Professional Documents

Culture Documents

Job Order Costing

Job Order Costing

Uploaded by

Syafira Agnia Lilla0 ratings0% found this document useful (0 votes)

1 views41 pagesOriginal Title

job order costing

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

1 views41 pagesJob Order Costing

Job Order Costing

Uploaded by

Syafira Agnia LillaCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 41

©Cengage Learning Asia Pte Ltd 2008

1. Perform job order cost accumulation.

2. Identify and prepare the eight basic cost accounting

entries involved in job order costing.

3. Prepare a job order cost sheet.

4. Use a predetermined overhead rate in job order

costing.

5. Recognize job order cost sheets in a variety of

forms, for both manufacturing and service

businesses.

©Cengage Learning Asia Pte Ltd 2008

In job order costing, or job costing, production

costs are accumulated for each separate job.

a job is the output identified to fill a certain

customer order or to replenish an item of

stock on hand..

©Cengage Learning Asia Pte Ltd 2008

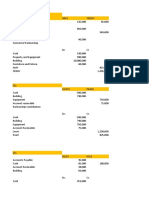

Details about a job are recorded

on a job order cost sheet, or

simply cost sheet, which can be

in paper or electronic form.

©Cengage Learning Asia Pte Ltd 2008

©Cengage Learning Asia Pte Ltd 2008

1. Overview of Job Order

Costing.

The basics of job order costing

involve only eight types of

accounting entries, one for each of

the following:

©Cengage Learning Asia Pte Ltd 2008

1. Materials purchased

2. Factory labor costs incurred

3. Factory overhead costs incurred

4. Materials used

5. Factory labor costs distributed

6. Estimated factory overhead applied

7. Jobs completed

8. Products sold

©Cengage Learning Asia Pte Ltd 2008

1. Overview of Job Order

Costing

©Cengage Learning Asia Pte Ltd 2008

(1)Materials Purchased

Cost accounting for purchased materials is

the same as it is for any perpetual inventory

system. As materials are received, the account

Materials is debited (rather than Purchases, in

a periodic inventory system).

©Cengage Learning Asia Pte Ltd 2008

2. Accounting for Materials.

©Cengage Learning Asia Pte Ltd 2008

(2)Materials Used

Direct materials for a job are issued to the

factory on the basis of materials requisitions,

which are documents prepared by production

schedulers or other personnel specifying the

job number and type and quantity of materials

required.

©Cengage Learning Asia Pte Ltd 2008

The details of overhead costs are also

posted to an overhead subsidiary record,

which may be a worksheet called a factory

overhead analysis sheet.

©Cengage Learning Asia Pte Ltd 2008

In many companies, a time clock registers

each employee on an individual clock card,

which may be on paper or in electronic form,

when the employee enters and leaves the

facility. Clock cards thus show the amount of

time worked and are used to compute earnings

of hourly wage earners.

©Cengage Learning Asia Pte Ltd 2008

To identify direct and indirect labor cost,

each worker prepares one or more labor time

tickets each day. Each labor time ticket is a

document showing the time spent by one

worker on a specific job order (direct labor)

or on any other task (indirect labor); any

labor not used in production is charged to

marketing or administrative expense

accounts.

©Cengage Learning Asia Pte Ltd 2008

Time tickets are costed and

summarized periodically, and

time ticket hours for each

employee are reconciled with

clock card hours.

©Cengage Learning Asia Pte Ltd 2008

(1)Factory Labor Cost Incurred

For each pay period, the liabilities for wages

and other payments are journalized and

posted to the general ledger. Regardless of the

number of liabilities recorded, the offsetting

debit will be made to Payroll, where labor cost

is accumulated temporarily until it is

distributed to the cost accounts, usually at

month-end.

©Cengage Learning Asia Pte Ltd 2008

(2)Factory Labor Costs Distributed

Most companies distribute labor costs monthly:

labor time tickets are sorted by job, entered on job

cost sheets, and recorded by summary general

journal entries. Time tickets are sorted and

entered on job cost sheets weekly, or even daily,

to cost products and bill customers promptly.

©Cengage Learning Asia Pte Ltd 2008

But because updated general ledger balances are

needed only at the end of a month or quarter when

financial statements are prepared, the general

journal entries are made monthly or quarterly in

summary form as shown. In some highly

automated systems, employees’ encoded

identification cards are scanned at the beginning

and end of their work on each job or other task,

and all records are updated instantly.

