Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

6 viewsHsw1e Macro Lecture Slides Ch17

Hsw1e Macro Lecture Slides Ch17

Uploaded by

dilpreetd88Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You might also like

- MINTZBERGDocument32 pagesMINTZBERGgeezee10004464100% (2)

- Optitech's CaseDocument4 pagesOptitech's CaseSamuel EncarnaciónNo ratings yet

- The Next Consumer Recession: Preparing NowDocument22 pagesThe Next Consumer Recession: Preparing NowPanther MelchizedekNo ratings yet

- Colander11e Ch24 FinalDocument28 pagesColander11e Ch24 Finalbosyapmalik31No ratings yet

- Econ Slides CH 24&25Document57 pagesEcon Slides CH 24&25bosyapmalik31No ratings yet

- Number 31, Spring 2009: Perspectives On Corporate Finance and StrategyDocument36 pagesNumber 31, Spring 2009: Perspectives On Corporate Finance and StrategyqweenNo ratings yet

- MECO 121-Module 9 Introduction To MacroeconomicsDocument20 pagesMECO 121-Module 9 Introduction To MacroeconomicszainabmossadiqNo ratings yet

- Lecture Seven - Financial CrisisDocument14 pagesLecture Seven - Financial CrisisWael chehataNo ratings yet

- JefferiesInsights April2023Document10 pagesJefferiesInsights April2023Nigam MohapatraNo ratings yet

- S1 PPTX Capitulo 6 EstudiantesDocument16 pagesS1 PPTX Capitulo 6 EstudiantesKrissya Masis MoraNo ratings yet

- ACFrOgB7sXdLWrQ00pleCJRI Gy IkJoyVCmEBMoGL ZZV6ubgMZb0o 5au3f g965n0 4cViL7s5Gn5QH8uOWd8vSkncdSl Lzsey2USKQ6j74AckVrZm83bwUBtgDocument30 pagesACFrOgB7sXdLWrQ00pleCJRI Gy IkJoyVCmEBMoGL ZZV6ubgMZb0o 5au3f g965n0 4cViL7s5Gn5QH8uOWd8vSkncdSl Lzsey2USKQ6j74AckVrZm83bwUBtgJelena Lecic MirceticNo ratings yet

- 09 Introduction To MacroeconomicsDocument23 pages09 Introduction To MacroeconomicsRobert Scott MadriagoNo ratings yet

- Class 3.2 Slides For Economic Cycle Lecture - Fall22Document16 pagesClass 3.2 Slides For Economic Cycle Lecture - Fall22tuyennguyen.iuNo ratings yet

- Macroeconomics: Macroeconomics: The Big PictureDocument35 pagesMacroeconomics: Macroeconomics: The Big PictureJulrick Cubio EgbusNo ratings yet

- Oppenheimer Investing Through The Credit CycleDocument12 pagesOppenheimer Investing Through The Credit CycleKapil AgrawalNo ratings yet

- Financial Meltdown - Crisis of Governance?Document6 pagesFinancial Meltdown - Crisis of Governance?Atif RehmanNo ratings yet

- Module 6Document5 pagesModule 6tunga computer net centerNo ratings yet

- Accelerating Out of The Great Recession Rhodes eDocument5 pagesAccelerating Out of The Great Recession Rhodes elynnvilleNo ratings yet

- Business Economics Chapter 5 NotesDocument2 pagesBusiness Economics Chapter 5 NotesMadesh KuppuswamyNo ratings yet

- Module 2 Session 2 Business CycleDocument28 pagesModule 2 Session 2 Business CycleROY PAULNo ratings yet

- Makro 1Document6 pagesMakro 1melikesubasi2003No ratings yet

- Business Cycles: Prof. (DR) Vandana BhavsarDocument34 pagesBusiness Cycles: Prof. (DR) Vandana BhavsarAKHIL JOSEPHNo ratings yet

- Somethings Coming How Us Companies Can Build Resilience and Survive A Downturn - FinalDocument12 pagesSomethings Coming How Us Companies Can Build Resilience and Survive A Downturn - FinalKeith SpencerNo ratings yet

- W1-1 Econ Growth, Biz Cycle, and Structural OrgDocument20 pagesW1-1 Econ Growth, Biz Cycle, and Structural OrgSyabella TrianaNo ratings yet

- Economic RecessionDocument12 pagesEconomic RecessionMonika Saxena100% (1)

- Guide To RecessionsDocument12 pagesGuide To RecessionsDei DataNo ratings yet

- Managing in Downtur Part OneDocument12 pagesManaging in Downtur Part OneVilius BenetisNo ratings yet

- Pursuit of Harmony, Working Together in Times of TurmoilDocument32 pagesPursuit of Harmony, Working Together in Times of TurmoilComunicarSe-ArchivoNo ratings yet

- Macroeconomics - ppt1 T41AAnQ0FLDocument47 pagesMacroeconomics - ppt1 T41AAnQ0FLAshutosh BiswalNo ratings yet

