Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

2 viewsChapter_05

Chapter_05

Uploaded by

Prithvi SoniLoma280 chapter 5

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You might also like

- Insurance Commission Exam ReviewerDocument5 pagesInsurance Commission Exam ReviewerApolinar Alvarez Jr.98% (40)

- LLQP Exam Prep Study NotesDocument361 pagesLLQP Exam Prep Study NotesMikaila Burnett100% (1)

- Lean Six Sigma ProjectDocument7 pagesLean Six Sigma ProjectOlumide Ambali100% (4)

- LLQP - Pre-Study Life InsuranceDocument88 pagesLLQP - Pre-Study Life Insurancetikeng olga carelle100% (1)

- INSURANCEDocument28 pagesINSURANCEcharuNo ratings yet

- Banking and InsuranceDocument20 pagesBanking and Insurancebeena antuNo ratings yet

- Insurance Law-ContributionDocument5 pagesInsurance Law-ContributionDavid FongNo ratings yet

- Life Insurance Products & Terms PDFDocument16 pagesLife Insurance Products & Terms PDFSuman SinhaNo ratings yet

- Chapter_06Document21 pagesChapter_06Prithvi SoniNo ratings yet

- CHAP5Life HealthDocument10 pagesCHAP5Life HealthEbsa AdemeNo ratings yet

- 280QR Lesson 06Document25 pages280QR Lesson 06prateek_3212No ratings yet

- Risk CH 5 PDFDocument14 pagesRisk CH 5 PDFWonde BiruNo ratings yet

- Chapter Five Life and Health InsuranceDocument10 pagesChapter Five Life and Health InsuranceHayelom Tadesse GebreNo ratings yet

- Term Life InsuranceDocument3 pagesTerm Life InsuranceAbhishek TendulkarNo ratings yet

- Unit 5 Life and Health InsuranceDocument19 pagesUnit 5 Life and Health InsuranceMahlet Abraha100% (1)

- Introduction To Insurance IndustriesDocument37 pagesIntroduction To Insurance IndustriesNishaTambeNo ratings yet

- Personal Finance-Types of Life InsuranceDocument12 pagesPersonal Finance-Types of Life InsurancePriyaNo ratings yet

- Insurance ServiceDocument31 pagesInsurance Servicepjsv12345No ratings yet

- Chap 5Document18 pagesChap 5yhikmet613No ratings yet

- Life InsuranceDocument13 pagesLife Insurancesmiley12345678910No ratings yet

- Principles of Insurance - NotesDocument4 pagesPrinciples of Insurance - NotesTarang SuriNo ratings yet

- 8 (22) (Read-Only)Document54 pages8 (22) (Read-Only)Kookie ShresthaNo ratings yet

- Unit 3 Life Insurance Products: ObjectivesDocument24 pagesUnit 3 Life Insurance Products: ObjectivesPriya ShindeNo ratings yet

- Chapter 06 RMIDocument19 pagesChapter 06 RMISudipta BaruaNo ratings yet

- Origin of The Company: Meaning and Definition Nature and Scope Importance of Insurance Objectives of The StudyDocument32 pagesOrigin of The Company: Meaning and Definition Nature and Scope Importance of Insurance Objectives of The Studypav_deshpande8055No ratings yet

- Meaning of Life Insurance and It Types of PoliciesDocument2 pagesMeaning of Life Insurance and It Types of Policiesshakti ranjan mohanty100% (1)

- Life Insurance Products - I: Chapter IntroductionDocument7 pagesLife Insurance Products - I: Chapter IntroductionMaulik PanchmatiaNo ratings yet

- Life Insurance ProductsDocument7 pagesLife Insurance ProductsalaguNo ratings yet

- Insurance Promotion - IIDocument12 pagesInsurance Promotion - IIAditi JainNo ratings yet

- Ch-5 Edited EndDocument40 pagesCh-5 Edited EndAbatneh mengistNo ratings yet

- RISK Chapter 5Document19 pagesRISK Chapter 5Taresa AdugnaNo ratings yet

- Life Assurance 225 KDocument18 pagesLife Assurance 225 KRiajul islamNo ratings yet

- Q - 13 Insurance PolicyDocument26 pagesQ - 13 Insurance PolicyMAHENDRA SHIVAJI DHENAKNo ratings yet

- Life InsuranceDocument36 pagesLife InsuranceDinesh Godhani0% (1)

- Poi New 1Document6 pagesPoi New 1Anil Bhard WajNo ratings yet

- Critical Years in The Programming of Life Insurance MeansDocument8 pagesCritical Years in The Programming of Life Insurance MeansRomz Ninz HernandezNo ratings yet