©Cengage Learning Asia Pte Ltd 2008

3. Accounting for Labor

©Cengage Learning Asia Pte Ltd 2008

Factory overhead consists of all costs that

are not traced directly to jobs but are

incurred in production (not marketing and

administration).

©Cengage Learning Asia Pte Ltd 2008

Instead, overhead costs are

broadly accumulated without

distinction as to job, and then

total overhead costs are allocated

among all jobs.

©Cengage Learning Asia Pte Ltd 2008

(1)Actual Factory Overhead Incurred

Some actual overhead costs, such as

indirect materials and indirect labor, are

recorded when they are incurred or by

periodic summary entries, as illustrated

previously.

©Cengage Learning Asia Pte Ltd 2008

(1)Actual Factory Overhead Incurred

Only four overhead costs have been

illustrated: indirect materials, indirect

labor, machinery depreciation, and

insurance.

©Cengage Learning Asia Pte Ltd 2008

(1)Estimated Factory Overhead Applied

A job’s prime costs are determined from

materials requisitions and time tickets.

Determining the amount of overhead to be

charged is more difficult. Some overhead

costs, such as rent and insurance, are fixed

regardless of the amount of production.

©Cengage Learning Asia Pte Ltd 2008

(1)Estimated Factory Overhead Applied

Others, such as power and lubricants, will

vary with the quantity of production. Overhead

costs such as major cleaning and remodeling

efforts are intermittent or seasonal; they

benefit all production but may be incurred

when some jobs are in production and not

incurred at all at other times.

©Cengage Learning Asia Pte Ltd 2008

The activity chosen is called the overhead

allocation base or simply the base. The base

chosen should be the one most closely related

to the costs being allocated; that is, the one

that appears to drive most of the factory

overhead.

©Cengage Learning Asia Pte Ltd 2008

To permit timely application of

overhead, a predetermined overhead

rate is used, which is the ratio of

estimated total overhead to the

estimated total of the overhead

allocation base.

©Cengage Learning Asia Pte Ltd 2008

The amount of overhead charged

to a job, called applied overhead,

is determined by multiplying $40

by the number of machine hours

used on that job.

©Cengage Learning Asia Pte Ltd 2008

4. Accounting for Factory

Overhead

©Cengage Learning Asia Pte Ltd 2008

5. Accounting for Jobs

Completed and Products Sold.

As jobs are completed, their cost sheets are

moved from the in-process category to a

finished work file. When a completed job is

intended to replenish stock on hand, the

quantity and cost are recorded on finished

goods record cards, which serve as a

subsidiary ledger supporting the finished

goods account.

©Cengage Learning Asia Pte Ltd 2008

A job for a specific

customer can be shipped

when completed and thus

never enter finished goods

inventory; Sales and Cost

of Goods Sold are recorded

when the job is transferred

from Work in Process.

©Cengage Learning Asia Pte Ltd 2008

When the purpose of a completed job is to

replenish the stock of a component used in

making other products, the cost of the

completed job is charged to Materials

rather than Finished Goods.

©Cengage Learning Asia Pte Ltd 2008

When stock on hand is shipped to customers,

the finished goods record cards are updated,

sales invoices prepared, and sales and the

cost of goods sold recorded, just as in any

perpetual inventory system.

©Cengage Learning Asia Pte Ltd 2008

5. Accounting for Jobs

Completed and Products Sold

Finished goods…………XX

work in process…………….XX

Account receivable……….XX

Sales………………………...XX

Cost of goods sold……… XX

Work in process/ FG………XX.

©Cengage Learning Asia Pte Ltd 2008

In service businesses where jobs differ from

each other and cost information is desired for

individual jobs, several varieties of job order

costing are used.

©Cengage Learning Asia Pte Ltd 2008

These service businesses include tailors,

lawn service companies, temporary-help

companies, repair shops, and professional

services such as legal, medical,

architectural, engineering, accounting, and

consulting.

©Cengage Learning Asia Pte Ltd 2008

The only remaining items to be

charged to each job are the

directly traceable costs other

than labor.

©Cengage Learning Asia Pte Ltd 2008

Weekly or monthly summaries of

all costs are prepared and

entered on job cost sheets,

which may be called by any of

several names, depending on the

type of business.

©Cengage Learning Asia Pte Ltd 2008

Notice that there is no

separate category for

overhead, because the

predetermined overhead

cost rate is included in the

hourly charges for labor.

