Professional Documents

Culture Documents

Taxation,Income Tax

Taxation,Income Tax

Uploaded by

abdurrahmanhridoy2019Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxation,Income Tax

Taxation,Income Tax

Uploaded by

abdurrahmanhridoy2019Copyright:

Available Formats

Income Tax

The tax imposed on a person or entity under the orbit of Income Tax Law is called income tax.

Characteristics:

It is a Direct tax

It is Charged on total income of a person

It is Charged on the income of the income year at the rate applicable in assessment year

It is payable in the year following the income year

It is generally charged on revenue income of a person

It is a tax charged on a person for income that comes within the preview of relevant Income Tax Law

The rate of income tax is determined by the government .

Constituents of Income Tax Ordinance in Bangladesh:

Income Tax Ordinance (xxxvI).1984

Income Tax Rules

Finance Act

Rules framed by NBR, Bangladesh

Orders ,notes, instructions , circulars

Income Tax Case Laws

Income Tax

Arguments in favor of income tax:

Justice can be maintained

Redistribution of income

Low cost of administration

Real budget estimation

Instrument of fiscal policy

Increase political consciousness

Arguments in against of income tax:

Difficult to define income

Ambiguous tax provision

Allegation about harassment

Hostile

Not compatible

Rise to arbitrary decision

Discourage savings, Investment and production

Income Tax

Role of income tax in the economic development of Bangladesh:

Tax holiday scheme

Tax holiday for tourist industry

Depreciation allowance

Investment allowance

Tax concession for small and cottage industry

Tax incentive for encouraging savings

Tax incentive for foreign investment

Allowance for scientific research

Tax incentives for remittance to Bangladesh

Income and its classification

Income:

Income as per sec. 2(34) of income tax ordinance ,1984 includes the following-

Any income ,receipt, profits or gains from whatever sources is derived which are chargeable to tax

Any amount which is subject to collection or deduction at source

Any loss of such income ,profits or gains

The profits and gains of any business of insurance carried on by a mutual insurance association

Any sum deemed to be income accruing or arising or received or deemed accrue or arise or received in

BD

Any amount on which tax is imposed

Any amount which is treated as income under the provision of this ordinance

Income means what comes in the hand of a person in terms of money or money’s worth as a result of

mental, physical and financial efforts during a period ,which has usual characteristics of income

and is within the preview of relevant income tax law.

Income and its classification

Characteristics :

1.Periodic return

2. Received from third party

3. Definite source

4. Revenue receipt

5. Tainted with illegality

6. Money or money form

7. Received or accrued

Income and its classification

Classification :

A. Non-assessable income

• Income from charitable and religious institution

• Voluntary contribution

• Income from local authority

• Income from provident fund or worker participation fund

• Special allowance

• Income received by the trustee

• Income of employees of foreign mission

• Pension, dividend , gratuity

B. Assessable income

• Tax free income

a)income from partnership firm

b)income from association

• Tax credit income

• Tax payable income

Income and its classification

Distinguish between capital receipt and revenue receipt:

Why we should distinguish them?

1.Sources of receipt

2. Isolated transaction

3.Nature of receipt

4. Surrender of rights

Distinguish between capital expenditure and revenue expenditure

1.Fixed and circulating capital

2. Purpose of expenditure

3.Nature of liability discharged

4. Nature of expenditure

On investment allowance /tax credit income , rebate will be allowed On:

LOWER OF

Actual investment

Or

1.5 crore

Or

25% of (total income-employers contribution to RPF)

Allowable rate:

1. Total income within 10 lakh @ 15% of allowable investment

2. Total income within (10-30)lakh

15% on 1st 2.5lakh, 12 % on rest

3. Total income above 30 lakh

15% on 1st 2.5lakh, 12 % on next 5lskh, 10% on balance

You might also like

- Chapter 3 Concept of IncomeDocument6 pagesChapter 3 Concept of IncomeChesca Marie Arenal Peñaranda100% (1)

- Notes On Income TaxationDocument21 pagesNotes On Income TaxationBen Dela Cruz100% (2)

