Professional Documents

Culture Documents

Cash Flow Statement

Cash Flow Statement

Uploaded by

nishavimal14250 ratings0% found this document useful (0 votes)

1 views10 pagesCopyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

1 views10 pagesCash Flow Statement

Cash Flow Statement

Uploaded by

nishavimal1425Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 10

CASH FLOW STATEMENT

WHAT IS CASH AND CASH EQUIVALENTS?

CASH EQUIVALENTS ARE HIGHLY LIQUID, SHORT TERM INVESTMENTS HELD FOR THE

PURPOSE OF MEETING THE SHORT TERM CASH COMMITMENTS OF AN ENTERPRISE.

INVESTMENTS ARE CATEGORIZED AS CASH EQUIVALENTS ONLY WHEN THESE HAVE SHORT

MATURITY PERIOD RANGING BETWEEN THREE MONTHS OR LESS.

THIS MEANS THAT SUCH INVESTMENTS MUST BE THE ONES THAT GET READILY CONVERTED

INTO CASH. ALSO, SUCH INVESTMENTS ARE LOW IN RISK AS THEY ARE NOT SUBJECT TO ANY

MATERIAL CHANGES IN VALUE.

FOR EXAMPLE, SHORT TERM MARKETABLE SECURITIES ARE TREATED AS CASH

EQUIVALENTS AS THESE ARE HIGHLY LIQUID AND CAN BE CONVERTED INTO CASH READILY.

IT IS IMPORTANT TO NOTE THAT ANY MOVEMENT OF CASH BETWEEN CASH OR CASH

EQUIVALENT ITEMS IS EXCLUDED FROM CASH FLOWS OF AN ENTERPRISE. THIS IS BECAUSE

SUCH MOVEMENT OF CASH IS NOT PART OF OPERATING, INVESTING AND FINANCING

ACTIVITIES. RATHER, IT COMES UNDER CASH MANAGEMENT OF AN ENTERPRISE.

Objectives of Cash Flow Statement

A Cash flow statement shows inflow and outflow of cash and cash

equivalents from various activities of a company during a specific

period. The primary objective of cash flow statement is to provide

useful information about cash flows (inflows and outflows) of an

enterprise during a particular period under various heads, i.e.,

operating activities, investing activities and financing activities.

This information is useful in providing users of financial

statements with a basis to assess the ability of the enterprise to

generate cash and cash equivalents and the needs of the

enterprise to utilise those cash flows. The economic decisions that

are taken by users require an evaluation of the ability of an

enterprise to generate cash and cash equivalents and the timing

and certainty of their generation.

Benefits of Cash Flow Statement

Cash flow statement provides the following benefits :

A cash flow statement when used along with other financial statements provides

information that enables users to evaluate changes in net assets of an enterprise, its

financial structure (including its liquidity and solvency) and its ability to affect the

amounts and timings of cash flows in order to adapt to changing circumstances and

opportunities.

Cash flow information is useful in assessing the ability of the enterprise to generate

cash and cash equivalents and enables users to develop models to assess and compare

the present value of the future cash flows of different enterprises.

It also enhances the comparability of the reporting of operating performance by

different enterprises because it eliminates the effects of using different accounting

treatments for the same transactions and events.

It also helps in balancing its cash inflow and cash outflow, keeping in response to

changing condition. It is also helpful in checking the accuracy of past assessments of

future cash flows and in examining the relationship between profitability and net cash

flow and impact of changing prices.

THE VARIOUS ACTIVITIES OF AN ENTERPRISE RESULT INTO CASH

FLOWS (INFLOWS OR RECEIPTS AND OUTFLOWS OR PAYMENTS)

WHICH IS THE SUBJECT MATTER OF A CASH FLOW STATEMENT. AS

PER AS-3, THESE ACTIVITIES ARE TO BE CLASSIFIED INTO THREE

CATEGORIES:

1. OPERATING,

2. INVESTING,

3. FINANCING ACTIVITIES

SO AS TO SHOW SEPARATELY THE CASH FLOWS GENERATED (OR

USED) BY (IN) THESE ACTIVITIES.

Cash flows from operating activities are primarily derived from the main

activities of the enterprise. They generally result from the transactions and other

events that enter into the determination of net profit or loss. Examples of cash

flows from operating activities are:

Cash Inflows from operating activities

cash receipts from sale of goods and the rendering of services.

cash receipts from royalties, fees, commissions and other revenues.

