Professional Documents

Culture Documents

DivineFx Trading Lesson 2

DivineFx Trading Lesson 2

Uploaded by

chengullahdaniel1900 ratings0% found this document useful (0 votes)

4 views28 pagesCopyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

4 views28 pagesDivineFx Trading Lesson 2

DivineFx Trading Lesson 2

Uploaded by

chengullahdaniel190Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 28

DivineFx Trading

LESSON 2. BOS, CHOCH, IDM, HH & HL

Break of Structure(BOS)

This denotes the continuation of a trend when the price

updates the previous higher high (HH) in a bullish trend

or a lower low (LL) in a bearish trend.

When the price updates the previous high in an ascending

trend or the low in a descending trend - the breakout

point is called BOS.

When breaking the previous high or low, the trend is

considered to be continuing. Nothing new here, it's all

consistent with classic technical analysis, just with trendy

notation.

This is schematically represented as follows:

Change of Character(CHoCH)

This indicates a trend reversal when the price drops

below the last low in an ascending structure(HL) or rises

above the last high in a descending structure(LH).

Sometime is formed when the price mitigates a supply or

demand and breaks the first recent Minor/Major

structure High/Low.

Remember; CHoCH and BOS may look alike in

appearance but there is difference between these two,

BOS are formed only in trend continuation whether trend

is Bullish or Bearish while CHoCH acts as a trend

reversal.

It looks like this:

Welcome to Advanced Market Structure

Inducement (IDM)

Is the last price pullback in the market structure.

Inducement is the area and the specific point that

prompts(stimulates) traders to buy and sell.

This is a false market structure break.

The market structure breaks, traders start trading in the

new direction, but instead of following the new structure,

the price continues the old one.

Such a sneaky trick.

Inducement (IDM,IND) is the extreme point of the last

pullback in the structure when the price makes a BOS.

Until the price updates the previous high in an ascending

trend or the low in a descending one, the IDM remains

the previous point.

With this in mind, the IDM will follow the price as long as it

remains valid and the price makes a BOS.

The main feature of market movement is liquidity, and

inducement is nothing more than a collection of liquidity.

As the price moves in one direction, it will always pull

back.

Regardless of the pullback's strength, liquidity is

collected; you can anticipate movement, but when it will

happen is a mystery.

Market Structure with IDM

Our strategy involves using the structure only with inducement.

Inducement acts as a trap for those, who base their strategy on

classic market structure.

The main catch for us is liquidity. Once you've collected liquidity,

you can look for an entry point.

Until liquidity is gathered, no trades. Act like you're in a street

fight, only jump in when your side is winning. Always step into a

fight when the war is already won.

Wait for the liquidity to be gathered before taking action;

otherwise, you might become the liquidity.

The dotted line represents the market

structures in classical application. The

solid line represents the market

structure using IDM.

When, according to the classic

definition of structure, there's a trend

change at our IDM point, in our new

version, it's merely inducement, i.e

liquidity collection, after which we can

look for an entry point.

As you can see, the structure drawing

takes this liquidity into account, which

didn't affect the trend itself.

Structure point formation

Structural points only appear when specific actions occur:

HH(higher high) in a bullish structure only appears

when the price drops and closes below IDM.

LL(lower low) in a bearish structure only appears when

the price rises and closes above IDM.

HL(higher low) in a bullish structure only appears when

the price rises and closes above BOS.

LH(lower high) in a bearish structure only appears when

the price drops and closes below BOS.

Assignment;

Identify structure point on 15 different charts.

You might also like

- The Pure Price Action and Market Structure With The Smart MoneyDocument53 pagesThe Pure Price Action and Market Structure With The Smart MoneyKevin Mwaura90% (10)

- True Smart Money ConceptsDocument24 pagesTrue Smart Money ConceptsDikgang Malaka94% (16)

- FAC1502 Assignment 4 2023Document193 pagesFAC1502 Assignment 4 2023Haat My Later100% (1)

- KM - Smart Money Concept - ICTDocument34 pagesKM - Smart Money Concept - ICTTonio100% (26)

- .ICT Mastery - 1614680538000Document36 pages.ICT Mastery - 1614680538000Laston Kingston94% (17)

- Order Block Institutional Trading Practical Guide by James J KingDocument59 pagesOrder Block Institutional Trading Practical Guide by James J KingKishor shinde75% (8)

- NJAT Private Telegram - Structure & Timeframes: Key Points To RememberDocument12 pagesNJAT Private Telegram - Structure & Timeframes: Key Points To RememberSharma comp100% (5)

- SMC Full Course (Fundfloat)Document27 pagesSMC Full Course (Fundfloat)igniteff41100% (19)

- The Ultimate Guide To Master Supply and Demand in ForexDocument28 pagesThe Ultimate Guide To Master Supply and Demand in ForexT51328295% (22)

- ICT Advanced Market StructureDocument19 pagesICT Advanced Market Structurepaola andrea pastrana martinez100% (11)

- Baby PipsDocument69 pagesBaby PipsJuttaSportNo ratings yet

- SMC1Document28 pagesSMC1andrewmmmm88% (8)

