Professional Documents

Culture Documents

Presentation On General Insurance

Presentation On General Insurance

Uploaded by

Nishita ShahOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Presentation On General Insurance

Presentation On General Insurance

Uploaded by

Nishita ShahCopyright:

Available Formats

PRESENTATION ON GENERAL INSURANCE

and Learning From Same

Prepared By :

Nishita Shah

(3rd Semester)

1- 18

UNIT-1,ORIGIN OF GENERAL INSURANCE AND ITS CONCEPTS

Insurance is a device by means of which the risks of two or more persons or firms are combined through actual or promised contributions to a fund out of which claimants are paid. In other words, a group of people having similar financial interests pool together a specified amount of money from which certain specified financial losses of any of the pool members are met. The custodian of the pool is the INSURER, the members of the pool are the INSURED and the money paid is PREMIUM. Insurance works as a contract of two parties. Risk : An uncertain out comes which gives loss.

Objective Risk : Exists in nature & applicable to all. Ex. Natural calamities. Subjective Risk : Depends on individual perception. Pure Risk : Chance of a loss without chances of a gain. Ex. Accident Speculative Risk : Possibility of a gain ensuring from the losses.

Peril : Specific kinds of risk that may give rise to claims.(fire, theft, hail, earthquake etc)

Hazard : Create the chance of a loss from a given peril.

Physical Hazard , Moral Hazard - Dishonesty, Fraud Morale Hazard - Carelessness ,

2- 18

UNIT-1,ORIGIN OF GENERAL INSURANCE AND ITS CONCEPTS

Evolution Of Insurance :

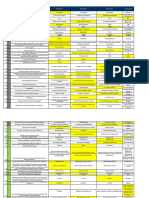

Phase Period 1850 to 1972 (about 122 yrs) Industry Many (107) private sector companies only, competitive market.

Phase I General Insurance

Phase II

General Insurance Phase III General Insurance After 2000 1972 to 2000 (about 28 yrs)

Nationalization, public sector monopoly, only one company with its four subsidiaries.

Opened to the entry of private domestic and foreign companies, mixed sector of public and private sector units, oligopoly of public sector companies (14 life insurance and 12 general insurance companies)

3- 18

UNIT-2, BASIC PRINCIPLES OF INSURANCE

PRINCIPLES OF INSURANCE :

The Principle Of Utmost Good Faith The Principle Of Insurable Interest

The Principle Of Indemnity

The Principle Of Subrogation ( passing the rights ) The Principle Of Proximate Cause

Excess / Deductible

Franchise

4- 18

UNIT-3,GENERAL INSURANCE MARKET

IRDAS MISSION

To protect the interests of the policyholders, to regulate, promote and ensure orderly growth of the insurance industry and for matters connected therewith or incidental thereto.

Composition of Authority under IRDA Act, 1999

As per the section 4 of IRDA Act' 1999, Insurance Regulatory and Development Authority (IRDA, which was constituted by an act of parliament) specify the composition of Authority.

The Authority Is A Ten Member Team Consisting Of

A Chairman- up to age of 65 years Five Whole-time Members- up to age of 62 years Four Part-time Members- not more than 5 years (All Appointed By The Government Of India)

5- 18

UNIT-3,GENERAL INSURANCE MARKET

Duties, Powers And Functions Of IRDA :

Section 14 of IRDA act, 1999 lays down the duties, powers and functions of IRDA.

1. Subject to the provisions of this act and any other law for the time being in force, the authority shall have the duty to regulate, promote and ensure orderly growth of the insurance business and re-insurance business. 2. Without prejudice to the generality of the provisions contained in sub-section (1), the powers and functions of the authority shall include:

Issue to the applicant a certificate of registration, renew, modify, withdraw, suspend or cancel such registration. Protection of the interests of the policy holders in matters concerning assigning of policy, nomination by policy holders, insurable interest, settlement of insurance claim, surrender value of policy and other terms and conditions of contracts of insurance.

6- 18

UNIT-3,GENERAL INSURANCE MARKET

Duties, Powers And Functions Of IRDA :

Specifying requisite qualifications, code of conduct and practical training for intermediary or insurance intermediaries and agents. Specifying the code of conduct for surveyors and loss assessors. Promoting efficiency in the conduct of insurance business. Specifying the form and manner in which books of account shall be maintained and statement of accounts shall be rendered by insurers and other insurance intermediaries. Regulating investment of funds by insurance companies. Regulating maintenance of margin of solvency. Adjudication of disputes between insurers and intermediaries or insurance intermediaries. Supervising the functioning of the tariff advisory committee.

