Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

2 viewsMFIN 5800 Chapter 23

MFIN 5800 Chapter 23

Uploaded by

AlanCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You might also like

- AU Tax Refund AmendmentDocument16 pagesAU Tax Refund Amendmentleslie woodsNo ratings yet

- Before The Hon'Ble Allahbad High Court: Petition Filed On Behalf of AppellantDocument17 pagesBefore The Hon'Ble Allahbad High Court: Petition Filed On Behalf of Appellantprashant jadhav50% (2)

- Basel III 1132438 Basel III PosterDocument1 pageBasel III 1132438 Basel III PosterAlexandra ChevalierNo ratings yet

- Prasad KodaliDocument9 pagesPrasad KodalijtnylsonNo ratings yet

- Alex Navab - Overview of Private EquityDocument21 pagesAlex Navab - Overview of Private EquityAlyson Davis100% (16)

- Barangay Anti-Drug Abuse Council (Badac) Training: Activity DesignDocument3 pagesBarangay Anti-Drug Abuse Council (Badac) Training: Activity DesignMaria Fiona Duran Merquita100% (2)

- Judicial AffidavitDocument4 pagesJudicial AffidavitEmmanuel Carasaquit100% (2)

- MFIN 5800 Chapter 26Document23 pagesMFIN 5800 Chapter 26AlanNo ratings yet

- MFIN 5800 Chapter 12Document25 pagesMFIN 5800 Chapter 12AlanNo ratings yet

- MFIN 5800 Chapter 27Document10 pagesMFIN 5800 Chapter 27AlanNo ratings yet

- Inv't Chapter - IIDocument29 pagesInv't Chapter - IIHana DestaNo ratings yet

- A Regulatory Perspective On Operational RiskDocument37 pagesA Regulatory Perspective On Operational RiskmonimoniNo ratings yet

- Op Risks in BanksDocument22 pagesOp Risks in Banksshubhkarman_sin2056100% (1)

- Simon Willis - OrXDocument31 pagesSimon Willis - OrXjtnylson0% (1)

- Icc Document Icc GCD Performance Guarantees StudyDocument10 pagesIcc Document Icc GCD Performance Guarantees StudyAlly Hassan AliNo ratings yet

- Chapter 13Document34 pagesChapter 13Aryan JainNo ratings yet

- Chapter 10 - Operational Risk ManagementDocument28 pagesChapter 10 - Operational Risk ManagementVishwajit GoudNo ratings yet

- Operational Risk Data SRMDocument5 pagesOperational Risk Data SRMHaseeb Ullah KhanNo ratings yet

- JaipurDocument26 pagesJaipurJatin SinghNo ratings yet

- Op Risk MGTDocument64 pagesOp Risk MGTDrAkhilesh TripathiNo ratings yet

- Ama ImplementationDocument12 pagesAma ImplementationMerugu BhaskarNo ratings yet

- Project Analysis Using Decision Trees and OptionsDocument16 pagesProject Analysis Using Decision Trees and OptionsFungai MukundiwaNo ratings yet

- Class 12: Summary: Valuation With LeverageDocument14 pagesClass 12: Summary: Valuation With LeverageYariko ChieNo ratings yet

- Demystifying Operational Risk: Asad Ullah Saleem April 19, 2007Document58 pagesDemystifying Operational Risk: Asad Ullah Saleem April 19, 2007Shiroy PatelNo ratings yet

- Business Impact Analysis ("BIA") : Joint Universities Computer Centre Limited ("JUCC")Document33 pagesBusiness Impact Analysis ("BIA") : Joint Universities Computer Centre Limited ("JUCC")AlaaNo ratings yet

- MFIN 5800 Chapter 1Document14 pagesMFIN 5800 Chapter 1AlanNo ratings yet

- Financial Statement Analysis: Text Book-Chapter 12Document13 pagesFinancial Statement Analysis: Text Book-Chapter 12anwesh pradhanNo ratings yet

- SFM Theorey Notes by Ankur MittalDocument73 pagesSFM Theorey Notes by Ankur MittalAnkur MittalNo ratings yet

- Audit CH 4Document39 pagesAudit CH 4RajNo ratings yet

- Country Risk AnalysisDocument32 pagesCountry Risk AnalysisImroz MahmudNo ratings yet