©Cengage Learning Asia Pte Ltd 2008

©Cengage Learning Asia Pte Ltd 2008

©Cengage Learning Asia Pte Ltd 2008

You might also like

- Scientific Glass Inc FinalDocument21 pagesScientific Glass Inc FinalSakshi ShardaNo ratings yet

- Job Order Costing: Managerial Accounting 14eDocument26 pagesJob Order Costing: Managerial Accounting 14ecykenNo ratings yet

- Chap 019Document62 pagesChap 019Husein GraphicNo ratings yet

- Chapter 3 Solutions Comm 305Document77 pagesChapter 3 Solutions Comm 305Maketh.ManNo ratings yet

- Process CostingDocument34 pagesProcess CostingSyafira Agnia LillaNo ratings yet

- AB-B - Rizky Fadillah Salam - Assignment Week 4 5Document13 pagesAB-B - Rizky Fadillah Salam - Assignment Week 4 5Reta AzkaNo ratings yet

- Job Order Costing: Financial and Managerial Accounting 14eDocument26 pagesJob Order Costing: Financial and Managerial Accounting 14eAlondra Joan MararacNo ratings yet

- Chapter 10Document11 pagesChapter 10clarice razonNo ratings yet

- Job Order Costing and Analysis: QuestionsDocument60 pagesJob Order Costing and Analysis: QuestionsLily CakesNo ratings yet

- AFAR-15 (Job Order Costing)Document11 pagesAFAR-15 (Job Order Costing)Jennifer ArcosNo ratings yet

- Job Order CostingDocument5 pagesJob Order CostingNishanth PrabhakarNo ratings yet

- CA - Topic 3 - 202405051917 - 04457Document21 pagesCA - Topic 3 - 202405051917 - 04457vooyinyin6No ratings yet

- Job-Order Costing: Cornerstones of Managerial Accounting, 4eDocument69 pagesJob-Order Costing: Cornerstones of Managerial Accounting, 4eLindaWidyanaNo ratings yet

- Steps in Job CostingDocument8 pagesSteps in Job CostingBhagaban DasNo ratings yet

- AFAR 15 Job Order CostingDocument11 pagesAFAR 15 Job Order CostingTrisha Marie BuendichoNo ratings yet

- Job Order Costing SystemDocument10 pagesJob Order Costing SystemfitsumNo ratings yet

- 5.1 Examples of Job Order CostingDocument2 pages5.1 Examples of Job Order CostingsanathNo ratings yet

- Solution Manual For Managerial Accounting 2nd Edition Whitecotton Libby Phillips 0078025516 9780078025518Document36 pagesSolution Manual For Managerial Accounting 2nd Edition Whitecotton Libby Phillips 0078025516 9780078025518danielrichardsonaewipbozyk100% (30)

- ACCT230 Ch5Document69 pagesACCT230 Ch5Said MohamedNo ratings yet

- Job-Order Costing: Managerial Accounting: The Cornerstone of Business Decisions, 4eDocument69 pagesJob-Order Costing: Managerial Accounting: The Cornerstone of Business Decisions, 4eNatasha HilsonNo ratings yet

- Chap008 Systems Design Job-Order CostingDocument81 pagesChap008 Systems Design Job-Order CostingAnonymous fE2l3Dzl0% (1)

- Costing Collab, PDFDocument4 pagesCosting Collab, PDFNithin SureshkumarNo ratings yet

- Job-Order Costing: Managerial Accounting: The Cornerstone of Business Decisions, 4eDocument69 pagesJob-Order Costing: Managerial Accounting: The Cornerstone of Business Decisions, 4eAndrea Florence Guy VidalNo ratings yet

- Lesson 10 Costing SystemsDocument8 pagesLesson 10 Costing SystemsSuhanna DavisNo ratings yet

- Job-Order Costing: Presented byDocument69 pagesJob-Order Costing: Presented byUstaz Jibril YahuzaNo ratings yet

- Job Costing Process CostingDocument25 pagesJob Costing Process CostingAnkul Baria100% (6)

- Definition of Job Order CostingDocument8 pagesDefinition of Job Order CostingWondwosen AlemuNo ratings yet

- Job Costing PDFDocument46 pagesJob Costing PDFBaziNo ratings yet

- AFAR 15 Job Order CostingDocument11 pagesAFAR 15 Job Order CostingMartin ManuelNo ratings yet