Cash Outflows from operating activities

Cash payments to suppliers for goods and services.

Cash payments to and on behalf of the employees.

Cash payments to an insurance enterprise for premiums and claims, annuities,

and other policy benefits.

Cash payments of income taxes unless they can be specifically identified with

financing and investing activities.

Cash Outflows from investing activities

Cash payments to acquire fixed assets including intangibles and capitalized

research and development.

Cash payments to acquire shares, warrants or debt instruments of other

enterprises other than the instruments those held for trading purposes.

Cash advances and loans made to third party (other than advances and

loans made by a financial enterprise wherein it is operating activities).

Cash Inflows from Investing Activities

Cash receipt from disposal of fixed assets including intangibles.

Cash receipt from the repayment of advances or loans made to third parties

(except in case of financial enterprise).

Cash receipt from disposal of shares, warrants or debt instruments of other

enterprises except those held for trading purposes.

Interest received in cash from loans and advances.

Dividend received from investments in other enterprises.

Cash Inflows from financing activities

Cash proceeds from issuing shares (equity or/and

preference).

Cash proceeds from issuing debentures, loans, bonds and

other short/ long-term borrowings.

Cash Outflows from financing activities

Cash repayments of amounts borrowed.

Interest paid on debentures and long-term loans and

advances.

Dividends paid on equity and preference capital.

You might also like

- Memorandum 2Document4 pagesMemorandum 2Catie MaasNo ratings yet

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Cash Flow Analysis PresentationDocument44 pagesCash Flow Analysis Presentationkojo2kg100% (1)

- Project On Cash Flow StatementDocument95 pagesProject On Cash Flow Statementravikumarreddyt58% (19)

- Cash Flow StatementDocument14 pagesCash Flow StatementTrending TamizhanNo ratings yet

- Karan 2Document17 pagesKaran 2harishNo ratings yet

- Cash Flow Statement AnalysisDocument29 pagesCash Flow Statement AnalysisCASAQUIT, IRA LORAINENo ratings yet

- Cash FlowDocument50 pagesCash FlowAnant AJNo ratings yet

- Microsoft Word - Cash Flow StatementDocument13 pagesMicrosoft Word - Cash Flow StatementAshishNo ratings yet

- Satish FinalDocument79 pagesSatish FinalAnonymous MhCdtwxQINo ratings yet

- Cash Flow StatementDocument19 pagesCash Flow StatementRoy YadavNo ratings yet

- Accounting Standard For Cash FlowDocument17 pagesAccounting Standard For Cash FlowKamal SoniNo ratings yet

- International Accounting Standard 7 Statement of Cash FlowsDocument8 pagesInternational Accounting Standard 7 Statement of Cash Flowsইবনুল মাইজভাণ্ডারীNo ratings yet

- REPORTING AND ANALYZING Cash FlowsDocument39 pagesREPORTING AND ANALYZING Cash FlowsmarieieiemNo ratings yet

- Chapter: - 8Document16 pagesChapter: - 8Kanu SubramanianNo ratings yet

- Cash Flow StatementDocument8 pagesCash Flow StatementHemant kumar JhaNo ratings yet

- Cash Flow Statement Full TheoryDocument3 pagesCash Flow Statement Full TheoryShubham BhaiNo ratings yet

- Cash Flow Analysis: Jerisse J. ParajesDocument15 pagesCash Flow Analysis: Jerisse J. ParajesLileth Lastra QuiridoNo ratings yet

- Cash FlowsDocument24 pagesCash Flowst4fgmwcb2kNo ratings yet

- Cash Flow Statements: Deepti Gurvinder Jitender Niraj PalakDocument29 pagesCash Flow Statements: Deepti Gurvinder Jitender Niraj PalakPalak GoelNo ratings yet

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Document34 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB Cloyd100% (1)

- FFS and CFSDocument28 pagesFFS and CFSAnuj DhamaNo ratings yet

- Cash Flow StatementDocument11 pagesCash Flow StatementHemanshu MehtaNo ratings yet

- Cash Flow Statements - Pdfshiv4Document10 pagesCash Flow Statements - Pdfshiv4Neha SinhaNo ratings yet

- Accounting Standard (AS) - 3 Cash Flow StatementsDocument20 pagesAccounting Standard (AS) - 3 Cash Flow StatementsPUTTU GURU PRASAD SENGUNTHA MUDALIAR100% (2)