- On Operational Risk at UbsDocument23 pagesOn Operational Risk at UbsSai KrishnaNo ratings yet

- Week 9 Notes OnCapital BudgetingDocument13 pagesWeek 9 Notes OnCapital BudgetingAnonymous O5asZmNo ratings yet

- BCBS 239 Compliance: A Comprehensive ApproachDocument7 pagesBCBS 239 Compliance: A Comprehensive ApproachCognizantNo ratings yet

- Presentation - Management of RiskDocument34 pagesPresentation - Management of RiskGopal SharmaNo ratings yet

- Corporate Finance: Laurence Booth - W. Sean ClearyDocument136 pagesCorporate Finance: Laurence Booth - W. Sean Clearyatif41No ratings yet

- Capital Finance Decisions For Project Managers - A Reflection On Current MethodsDocument6 pagesCapital Finance Decisions For Project Managers - A Reflection On Current MethodsRajiv KharbandaNo ratings yet

- Valuation - DCFDocument38 pagesValuation - DCFKumar Prashant100% (1)

- Current Liabilities: 15.515 2003 Session 12Document9 pagesCurrent Liabilities: 15.515 2003 Session 12Cindy LamusuNo ratings yet

- FRM Unit-2Document31 pagesFRM Unit-2prasanthi CNo ratings yet

- Business School: Risk and Actuarial StudiesDocument37 pagesBusiness School: Risk and Actuarial StudiesBobNo ratings yet

- Financial Study of Iti LTD MankapurDocument22 pagesFinancial Study of Iti LTD MankapurAshwani SinghNo ratings yet

- Auditing and Assurance Services: Seventeenth Edition, Global EditionDocument34 pagesAuditing and Assurance Services: Seventeenth Edition, Global EditionChoki Coklat AsliNo ratings yet

- Topic 4Document30 pagesTopic 4aboalnadaratNo ratings yet

- 9 Operational Risk - IdentificationDocument13 pages9 Operational Risk - IdentificationThineshNo ratings yet

- Operational RiskDocument25 pagesOperational RiskAngela ChuaNo ratings yet

- Basel NormsDocument20 pagesBasel NormsAbhilasha Mathur100% (1)

- Cost Allocations For Construction Insurance and Risk - Charlie Woodman and Caroline KoenraadDocument32 pagesCost Allocations For Construction Insurance and Risk - Charlie Woodman and Caroline KoenraadvihangimaduNo ratings yet

- 2013 S1 Tutorial - Mini Audit - Vospa LTD - QuestionsDocument25 pages2013 S1 Tutorial - Mini Audit - Vospa LTD - QuestionsyoNo ratings yet

- Chapter 20 - Cost of CapitalDocument151 pagesChapter 20 - Cost of CapitalSudhakar RoutNo ratings yet

- G18 - L - Afm - Case Study - Q1 To Q4 - TheoryDocument5 pagesG18 - L - Afm - Case Study - Q1 To Q4 - Theoryjr ylvsNo ratings yet

- Adjusted Present ValueDocument30 pagesAdjusted Present ValueBhuvnesh PrakashNo ratings yet

- Risk Analysis in Capital BudgetingDocument37 pagesRisk Analysis in Capital BudgetingAshish JainNo ratings yet

- Rating Methodology For Infrastructure Investment Trusts (Invits)Document9 pagesRating Methodology For Infrastructure Investment Trusts (Invits)arpanarajbhattNo ratings yet

- Basel Ii and Its ImplicationsDocument24 pagesBasel Ii and Its ImplicationsMon SethNo ratings yet

- Session7 2020Document55 pagesSession7 2020SaraQureshiNo ratings yet

- 2 Leading Indicators of Turnaround Performance OutcomesDocument12 pages2 Leading Indicators of Turnaround Performance OutcomesPrettyAnnie51No ratings yet

- Ch-4 Risk and ReturnDocument40 pagesCh-4 Risk and ReturnEyuel SintayehuNo ratings yet

- Capital Budgeting: Risk AnalysisDocument25 pagesCapital Budgeting: Risk AnalysisPrathishNo ratings yet