- Life InsuranceDocument10 pagesLife InsuranceRitika SharmaNo ratings yet

- Chapter 5Document33 pagesChapter 5Yebegashet AlemayehuNo ratings yet

- Term Life Insurance FinalDocument10 pagesTerm Life Insurance FinalsearchingnobodyNo ratings yet

- Chapter FiveDocument27 pagesChapter FiveMeklit TenaNo ratings yet

- Insurance: Institute of Productivity & ManagementDocument39 pagesInsurance: Institute of Productivity & ManagementishanchughNo ratings yet

- Task 4Document6 pagesTask 4sahilNo ratings yet

- Chapter Five: Life and Health InsuranceDocument36 pagesChapter Five: Life and Health InsuranceMewded DelelegnNo ratings yet

- #14 Aesthetic MintDocument37 pages#14 Aesthetic MintPahilangco, ErikaNo ratings yet

- Handbook On Life InsuranceDocument17 pagesHandbook On Life InsuranceDeeptiNo ratings yet

- Risk Chap 5 Edited Final 1(2)Document44 pagesRisk Chap 5 Edited Final 1(2)brukzelalemNo ratings yet

- Rashdullah Shah 133Document14 pagesRashdullah Shah 133Rashdullah Shah 133No ratings yet

- Insurance TutorialDocument11 pagesInsurance TutorialSadhvi SinghNo ratings yet

- Icici PrudentialDocument33 pagesIcici PrudentialDiksha KukrejaNo ratings yet

- Types of Life InsuranceDocument5 pagesTypes of Life InsuranceFatema KhambatiNo ratings yet

- Chapter 9 10Document9 pagesChapter 9 10alessiamenNo ratings yet

- Chapter_07Document23 pagesChapter_07Prithvi SoniNo ratings yet

- Chapter 2 InsuranceDocument31 pagesChapter 2 InsurancegirishNo ratings yet

- How Life Insurance Differ From OtherDocument2 pagesHow Life Insurance Differ From OtherishwarNo ratings yet

- A Interim Report 1Document28 pagesA Interim Report 1Mayank MahajanNo ratings yet

- Types of Life Insurance PoliciesDocument6 pagesTypes of Life Insurance PoliciesrahulNo ratings yet

- IDBI Federal Lifesurance Savings Insurance PlanDocument16 pagesIDBI Federal Lifesurance Savings Insurance PlanKumarniksNo ratings yet

- Insurance Glossary: AccidentDocument7 pagesInsurance Glossary: AccidentVipul DesaiNo ratings yet

- Life Insurance Kotak Mahindra Group Old MutualDocument16 pagesLife Insurance Kotak Mahindra Group Old MutualKanchan khedaskerNo ratings yet

- Risk Managemennt Chapter 6 - AAU 2020Document12 pagesRisk Managemennt Chapter 6 - AAU 2020Gregg AaronNo ratings yet

- Whole Life InsuranceDocument14 pagesWhole Life InsuranceSushma DudyallaNo ratings yet

- The Basics of Life Insurance: The Answer to What Life Insurance is and How It Works: Personal Finance, #1From EverandThe Basics of Life Insurance: The Answer to What Life Insurance is and How It Works: Personal Finance, #1No ratings yet

- Chapter_01Document25 pagesChapter_01Prithvi SoniNo ratings yet

- Chapter_04Document13 pagesChapter_04Prithvi SoniNo ratings yet

- Chapter_02Document15 pagesChapter_02Prithvi SoniNo ratings yet

- Chapter_03Document16 pagesChapter_03Prithvi SoniNo ratings yet

- A Study On Bancassurance at State Bank of India, AgraDocument108 pagesA Study On Bancassurance at State Bank of India, AgrasuryakantshrotriyaNo ratings yet

- Sapm MCQ Chapter WiseDocument16 pagesSapm MCQ Chapter WiseDR. BHAVIN PATELNo ratings yet

- The REIT Stuff: Investment ViewsDocument9 pagesThe REIT Stuff: Investment ViewsJerry ThngNo ratings yet

- General Principles of Credit RiskDocument20 pagesGeneral Principles of Credit Riskmentor_muhaxheriNo ratings yet

- Contributor: Atty. Mendoza, B. Date Contributed: March 2011Document8 pagesContributor: Atty. Mendoza, B. Date Contributed: March 2011Darynn LinggonNo ratings yet

- Annapolis Credit Management Services Inc.: Slide 1Document9 pagesAnnapolis Credit Management Services Inc.: Slide 1mariaNo ratings yet

- R.K. Dalmia vs. Delhi Administration PDFDocument64 pagesR.K. Dalmia vs. Delhi Administration PDFSandeep Kumar VermaNo ratings yet

