Professional Documents

Culture Documents

Unit-5 Merger & Acquisition

Unit-5 Merger & Acquisition

Uploaded by

bhanwariaarpitaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Unit-5 Merger & Acquisition

Unit-5 Merger & Acquisition

Uploaded by

bhanwariaarpitaCopyright:

Available Formats

Unit-V: Merger and Acquisition

The main learning objectives of M&A is to

provide students with an understanding of: The

highly practical “planning-based” approach to

managing the acquisition process and the issues

associated with each phase of the M&A process.

To make students learn that how to implement

provisions put in a nutshell in the mergers and

acquisitions agreement in the event of non-

compliance.

Merger and Acquisition

Mergers and acquisitions (M&A) involve the consolidation

of companies. It is a strategic business decision following

which two or more companies become a single entity.

Also students will learn that why the companies pursue

M&A for reasons and what may be the outcomes such

as achieving economies of scale, expanding market share,

and improving financial performance.

As M&A helps gain a competitive edge, increase market

share, expand into new regions or markets, and access

new customer bases.

M&A: Meaning

• Merger and acquisition (M&A) is a corporate

strategy that involves the combination of two

or more companies into a single entity.

• This strategy is typically used by companies

looking to expand their operations, increase

market share, or gain access to new products

or technologies.

Merger and Acquisition

• Merger refers to a strategic process whereby

two or more companies mutually form a new

single legal venture.

• Mergers and acquisitions are usually

undertaken to extend the size of a business,

grow into new markets or gain market share.

Merger: Meaning

• A merger is an agreement that unites two

existing companies into one new company.

• A merger is a corporate strategy to combine

with another company and operate as a single

legal entity.

• Finally, it is a kind of deal that unifies two

existing firms into one new company.

Types of Mergers

There are various types of mergers, depending on

the goal of the companies involved. Below are some

of the most common types of mergers.

The three main types of mergers are:

1. Congeneric/Product extension merger

2. Conglomerate merger

3. Market extension merger

4. Horizontal merger

5. Vertical merger

Congeneric/Product extension merger

• Such mergers happen between companies

operating in the same market. The merger

results in the addition of a new product to the

existing product line of one company. As a

result of the union, companies can access a

larger customer base and increase their

market share.

Conglomerate merger

• Conglomerate merger is a union of companies

operating in unrelated activities. The union

will take place only if it increases the wealth of

the shareholders.

Market extension merger

• Companies operating in different markets, but

selling the same products, combine in order to

access a larger market and larger customer

base.

Horizontal merger

• A horizontal merger is a type of consolidation of

companies selling similar products or services. It

results in the elimination of competition; hence,

economies of scale can be achieved.

• Horizontal mergers occur when two companies that

already offer the same products or services combine.

These mergers help companies reduce competition

and dominate the market.

• For example, Exxon combined with Mobil back in

1998 to form ExxonMobil.

Vertical merger

• A vertical merger occurs when companies

operating in the same industry, but at different

levels in the supply chain, merge. Such

mergers happen to increase synergies, supply

chain control, and efficiency.

Advantages of Merger

• 1. Increases market share: When companies merge, the new company

gains a larger market share and gets ahead in the competition.

• 2. Reduces the cost of operations: Companies can achieve economies of

scale, such as bulk buying of raw materials, which can result in cost

reductions.

• 3. Avoids replication: Some companies producing similar products may

merge to avoid duplication and eliminate competition. It also results in

reduced prices for the customers.

• 4. Expands business into new geographic areas: A company seeking to

expand its business in a certain geographical area may merge with

another similar company operating in the same area to get the business

started.

• 5. Prevents closure of an unprofitable business: Mergers can save a

company from going bankrupt and also save many jobs.

Disadvantages of Merger

• 1. Raises prices of products or services: A merger results in reduced

competition and a larger market share. Thus, the new company can gain a

monopoly and increase the prices of its products or services.

• 2. Creates gaps in communication: The companies that have agreed to

merge may have different cultures. It may result in a gap in communication

and affect the performance of the employees.

• 3. Creates unemployment: In an aggressive merger, a company may opt to

eliminate the underperforming assets of the other company. It may result

in employees losing their jobs.

• 4. Prevents economies of scale: In cases where there is little in common

between the companies, it may be difficult to gain synergies. Also, a bigger

company may be unable to motivate employees and achieve the same

degree of control. Thus, the new company may not be able to achieve

economies of scale.

Types of Acquisitions

• Companies consolidate for a variety of reasons

and in a number of ways. The most common

types of acquisitions include:

• Horizontal Acquisition

• Vertical Acquisition

• Congeneric Acquisition

• Conglomerate Acquisition

Pros and Cons of Acquisitions

• There are many reasons why a company might

decide to acquire another company — or to

allow another company to acquire it.