- Audit Team Deliverable 1Document4 pagesAudit Team Deliverable 1PriyankaNo ratings yet

- Basel AccordsDocument52 pagesBasel AccordsDavid Cai100% (1)

- PGP 2007-09: Term III: Commercial BankingDocument40 pagesPGP 2007-09: Term III: Commercial Bankingrammu1234No ratings yet

- IT Auditing and Application Controls for Small and Mid-Sized Enterprises: Revenue, Expenditure, Inventory, Payroll, and MoreFrom EverandIT Auditing and Application Controls for Small and Mid-Sized Enterprises: Revenue, Expenditure, Inventory, Payroll, and MoreNo ratings yet

- Credit Risk Management In and Out of the Financial Crisis: New Approaches to Value at Risk and Other ParadigmsFrom EverandCredit Risk Management In and Out of the Financial Crisis: New Approaches to Value at Risk and Other ParadigmsRating: 1 out of 5 stars1/5 (1)

- MFIN 5800 Chapter 9Document32 pagesMFIN 5800 Chapter 9AlanNo ratings yet

- MFIN 5800 Chapter 8Document23 pagesMFIN 5800 Chapter 8AlanNo ratings yet

- MFIN 5800 Chapter 6Document28 pagesMFIN 5800 Chapter 6AlanNo ratings yet

- MFIN 5800 Chapter 7Document18 pagesMFIN 5800 Chapter 7AlanNo ratings yet

- Professional Ethics U-1Document11 pagesProfessional Ethics U-1Ashutosh BagchiNo ratings yet

- DIFFUSIONISMDocument14 pagesDIFFUSIONISMrieann leonNo ratings yet

- SSC Idp ProjectDocument4 pagesSSC Idp ProjectRayNo ratings yet

- Letter To Fulton County Sheriff 4-24-23Document2 pagesLetter To Fulton County Sheriff 4-24-23CBS News PoliticsNo ratings yet

- Modul 1 Peraturan Yang Berlaku Untuk SPUKTA (9 Sep 22) V3 PDFDocument103 pagesModul 1 Peraturan Yang Berlaku Untuk SPUKTA (9 Sep 22) V3 PDFAdmin PT PLN UPT MakassarNo ratings yet

- Sunday River Brewing LawsuitDocument22 pagesSunday River Brewing LawsuitNEWS CENTER MaineNo ratings yet

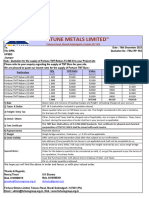

- "Fortune Metals Limited": Talwara Road, Mandi Gobindgarh, Punjab-147 301Document1 page"Fortune Metals Limited": Talwara Road, Mandi Gobindgarh, Punjab-147 301S K SharmaNo ratings yet

- Doctrinal Legal Research Methodology: A Critical AnalysisDocument11 pagesDoctrinal Legal Research Methodology: A Critical Analysispriya dudejaNo ratings yet

- Gandionco V PenarandaDocument3 pagesGandionco V PenarandaAggy AlbotraNo ratings yet

- Practical Training 2: Jigar Ashar & Akash KannaujiyaDocument58 pagesPractical Training 2: Jigar Ashar & Akash Kannaujiyastudylaw201No ratings yet

- Q Asgt - Biz Law - A192Document10 pagesQ Asgt - Biz Law - A192otaku himeNo ratings yet

- Feminist Critical Theory in Tangledd 1 1Document13 pagesFeminist Critical Theory in Tangledd 1 1Haroon HamidNo ratings yet

- PLATODocument33 pagesPLATOAsim NowrizNo ratings yet

- Emilio Aguinaldomgagunita NG HimagsikanDocument8 pagesEmilio Aguinaldomgagunita NG HimagsikanKent LasicNo ratings yet

- Paper 3Document3 pagesPaper 3Ofelia SierraNo ratings yet

- Acer V5-131 - v5-171 LS-8941PR10 - 20120411Document2 pagesAcer V5-131 - v5-171 LS-8941PR10 - 20120411vi aNo ratings yet

- Daily Diary - Ojt - 62 - ProbationersDocument98 pagesDaily Diary - Ojt - 62 - Probationersmsnethrapal100% (1)