7- 18

UNIT-4, INSURANCE FORMS

FORMS RELATING TO THE INSURANCE CONTRACT :

Proposal Form Basic Document Cover Note Documents Issued By Insurer In Advance Of Policy Certificate of Insurance Policy Form

FORMS RELATING TO THE PROVIDERS ESTABLISHMENT :

Insurers Licensing Intermediaries Licensing Product Approval

Statistical Data Submission- Tariff Advisory Committee (TAC)

Other Forms/ Documents ( Accounts and disclosure of financial statement etc.)

8- 18

UNIT- 5, TYPES OF INSURANCE

TYPES OF INSURANCE : 2. Transit Insurances

- Marine Cargo Policy - Inland Transit Policy

1. Property Insurances

- Fire Insurance - Engineering Insurance

3. Accident Insurances

- Motor vehicle Insurance - Marine Hull Insurance - Aviation Hull Insurance44

4. In come Insurances

- Business Loss Of Profit Insurance - Advance Loss of Profit Insurance(delay in project) - Credit Guarantee Insurance - Financial Guarantee Insurance(employee)

5. Liability Insurances

- Motor TP Insurance - Public Liability Insurance - Product Liability Insurance - Professional Liability Insurance - Workmens Composition Insurance

6. Personal Insurances

- Health Insurance - Personal Accident Insurance - Life Insurance

7. Specialized Insurances

- Agriculture Insurance - Specialty Insurance ( Hybrid Cover )

9- 18

UNIT- 5, TYPES OF INSURANCE

TYPES OF LOSSES :

Property Losses Liability Losses Income Losses Personal Losses

Silent features of Insurance Policies :

Cover Sum Insured Basis Of Premium Condition Of Excess Significant Exclusions Main Extension

General Condition Policy Covered Calamities Covered Fire and Burglary

10- 18

UNIT- 6, UNDERWRITING AND RATING PRACTICES

UNDERWRITING PRACTICES : It involves

Evaluating the Risk Measuring the Risk To check whether the contract is legal, capacity to insure the risk

Underwriting Guidelines :

1. Acceptance of New Business

- Internal guidelines - Rejection - Limits on Sum Insured - Limits by Types of Insurance - Accommodation Risk - Control By Inspection - Restrictive Wordings

2. Renewal of Business

- Bonus

11- 18

UNIT- 6, UNDERWRITING AND RATING PRACTICES

RATING PRACTICES :

To achieve a specified rate of capita To maximize profits

To maintain or extend market share

Pricing Method :

-

Manual rate

Experience rating

Modification rating

12- 18

UNIT- 7, CLAIMS PRACTICE AND PROCEDURE

CLAIMS CONCEPTS AND PRACTICE, TYPES OF LOSSES :

- Definite Loss - Accidental Loss - Large Loss - Calculable Loss

CLAIMS PROCEDURE :

Preliminary Procedure

- Notice of Loss - Minimizing Losses -Procedural Formalities

Settlement Procedure

- Establishing Admissibility - Disputed Claims

Investigation Procedure

-Investigation and Assessment - Survey Report - Re- survey - Documentary Proof

Motor Insurance Claims Procedure Industrial Insurance Claims Procedure Fire Insurance Claims Procedure Agriculture Insurance Claims Procedure Travel Insurance Claims Procedure

13- 18

UNIT- 7, CLAIMS PRACTICE AND PROCEDURE

CLAIMS DOCUMENTS :

1. Claims Forms 2. Survey Report

3. Legal Opinion

4. Specialists Opinion (Fire, Burglary, Motor, Marine Cargo,Fatal Claims ) 5. Other Evidences 6. Other Documents and Original Policy

14- 18

UNIT- 8,ORGANIZATIONAL STRUCTURE OF AN INSURANCE COMPANY

* Organizational Structure of an Insurance Company : Head Office Zonal/Regional Office Branch office 1. Non-technical Areas

Divisional/Area Office

* Departmental Structure of an Insurance Company

-Accounts Department -Administration Department -Estate and Establishment Department -HR and Personnel Department -IT Department

2. Technical Areas

-Risk Management and Inspection Department

-Portfolio-wise Departments

15- 18

UNIT- 8, ORGANIZATIONAL STRUCTURE OF AN INSURANCE COMPANY

*Functional Structure of an Insurance Company:

- Sales and Marketing Department - Strategy, Underwriting and Reinsurance Department - Business Systems and IT Application Department - Operations and Customer Services Department - Finance Department - Claims Department - Motor Claims Coordinator (At the Regional Level ) - Claims Officer - In-house Motor Surveyor at the Region Level -Motor technical Officer -Claims Manager

16- 18

Thank You !!!