- DOT of Kansas (KDOT) - Bridge Design Manual (2014) PDFDocument1,240 pagesDOT of Kansas (KDOT) - Bridge Design Manual (2014) PDFJohnNo ratings yet

- MidTerm Lesson Part 1Document34 pagesMidTerm Lesson Part 1ARMAN WAYNE ANGELESNo ratings yet

- Income Tax - Individuals FULL PPT.2Document82 pagesIncome Tax - Individuals FULL PPT.2Pauline89% (9)

- Income and Tax AuthorityDocument21 pagesIncome and Tax AuthorityRatul HaqueNo ratings yet

- 3 Income Tax ConceptsDocument37 pages3 Income Tax ConceptsRommel Espinocilla Jr.No ratings yet

- Income Tax - 4 NewDocument42 pagesIncome Tax - 4 Newrehan87100% (2)

- Taxation ReviewerDocument19 pagesTaxation ReviewerjwualferosNo ratings yet

- Income Taxation Mamalateo NotesDocument19 pagesIncome Taxation Mamalateo Notesclandestine2684100% (1)

- Unit 3 - Concepts of Income & Income TaxationDocument10 pagesUnit 3 - Concepts of Income & Income TaxationJoseph Anthony RomeroNo ratings yet

- Income Tax and GstDocument27 pagesIncome Tax and Gstabhisheknechi383No ratings yet

- Taxation Review: Module Ii - Income TaxDocument51 pagesTaxation Review: Module Ii - Income TaxCanapi AmerahNo ratings yet

- E Filing Income Tax Return OnlineDocument53 pagesE Filing Income Tax Return OnlineMd MisbahNo ratings yet

- Chapter 2Document38 pagesChapter 2Alyssa Camille DiñoNo ratings yet

- Tax AssignmentDocument14 pagesTax Assignmentrushi sreedhar100% (1)

- Lecture-3 Income Classsification and Residential StatusDocument25 pagesLecture-3 Income Classsification and Residential Statusimdadul haqueNo ratings yet

- Total IncomeDocument3 pagesTotal IncomeFaisal AhmedNo ratings yet

- IrsDocument64 pagesIrsYogesh KumarNo ratings yet

- Taxation NotesDocument17 pagesTaxation NotesHinata UmazakiNo ratings yet

- Tax CLASS NOTESDocument17 pagesTax CLASS NOTESAks SinhaNo ratings yet

- BIR How To Compute Fringe Benefit Tax REL PARTYDocument69 pagesBIR How To Compute Fringe Benefit Tax REL PARTYRyoNo ratings yet

- EC1B1 - Intro TaxationDocument38 pagesEC1B1 - Intro TaxationZen Marcus RodasNo ratings yet

- B - Individual Taxation: PhilippinesDocument4 pagesB - Individual Taxation: PhilippinesJasper Allen B. Barrientos100% (1)

- Summary of Income TaxDocument11 pagesSummary of Income TaxPriyanka KhadkaNo ratings yet

- Collection OF Income Tax in Pakistan: TO: Sir Rizwan Ul HassanDocument21 pagesCollection OF Income Tax in Pakistan: TO: Sir Rizwan Ul HassanAsif AliNo ratings yet

- I. Basic Concepts in Income TaxationDocument79 pagesI. Basic Concepts in Income Taxationcmv mendoza100% (1)

- Lesson Income TaxDocument8 pagesLesson Income TaxEfren Lester ReyesNo ratings yet

- Income Tax Matatag NotesDocument21 pagesIncome Tax Matatag NotesRicel CriziaNo ratings yet

- Taxation Interest Income and Its Effect On SavingsDocument25 pagesTaxation Interest Income and Its Effect On SavingsTimothy AngeloNo ratings yet

- Part IV 2 Exclusion and Inclusion Regular Income TaxationDocument11 pagesPart IV 2 Exclusion and Inclusion Regular Income Taxationmary jhoyNo ratings yet