- Medical & Dental Practitioners ActDocument40 pagesMedical & Dental Practitioners ActMijja Coll BulamuNo ratings yet

- Guidelines of An Effective Interview and Ethico-Legal ConsiderationsDocument37 pagesGuidelines of An Effective Interview and Ethico-Legal ConsiderationsSherinne Jane CariazoNo ratings yet

- Lecture 4 - The First Five-Year Plan and The Cultural RevolutionDocument31 pagesLecture 4 - The First Five-Year Plan and The Cultural Revolutionestevesuarez3No ratings yet

- CEP Study - Violent Right-Wing Extremism and Terrorism - Nov 2020Document158 pagesCEP Study - Violent Right-Wing Extremism and Terrorism - Nov 2020Jean Yves CamusNo ratings yet

- Moot Court CompetitionDocument5 pagesMoot Court CompetitionVikki AmorioNo ratings yet

- Tiomico Vs CA - GR No. 122539-March 4, 1999Document2 pagesTiomico Vs CA - GR No. 122539-March 4, 1999Thoughts and More ThoughtsNo ratings yet

- The Oriental Insurance Company Limited: Particulars of Insured VehicleDocument3 pagesThe Oriental Insurance Company Limited: Particulars of Insured VehiclehancyboxNo ratings yet

- Chapter 2: Tax Laws and Tax AdminstrationDocument7 pagesChapter 2: Tax Laws and Tax AdminstrationRover Ross100% (1)

- CONTRACT - CuerpoAylan MSIDocument9 pagesCONTRACT - CuerpoAylan MSIAli KayaNo ratings yet

MFIN 5800 Chapter 23

MFIN 5800 Chapter 23

Uploaded by

Alan0 ratings0% found this document useful (0 votes)

2 views22 pagesCopyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

0 ratings0% found this document useful (0 votes)

2 views22 pagesMFIN 5800 Chapter 23

MFIN 5800 Chapter 23

Uploaded by

AlanCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

You are on page 1of 22

Chapter 23

Operational Risk

©2015 by Scott Warlow 1

Definition of Operational Risk

“Operational risk is the risk of loss resulting

from inadequate or failed internal

processes, people, and systems, or from

external events”

Basel Committee, January 2001

©2015 by Scott Warlow 2

The Biggest Risk?

• Operational risk is difficult to quantify but

is now regarded as the biggest risk facing

banks

• Cyber risk is a big concern

• Compliance risks can lead to huge losses

(e.g. BNP Paribas’s $9 billion loss in 2014)

©2015 by Scott Warlow 3

What It Includes

• The definition includes people risks,

technology and processing risks, physical

risks, legal risks, etc.

• The definition excludes reputation risk and

strategic risk

©2015 by Scott Warlow 4

Regulatory Capital (page 481)

• In Basel II there is a capital charge for

Operational Risk

• Three alternatives:

– Basic Indicator (15% of annual gross income)

– Standardized (different percentage for each

business line)

– Advanced Measurement Approach (AMA)

©2015 by Scott Warlow 5

Categorization of Business Lines (8)

• Corporate finance

• Trading and sales

• Retail banking

• Commercial banking

• Payment and settlement

• Agency services

• Asset management

• Retail brokerage

©2015 by Scott Warlow 6

Categorization of Risks (7)

• Internal fraud

• External fraud

• Employment practices and workplace safety

• Clients, products and business practices

• Damage to physical assets

• Business disruption and system failures

• Execution, delivery and process

management

©2015 by Scott Warlow 7

The AMA Approach

©2015 by Scott Warlow 8

The Task Under AMA

• Banks need to estimate their exposure to

each combination of type of risk and

business line

• Ideally this will lead to 7 × 8 = 56 VaR

measures that can be combined into an

overall VaR measure (Chapter 26 on

RAROC will discuss how this can be done)

©2015 by Scott Warlow 9

Loss Severity vs. Loss Frequency

(page 484)

• Loss frequency should be estimated from the banks

own data as far as possible. One possibility is to

assume a Poisson distribution so that we need only

estimate an average loss frequency. Probability of n

events in time T is then

( T ) n

e T

n!