17- 18

You might also like

- Aspiration Bank 2020Document6 pagesAspiration Bank 2020SAM0% (1)

- Loan Sanction-Letter With kfs4330739025633689315Document4 pagesLoan Sanction-Letter With kfs4330739025633689315Sapan MishraNo ratings yet

- Monzo Bank Statement 2020 08 08 133631Document4 pagesMonzo Bank Statement 2020 08 08 13363113KARATNo ratings yet

- Idbi Ic 38 TrainingDocument74 pagesIdbi Ic 38 TrainingJai Rajesh100% (1)

- Syllabus Ic 88 Marketing and Public RelationsDocument1 pageSyllabus Ic 88 Marketing and Public RelationsVINAY S N100% (1)

- New Syllabus PDFDocument77 pagesNew Syllabus PDFPrashantNo ratings yet

- IC 38 My NotesDocument51 pagesIC 38 My NotesShri RanjanNo ratings yet

- Presentation On General Insurance CompaniesDocument43 pagesPresentation On General Insurance Companiesskenkan50% (6)

- Test Yourselfic38Document62 pagesTest Yourselfic38EMMANUEL S100% (1)

- Question Bank 1 PDFDocument56 pagesQuestion Bank 1 PDFAnandjit Patnaik100% (1)

- IRDA IC-38 (1-5) RefresherDocument20 pagesIRDA IC-38 (1-5) RefresherTechi Kakow100% (1)

- General InsruanceDocument53 pagesGeneral InsruanceDeep LathNo ratings yet

- Motor Tariff Gist - Study MaterialDocument9 pagesMotor Tariff Gist - Study MaterialSadasivuni007No ratings yet

- IC38 SushantDocument46 pagesIC38 SushantAyush BhardwajNo ratings yet

- Ic 38 - Rnis Mock Test Paper 2017Document46 pagesIc 38 - Rnis Mock Test Paper 2017Rekha GuptaNo ratings yet

- Ic33 Print Out 660 English PDFDocument54 pagesIc33 Print Out 660 English PDFumesh100% (1)

- IC-38 - Short Notes (Life) & QPDocument135 pagesIC-38 - Short Notes (Life) & QPVenkatesh Kalburgi100% (1)

- Free Irda Ic 38 Insurance Agents GeneralDocument12 pagesFree Irda Ic 38 Insurance Agents GeneralShabaz AliNo ratings yet

- New Black Book General Insurance 2017Document69 pagesNew Black Book General Insurance 2017Siddhesh VarerkarNo ratings yet

- Marketing Mix Insurance SectorDocument4 pagesMarketing Mix Insurance SectorSantosh Pradhan100% (1)

- Legal Framework in InsuranceDocument36 pagesLegal Framework in InsuranceHarshit Srivastava 18MBA0050No ratings yet

- III AssociateDocument2 pagesIII Associateagupta_118177No ratings yet

- Royal Sundaram General InsuranceDocument22 pagesRoyal Sundaram General InsuranceVinayak BhardwajNo ratings yet

- FIN 238 Risk and Insurance Management (BBA-BI: 4 Semester)Document2 pagesFIN 238 Risk and Insurance Management (BBA-BI: 4 Semester)Sakshi Adhikary0% (1)

- Market Segmentation For Insurance: Users of Insurance Service: Marketing Information SystemDocument10 pagesMarket Segmentation For Insurance: Users of Insurance Service: Marketing Information SystemTejal GuptaNo ratings yet

- Insurance Hiring AdvisorDocument79 pagesInsurance Hiring AdvisorMukesh Sahu100% (1)

- IciciDocument8 pagesIcicidhanushNo ratings yet

- ReinsuranceDocument14 pagesReinsuranceKrishnanunni VijayakumarNo ratings yet

- General InsuranceDocument100 pagesGeneral InsuranceShivani YadavNo ratings yet

- Fire & Consequential Loss Insurance 57Document15 pagesFire & Consequential Loss Insurance 57surjith rNo ratings yet

- Shubham Sharma (Internship Report)Document47 pagesShubham Sharma (Internship Report)SHARMA TECH0% (1)

- Report On BhartiDocument57 pagesReport On BhartiWendy CannonNo ratings yet

- Marketing of InsuranceDocument22 pagesMarketing of InsuranceshrenikNo ratings yet

- Finacial Performance of Life InsuracneDocument24 pagesFinacial Performance of Life InsuracneCryptic LollNo ratings yet