- Introduction To Macroeconomics: Chapter OutlineDocument26 pagesIntroduction To Macroeconomics: Chapter OutlineTanvir IslamNo ratings yet

- 74667bos60481 FND p4 cp5Document22 pages74667bos60481 FND p4 cp5anushkaprajput0525No ratings yet

- Session 1 - Introduction To MacroeconomicsDocument6 pagesSession 1 - Introduction To MacroeconomicsNikhil kumarNo ratings yet

- 2020 Invrel Finrep Annual Report For 2019 2020 Aug 09 2020Document324 pages2020 Invrel Finrep Annual Report For 2019 2020 Aug 09 2020Asim HussainNo ratings yet

- Eco2 L01Document10 pagesEco2 L01PranavKathuriaNo ratings yet

- A Test of Resilience Banking Through The Crisis and Beyond VFDocument53 pagesA Test of Resilience Banking Through The Crisis and Beyond VFJózsef PataiNo ratings yet

- DBS 200818 - Insights - SG - Financial - Wellness PDFDocument40 pagesDBS 200818 - Insights - SG - Financial - Wellness PDFhhNo ratings yet

- Luxury M& A KPMG 2009Document12 pagesLuxury M& A KPMG 2009paulNo ratings yet

- MacroeconomicsDocument17 pagesMacroeconomicslaiba.rashid954No ratings yet

- 2024 R13 Module 13.1Document9 pages2024 R13 Module 13.1Khushie SanghviNo ratings yet

- Recession - A Way AheadDocument7 pagesRecession - A Way AheadarashpreetNo ratings yet

- Levant-Aboutsamsung-Group Ar 1997Document48 pagesLevant-Aboutsamsung-Group Ar 1997Nguyễn Lan AnhNo ratings yet

- Karlan Microeconomics 2ce - Ch. 1Document24 pagesKarlan Microeconomics 2ce - Ch. 1Gurnoor KaurNo ratings yet

- The Stuff That Drives Markets (Handbook)Document25 pagesThe Stuff That Drives Markets (Handbook)brianvo1901No ratings yet

- DESM#13 Model UncertaintyDocument39 pagesDESM#13 Model Uncertaintyz god luckNo ratings yet

- Murugappa groups-Annual-Report-2019-20Document124 pagesMurugappa groups-Annual-Report-2019-20KumaramNo ratings yet

- Macro Final Project Presentation SlidesDocument22 pagesMacro Final Project Presentation SlidesHaseeb RehmanNo ratings yet

- Resilience: Building Back: NavigatorDocument18 pagesResilience: Building Back: NavigatorBrian HughesNo ratings yet

- Resilience: Building Back: NavigatorDocument17 pagesResilience: Building Back: NavigatorDostfijiNo ratings yet

- Ec102 Chapter 26Document61 pagesEc102 Chapter 26Bahar SamiNo ratings yet

- Chap 10-Business CycleDocument43 pagesChap 10-Business CycleNabeel AhmedNo ratings yet

- Article NotesDocument3 pagesArticle NotesHaniya ShoaibNo ratings yet

- Block 4Document35 pagesBlock 4chiscribdNo ratings yet

- The Emerging Resilients: Achieving Escape Velocity'Document7 pagesThe Emerging Resilients: Achieving Escape Velocity'Anushree PawanrajNo ratings yet

- Focus Question: To What Extent Can Businesses Avoid Being Hurt by Downturns in The Business Cycle?Document5 pagesFocus Question: To What Extent Can Businesses Avoid Being Hurt by Downturns in The Business Cycle?Walaa Al-BayaaNo ratings yet

- Global Annual Review 2009 PWCDocument62 pagesGlobal Annual Review 2009 PWCDeepesh SinghNo ratings yet

- Lec6-Business CyclesDocument30 pagesLec6-Business Cyclesp44187No ratings yet

- WWW Istudy Org Uk ...Document10 pagesWWW Istudy Org Uk ...Surajit DasNo ratings yet

- Financial Risk ManagementDocument19 pagesFinancial Risk ManagementScribd007No ratings yet

- Introducing Macro Economics: Macroeconomics Considers The Performance of The Economy As A WholeDocument24 pagesIntroducing Macro Economics: Macroeconomics Considers The Performance of The Economy As A WholeEsther Sim In-WooNo ratings yet

- Stressed Assets in Power Sector-Clear and Present Danger: 25 July 2019Document50 pagesStressed Assets in Power Sector-Clear and Present Danger: 25 July 2019Lakshmi SNo ratings yet

- MC Kinsey - Strategy in A Structural BreakDocument8 pagesMC Kinsey - Strategy in A Structural BreakAlejandro Aguilar LanasNo ratings yet

- Hsw1e Macro Lecture Slides Ch11Document39 pagesHsw1e Macro Lecture Slides Ch11dilpreetd88No ratings yet

- Mosw1e Micro Lectureslides Ch03Document38 pagesMosw1e Micro Lectureslides Ch03dilpreetd88No ratings yet