- Casent Realty Vs Philbanking CorpDocument53 pagesCasent Realty Vs Philbanking CorpAthena AthenaNo ratings yet

- Reliance General Insurance Company Limited: Reliance Two Wheeler Package Policy - ScheduleDocument6 pagesReliance General Insurance Company Limited: Reliance Two Wheeler Package Policy - SchedulezuneriyaNo ratings yet

- COMMERCIAL LAW-creditDocument16 pagesCOMMERCIAL LAW-creditrahhar001No ratings yet

- PRB CVP Deck Nov 2013Document23 pagesPRB CVP Deck Nov 2013OdnooMgmrNo ratings yet

- 04 Understanding Business Cycles-1Document14 pages04 Understanding Business Cycles-1ajay sahuNo ratings yet

- Loan SchemesDocument48 pagesLoan SchemesbalwinderNo ratings yet

- LIaR Module 8 Q and ADocument5 pagesLIaR Module 8 Q and AJeff JonesNo ratings yet

- Legal Forms Case DigestsDocument99 pagesLegal Forms Case DigestsGerard BaltazarNo ratings yet

- Jamia Millia Islamia: Faculty of LawDocument11 pagesJamia Millia Islamia: Faculty of LawShivam KumarNo ratings yet

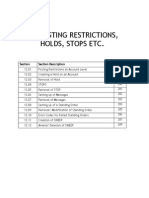

- 01.12 Posting RestrictionsDocument14 pages01.12 Posting Restrictionsmevrick_guyNo ratings yet

- Research Report - TP KatabuaDocument78 pagesResearch Report - TP KatabuaEshan KapoorNo ratings yet

- 1.1 Concept of BankingDocument12 pages1.1 Concept of BankingsidharthNo ratings yet

- Organisational Behavior On SBM BANKDocument101 pagesOrganisational Behavior On SBM BANKkeshav_26No ratings yet

- 2018 Greenville Parade of Homes GDRSS-042518Document32 pages2018 Greenville Parade of Homes GDRSS-042518Adams Publishing Group Eastern North CarolinaNo ratings yet

- 2020LHC456 - Sec15 Finance PDFDocument103 pages2020LHC456 - Sec15 Finance PDFHamza SiddiquiNo ratings yet

- UCT2 (Completed)Document8 pagesUCT2 (Completed)Justin Michael EdelsteinNo ratings yet

- Discharge of Contract PG 12-22Document11 pagesDischarge of Contract PG 12-22Sumit KumarNo ratings yet

- Naguiat Vs CADocument4 pagesNaguiat Vs CASinetch EteyNo ratings yet

- Credit Scoring Application at Banks - Mapping To Basel IIDocument9 pagesCredit Scoring Application at Banks - Mapping To Basel IIeduardohfariasNo ratings yet

- Insurance ReviewerDocument43 pagesInsurance ReviewerquericzNo ratings yet

- Summer Intership Project Bajaj FinservDocument51 pagesSummer Intership Project Bajaj FinservAMBIYA JAGIRDAR50% (2)

Chapter_05

Chapter_05

Uploaded by

Prithvi Soni0 ratings0% found this document useful (0 votes)

2 views25 pagesLoma280 chapter 5

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentLoma280 chapter 5

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

0 ratings0% found this document useful (0 votes)

2 views25 pagesChapter_05

Chapter_05

Uploaded by

Prithvi SoniLoma280 chapter 5

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

You are on page 1of 25

Chapter 5

LOMA 280

Principles

of

Insurance

CHAPTER 5

Term Life Insurance

Press “Esc” to return to main menu CHAPTER FIVE 1

Chapter 5

Needs Met by Life Insurance

Personal Needs

Some of the typical personal needs that life insurance

can meet are

Dependents’

support

Estate planning

Debts and final

expenses

Press “Esc” to return to main menu CHAPTER FIVE 2

Chapter 5

Needs Met by Life Insurance

Business Needs

Life insurance can meet two main business needs:

Business continuation needs

A life insurance policy can provide funds to ensure

that a business continues in the event of the death

of an owner, partner, or other key person.

Employee benefit needs

A business can purchase life insurance to provide

benefits for its employees.

Press “Esc” to return to main menu CHAPTER FIVE 3

Chapter 5

Characteristics of Term Life

Insurance Products

The length of the policy term varies considerably

from policy to policy, and can be shown as either

A specified number of years

For example, a policy may specify a term of

1 year, 5 years, 10 years, or 20 years (generally

speaking, insurers seldom sell term life insurance

to cover periods of less than 1 year).