Understanding these reasons, along with the

potential drawbacks of an acquisition, are

important if you’re interested in pursuing a

career in M&A.

Pros of Acquisitions

Acquisitions are often one of the quickest

ways to enter a new market & to increase the

market share.

They can lower costs. Acquisitions help

companies reach economies of scale because

production increase results in cost reduction.

Acquisitions are often helpful in reducing or

eliminating the competition.

Cons of Acquisitions

• Acquisition is a time consuming process: Acquisition is still

complex legal arrangements, subject to internal and

external negotiations, investigations, audits, and reviews,

and takes months or, even, a few years to complete.

• Acquisition is expensive: The acquirer has to pay for the

target company in cash, stock, and/or borrowed funds

(known as a leveraged buyout). There are also legal fees

and tax implications associated with each deal.

• Acquisition can be mispriced. While M&A professionals

rely on a variety of business valuation methods, it still can

be tricky to pinpoint how much exactly a company is worth.

Acquisition vs. Merger

• The term acquisition is also sometimes used

synonymously with merger, but both words technically

have different meanings. In an acquisition, the two

companies continue to function as separate legal

entities.

• A merger, conversely, occurs when two existing

companies combine to form a new legal entity.

• Think Exxon and Mobil coming together to form

ExxonMobil back in 1999.

• Price Waterhouse merging with Coopers and Lybrand to

form PricewaterhouseCoopers (PwC) in 1998.

Exchange Ratio

• In mergers and acquisitions (M&A), the exchange ratio is the relative number of

new shares that will be given to existing shareholders of a company that has been

acquired or that has merged with another.

• Exchange Ratio = Offer Price for Target’s Shares / Acquirer’s Share Price

• Exchange ratio typically refers to the ratio used to determine how many shares of

one company’s stock will be exchanged for a certain number of shares of another

company’s stock in a merger or acquisition.

• For example, if Company A acquires Company B and the exchange ratio is 1:2,

it means that for every one share of Company A stock, Company B stockholders

will receive two shares of Company A stock.

• The exchange ratio can have a significant impact on the value of the deal for

both companies’ shareholders. A favorable exchange ratio can make the deal

more attractive to the shareholders of the acquired company, while an

unfavorable exchange ratio can lead to opposition to the deal.

Exchange Ratio example

• Suppose; Rohit Shetty & Co. is the acquirer and Dharma

Productions Pvt. Ltd. is the target firm. DPPL has 10,000

outstanding shares and is trading at a current price of

Rs.16, and RSC is willing to pay a 25% takeover

premium. This means the offer price for DPPL is Rs.20.

Firm RSC is currently trading at Rs.10 per share.

• To calculate the exchange ratio, we take the offer price

of Rs.20 and divide it by RSC’s share price of Rs.10.

• Exchange Ratio = Offer Price for Target’s Shares / Acquirer’s Share Price

• The result is 2.

• Means; RSC has to issue 2 of its own shares for every 1

share of the Target it plans to acquire.

Synergy

• Synergy is a process in which individuals or companies

combine their resources and efforts to achieve more

productivity, efficacy, and performance than they

could alone.

• Synergy is the concept that the value and

performance of two companies combined will be

greater than the sum of the separate individual parts.

• Mergers and acquisitions are the best example-

• If the two companies merge, they can accomplish

more together than they could apart.

Synergy & its benefits

Term Synergy refers to the benefit that results from the merger of two

agents who want to achieve something that neither of them would be able

to achieve on their own.

If the two companies merge, they can accomplish more together than they

could apart.

Some examples of synergy benefits include:

Revenue benefits,

Cost benefits, and

Improved Financial & Operational benefits

• What can you do with one hand?

• What can you do with both of your hands? Twice as much?

• No! You can do much, much more! You can do

absolutely new things.

• For example, play the violin.

• That's synergy!

Post-Merger EPS

Post-merger EPS (earnings per share) is a financial metric

used to evaluate the impact of a merger or acquisition on

a company’s earnings per share after the transaction is

completed. EPS is calculated by dividing a company’s net

income by the number of outstanding shares of its

common stock.

It is important to note that post-merger EPS is just one of

several financial metrics used to evaluate the success of a

merger or acquisition, and should be considered in

conjunction with other metrics such as revenue growth,

cost savings, and return on investment.

Post Merger Price of Share

The post-merger price of a share is the price of a

company’s stock after a merger or acquisition has been

completed.