- Hsw1e Macro Lecture Slides Ch12Document40 pagesHsw1e Macro Lecture Slides Ch12dilpreetd88No ratings yet

- Final Exam - Answer KeyDocument24 pagesFinal Exam - Answer Keydilpreetd88No ratings yet

- Rogue Trader - Ship SheetDocument1 pageRogue Trader - Ship SheetGeorges GodfroyNo ratings yet

- Wittek Stereo Surround PDFDocument43 pagesWittek Stereo Surround PDFАлександр СидоровNo ratings yet

- Lesson PlanDocument5 pagesLesson Planapi-239291032No ratings yet

- Hailing A Taxi - English LearningDocument4 pagesHailing A Taxi - English Learningclinta1979No ratings yet

- Virtualization Without Direct Execution or Jitting: Designing A Portable Virtual Machine InfrastructureDocument16 pagesVirtualization Without Direct Execution or Jitting: Designing A Portable Virtual Machine InfrastructureihoneeNo ratings yet

- Online Signature Verification Using Dynamic Time WarpingDocument5 pagesOnline Signature Verification Using Dynamic Time Warpingapi-3837813No ratings yet

- Modifications of Conventional Rigid and Flexible Methods For Mat Foundation DesignDocument156 pagesModifications of Conventional Rigid and Flexible Methods For Mat Foundation Designapirakq100% (1)

- Trade War Between US and China - Docx-2Document32 pagesTrade War Between US and China - Docx-2Khanh Linh HoangNo ratings yet

- Resume PatelDocument2 pagesResume Patelsubhash_tuhhNo ratings yet

- Water Treatment Plant Residuals Management PDFDocument4 pagesWater Treatment Plant Residuals Management PDFWil OrtizNo ratings yet

- GoogleDocument1 pageGooglegilbertoNo ratings yet

- Instructor'S Guide To Teaching Solidworks Software Lesson 10Document27 pagesInstructor'S Guide To Teaching Solidworks Software Lesson 10Rafael Diaz RomeroNo ratings yet

- Symmetry: He Quality of Being Made Up of Exactly Similar Parts Facing Each Other or Around An AxisDocument3 pagesSymmetry: He Quality of Being Made Up of Exactly Similar Parts Facing Each Other or Around An AxisJubelle Mae Batalla RentuzaNo ratings yet

- The Four Pillars of LearningDocument7 pagesThe Four Pillars of LearningAnonymous sYlElNGrMQNo ratings yet

- Art DrugsDocument70 pagesArt DrugsDr Daulat Ram DhakedNo ratings yet

- Ad 2 Fapp enDocument12 pagesAd 2 Fapp enNagapranav Nagapranavm.jNo ratings yet

- Pubertad Precoz NEJMDocument12 pagesPubertad Precoz NEJMAdrianaGallardoTapiaNo ratings yet

- Wiley - Modern Thermodynamics - From Heat Engines To Dissipative Structures, 2nd Edition - 978-1-118-37181-7Document2 pagesWiley - Modern Thermodynamics - From Heat Engines To Dissipative Structures, 2nd Edition - 978-1-118-37181-7JubairAhmedNo ratings yet

- Air Bearing Research PaperDocument6 pagesAir Bearing Research Paperfvgymwfv100% (1)

- The Safety Culture Stack - The Next Evolution of Safety Culture?Document19 pagesThe Safety Culture Stack - The Next Evolution of Safety Culture?Deisy QuevedoNo ratings yet

- CIBIL Consent FormDocument4 pagesCIBIL Consent FormKuldeep BatraNo ratings yet

- Lecture 1Document13 pagesLecture 1amritaNo ratings yet

- Territorial and Extraterritorial Application of Criminal LawDocument8 pagesTerritorial and Extraterritorial Application of Criminal LawVirat SinghNo ratings yet

- Academic Translation, Vocabulary, ReadingDocument573 pagesAcademic Translation, Vocabulary, ReadingEce GürtekinNo ratings yet

- Grade 11 Provincial Examination Mathematics P1 (English) June 2022 Question PaperDocument7 pagesGrade 11 Provincial Examination Mathematics P1 (English) June 2022 Question PaperSiyamtanda DlangaNo ratings yet

- Food Industry JFCDocument31 pagesFood Industry JFCJheanniver Nablo-PeñaNo ratings yet

- Cam Band Assembly: Lacing Webbing Bands Through Scuba Cam BucklesDocument10 pagesCam Band Assembly: Lacing Webbing Bands Through Scuba Cam BuckleshdhdhdNo ratings yet

- 1964 - Blyholder ModelDocument1 page1964 - Blyholder Model1592162022No ratings yet

Hsw1e Macro Lecture Slides Ch17

Hsw1e Macro Lecture Slides Ch17

Uploaded by

dilpreetd880 ratings0% found this document useful (0 votes)

6 views31 pagesOriginal Title

Hsw1e Macro Lecture Slides Ch17 (1)