- Cash Flow StatementDocument11 pagesCash Flow StatementAnonymous E0dOQEqIyNo ratings yet

- Accounting Standard - 3Document29 pagesAccounting Standard - 3Nilotpal DasNo ratings yet

- Accounting Standard (AS) - 3: Cash Flow StatementsDocument20 pagesAccounting Standard (AS) - 3: Cash Flow Statementsmkumar_pdfNo ratings yet

- Accounting Standard (AS) - 3: Cash Flow Statements - Pratap Karmokar (ACA)Document20 pagesAccounting Standard (AS) - 3: Cash Flow Statements - Pratap Karmokar (ACA)Jasmeen GhaiNo ratings yet

- (Ana) Slide 1: What Is A Cash Flow Statement?Document4 pages(Ana) Slide 1: What Is A Cash Flow Statement?ketiNo ratings yet

- Ch-5 Cash Flow AnalysisDocument9 pagesCh-5 Cash Flow AnalysisQiqi GenshinNo ratings yet

- IND AS 7Document3 pagesIND AS 7shnkrrng120No ratings yet

- Unit Ii Accounting PDFDocument11 pagesUnit Ii Accounting PDFMo ToNo ratings yet

- PAS 7 Statement of Cash FlowsDocument6 pagesPAS 7 Statement of Cash FlowsLykaArcheNo ratings yet

- PAS 7 Statement of Cash FlowDocument13 pagesPAS 7 Statement of Cash FlowLykaArcheNo ratings yet

- Index: Operating Activities Investing Activities Financing ActivitiesDocument19 pagesIndex: Operating Activities Investing Activities Financing ActivitiesKanchan GargNo ratings yet

- Cash Flow StatementDocument20 pagesCash Flow StatementYASH SARDANo ratings yet

- Cash Flow StatementsDocument48 pagesCash Flow StatementsApollo Institute of Hospital Administration60% (5)

- CFS PDFDocument50 pagesCFS PDFSubbu ..No ratings yet

- Meaning of CashDocument22 pagesMeaning of CashShashi Kant SinghNo ratings yet

- Cash Flow AnalysisDocument7 pagesCash Flow AnalysisDr. Shoaib MohammedNo ratings yet

- Cash Flow Statement - NCERTDocument54 pagesCash Flow Statement - NCERTHJ ManviNo ratings yet

- Cash Flow Statement PDFDocument48 pagesCash Flow Statement PDFsukriti dhauniNo ratings yet

- CH 7 CFSDocument10 pagesCH 7 CFSSyed AndrabiNo ratings yet

- Cash Flow StatementDocument46 pagesCash Flow StatementAnanyaNo ratings yet

- Chapter 6Document46 pagesChapter 6Aditya GuptaNo ratings yet

- Cash ManagementDocument8 pagesCash ManagementsujkubvsNo ratings yet

- Cash Flow Statements Bas 7Document12 pagesCash Flow Statements Bas 7Hasnain MahmoodNo ratings yet

- Accounting Standard FinalDocument2 pagesAccounting Standard FinalZahir ShahNo ratings yet

- T9 Cash FlowDocument16 pagesT9 Cash FlowHD DNo ratings yet

- Cash Flow Analysis: Ahsan Aslam Reg # L1f19bsaf0096Document10 pagesCash Flow Analysis: Ahsan Aslam Reg # L1f19bsaf0096Waleed KhalidNo ratings yet

- Atp 106 LPM Accounting - Topic 5 - Statement of Cash FlowsDocument17 pagesAtp 106 LPM Accounting - Topic 5 - Statement of Cash FlowsTwain JonesNo ratings yet

- Summary Report - Group 2: Definition of TermsDocument8 pagesSummary Report - Group 2: Definition of TermsRigor Salonga BaldemosNo ratings yet

- Pas 7 - Statement of Cash FlowsDocument8 pagesPas 7 - Statement of Cash FlowsJohn Rafael Reyes PeloNo ratings yet

- As 03Document18 pagesAs 03Simran SuriNo ratings yet

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Mid Test FRC Blemba 69 Evening Class - Berlin Novanolo G (29123112)Document10 pagesMid Test FRC Blemba 69 Evening Class - Berlin Novanolo G (29123112)catatankotakkuningNo ratings yet

- PT Garudafood Putra Putri Jaya TBK - Q3 - 30.09.2019Document96 pagesPT Garudafood Putra Putri Jaya TBK - Q3 - 30.09.2019We Luph NNo ratings yet