The post-merger price of a share is not always directly

correlated with the success of a merger or acquisition, as

there may be other factors that can influence the stock

price such as overall market conditions and investor

sentiment. It is important to conduct a thorough analysis

of the merged company’s financials and business

prospects to determine the potential impact on the post-

merger share price.

Required Rate of Return of Merged

Company

The required rate of return of a merged company or a de-

merged company depends on various factors such as the

risk profile of the merged company or the de-merged

companies, the expected cash flows, and the prevailing

market conditions.

For a merged company, the required rate of return can be

calculated by taking the weighted average cost of capital

(WACC) of the combined entity. WACC is the average rate

of return required by investors to invest in a company,

taking into account the relative weights of the company’s

debt and equity capital.

Required Rate of Return of De-Merged

Company

For a de-merged company, the required rate of

return of each company can be calculated

separately based on their respective risk profiles

and expected cash flows. The required rate of

return of each company can be determined by

applying the capital asset pricing model (CAPM)

or other models that consider the company’s

risk profile and expected returns.

Required Rate of Return for both

In general, a merged company or a de-merged

company is expected to have a higher required rate

of return if it is perceived to be riskier by investors, or

if the expected cash flows are lower. Conversely, a

company with lower perceived risk or higher

expected cash flows may have a lower required rate

of return. The required rate of return is an important

factor in determining the valuation of a company and

can impact the decisions of investors, analysts, and

other stakeholders.

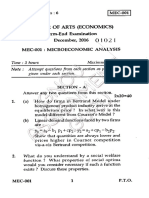

Questions

1. What is meant by merger? Discuss the types & benefits of mergers:

2. What is an Acquisition? Definition, Types, and Examples.

3. What is merger & how it differs from acquisition?

4. An acquisition is a business transaction that occurs when one company purchases and gains

control over another company.

5. A business acquisition occurs when one company (the acquirer) buys most or all shares in

another company (the target) to assume control of its assets and operations.

6. Acquisitions are often amicable, meaning both companies are on-board with and negotiate the

terms of the transaction. However, the word “acquisition” is sometimes used interchangeably

with “takeover,” which can be hostile.

7. Acquisitions are often coordinated by investment bankers or lawyers. Large companies,

including private equity firms, often have internal teams that manage the process.

8. What is Exchange Ratio? explain with help of an example.

9. What are the synergy benefits of merger & acquisition?

10. How the Post Merger EPS & Post Merger Price of Share are computed?

11. Explain the Required Rate of Return of Merged & De-Merged Company separately.

12. What is de_merger?

13. What is the post-merger EPS? Explain clearly

14. What will be the post-merger relationship between EPS, MPS & K e? Explain with help of suitable

example.

You might also like

- HBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)From EverandHBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)Rating: 4.5 out of 5 stars4.5/5 (25)

- International MarketingDocument14 pagesInternational MarketingShannon InmanNo ratings yet

- BL Econ 6142 Lec 1933T Managerial EconomicsDocument9 pagesBL Econ 6142 Lec 1933T Managerial EconomicsJamie Balisi100% (1)

- Types of Mergers and Acq PDFDocument16 pagesTypes of Mergers and Acq PDFNaman Jain0% (1)

- Theories in Merger and AcquisitionDocument123 pagesTheories in Merger and Acquisitiongoel76vishal100% (3)

- W3 Repco Case StudyDocument13 pagesW3 Repco Case StudyRahul SuriNo ratings yet

- Unit 1 About MergerDocument6 pagesUnit 1 About MergerJhumri TalaiyaNo ratings yet

- MergerDocument26 pagesMergerSithara ThathsaraniNo ratings yet

- Mergers and AcquisitionDocument38 pagesMergers and AcquisitionRajesh WariseNo ratings yet

- Merger & ConsolidationDocument21 pagesMerger & Consolidationgilberthufana446877100% (1)

- Introduction To Mergers and AcquisitionsDocument38 pagesIntroduction To Mergers and AcquisitionsSwati TiwariNo ratings yet

- Mergers & AcquisitionDocument54 pagesMergers & AcquisitionMegha Bhatt JoshiNo ratings yet

- M&a 3Document25 pagesM&a 3Xavier Francis S. LutaloNo ratings yet

- Chapter-4 Business Acquisition & FranchaisingDocument35 pagesChapter-4 Business Acquisition & FranchaisingLowzil Rayan AranhaNo ratings yet

- Growth Strategies For SMEsDocument82 pagesGrowth Strategies For SMEsLong BunNo ratings yet

- Corporate Finance - Unit 5 NotesDocument11 pagesCorporate Finance - Unit 5 NotesairmanchulbulpandeyNo ratings yet