A specified age the insured has reached

For example, a term insurance policy may cover an

insured until age 65 (referred to as term to age 65).

Press “Esc” to return to main menu CHAPTER FIVE 4

Chapter 5

Plans of Term Life

Insurance Coverage

By far, the most common plan of term insurance is level

term life insurance, which provides a policy benefit

that remains the same over the term of the policy.

Example: Under a 5-year level term policy that provides

$100,000 of coverage, the insurer agrees to pay

$100,000 if the insured dies at any time during the 5-

year period that the policy is in force.

The amount of each renewal premium payable for a

level term life insurance policy usually remains the

same throughout the stated term of coverage.

Press “Esc” to return to main menu CHAPTER FIVE 5

Chapter 5

Plans of Term Life

Insurance Coverage

Decreasing term life insurance provides a policy benefit that

decreases in amount over the term of coverage. The policy

benefit begins as a set face amount and then decreases over the

policy term according to a stated method in the policy.

Example: Under a 5-year decreasing term policy that provides a

1st year benefit of $50,000 and decreases by $10,000 on each

policy anniversary, the insurer agrees to pay, while the policy is in

force:

$50,000 if the insured dies during the 1st policy year

$40,000 if the insured dies during the 2nd policy year

$30,000 if the insured dies during the 3rd policy year

$20,000 if the insured dies during the 4th policy year

$10,000 if the insured dies during the 5th policy year

Coverage ends at the end of the 5th policy year.

Press “Esc” to return to main menu CHAPTER FIVE 6

Chapter 5

Plans of Term Life

Insurance Coverage

The amount of each renewal premium payable for a

decreasing term life insurance policy usually remains

level throughout the policy term.

Insurers offer several plans of decreasing term

insurance, including

Mortgage

insurance

Credit life

insurance

Family income

insurance

Press “Esc” to return to main menu CHAPTER FIVE 7

Chapter 5

Plans of Term Life

Insurance Coverage

mortgage insurance: a plan of decreasing term insurance

designed to provide a benefit amount that corresponds to

the decreasing amount owed on a mortgage loan

The term of a mortgage policy is based on the length of

the mortgage, usually 15 or 30 years.

Renewal premiums are generally level throughout the

term.

In most instances, the life insurance policy is

independent of the mortgage—the institution granting the

mortgage is not a party to the insurance contract.

The beneficiary is not required to use the proceeds of the

policy to repay the mortgage.

Press “Esc” to return to main menu CHAPTER FIVE 8

Chapter 5

Plans of Term Life

Insurance Coverage

joint mortgage insurance: a variation of mortgage

insurance which provides the same benefit as a

mortgage insurance policy except the joint policy

insures the lives of two people

If both insureds survive until the end of the stated

term, the joint mortgage policy expires.

If one of the insureds dies while the policy is in

force, the insurer pays the policy benefit to the

beneficiary (typically the surviving insured).

Press “Esc” to return to main menu CHAPTER FIVE 9

Chapter 5

Plans of Term Life

Insurance Coverage

credit life insurance: a type of term life insurance

designed to pay the balance due on a loan if the

borrower dies before the loan is repaid

Unlike mortgage insurance policies, credit life

insurance policies always provide that the policy

benefit is payable directly to the lender, or

creditor, if the insured borrower dies during the

policy’s term.

Although credit life insurance is available on an

individual basis, most credit life insurance is sold

to lending institutions as group insurance to cover

the lives of the borrowers of that lender.

Press “Esc” to return to main menu CHAPTER FIVE 10

Chapter 5

Plans of Term Life

Insurance Coverage

The amount of credit life insurance benefit payable is

usually equal to the amount of the unpaid debt; as the

amount of the loan decreases, the face amount of the

coverage decreases.

Credit life insurance premiums may be level over the

duration of the loan or, in cases in which the amount of the

loan varies, may increase or decrease as the amount of the

outstanding loan balance—and the corresponding policy

benefit—increases or decreases.

Premiums for credit life insurance may be paid to the

insurance company by the lender or by the insured

borrower; in most cases, the borrower pays the premium to

the lender, which then remits the premium to the insurer.

Press “Esc” to return to main menu CHAPTER FIVE 11

Chapter 5

Plans of Term Life

Insurance Coverage

family income coverage: a plan of decreasing term life

insurance that provides a stated monthly income benefit

amount to the insured’s surviving spouse if the insured

dies during the term of coverage

The longer the insured remains alive during the term

of coverage, the smaller the total amount of benefits

the insurer will pay out.

Under some family income coverages, the insurer

promises to pay the income benefit amount for at

least a stated minimum number of years if the

insured dies during the policy’s term.