• Loss severity can be based on internal and external

historical data. (One possibility is to assume a

lognormal distribution so that we need only estimate

the mean and SD of losses)

©2015 by Scott Warlow 10

Using Monte Carlo to Combine the

Distributions (Figure 23.2)

©2015 by Scott Warlow 11

Monte Carlo Simulation Trial

• Sample from frequency distribution to

determine the number of loss events (= n)

• Sample n times from the loss severity

distribution to determine the loss severity

for each loss event

• Sum loss severities to determine total loss

©2015 by Scott Warlow 12

AMA Approach

Four elements specified by Basel committee:

• Internal data

• External data

• Scenario analysis

• Business environment and internal control

factors

©2015 by Scott Warlow 13

Internal Data

• Operational risk losses have not been

recorded as well as credit risk losses

• Important losses are low-frequency high

severity-losses

• Loss frequency should be estimated from

internal data

©2015 by Scott Warlow 14

External Historical Loss Severity Data

• Two possibilities

– data sharing

– data vendors

• Data from vendors is based on publicly

available information and therefore is

biased towards large losses

• Data from vendors can therefore only be

used to estimate the relative size of the

mean losses and SD of losses for different

risk categories

©2015 by Scott Warlow 15

Scaling for Size (page 487)

Estimated Loss for Bank A

Bank A Revenue

Observed Loss for Bank B

Bank B Revenue

Using external data, [Shih et al.] estimate 0.23

©2015 by Scott Warlow 16

Scenario Analysis

• Aim is to generate scenarios covering all

low frequency high severity losses

• Can be based on own experience and

experience of other banks

• Assign probabilities

• Aggregate scenarios to provide loss

distributions

©2015 by Scott Warlow 17

Business Environment and

Internal Control Factors

Take account of

• Complexity of business line

• Technology used

• Pace of change

• Level of supervision

• Staff turnover rates

• etc.

©2015 by Scott Warlow 18

Proactive Approaches

• Establish causal relationships

• RCSA (risk control and self assessment)

• KRI (key risk indicators)

• Allocate operational risk capital to encourage

business units to reduce operational risk

• Educate employees to be careful about what they

write in emails and (when they work in the trading

room) what they say over the phone

©2015 by Scott Warlow 19

Power Law

Prob (v > x) = Kx-

• Research shows that this works quite well

for operational risk losses

• Distribution with heaviest tails (lowest )

tend to define the 99.9% worst case result

©2015 by Scott Warlow 20

Insurance (pages 493-494)

• Factors that affect the design of an insurance

contract

– Moral hazard

– Adverse selection

• To take account of these factors there are

– deductibles

– co-insurance provisions

– policy limits

©2015 by Scott Warlow 21

Sarbanes-Oxley (pages 494-495)

• CEO and CFO are more accountable

• SEC has more powers

• Auditors are not allowed to carry out

significant non-audit tasks

• Audit committee of board must be made

aware of alternative accounting treatments

• CEO and CFO must return bonuses in the

event financial statements are restated

©2015 by Scott Warlow 22

You might also like

- AU Tax Refund AmendmentDocument16 pagesAU Tax Refund Amendmentleslie woodsNo ratings yet

- Before The Hon'Ble Allahbad High Court: Petition Filed On Behalf of AppellantDocument17 pagesBefore The Hon'Ble Allahbad High Court: Petition Filed On Behalf of Appellantprashant jadhav50% (2)

- Basel III 1132438 Basel III PosterDocument1 pageBasel III 1132438 Basel III PosterAlexandra ChevalierNo ratings yet

- Prasad KodaliDocument9 pagesPrasad KodalijtnylsonNo ratings yet

- Alex Navab - Overview of Private EquityDocument21 pagesAlex Navab - Overview of Private EquityAlyson Davis100% (16)

- Barangay Anti-Drug Abuse Council (Badac) Training: Activity DesignDocument3 pagesBarangay Anti-Drug Abuse Council (Badac) Training: Activity DesignMaria Fiona Duran Merquita100% (2)

- Judicial AffidavitDocument4 pagesJudicial AffidavitEmmanuel Carasaquit100% (2)