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

6 views31 pagesHsw1e Macro Lecture Slides Ch17

Hsw1e Macro Lecture Slides Ch17

Uploaded by

dilpreetd88Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 31

Chapter 17

1. Macroeconomic Trends and Cycles

Tracking the 2. Common Characteristics of

Business Cycle Business Cycles

3. Analysing Macroeconomic Data

Macmillan Learning, ©2023

Chapter 17

Distinguish between long-

run economic trends and 1. Macroeconomic Trends and Cycles

short-run fluctuations:

Trend growth and the

2. Common Characteristics of

output gap Business Cycles

Business cycles are not 3. Analysing Macroeconomic Data

cycles

Macmillan Learning, ©2023

The chief economist of Ray White real estate

Before Mirvac decides to build a new apartment complex,

it looks at forecasts of people like Nerida Conisbee, the

chief economist at Ray White real estate.

She is in charge of making sure that property investors

are well informed about the economy.

Conisbee’s assessment of the strength of the economy and

how long she expects it to stay strong is actionable

information that will help her colleagues adjust their

property development, sales, and financing plans.

Boom economy = ramp up construction!

Recession = hold off on new projects

Year-to-year economic fluctuations have a major impact

on business and people’s lives.

3 Macmillan Learning, ©2023

Key Definitions Diving into the Definition

Long-run economic growth reflects growth in Business cycles cause actual output to

a country’s potential output. deviate from potential output.

Potential output: the level of output that

occurs when all resources are fully employed.

What we can sustainably produce given

our current resources.

HOWEVER, in the short run, the economy

may fail to meet its potential.

Business cycle: short-term fluctuations in

economic activity.

Short-turn deviations from potential output.

4 Macmillan Learning, ©2023

The ups and downs of the business cycle

The Unemployment Rate Fluctuates over the Business

Cycle.

While recessions don’t usually last

long, they have a lasting impact on

people’s careers:

Research shows that even

decades later, people who

graduated in a recession tend to

earn less than those who

graduated in better economic

times.

5 Macmillan Learning, ©2023

Key Definition Diving into the Definition

Recall, business cycles cause actual Negative output gap: The economy is

output to deviate from potential output producing less than it can.

Idle resources: workers can’t find

Output gap: the difference between

jobs, storefronts are shuttered, etc.

actual and potential output, measured as

a percentage of potential output.

Positive output gap: The economy is

producing more than its potential.

Output gap = This unsustainable intensity is

× 100 possible only for a short while.

Think about your life in the days

leading up to an exam.

6 Macmillan Learning, ©2023

Examining Australian Output Gaps

7 Macmillan Learning, ©2023

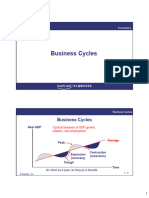

Stages of the business cycle

Peak: a high point in economic activity.

Trough: a low point in economic activity.

Recession: a period of declining

economic activity.

Runs from peak to trough.

Expansion: a period of increasing

economic activity.

Runs from trough to peak.

Expansions keep going until they’re

killed by an adverse shock (they don’t

die of old age).

8 Macmillan Learning, ©2023

Business cycles are NOT cycles

The economy’s fluctuations are

NOT rhythmic, reliable, or

predictable.

Some expansions have lasted

only a year, while others

have lasted for decades.

Expansions end because of

some adverse shock.

Recessions are NOT

inevitable.

9 Macmillan Learning, ©2023

Key take-aways: Macroeconomic trends and cycles

10 Macmillan Learning, ©2023

Chapter 17

Describe the common

1. Macroeconomic Trends and Cycles

features of business cycles:

Common features 2. Common Characteristics of

Business Cycles

Okun’s Rule of Thumb

3. Analysing Macroeconomic Data

Macmillan Learning, ©2023

Common characteristics of business cycles

“every unhappy family is unhappy in its own way.” - Anna Karenina

No two business cycles are ever the same, but they do have some common

features:

Recessions are short and sharp; expansions are long and gradual.

Business cycles are persistent.

Business cycles impact many parts of the economy.

12 Macmillan Learning, ©2023

Short, Sharp Recessions and Long, Gradual Expansions

Since World War II, the average

recession has lasted less than one

year, while the average economic

expansion has lasted 11 years.

Recessions triggered by various

disruptions:

slowing productivity, oil price

hikes, high interest rates, banking

crises, and a global pandemic

13 Macmillan Learning, ©2023

Business cycles are persistent

The state of the economy this year is

closely related to the conditions next

year.

Understanding the figure:

45-degree line represents if this

year’s conditions were to repeat

themselves next year

Output gap would never

change.

14 Macmillan Learning, ©2023

Interdependence principle and comovement

Comovement: variables that move up and down together.

If one part of the economy is doing well, the other parts of the economy are probably also doing well.