Press “Esc” to return to main menu CHAPTER FIVE 12

Chapter 5

Plans of Term Life

Insurance Coverage

Increasing Term Life Insurance provides a death benefit

that starts at one amount and increases by some specified

amount or percentage at stated intervals over the policy

term.

Example: Coverage starts at $100,000 and then increases

by 5 percent on each policy anniversary date throughout the

term of the policy.

The premium for increasing term insurance generally

increases as the amount of coverage increases.

The policyowner usually has the option of freezing at any

time the amount of coverage provided by the increasing

term insurance.

Press “Esc” to return to main menu CHAPTER FIVE 13

Chapter 5

Renewable Term and Convertible

Term Life Insurance

Term life insurance policies often contain features that allow

the policyowner to continue the life insurance coverage

beyond the end of the original term.

If the policy gives the If the policy gives the

policyowner the option to policyowner the right to

continue the policy’s convert the term policy to a

coverage for an additional cash value policy, then the

policy term, then the policy is policy is referred to as a

a called a renewable term convertible term insurance

insurance policy. policy.

Some policies, called renewable/convertible term insurance

policies, contain both of these features.

Press “Esc” to return to main menu CHAPTER FIVE 14

Chapter 5

Renewable Term and Convertible

Term Life Insurance

Renewable term life Evidence of insurability:

insurance policies include a proof that the insured

renewal provision that person continues to be an

gives the policyowner the insurable risk

right, within specified limits,

The insured is not

to renew the insurance

required to undergo a

coverage at the end of the

medical examination or to

specified term without

provide the insurer with an

submitting evidence of

updated health history.

insurability.

Often, all the policyowner

must do to renew the

policy is pay the renewal

premium.

Press “Esc” to return to main menu CHAPTER FIVE 15

Chapter 5

Renewable Term and Convertible

Term Life Insurance

Under most renewable term insurance policies, the policyowner

has the right to renew the coverage for the same term and face

amount originally provided by the policy.

Example: A 10-year, $100,000 renewable term policy usually

can be renewed for another 10-year period and for $100,000 in

coverage.

Most insurers allow the policyowner to renew the policy for a

smaller face amount and/or a shorter period than provided by

the original contract, but not for a larger face amount and/or a

longer period.

One-year term policies and riders are usually renewable, and

such coverage is called yearly renewable term (YRT)

insurance or annually renewable term (ART) insurance.

Press “Esc” to return to main menu CHAPTER FIVE 16

Chapter 5

Renewable Term and Convertible

Term Life Insurance

Often, the renewal provision places some limit on the

policyowner’s right to renew. The most common

limitations are:

The coverage may be The coverage may be

renewed only until the or renewed only a stated

insured attains a stated maximum number of

age times

Example: The renewal provision of a policy may specify

that the coverage is not renewable after the insured has

reached age 75. Another policy may specify that the

coverage is renewable no more than three times.

Press “Esc” to return to main menu CHAPTER FIVE 17

Chapter 5

Renewable Term and Convertible

Term Life Insurance

The renewal premium rate is based on the insured

person’s attained age—the age the insured has

reached (attained) on the renewal date.

As people age, mortality rates and the insured’s

mortality risk increase.

As people age, renewal premium rates also

increase.

The renewal premium rate remains level throughout

the new term of coverage.

Press “Esc” to return to main menu CHAPTER FIVE 18

Chapter 5

Renewable Term and Convertible

Term Life Insurance

The renewal feature can lead to antiselection.

Insureds in poor health are more likely to renew

their policies because they may not be able to

obtain other life insurance.

Because of this risk of antiselection, the premium

for a renewable term life insurance policy is usually

slightly higher than the premium for a comparable

nonrenewable term life insurance policy.

Press “Esc” to return to main menu CHAPTER FIVE 19

Chapter 5

Renewable Term and Convertible

Term Life Insurance

Convertible term insurance policies contain a conversion

privilege that allows the policyowner to change—convert—

the term insurance policy to a cash value policy without

providing evidence that the insured is an insurable risk.

Cash value coverage is available if the health of the person

insured by a convertible term policy has deteriorated to the

point that the person would otherwise be uninsurable.

The premium for the cash value policy cannot be based on

any increase in the insured’s mortality risk, except with

regard to an increase in the insured’s age.

Press “Esc” to return to main menu CHAPTER FIVE 20

Chapter 5

Renewable Term and Convertible

Term Life Insurance

As in the case of the renewal provision, the

conversion privilege can lead to antiselection.

Insureds in poor health are more likely to convert

their coverage because they may not be able to

obtain other life insurance.