- MFIN 5800 Chapter 26Document23 pagesMFIN 5800 Chapter 26AlanNo ratings yet

- MFIN 5800 Chapter 12Document25 pagesMFIN 5800 Chapter 12AlanNo ratings yet

- MFIN 5800 Chapter 27Document10 pagesMFIN 5800 Chapter 27AlanNo ratings yet

- Inv't Chapter - IIDocument29 pagesInv't Chapter - IIHana DestaNo ratings yet

- A Regulatory Perspective On Operational RiskDocument37 pagesA Regulatory Perspective On Operational RiskmonimoniNo ratings yet

- Op Risks in BanksDocument22 pagesOp Risks in Banksshubhkarman_sin2056100% (1)

- Simon Willis - OrXDocument31 pagesSimon Willis - OrXjtnylson0% (1)

- Icc Document Icc GCD Performance Guarantees StudyDocument10 pagesIcc Document Icc GCD Performance Guarantees StudyAlly Hassan AliNo ratings yet

- Chapter 13Document34 pagesChapter 13Aryan JainNo ratings yet

- Chapter 10 - Operational Risk ManagementDocument28 pagesChapter 10 - Operational Risk ManagementVishwajit GoudNo ratings yet

- Operational Risk Data SRMDocument5 pagesOperational Risk Data SRMHaseeb Ullah KhanNo ratings yet

- JaipurDocument26 pagesJaipurJatin SinghNo ratings yet

- Op Risk MGTDocument64 pagesOp Risk MGTDrAkhilesh TripathiNo ratings yet

- Ama ImplementationDocument12 pagesAma ImplementationMerugu BhaskarNo ratings yet

- Project Analysis Using Decision Trees and OptionsDocument16 pagesProject Analysis Using Decision Trees and OptionsFungai MukundiwaNo ratings yet

- Class 12: Summary: Valuation With LeverageDocument14 pagesClass 12: Summary: Valuation With LeverageYariko ChieNo ratings yet

- Demystifying Operational Risk: Asad Ullah Saleem April 19, 2007Document58 pagesDemystifying Operational Risk: Asad Ullah Saleem April 19, 2007Shiroy PatelNo ratings yet

- Business Impact Analysis ("BIA") : Joint Universities Computer Centre Limited ("JUCC")Document33 pagesBusiness Impact Analysis ("BIA") : Joint Universities Computer Centre Limited ("JUCC")AlaaNo ratings yet

- MFIN 5800 Chapter 1Document14 pagesMFIN 5800 Chapter 1AlanNo ratings yet

- Financial Statement Analysis: Text Book-Chapter 12Document13 pagesFinancial Statement Analysis: Text Book-Chapter 12anwesh pradhanNo ratings yet

- SFM Theorey Notes by Ankur MittalDocument73 pagesSFM Theorey Notes by Ankur MittalAnkur MittalNo ratings yet

- Audit CH 4Document39 pagesAudit CH 4RajNo ratings yet

- Country Risk AnalysisDocument32 pagesCountry Risk AnalysisImroz MahmudNo ratings yet

- On Operational Risk at UbsDocument23 pagesOn Operational Risk at UbsSai KrishnaNo ratings yet

- Week 9 Notes OnCapital BudgetingDocument13 pagesWeek 9 Notes OnCapital BudgetingAnonymous O5asZmNo ratings yet

- BCBS 239 Compliance: A Comprehensive ApproachDocument7 pagesBCBS 239 Compliance: A Comprehensive ApproachCognizantNo ratings yet

- Presentation - Management of RiskDocument34 pagesPresentation - Management of RiskGopal SharmaNo ratings yet

- Corporate Finance: Laurence Booth - W. Sean ClearyDocument136 pagesCorporate Finance: Laurence Booth - W. Sean Clearyatif41No ratings yet

- Capital Finance Decisions For Project Managers - A Reflection On Current MethodsDocument6 pagesCapital Finance Decisions For Project Managers - A Reflection On Current MethodsRajiv KharbandaNo ratings yet

- Valuation - DCFDocument38 pagesValuation - DCFKumar Prashant100% (1)

- Current Liabilities: 15.515 2003 Session 12Document9 pagesCurrent Liabilities: 15.515 2003 Session 12Cindy LamusuNo ratings yet

- FRM Unit-2Document31 pagesFRM Unit-2prasanthi CNo ratings yet

- Business School: Risk and Actuarial StudiesDocument37 pagesBusiness School: Risk and Actuarial StudiesBobNo ratings yet