- Cost Accouting-JOCDocument3 pagesCost Accouting-JOCAli ImranNo ratings yet

- 74752bos60489 cp9Document23 pages74752bos60489 cp9Parth RasadiyaNo ratings yet

- Chapter 3 AccountingDocument3 pagesChapter 3 Accountingmirzaaish112233No ratings yet

- Job-Order Costing and Overhead Application: Seventh EditionDocument113 pagesJob-Order Costing and Overhead Application: Seventh EditionLee Tarroza100% (1)

- WK 1 - Cost Accounting Techniques Part 1 - HandoutDocument27 pagesWK 1 - Cost Accounting Techniques Part 1 - HandoutEENo ratings yet

- Managerial Accounting 2nd Edition Whitecotton Solutions ManualDocument35 pagesManagerial Accounting 2nd Edition Whitecotton Solutions Manualoutroarzimocca469r100% (25)

- Job Costing: 1. Whether Actual or Estimated Costs Are UsedDocument16 pagesJob Costing: 1. Whether Actual or Estimated Costs Are UsedalemayehuNo ratings yet

- Acctg201 JobOrderCostingLectureNotesDocument20 pagesAcctg201 JobOrderCostingLectureNotesaaron manacapNo ratings yet

- Job Order CostingDocument6 pagesJob Order CostingJomar Teneza100% (1)

- ACCA105Document2 pagesACCA105Shane TabunggaoNo ratings yet

- Ae 103: Cost Accounting and ControlDocument7 pagesAe 103: Cost Accounting and ControlClariz Angelika EscocioNo ratings yet

- Topic Four - Job CostingDocument6 pagesTopic Four - Job CostingABDULSWAMADU KARIMUNo ratings yet

- Module For Managerial Accounting-Job Order CostingDocument17 pagesModule For Managerial Accounting-Job Order CostingMary De JesusNo ratings yet

- Chapter 10 Job CostingDocument21 pagesChapter 10 Job CostingTadiwanashe BadzaNo ratings yet

- Exercise 5 - Topic 4 (Chapter 3)Document2 pagesExercise 5 - Topic 4 (Chapter 3)sameerhaNo ratings yet

- Business Process Analysis: 2.6 Cost SheetDocument9 pagesBusiness Process Analysis: 2.6 Cost SheetDarshitNo ratings yet

- Handout - Job Order CostingDocument6 pagesHandout - Job Order CostingedzateradoNo ratings yet

- Dwnload Full Managerial Accounting 6th Edition Wild Solutions Manual PDFDocument35 pagesDwnload Full Managerial Accounting 6th Edition Wild Solutions Manual PDFlinnet.discreet.h5jn2s100% (15)

- Managerial Accounting Version 2 1st Edition Heisinger Test BankDocument30 pagesManagerial Accounting Version 2 1st Edition Heisinger Test BankLNo ratings yet

- Assignment For Cost TodayDocument5 pagesAssignment For Cost TodayYohannes MejaNo ratings yet

- Procedure For Job Cost AccountingDocument6 pagesProcedure For Job Cost Accountingravi sainiNo ratings yet

- Seu Act500 Module02 PPT Ch02Document37 pagesSeu Act500 Module02 PPT Ch02Fatima WassliNo ratings yet

- Cost For p2Document10 pagesCost For p2Elizabeth Zausa AseoNo ratings yet

- LP4 - Accounting For Job Order Costing-2Document4 pagesLP4 - Accounting For Job Order Costing-2Ciana SacdalanNo ratings yet

- Job and Batch Costing NotesDocument5 pagesJob and Batch Costing NotesFarrukhsg100% (1)

- Measuring and Recording Manufacturing Overhead CostDocument2 pagesMeasuring and Recording Manufacturing Overhead CostAngelicaNo ratings yet

- Job Order Costing: Group 3 Santiago, Erica DDocument17 pagesJob Order Costing: Group 3 Santiago, Erica DPatrick LanceNo ratings yet

- Lecture 3 - Cost & Management Accounting - March 3, 2019 - 3pm To 6pmDocument3 pagesLecture 3 - Cost & Management Accounting - March 3, 2019 - 3pm To 6pmBhunesh KumarNo ratings yet

- Ala ToDocument20 pagesAla ToMax Dela TorreNo ratings yet

- Chapter 5 & 6 Cost Accounting HorngrenDocument40 pagesChapter 5 & 6 Cost Accounting HorngrenNHNo ratings yet

