investment Banks

Bank, Stock Savings and Loan e. Finance Company

Association) f. Securities Dealer

d. Rural Bank g. Savings and Loan Associations

e. Cooperative Bank h. Mutual Funds

i. Pawnshop

V. Government Non-Bank j. Lending

f. GSIS k. Pension Fund

g. SSS l. Insurance

m. Credit Union

h. Pag-Ibig

• The PDIC is a government instrumentality created in

1963 by virtue of Republic Act No. 3591 to insure the

deposits of all banks.

• The PDIC exists to protect depositors by providing

deposit insurance coverage for the depositing public

and to help promote financial stability.

THE PDIC HAS THE FOLLOWING

ROLES:

• Deposit Insurance. PDIC provides a maximum deposit insurance

coverage of PhP500,000 per depositor per bank.

• Co-Regulator of Banks. PDIC works closely with the country's

financial regulators such as the Bangko Sentral ng Pilipinas (BSP) to

ensure the stability of the banking system.

• III. Liquidation of Closed Banks. PDIC proceeds with the

liquidation process upon order of the Monetary Board of the Bangko

Sentral ng Pilipinas.

You might also like

- Bank and Banking PerspectivesDocument4 pagesBank and Banking PerspectivesMariel Crista Celda MaravillosaNo ratings yet

- Thrift Banks Reporting Banking and FinanceDocument18 pagesThrift Banks Reporting Banking and FinanceNick Jagolino100% (2)

- c6 Philippine Financial System StudentDocument38 pagesc6 Philippine Financial System StudentAyessa ViojanNo ratings yet

- The Philippine Financial System-NewDocument3 pagesThe Philippine Financial System-Newrosalyn mauricioNo ratings yet

- bstract-Thesis-Defense-Presentation 20240217 070252 0000Document15 pagesbstract-Thesis-Defense-Presentation 20240217 070252 0000roxanneestopaNo ratings yet

- Financial System IntroDocument9 pagesFinancial System IntroAina Nicole IntongNo ratings yet

- Financial SystemDocument41 pagesFinancial SystemCherilyn BongcawilNo ratings yet

- Chapter 1Document7 pagesChapter 1Bryan Ramon TuazonNo ratings yet

- What Makes Banking UniqueDocument2 pagesWhat Makes Banking UniqueFaithful FighterNo ratings yet

- Banking Financial InstitutionsDocument252 pagesBanking Financial Institutionspraise ferrerNo ratings yet

- Brown Creative Company Profile Presentation 3Document20 pagesBrown Creative Company Profile Presentation 3Florence Joy AbkilanNo ratings yet

- Chapter 1 - Introduction To Philippine Financial SystemDocument14 pagesChapter 1 - Introduction To Philippine Financial SystemAnthony BalandoNo ratings yet

- Preliminary ProjectDocument9 pagesPreliminary ProjectLuna, Annalie RamirezNo ratings yet

- Chapter 1 - Miraballes, FerlynDocument17 pagesChapter 1 - Miraballes, FerlynLyn AmbrayNo ratings yet

- Financial Institutions Market and InstrumentsDocument36 pagesFinancial Institutions Market and InstrumentsJean FlordelizNo ratings yet

- Private Commercial BanksDocument7 pagesPrivate Commercial Banksjakia sultanaNo ratings yet

- Structure of The Philippine Financial SystemDocument33 pagesStructure of The Philippine Financial SystemGrace ManaloNo ratings yet

- CHAPTER I Introduction To Financial SevicesDocument88 pagesCHAPTER I Introduction To Financial SevicesMengsong NguonNo ratings yet

- Into To Financial Markets.9q7zOKK1Document23 pagesInto To Financial Markets.9q7zOKK1JabbaNo ratings yet

- Fin 4Document4 pagesFin 4kablon farm foods CorporationNo ratings yet

- ReportDocument7 pagesReportJordan AncayanNo ratings yet

- Multiple Choice. Choose The Letter of The Correct Answer.: Asian Development Foundation CollegeDocument2 pagesMultiple Choice. Choose The Letter of The Correct Answer.: Asian Development Foundation CollegeEm MendozaNo ratings yet

- Banking and FinancialDocument8 pagesBanking and FinancialBaby PinkNo ratings yet

- CHAPTER 1 - Business FinanceDocument10 pagesCHAPTER 1 - Business FinanceMARL VINCENT L LABITADNo ratings yet

- Chapter 1 INTRODUCTION TO PHILIPPINE FINANCIAL SYSTEMDocument12 pagesChapter 1 INTRODUCTION TO PHILIPPINE FINANCIAL SYSTEMReggie AlisNo ratings yet

- Monetary PolicyDocument4 pagesMonetary PolicyBunnyNo ratings yet

- Banking InstitutionsDocument5 pagesBanking InstitutionsangelicamadscNo ratings yet

- CB-01 The Philippine Financial SystemDocument3 pagesCB-01 The Philippine Financial SystemJHERRY MIG SEVILLA100% (1)

- Ba100 2NDDocument4 pagesBa100 2NDDORELYN ALBIANo ratings yet

- Finance ReviewerDocument13 pagesFinance ReviewerSAAVEDRA , ANDREA COLUMBRESNo ratings yet

- Banking NotesDocument1 pageBanking NotesCherith Inna MonteroNo ratings yet

- The Philippine Financial SystemDocument17 pagesThe Philippine Financial SystemCharisa SamsonNo ratings yet

- Assignment 1.1Document5 pagesAssignment 1.1John Vincent SantiagoNo ratings yet

- Central Bank Regulation and SupervisionDocument13 pagesCentral Bank Regulation and SupervisionArmand RoblesNo ratings yet