- Financial Study of Iti LTD MankapurDocument22 pagesFinancial Study of Iti LTD MankapurAshwani SinghNo ratings yet

- Auditing and Assurance Services: Seventeenth Edition, Global EditionDocument34 pagesAuditing and Assurance Services: Seventeenth Edition, Global EditionChoki Coklat AsliNo ratings yet

- Topic 4Document30 pagesTopic 4aboalnadaratNo ratings yet

- 9 Operational Risk - IdentificationDocument13 pages9 Operational Risk - IdentificationThineshNo ratings yet

- Operational RiskDocument25 pagesOperational RiskAngela ChuaNo ratings yet

- Basel NormsDocument20 pagesBasel NormsAbhilasha Mathur100% (1)

- Cost Allocations For Construction Insurance and Risk - Charlie Woodman and Caroline KoenraadDocument32 pagesCost Allocations For Construction Insurance and Risk - Charlie Woodman and Caroline KoenraadvihangimaduNo ratings yet

- 2013 S1 Tutorial - Mini Audit - Vospa LTD - QuestionsDocument25 pages2013 S1 Tutorial - Mini Audit - Vospa LTD - QuestionsyoNo ratings yet

- Chapter 20 - Cost of CapitalDocument151 pagesChapter 20 - Cost of CapitalSudhakar RoutNo ratings yet

- G18 - L - Afm - Case Study - Q1 To Q4 - TheoryDocument5 pagesG18 - L - Afm - Case Study - Q1 To Q4 - Theoryjr ylvsNo ratings yet

- Adjusted Present ValueDocument30 pagesAdjusted Present ValueBhuvnesh PrakashNo ratings yet

- Risk Analysis in Capital BudgetingDocument37 pagesRisk Analysis in Capital BudgetingAshish JainNo ratings yet

- Rating Methodology For Infrastructure Investment Trusts (Invits)Document9 pagesRating Methodology For Infrastructure Investment Trusts (Invits)arpanarajbhattNo ratings yet

- Basel Ii and Its ImplicationsDocument24 pagesBasel Ii and Its ImplicationsMon SethNo ratings yet

- Session7 2020Document55 pagesSession7 2020SaraQureshiNo ratings yet

- 2 Leading Indicators of Turnaround Performance OutcomesDocument12 pages2 Leading Indicators of Turnaround Performance OutcomesPrettyAnnie51No ratings yet

- Ch-4 Risk and ReturnDocument40 pagesCh-4 Risk and ReturnEyuel SintayehuNo ratings yet

- Capital Budgeting: Risk AnalysisDocument25 pagesCapital Budgeting: Risk AnalysisPrathishNo ratings yet

- Audit Team Deliverable 1Document4 pagesAudit Team Deliverable 1PriyankaNo ratings yet

- Basel AccordsDocument52 pagesBasel AccordsDavid Cai100% (1)

- PGP 2007-09: Term III: Commercial BankingDocument40 pagesPGP 2007-09: Term III: Commercial Bankingrammu1234No ratings yet

- IT Auditing and Application Controls for Small and Mid-Sized Enterprises: Revenue, Expenditure, Inventory, Payroll, and MoreFrom EverandIT Auditing and Application Controls for Small and Mid-Sized Enterprises: Revenue, Expenditure, Inventory, Payroll, and MoreNo ratings yet

- Credit Risk Management In and Out of the Financial Crisis: New Approaches to Value at Risk and Other ParadigmsFrom EverandCredit Risk Management In and Out of the Financial Crisis: New Approaches to Value at Risk and Other ParadigmsRating: 1 out of 5 stars1/5 (1)

- MFIN 5800 Chapter 9Document32 pagesMFIN 5800 Chapter 9AlanNo ratings yet

- MFIN 5800 Chapter 8Document23 pagesMFIN 5800 Chapter 8AlanNo ratings yet

- MFIN 5800 Chapter 6Document28 pagesMFIN 5800 Chapter 6AlanNo ratings yet

- MFIN 5800 Chapter 7Document18 pagesMFIN 5800 Chapter 7AlanNo ratings yet

- Professional Ethics U-1Document11 pagesProfessional Ethics U-1Ashutosh BagchiNo ratings yet