- Types of Mergers & AcquisitionsDocument16 pagesTypes of Mergers & Acquisitionschandran0567No ratings yet

- Session 11Document24 pagesSession 11Yash MayekarNo ratings yet

- Cor - Res M1Document107 pagesCor - Res M1Sobhan PradhanNo ratings yet

- SFMDocument10 pagesSFMSoorajKrishnanNo ratings yet

- Mergers and AcquisitionsDocument6 pagesMergers and AcquisitionsVishnu RajeshNo ratings yet

- Merger Acquisition & Corporate RestructuringDocument23 pagesMerger Acquisition & Corporate RestructuringHarsha GuptaNo ratings yet

- Introduction To M & ADocument35 pagesIntroduction To M & AShefali PawarNo ratings yet

- Corporate ResDocument22 pagesCorporate Res20bal216No ratings yet

- MACR Lec 3 4eDocument18 pagesMACR Lec 3 4epurple0123No ratings yet

- Merger StrategyDocument23 pagesMerger Strategypurple0123No ratings yet

- Merger and AcquisitionsDocument16 pagesMerger and Acquisitionsanuja kharelNo ratings yet

- Types of M&ADocument31 pagesTypes of M&Adhruv vashisth100% (1)

- Merger and AcquisitionDocument74 pagesMerger and AcquisitionYusuph HajiNo ratings yet

- Mergers and AcquisitionsDocument50 pagesMergers and Acquisitionsvijay kumarNo ratings yet

- Horizontal Merger: Reason For MergersDocument5 pagesHorizontal Merger: Reason For MergershiteshNo ratings yet

- Corporate RestructuringDocument27 pagesCorporate RestructuringAkash Bafna100% (1)

- Law of Mergers and Governance-3Document73 pagesLaw of Mergers and Governance-3Mohit PrasadNo ratings yet

- Merger Dan Akuisisi-2Document46 pagesMerger Dan Akuisisi-2RatnaNo ratings yet

- Cours MA Private EquityDocument198 pagesCours MA Private EquityOmar MechyakhaNo ratings yet

- Corporate RestructuringDocument9 pagesCorporate RestructuringParvin AkterNo ratings yet

- Strategy FormulationDocument53 pagesStrategy FormulationJoeNo ratings yet

- Mergers and AcquisitionsDocument17 pagesMergers and AcquisitionsTahseenKhanNo ratings yet

- Strategic Financial ManagementDocument14 pagesStrategic Financial ManagementDeepak ParidaNo ratings yet

- What Is Corporate RestructuringDocument45 pagesWhat Is Corporate RestructuringPuneet GroverNo ratings yet

- Acquisition Merger & ConsolidationDocument32 pagesAcquisition Merger & Consolidationgilberthufana446877No ratings yet

- Final PPTDocument141 pagesFinal PPTJanhvi ShahNo ratings yet

- Theory of MergersDocument37 pagesTheory of MergersJoyal JosephNo ratings yet

- What Is Grand Strategy ?Document48 pagesWhat Is Grand Strategy ?Vishwajeet ChavanNo ratings yet

- Grand Strategy Unit 6Document48 pagesGrand Strategy Unit 6ReenaAswaneyNo ratings yet

- Intro To Mergers and AcquisitionDocument54 pagesIntro To Mergers and AcquisitionAmeesha MunjalNo ratings yet

- Theory of Mergers: Presented By: EekshithDocument7 pagesTheory of Mergers: Presented By: EekshithRaghava PrusomulaNo ratings yet

- Mergers AcquisitionDocument11 pagesMergers AcquisitionAamir NabiNo ratings yet

- Merger Strategies and MotivesDocument18 pagesMerger Strategies and MotivesGaurav RathaurNo ratings yet

- MergerDocument24 pagesMergerAkansha AggarwalNo ratings yet

- Mergers and AcquisitionsDocument21 pagesMergers and AcquisitionsEdga WariobaNo ratings yet

- Ify Growth of FirmsDocument15 pagesIfy Growth of Firmsdestinyebeku01No ratings yet

- Mergers and AcquisitionDocument95 pagesMergers and AcquisitionjffhNo ratings yet

- Seminar Presentation ON Mergers & Acquisitions: Issues and ChallengesDocument13 pagesSeminar Presentation ON Mergers & Acquisitions: Issues and ChallengesSubrata kumar sahooNo ratings yet

- Submitted To Course InstructorDocument15 pagesSubmitted To Course InstructorAmitesh TejaswiNo ratings yet

- Types of Strategies: Unit 4Document43 pagesTypes of Strategies: Unit 4Arushi GuptaNo ratings yet