Because of this risk of antiselection, the premium

for a convertible term life insurance policy is

usually higher than the premium for a comparable

nonconvertible term life insurance policy.

Press “Esc” to return to main menu CHAPTER FIVE 21

Chapter 5

Renewable Term and Convertible

Term Life Insurance

Conversion may not be permitted

After the insured attains a After the term policy has

stated age or been in force for a specified

time

Example: A 10-year term policy may not permit conversion after the

insured has attained age 65 or may only permit conversion during

the first 8 years of the term.

Conversion also may be limited to an amount that is only a

percentage of the original face amount.

Example: A 10-year term policy may permit conversion of 100

percent of the face amount within the first 5 years of the 10-year

term, and a smaller percentage, such as 50 percent, if the policy is

converted during the last 5 years of the 10-year term.

Press “Esc” to return to main menu CHAPTER FIVE 22

Chapter 5

Renewable Term and Convertible

Term Life Insurance

Premiums for a converted policy depend on the type of

conversion.

Under an attained age conversion, the renewal

premium rate is based on the insured’s age when the

coverage is converted.

Under an original age conversion, the effective date of

the cash value life insurance policy is considered to be

the date on which the policyowner purchased the original

term insurance policy; as a result, the premium rate for

the cash value policy is based on the insured's age at

the time the original term insurance policy was

purchased.

Press “Esc” to return to main menu CHAPTER FIVE 23

Chapter 5

Return of Premium Term Insurance

(ROP)

Return of Premium is a form of term life insurance

that provides a death benefit if the insured dies using

the policy term and promised a return of premiums if

insured does not die during the policy term

Press “Esc” to return to main menu CHAPTER FIVE 24

Chapter 5

End of Chapter 5

Press “Esc” to return to main menu CHAPTER FIVE 25

You might also like

- Insurance Commission Exam ReviewerDocument5 pagesInsurance Commission Exam ReviewerApolinar Alvarez Jr.98% (40)

- LLQP Exam Prep Study NotesDocument361 pagesLLQP Exam Prep Study NotesMikaila Burnett100% (1)

- Lean Six Sigma ProjectDocument7 pagesLean Six Sigma ProjectOlumide Ambali100% (4)

- LLQP - Pre-Study Life InsuranceDocument88 pagesLLQP - Pre-Study Life Insurancetikeng olga carelle100% (1)

- INSURANCEDocument28 pagesINSURANCEcharuNo ratings yet

- Banking and InsuranceDocument20 pagesBanking and Insurancebeena antuNo ratings yet

- Insurance Law-ContributionDocument5 pagesInsurance Law-ContributionDavid FongNo ratings yet

- Life Insurance Products & Terms PDFDocument16 pagesLife Insurance Products & Terms PDFSuman SinhaNo ratings yet

- Chapter_06Document21 pagesChapter_06Prithvi SoniNo ratings yet

- CHAP5Life HealthDocument10 pagesCHAP5Life HealthEbsa AdemeNo ratings yet

- 280QR Lesson 06Document25 pages280QR Lesson 06prateek_3212No ratings yet

- Risk CH 5 PDFDocument14 pagesRisk CH 5 PDFWonde BiruNo ratings yet

- Chapter Five Life and Health InsuranceDocument10 pagesChapter Five Life and Health InsuranceHayelom Tadesse GebreNo ratings yet

- Term Life InsuranceDocument3 pagesTerm Life InsuranceAbhishek TendulkarNo ratings yet

- Unit 5 Life and Health InsuranceDocument19 pagesUnit 5 Life and Health InsuranceMahlet Abraha100% (1)

- Introduction To Insurance IndustriesDocument37 pagesIntroduction To Insurance IndustriesNishaTambeNo ratings yet

- Personal Finance-Types of Life InsuranceDocument12 pagesPersonal Finance-Types of Life InsurancePriyaNo ratings yet

- Insurance ServiceDocument31 pagesInsurance Servicepjsv12345No ratings yet

- Chap 5Document18 pagesChap 5yhikmet613No ratings yet

- Life InsuranceDocument13 pagesLife Insurancesmiley12345678910No ratings yet

- Principles of Insurance - NotesDocument4 pagesPrinciples of Insurance - NotesTarang SuriNo ratings yet

- 8 (22) (Read-Only)Document54 pages8 (22) (Read-Only)Kookie ShresthaNo ratings yet

- Unit 3 Life Insurance Products: ObjectivesDocument24 pagesUnit 3 Life Insurance Products: ObjectivesPriya ShindeNo ratings yet