State Unemployment Rates Rise and Fall Together

15 Macmillan Learning, ©2023

Different economic indicators rise and fall together

Other indicators that move

together.

creation of new businesses,

housing construction, car

sales, imports from overseas,

new investment projects,

business profits, workers’ real

wages, stock prices, inflation

and interest rates

16 Macmillan Learning, ©2023

Most Private-Sector Industries Rise and Fall Together

17 Macmillan Learning, ©2023

Leading indicators Lagging indicators

Variables that tend to predict the Variables that tend to follow

future path of the economy. business cycle movements with a

Give a sense of where the bit of a delay.

economy is headed.

Tend to change first. Examples:

Examples: Unemployment

Business confidence;

consumer confidence; the

stock market.

18 Macmillan Learning, ©2023

Okun’s rule of thumb

Okun’s Rule of Thumb Links Unemployment and

For every percentage point that actual

GDP

output is less than potential output, the

unemployment rate will be around half

a percentage point higher.

Example:

Output gap: decline from 0% to

−2%.

Unemployment rate will likely rise

by about 1% (maybe from 5% to

6%).

19 Macmillan Learning, ©2023

Key take-aways:

Common characteristics of business cycles

Features of business cycles:

1. Business cycles are not cycles. 5. A typical business cycles involves

2. Recessions vary in their causes, a short, sharp recession, followed

duration, and depth. by a long and gradual expansion.

3. Some variables lead recessions, 6. Many economic variables comove

while others lag. up and down together over the

4. The business cycle is persistent. business cycle.

20 Macmillan Learning, ©2023

Chapter 17

Learn to use macroeconomic

data to track the economy: 1. Macroeconomic Trends and Cycles

The basics of

macroeconomic data 2. Common Characteristics of

Business Cycles

Top Ten Economic

Indicators 3. Analysing Macroeconomic Data

An economy watcher’s

guide

Macmillan Learning, ©2023

Seasonally adjusted: data stripped of predictable seasonal patterns.

Helps you see the underlying trends.

22 Macmillan Learning, ©2023

Annualised rates Real data

Different data series are collected at Recall: real variables are adjusted

different rates: for inflation.

Weekly, monthly, quarterly, Comparing quantities, holding

annually. prices constant.

Measured in something like

For easier comparison of data with “chained 2012 dollars”

different rates, use annualised rates.

Nominal data makes it difficult to

Annualised rates: data converted tell whether an increase reflects rising

to the rate that would occur if the prices or rising quantities.

same rate had occurred throughout

the year.

Data from a time period of less than

a year converted into an annual rate.

23 Macmillan Learning, ©2023

Pay attention to data revisions

Updates to earlier estimates are called revisions.

Some data is frequently revised.

Revised because initial estimates can be based on incomplete data.

24 Macmillan Learning, ©2023

Top Ten Economic Indicators:

1. Real GDP 6. Business confidence

2. Real GDI 7. Consumer confidence

3. Employment 8. Inflation

4. Unemployment rate 9. Wage price index

5. Real retail sales 10. The stock market

25 Macmillan Learning, ©2023

Indicator 1: Real GDP is the broadest Indicator 3: Employment tell you if the

measure of economic activity. labour market is improving.

Measures the total size of the Tracks how many jobs are created each

economy. month.

CAUTION: incomplete when first One of the most important indicators

released.

Indicator 4: The unemployment rate is an

Indicator 2: Real GDI acts as a useful indicator of excess capacity.

cross-check on GDP.

Share of the labour force that wants a

Gross Domestic Income adds up job but can’t find one.

total income.

Indicator 5: Real retail sales provide a

GDP and GDI should be equal, but

timely indicator.

often differ.

Tells you how much money people are

Early reports of GDI are often more

spending, including on discretionary

reliable than GDP.

items.

26 Macmillan Learning, ©2023

Indicator 6: Business confidence tells Indicator 8: The inflation rate tells you

you what managers are planning. what’s happening with prices.

Performance of Manufacturing Consumer price index provides a sense

Index. of how much economy-wide prices are

growing.

Indicator 9: The wage price index tells

Indicator 7: Consumer confidence you what’s happening with wages.

tells you what consumers are thinking. How fast wages and benefits are rising.

Asks regular people how optimistic Leading indicator of inflationary

they are about the economy. pressure.

Westpac/Melbourne Institute Indicator 10: The stock market tells you

Consumer Sentiment Index about future expected profits of businesses.

CAREFUL: “The stock market has

predicted nine out of the last five

27 recessions.” Macmillan Learning, ©2023

A dashboard for tracking the economy

28 Macmillan Learning, ©2023

An economy watcher’s guide

1. Track many indicators (not just one)

Imperfect measures 4. Find the signal amid the noise.

2. Broad indicators beat narrow indicators. Averaging over the past few data points.

Give more weight to indicators that Look past volatile components.

account for a greater share of the

5. Adjust your outlook when data differ from

economy.

expectations.

3. Seek just-in-time data and distinguish If the data show that the economy is

between leading and lagging indicators.

stronger or weaker than you expected,

Timely indicators about current trends. then you’ll need to adjust your outlook.