- Chapter 8 of BBS 3rd YearDocument26 pagesChapter 8 of BBS 3rd YearAmar Singh SaudNo ratings yet

- Mergers and AcquisitionDocument32 pagesMergers and AcquisitionjffhNo ratings yet

- Businesscombination Copy Imp Topic 3Document29 pagesBusinesscombination Copy Imp Topic 3Gul khanNo ratings yet

- Corporate RestructuringDocument13 pagesCorporate RestructuringSubrahmanya SringeriNo ratings yet

- What Is MergersDocument10 pagesWhat Is MergersSri VaishnaviNo ratings yet

- The Profit Zone (Review and Analysis of Slywotzky and Morrison's Book)From EverandThe Profit Zone (Review and Analysis of Slywotzky and Morrison's Book)No ratings yet

- Efsf 2013Document59 pagesEfsf 2013LuxembourgAtaGlanceNo ratings yet

- Chapter 1 The Demand For Audit and Other Assurance ServicesDocument2 pagesChapter 1 The Demand For Audit and Other Assurance ServicesPrincess MaroNo ratings yet

- MODULE 6 Topic 2Document10 pagesMODULE 6 Topic 2Lowie Aldani SantosNo ratings yet

- Mastering The MacdDocument4 pagesMastering The Macdsaran21No ratings yet

- MEC-001 - ENG-D16 - Compressed PDFDocument3 pagesMEC-001 - ENG-D16 - Compressed PDFTamash MajumdarNo ratings yet

- Sales Forecasting & TrainingDocument15 pagesSales Forecasting & TrainingANKITA CHANDEL100% (1)

- HRM ModuleDocument137 pagesHRM Moduletarekegn gezahegnNo ratings yet

- Services Marketing Planning and Management - Action PlanDocument12 pagesServices Marketing Planning and Management - Action PlanPeterNo ratings yet

- RhodaDocument3 pagesRhodaNana Hemaa RhodaNo ratings yet

- Reports On Audited Financial Statements: CompanyDocument37 pagesReports On Audited Financial Statements: Companyhassan nassereddineNo ratings yet

- Ellin Loraine: Account ExecutiveDocument1 pageEllin Loraine: Account ExecutiveNeeraj JoshiNo ratings yet

- Asian Paints FinalDocument17 pagesAsian Paints FinalDevendra MishraNo ratings yet

- Statement of Cash Flows - IAS 7Document32 pagesStatement of Cash Flows - IAS 7Ryan RascoNo ratings yet

- 1 IntroductionDocument22 pages1 IntroductionLeigh AuroraNo ratings yet

- Example Company (Pty) LTD: Cashbook TransactionsDocument8 pagesExample Company (Pty) LTD: Cashbook TransactionsShakkuNo ratings yet

- AKMY 6e ch01 - SMDocument20 pagesAKMY 6e ch01 - SMSajid AliNo ratings yet

- ch9 MKT 301 Quiz ReviewDocument4 pagesch9 MKT 301 Quiz ReviewSergio HoffmanNo ratings yet

- Ulips 221007Document6 pagesUlips 221007pushpendra_25No ratings yet

- Interior Design Business Plan: Executive SummaryDocument8 pagesInterior Design Business Plan: Executive SummaryRajendra PrasadNo ratings yet

- Consumer Behavior and Marketing Strategy of Apparel Luxury Goods On Chinese E-Commerce PlatformDocument7 pagesConsumer Behavior and Marketing Strategy of Apparel Luxury Goods On Chinese E-Commerce PlatformÃmânî TëfëNo ratings yet

- Tgs Kelompok Best BuyDocument10 pagesTgs Kelompok Best BuyLiana ReginaNo ratings yet

- Dove Vs Lux: A Strong Corporate Brand or A Strong Product BrandDocument5 pagesDove Vs Lux: A Strong Corporate Brand or A Strong Product BrandDiana KilelNo ratings yet

- A Comparative Study of Digital Banking in Public and Private Sector BanksDocument5 pagesA Comparative Study of Digital Banking in Public and Private Sector BanksVishal Sharma100% (1)

- Shahzad Et Al 2020Document29 pagesShahzad Et Al 2020Sahirr SahirNo ratings yet

- FEC ContractsDocument2 pagesFEC ContractssatyambhanduNo ratings yet

- Pricing Methods: Presented By: Rachana K S Qaiser Pasha KeerthiDocument16 pagesPricing Methods: Presented By: Rachana K S Qaiser Pasha KeerthiM KEERTHI AMRENo ratings yet

- Chapter 7 Customer - Driven Marketing StrategyDocument40 pagesChapter 7 Customer - Driven Marketing StrategyVy NguyenNo ratings yet