- Cost I Ch. 3Document57 pagesCost I Ch. 3Magarsaa AmaanNo ratings yet

- OMS413 Review Questions (Chapters 1,2,3,4 and 5) Part I. ConceptDocument2 pagesOMS413 Review Questions (Chapters 1,2,3,4 and 5) Part I. Conceptdev4c-1No ratings yet

- Increasing Efficiency Worksheet For StudentDocument8 pagesIncreasing Efficiency Worksheet For StudentKristjan KunilaNo ratings yet

- Chapter 6 Just in Time and Bacflush AccountingDocument17 pagesChapter 6 Just in Time and Bacflush AccountingだみNo ratings yet

- RF-SMART PAR Best Practices GuideDocument7 pagesRF-SMART PAR Best Practices Guidegpcrao143No ratings yet

- Quality ManagementDocument6 pagesQuality ManagementNickesh ShahNo ratings yet

- Webinar Control and Management of InventoryDocument18 pagesWebinar Control and Management of InventoryRae KickNo ratings yet

- Unit 1 - Basic Concepts & Goal of Logistics: Logistics & The Supply ChainDocument3 pagesUnit 1 - Basic Concepts & Goal of Logistics: Logistics & The Supply ChainMaks MahlatsiNo ratings yet

- Indian Institute of Management Kozhikode: About WalkarooDocument3 pagesIndian Institute of Management Kozhikode: About WalkarooDeep AgrawalNo ratings yet

- Lathian Soal CH 5 Kelompok 7 P5-3Document2 pagesLathian Soal CH 5 Kelompok 7 P5-3AshdhNo ratings yet

- North Wester Hospital ChicargoDocument20 pagesNorth Wester Hospital Chicargojames.sen76No ratings yet

- InventoriesDocument17 pagesInventoriesYash AggarwalNo ratings yet

- Inventory ManagementDocument8 pagesInventory ManagementMike Padilla IINo ratings yet

- Inventory Internal Audit ProgramDocument2 pagesInventory Internal Audit ProgramZegera MgendiNo ratings yet

- Yaba, Brixzel's AssignmentDocument4 pagesYaba, Brixzel's AssignmentYaba Brixzel F.No ratings yet

- Premium Garden Products PGP Supplies Gardening Enthusiasts and Commercial GardenDocument1 pagePremium Garden Products PGP Supplies Gardening Enthusiasts and Commercial GardenAmit PandeyNo ratings yet

- Abigail Santos Boutique, FS ProblemDocument3 pagesAbigail Santos Boutique, FS ProblemFeiya LiuNo ratings yet

- 5 POM Inventory ManagementDocument52 pages5 POM Inventory Managementbt20107059 Tarun KaushikNo ratings yet

- Inventory Management and ControlDocument4 pagesInventory Management and Controlprerna raiNo ratings yet

- Principles of Accounting II (1) - 1-3Document127 pagesPrinciples of Accounting II (1) - 1-3Ebsa AdemeNo ratings yet

- Operations Management A Supply Chain Process Approach 1st Edition Wisner Solutions ManualDocument10 pagesOperations Management A Supply Chain Process Approach 1st Edition Wisner Solutions Manualsiccadyeingiyp100% (30)

- Fourth ModuleDocument40 pagesFourth ModuleABOOBAKKERNo ratings yet

- Prelim Quiz No 1Document4 pagesPrelim Quiz No 1regent galokrNo ratings yet

- 1040 Inventory Control Condemnation ProceduresDocument44 pages1040 Inventory Control Condemnation ProceduresnagssaraNo ratings yet

- Material Cost, Inventory Valuation and ControlDocument48 pagesMaterial Cost, Inventory Valuation and ControlThanousha AbrahamsNo ratings yet

- Pertemuan 6b - Manajemen Persediaan (Bag 1)Document31 pagesPertemuan 6b - Manajemen Persediaan (Bag 1)Charles FredericNo ratings yet

- Strengths Weakness: SWOT Matrix MapDocument3 pagesStrengths Weakness: SWOT Matrix MapHabibaNo ratings yet

- Activity in Just in Time Acctg. With Answer KeyDocument3 pagesActivity in Just in Time Acctg. With Answer KeyLucy HeartfiliaNo ratings yet

- Supply Chain Strategies 2022 - Module 4 Inventory HellriegelDocument54 pagesSupply Chain Strategies 2022 - Module 4 Inventory HellriegelAakarshan MundraNo ratings yet

- Costs of Goods ManufacturedDocument3 pagesCosts of Goods ManufacturedCJ PayabyabNo ratings yet