- Kotak Life InsuranceDocument72 pagesKotak Life InsuranceGanesh D Panda100% (3)

- Final Project Fire InsuranceDocument22 pagesFinal Project Fire InsuranceDeep Lath50% (2)

- 2 - Integrated L&SCMDocument1 page2 - Integrated L&SCMsukumaran321No ratings yet

- Introduction To Insurance SectorDocument71 pagesIntroduction To Insurance Sectorbunty100% (6)

- Marketing Strategies of Insurance Companies in Us, Uk, India EtcDocument15 pagesMarketing Strategies of Insurance Companies in Us, Uk, India EtclegendarystuffNo ratings yet

- Guide For Marketing & Public Relations: Key For Fellowship ExaminationDocument14 pagesGuide For Marketing & Public Relations: Key For Fellowship ExaminationRakesh KumarNo ratings yet

- Factors Affecting Buying Behaviour of Customers of Life Insurance PDFDocument47 pagesFactors Affecting Buying Behaviour of Customers of Life Insurance PDFAkshay Akki Gupta100% (1)

- IC-38 - Short Notes Life QPDocument137 pagesIC-38 - Short Notes Life QPkuntal199No ratings yet

- Risk Presentation To Insurance CompanyDocument11 pagesRisk Presentation To Insurance CompanyNaushad MuttipalathingalNo ratings yet

- A Report On: Customer Relationship Management of Idbi Federal Life InsuranceDocument95 pagesA Report On: Customer Relationship Management of Idbi Federal Life InsuranceamitNo ratings yet

- HDFC LifeDocument66 pagesHDFC LifeChetan PahwaNo ratings yet

- Introduction On Motor Insurance: TH STDocument32 pagesIntroduction On Motor Insurance: TH STRahil Khan100% (1)

- Project Hire Purchase and LeasingDocument32 pagesProject Hire Purchase and Leasingjesudas_joseph78% (9)

- Marine Insurance - LossesDocument20 pagesMarine Insurance - LossesShivam Kumar100% (1)

- 88 - IC-Marketing-and-Public-RelationsDocument1 page88 - IC-Marketing-and-Public-RelationsVINAY S N33% (3)

- Basics of InsuranceDocument20 pagesBasics of InsuranceSunny RajNo ratings yet

- Presentation On Hire Purchase and LeasingDocument25 pagesPresentation On Hire Purchase and Leasingmanoj100% (1)

- Strategic Analysis of Indian Life Insurance IndustryDocument40 pagesStrategic Analysis of Indian Life Insurance IndustryPunit RaithathaNo ratings yet

- IRDA Agent Exam Sample Paper 1Document12 pagesIRDA Agent Exam Sample Paper 1Awdhesh SoniNo ratings yet

- IC34 Question Bank New Syllabus - Sep. '15Document28 pagesIC34 Question Bank New Syllabus - Sep. '15Lalit JainNo ratings yet

- Green Delta Insurance PDFDocument98 pagesGreen Delta Insurance PDFSayeedMdAzaharulIslamNo ratings yet

- Consequential Loss PolicyDocument34 pagesConsequential Loss PolicyAnmol GulatiNo ratings yet

- Annexure - I Syllabus For Training and Examination For Insurance BrokersDocument19 pagesAnnexure - I Syllabus For Training and Examination For Insurance BrokersHanuman MbaliveprojectsNo ratings yet

- Fire Specialised DiplomaDocument10 pagesFire Specialised DiplomaNeetu Deepak NagalNo ratings yet

- SYLLABUS of Health InsuranceDocument10 pagesSYLLABUS of Health InsuranceSuchetana SenNo ratings yet

- Swamy InsuranceDocument7 pagesSwamy InsuranceSannidhi MukeshNo ratings yet

- Ic 38 Non Life SyllabusDocument4 pagesIc 38 Non Life SyllabusSKNo ratings yet

- Web Aggregator SyllabusDocument5 pagesWeb Aggregator Syllabussam franklinNo ratings yet

- Introduction To Risk (Rohit BansalDocument33 pagesIntroduction To Risk (Rohit BansalKulwant SinghNo ratings yet

- Packing and MarkingDocument4 pagesPacking and MarkingNishita ShahNo ratings yet

- Import Export ManagementDocument130 pagesImport Export ManagementNishita ShahNo ratings yet

- Report On Measures Taken For Business ImprovementDocument8 pagesReport On Measures Taken For Business ImprovementNishita ShahNo ratings yet

- Ambush Marketing - An Effective Marketing Technique or Just A Worthless Fad!Document3 pagesAmbush Marketing - An Effective Marketing Technique or Just A Worthless Fad!Nishita ShahNo ratings yet