- Chapter 06 RMIDocument19 pagesChapter 06 RMISudipta BaruaNo ratings yet

- Origin of The Company: Meaning and Definition Nature and Scope Importance of Insurance Objectives of The StudyDocument32 pagesOrigin of The Company: Meaning and Definition Nature and Scope Importance of Insurance Objectives of The Studypav_deshpande8055No ratings yet

- Meaning of Life Insurance and It Types of PoliciesDocument2 pagesMeaning of Life Insurance and It Types of Policiesshakti ranjan mohanty100% (1)

- Life Insurance Products - I: Chapter IntroductionDocument7 pagesLife Insurance Products - I: Chapter IntroductionMaulik PanchmatiaNo ratings yet

- Life Insurance ProductsDocument7 pagesLife Insurance ProductsalaguNo ratings yet

- Insurance Promotion - IIDocument12 pagesInsurance Promotion - IIAditi JainNo ratings yet

- Ch-5 Edited EndDocument40 pagesCh-5 Edited EndAbatneh mengistNo ratings yet

- RISK Chapter 5Document19 pagesRISK Chapter 5Taresa AdugnaNo ratings yet

- Life Assurance 225 KDocument18 pagesLife Assurance 225 KRiajul islamNo ratings yet

- Q - 13 Insurance PolicyDocument26 pagesQ - 13 Insurance PolicyMAHENDRA SHIVAJI DHENAKNo ratings yet

- Life InsuranceDocument36 pagesLife InsuranceDinesh Godhani0% (1)

- Poi New 1Document6 pagesPoi New 1Anil Bhard WajNo ratings yet

- Critical Years in The Programming of Life Insurance MeansDocument8 pagesCritical Years in The Programming of Life Insurance MeansRomz Ninz HernandezNo ratings yet

- Life InsuranceDocument10 pagesLife InsuranceRitika SharmaNo ratings yet

- Chapter 5Document33 pagesChapter 5Yebegashet AlemayehuNo ratings yet

- Term Life Insurance FinalDocument10 pagesTerm Life Insurance FinalsearchingnobodyNo ratings yet

- Chapter FiveDocument27 pagesChapter FiveMeklit TenaNo ratings yet

- Insurance: Institute of Productivity & ManagementDocument39 pagesInsurance: Institute of Productivity & ManagementishanchughNo ratings yet

- Task 4Document6 pagesTask 4sahilNo ratings yet

- Chapter Five: Life and Health InsuranceDocument36 pagesChapter Five: Life and Health InsuranceMewded DelelegnNo ratings yet

- #14 Aesthetic MintDocument37 pages#14 Aesthetic MintPahilangco, ErikaNo ratings yet

- Handbook On Life InsuranceDocument17 pagesHandbook On Life InsuranceDeeptiNo ratings yet

- Risk Chap 5 Edited Final 1(2)Document44 pagesRisk Chap 5 Edited Final 1(2)brukzelalemNo ratings yet

- Rashdullah Shah 133Document14 pagesRashdullah Shah 133Rashdullah Shah 133No ratings yet

- Insurance TutorialDocument11 pagesInsurance TutorialSadhvi SinghNo ratings yet

- Icici PrudentialDocument33 pagesIcici PrudentialDiksha KukrejaNo ratings yet

- Types of Life InsuranceDocument5 pagesTypes of Life InsuranceFatema KhambatiNo ratings yet

- Chapter 9 10Document9 pagesChapter 9 10alessiamenNo ratings yet

- Chapter_07Document23 pagesChapter_07Prithvi SoniNo ratings yet

- Chapter 2 InsuranceDocument31 pagesChapter 2 InsurancegirishNo ratings yet

- How Life Insurance Differ From OtherDocument2 pagesHow Life Insurance Differ From OtherishwarNo ratings yet

- A Interim Report 1Document28 pagesA Interim Report 1Mayank MahajanNo ratings yet

- Types of Life Insurance PoliciesDocument6 pagesTypes of Life Insurance PoliciesrahulNo ratings yet

- IDBI Federal Lifesurance Savings Insurance PlanDocument16 pagesIDBI Federal Lifesurance Savings Insurance PlanKumarniksNo ratings yet

- Insurance Glossary: AccidentDocument7 pagesInsurance Glossary: AccidentVipul DesaiNo ratings yet

- Life Insurance Kotak Mahindra Group Old MutualDocument16 pagesLife Insurance Kotak Mahindra Group Old MutualKanchan khedaskerNo ratings yet

- Risk Managemennt Chapter 6 - AAU 2020Document12 pagesRisk Managemennt Chapter 6 - AAU 2020Gregg AaronNo ratings yet

- Whole Life InsuranceDocument14 pagesWhole Life InsuranceSushma DudyallaNo ratings yet