- Trading With EvelynDocument90 pagesTrading With EvelynCrystalNo ratings yet

- Market Structure Masterclass - Inside Market StructureDocument44 pagesMarket Structure Masterclass - Inside Market Structuremunzerkhzy100% (8)

- Supply and Demand PDFDocument95 pagesSupply and Demand PDFRodrigoGomezGallego100% (2)

- Case StudyfdffdfDocument3 pagesCase StudyfdffdffreNo ratings yet

- Soft Corporate Offer Sugar Icumsa-45Document7 pagesSoft Corporate Offer Sugar Icumsa-45lee kok onnNo ratings yet

- Forex Trading Bootcamp Day 4 - Trading With OBDocument31 pagesForex Trading Bootcamp Day 4 - Trading With OBArrow Builders100% (4)

- PA Part 1 Market StructureDocument19 pagesPA Part 1 Market Structurealejandro behr100% (1)

- SK Investment Group's ProposalDocument31 pagesSK Investment Group's ProposalLansingStateJournalNo ratings yet

- Buy and Sell Day Trading Signals: Profitable Trading Strategies, #4From EverandBuy and Sell Day Trading Signals: Profitable Trading Strategies, #4No ratings yet

- Flipping Markets: PDF Cheat SheetDocument59 pagesFlipping Markets: PDF Cheat SheetAsh Sam100% (9)

- ICT SummaryDocument35 pagesICT Summaryrerer100% (3)

- ReadingthemarketDocument66 pagesReadingthemarketMugavaiselvam Govindaraj100% (16)

- Made by Big Joint: #TradegangDocument70 pagesMade by Big Joint: #TradegangBoyan Zrncic100% (2)

- Swing Trading Startegy - Greg CapraDocument33 pagesSwing Trading Startegy - Greg CapraAbilio Jose100% (10)

- Chart Patterns ForexDocument16 pagesChart Patterns Forexnishitsardhara83% (6)

- Sliced Bread PLC Is A Divisionalized Company Among Its DivisionsDocument2 pagesSliced Bread PLC Is A Divisionalized Company Among Its DivisionsAmit PandeyNo ratings yet

- Chapter 4Document50 pagesChapter 4Nguyen Hai AnhNo ratings yet

- market structure_copyDocument9 pagesmarket structure_copyhabibalimalala3No ratings yet

- Breaker BlockDocument15 pagesBreaker BlockJuanchi GomarizNo ratings yet

- Market StructureDocument8 pagesMarket StructuresolomoneditasNo ratings yet

- NJAT Private Telegram - Lingo (Updating) - Wb3PVgDocument4 pagesNJAT Private Telegram - Lingo (Updating) - Wb3PVgJimmy GoeiNo ratings yet

- Market StructureDocument6 pagesMarket StructureRadu MihaiNo ratings yet

- Smart Money ConceptDocument13 pagesSmart Money Conceptst lalnunmawiaNo ratings yet

- Wizards Trading GuideDocument14 pagesWizards Trading Guidejunaidjabbar972No ratings yet

- Market Structure and TrendDocument10 pagesMarket Structure and TrendbillNo ratings yet

- Advanced Market Structure Trading With Price Action and OrderblockDocument27 pagesAdvanced Market Structure Trading With Price Action and OrderblockEmmanuel SuurulereNo ratings yet

- 7 Popular Technical Indicators and How To Use Them To Increase Your Trading ProfitsDocument19 pages7 Popular Technical Indicators and How To Use Them To Increase Your Trading ProfitsHeiki KanalomNo ratings yet

- Market StructureDocument21 pagesMarket StructureSell wayNo ratings yet

- Fundamental Analysis Using WYCKOFF Analysis and Earning On NewsDocument16 pagesFundamental Analysis Using WYCKOFF Analysis and Earning On Newsdanieloladele92No ratings yet

- Baby PipsDocument109 pagesBaby PipsMonty001100% (2)

- Tren Line PDFDocument28 pagesTren Line PDFNizam Uddin100% (2)

- Trading Tips Manual For EducationDocument18 pagesTrading Tips Manual For EducationJeeva 07No ratings yet

- Risk Management Tut V3Document40 pagesRisk Management Tut V3Roldan EgosNo ratings yet

- Market StructureDocument19 pagesMarket StructureAdekunle Joseph100% (8)

- How To Trade With ConfluenceDocument13 pagesHow To Trade With ConfluenceFesto ShaneNo ratings yet

- Bollinger Band Trading StrategyDocument15 pagesBollinger Band Trading Strategyanon100% (1)

- Break of Structure (BOS)Document3 pagesBreak of Structure (BOS)prabinmali62No ratings yet

- Tony ChartDocument10 pagesTony ChartHouston ChalzNo ratings yet

- SMC - All in 1Document126 pagesSMC - All in 1Vitor ConsalterNo ratings yet

- How To Correctly Interpret Market BehaviorDocument17 pagesHow To Correctly Interpret Market Behaviorgumnani.rewachandNo ratings yet

- ff059eb0-4ba4-4d3b-8691-b61ee70c1471Document3 pagesff059eb0-4ba4-4d3b-8691-b61ee70c1471sidharth dashNo ratings yet