- Worksheet 5 q2 TaxationDocument15 pagesWorksheet 5 q2 TaxationAllan TaripeNo ratings yet

- CE22 - 14 - After Tax Economic AnalysisDocument50 pagesCE22 - 14 - After Tax Economic AnalysisNina MabantaNo ratings yet

- Fisher v. Trinidad (43 Phil 973) : Stock: Income TaxationDocument48 pagesFisher v. Trinidad (43 Phil 973) : Stock: Income TaxationCassey Koi Farm0% (1)

- Basic Concept of Income TaxDocument4 pagesBasic Concept of Income TaxNaurah Atika DinaNo ratings yet

- Income TaxationDocument3 pagesIncome TaxationFelix C. JAGOLINO IIINo ratings yet

- Tax 101Document5 pagesTax 101Seanmigue TomaroyNo ratings yet

- Report in Taxation Group 3Document25 pagesReport in Taxation Group 3Patricia BacatanoNo ratings yet

- Lecture 1 - Introduction To Income TaxDocument27 pagesLecture 1 - Introduction To Income TaxMimi kupiNo ratings yet

- Gross Income and ExclusionsDocument37 pagesGross Income and ExclusionsMo ZhuNo ratings yet

- Income Tax 1. Definition, Nature, and General Principles A. Criteria in Imposing Philippine Income TaxDocument36 pagesIncome Tax 1. Definition, Nature, and General Principles A. Criteria in Imposing Philippine Income TaxPascua PeejayNo ratings yet

- Income Tax NotesDocument17 pagesIncome Tax Notesrushdarais7No ratings yet

- L.B and TaxationDocument18 pagesL.B and TaxationHasnain RazaNo ratings yet

- Introduction To Income Tax Integ REVISED 2022 1Document14 pagesIntroduction To Income Tax Integ REVISED 2022 1brr brrNo ratings yet

- Income and Situs of TaxationDocument55 pagesIncome and Situs of TaxationipbsalanguitNo ratings yet

- Income Tax Law & Practice-Lesson - 1 To 12Document250 pagesIncome Tax Law & Practice-Lesson - 1 To 12Space ResearchNo ratings yet

- Income TaxationDocument31 pagesIncome Taxationbenjamintee86% (7)

- Philippine Income Taxation - IncomeDocument48 pagesPhilippine Income Taxation - IncomeJenny Malabrigo, MBANo ratings yet

- BIR-How To Compute Fringe Benefit Tax, REL PARTYDocument69 pagesBIR-How To Compute Fringe Benefit Tax, REL PARTYLeandrix Billena Remorin Jr75% (4)

- Income Tax (1) - FinalDocument50 pagesIncome Tax (1) - FinalMay Encarnina P. Gaoiran100% (5)

- Taxation 2 NIRCDocument84 pagesTaxation 2 NIRCEric GarciaNo ratings yet

- Income TaxationDocument32 pagesIncome Taxationblackphoenix303No ratings yet

- UP 2008 Taxation Law (Taxation 1)Document63 pagesUP 2008 Taxation Law (Taxation 1)Gol LumNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- CPAR Lesson1 Three Major TraditionsDocument28 pagesCPAR Lesson1 Three Major TraditionsShyra Mae PonceNo ratings yet

- Kip, The Race Car DriverDocument10 pagesKip, The Race Car DriverThom DTNo ratings yet

- What Is Time Complexity?: Produce There Required OutputDocument4 pagesWhat Is Time Complexity?: Produce There Required OutputrohitNo ratings yet

- Do's & Don'Ts For TurbochargersDocument7 pagesDo's & Don'Ts For Turbochargersvikrant GarudNo ratings yet

- Mass SongsDocument20 pagesMass SongsJason LayaNo ratings yet

- English Morphology: by Drs. I Wayan Suarnajaya, M.A., PH.DDocument33 pagesEnglish Morphology: by Drs. I Wayan Suarnajaya, M.A., PH.DDewa'd KrishnaDanaNo ratings yet