- Nikhil - Direct MarketingDocument16 pagesNikhil - Direct MarketingNishita ShahNo ratings yet

- Introduction To Accounting JGF - July 31 and Aug 1Document26 pagesIntroduction To Accounting JGF - July 31 and Aug 1LARINGO IanNo ratings yet

- Medical Repricing RevisionDocument10 pagesMedical Repricing RevisionYaaminni ArumukamNo ratings yet

- Inclusivebankingsuite User Guide: Parameters, Head Teller and TellerDocument123 pagesInclusivebankingsuite User Guide: Parameters, Head Teller and TellerMark MahuaNo ratings yet

- Shubam Roy PDFDocument11 pagesShubam Roy PDFparul jainNo ratings yet

- The 2 - Ques Fin2603 S1 2022Document2 pagesThe 2 - Ques Fin2603 S1 2022btsj43254No ratings yet

- Isave Account Terms and ConditionsDocument10 pagesIsave Account Terms and Conditionsfennie ilinah molinaNo ratings yet

- PD3-2017-qualifying Criteria For Audit Eemption For Certain Categories of Private Companies 0Document8 pagesPD3-2017-qualifying Criteria For Audit Eemption For Certain Categories of Private Companies 0keishaelinaNo ratings yet

- Advanced Finance, Banking and Insurance SamenvattingDocument50 pagesAdvanced Finance, Banking and Insurance SamenvattingLisa TielemanNo ratings yet

- 9 Problems After Accounting Cycle Book1Document7 pages9 Problems After Accounting Cycle Book1Efi of the IsleNo ratings yet

- Principle of Accounting 1Document25 pagesPrinciple of Accounting 1Quỳnh Trang NguyễnNo ratings yet

- List of Banks Enabled For Epayeezz Registration As Per Mfu / Npci With Various Modes of Registrations SR - No. Bank Name Net Banking Debit CardDocument2 pagesList of Banks Enabled For Epayeezz Registration As Per Mfu / Npci With Various Modes of Registrations SR - No. Bank Name Net Banking Debit CardJpNo ratings yet

- Assignment 2 Fin536Document6 pagesAssignment 2 Fin536mypinkladyNo ratings yet

- Voucher PDFDocument1 pageVoucher PDFDevrat UjoodhaNo ratings yet

- A. Basic Liquidity Ratio 3-6 Month: 1. Based On The Financial Statements, Compute June'sDocument13 pagesA. Basic Liquidity Ratio 3-6 Month: 1. Based On The Financial Statements, Compute June's1 KohNo ratings yet

- Islamic Banking and Finance Insight On Possibilities For EuropeDocument100 pagesIslamic Banking and Finance Insight On Possibilities For EuropeZulejha IsmihanNo ratings yet

- Quiz 3 ADocument4 pagesQuiz 3 AArooj ImranNo ratings yet

- The Credit Risk and Its Measurement Hedging and MoDocument8 pagesThe Credit Risk and Its Measurement Hedging and MoPranshu SrivastavaNo ratings yet

- Ic 78 Misc mcq7Document30 pagesIc 78 Misc mcq7Samba SivaNo ratings yet

- ACC 416 Absorption Costing Vs Marginal CostingDocument6 pagesACC 416 Absorption Costing Vs Marginal CostingNUR IZZATY ALIAH SAMIA'ANNo ratings yet

- Circular - RCS - 2011 Corrected PDFDocument161 pagesCircular - RCS - 2011 Corrected PDFSuresh MuthuNo ratings yet

- 5 6059900569177293719Document76 pages5 6059900569177293719chinna ladduNo ratings yet

- A Stockbroker Is A Regulated Professional IndividualDocument2 pagesA Stockbroker Is A Regulated Professional Individualmldc2006No ratings yet

- CAlAMBA AND SANTIAGO - TUGOTDocument2 pagesCAlAMBA AND SANTIAGO - TUGOTAndrea Tugot100% (1)

- 8.municipal Tax Receipt 2Document1 page8.municipal Tax Receipt 2Ravi ChandraNo ratings yet

- 0 Accounting For Merchandising BusinessDocument114 pages0 Accounting For Merchandising BusinessIan RanilopaNo ratings yet

- Tool 7 Template Materiality Assessment PaperDocument4 pagesTool 7 Template Materiality Assessment PaperMargenete CasianoNo ratings yet

- VAC Financial Literacy NotesDocument19 pagesVAC Financial Literacy NotesDaksh Gautam93% (15)