- PRICEACTIONDocument28 pagesPRICEACTIONKaizheng100% (1)

- When To Use The Momentum Entry TechniqueDocument4 pagesWhen To Use The Momentum Entry Techniqueartus14No ratings yet

- RTM Chapter OneDocument6 pagesRTM Chapter OneAhmd HfzNo ratings yet

- Hertz DT StrategryDocument13 pagesHertz DT Strategrysandra akinseteNo ratings yet

- FX Book MentorshipDocument114 pagesFX Book Mentorshipforextrader7hNo ratings yet

- Free Ebook IncognitoDocument53 pagesFree Ebook IncognitoAnderson Bragagnolo100% (4)

- Understanding Market StructureDocument30 pagesUnderstanding Market Structuretosheensaifi100% (1)

- Forex Range Trading with Price ActionFrom EverandForex Range Trading with Price ActionRating: 4.5 out of 5 stars4.5/5 (40)

- Bear Market Day Trading Strategies: Day Trading Strategies, #1From EverandBear Market Day Trading Strategies: Day Trading Strategies, #1Rating: 5 out of 5 stars5/5 (2)

- SA108 Notes 2021 - EnglishDocument12 pagesSA108 Notes 2021 - EnglishSameh MohamedNo ratings yet

- BBA 2433 Auditing and AssuranceDocument33 pagesBBA 2433 Auditing and AssuranceJoin Law Zhi XuanNo ratings yet

- Soverign Risk (Test)Document18 pagesSoverign Risk (Test)Kshitij PrasadNo ratings yet

- The Black Scholes FormulaDocument12 pagesThe Black Scholes FormulaNiyati ShahNo ratings yet

- Citystate Savings Bank v. Teresita Tobias GR No. 22790 Reyes, JR., JDocument7 pagesCitystate Savings Bank v. Teresita Tobias GR No. 22790 Reyes, JR., JAnastasia ZaitsevNo ratings yet

- Investment and Finance Lecture NotesDocument56 pagesInvestment and Finance Lecture NotesJustus Nderitu GathukuNo ratings yet

- Audit of Banks: Audited Financial StatementsDocument7 pagesAudit of Banks: Audited Financial StatementsMa. Hazel Donita Diaz100% (1)

- Suppose That GM's Smith Estimated The Following Regression Equation For Chevrolet AutomobilesDocument3 pagesSuppose That GM's Smith Estimated The Following Regression Equation For Chevrolet AutomobilesreezakusumaNo ratings yet

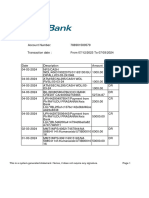

- 2024 07 3 17 57 38 Statement - 1709814458008Document7 pages2024 07 3 17 57 38 Statement - 1709814458008golusharma55966No ratings yet

- 101 Ways To Cut ExpensesDocument4 pages101 Ways To Cut ExpensesSurya Srivatsa100% (6)

- New Venture Creation Entrepreneurship For The 21St Century 10Th Edition Spinelli Test Bank Full Chapter PDFDocument36 pagesNew Venture Creation Entrepreneurship For The 21St Century 10Th Edition Spinelli Test Bank Full Chapter PDFmichaelkrause22011998gdj100% (8)

- Avantha Holdings Letter To BRDocument5 pagesAvantha Holdings Letter To BRPrabhleen KaurNo ratings yet

- 2017TAtA Steel Annual ReportDocument8 pages2017TAtA Steel Annual ReportHeadshot's GameNo ratings yet

- AP - Diagnostic Exam.Document8 pagesAP - Diagnostic Exam.sapilanfranceneNo ratings yet

- UCC 3 PF Pro6 2021 08 24 Certificate s2Document2 pagesUCC 3 PF Pro6 2021 08 24 Certificate s2MaxBestNo ratings yet

- Volatility of Stock MarketDocument18 pagesVolatility of Stock MarketskirubaarunNo ratings yet

- PAMM Copy Trading AgreementDocument4 pagesPAMM Copy Trading AgreementGladsonNo ratings yet

- Do ETFs Increase Volatility - JF 2018 - ETF DetailsDocument65 pagesDo ETFs Increase Volatility - JF 2018 - ETF DetailssdadadNo ratings yet

- Wearmouth Josh ResumeDocument1 pageWearmouth Josh Resumeapi-433757016No ratings yet

- Financial Markets and Institutions: Lecture 1: IntroductionDocument41 pagesFinancial Markets and Institutions: Lecture 1: IntroductionGaurav007No ratings yet

- Chapter 1 Additional 2 - Cochlear SOLUTIONSDocument3 pagesChapter 1 Additional 2 - Cochlear SOLUTIONSPNo ratings yet

- Financial Management I Ch4Document11 pagesFinancial Management I Ch4bikilahussenNo ratings yet

- Ifr Pro-The-Core-PrinciplesDocument34 pagesIfr Pro-The-Core-PrinciplesJuniorReisNo ratings yet

- Micro Credit OperationDocument4 pagesMicro Credit OperationShreerangan ShrinivasanNo ratings yet