- DIFFUSIONISMDocument14 pagesDIFFUSIONISMrieann leonNo ratings yet

- SSC Idp ProjectDocument4 pagesSSC Idp ProjectRayNo ratings yet

- Letter To Fulton County Sheriff 4-24-23Document2 pagesLetter To Fulton County Sheriff 4-24-23CBS News PoliticsNo ratings yet

- Modul 1 Peraturan Yang Berlaku Untuk SPUKTA (9 Sep 22) V3 PDFDocument103 pagesModul 1 Peraturan Yang Berlaku Untuk SPUKTA (9 Sep 22) V3 PDFAdmin PT PLN UPT MakassarNo ratings yet

- Sunday River Brewing LawsuitDocument22 pagesSunday River Brewing LawsuitNEWS CENTER MaineNo ratings yet

- "Fortune Metals Limited": Talwara Road, Mandi Gobindgarh, Punjab-147 301Document1 page"Fortune Metals Limited": Talwara Road, Mandi Gobindgarh, Punjab-147 301S K SharmaNo ratings yet

- Doctrinal Legal Research Methodology: A Critical AnalysisDocument11 pagesDoctrinal Legal Research Methodology: A Critical Analysispriya dudejaNo ratings yet

- Gandionco V PenarandaDocument3 pagesGandionco V PenarandaAggy AlbotraNo ratings yet

- Practical Training 2: Jigar Ashar & Akash KannaujiyaDocument58 pagesPractical Training 2: Jigar Ashar & Akash Kannaujiyastudylaw201No ratings yet

- Q Asgt - Biz Law - A192Document10 pagesQ Asgt - Biz Law - A192otaku himeNo ratings yet

- Feminist Critical Theory in Tangledd 1 1Document13 pagesFeminist Critical Theory in Tangledd 1 1Haroon HamidNo ratings yet

- PLATODocument33 pagesPLATOAsim NowrizNo ratings yet

- Emilio Aguinaldomgagunita NG HimagsikanDocument8 pagesEmilio Aguinaldomgagunita NG HimagsikanKent LasicNo ratings yet

- Paper 3Document3 pagesPaper 3Ofelia SierraNo ratings yet

- Acer V5-131 - v5-171 LS-8941PR10 - 20120411Document2 pagesAcer V5-131 - v5-171 LS-8941PR10 - 20120411vi aNo ratings yet

- Daily Diary - Ojt - 62 - ProbationersDocument98 pagesDaily Diary - Ojt - 62 - Probationersmsnethrapal100% (1)

- Medical & Dental Practitioners ActDocument40 pagesMedical & Dental Practitioners ActMijja Coll BulamuNo ratings yet

- Guidelines of An Effective Interview and Ethico-Legal ConsiderationsDocument37 pagesGuidelines of An Effective Interview and Ethico-Legal ConsiderationsSherinne Jane CariazoNo ratings yet

- Lecture 4 - The First Five-Year Plan and The Cultural RevolutionDocument31 pagesLecture 4 - The First Five-Year Plan and The Cultural Revolutionestevesuarez3No ratings yet

- CEP Study - Violent Right-Wing Extremism and Terrorism - Nov 2020Document158 pagesCEP Study - Violent Right-Wing Extremism and Terrorism - Nov 2020Jean Yves CamusNo ratings yet

- Moot Court CompetitionDocument5 pagesMoot Court CompetitionVikki AmorioNo ratings yet

- Tiomico Vs CA - GR No. 122539-March 4, 1999Document2 pagesTiomico Vs CA - GR No. 122539-March 4, 1999Thoughts and More ThoughtsNo ratings yet

- The Oriental Insurance Company Limited: Particulars of Insured VehicleDocument3 pagesThe Oriental Insurance Company Limited: Particulars of Insured VehiclehancyboxNo ratings yet

- Chapter 2: Tax Laws and Tax AdminstrationDocument7 pagesChapter 2: Tax Laws and Tax AdminstrationRover Ross100% (1)

- CONTRACT - CuerpoAylan MSIDocument9 pagesCONTRACT - CuerpoAylan MSIAli KayaNo ratings yet