29 Macmillan Learning, ©2023

Key take-aways: Analysing macroeconomic data

30 Macmillan Learning, ©2023

Chapter 17

1. The business cycle reflects

the tendency for actual 1. Macroeconomic Trends and Cycles

output to deviate from

potential output. 2. Common Characteristics of

2. Business cycles are not Business Cycles

cycles.

3. Analysing Macroeconomic Data

3. The top ten economic

indicators can help you get a

sense of the economic

condition of the country.

Macmillan Learning, ©2023

You might also like

- MINTZBERGDocument32 pagesMINTZBERGgeezee10004464100% (2)

- Optitech's CaseDocument4 pagesOptitech's CaseSamuel EncarnaciónNo ratings yet

- The Next Consumer Recession: Preparing NowDocument22 pagesThe Next Consumer Recession: Preparing NowPanther MelchizedekNo ratings yet

- Colander11e Ch24 FinalDocument28 pagesColander11e Ch24 Finalbosyapmalik31No ratings yet

- Econ Slides CH 24&25Document57 pagesEcon Slides CH 24&25bosyapmalik31No ratings yet

- Number 31, Spring 2009: Perspectives On Corporate Finance and StrategyDocument36 pagesNumber 31, Spring 2009: Perspectives On Corporate Finance and StrategyqweenNo ratings yet

- MECO 121-Module 9 Introduction To MacroeconomicsDocument20 pagesMECO 121-Module 9 Introduction To MacroeconomicszainabmossadiqNo ratings yet

- Lecture Seven - Financial CrisisDocument14 pagesLecture Seven - Financial CrisisWael chehataNo ratings yet

- JefferiesInsights April2023Document10 pagesJefferiesInsights April2023Nigam MohapatraNo ratings yet

- S1 PPTX Capitulo 6 EstudiantesDocument16 pagesS1 PPTX Capitulo 6 EstudiantesKrissya Masis MoraNo ratings yet

- ACFrOgB7sXdLWrQ00pleCJRI Gy IkJoyVCmEBMoGL ZZV6ubgMZb0o 5au3f g965n0 4cViL7s5Gn5QH8uOWd8vSkncdSl Lzsey2USKQ6j74AckVrZm83bwUBtgDocument30 pagesACFrOgB7sXdLWrQ00pleCJRI Gy IkJoyVCmEBMoGL ZZV6ubgMZb0o 5au3f g965n0 4cViL7s5Gn5QH8uOWd8vSkncdSl Lzsey2USKQ6j74AckVrZm83bwUBtgJelena Lecic MirceticNo ratings yet

- 09 Introduction To MacroeconomicsDocument23 pages09 Introduction To MacroeconomicsRobert Scott MadriagoNo ratings yet

- Class 3.2 Slides For Economic Cycle Lecture - Fall22Document16 pagesClass 3.2 Slides For Economic Cycle Lecture - Fall22tuyennguyen.iuNo ratings yet

- Macroeconomics: Macroeconomics: The Big PictureDocument35 pagesMacroeconomics: Macroeconomics: The Big PictureJulrick Cubio EgbusNo ratings yet

- Oppenheimer Investing Through The Credit CycleDocument12 pagesOppenheimer Investing Through The Credit CycleKapil AgrawalNo ratings yet

- Financial Meltdown - Crisis of Governance?Document6 pagesFinancial Meltdown - Crisis of Governance?Atif RehmanNo ratings yet

- Module 6Document5 pagesModule 6tunga computer net centerNo ratings yet

- Accelerating Out of The Great Recession Rhodes eDocument5 pagesAccelerating Out of The Great Recession Rhodes elynnvilleNo ratings yet

- Business Economics Chapter 5 NotesDocument2 pagesBusiness Economics Chapter 5 NotesMadesh KuppuswamyNo ratings yet

- Module 2 Session 2 Business CycleDocument28 pagesModule 2 Session 2 Business CycleROY PAULNo ratings yet

- Makro 1Document6 pagesMakro 1melikesubasi2003No ratings yet

- Business Cycles: Prof. (DR) Vandana BhavsarDocument34 pagesBusiness Cycles: Prof. (DR) Vandana BhavsarAKHIL JOSEPHNo ratings yet

- Somethings Coming How Us Companies Can Build Resilience and Survive A Downturn - FinalDocument12 pagesSomethings Coming How Us Companies Can Build Resilience and Survive A Downturn - FinalKeith SpencerNo ratings yet

- W1-1 Econ Growth, Biz Cycle, and Structural OrgDocument20 pagesW1-1 Econ Growth, Biz Cycle, and Structural OrgSyabella TrianaNo ratings yet

- Economic RecessionDocument12 pagesEconomic RecessionMonika Saxena100% (1)

- Guide To RecessionsDocument12 pagesGuide To RecessionsDei DataNo ratings yet

- Managing in Downtur Part OneDocument12 pagesManaging in Downtur Part OneVilius BenetisNo ratings yet