- Group 05 Report On Banking Sector of BangladeshDocument10 pagesGroup 05 Report On Banking Sector of BangladeshShifat ShahriarNo ratings yet

- Philippine-Veterans-Bank SwotDocument34 pagesPhilippine-Veterans-Bank SwotAhnJello100% (1)

- Overview of Market Participants and Financial InnovationDocument5 pagesOverview of Market Participants and Financial InnovationLeonard CañamoNo ratings yet

- Mutual Funds & UITFs in The PhilippinesDocument5 pagesMutual Funds & UITFs in The PhilippinesGeewee Vera FloresNo ratings yet

- Hedge Fund NotesDocument5 pagesHedge Fund NotesVandana DubeyNo ratings yet

- FM 422Document8 pagesFM 422Harmaein KuaNo ratings yet

- BANKING AND INSURANCE (1) .Docx NewDocument59 pagesBANKING AND INSURANCE (1) .Docx Newsuganya100% (1)

- Chap 2 QuizDocument2 pagesChap 2 QuizLeonard CañamoNo ratings yet

- philippine financial systemDocument3 pagesphilippine financial systemjingparkNo ratings yet

- Classifications of BanksDocument5 pagesClassifications of Bankscassandrallanos2024No ratings yet

- Mga Bumubuo Sa Sektor NG PananalapiDocument1 pageMga Bumubuo Sa Sektor NG PananalapiZapphire Peña MainNo ratings yet

- Bofi QuizzesDocument9 pagesBofi QuizzesChristine Joy MauroNo ratings yet

- A. Pawnshops 4. B. Pawner 5. C. Pawnee D. Pawn 6. E. Pawn Ticket 7. F. Property G. Stock H. Bulky Pawns 8. I. Service Charge 9. 10Document18 pagesA. Pawnshops 4. B. Pawner 5. C. Pawnee D. Pawn 6. E. Pawn Ticket 7. F. Property G. Stock H. Bulky Pawns 8. I. Service Charge 9. 10Darwin SolanoyNo ratings yet

- Chap 1&2Document10 pagesChap 1&2Raihanah HassanNo ratings yet

- Structure of The Philippine Financial SystemDocument28 pagesStructure of The Philippine Financial SystemJenielyn DelamataNo ratings yet

- Thrift BankDocument23 pagesThrift BankErl JohnNo ratings yet

- PPTXDocument25 pagesPPTXJANDREI EZEKIEL LAUSNo ratings yet

- Fin101 Notes For PrelimDocument1 pageFin101 Notes For PrelimEmily ResuentoNo ratings yet

- CAED102 ReviewerDocument8 pagesCAED102 ReviewerelaiNo ratings yet

- Public Financial System and Public Enterprises ExperiencesDocument5 pagesPublic Financial System and Public Enterprises ExperiencesMeane BalbontinNo ratings yet

- AssignmentDocument4 pagesAssignmentHaziel LadananNo ratings yet

- Citi Bank FinalDocument64 pagesCiti Bank Finalmldc2011No ratings yet

- Types of BanksDocument2 pagesTypes of BanksJeCabaisNo ratings yet

- An Overview of BanksDocument11 pagesAn Overview of BanksgishaNo ratings yet

- Topic 1 Development of CreditDocument3 pagesTopic 1 Development of CreditPhilip Jayson CarengNo ratings yet

- List of Present Students in FLB May 8, 2024Document5 pagesList of Present Students in FLB May 8, 2024Ma'am Katrina Marie MirandaNo ratings yet

- Monetary SystemDocument14 pagesMonetary SystemMa'am Katrina Marie MirandaNo ratings yet

- Philippine Money and Currency - PESO Bills and CoinsDocument6 pagesPhilippine Money and Currency - PESO Bills and CoinsMa'am Katrina Marie MirandaNo ratings yet

- Introduction To FinanceDocument40 pagesIntroduction To FinanceMa'am Katrina Marie MirandaNo ratings yet

- Concept of MoneyDocument37 pagesConcept of MoneyMa'am Katrina Marie MirandaNo ratings yet

- Life GoalsDocument29 pagesLife GoalsMa'am Katrina Marie MirandaNo ratings yet

- Activity No 2Document1 pageActivity No 2Ma'am Katrina Marie MirandaNo ratings yet

- Introduction To Personal FinanceDocument15 pagesIntroduction To Personal FinanceMa'am Katrina Marie MirandaNo ratings yet

- Activity No. 3Document1 pageActivity No. 3Ma'am Katrina Marie MirandaNo ratings yet

- InvestingDocument32 pagesInvestingMa'am Katrina Marie MirandaNo ratings yet

- InsuranceDocument35 pagesInsuranceMa'am Katrina Marie MirandaNo ratings yet

- 5.time Value of MoneyDocument20 pages5.time Value of MoneyMa'am Katrina Marie MirandaNo ratings yet

- Saving, Spending, & BudgetingDocument32 pagesSaving, Spending, & BudgetingMa'am Katrina Marie MirandaNo ratings yet

- Debt and CreditDocument19 pagesDebt and CreditMa'am Katrina Marie MirandaNo ratings yet

- PD102Document15 pagesPD102Ma'am Katrina Marie MirandaNo ratings yet

- Chap 07Document13 pagesChap 07Ma'am Katrina Marie MirandaNo ratings yet

- Feasibility Coffeesal Final 6Document213 pagesFeasibility Coffeesal Final 6Ma'am Katrina Marie MirandaNo ratings yet

- Kindergarten 2022 2023Document6 pagesKindergarten 2022 2023Ma'am Katrina Marie MirandaNo ratings yet