- The Basics of Life Insurance: The Answer to What Life Insurance is and How It Works: Personal Finance, #1From EverandThe Basics of Life Insurance: The Answer to What Life Insurance is and How It Works: Personal Finance, #1No ratings yet

- Chapter_01Document25 pagesChapter_01Prithvi SoniNo ratings yet

- Chapter_04Document13 pagesChapter_04Prithvi SoniNo ratings yet

- Chapter_02Document15 pagesChapter_02Prithvi SoniNo ratings yet

- Chapter_03Document16 pagesChapter_03Prithvi SoniNo ratings yet

- A Study On Bancassurance at State Bank of India, AgraDocument108 pagesA Study On Bancassurance at State Bank of India, AgrasuryakantshrotriyaNo ratings yet

- Sapm MCQ Chapter WiseDocument16 pagesSapm MCQ Chapter WiseDR. BHAVIN PATELNo ratings yet

- The REIT Stuff: Investment ViewsDocument9 pagesThe REIT Stuff: Investment ViewsJerry ThngNo ratings yet

- General Principles of Credit RiskDocument20 pagesGeneral Principles of Credit Riskmentor_muhaxheriNo ratings yet

- Contributor: Atty. Mendoza, B. Date Contributed: March 2011Document8 pagesContributor: Atty. Mendoza, B. Date Contributed: March 2011Darynn LinggonNo ratings yet

- Annapolis Credit Management Services Inc.: Slide 1Document9 pagesAnnapolis Credit Management Services Inc.: Slide 1mariaNo ratings yet

- R.K. Dalmia vs. Delhi Administration PDFDocument64 pagesR.K. Dalmia vs. Delhi Administration PDFSandeep Kumar VermaNo ratings yet

- Casent Realty Vs Philbanking CorpDocument53 pagesCasent Realty Vs Philbanking CorpAthena AthenaNo ratings yet

- Reliance General Insurance Company Limited: Reliance Two Wheeler Package Policy - ScheduleDocument6 pagesReliance General Insurance Company Limited: Reliance Two Wheeler Package Policy - SchedulezuneriyaNo ratings yet

- COMMERCIAL LAW-creditDocument16 pagesCOMMERCIAL LAW-creditrahhar001No ratings yet

- PRB CVP Deck Nov 2013Document23 pagesPRB CVP Deck Nov 2013OdnooMgmrNo ratings yet

- 04 Understanding Business Cycles-1Document14 pages04 Understanding Business Cycles-1ajay sahuNo ratings yet

- Loan SchemesDocument48 pagesLoan SchemesbalwinderNo ratings yet

- LIaR Module 8 Q and ADocument5 pagesLIaR Module 8 Q and AJeff JonesNo ratings yet

- Legal Forms Case DigestsDocument99 pagesLegal Forms Case DigestsGerard BaltazarNo ratings yet

- Jamia Millia Islamia: Faculty of LawDocument11 pagesJamia Millia Islamia: Faculty of LawShivam KumarNo ratings yet

- 01.12 Posting RestrictionsDocument14 pages01.12 Posting Restrictionsmevrick_guyNo ratings yet

- Research Report - TP KatabuaDocument78 pagesResearch Report - TP KatabuaEshan KapoorNo ratings yet

- 1.1 Concept of BankingDocument12 pages1.1 Concept of BankingsidharthNo ratings yet

- Organisational Behavior On SBM BANKDocument101 pagesOrganisational Behavior On SBM BANKkeshav_26No ratings yet

- 2018 Greenville Parade of Homes GDRSS-042518Document32 pages2018 Greenville Parade of Homes GDRSS-042518Adams Publishing Group Eastern North CarolinaNo ratings yet

- 2020LHC456 - Sec15 Finance PDFDocument103 pages2020LHC456 - Sec15 Finance PDFHamza SiddiquiNo ratings yet

- UCT2 (Completed)Document8 pagesUCT2 (Completed)Justin Michael EdelsteinNo ratings yet

- Discharge of Contract PG 12-22Document11 pagesDischarge of Contract PG 12-22Sumit KumarNo ratings yet

- Naguiat Vs CADocument4 pagesNaguiat Vs CASinetch EteyNo ratings yet

- Credit Scoring Application at Banks - Mapping To Basel IIDocument9 pagesCredit Scoring Application at Banks - Mapping To Basel IIeduardohfariasNo ratings yet

- Insurance ReviewerDocument43 pagesInsurance ReviewerquericzNo ratings yet

- Summer Intership Project Bajaj FinservDocument51 pagesSummer Intership Project Bajaj FinservAMBIYA JAGIRDAR50% (2)