- Pursuit of Harmony, Working Together in Times of TurmoilDocument32 pagesPursuit of Harmony, Working Together in Times of TurmoilComunicarSe-ArchivoNo ratings yet

- Macroeconomics - ppt1 T41AAnQ0FLDocument47 pagesMacroeconomics - ppt1 T41AAnQ0FLAshutosh BiswalNo ratings yet

- Introduction To Macroeconomics: Chapter OutlineDocument26 pagesIntroduction To Macroeconomics: Chapter OutlineTanvir IslamNo ratings yet

- 74667bos60481 FND p4 cp5Document22 pages74667bos60481 FND p4 cp5anushkaprajput0525No ratings yet

- Session 1 - Introduction To MacroeconomicsDocument6 pagesSession 1 - Introduction To MacroeconomicsNikhil kumarNo ratings yet

- 2020 Invrel Finrep Annual Report For 2019 2020 Aug 09 2020Document324 pages2020 Invrel Finrep Annual Report For 2019 2020 Aug 09 2020Asim HussainNo ratings yet

- Eco2 L01Document10 pagesEco2 L01PranavKathuriaNo ratings yet

- A Test of Resilience Banking Through The Crisis and Beyond VFDocument53 pagesA Test of Resilience Banking Through The Crisis and Beyond VFJózsef PataiNo ratings yet

- DBS 200818 - Insights - SG - Financial - Wellness PDFDocument40 pagesDBS 200818 - Insights - SG - Financial - Wellness PDFhhNo ratings yet

- Luxury M& A KPMG 2009Document12 pagesLuxury M& A KPMG 2009paulNo ratings yet

- MacroeconomicsDocument17 pagesMacroeconomicslaiba.rashid954No ratings yet

- 2024 R13 Module 13.1Document9 pages2024 R13 Module 13.1Khushie SanghviNo ratings yet

- Recession - A Way AheadDocument7 pagesRecession - A Way AheadarashpreetNo ratings yet

- Levant-Aboutsamsung-Group Ar 1997Document48 pagesLevant-Aboutsamsung-Group Ar 1997Nguyễn Lan AnhNo ratings yet

- Karlan Microeconomics 2ce - Ch. 1Document24 pagesKarlan Microeconomics 2ce - Ch. 1Gurnoor KaurNo ratings yet

- The Stuff That Drives Markets (Handbook)Document25 pagesThe Stuff That Drives Markets (Handbook)brianvo1901No ratings yet

- DESM#13 Model UncertaintyDocument39 pagesDESM#13 Model Uncertaintyz god luckNo ratings yet

- Murugappa groups-Annual-Report-2019-20Document124 pagesMurugappa groups-Annual-Report-2019-20KumaramNo ratings yet

- Macro Final Project Presentation SlidesDocument22 pagesMacro Final Project Presentation SlidesHaseeb RehmanNo ratings yet

- Resilience: Building Back: NavigatorDocument18 pagesResilience: Building Back: NavigatorBrian HughesNo ratings yet

- Resilience: Building Back: NavigatorDocument17 pagesResilience: Building Back: NavigatorDostfijiNo ratings yet

- Ec102 Chapter 26Document61 pagesEc102 Chapter 26Bahar SamiNo ratings yet

- Chap 10-Business CycleDocument43 pagesChap 10-Business CycleNabeel AhmedNo ratings yet

- Article NotesDocument3 pagesArticle NotesHaniya ShoaibNo ratings yet

- Block 4Document35 pagesBlock 4chiscribdNo ratings yet

- The Emerging Resilients: Achieving Escape Velocity'Document7 pagesThe Emerging Resilients: Achieving Escape Velocity'Anushree PawanrajNo ratings yet

- Focus Question: To What Extent Can Businesses Avoid Being Hurt by Downturns in The Business Cycle?Document5 pagesFocus Question: To What Extent Can Businesses Avoid Being Hurt by Downturns in The Business Cycle?Walaa Al-BayaaNo ratings yet

- Global Annual Review 2009 PWCDocument62 pagesGlobal Annual Review 2009 PWCDeepesh SinghNo ratings yet

- Lec6-Business CyclesDocument30 pagesLec6-Business Cyclesp44187No ratings yet

- WWW Istudy Org Uk ...Document10 pagesWWW Istudy Org Uk ...Surajit DasNo ratings yet

- Financial Risk ManagementDocument19 pagesFinancial Risk ManagementScribd007No ratings yet

- Introducing Macro Economics: Macroeconomics Considers The Performance of The Economy As A WholeDocument24 pagesIntroducing Macro Economics: Macroeconomics Considers The Performance of The Economy As A WholeEsther Sim In-WooNo ratings yet

- Stressed Assets in Power Sector-Clear and Present Danger: 25 July 2019Document50 pagesStressed Assets in Power Sector-Clear and Present Danger: 25 July 2019Lakshmi SNo ratings yet

- MC Kinsey - Strategy in A Structural BreakDocument8 pagesMC Kinsey - Strategy in A Structural BreakAlejandro Aguilar LanasNo ratings yet