- Short Donald Trump - Jim GrantDocument4 pagesShort Donald Trump - Jim GrantsuperinvestorbulletiNo ratings yet

- SPADE Analysis Globe Telecom Inc PDFDocument29 pagesSPADE Analysis Globe Telecom Inc PDFLara FloresNo ratings yet

- Statement Period Member Number SCCU Members' Watchdog PromiseDocument4 pagesStatement Period Member Number SCCU Members' Watchdog Promiseshahzad afzalNo ratings yet

- Rural Marketing (2 Assignment) Casas BahiaDocument8 pagesRural Marketing (2 Assignment) Casas BahiaRuy SantosNo ratings yet

- Real Estate Finance 9th Edition Wiedemer Test BankDocument4 pagesReal Estate Finance 9th Edition Wiedemer Test Bankkietermintrudegjd100% (30)

- Cooperative Bank of Cotabato: Performance Report by Account OfficerDocument3 pagesCooperative Bank of Cotabato: Performance Report by Account OfficerYurih Khei Jham AluminumNo ratings yet

- Truth in Lending - Act PDF BookDocument91 pagesTruth in Lending - Act PDF BookBOSSKING DESIGNS67% (3)

- Patterns of Bank Credit Allocation and Economic Growth: General IssuesDocument35 pagesPatterns of Bank Credit Allocation and Economic Growth: General Issuesbabutu123No ratings yet

- Par Spot and Forward CurvesDocument2 pagesPar Spot and Forward CurvesOrestis :. KonstantinidisNo ratings yet

- HW 2 SolutionsDocument4 pagesHW 2 SolutionsJohn SmithNo ratings yet

- Module 4Document17 pagesModule 4Andrea AbellanozaNo ratings yet

- Peter Van Kerckhoven - 4 PDFDocument16 pagesPeter Van Kerckhoven - 4 PDFEmil AzhibayevNo ratings yet

- Draft PPT For ReviewDocument33 pagesDraft PPT For ReviewAkshay Raj YerabatiNo ratings yet

- Mzfilemanagerv 2 Dorigin 1Document30 pagesMzfilemanagerv 2 Dorigin 1Jorge EchanizNo ratings yet

- Consent Form-IDFC Buy Back - Tranche 2 - 2010-11Document1 pageConsent Form-IDFC Buy Back - Tranche 2 - 2010-11tkchauhan1No ratings yet

- SMB2F2 2Document183 pagesSMB2F2 2Bajaj BhagyashreeNo ratings yet

- Cash Flow Statement Full TheoryDocument3 pagesCash Flow Statement Full TheoryShubham BhaiNo ratings yet

- SEC v. Merrill Am ComplaintDocument51 pagesSEC v. Merrill Am ComplaintWWMTNo ratings yet

- SARFAESI Act For NBFCsDocument22 pagesSARFAESI Act For NBFCsdeba3589No ratings yet

- DawesCo LLP - Doing Business in IndiaDocument22 pagesDawesCo LLP - Doing Business in Indiarahul rajpurohitNo ratings yet

- Valuation TechniquesDocument22 pagesValuation Techniquespoisonbox100% (1)

- Residential Interior Design, Furniture and Supply ContractDocument15 pagesResidential Interior Design, Furniture and Supply ContractDaniel BuiNo ratings yet

- SWOT Analysis-KrogerDocument2 pagesSWOT Analysis-KrogerAspenNo ratings yet

- Analysis of Profitability of Selected Two Major Two-Wheeler Automobile Companies in IndiaDocument9 pagesAnalysis of Profitability of Selected Two Major Two-Wheeler Automobile Companies in IndiabhaveshjadavNo ratings yet

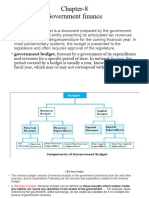

- Chapter-8 Bbs 2 NDDocument32 pagesChapter-8 Bbs 2 NDmagardiwakar11No ratings yet

- 0252445849ed2-Simple Interest Vyapam Replace PDFDocument14 pages0252445849ed2-Simple Interest Vyapam Replace PDFPrafulla JoshiNo ratings yet

- Accountancy PaperDocument9 pagesAccountancy PaperVarsha AswaniNo ratings yet

- Book-Keeping Form ThreeDocument182 pagesBook-Keeping Form ThreeChizani MnyifunaNo ratings yet