- TechRef StationControllerDocument28 pagesTechRef StationControllerАлишер ГалиевNo ratings yet

- OurMoravianTreasures 2019finalDocument192 pagesOurMoravianTreasures 2019finalJosé CotesNo ratings yet

- Briefcase On Company Law Briefcase Series Michael Ottley Z LibraryDocument181 pagesBriefcase On Company Law Briefcase Series Michael Ottley Z Libraryhillaryambrose030No ratings yet

- Eng1 Q3 Mod20 Asking-Permission V4Document21 pagesEng1 Q3 Mod20 Asking-Permission V4Silverangel Gayo100% (1)

- A Quantitative Approach To Problem Solving 1Document80 pagesA Quantitative Approach To Problem Solving 1Isha AggarwalNo ratings yet

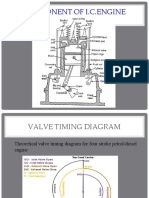

- Valve Timing DiagramDocument43 pagesValve Timing Diagramѕυdeѕн ĸNo ratings yet

- Maap 011232-1021700 2Document16 pagesMaap 011232-1021700 2Fehmi YOUSFINo ratings yet

- Com - Pg.game6327838 LogcatDocument53 pagesCom - Pg.game6327838 Logcatfordcannabis07No ratings yet

- Investigate The Impact of Social Media On Students: Cardiff Metropolitan UniversityDocument57 pagesInvestigate The Impact of Social Media On Students: Cardiff Metropolitan UniversityKarlo JayNo ratings yet

- Chemistry Form 5 Chapter 1Document20 pagesChemistry Form 5 Chapter 1Suriati Bt A Rashid90% (10)

- Track DHL Express Shipments: Result SummaryDocument2 pagesTrack DHL Express Shipments: Result SummaryJorge Adolfo Barajas VegaNo ratings yet

- Midwifery: Kelly Ackerson, PHD, RN, WHNP-BC, Ruth Zielinski, PHD, CNM, FacnmDocument26 pagesMidwifery: Kelly Ackerson, PHD, RN, WHNP-BC, Ruth Zielinski, PHD, CNM, FacnmMILANo ratings yet

- Chapter OneDocument5 pagesChapter OneJosam Montero FordNo ratings yet

- Kono Subarashii Sekai Ni Shukufuku Wo! Volume 2 PDFDocument198 pagesKono Subarashii Sekai Ni Shukufuku Wo! Volume 2 PDFRokhi NNo ratings yet

- The Plant Journal - 2023 - Selma Garc A - Engineering The Plant Metabolic System by Exploiting Metabolic RegulationDocument28 pagesThe Plant Journal - 2023 - Selma Garc A - Engineering The Plant Metabolic System by Exploiting Metabolic RegulationRodrigo ParolaNo ratings yet

- Eastern Grey Kangaroo AnatomyDocument3 pagesEastern Grey Kangaroo AnatomyKayla FreilichNo ratings yet

- Problem 1Document8 pagesProblem 1KyleRhayneDiazCaliwagNo ratings yet

- Today1 AchievementTestUnits3 4extensionDocument2 pagesToday1 AchievementTestUnits3 4extensionEmii GarcíaNo ratings yet

- CarbonCure Whitepaper Impact of CO2 Utilization in Fresh Concrete On Corrosion of Steel ReinforcementDocument6 pagesCarbonCure Whitepaper Impact of CO2 Utilization in Fresh Concrete On Corrosion of Steel ReinforcementSakineNo ratings yet

- KFC Case StudyDocument7 pagesKFC Case StudyOfficial WorkNo ratings yet

- Homework Font DownloadDocument5 pagesHomework Font Downloader9rz5b2100% (1)

- 1-Sentence-Summary: The Unexpected Joy of Being Sober Will Help You Have ADocument4 pages1-Sentence-Summary: The Unexpected Joy of Being Sober Will Help You Have ASainolzii GanboldNo ratings yet

- Perancangan Sistem OperasiDocument48 pagesPerancangan Sistem OperasiZulfikar YahyaNo ratings yet