- Hsw1e Macro Lecture Slides Ch11Document39 pagesHsw1e Macro Lecture Slides Ch11dilpreetd88No ratings yet

- Mosw1e Micro Lectureslides Ch03Document38 pagesMosw1e Micro Lectureslides Ch03dilpreetd88No ratings yet

- Hsw1e Macro Lecture Slides Ch12Document40 pagesHsw1e Macro Lecture Slides Ch12dilpreetd88No ratings yet

- Final Exam - Answer KeyDocument24 pagesFinal Exam - Answer Keydilpreetd88No ratings yet

- Rogue Trader - Ship SheetDocument1 pageRogue Trader - Ship SheetGeorges GodfroyNo ratings yet

- Wittek Stereo Surround PDFDocument43 pagesWittek Stereo Surround PDFАлександр СидоровNo ratings yet

- Lesson PlanDocument5 pagesLesson Planapi-239291032No ratings yet

- Hailing A Taxi - English LearningDocument4 pagesHailing A Taxi - English Learningclinta1979No ratings yet

- Virtualization Without Direct Execution or Jitting: Designing A Portable Virtual Machine InfrastructureDocument16 pagesVirtualization Without Direct Execution or Jitting: Designing A Portable Virtual Machine InfrastructureihoneeNo ratings yet

- Online Signature Verification Using Dynamic Time WarpingDocument5 pagesOnline Signature Verification Using Dynamic Time Warpingapi-3837813No ratings yet

- Modifications of Conventional Rigid and Flexible Methods For Mat Foundation DesignDocument156 pagesModifications of Conventional Rigid and Flexible Methods For Mat Foundation Designapirakq100% (1)

- Trade War Between US and China - Docx-2Document32 pagesTrade War Between US and China - Docx-2Khanh Linh HoangNo ratings yet

- Resume PatelDocument2 pagesResume Patelsubhash_tuhhNo ratings yet

- Water Treatment Plant Residuals Management PDFDocument4 pagesWater Treatment Plant Residuals Management PDFWil OrtizNo ratings yet

- GoogleDocument1 pageGooglegilbertoNo ratings yet

- Instructor'S Guide To Teaching Solidworks Software Lesson 10Document27 pagesInstructor'S Guide To Teaching Solidworks Software Lesson 10Rafael Diaz RomeroNo ratings yet

- Symmetry: He Quality of Being Made Up of Exactly Similar Parts Facing Each Other or Around An AxisDocument3 pagesSymmetry: He Quality of Being Made Up of Exactly Similar Parts Facing Each Other or Around An AxisJubelle Mae Batalla RentuzaNo ratings yet

- The Four Pillars of LearningDocument7 pagesThe Four Pillars of LearningAnonymous sYlElNGrMQNo ratings yet

- Art DrugsDocument70 pagesArt DrugsDr Daulat Ram DhakedNo ratings yet

- Ad 2 Fapp enDocument12 pagesAd 2 Fapp enNagapranav Nagapranavm.jNo ratings yet

- Pubertad Precoz NEJMDocument12 pagesPubertad Precoz NEJMAdrianaGallardoTapiaNo ratings yet

- Wiley - Modern Thermodynamics - From Heat Engines To Dissipative Structures, 2nd Edition - 978-1-118-37181-7Document2 pagesWiley - Modern Thermodynamics - From Heat Engines To Dissipative Structures, 2nd Edition - 978-1-118-37181-7JubairAhmedNo ratings yet

- Air Bearing Research PaperDocument6 pagesAir Bearing Research Paperfvgymwfv100% (1)

- The Safety Culture Stack - The Next Evolution of Safety Culture?Document19 pagesThe Safety Culture Stack - The Next Evolution of Safety Culture?Deisy QuevedoNo ratings yet

- CIBIL Consent FormDocument4 pagesCIBIL Consent FormKuldeep BatraNo ratings yet

- Lecture 1Document13 pagesLecture 1amritaNo ratings yet

- Territorial and Extraterritorial Application of Criminal LawDocument8 pagesTerritorial and Extraterritorial Application of Criminal LawVirat SinghNo ratings yet

- Academic Translation, Vocabulary, ReadingDocument573 pagesAcademic Translation, Vocabulary, ReadingEce GürtekinNo ratings yet

- Grade 11 Provincial Examination Mathematics P1 (English) June 2022 Question PaperDocument7 pagesGrade 11 Provincial Examination Mathematics P1 (English) June 2022 Question PaperSiyamtanda DlangaNo ratings yet

- Food Industry JFCDocument31 pagesFood Industry JFCJheanniver Nablo-PeñaNo ratings yet

- Cam Band Assembly: Lacing Webbing Bands Through Scuba Cam BucklesDocument10 pagesCam Band Assembly: Lacing Webbing Bands Through Scuba Cam BuckleshdhdhdNo ratings yet

- 1964 - Blyholder ModelDocument1 page1964 - Blyholder Model1592162022No ratings yet